A difficult start to August seems to be driven by the Japanese carry-trade unwinding. Companies covered: DATA, LTG, CRPR.

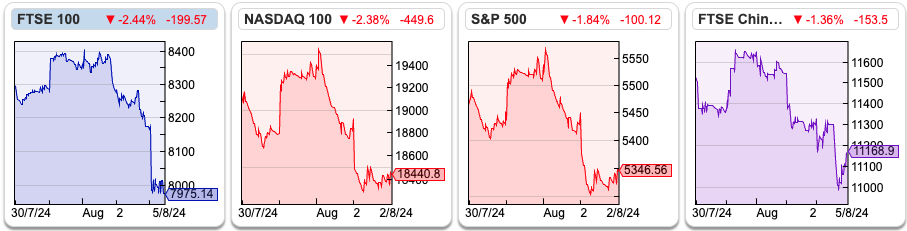

Markets sold off heavily on Monday. The FTSE 100 fell -3.6% in the last 5 days to 7,974. Meanwhile, the futures market suggested that US markets would start the week badly. The FT contained an article quoting Larry Fink of BlackRock complaining that investors were keeping too much money in cash ($6.1 trillion is held in money market funds). The same newspaper also had an article about Berkshire Hathaway sitting on $277bn of cash, with Buffett selling some of his Apple stake after the shares are up c. 8x since Berkshire first disclosed owning a stake in 2016.

The BoE cut interest rates 25bp to 5.00% last week. That was the first rate cut since March 2020 down to 0.10% in response to market panic and Covid-19-related disruption. Sharepad shows that the 2-year fixed rate (UKTSY02), which will be the reference rate for 2-year fixed rate mortgages, has already anticipated the Central Bank’s move. The rate has fallen to 3.7% currently, down 165bp from its July peak last year.

The recent sell-off in markets has been attributed to the Bank of Japan raising interest rates and the carry trade (borrowing in Yen, financing speculative positions elsewhere) unwinding. Japan’s Topix index fell -12% on Monday, its worst day in 37 years. The index has given up all its gains for the year and is now down -6% YTD.

That said, I think that the UK markets looks more resilient than other indices, given how attractive valuations have become. This week I look at a special situation with Global Data H1 June results, following an unusual transaction, selling 40% of their Healthcare division to Private Equity. I also look at Learning Technologies and James Cropper’s results, both of these shares are down more than -70% over the past few years, but could now represent good value assuming no further deterioration.

Global Data H1 June Results

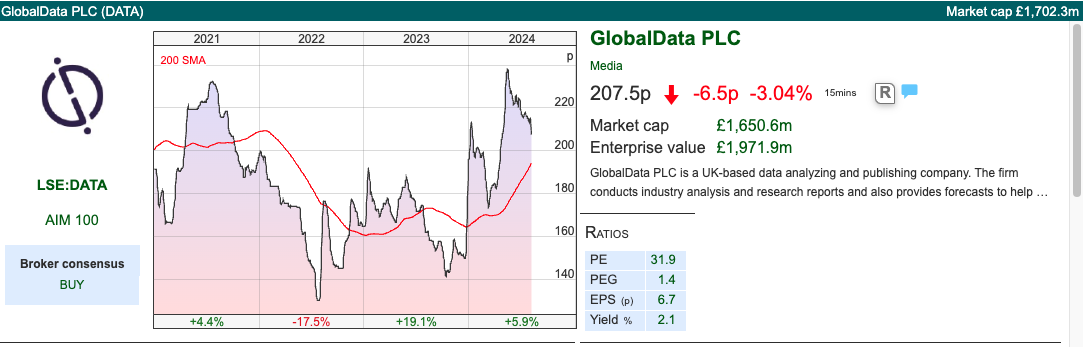

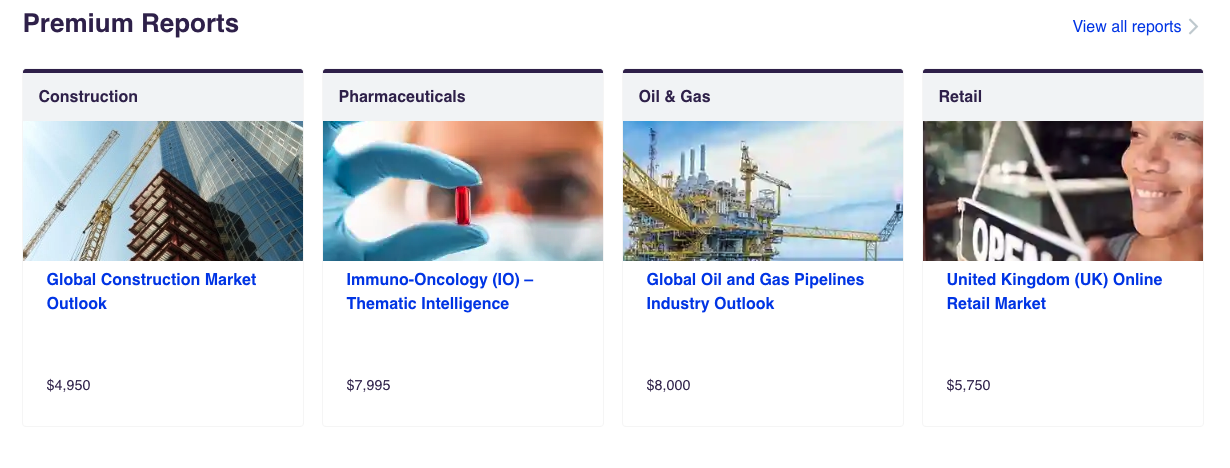

This business formed in 2015 when Progressive Digital Media bought Datamonitor and Verdict businesses from Informa. DATA sells industry and thematic reports for around $5 to $10K and with a market cap of £1.65bn, it’s one of the top 5 largest stocks on AIM. The original Datamonitor went from £1 per share to over £6 (or £500m market cap) when it was bought by Informa in 2007. The Datamonitor founder, Mike Danson, then set up a second company, Global Data in 2008 and went on to buy back parts of Datamonitor in 2015 from Informa. He currently owns 57.8% of DATA, and Liontrust is the next largest holder with just under 7%. His other interests include The New Statesman, Wigan Athletic Football Club and Wigan Warriors rugby league club, as well as the Danson Foundation. His very high share of insider ownership means that the business could be at risk of de-listing, so I can understand why investors might avoid DATA, but it strikes me that the founder is a very different personality to Tedi Sagi, who took Kape private at an attractive (for him) price. So I’m flagging the company as an interesting special situation.

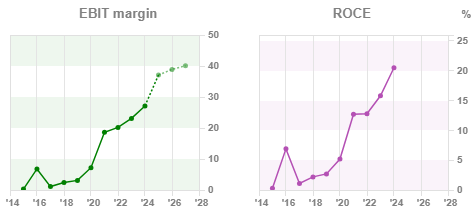

Results: H1 Jun 2024 revenue was up +2% to £140m, and underlying revenue growth was +5% with just under 80% recurring subscription revenue. H1 PBT was up +13% to £27m and net cash stood at £188m at the end of June. The company has launched a £10m buyback program, but the company will cut its dividend to allocate more capital to M&A.

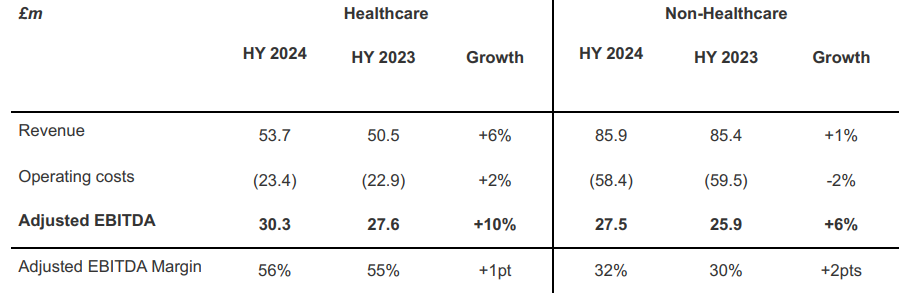

The net cash position is so strong because Global Data sold a 40% stake in their Healthcare business to Inflexion Private Equity, which completed in June and they received net cash proceeds of £434m. The transaction valued the whole Healthcare business at £1.1bn, or 22x the previous 12m EBITDA. When the transaction was first announced in December last year, DATA’s entire market cap was just £1.35bn, while the Healthcare division was 36% of group revenues. Below is a split of the business, showing that Healthcare’s adj EBITDA margin at 56% is roughly double that of the rest of the Group.

NB the Healthcare division remains fully consolidated with the accounting treatment leaving the group p&l unchanged, but with a deduction coming in future through the minority interest line below statutory PBT. Thus there will be a hit to EPS estimates, but not revenue or PBT lines in future.

NB the Healthcare division remains fully consolidated with the accounting treatment leaving the group p&l unchanged, but with a deduction coming in future through the minority interest line below statutory PBT. Thus there will be a hit to EPS estimates, but not revenue or PBT lines in future.

Background: Around 20 years ago I had a job interview with the Chief Exec Mike Danson after Credit Suisse made me redundant. He was looking to see what opportunities there were following the Spitzer settlement when 10 US investment banks paid $1.4bn to compensate for conflicts of interest between investment banking and equity research. Some of that $1.4bn was earmarked to provide independent research and Mike Danson thought he might have spotted an opportunity to benefit. I actually talked him out of the idea (and myself out of a job) because professional fund managers weren’t interested in independent research, they understood the conflicts of interest and preferred to reward equity research analysts in banks for “corporate access” (ie being close to company management). Some of the Spitzer money went to the US rating agencies like S&P, which of course had their own conflicts of interest exposed during the 2007-9 financial crisis. Global Data does offer equity research on their website, but there’s no mention of the business in the company’s 2023 Annual Report, suggesting my analysis was correct and professional fund managers do not contribute much to group revenue. Anyhow, I was impressed with Mike Danson’s entrepreneurial spirit, but also that he was prepared to listen to someone in their 20s pouring cold water on his idea.

Outlook: FY Dec 2024F results are “in line” with expectations, without saying what those expectations are. Annoyingly management publish adj EBITDA consensus of £121m on their website, but no EPS forecast. Sharepad shows EPS FY Dec 2024F of 8.5p, rising to 11p in two years time. Management have a medium-term target of high single-digit or double-digit revenue growth, supplemented by M&A to surpass £500m revenue in three years time (£273m reported FY Dec 2023).

Valuation: Assuming the whole Healthcare business is worth £1.1bn (18x EV/EBITDA), and deducting that from the current market cap of £1.65bn, means that the rest of the business is worth 9x EV/EBITDA. However, the multiple drops to 6x if we deduct the net cash. It looks like most of the cash is going to buy other businesses, rather than being returned to shareholders, I’m simply flagging that the rest of the business trades on a significant discount to what PE were prepared to pay for the Healthcare division.

Opinion: It’s natural to suppose that Private Equity have cherry-picked the business with the deepest moat and highest margins, but nevertheless this looks like an interesting situation, particularly if the Chief Exec can reinvest the proceeds to recreate something valuable. My feeling is that eventually the whole Healthcare business will likely be sold to the PE firm, so investors need to spend time gaining a good understanding of what they will be left with. It could be worth backing the founder to go on and create something valuable from the rump. Ironically given the background I mentioned above, I think that the investment case is one which would benefit from having corporate access to management to hear the story first-hand.

Learning Technologies H1 June Trading Update

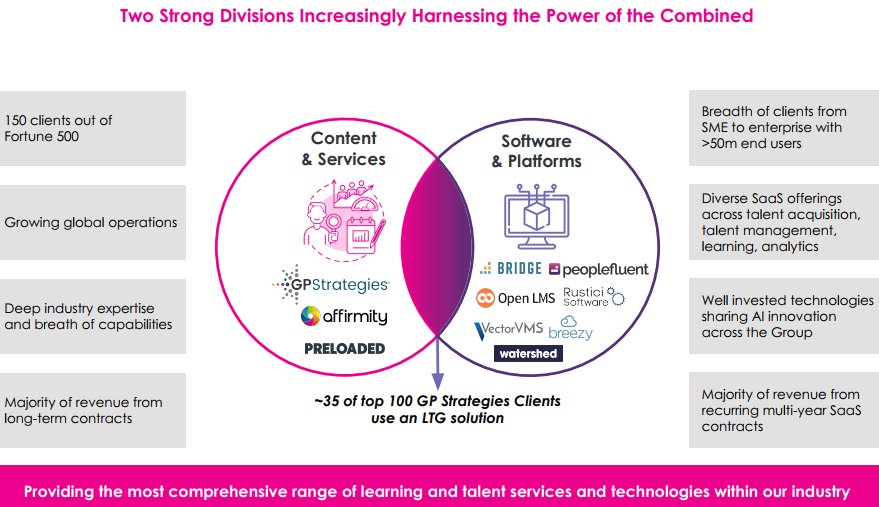

This workplace eLearning company, with brands like Affirmity, Breezy HR, Bridge, Gomo, Open LMS, PeopleFluent, Rustici Software and Watershed, announced H1 June revenue would be down c. -7% to £248m. They attribute the decline to FX headwinds, (ie strong pound/weak dollar) and subdued transactional revenues. H1 Group adj EBIT is expected to £43m, up +5% from the previous H1 on a like-for-like basis.

The group is deleveraging by selling non-core assets, after a disappointing 2022 and 2023. At the end of June, net debt stood at £57m, but has since fallen to £6m, following the sale of VectorVMS for $50m cash total consideration. VectorVMS was originally part of PeopleFluent, bought by LTG in 2018 for $150m and was subsequently separated into an independent business and brand later that year. For the full year ended 31 December 2023, Vector generated revenue and Adjusted EBIT of $11.4m and $7.1 million respectively. So management have sold the business for 4.4x historic revenues, versus a current valuation of LTG of around 1.1x revenues.

US regulatory approval suspended: The RNS also includes a warning that one of the Group’s eLearning applications, GP Strategies, bought in July 2021 for £284m has had its approval to work on new classified contracts invalidated. LTG funded the acquisition with a placing, raising £85m at 192p, the rest was funded from debt and existing resources. AS LTG is a foreign owner of a US company performing classified work for the US Government, they required clearance, which was granted in October 2021. Management doesn’t explain in the RNS what has gone wrong, but say they are fully aware of the seriousness and trying to resolve the situation. GP Strategies intends to continue working on existing classified contracts and no customer has said they will terminate their contract. The Board believes that the value of the contracts is not material in the context of total Group revenue and profit.

Valuation: The shares are trading on a PER of 8x Dec 2025F and Dec 2026F. The price to sales is 1x, which seems low for a business that ought to be able to generate EBIT margins over 20%. The largest shareholder is Andrew Brodie, with c. 15%, Maynard recently wrote up his analysis of RWS which has also sold off heavily over the last few years here.

Opinion: Richard looked at this in 2022. He and Maynard both point out that the company has struggled to generate organic growth, almost all the increase in sales has come from buying other companies. That continues to be true (organic revenue declined -2% FY Dec 2023). This reminds me of SDI, which also reported FY Apr 2024 results last week showing that organic growth had stalled. For comparison, Keyword Studios could still manage organic revenue growth of +9% FY Dec 2023. The latter tends to buy businesses that continue to expand, which means investors are prepared to reward KWS with a higher multiple for the growth, despite both companies having a “buy and build” strategy.

That said, the reduction in LTG net debt from Dec 2021, when the figure was £141m or 1.8x EBITDA, has been impressive. Management says that ¾ of revenues are from SaaS or long-term contracts, which remain resilient. I’m not sure what to make of the US clearance being withdrawn, but my instinct is that this could present risk-tolerant investors with a buying opportunity at some point.

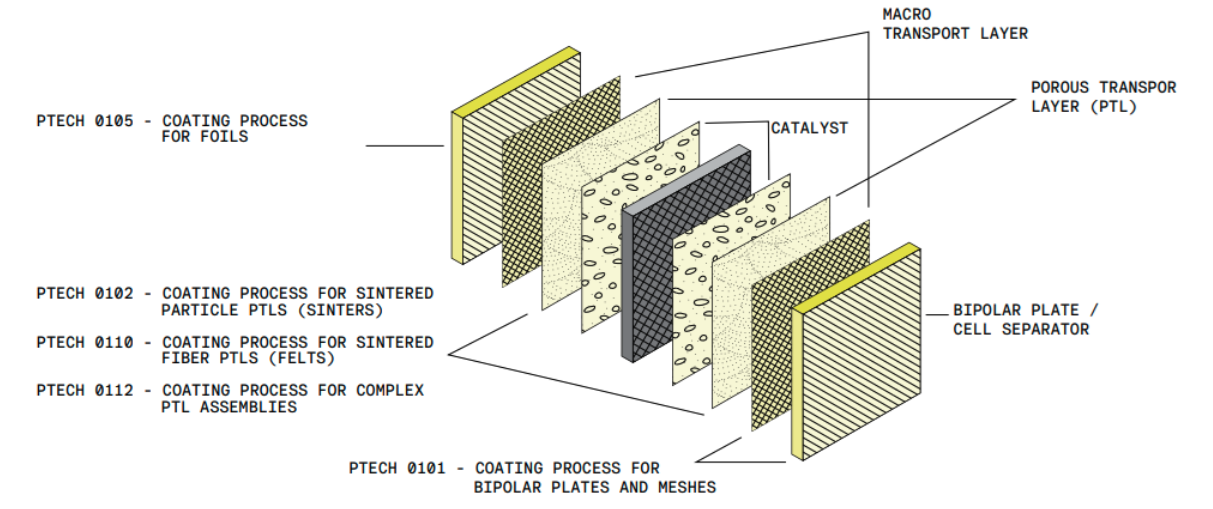

James Cropper FY March Results

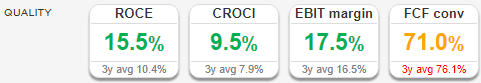

This family-owned Paper and Packing group with a hydrogen fuel cells business has struggled in recent years. FY Mar 2024 revenue was down -21% to £103m, after management warned in January about a difficult H2 (ie Sept-Mar). I looked at the profit warning back in January, when the share price was 420p and suggested that the chart looked terrible, but I would revisit the investment case later.

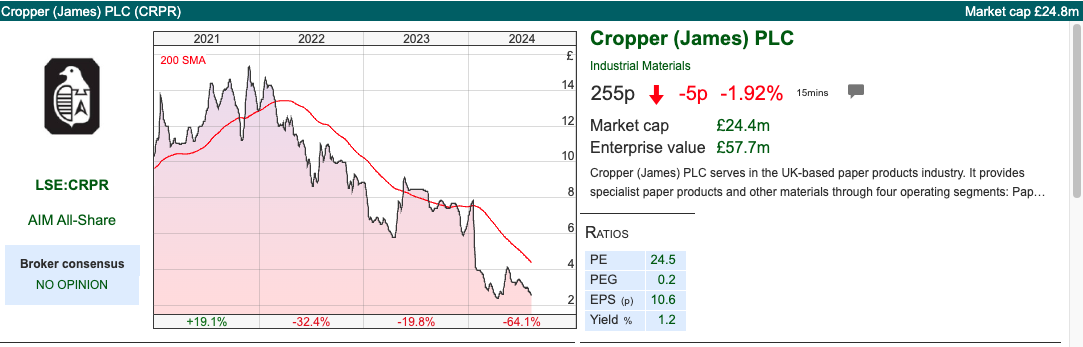

Net debt at the end of March was £15.5m, helped by cancelling the final dividend and reducing capex to £3.8m (£5.8m in the previous year). That net debt figure does not include a £17m pension deficit, which is up from the previous year by just under £1m. That consists of £70m of pension assets, less £87m of future liabilities. As bond yields have risen the pension deficit should be reducing, however, there are comments on pages 36-38 of the Annual Report saying that plan assets have fallen due to Liability Driven Investment strategy that had been adopted in 2018, then increased their “hedging” in December 2021. The timing of this “improved long-term risk management” meant that the deficit didn’t reduce when interest rates rose. Translating into the vernacular: someone has made an expensive mistake. For contrast, Renold’s deficit halved from £102m in Mar 2021 to £54m 3 years later, while CRPR’s has barely moved from £18m Mar 2021. Following the triennial actuarial valuation in March 2022 management agreed £1.4m per annum deficit reduction program, which doesn’t go through the P&L.

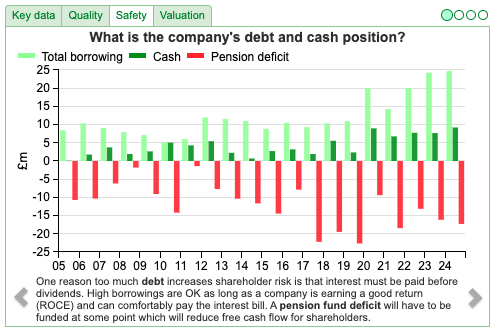

The company also reported a £5.3m statutory loss FY Mar 2024. That loss was driven almost entirely by the Paper and Packaging division, (£68m revenue, adj loss £5.2m). Management explained that “many packaging customers built up stock following the pandemic, but a slowdown in consumer demand led to full supply chains and significant destocking as companies sought to preserve cash.” The business has now been restructured (15% headcount reduction, £2.5m annual cost saving) and around the end of Q4 start of Q1, they saw a recovery in orders. The Advanced Materials division (£34.5m revenue, £7.7m adj profit) also saw a marked slowdown in H2 last year. The group has a proprietary coating technology, Resillion, which is used for manufacturing Proton Exchange Membranes (PEM, used in a type of hydrogen fuel cell). They also mention large aerospace manufacturers in the Fortune 100 as customers. They say that the future project pipeline is encouraging and forward indicators, such as order intake, point to signs of market recovery in FY2025 in the Advanced Materials division.

At a group level, they say that FY Mar 2024F is in line with the Board’s expectations, and comfortably within the bank covenants reset in June 2024 (maximum net debt 3.5x EBITDA). The going concern statement does say that without the covenant reset, they might have been in breach FY 2025F, but now they’ve reached an agreement with their bankers, and management are satisfied with their going concern statement.

Valuation: The shares are trading on 9x Mar 2025F PER dropping to just 5x Mar 2026F. This does look to be a cyclical business, currently experiencing a difficult time but I find the long history going back almost 180 years reassuring.

Opinion: The net debt looks high, but manageable. I am assuming that Paper & Packaging will always be cyclical and low margin, this may become a smaller part of the group as management continues to grow the Advanced Materials side. My feeling is that this could be an opportunity if investors can time their entry point, but it’s not without risk. I’ve put it on my watchlist, but haven’t bought any.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 06/08/2024 | DATA, LTG, CRPR | Hitting some turbulence

A difficult start to August seems to be driven by the Japanese carry-trade unwinding. Companies covered: DATA, LTG, CRPR.

Markets sold off heavily on Monday. The FTSE 100 fell -3.6% in the last 5 days to 7,974. Meanwhile, the futures market suggested that US markets would start the week badly. The FT contained an article quoting Larry Fink of BlackRock complaining that investors were keeping too much money in cash ($6.1 trillion is held in money market funds). The same newspaper also had an article about Berkshire Hathaway sitting on $277bn of cash, with Buffett selling some of his Apple stake after the shares are up c. 8x since Berkshire first disclosed owning a stake in 2016.

The BoE cut interest rates 25bp to 5.00% last week. That was the first rate cut since March 2020 down to 0.10% in response to market panic and Covid-19-related disruption. Sharepad shows that the 2-year fixed rate (UKTSY02), which will be the reference rate for 2-year fixed rate mortgages, has already anticipated the Central Bank’s move. The rate has fallen to 3.7% currently, down 165bp from its July peak last year.

The recent sell-off in markets has been attributed to the Bank of Japan raising interest rates and the carry trade (borrowing in Yen, financing speculative positions elsewhere) unwinding. Japan’s Topix index fell -12% on Monday, its worst day in 37 years. The index has given up all its gains for the year and is now down -6% YTD.

That said, I think that the UK markets looks more resilient than other indices, given how attractive valuations have become. This week I look at a special situation with Global Data H1 June results, following an unusual transaction, selling 40% of their Healthcare division to Private Equity. I also look at Learning Technologies and James Cropper’s results, both of these shares are down more than -70% over the past few years, but could now represent good value assuming no further deterioration.

Global Data H1 June Results

This business formed in 2015 when Progressive Digital Media bought Datamonitor and Verdict businesses from Informa. DATA sells industry and thematic reports for around $5 to $10K and with a market cap of £1.65bn, it’s one of the top 5 largest stocks on AIM. The original Datamonitor went from £1 per share to over £6 (or £500m market cap) when it was bought by Informa in 2007. The Datamonitor founder, Mike Danson, then set up a second company, Global Data in 2008 and went on to buy back parts of Datamonitor in 2015 from Informa. He currently owns 57.8% of DATA, and Liontrust is the next largest holder with just under 7%. His other interests include The New Statesman, Wigan Athletic Football Club and Wigan Warriors rugby league club, as well as the Danson Foundation. His very high share of insider ownership means that the business could be at risk of de-listing, so I can understand why investors might avoid DATA, but it strikes me that the founder is a very different personality to Tedi Sagi, who took Kape private at an attractive (for him) price. So I’m flagging the company as an interesting special situation.

Results: H1 Jun 2024 revenue was up +2% to £140m, and underlying revenue growth was +5% with just under 80% recurring subscription revenue. H1 PBT was up +13% to £27m and net cash stood at £188m at the end of June. The company has launched a £10m buyback program, but the company will cut its dividend to allocate more capital to M&A.

The net cash position is so strong because Global Data sold a 40% stake in their Healthcare business to Inflexion Private Equity, which completed in June and they received net cash proceeds of £434m. The transaction valued the whole Healthcare business at £1.1bn, or 22x the previous 12m EBITDA. When the transaction was first announced in December last year, DATA’s entire market cap was just £1.35bn, while the Healthcare division was 36% of group revenues. Below is a split of the business, showing that Healthcare’s adj EBITDA margin at 56% is roughly double that of the rest of the Group.

Background: Around 20 years ago I had a job interview with the Chief Exec Mike Danson after Credit Suisse made me redundant. He was looking to see what opportunities there were following the Spitzer settlement when 10 US investment banks paid $1.4bn to compensate for conflicts of interest between investment banking and equity research. Some of that $1.4bn was earmarked to provide independent research and Mike Danson thought he might have spotted an opportunity to benefit. I actually talked him out of the idea (and myself out of a job) because professional fund managers weren’t interested in independent research, they understood the conflicts of interest and preferred to reward equity research analysts in banks for “corporate access” (ie being close to company management). Some of the Spitzer money went to the US rating agencies like S&P, which of course had their own conflicts of interest exposed during the 2007-9 financial crisis. Global Data does offer equity research on their website, but there’s no mention of the business in the company’s 2023 Annual Report, suggesting my analysis was correct and professional fund managers do not contribute much to group revenue. Anyhow, I was impressed with Mike Danson’s entrepreneurial spirit, but also that he was prepared to listen to someone in their 20s pouring cold water on his idea.

Outlook: FY Dec 2024F results are “in line” with expectations, without saying what those expectations are. Annoyingly management publish adj EBITDA consensus of £121m on their website, but no EPS forecast. Sharepad shows EPS FY Dec 2024F of 8.5p, rising to 11p in two years time. Management have a medium-term target of high single-digit or double-digit revenue growth, supplemented by M&A to surpass £500m revenue in three years time (£273m reported FY Dec 2023).

Valuation: Assuming the whole Healthcare business is worth £1.1bn (18x EV/EBITDA), and deducting that from the current market cap of £1.65bn, means that the rest of the business is worth 9x EV/EBITDA. However, the multiple drops to 6x if we deduct the net cash. It looks like most of the cash is going to buy other businesses, rather than being returned to shareholders, I’m simply flagging that the rest of the business trades on a significant discount to what PE were prepared to pay for the Healthcare division.

Opinion: It’s natural to suppose that Private Equity have cherry-picked the business with the deepest moat and highest margins, but nevertheless this looks like an interesting situation, particularly if the Chief Exec can reinvest the proceeds to recreate something valuable. My feeling is that eventually the whole Healthcare business will likely be sold to the PE firm, so investors need to spend time gaining a good understanding of what they will be left with. It could be worth backing the founder to go on and create something valuable from the rump. Ironically given the background I mentioned above, I think that the investment case is one which would benefit from having corporate access to management to hear the story first-hand.

Learning Technologies H1 June Trading Update

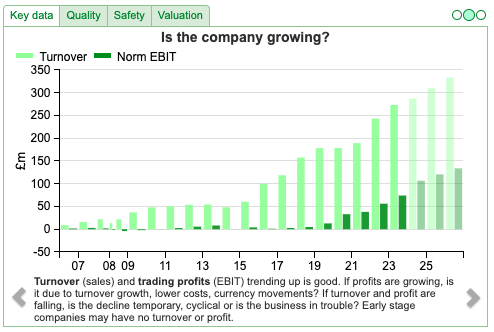

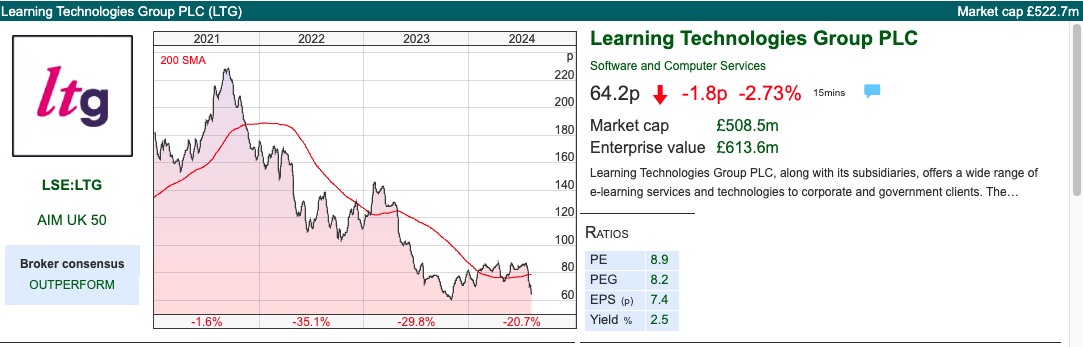

This workplace eLearning company, with brands like Affirmity, Breezy HR, Bridge, Gomo, Open LMS, PeopleFluent, Rustici Software and Watershed, announced H1 June revenue would be down c. -7% to £248m. They attribute the decline to FX headwinds, (ie strong pound/weak dollar) and subdued transactional revenues. H1 Group adj EBIT is expected to £43m, up +5% from the previous H1 on a like-for-like basis.

The group is deleveraging by selling non-core assets, after a disappointing 2022 and 2023. At the end of June, net debt stood at £57m, but has since fallen to £6m, following the sale of VectorVMS for $50m cash total consideration. VectorVMS was originally part of PeopleFluent, bought by LTG in 2018 for $150m and was subsequently separated into an independent business and brand later that year. For the full year ended 31 December 2023, Vector generated revenue and Adjusted EBIT of $11.4m and $7.1 million respectively. So management have sold the business for 4.4x historic revenues, versus a current valuation of LTG of around 1.1x revenues.

US regulatory approval suspended: The RNS also includes a warning that one of the Group’s eLearning applications, GP Strategies, bought in July 2021 for £284m has had its approval to work on new classified contracts invalidated. LTG funded the acquisition with a placing, raising £85m at 192p, the rest was funded from debt and existing resources. AS LTG is a foreign owner of a US company performing classified work for the US Government, they required clearance, which was granted in October 2021. Management doesn’t explain in the RNS what has gone wrong, but say they are fully aware of the seriousness and trying to resolve the situation. GP Strategies intends to continue working on existing classified contracts and no customer has said they will terminate their contract. The Board believes that the value of the contracts is not material in the context of total Group revenue and profit.

Valuation: The shares are trading on a PER of 8x Dec 2025F and Dec 2026F. The price to sales is 1x, which seems low for a business that ought to be able to generate EBIT margins over 20%. The largest shareholder is Andrew Brodie, with c. 15%, Maynard recently wrote up his analysis of RWS which has also sold off heavily over the last few years here.

Opinion: Richard looked at this in 2022. He and Maynard both point out that the company has struggled to generate organic growth, almost all the increase in sales has come from buying other companies. That continues to be true (organic revenue declined -2% FY Dec 2023). This reminds me of SDI, which also reported FY Apr 2024 results last week showing that organic growth had stalled. For comparison, Keyword Studios could still manage organic revenue growth of +9% FY Dec 2023. The latter tends to buy businesses that continue to expand, which means investors are prepared to reward KWS with a higher multiple for the growth, despite both companies having a “buy and build” strategy.

That said, the reduction in LTG net debt from Dec 2021, when the figure was £141m or 1.8x EBITDA, has been impressive. Management says that ¾ of revenues are from SaaS or long-term contracts, which remain resilient. I’m not sure what to make of the US clearance being withdrawn, but my instinct is that this could present risk-tolerant investors with a buying opportunity at some point.

James Cropper FY March Results

This family-owned Paper and Packing group with a hydrogen fuel cells business has struggled in recent years. FY Mar 2024 revenue was down -21% to £103m, after management warned in January about a difficult H2 (ie Sept-Mar). I looked at the profit warning back in January, when the share price was 420p and suggested that the chart looked terrible, but I would revisit the investment case later.

Net debt at the end of March was £15.5m, helped by cancelling the final dividend and reducing capex to £3.8m (£5.8m in the previous year). That net debt figure does not include a £17m pension deficit, which is up from the previous year by just under £1m. That consists of £70m of pension assets, less £87m of future liabilities. As bond yields have risen the pension deficit should be reducing, however, there are comments on pages 36-38 of the Annual Report saying that plan assets have fallen due to Liability Driven Investment strategy that had been adopted in 2018, then increased their “hedging” in December 2021. The timing of this “improved long-term risk management” meant that the deficit didn’t reduce when interest rates rose. Translating into the vernacular: someone has made an expensive mistake. For contrast, Renold’s deficit halved from £102m in Mar 2021 to £54m 3 years later, while CRPR’s has barely moved from £18m Mar 2021. Following the triennial actuarial valuation in March 2022 management agreed £1.4m per annum deficit reduction program, which doesn’t go through the P&L.

The company also reported a £5.3m statutory loss FY Mar 2024. That loss was driven almost entirely by the Paper and Packaging division, (£68m revenue, adj loss £5.2m). Management explained that “many packaging customers built up stock following the pandemic, but a slowdown in consumer demand led to full supply chains and significant destocking as companies sought to preserve cash.” The business has now been restructured (15% headcount reduction, £2.5m annual cost saving) and around the end of Q4 start of Q1, they saw a recovery in orders. The Advanced Materials division (£34.5m revenue, £7.7m adj profit) also saw a marked slowdown in H2 last year. The group has a proprietary coating technology, Resillion, which is used for manufacturing Proton Exchange Membranes (PEM, used in a type of hydrogen fuel cell). They also mention large aerospace manufacturers in the Fortune 100 as customers. They say that the future project pipeline is encouraging and forward indicators, such as order intake, point to signs of market recovery in FY2025 in the Advanced Materials division.

At a group level, they say that FY Mar 2024F is in line with the Board’s expectations, and comfortably within the bank covenants reset in June 2024 (maximum net debt 3.5x EBITDA). The going concern statement does say that without the covenant reset, they might have been in breach FY 2025F, but now they’ve reached an agreement with their bankers, and management are satisfied with their going concern statement.

Valuation: The shares are trading on 9x Mar 2025F PER dropping to just 5x Mar 2026F. This does look to be a cyclical business, currently experiencing a difficult time but I find the long history going back almost 180 years reassuring.

Opinion: The net debt looks high, but manageable. I am assuming that Paper & Packaging will always be cyclical and low margin, this may become a smaller part of the group as management continues to grow the Advanced Materials side. My feeling is that this could be an opportunity if investors can time their entry point, but it’s not without risk. I’ve put it on my watchlist, but haven’t bought any.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.