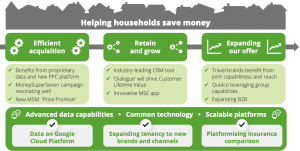

Weekly Market Commentary | 30/05/23 | AJB, ETP, HEAD | Inflation core

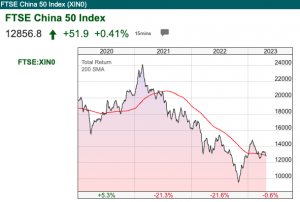

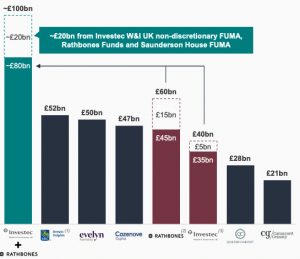

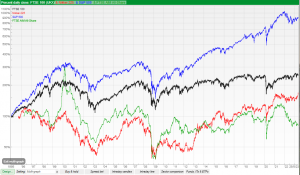

Bruce looks at trends in core inflation, plus observes first-hand that the UK economy has been stronger than many predicted. Companies covered AJB, ETP and HEAD. The FTSE 100 was down -1.7% in the last 5 days to 7,627. The Nasdaq100 was up +2.5% and the S&P 500 was flat. The price of gold was