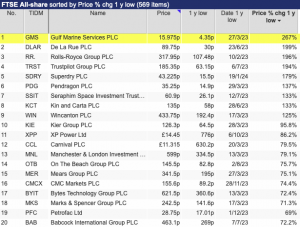

Two companies pass first hurdle

IntegraFin and Shoe Zone are the only companies to achieve less than three strikes as the winter lull in annual reporting intensifies. Richard also takes a closer look at Renew. 5 Strikes Since my last 5 Strikes update, I have only found two shares that achieve less than three strikes. A strike is a complicating