Bruce asks the FinTwit community for some share ideas for 2023. Also looks at one retailer, SDRY, which could benefit from the recovery.

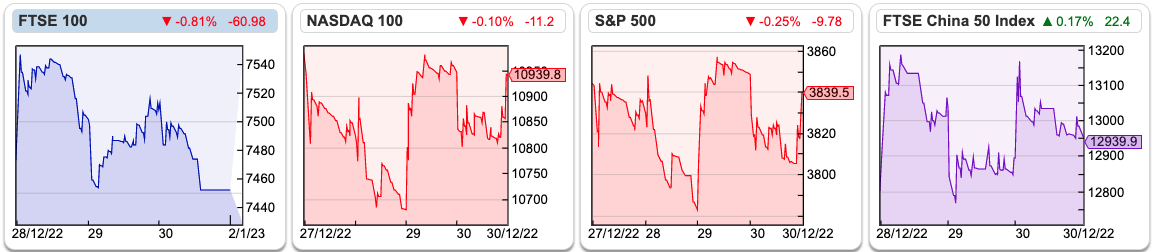

The Santa Rally failed to materialise with the FTSE 100 was down -1.4% in December (and flat for the whole year). The S&P500 was down -19% in 2022, and down -5.7% last month. The Nasdaq100 did even worse down -33% for the whole year and -8.8% last month. Both AIM and Nasdaq fell by a third, but AIM had a much better December down -2.6%.

Nevertheless, that is still worse than the Chinese indices, despite the country’s frequent lockdowns, then more recently chaotic reopening. The FTSE China 50 is down -22% for the year, but up +5.9% last month, which along with the Hang Seng (Hong Kong) were the best performing sectors in the last month.

Heating oil +40%, Coal +38% and Natural Gas +16% were the best-performing commodities last year. Bitcoin (which perhaps isn’t a commodity) was down -64% finishing the year at just over $16,000. Other commodities also sensitive to energy costs and water usage, were the worst performers: Steel -48%, Cotton -27% and Copper -14%. The latter is often used as a proxy for economic activity and is required in Electric Vehicles. Brent Crude finished the year up +7% at $83 per barrel, which seems remarkable given Putin’s invasion of Ukraine.

Sector performance

The 3 best performing FTSE 350 sectors of 2022 year were 1) Oil, Gas & Coal +42% 2) Healthcare +33%. Then there was a tie for third place between Industrial Metals and Mining +23% and Aerospace & Defence also +23%. Defence is an obvious beneficiary of the war in Ukraine, but interesting that it has tied with the Industrial Metals sector despite China being in lockdown for most of the year. That contrasts with Precious Metals Miners -43% which was the third worst performing sector, beating only Household Goods and Construction (which contains housebuilders) -44% and Autos and Autoparts -59%.

Below is a sector chart, using Sharepad’s “Multi-graph” feature which compares industrial miners to precious metals miners over the last decade. Up until 2016, these two sectors seemed to broadly track each other, but with industrial miners showing greater deviation (higher highs, but lower lows). Since the vaccine rally industrial miners have been very strong, while precious metals miners have sold off.

I wouldn’t have expected gold and platinum miners to do so badly in a year of global instability and rising inflation expectations. Gold is still below its $2000 an-ounce peak in mid-2020, but is now up +12% since the start of November to finish the year at $1813 per ounce. Similarly, the price of Platinum is up c. +10% in the last two months to finish 2022 at $1031 per ounce. Perhaps the precious metals sector is due for a rebound? I own Sylvania Platinum and also Capital Drilling, so I do hope so.

The AIM index was down -33%, the same as the Nasdaq performance, suggesting the sell-off has been driven by sector and valuation concerns, rather than political or country-specific trends. Within AIM, the Utilities were the best-performing sector +6%, the only sector to make a positive return. Retail was the worst-performing sector -61%. On the positive side SHOE doubled, but the likes of MMAG, ITS, WINE and BOO were all down between -70% and -86%.

Ideas for 2023

There wasn’t much news from investable shares over the holiday season, apart from Superdry, which I cover below. Rather than write up Argo Blockchain and Harland & Wolff’s profit warning, I’ve asked a few people on Twitter for their picks for 2023. These are just ideas, to provoke some thoughts and are not meant to be a substitute for using Sharepad to research stocks and doing your own thinking. The one-year time horizon is rather contrived; I think most investors would have a time horizon of 3-5 years (or longer), unless you are Michael Taylor, who has a much shorter time horizon than a year. So with that in mind, here are the ideas of three people I follow on Twitter.

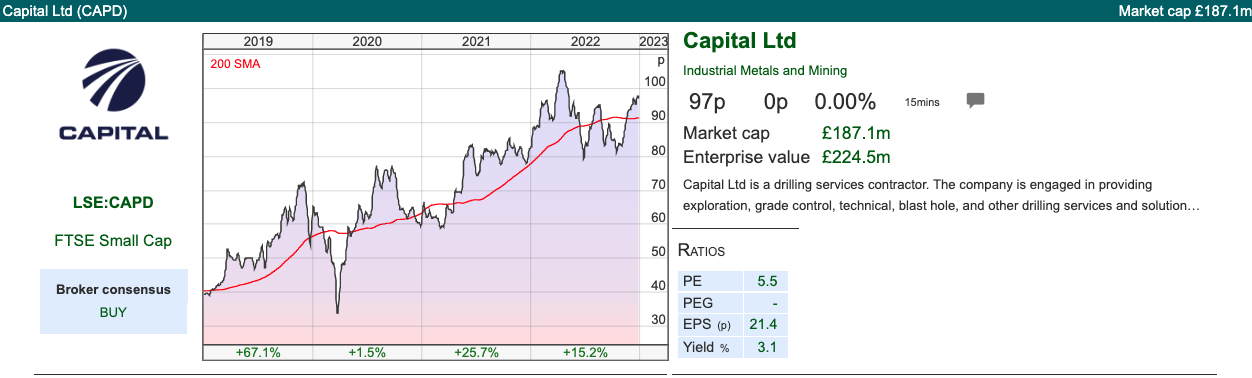

First, Mark Simpson suggested Capital Ltd, the African mining services provider of rigs and other services for gold miners. I last wrote about CAPD here. Mark points out that there are low multiple (cheap) stocks and more expensive growth and momentum stocks, but it is rare to find a stock that is on 5x PER Dec 2023F that is also trading well. I agree with him and have been buying CAPD throughout the year.

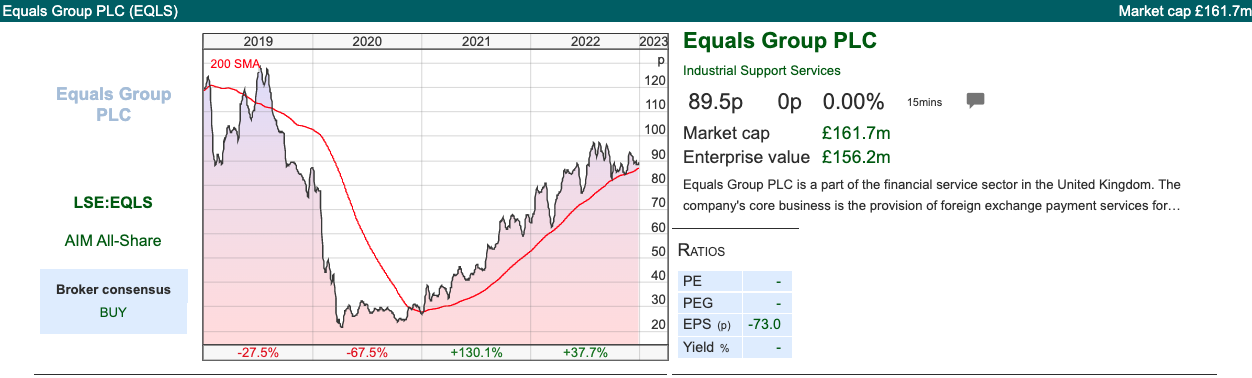

Next comes Gordon, aka Glasshalfull, who has taken an extended break from Twitter (wise man) but was kind enough to reply to my message. He suggested Equals, the forex currency trader, which I wrote about here.

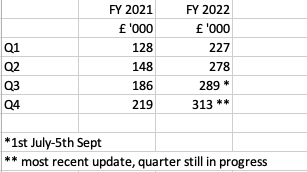

Gordon notes the 5 earnings upgrades through 2022, and points to an EQLS December trading update where revenue per day has climbed to £313K per day, implying further upward pressure on numbers.

Other suggestions he mentioned are Spectra Systems (SPSY), Zoo Digital (ZOO) & Mears Group (MER). I wrote about Spectra here and Zoo here, but I don’t own any of his picks. I’ll make a note to keep an eye for the next Mears announcement.

Finally, Carcossa, who is also a fan of Equals gave me a list of stocks he thought could do well, some of which he owns, but that he rejected for one reason or another.

I have edited his words slightly for context and clarity: IEnergizer (IBPO) metrics look good, but CEO Anil Aggarwal, owns 80% of the company. The shares may do well, he says, but could be beyond most people’s risk tolerance. Argentex (AGFX) is too similar to Equals (EQLS) so he rejects that. He’s positive on Jersey Oil & Gas (JOG) but it is a resource share which many readers will avoid. Similarly, Ferrexpo (FXPO) the Ukrainian-based Iron Ore producer could be an interesting opportunity if/how the Ukrainian war is resolved. He likes Games Workshop (GAW) but thinks it is early days for the recently announced TV/Movie agreement, so perhaps a 2024 pick rather than this year. He’s owned Anexo Group (ANX) since 2021. Seems extraordinarily under-priced in his view, but he says that there’s always a nagging feeling when you have a value stock, that you’ve overlooked something and the shares are cheap for a reason.

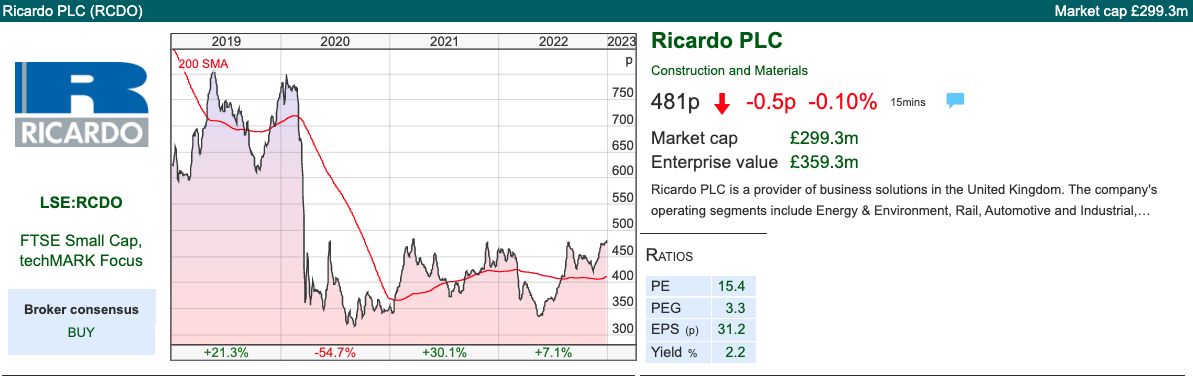

That leaves him with Ricardo (RCDO), founded in 1916 to build tank engines, which I hadn’t come across before. He says the investment case is based on a change in strategy to become a leading environmental and energy transition consultancy over the next five years. Very diversified customer base. Targeting a doubling of operating profit over the five years to FY 2027F. M&A activity planned. Capital Markets Day Presentation May 2022 here.

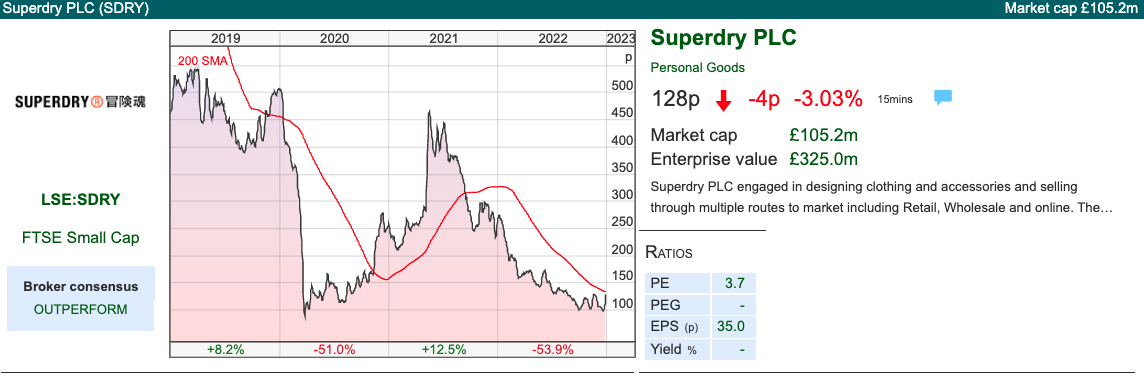

Below I look at Superdry’s RNS just before Christmas, with a new auditor and loan facility in place, this looks like it could do very well at some point. There’s always a chance that they disappoint versus guidance, with consumer disposable income under pressure through 2023. However, unlike ASOS and Boohoo, SDRY has already had a torrid three years between Apr 2019-Apr 2021. I think it is well-placed for a recovery.

Superdry trading update end Oct

This retailer with an April year end announced that it had i) appointed a new auditor (called RSM) after the previous auditor (Deloitte) had resigned after flagging weak financial controls a couple of years in a row ii) agreed an up to £80m 3 year loan facility with Bantry Bay, at SONIA plus 7.5% (ie c. 11-12%) iii) group revenue was up +3.6% to end of October. That compares to +7% for the 22-week period to the beginning of October, implying a sharp slowdown in the final month of their H1.

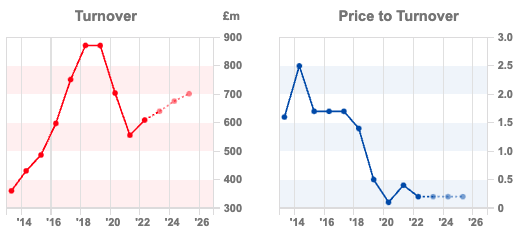

The shares reacted by rising +16% in relief on the day of the announcement. I took a starter position in the shares a couple of months ago, but didn’t follow up with further buying as I wanted to see how trading goes around the key Christmas period and in the January sales (and how much discounting they were doing to sell stock). There’s already been a -30% decline from peak revenue of £871m FY Apr 2019, so I’m hoping that after revenue declines of the last 3 years, this is more a stock-specific recovery story than a play on consumer spending.

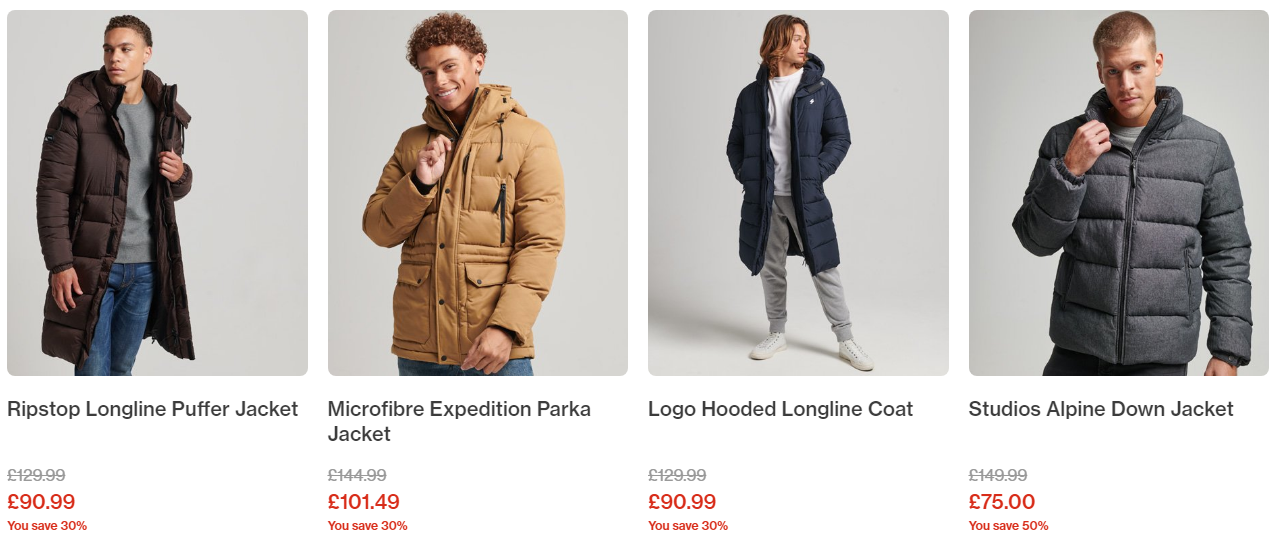

The trading update is only to the end of Oct, we have to read between the lines to see how well current trading is going. Jules Dunkerton, in the CEO’s commentary refers to unseasonably warm weather in October and early November, which would not have been helpful for jacket sails. As an aside, I’ve always thought it odd that retail analysts pay such close attention to the weather. In one sense the weather should be irrelevant because it doesn’t affect the long-term prospects of a brand and it is the same for all retailers. However, retailers don’t want to be stuck with a high level of unsold inventory and be forced to discount stock heavily in order to move their merchandise. So there’s a real knack to managing inventory with half an eye on the weather and buyer behaviour. Warm weather in October has come in a year when consumer incomes were already under pressure. The week before Christmas I went on to the SDRY website and found some hefty 30-50% discounts on the jackets already being offered.

Out of curiosity I also visited the German website, https://www.superdry.de/sale/herren/alles-anzeigen and there seemed to be more jackets that were discounted -70%. I thought that I was going to pick up a bargain, then discovered that the jackets that I liked the look of were only available in XXL size, which would be far too big for me. An example of a value investor thinking he’s spotted a bargain, only to discover that he’s overlooked something.

The RNS goes on to say H2 (ie November-April) has seen an encouraging start with SDRY’s biggest-ever week for Ecommerce orders driven by record levels of jacket sales over the Black Friday period (late November) followed by good momentum through the cold weather in December. That sounds upbeat, but we don’t know the level of discounting to achieve that momentum.

For context, Ecommerce was a quarter of FY 2002 revenue and 29% of gross profit. That compares to Stores and Wholesale which were both 37% of group revenue, though the gross margins on Wholesale are much lower. Revenues at the latter were down -5.2% in H1 to end of October, and margins were down sharply in the division too. As of 20th December, the group had reduced net debt to £13m, versus £39m on the 1st of October.

Valuation: Liberum, their broker, reduced estimated profit by 35% from £16.2m to £10.4m for FY Apr 2023F. Like SDI Group a couple of weeks ago, I see this as another example of an upbeat RNS followed by a broker note with an EPS downgrade. Sharepad has the shares trading on 11x Apr 2023F dropping to 6x Apr 2025F in two years’ time. On a price/sales basis, they’re on 0.2x. That seems to me an attractive valuation but not without risk.

Opinion: My feeling is that SDRY will pull through and this could be a very strong performer if/when they turn things around. The Sunday Times said a couple of weeks ago that Jules Dunkerton, who owns 23.9%, was frustrated with the ‘super-cheap’ valuation and was considering taking the group private. The only problem with this is that the Chief Exec/founder actually has more control over his own destiny as a public company, rather than making a Faustian pact with Private Equity.

Although I use Sharepad as a starting point to look at historic profitability and valuation, in these uncertain situations historic numbers can only tell you so much. Instead, it can be useful for investors to visit the stores and judge with their own eyes how things are going in real-time, and maybe even buying a bargain-priced jacket before acquiring the discounted shares.

Notes

The author owns shares in Superdry, Argentex, Capital Ltd and other shares mentioned. I have not verified the track records or the current investments of other investors on Twitter. Companies mentioned may not suit your risk appetite, so please apply common sense and use Sharepad, company websites and presentations to explore ideas.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 03/01/23 | SDRY | Ideas for 2023

Bruce asks the FinTwit community for some share ideas for 2023. Also looks at one retailer, SDRY, which could benefit from the recovery.

The Santa Rally failed to materialise with the FTSE 100 was down -1.4% in December (and flat for the whole year). The S&P500 was down -19% in 2022, and down -5.7% last month. The Nasdaq100 did even worse down -33% for the whole year and -8.8% last month. Both AIM and Nasdaq fell by a third, but AIM had a much better December down -2.6%.

Nevertheless, that is still worse than the Chinese indices, despite the country’s frequent lockdowns, then more recently chaotic reopening. The FTSE China 50 is down -22% for the year, but up +5.9% last month, which along with the Hang Seng (Hong Kong) were the best performing sectors in the last month.

Heating oil +40%, Coal +38% and Natural Gas +16% were the best-performing commodities last year. Bitcoin (which perhaps isn’t a commodity) was down -64% finishing the year at just over $16,000. Other commodities also sensitive to energy costs and water usage, were the worst performers: Steel -48%, Cotton -27% and Copper -14%. The latter is often used as a proxy for economic activity and is required in Electric Vehicles. Brent Crude finished the year up +7% at $83 per barrel, which seems remarkable given Putin’s invasion of Ukraine.

Sector performance

The 3 best performing FTSE 350 sectors of 2022 year were 1) Oil, Gas & Coal +42% 2) Healthcare +33%. Then there was a tie for third place between Industrial Metals and Mining +23% and Aerospace & Defence also +23%. Defence is an obvious beneficiary of the war in Ukraine, but interesting that it has tied with the Industrial Metals sector despite China being in lockdown for most of the year. That contrasts with Precious Metals Miners -43% which was the third worst performing sector, beating only Household Goods and Construction (which contains housebuilders) -44% and Autos and Autoparts -59%.

Below is a sector chart, using Sharepad’s “Multi-graph” feature which compares industrial miners to precious metals miners over the last decade. Up until 2016, these two sectors seemed to broadly track each other, but with industrial miners showing greater deviation (higher highs, but lower lows). Since the vaccine rally industrial miners have been very strong, while precious metals miners have sold off.

I wouldn’t have expected gold and platinum miners to do so badly in a year of global instability and rising inflation expectations. Gold is still below its $2000 an-ounce peak in mid-2020, but is now up +12% since the start of November to finish the year at $1813 per ounce. Similarly, the price of Platinum is up c. +10% in the last two months to finish 2022 at $1031 per ounce. Perhaps the precious metals sector is due for a rebound? I own Sylvania Platinum and also Capital Drilling, so I do hope so.

The AIM index was down -33%, the same as the Nasdaq performance, suggesting the sell-off has been driven by sector and valuation concerns, rather than political or country-specific trends. Within AIM, the Utilities were the best-performing sector +6%, the only sector to make a positive return. Retail was the worst-performing sector -61%. On the positive side SHOE doubled, but the likes of MMAG, ITS, WINE and BOO were all down between -70% and -86%.

Ideas for 2023

There wasn’t much news from investable shares over the holiday season, apart from Superdry, which I cover below. Rather than write up Argo Blockchain and Harland & Wolff’s profit warning, I’ve asked a few people on Twitter for their picks for 2023. These are just ideas, to provoke some thoughts and are not meant to be a substitute for using Sharepad to research stocks and doing your own thinking. The one-year time horizon is rather contrived; I think most investors would have a time horizon of 3-5 years (or longer), unless you are Michael Taylor, who has a much shorter time horizon than a year. So with that in mind, here are the ideas of three people I follow on Twitter.

First, Mark Simpson suggested Capital Ltd, the African mining services provider of rigs and other services for gold miners. I last wrote about CAPD here. Mark points out that there are low multiple (cheap) stocks and more expensive growth and momentum stocks, but it is rare to find a stock that is on 5x PER Dec 2023F that is also trading well. I agree with him and have been buying CAPD throughout the year.

Next comes Gordon, aka Glasshalfull, who has taken an extended break from Twitter (wise man) but was kind enough to reply to my message. He suggested Equals, the forex currency trader, which I wrote about here.

Gordon notes the 5 earnings upgrades through 2022, and points to an EQLS December trading update where revenue per day has climbed to £313K per day, implying further upward pressure on numbers.

Other suggestions he mentioned are Spectra Systems (SPSY), Zoo Digital (ZOO) & Mears Group (MER). I wrote about Spectra here and Zoo here, but I don’t own any of his picks. I’ll make a note to keep an eye for the next Mears announcement.

Finally, Carcossa, who is also a fan of Equals gave me a list of stocks he thought could do well, some of which he owns, but that he rejected for one reason or another.

I have edited his words slightly for context and clarity: IEnergizer (IBPO) metrics look good, but CEO Anil Aggarwal, owns 80% of the company. The shares may do well, he says, but could be beyond most people’s risk tolerance. Argentex (AGFX) is too similar to Equals (EQLS) so he rejects that. He’s positive on Jersey Oil & Gas (JOG) but it is a resource share which many readers will avoid. Similarly, Ferrexpo (FXPO) the Ukrainian-based Iron Ore producer could be an interesting opportunity if/how the Ukrainian war is resolved. He likes Games Workshop (GAW) but thinks it is early days for the recently announced TV/Movie agreement, so perhaps a 2024 pick rather than this year. He’s owned Anexo Group (ANX) since 2021. Seems extraordinarily under-priced in his view, but he says that there’s always a nagging feeling when you have a value stock, that you’ve overlooked something and the shares are cheap for a reason.

That leaves him with Ricardo (RCDO), founded in 1916 to build tank engines, which I hadn’t come across before. He says the investment case is based on a change in strategy to become a leading environmental and energy transition consultancy over the next five years. Very diversified customer base. Targeting a doubling of operating profit over the five years to FY 2027F. M&A activity planned. Capital Markets Day Presentation May 2022 here.

Below I look at Superdry’s RNS just before Christmas, with a new auditor and loan facility in place, this looks like it could do very well at some point. There’s always a chance that they disappoint versus guidance, with consumer disposable income under pressure through 2023. However, unlike ASOS and Boohoo, SDRY has already had a torrid three years between Apr 2019-Apr 2021. I think it is well-placed for a recovery.

Superdry trading update end Oct

This retailer with an April year end announced that it had i) appointed a new auditor (called RSM) after the previous auditor (Deloitte) had resigned after flagging weak financial controls a couple of years in a row ii) agreed an up to £80m 3 year loan facility with Bantry Bay, at SONIA plus 7.5% (ie c. 11-12%) iii) group revenue was up +3.6% to end of October. That compares to +7% for the 22-week period to the beginning of October, implying a sharp slowdown in the final month of their H1.

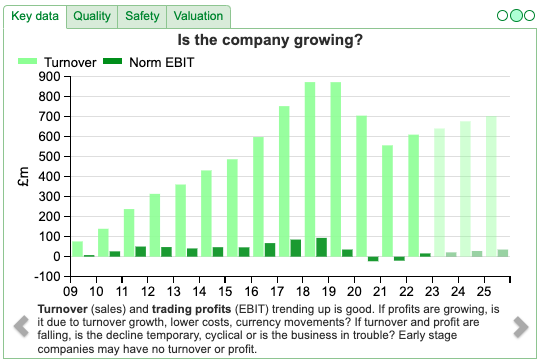

The shares reacted by rising +16% in relief on the day of the announcement. I took a starter position in the shares a couple of months ago, but didn’t follow up with further buying as I wanted to see how trading goes around the key Christmas period and in the January sales (and how much discounting they were doing to sell stock). There’s already been a -30% decline from peak revenue of £871m FY Apr 2019, so I’m hoping that after revenue declines of the last 3 years, this is more a stock-specific recovery story than a play on consumer spending.

The trading update is only to the end of Oct, we have to read between the lines to see how well current trading is going. Jules Dunkerton, in the CEO’s commentary refers to unseasonably warm weather in October and early November, which would not have been helpful for jacket sails. As an aside, I’ve always thought it odd that retail analysts pay such close attention to the weather. In one sense the weather should be irrelevant because it doesn’t affect the long-term prospects of a brand and it is the same for all retailers. However, retailers don’t want to be stuck with a high level of unsold inventory and be forced to discount stock heavily in order to move their merchandise. So there’s a real knack to managing inventory with half an eye on the weather and buyer behaviour. Warm weather in October has come in a year when consumer incomes were already under pressure. The week before Christmas I went on to the SDRY website and found some hefty 30-50% discounts on the jackets already being offered.

Out of curiosity I also visited the German website, https://www.superdry.de/sale/herren/alles-anzeigen and there seemed to be more jackets that were discounted -70%. I thought that I was going to pick up a bargain, then discovered that the jackets that I liked the look of were only available in XXL size, which would be far too big for me. An example of a value investor thinking he’s spotted a bargain, only to discover that he’s overlooked something.

The RNS goes on to say H2 (ie November-April) has seen an encouraging start with SDRY’s biggest-ever week for Ecommerce orders driven by record levels of jacket sales over the Black Friday period (late November) followed by good momentum through the cold weather in December. That sounds upbeat, but we don’t know the level of discounting to achieve that momentum.

For context, Ecommerce was a quarter of FY 2002 revenue and 29% of gross profit. That compares to Stores and Wholesale which were both 37% of group revenue, though the gross margins on Wholesale are much lower. Revenues at the latter were down -5.2% in H1 to end of October, and margins were down sharply in the division too. As of 20th December, the group had reduced net debt to £13m, versus £39m on the 1st of October.

Valuation: Liberum, their broker, reduced estimated profit by 35% from £16.2m to £10.4m for FY Apr 2023F. Like SDI Group a couple of weeks ago, I see this as another example of an upbeat RNS followed by a broker note with an EPS downgrade. Sharepad has the shares trading on 11x Apr 2023F dropping to 6x Apr 2025F in two years’ time. On a price/sales basis, they’re on 0.2x. That seems to me an attractive valuation but not without risk.

Opinion: My feeling is that SDRY will pull through and this could be a very strong performer if/when they turn things around. The Sunday Times said a couple of weeks ago that Jules Dunkerton, who owns 23.9%, was frustrated with the ‘super-cheap’ valuation and was considering taking the group private. The only problem with this is that the Chief Exec/founder actually has more control over his own destiny as a public company, rather than making a Faustian pact with Private Equity.

Although I use Sharepad as a starting point to look at historic profitability and valuation, in these uncertain situations historic numbers can only tell you so much. Instead, it can be useful for investors to visit the stores and judge with their own eyes how things are going in real-time, and maybe even buying a bargain-priced jacket before acquiring the discounted shares.

Notes

The author owns shares in Superdry, Argentex, Capital Ltd and other shares mentioned. I have not verified the track records or the current investments of other investors on Twitter. Companies mentioned may not suit your risk appetite, so please apply common sense and use Sharepad, company websites and presentations to explore ideas.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.