Updated: August 2024

Now that we’ve dealt with the basic format of an income statement it’s time to move on and show you how ShareScope turns those numbers into really useful information.

Knowing your way around an income statement is vital to understanding what makes a company tick. However, to get the most out of it you need to be able to crunch some numbers. As with balance sheets, These numbers are known as ratios and compare one number in the profit and loss account with another one.

Ratios can tell you a great deal about a company. The most important thing to remember with ratios is that they are mostly meaningless in isolation. To have any use you have to compare them with previous years or with a similar or competitor company.

As with the balance sheet, you don’t have to spend hours collecting numbers and punching numbers into a spreadsheet or calculator, ShareScope has done the hard work for you. If you want to, you can go back more than twenty years. This might be very useful if you want to find out how a company performed during a recession or a boom.

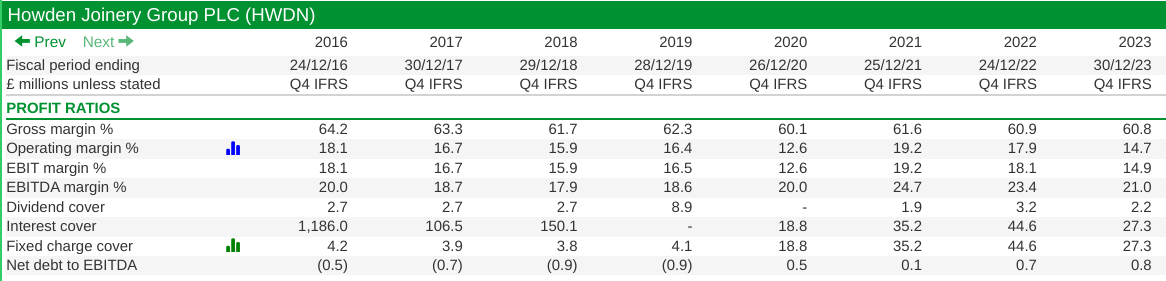

In this chapter, I’m going to talk about the key profit ratios that ShareScope calculates for you and mention a couple of others. The profit ratios for Howden Joinery are shown in the table below:

Profit margins

Profit margin tells you the amount of profit earned per £1 of sales expressed as a percentage.

Profit margin = Profits/Turnover x 100%

Now, as you will have seen in the previous chapter there are lots of different measures of profit: gross profit, operating profit, EBITDA, EBIT, pre-tax profit and post-tax profit. Profit margins are commonly calculated for the first four of these:

- Gross profit margin

- Operating profit margin

- EBITDA margin

- EBIT margin

The higher the profit margin number, the more profitable a company is. Many successful long-term investments have come from companies with high profit margins which is why they are highly sought after by investors. However, there are some cases where companies with low-profit margins that sell a lot of products can produce very good results.

Gross profit margin

This shows the amount of gross profit earned as a percentage of turnover expressed as a percentage

Gross profit margin = gross profit/turnover x 100%

In the case of Howden in 2023, its gross margin was 60.8%. This means that it made 60.8p of gross profit for every £1 of sales made. The other helpful way to understand gross margins is to take the 60.8 and take this away from 100 to get 39.2 This tells you that this is the equivalent of the company making something for 39.2 and selling it for 100.

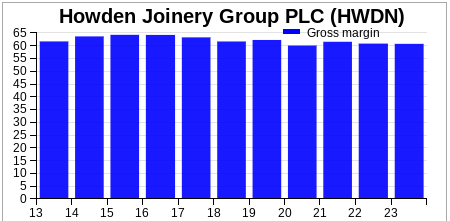

The most important thing to consider is the trend in the gross profit margin. The chart above shows that Howden has had very high and consistent gross profit margins which is always a welcome sign. The margins are slightly lower than the company was earning a few years ago.

It’s always a good idea to try and understand how and why a ratio has changed over time. That’s the great thing about ratios, they get you to ask questions about the company you are analysing and this can only help to make you a better investor.

A company’s annual report will contain a financial report and may tell you why margins have changed. Gross profit margins can change for a number of reasons such as a change to selling prices or a change in sales mix between higher and lower margin products.

Just a quick point on gross profit margins. It may or may not be a useful ratio to calculate. Why do I say this?

As I said in the previous chapter, it all depends on how a company decides to calculate its gross profit which is all down to what it classifies as the cost of goods sold. Different companies will have different approaches which makes comparisons between companies difficult.

Operating and EBIT margins

This shows the amount of operating/trading profit or EBIT a company has made as a percentage of turnover.

Operating margin = Operating profit/Turnover x 100%

EBIT margin = EBIT/Turnover x 100%

I’ll concentrate on EBIT margins here as this is the measure that most professional investors will tend to pay the closest attention to and is therefore probably the most relevant to you.

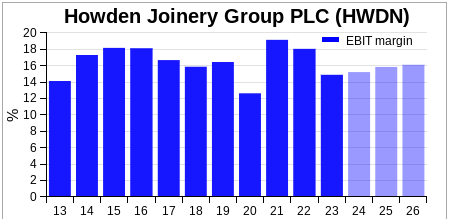

In 2023, Howden’s EBIT margin was 14.9% down from 18.1% in 2022. Always look at the trend and you can see if the EBIT or operating margin has been on a downward or upwards trend. Find out why this has been happening.

Howden’s EBIT margins have been operating in a range over the last decade and have fallen some way from their peak in 2021. ShareScope helpfully provides analysts’ forecasts of profit margins which are shown by the lighter bars in the chart. Howden’s EBIT margins are expected to improve year-on-year which is an encouraging sign.

Operating and EBIT margins are a much more useful ratio to compare companies with than gross margins. That’s because operating costs -which include the cost of sales included in gross profit – are likely to be calculated in the same way.

What do profit margins tell us?

Crunching numbers is all well and good but they have to be meaningful and increase our understanding of a company. You need to start thinking why the numbers are what they are.

You might think that high-profit margins (turning a large chunk of turnover into profit) is a good sign. Often it can be. However, this might not always be the case.

High-profit margins may be a sign that a company is overcharging its customers. It may lose customers or attract new competition which will result in the company making less money in the future.

Having said that, if you can find a company that has been earning consistently high-profit margins for a long period of time (I’m talking ten years or more here) then you may have come across a very good company.

It could be a sign that the company has something – such as a brand patent or cost advantage – that stops others competing with it effectively. These are the types of companies that legendary investor Warren Buffett likes to buy.

On the other hand, you might think that low-profit margins are a bad sign. Again, this might be the right conclusion to make but something else might be going on.

For example, a company may be trying to break into a market by keeping its prices low and looking to make money by selling lots of goods (Amazon is a good example of this). Or a company may be spending a lot of money developing a new product but hasn’t started selling it yet. Another possibility is that profits are temporarily depressed and could be about to recover.

The bottom line here is that numbers can tell you a lot but they don’t tell you the whole story. As well as crunching numbers in ShareScope it’s probably a good idea to pay close attention to what the company’s management has said about the financial performance. You can find most of what you are looking for by searching for news items in ShareScope under the “news” tab.

What you’ll find is that different companies in different industries will have different profit margins. Comparing the profit margins of a food retailer with an engineering company will tell you something but may not be a meaningful comparison. It is best to compare companies in the same line of business.

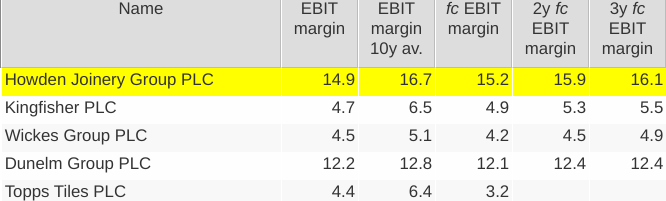

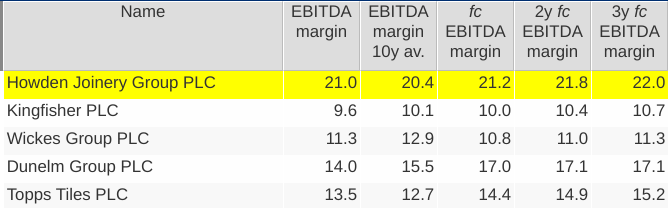

You can do this in ShareScope. The table below shows Howden’s EBIT margins compared with similar companies in the FTSE All Share index.

Source: ShareScope

We can see that Howden has consistently been the most profitable company in its sector based on its EBIT margins and is expected to stay that way based on forecast margins over the next three years. Its current margin is close to its 10-year average which is a sign of consistency.

The same story is true if we look at EBITDA margins.

Source: ShareScope

Interest cover

A company with very high debt (or borrowings) can be a big issue for shareholders. The reasoning for this is quite simple. Lenders get paid their interest before shareholders can be paid any dividends. The more interest on debt that has to be paid the more at risk your dividend payment tends to be.

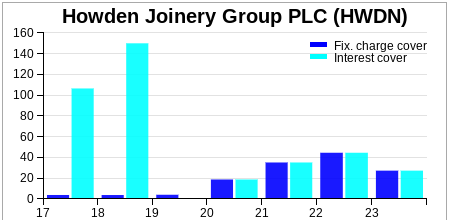

That’s why it’s a good idea to look at how easily a company can pay its interest bill out of its profits. You can do this by calculating a ratio known as interest cover. This looks at how many times a company’s EBIT (earnings before interest and tax) covers the interest bill.

Interest cover = EBIT/Interest payable

Generally speaking, the higher the level of interest cover, the better. Based on its 2023 EBIT, Howden had interest cover of over 27 times which suggests that paying its lenders and its rents was not a problem for it.

Low levels of interest cover might not mean that there is trouble ahead but that isn’t always the case.

. Regulated utility companies – such as water, electricity and gas networks – can have interest cover ratios as low as 2-3 times because they finance themselves with a lot of debt. This is not necessarily a problem as their sales and profits don’t tend to fluctuate too much and so this level of interest cover should not automatically be a cause for concern.

However, if you are looking at the shares of a company whose profits tend to move up and down with the general economy – engineering or construction companies for example – then a low level of interest cover might be a problem. It can be an early sign of trouble, which, if things get really bad, can mean a cut in dividend payments and shareholders being asked to put up more money to keep the company going.

Fixed charge cover

Fixed charge cover looks at how easily a company can pay its fixed charges such as interest on debts and rental expenses. It was very underused by investors but is extremely useful in spotting companies that might get into trouble.

It is similar to interest cover but takes into account the ability of a company to pay any rental expenses as well as interest on borrowings. However, since a change in accounting standards, the interest on rental expenses is now included in the calculation of interest cover.

The chart below shows that Howden’s fixed charge cover and interest cover values used to be very different but are now the same number.

Interest payments and rental expenses are known as fixed charges – they stay the same regardless of the level of turnover and have to be paid. Lots of companies decide to rent rather than own assets. Examples of this are retailers who rent their stores, train companies who rent access to tracks and stations and their rolling stock and trucking companies who rent warehouses and trucks.

Fixed charge cover is now largely redundant for income statements after 2020 but it is still useful for looking at how strong a company’s financial position was before then.

Rental expenses (also known as operating leases) used to be deducted in the calculation of EBIT, but they are now split between a depreciation charge which reduces EBIT and an interest charge which doesn’t. To calculate fixed charge cover you had to add back the total rental expense to EBIT to get the profits figure that is used to pay them and the interest on borrowings.

Fixed charge cover = (EBIT + rental expenses)/(rental expense + Interest expense)

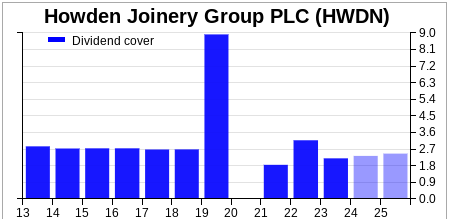

Dividend cover

This looks at how many times a company’s post-tax profits (or earnings) cover the annual dividend paid to shareholders. It is used to give an indication of how likely it is that the existing dividend payment will be maintained – how safe it is.

It is calculated by dividing the company’s earnings per share (EPS) by its dividend per share (DPS).

Dividend cover = EPS/DPS

You might be wondering which EPS figure ShareScope uses to calculate dividend cover. It uses the fully diluted normalised continuous EPS figure as this is deemed to be the best measure of underlying profits to pay the dividend.

In 2023, Howden’s dividend cover was 2.2 times, indicating that its dividend per share of 21.0p was relatively safe.

Clearly, the higher the dividend cover, the safer a dividend might appear to be. I’ll talk more about how you can use some other tools in ShareScope to test dividend safety in a later chapter.

If a company pays out a dividend per share which is greater than its earnings per share it is said to be paying an uncovered dividend.

You might want to consider another way of looking at dividend cover. If you take the reciprocal of it (one divided by dividend cover) it will tell you what percentage of earnings is being paid out as a dividend – otherwise known as the dividend payout ratio. You can also just divide DPS by EPS. You can find this ratio calculated in ShareScope.

Dividend payout ratio = 1/Dividend cover x 100% or DPS/EPS

In Howden’s case, the payout ratio in 2023 was 45.5%.

Companies with low payout ratios (high dividend cover) tend to have safer dividends with more potential to increase them in the future. A low payout ratio means that a company is retaining most of its profits within the business for future growth. Growth companies tend to have low dividend payout ratios and high retention ratios. You can calculate the retention ratio as follows:

Retention ratio = 1-Payout ratio.

Howden’s retention ratio in 2023 was 54.5%

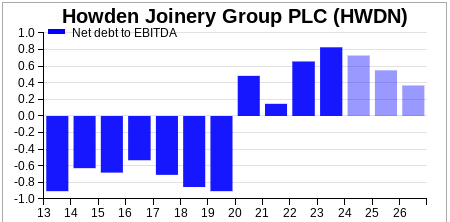

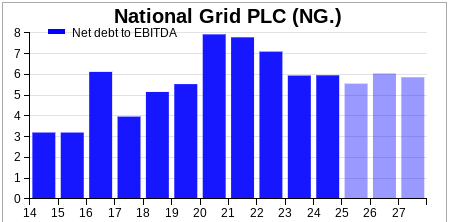

Net debt to EBITDA

Net debt to EBITDA is not a measure of profitability. It is a commonly used measure of a company’s financial strength using the profit measure EBITDA. It compares the size of a company’s net debt with its EBITDA.

Both net debt and EBITDA have their limitations and critics, but the ratio is commonly used by credit rating agencies to pass opinions on the safety or otherwise of a company’s debt to investors.

The ratio is also used as a condition in loan agreements. If the condition is broken, a company may have to pay a higher rate of interest and suffer lower profits as a result.

As a rough rule of thumb, non-financial companies don’t tend to generate causes for concern if their net debt to EBITDA ratio is below 3 times. The lower the ratio, the stronger the financial position of a company is deemed to be.

Howden scores well here with a net debt to EBITDA ratio of less than 1 and where the ratio is expected to keep on falling over the next three years.

Note that this ratio was negative before 2020. This was because obligations to pay rent on leased assets such as stores and vehicles were not classified as debt. Since 2020, they have and the value of future payments now goes on the balance sheet as debt.

Utility company National Grid is largely financed with debt and therefore has a much higher net debt to EBITDA ratio. The ratio has arguably been too high in recent times but has been coming down.

Next: Chapter 6 – The cash flow statement

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.