Dynamic 35: BlackRock World Mining Review

Investing in mining stocks is always a speculative exercise. Where are we in the cycle?

David Stevenson is an investment columnist for the Financial Times (the Adventurous Investor), Citywire and MoneyWeek. He’s also the author of the Adventurous Investor blog – www.adventurousinvestor.com – and is executive editor of ETF Stream – www.etfstream.com – and fintech news service AltFi – www.altfi.com.

I believe in keeping investing simple and I think that investment trusts are an ideal structure for private investors. Whatever your investment goal, be it long term capital growth, or income or even defensive strategies, there is likely to be an investment trust that will work for you over the long term. The key is picking the right trust or fund and the London market has a huge range. Having watched this sector – and invested in it – for over 20 years I think i have developed a fairly in depth understanding of which funds work, and why. My articles on investment trusts will hopefully help guide private investors in the right direction.

Investing in mining stocks is always a speculative exercise. Where are we in the cycle?

In these articles about funds, I have tended to steer clear of the many, many alternative funds listed on the London market. That is not because these funds are not interesting – many of them are – but because I felt their business model hasn’t entirely been proved.

Private equity fund in transition – new addition to Dynamic 35 Listed private equity funds have had a chequered record on the London Stock Exchange. On paper they are a great innovation, allowing private investors access to usually institutional grade alternative assets. Crucially they allow investors to put money to work in profitable, scaled up

Back in the middle of August I outlined two growth-oriented portfolios, comprising a gaggle of exchange traded funds. The first was a Global Trends portfolio, a collection of eight ETFs which aim to track a selection of key thematic big trends. To monitor performance, I established two live portfolios on the SharePad platform, with the

“While we have this euphoria it’s pretty hard to imagine the bubble breaking. But look at the data and you think this thing could go…” (Grantham, GMO, Dec 2020). “In every portfolio, you need to ask yourself what is going to be more relevant [in] five to 10 years versus today. The most interesting trend

Traditionally most investors tend to regard the division between developed markets (DM) and emerging markets (EM) as a simple divide. We all put more money in the DM but then try and make sure we have some, smaller exposure, to the broad gaggle of national markets which represents the developing world or EM for short.

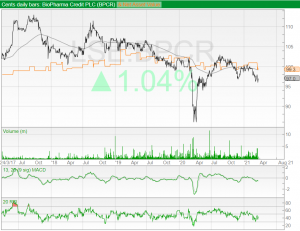

This week I have a very adventurous addition to my list of 35 Dynamic funds. I admit that it’s not without risk and its recent track record hasn’t been fab if I’m honest but I think the seeds for a rapid turnaround are being laid and if nothing else a future redemption opportunity might provide

A new addition to the Dynamic 35 Aurora Investment trust I wanted to start this article with an immediate declaration. I am a non-executive director at my new addition to the Dynamic 35, the Aurora investment trust. As a general rule I tend not to discuss any fund where I have some form of professional

I have a new addition to my Dynamic 35 list of investment trusts and closed end funds. It is called RTW Venture and it is a venture capital fund which invests in life sciences businesses – mainly in the biotech and MedTech space. Its key differentiator is that it invests in later stage private businesses

This week I am focusing not on my usual subject of investment trusts but switching attention to exchange traded funds or ETFs. These are a useful vehicle for investors, and I think they can easily sit alongside investment trusts. What do I mean by that? Let’s say for instance that you want to have exposure

I do not think it is unfair to say that over the last decade we have seen a powerful shift in sentiment towards utility stocks, arguably in a very negative direction. For much of the last few decades, private investors could not get enough of these boring stocks. They paid out a generous dividend, seem

The safe bet on infrastructure: INPP (International Public Partnerships) Over the next couple of articles, we’ll be adding two new funds to our Prudent 15 list, both in the broad infrastructure and utilities space. My next article will be on a fund that invests very broadly in the shares of other infrastructure and utility companies