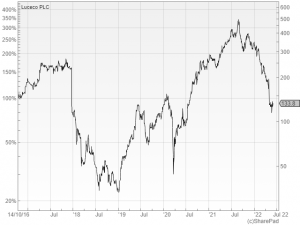

When the facts change…

Events at Luceco and Oxford Metrics may tell us more about the companies’ strategies, and whether they might make good long-term investments. Richard investigates. It is hard to believe Luceco’s share price is below the price it floated at in 2016, when turnover was 71% higher in the year to December 2021 than it was