Richard enters 2020 with a cleaned-up SharePad setup primed to help him find companies developing competitive advantages. He expects it to make him a better long-term investor too.

Happy New Year! As a full time writer/investor the festive season is the only set time in the year when I fully shut down. Like an ancient computer, it takes a while to switch off and just as long to boot back up, a ritual in which my focus drifts away from analysing companies to thinking about whether I have analysed them well and finally to a restful place where I don’t think about analysing anything at all except perhaps the currant count in the Christmas pudding. Powering up is the same process in reverse. It’s a bit like going to sleep and waking up, except it takes nearly two weeks.

So here we are. What worked well in 2019? And which bright ideas have I quietly deleted from my SharePad setup? How’s SharePad going to help me be more efficient in 2020?

Read all about it

My starting point is last year’s version of this article. It unveiled a new three window layout for more efficient news reading, which I subsequently developed into an all singing-all-dancing five window layout.

I got a bit of a ribbing from readers for boasting about my laptop’s enormous screen resolution in the second article, and I am embarrassed to reveal my flirtation with proliferating windows is over. It ended not because multiple windows are a bad idea, if you have a big screen my advice is to go for it (just don’t boast about it), it ended because my new computing workhorse is a Microsoft Surface Go, which is about the size of a normally-sized iPad. Now I can walk into a coffee shop, or an AGM, and it no longer looks like I have come to plug my computer into the mainframe and steal state secrets. One reason I have been liberated is that I carry another device with me, which is even thinner and lighter. It’s a ReMarkable, an e-ink tablet for taking handwritten notes on. So I have SharePad, annual reports, and other sources of information on my computer screen while I make notes on my ReMarkable. I love it even more than the Surface Go. It’s changed my (working) life.

The good news is the standard one/two window layout is perfectly adequate for news reading. In fact it has improved now that SharePad has introduced a split screen news layout. Dare I say, it looks a bit like a three window layout (the split screen options are at the bottom of the news feed. I’ve highlighted them in yellow):

Some of my news reading habits have stood the test of time. I still check my portfolio news feeds last thing in the day, or if I’m really busy, last thing in the week, a luxury of being a long-term investor rather than a trader. And I still rely on my “Irrelevant news” filter to screen out all the routine announcements that I have no use for. In my final article of 2019 I upgraded the “Companies that speak my language” news filter and expect this to be a great help in 2020 as I continue to search for companies developing competitive advantages.

Most of my other news filters were ad-hoc experiments, and I have deleted them to keep things clean and simple.

Filtering data

Speaking of keeping things simple, back in 2018 I introduced the idea of a “base” filter, a filter that excludes shares that simply do not interest me. Because we are all different, your base filter will not be the same as mine, but the idea was to limit SharePad to showing us shares we are competent to analyse, which we can subsequently tune. My first stab was a sector filter, excluding whole industries because they are unstable, unsavoury or otherwise unsuitable for investment.

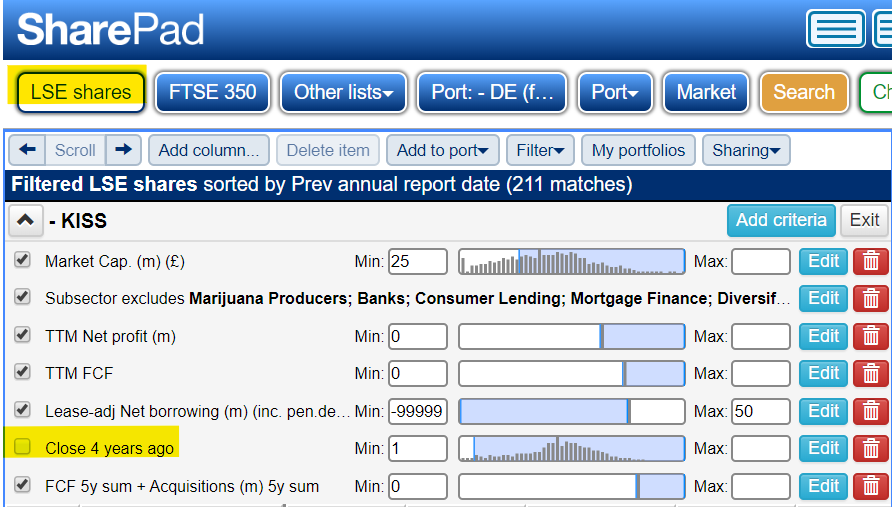

In 2019, I ran with the idea, developing it into a ”Keep it Simple” filter that also excludes a smorgasbord of sins: companies making losses and racking up debt, primarily, but also companies that have not been listed on the stockmarket long, and companies spending a lot on acquisitions.

This filter is most often my starting point in the quest to find the next share to research, but although it is good to focus I do not want to get stuck in a rut. Sometimes we should look at the wider opportunity set and because SharePad filters allow us to disable criteria by unchecking the boxes next to them, this is easily done.

In December, when I went in search of people-first businesses, I disabled the criterion that restricts the “Keep it Simple” filter to companies that have been listed for more than four years. Newly listed businesses sometimes come to market with their founders still in control, and since I associate a focus on employees with dynamic founders I didn’t want to miss them.

Continuing with the keeping things clean theme, I have deleted most of my other filters, except Fishing like Fundsmith.

Portfolios and groups

My strategy, boiled down, is to invest in companies when I can identify a competitive advantage in industries in which I have, or I am developing, expertise by dint of owning and analysing shares.

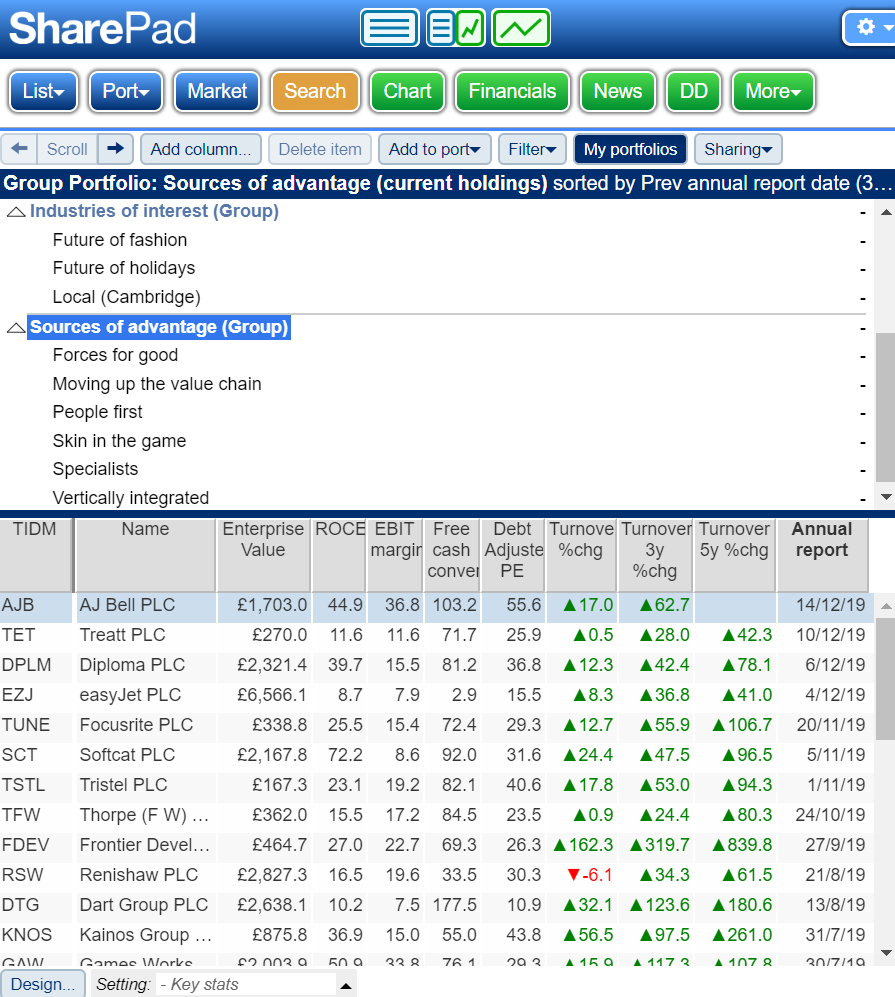

In 2020 I will continue staking out this territory by augmenting and honing two groups of watchlist that allow me to track shares through SharePad’s news and data feeds. I call them “Industries of interest” and “Sources of advantage”. Grouping watchlists in this way allows us to read the news and key stats for a group as a whole, or for a particular watchlist:

More watchlists will follow, but in 2019 I made a start with:

Future of fashion and vertically integrated companies

Killing two birds with one stone in this article, I created a portfolio of vertically integrated companies from a filter and added vertically integrated Burberry to the Future of fashion portfolio. The attraction of vertically integrated companies, business that control many of the capabilities required to bring their product or service to market, is that they are self reliant.

A fascination with Jet2holidays, owned by London listed Dart, has led me to consider holidays more widely. There’s a paucity of UK-listed holiday firms though, so to develop this portfolio I may have to look across the Atlantic, where the firms I actually use to book holidays, Expedia, Booking, and maybe one day soon, Airbnb, are listed.

My manor is Cambridge, but you can use the techniques in this article to find your local businesses too. They’re easier to research and somehow more satisfying.

Possibly the watchlist that excites me the most, it contains potential recruiting machines. Companies dedicated to recruiting and retaining staff to sustain their unique cultures in the expectation that happy staff means happy customers and happy customers means happy shareholders.

Incentives matter. The companies in this watchlist have owner managers whose interests should be aligned with minority shareholders.

One theme uniting the shares in the “Sources of advantage” group is harmony. I think we all know in our hearts a company can only prosper in the long-term if relations between its shareholders, managers, staff and customers are mutually beneficial.

Ideas I first aired here in 2019, like RM (part 1, part 2) and Bloomsbury Publishing (part 1, part 2) have turned into actual investments for me, my portfolios are reasonably well set up for the future (this is one way to check), and harmony seems like a fitting aspiration for the 2020’s.

As I have reported elsewhere, 2019 was a good year for me investing-wise, and the 2010’s were a good decade, but I am far from complacent. A decade isn’t long in an investing lifetime.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.