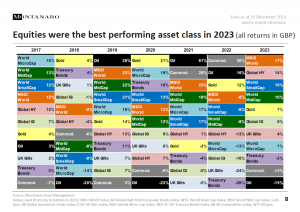

Monthly Fund Focus: Asset Class Idea, UK PLC Review, Leveraged Shares and Tech

In this month’s focus on funds, we take a quick look at asset class returns in 2023 courtesy of some wonderful heatmaps, we eavesdrop on a recent bank event at the state of UK PLC, and we examine an under-owned asset class that could be the verge of big things – local currency emerging markets