Updated: August 2024

In the next three chapters we are going to be looking at three different styles of investing, starting with Value investing.

The previous chapters have hopefully shown you how useful SharePad can be when you are sifting through the finances of a company.

Information that might have taken you hours or even days to obtain can be worked out in just a few minutes.

Understanding how money flows around a company’s financial statements is an essential part of good investing.

However, to stand a chance of making money from the stock market you have to know how to apply your financial knowledge.

There are lots of different ways to be a successful stock market investor. However, if you are going to grow the value of your savings over time you have to find a style of investing that you are comfortable with.

And when you do, it’s important to have the discipline to stick with it.

Professional investing attracts some of the brightest minds out there – probably because the financial rewards can be so big – but you do not need a high IQ to be a good investor. Common sense, hard work and discipline often count for a lot more.

In the next three chapters we are going to be looking at three different styles of investing and how you can use SharePad to practise them. This chapter is going to be all about value investing.

What is value investing?

Value investing essentially boils down to three main principles:

- Buying the shares of a business for less than they are really worth (known as its intrinsic value).

- Buying them at a big enough discount to what they are really worth so that if something goes wrong you won’t lose money. This is known as the margin of safety.

- On top of this, you are advised to avoid bad businesses with weak finances.

The origins of value investing can be traced back to the 1930’s and a man called Benjamin Graham. In 1934 he – along with David Dodd – wrote a book called Security Analysis which has assumed the mantle of the value investor’s bible.

This book is quite heavy going for the layperson, but he later wrote a book called The Intelligent Investor which is a lot easier to read and understand.

Having witnessed the terrible losses suffered by shares in the Wall Street Crash in 1929 and the depression that followed, Graham devised a way of investing that still aimed to make money but more importantly protected investors from losing too much if things didn’t work out.

People have compared his approach with trying to buy a dollar for fifty cents or buying groceries when they are on sale.

Value investing is seen as a medium- to long-term investment strategy in which shares are held for several years or more (unless a reason to sell emerges).

It can also take time for undervalued companies to recover or to be re-rated by the market.

So how do you go about becoming a value investor?

Working out what a business is really worth

This is the question that all investors are really trying to answer.

The truth is that you will never get a definitive answer but that doesn’t really matter. What you are trying to find out is a reasonable estimate of what a company’s shares should be selling for.

There are a number of ways to try and find this estimate. Many value investors have looked for shares selling for a low multiple of their earnings (a low PE ratio) or cash flows (a high free cash flow yield) or less than the net asset value per share (low price to NAV).

The reckoning here is that shares with these characteristics could be too cheap and therefore possibly be a bargain purchase.

So one of the first things a value investor might do is screen for shares with low PE ratios or a price to NAV of considerably less than 1. This is very easily done in SharePad.

However, the smarter investors will do much more than this.

They will compare the valuations (such as PE or P/NAV or their chosen valuation method) with those of similar businesses.

Say there are two identical petrol stations in your town. If the BP station is selling for 5 times earnings (a PE of 5) and the Shell station is selling for 10 times earnings then the BP station might be a bargain. Alternatively, the Shell one could be too expensive.

It’s also worth checking the history of company valuations.

If the shares of petrol stations have historically traded on much higher PE ratios then it could be a sign that the shares are currently cheap.

The key part of value investing is finding out why a company’s shares look cheap. More on this in a little while.

Another thing good value investors pay close attention to is the price paid for businesses when they are taken over (takeover valuations). The reasoning here is that prices paid in takeovers can be close to the true valuation of a business.

So if a petrol station in the next town has just been taken over for 15 times earnings (a PE of 15) then the petrol stations in your town could be very cheap and you should consider buying their shares.

Bear in mind though that takeover valuations aren’t always right. Companies can and do pay too much when they are buying other companies. Again, this is where a bit of extra research comes in handy.

How to achieve a margin of safety

As well as trying to buy shares for less than they are worth, value investing is about not losing money. These two objectives go hand in hand.

One of the reasons why value investors focus on shares with low valuations is that there is already a lot of pessimism baked into the share price.

Low PEs and low P/NAVs are often a sign that investors are very downbeat on a company’s future prospects. So when something disappointing happens – such as a poor set of financial results – there’s a good chance that the share price won’t go down too much as people already expected it.

The same thing can’t be said for shares that trade on very lofty valuations (such as high PE ratios).

Here the expectation is for profits to grow very strongly for many years into the future. This is why when companies with high valuations disappoint investors the share price can go down a lot and inflict some very heavy losses on shareholders.

A classic example of this came in the late 1990s and early 2000s when shares in internet and technology companies – many of which had no profits and few assets – plummeted when their businesses couldn’t justify the valuations put on them by the stock market. In other words, there was no margin of safety for anything going wrong.

This is why most value investors stayed clear of these shares and were proved right.

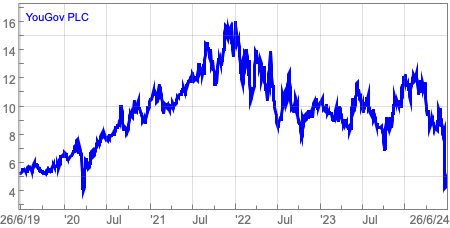

A more recent example is seen with the share price of YouGov where the shares have commanded a high PE ratio for many years. Bad news on its expected profits saw the shares halve in value as its PE ratio collapsed.

A great example of what a margin of safety is in practice can be seen in one of the ways Ben Graham used to look for extremely cheap shares.

He used to look for companies that were trading below what he called their net working capital value. This is the value of a company’s current assets (stocks, trade debtors and cash) less all its liabilities.

Graham didn’t want to pay anything for land or buildings or goodwill (the fixed assets) and reckoned if he could buy a share for less than its net working capital value he was unlikely to lose much money and could end up with a nice profit.

Graham used to try and pay a maximum of two thirds the net working capital value.

He also used to hold lots of different shares on this basis to reduce the risk of something going wrong. Although he often had to wait for the shares to come good, he often made substantial profits with this approach to value investing.

Today, you won’t find many shares trading below their net working capital value.

However, in bear markets when pessimism increases more of them tend to appear.

SharePad can help you find these types of shares and they are definitely worth keeping an eye out for.

The other main way that value investors try and stay safe is by spreading their portfolio across lots of different shares.

This is known as diversification and protects the investor from a bad result from some of their shares.

Better results can undoubtedly be achieved by holding fewer shares – known as a concentrated portfolio – but if something goes wrong with just one investment it can have a bigger overall effect on your savings pot.

How to find value shares

Before you can start practising value investing you first need to find some possible investment candidates.

The best place to start is to look for companies whose shares have suffered a significant fall in price.

Famous value investors such as John Neff and Walter Schloss used to look for shares that were hitting new lows.

They were looking for shares where the market had become too pessimistic and there was potential for a recovery.

Neff and Schloss used to spend hours sifting through investment directories and newspapers looking for these distressed shares.

With SharePad you can find them in just a few minutes.

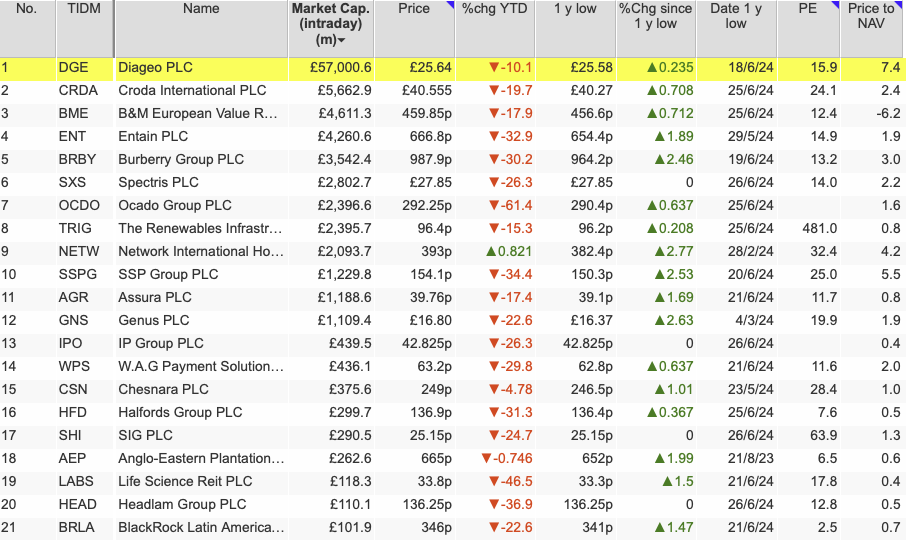

What I’ve done here is set up a filter in SharePad to look for shares where the current share price is within 3% of its one year low.

So in other words, I’m asking SharePad to provide me with a list of shares that are trading very close to their lowest prices for the last year.

I’ve used the FTSE All Share index here, but you can choose from a number of different indices. You can also choose to set the range to within different percentages of the one year low.

I’ve also added some columns to this filter to give me some more information.

The percentage change in the share price over the last year can give you some insight into how badly the shares have performed.

Big share price falls are a sign that the shares are subject to a lot of pessimistic sentiment which could give rise to a potential bargain.

Basic valuation yardsticks such as the current PE ratio and price to NAV also give a quick snapshot of whether the shares could be attractive or not.

When the stock market is buoyant and going up you don’t tend to find that many bargains.

This can be a sign that the market itself is not particularly good value.

When it is falling though, the number of potential bargains increases and the quality of companies available at bargain prices increases as well. If you are going to be a successful value investor then you have to learn to love falling share prices.

The best buying opportunities have always tended to have been after the stock market has fallen a long way. Years such as 1974, 1982, 1987, 2003, 2009, 2016 and 2020 saw shrewd investors pick up good companies at great prices. This is how people such as Warren Buffett have become very rich.

However, in order to take advantage of these opportunities you need to have some cash. Therefore, keeping some of your portfolio in cash is a good idea.

How to avoid getting burned

Finding shares that look cheap is your first step. It’s worth remembering though that shares usually become cheap for a reason. Just because a share looks cheap doesn’t automatically mean that it is also good value. Your job as a value investor is to find shares where the market has been too pessimistic and there is scope for the company to have better days in the future.

When it comes to finding out why a share price has fallen, there are good reasons and bad reasons.

Let’s look at the good reasons first.

One of the most common reasons for a share price fall is a disappointing profit performance.

Many shares on the stock market are followed by thousands of professional investors and analysts who spend a lot of their working day trying to predict a company’s future profits.

To be a good investor involves taking a long-term view but the City and Wall Street can be very short-term in how they look at companies.

Businesses are under tremendous pressure to meet the short-term profit expectations of professional investors. If they fall short, their share price is often hammered even though profits may still be increasing.

If this is a temporary blip and the company can get back on track then the fall in the share price can be seen as an overreaction and therefore possibly a good buying opportunity.

If profits are coming under pressure for some reason then buying the shares may be a mistake.

Share prices of underperforming businesses are often depressed. Investors shun them as they see no prospect of making money.

However, a change of management can often be the catalyst for the share price to go up. If the new management has a credible plan to turn the business around and boost future profits then the shares may be worth a look.

As mentioned earlier, a general sell off in the stock market can be a good opportunity to buy shares at bargain prices. During times of a stock market panic, selling is often indiscriminate as investors become fearful of losing lots of money. This can see very good businesses literally on sale at bargain prices.

Now for the bad reasons for a share price fall or a depressed share price.

Probably the biggest warning sign that you should stay away from a share that looks cheap is because it has too much debt.

Debt is the enemy of the shareholder.

The more debt (or gearing) that a company has the bigger the risk that shareholders will lose lots of money or be wiped out.

Debt makes it difficult for a company to survive when trading conditions get tough. Profits for shareholders can turn to losses and they may even be asked to put in more of their own money to shore up the business.

You should therefore pay very close attention to a company’s debt levels compared with shareholders’ equity.

Look at the ability of profits to pay the interest bill (interest cover) and also look at other debt-like liabilities such as pension fund deficits.

As a rule, shares that look cheap but have lots of debt should probably be avoided if you like sleeping well at night.

Shares may also look cheap because of changing technology. Today’s technology can quickly become obsolete if something better comes along. Think of products such as Polaroid cameras or video rental shops that were trumped by new technology. Buying shares exposed to this risk can be very risky.

A related issue is rising competition. A company may have taken its eye off the ball and left with products or business costs that make it uncompetitive with other companies. This has happened in areas such as retail where many high street shops with expensive rents and staff costs have found it hard to compete with internet retailers selling direct to customers from warehouses. Buying shares in struggling retailers in recent years has often ended badly.

Checking the company out

Before you buy any share that looks cheap you have to do your homework. You may get lucky blindly buying shares where the numbers look attractive. But you stand a much better chance of being successful if you take a little bit of time to learn some important facts about a company.

This is where SharePad comes in very handy. It can help you answer some important questions about a company’s finances and valuation in just a few minutes. This in turn will help you focus on where to do more research.

To show you what I mean, let’s take a company from the one year low list earlier in the chapter and go through how you might start finding out whether you should buy the shares or not.

Case study: Diageo

Let’s take a look at Diageo. The world’s biggest spirits company had been quite popular with investors for a long time but is now somewhat out of fashion.

What I am going to do here is use some of the important ratios that we’ve covered in the previous chapters. I am also going to show you some other features of SharePad that can help you to research a company.

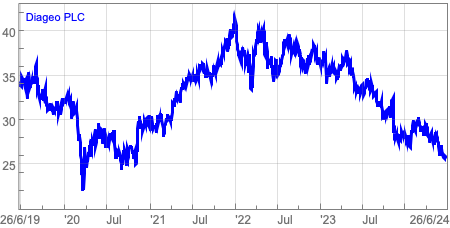

Diageo’s shares have had a rough time having fallen from well over £40 per share to just over £25. At the time of writing, the shares are trading just adobe their one year low.

What should you be looking at if you are thinking about buying Diageo shares after the share price sell off.

We can use SharePad to help us by looking at the company’s financial history and trying to get some insight into its future. Let’s start by looking at some key numbers. If you want to understand a company’s future then it is usually very helpful to understand its past. I’d suggest looking back at least five years, preferably ten.

SharePad’s financial charts are especially useful in this kind of exercise.

Sales

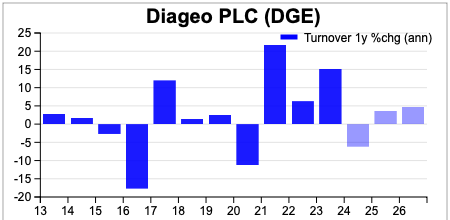

Sales are the lifeblood of any business. If a company cannot grow its sales then it may not be able to grow its profits in the future. Let’s have a look at what’s been happening to Diageo’s sales growth and what is expected over the next few years.

We can see that growth rates have been quite lumpy, Strong growth in 2021 and 2023 are expected to see a fall in sales in 2024 and weak growth thereafter.

The recent trend in sales growth is quite concerning and could make it quite difficult for Diageo to grow its profits. For some investors, this may be enough for them to dismiss Diageo as a potential investment and move on to another opportunity..

EBIT and EBIT margins

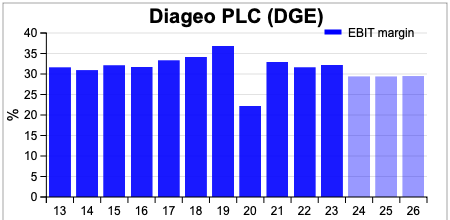

The next item to look at is profit. I’m going to focus on EBIT (earnings before interest and tax) as this is arguably the best measure of profit. It is not distorted by changes in tax rates or interest rates. It’s the profit from selling things.

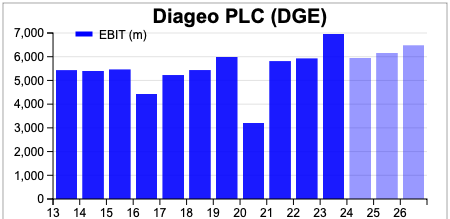

Diageo’s profit growth did not grow much between 2013 and 2022 before seeing a sharp rise in 2023. They are expected to fall in 2024 before recovering slightly. However, they are nor expected to get back to 2023 levels by 2026.

The business continues to earn high profit margins albeit at a lower level than seen historically.

ROCE

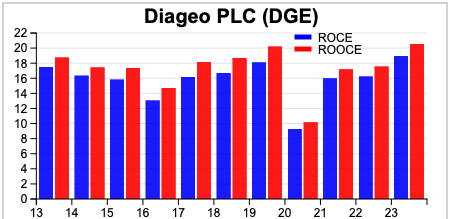

ROCE is the financial benchmark of whether a company is any good or not.

Encouragingly for Diageo, its ROCE and return on operating capital employed (ROOCE) had been on an upwards trend until 2023. The actual numbers are also at a high level which shows that Diageo remains a very profitable business which is a good sign.

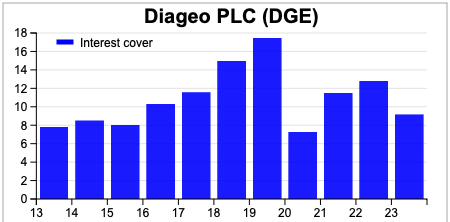

Debt and interest cover

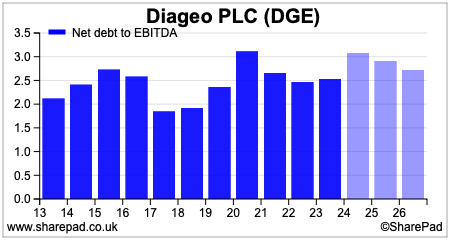

Debt is the enemy of the value investor. It makes it more difficult for companies to survive difficult trading environments.

As discussed earlier,Net debt to EBITDA may have a few drawbacks as a measure of company indebtedness, but it is one that is clearly watched by professional investors and is therefore a key determinant of sentiment towards a company.

Diageo has quite a lot of debt – anything approaching 3 times for a non-financial company is usually seen as quite large – but the ratio is expected to come down in the coming years.

However, Diageo’s interest cover is very comfortable which suggests that its debts remain very manageable.

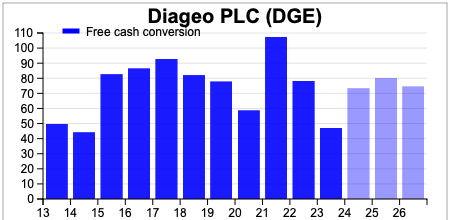

Free cash flow conversion

Diageo’s free cash flow conversion has been generally acceptable in recent years but has deteriorated quite sharply. It is expected to improve according to analysts’ forecasts. That said, for a reasonably mature business, it could be argued that the company still has room for improvement on this measure.

Are the shares really cheap?

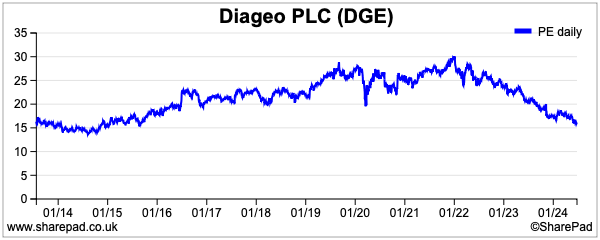

Diageo shares have attracted a very high valuation – as evidenced by a high PE ratio – over the last decade. It’s current valuation on a PE basis is close to a decade low which may suggest that the shares are cheap.

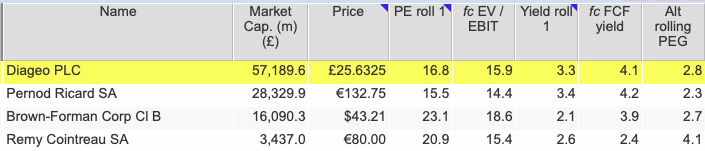

A better insight may come from comparing Diageo with the valuation of its major global spirits competitors.

Here we can see that Diageo is considerably cheaper on a PE basis compared with Brown-Forman and Remy Cointreau and has one of the highest free cash flow yields.

That said, its forecast free cash flow yield is not likely to be considered high enough to suggest that Diageo’s shares are really cheap. On measures such as PEG, the shares do not look very cheap when compared with the expected earnings per share (EPS growth)

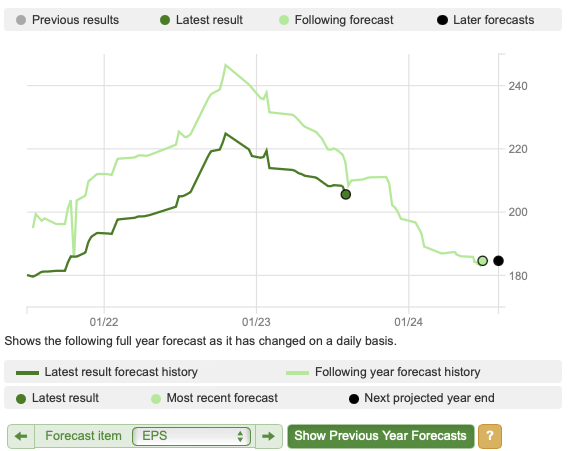

Analyst forecasts

Whether you should rely on the forecasts of professional analysts when making investment decisions is debatable as they are often wrong. However, they do give you an insight of what the market is expecting from a company and whether the future is expected to be much different from the past.

The trend in analysts’ forecasts is also something to keep an eye on as they are a good indicator of business momentum – is its trading performance on an upwards or downwards trend.

This does not paint a pretty picture for Diageo. Not only is EPS expected to fall year on year, but the forecasts for 2024 have fallen for a long period of time.

This shows very weak business momentum which raises the question as to whether this could continue to get worse. Further profit warnings would likely inflict a lot of pain on any investor buying Diageo shares at its current price.

Recent news

SharePad can provide you with a lot of useful news. However, it makes sense to read the latest annual report and visit the investor relations section on the company’s website to find out more information. I’ll have more to say on how to use annual reports in a later chapter.

Here we can see that the news flow on trading has been quiet. However, there have been a lot of brokers cutting their price targets for the company which is not positive,

The company has also sold 58% of its stake in its Guinness Nigeria business.

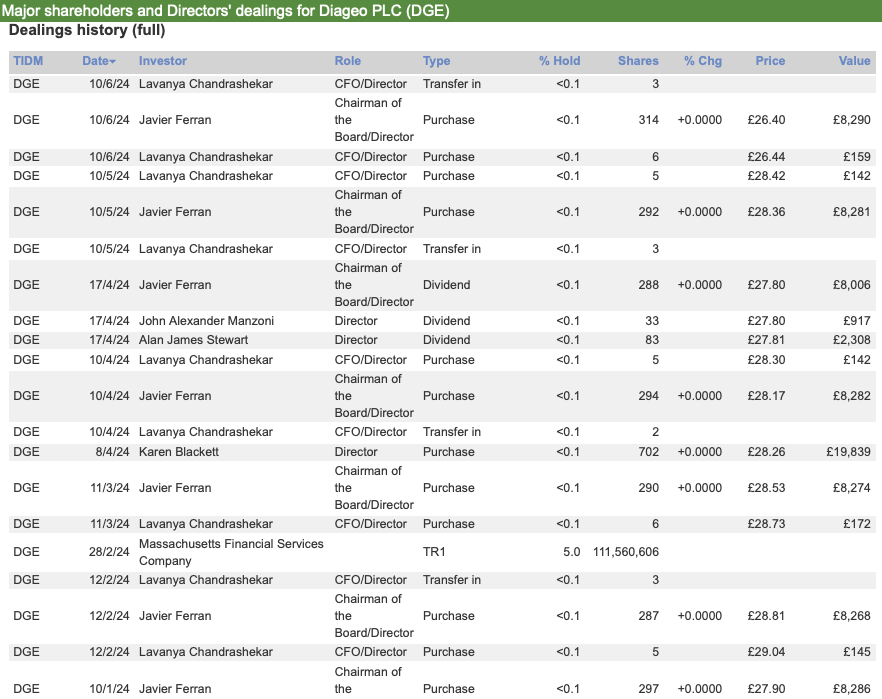

Are directors buying or selling shares?

You always want to see the directors of a company having a substantial stake in the business in order to align their interests with shareholders.

When a company’s share price has fallen a long way or is depressed, significant buying of shares by directors can be seen as a useful sign of confidence in the company’s prospects. Big director sales could be seen as a warning sign or red flag.

SharePad allows you to quickly and easily keep track of director shareholdings and dealings.

There have not been any big purchases or sales of shares by Diageo directors during 2024.

Do you have the right temperament to be a value investor?

Like lots of things in investing, value investing sounds quite straightforward and seems to have a lot going for it. However, it is easier said than done in practice.

This is because value investing usually involves buying shares in businesses that currently have something wrong with them which is why they have fallen in price. This means that there will be lots of reasons why you shouldn’t buy the shares.

However, if the valuation of the shares is cheap and you have done your homework and you think the shares can recover, then you will make money if your reasoning is proved right. To be successful at doing this, I can think of four essential questions that you need to answer:

- Can you cope if the share price falls further?

- Are you comfortable going against the crowd?

- Do you have the patience to wait for value to be realised?

- Do you have the discipline to stick to your strategy?

If the answer to any of these is no, then value investing will not be for you. You will need to find another way of investing that suits you better.

Next: Chapter 11 – Dividend investing

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.