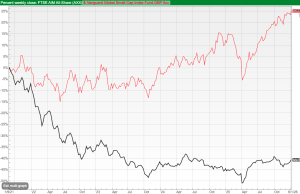

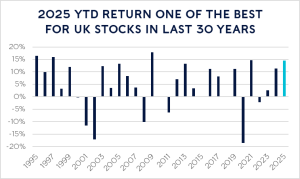

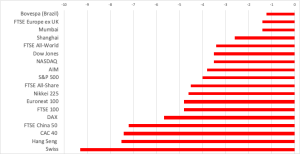

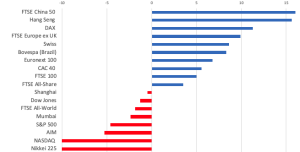

Michael Taylor explores why so many traders fail by blurring short-term trades with long-term investments, and introduces his M2M versus T2H framework to define each clearly. In Part I, he explains how aligning timeframe, risk and discipline with the right strategy is critical to consistent performance. Most traders fail because they don’t know what game […]