Next – A closer look at its online business

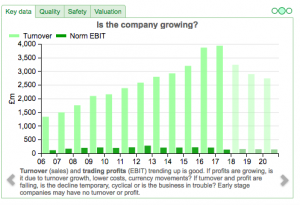

For many years Next has been a very profitable retailer of clothes and homewares. Like most of its peers it has had to face up to the changing world of shopping that has led more people to buy stuff over the internet instead of from shops on the high streets or in retail parks. Profits