Six shares have passed the first stage of Richard’s 5 Strikes process. Many of them are destined for the “too hard pile”, perhaps the most underrated element in an investor’s toolkit.

Here is an update on the latest companies to have published annual reports and passed the 5 Strikes system*. Since the last update four weeks ago only six shares have accumulated two strikes or less:

5 strikes update

| Name | TIDM | AR date | Strikes | Score |

|---|---|---|---|---|

| Dotdigital | DOTD | 17/11/23 | – Holdings – Shares | 2 |

| Bioventix | BVXP | 10/11/23 | 0 | |

| Associated British Foods | ABF | 7/11/23 | – CROCI – Growth | 2 |

| YouGov | YOU | 7/11/23 | – Shares | 1 |

| Bellway | BWY | 6/11/23 | – Holdings – CROCI | 2 |

| Softcat | SCT | 1/11/23 | – Holdings – Growth | 2 |

For reasons that will become apparent, I have little to say about them:

YouGov

I first looked at opinion pollster YouGov last December, deeming it “a special business with financials to match”, and it quickly graduated to the pool of 40 shares I cover routinely at Interactive Investor. The value at YouGov is in its panels, the people whose opinions it polls, and the speed it can report those opinions.

Softcat

Softcat is also one of the 40 shares I re-examine routinely. It resells computer software and hardware. I deemed Softcat better than Computacenter, a rival, in 2018. It is special because of its culture.

Culture is hard to evaluate from outside a firm, but the chief executive of Bytes Technology, another reseller, might be a voice we can trust. Five years ago he honoured Softcat with the ultimate compliment by saying Bytes compares itself to its rival. My most recent evaluation should be updated soon.

Bellway

Bellway is offering buyers £1,000 a month towards their mortgages. That is good news for customers but raises all my insecurities about the instability of the property market and its impact on the profits and financial health of housebuilders. Bellway is in my “too hard pile”, and I am not inclined to take it out.

Associated British Foods

Associated British Foods is a food and ingredients conglomerate that farms, processes, and manufactures ingredients and food products. It owns British Sugar, the only processor of the British sugar beet crop, and Twinings, Ovaltine, Kingsmill, Jordans and many other brands.

But it also owns retailer Primark, a cheaper Next. The financials indicate ABF is a good business, but it is not a simple one.

Dotdigital

I have enjoyed trying to fathom Dotdigital over the years. Back in 2018, it was evolving from an email marketing service to an “omnichannel” marketing automation platform (think text messaging and chat as well as email). Since then it has emerged, butterfly-like as a customer data platform.

Despite all this sweat, I am not much wiser. In software, it seems there are hundreds of potential competitors with overlapping capabilities. I have trouble distinguishing one from another.

Bioventix

Last, and with no strikes at all, is Bioventix. It is an extraordinary business, and not just financially.

As I wrote in 2020, everything is small about the company except for profit. It relies on a handful of staff to develop and sell a handful of antibodies often to a handful of customers.

All of these attributes seem like risks to me, and it takes years to develop the antibodies, a big investment for the company if they don’t pay off. They have paid off though!

The triumph of the too hard pile

Rattling through that list, you may be wondering why I bothered. Apart from the shares I am already keen on, the others are all in, or candidates for, the too hard pile.

The too hard pile sounds like failure. But it is a triumph. There are thousands of shares and I reckon I only need to be invested in a couple of dozen.

Every share that goes in the too hard pile is a step closer to finding good long-term investments.

Maybe I will give myself another shot at getting to grips with DotDigital and Bioventix, but not if there are more straightforward candidates to investigate.

Ahead of DotDigital and Bioventix in my research list are four more straightforward-looking investments already dredged up by 5 Strikes. They are Dunelm, Keystone Law, Cakebox, and FDM.

In my next article, I will consider one of them. Specifically, I will look beyond the numbers to identify how the company makes money and whether it is likely to make more in future.

Turning back to the too hard pile, though, sometimes there are itches we cannot resist scratching. I need to remind myself that scratching itches can lead to ruin…

Here we RM again

My latest infatuation with RM lasted two years and ended in 2021.

The first of my infatuations was a decade earlier and lasted only ten months.

These trades do not burnish my credentials as a long-term investor or as a picker of good quality shares at reasonable prices:

Buys (‘b’) and sells (‘s’) refer to trades in the Share Sleuth portfolio, a model portfolio Richard runs for Interactive Investor using SharePad. He also owned RM personally.

I mention this because my last RM infatuation was powered by a seductive “opportunity”, and it is offering us the same opportunity now.

When part of a business is performing badly and dragging down the results of a firm, shedding that poorly performing business can reveal hidden value. The conceit here is that we, and not many others, have taken the trouble to look at the company’s segmental report.

Should the firm sell off or wind down the troublesome business it will grow as fast and profitably as the decent businesses were growing within it. Those of us perceptive enough to buy into the firm before that performance is revealed will do nicely.

This idea works out very well sometimes. 4Imprint, for example, shook off its wholesaling businesses to become a direct seller of promotional materials (branded T-shirts, coffee cups and so on). Shareholders have never looked back.

RM, in 2019 looked attractive because one part of the business had been running down unprofitable long-term contracts to supply IT to schools. As the contracts ended revenue fell but profitability improved. When the last contract ended, the contraction would be over, and the much better performance of the troublesome division and the rest of the business would be revealed.

As I documented in this post-mortem, RM had also bought Consortium and folded it into a different part of the business. That business distributes educational materials and already contained TTS. TTS was more profitable than Consortium, but I imagine RM hoped to change that.

It turns out that RM got rid of one duff business line, only to have entered another.

Earlier this month, RM announced that it is to close Consortium. It blamed the negative impact of a new e-commerce platform introduced to integrate the company’s businesses. Before the ecommerce platform though, was the costly rationalisation of Consortium’s and TTS’ warehouses. And before the warehouse consolidation was the acquisition, which triggered the whole series of wasteful decisions.

RM is under new management now. It will reveal its new strategy in the spring when it publishes results for the year to the end of this month. The strategy will focus on RM’s other divisions, which provide managed IT services to schools and online examinations and marking to examination boards and professional bodies.

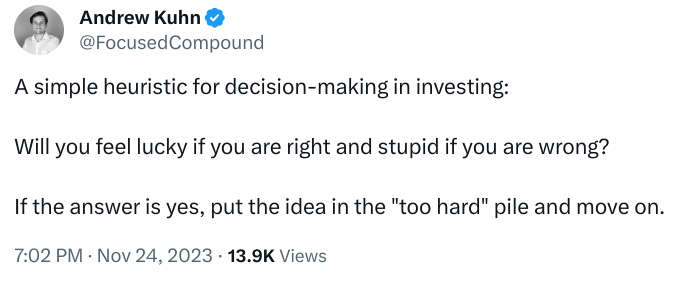

Perhaps their value will be revealed, now they are no longer being dragged down by Consortium. But we have been here before. If I examine the results next spring, I will be thinking hard about a question posed by investor Andrew Kuhn on X. He said:

Declaring that a “share is too hard” feels like failure, but in fact, it is one of the most powerful things an investor can do.

It stops us taking punts on risky shares.

*Five Strikes

Five strikes is my main method of deciding which new shares to analyse. It uses a SharePad filter, A sharePad list view and a SharePad custom table to show me the numbers I need to make a preliminary evaluation.

Unless I am on holiday, I perform the same routine every day the stockmarket is open, although I could do it once a week, or once a month, there would just be more shares to evaluate each time.

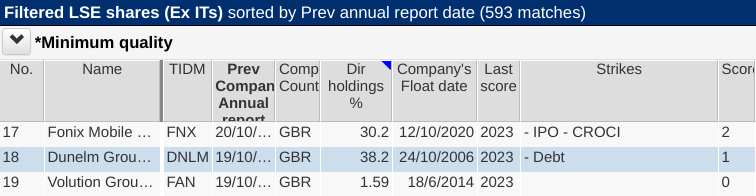

First I run a “Minimum quality” filter on SharePad’s list of LSE shares (excluding investment trusts). This filters out all companies that have been listed for less than three years or produced negative cash flows over the last three years. For these companies, there is very little data to go on.

Source: SharePad list view

The list view is sorted by the date of each company’s annual report, so I can easily see any that have reported since I last checked the list. The next three columns show three data points that can potentially count against companies.

They are the company’s domicile (any company headquartered abroad gets a strike), directors’ holdings (if the directors do not have substantial shareholdings they receive a strike), and the company’s float date (if the company floated after 2015 it receives a strike).

The first thing I note is the calendar year in the “last score” column so that I do not accidentally put a share through the process more than once a year.

Then I write down a code for each strike, so I know what I don’t like about the share. For example, Fonix Mobile floated in 2020, so it gets a strike “- IPO”. The other strikes in the screenshot relate to a custom table, which I display below the list view:

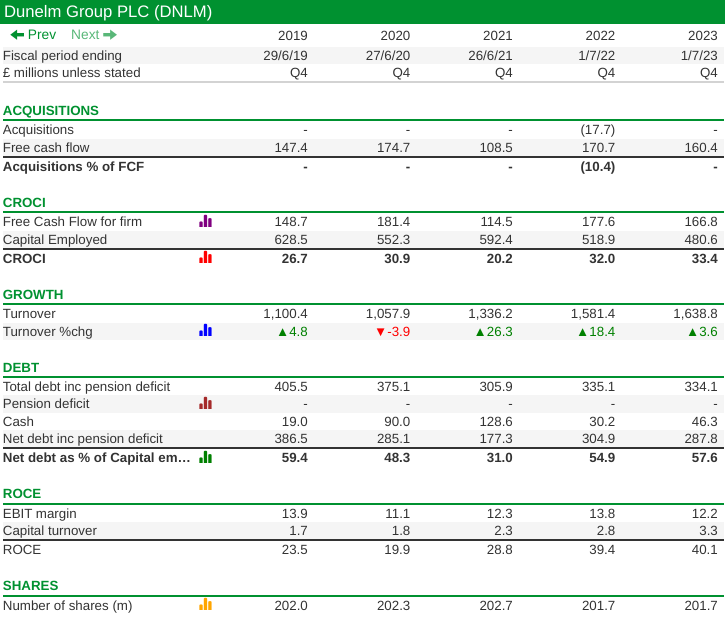

Source: SharePad custom view

Although I can only fit five years of data in the width of this article SharePad’s data goes back for decades if the company has been listed long enough, which means almost at a glance we can form an impression of how profitable and reliable a business has been.

Reliable growing businesses are often easier to analyse, and they can also be underrated because they tend not to be exciting, which is why they are my natural hunting ground.

Dunelm is a good example, which is why it scores only 1 strike. The one strike is for debt, which is typically above my benchmark level of 50% of capital employed.

Deciding whether a business has performed well or badly over the long-term requires judgement. I did not penalise Dunelm’s negative growth in 2020, it was, after all, the first year of a pandemic, and anyway, I do not expect good companies to grow every single year.

If a company spends more than it earns on acquisitions in a single year, that may not be cause for concern. But if it spends many times more than it earns, or it spends more than it earns over a long-period of time, it may be taking big risks.

These are judgements investors make all the time, but I am trying to bring a bit more rigour to the process.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.