Running filters or screens is a popular way of finding shares to invest in. Whilst screening can be very powerful it is important to recognise that blindly buying shares which meet a set of financial criteria is rarely a route to success. Good investors use screening as a way of concentrating their research efforts. SharePad […]

Category: Phil Oakley

UK Dividend aristocrats

Phil’s Investors Chronicle article on how to be a successful dividend investor. Read the article

Why depreciation matters and EBITDA doesn’t

When it comes to weighing up asset-intensive sectors, depreciation matters. It is a real cost. This does not stop people ignoring it and touting the merits of companies based on their EBITDA. Investors ignore the significance of depreciation at their peril and should be suspicious of companies that talk about EBITDA too much. To get […]

The end of “hidden debts”

Accounting is a dry subject but a very important one. I perfectly understand why private investors’ eyes glaze over at the mere mention of the topic. That said, I am a firm believer that when it comes to this subject a little knowledge can go a long way and can help you make better investment […]

Stock Watch: XP Power

XP Power is based is headquartered in Singapore and has manufacturing sites in Vietnam and China. The company makes power control systems which convert power from an electrical mains supply to a safe level to be used in its customers’ products. It sells its products into the Industrial, Healthcare and Technology sector where they are […]

How to avoid value traps

In this instalment, Phil explains how to spot value traps and finds some cheap shares that might bounce back. Read the article

Free cash flow: what it is and how to use it

In this week’s Investors Chronicle, Phil explains how to use free cash flow to your advantage. Read the article

Stock Watch: Treatt plc (LSE:TET)

Treatt plc has been in business since 1886. Based in Bury St Edmunds, the company specialises in making and selling products based on essential oils. It takes natural plant oils such as orange, lime, peppermint and eucalyptus and uses them to create flavours and fragrances to sell to consumer goods companies. These flavours and fragrances […]

Kraft-Heinz’s bid for Unilever

Disclosure: Phil Oakley owns shares in Unilever Last week’s bid by US food company Kraft-Heinz for Unilever caught many investors by surprise. But in retrospect maybe it shouldn’t have. The bid came in response to the difficulties that many large consumer goods companies are facing right now. It also tells investors a great deal about […]

Weighing up investment trusts

Many private investors like to build a portfolio of individual shares in order to grow the value of their savings as well as trying to beat the market as a whole. But some also like to complement their portfolios by owning investment funds. One of the best and easiest ways to do this is to […]

Riding a retail roll out

Note: This in an advanced article best suited to more experienced and confident investors. One of the most profitable investing strategies can be to buy the shares of rapidly expanding retail companies – when a company sets out a plan to open lots of new stores over a period of time. This is affectionately known […]

Does Tesco buying Booker make sense?

Mergers and takeovers are part and parcel of the investing world. However, I think it’s fair to say that last week’s (27th January 2017) announcement that supermarket giant Tesco (LSE:TSCO) was buying cash and carry operator Booker (LSE:BOK) was something of a surprise. Takeovers or acquisitions as they are commonly known are a very grey area for investors. Are […]

Value investing today

One of the great things about investing is that there are lots of different ways for people to try and make money. This means that there is a style out there that will suit most temperaments. Probably the most well known investing strategy is value investing. Yet I find that this term is frequently overused […]

If you want to beat the stock market own fewer shares not more

As a private investor managing your own share portfolio you have to achieve two things over the long haul to consider your efforts a success. First and foremost you have to make money. This means doing better than if you had put your money in a savings account. The second thing you need to try […]

Sector Watch: Beverages

Companies which make and sell branded drinks have long been popular with investors. One of the main reasons for this is that as businesses they are very easy to understand. They sell products which millions of people consume daily and are very familiar with. Let’s take a quick tour around the UK quoted beverages sector […]

Sector Watch: FTSE 100 and AIM 100 Miners

Mining companies are very difficult to analyse. Their profits and cash flows are very closely related to trends in commodity prices and sentiment towards the economy in general which means that they tend to be very volatile. Unsurprisingly, share prices move and up and down a lot too. From an investor viewpoint, the inherent volatility […]

Paying up for quality shares – how much is too much?

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett “The desirability of a business with outstanding economic characteristics can be ruined by the price you pay for it. The opposite is not true.” – Charlie Munger The quote from Warren Buffett above is often cited […]

A great year for modified magic formula investing

A year ago I started a trial of three model portfolios based on Joel Greenblatt’s magic formula approach (click here to read more about this). I wanted to see how this strategy would work in the real world and with all investing costs taken into account as many studies of investment strategies ignore costs. The portfolios are […]

What is investing?

Why do people invest their money rather than just save? It’s not just about growing your savings so that you will have more money in the future. It’s about growing the buying power of your money. You want the £1 that you are investing today to buy more things in the future than it does […]

A brief guide to tax-efficient saving

Tax-efficient savings accounts (ISAs) and self-invested personal pensions (SIPPs) are the best option for most savers and investors. Here’s what you need to know. Savings Individual savings accounts (ISAs) are tax-free savings accounts. That is, you are not liable to pay capital gains tax (CGT) on the profits you make on this money. You can […]

Choosing your first investments

For some people the thought of picking their own shares can be a little bit daunting. Rest assured, it doesn’t have to be. Whilst it is best to do at least a little bit of homework before you part with your hard earned cash, successful investing does not require a high IQ or lots of […]

Investing in funds, investment trusts and ETFs

Many investors like to build a portfolio of individual shares and even bonds but for some investors, investment funds can be a useful alternative. For example, some investors may want to have a degree of control over their investments but don’t wish to dedicate the time to choosing and managing a lot off individual investments. […]

Investing your portfolio for retirement income

From what I can see we are still firmly in a bull market in shares. Momentum remains a strategy that is paying off handsomely with a select group of companies continuing to see their share prices increase faster than their profits. But this will not go on forever. Shares with stretched valuations have little downside […]

Chapter 1: You can be a Stock Market Analyst

Updated: August 2024 If you are reading this, the chances are that you’ve decided to take control of your investments or are doing so already. You may have been investing for some time but feel you could do better. Many of you may be new to investing, or have previously left the management of your […]

Chapter 2: Balance sheets

Updated: August 2024 ShareScope is packed full of useful financial data. This data holds the key to understanding the financial health and value of any company you are looking at. To a new or inexperienced investor, the mass of numbers may seem a little daunting. That’s quite understandable but it shouldn’t be. If you understand […]

Chapter 3: Analysing balance sheets

Updated: August 2024 In the previous chapter, we looked at how a balance sheet was put together and the numbers that go into it. In this chapter, we are going to take all those numbers from the balance sheet and turn it into useful information for investors. A company’s balance sheet contains a wealth of […]

Chapter 4: Income statements

Updated: August 2024 Hopefully, you will now understand balance sheets and how important and useful they are. Let’s move on to a set of numbers which most people think are even more important – profits. Just as we did with balance sheets, I am going to explain the numbers in an income statement in this […]

Chapter 5: Analysing income statements

Updated: August 2024 Now that we’ve dealt with the basic format of an income statement it’s time to move on and show you how ShareScope turns those numbers into really useful information. Knowing your way around an income statement is vital to understanding what makes a company tick. However, to get the most out of […]

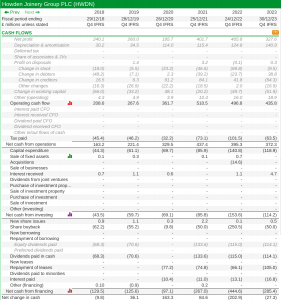

Chapter 6: The cash flow statement

Updated: August 2024 The last four chapters have been spent looking at the balance sheet and income statement and how to use them. In this chapter, we will move on to arguably the most revealing piece of financial information that a company gives investors – its cash flow statement. When a company’s financial results are […]

Chapter 7: Analysing cash flow statements

Updated: August 2024 We did a little bit of cash flow analysis in the last chapter. In this one, we look at the cash flow ratios that ShareScope calculates for you and what they can tell you about a company’s financial performance. The key issues that this chapter will point out are: Cash flow is […]

Chapter 8: Is this a good business?

Updated: August 2024 In this chapter, we look at ways to measure how good a company is at generating profits from the resources at its disposal. We will be looking at what the company is getting back in profits as a percentage of the money it has invested. This is the real measure of how […]

Chapter 9: Share valuations

Updated: August 2024 In the previous chapter, we looked at how to find out if a company was any good or not. In a nutshell, good companies get back a lot of profit or cash flow as a percentage of the money they invest – they earn high financial returns. How to tell when shares […]

Chapter 10: Value investing

Updated: August 2024 In the next three chapters we are going to be looking at three different styles of investing, starting with Value investing. The previous chapters have hopefully shown you how useful ShareScope can be when you are sifting through the finances of a company. Information that might have taken you hours or even […]

Chapter 11: Dividend investing

Updated: August 2024 If you are watching or listening to the news at the end of the day you will usually be told what happened to the stock market that day. More precisely, you will be told whether it went up or down in price. Yet investing in shares is not just about changes in […]

Chapter 12: Growth investing

Updated: August 2024 The last couple of chapters have focused on two particular styles of investing – value investing and dividend investing. Both these approaches to owning shares are largely based on the current state of a company – its profits and its dividends. In this chapter, we are going to turn our attention to […]

Chapter 13: Investing in bonds

Updated: August 2024 Despite its name, ShareScope is not just all about shares. It can help you with other investments as well. In this chapter, I’m going to show you how you can use the information available to invest in bonds.. What are bonds Bonds are IOUs. Just like shares you can buy bonds on […]

Chapter 14: Putting it all together

Updated: August 2024 In this final chapter, I use the data and tools in ShareScope to show you how I analyse shares. Even if you are not a subscriber, you should find this article extremely useful as a guide to making informed investment decisions. One of the main selling pitches of the fund management industry […]