Five strikes and you’re out

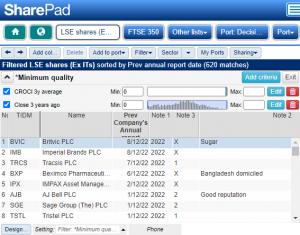

Richard employs some fuzzy logic to narrow the number of companies returned by his filter. A bit like we might do a set of press-ups every day, it is a routine to make him a stronger investor. While everybody is talking about the latest developments in artificial intelligence, getting computers to think more like humans,