If the price of trophy assets like football clubs are wildly above intrinsic value, perhaps there’s a way for less wealthy investors to benefit from the same theme? Companies covered SDRY, BNZL and PBEE.

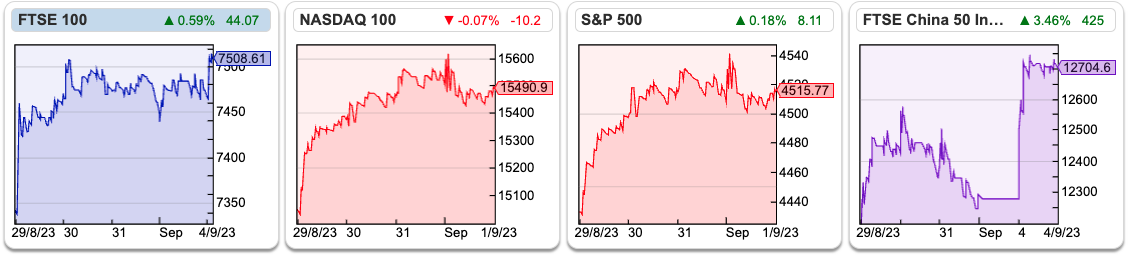

The FTSE 100 was up +2.4% at 7,511 last week. The index is exactly flat on 5 years, though what 5 years it has been with a high just over 8,000 in February this year and a low of below 5,200 in March 2020. The Nasdaq 100 was up +3.7% and S&P500 +2.5. The FTSE China 50 index was even stronger +5.7%, suggesting that some liquidity from the PBOC is fuelling that market.

I wrote a couple of weeks ago how flows of cross-border funds are creating price distortions in trophy assets like football teams. Aswath Damodaran, the Stern School of Business Professor of Finance, has published a post on this, saying that the top 20 Premier League teams are worth around $30bn. In fact, I’m rather dubious of Damodaran’s numbers, because it was widely reported in October 2021 that Saudi Arabia paid £300m to buy Newcastle Town FC, Everton FC are currently for sale for £600m apparently. Damodaran thinks the lowest paid price for a Premier League team is $1.5bn or £1.2bn at the current exchange rate.

That said, I think he is directionally right and I reproduce his whole table below, which I have taken from Damodaran’s website.

|

Cumulative Pricing (in $ bn) |

Highest Priced |

Lowest Priced |

| NFL (US Football) |

$132 |

$7.6 |

$4.1 |

| NBA (Basketball) |

$86 |

$7.0 |

$1.6 |

| MLB (Baseball) |

$70 |

$7.1 |

$1.0 |

| NHL (Hockey) |

$32 |

$2.2 |

$0.5 |

| MLS (US Soccer) |

$16 |

$1.0 |

$0.4 |

| Premier League (Top 20) |

$30? |

$6.0? |

$1.5??? |

| IPL (Indian Cricket) |

$10 |

$1.3 |

$0.85 |

One interesting difference is the contrast between the highest and lowest-priced teams across leagues. In the NFL teams with the most losses, who finish bottom of the table are not relegated. This is great for the owners, though it removes some of the drama for spectators.

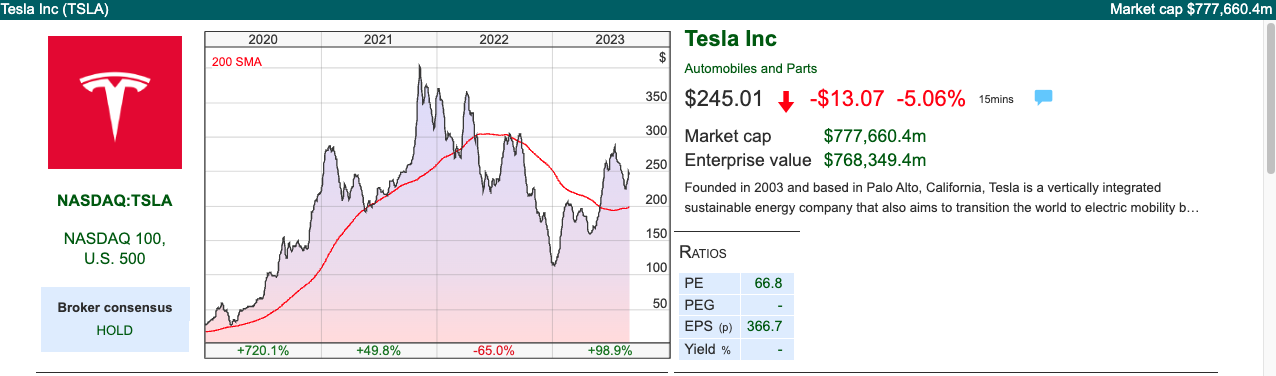

Damodaran makes the obvious point that financial considerations like Return on Capital Employed often don’t play much of a role in the billionaire team owners’ thinking. A more interesting suggestion he has is that the role of the Chief Exec/Founder of any listed business is to convert the investment case into a trophy asset, where shareholders generally aren’t really thinking about financial considerations. He suggests that Tesla (the share price up +99% YTD) is more of a trophy asset than a financial investment. Elon Musk seems to have figured out how to create a ‘fanbase’ of shareholders. Damodaran says that he has exchanged emails with Tesla investors who:

“have not only invested a large proportion of their wealth in the company, but have done so because they want to be part of what they see as a historical disruptor, one that will upend the way we not only drive, but live. The implication then is that Tesla will trade at prices that are difficult to justify, given the company’s financials, that it will attract a subset of investors who receive emotional dividends from owning the stock.” [my emphasis]

Tesla, of course, does not pay financial dividends, so emotional dividends are the next best thing. Perhaps the trick for the rest of us, is to use Sharepad to invest in businesses before they become “trophy assets”, and sell to trophy hunters at a price wildly above intrinsic value? If readers have thoughts on what makes a potential trophy asset, please do post in the chat.

My suggestions would be an environmentally positive story, so either Impax or one of the hydrogen stocks? Or life sciences and health (like KOO) wouldn’t it be great to tell your friends that you had backed a company that had helped young people with mental health problems?*

The Fevertree “hero’s journey” story, an 18-month adventure researching the archives in the British Library to facing the wrong end of a Kalashnikov in the Congolese jungle strikes me as adding a premium to the investment case, as well as the drink itself. Another suggestion is Games Workshop, which has a fan club of shareholders, as well as customers. I like to buy shares in businesses with attractive valuations, however, my best investments have come from identifying a good story too, as investors pay up for the emotional dividends they receive from ownership.

This week I look at Bunzl, which certainly isn’t a trophy asset but has quietly compounded away and PensionBee. I start though with Superdry’s disappointing Full Year April results.

*I am sceptical about this, and don’t own KOO, but would be delighted for them to prove me wrong. I do own GAW and IPX. The “hero’s journey” is a phrase taken from the anthropologist Joseph Campbell, who heavily influenced Hollywood storytelling, particularly George Lucas.

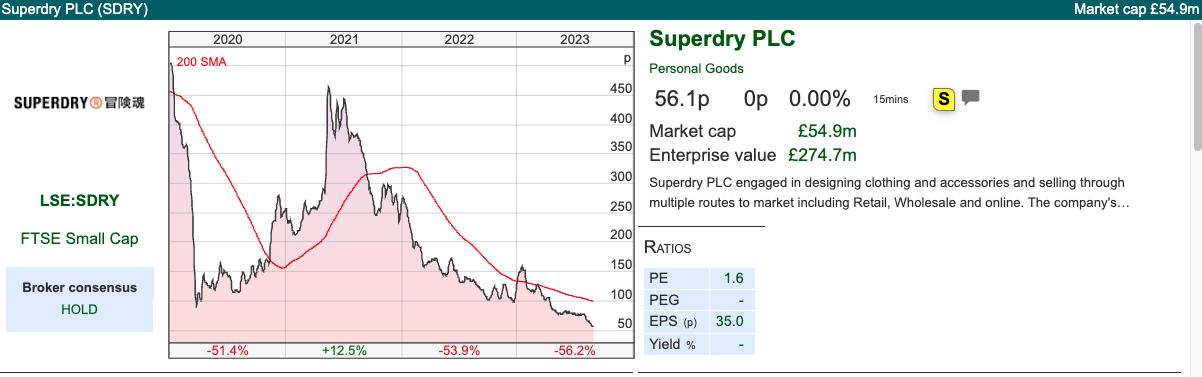

Superdry FY April Results

This fashion retailer briefly asked to have its shares suspended last week, as they couldn’t comply with the 4-month deadline to publish their audited FY results to April by the end of August. They then published results on Friday 1st September. These delays seem to be more frequent now that auditors are working from home, however, Superdry has been plagued by difficulties in its financial control and reporting systems going back years.

They say that the disposal of their Asian business has completed and they have received the proceeds of $50m, or around £34 million net of transaction costs and taxation. This is clearly material, I have no idea why they didn’t announce it earlier. They also did an equity raise in May this year raising £12m at 76p per share. So, they’ve received £45m in cash since their April year end, which compares to a current market cap for SDRY group of just £55m!

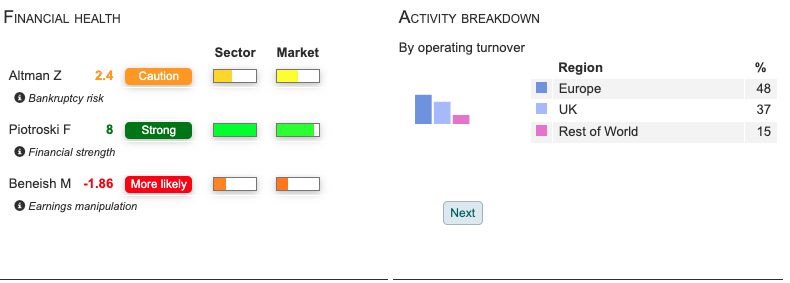

The results for FY April showed revenues +2.1% to £622m, but a huge statutory loss of £148m, around 3x the current market cap. To put that loss into context, in January they were still saying that they were expecting FY Apr 2023 PBT to be between £10-20m, then at the end of January downgraded this to “broadly breakeven”. So, the January sales and start to this year have been seriously disappointing. The negative adjustments are impairments of store assets of £43m for 141 stores, or 66% of the entire estate, now have an impairment charge against them. Germany and the UK are mentioned in the commentary. The second large write-down deferred tax assets from £66m to nil. Both of these items are non-cash, but leave them with negative equity of £53m, or £96m negative book value after deducting intangible assets at the end of April. They had net debt of £26m at the end of April, versus £1m at the same time last year.

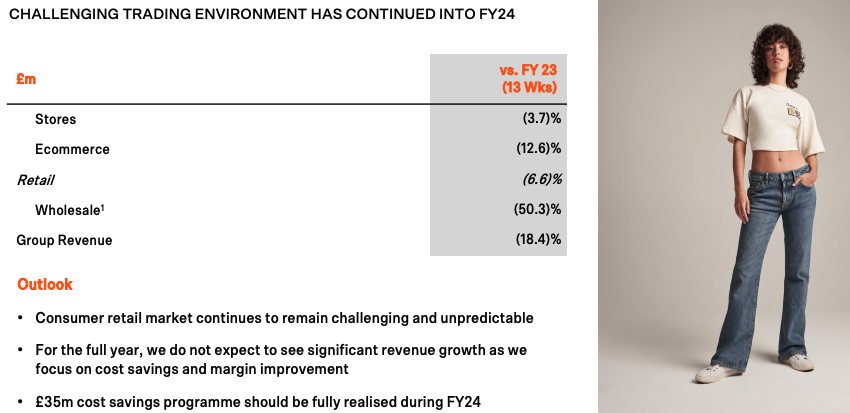

FY April 2023 results are very backward looking, they also released a Q1 trading update, with group revenue falling -18%, with the damage being done by their Wholesale division -50%.

Valuation: The shares are trading on a distressed valuation, and I think this is 50/50 if it can survive until the end of next financial year. That said, if management can save the business there’s plenty of upside. This is another share that is reflecting a high degree of uncertainty, in 18 months’ time the share price will be either much higher or the business might have failed, in my view.

Opinion: The worrying thing for me is that these results have been so poor without the UK entering into a recession. I think the next two trading updates will be very important for “uncertainty reduction” i.e. deciding if management can save the situation. I bought at the start of the year and theoretically, I should now either cut my losses or increase my position size. I’m certainly not going to do the latter, instead, I will wait to see how Christmas trading and January sales go. After that, I will make a decision whether to cut my losses. By that time, I may well have lost more than half my investment, however, a -50% loss is better than a -100% loss.

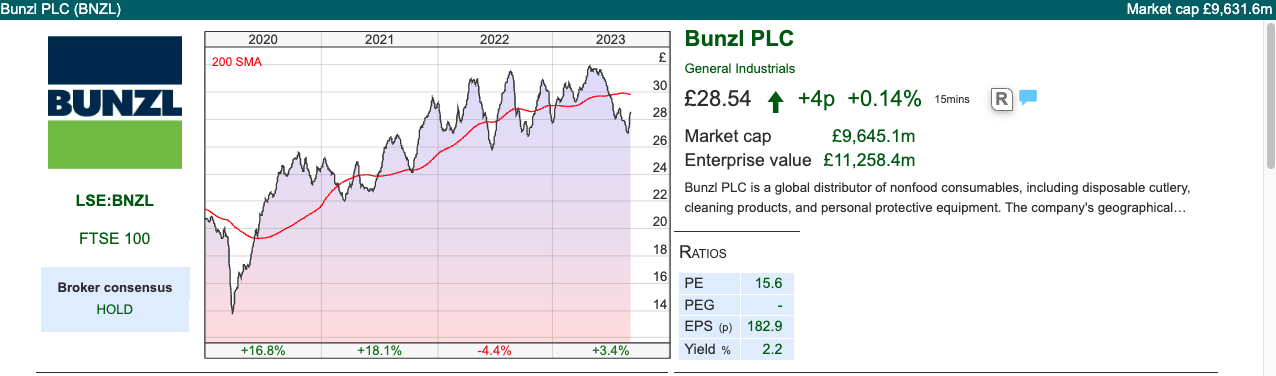

Bunzl H1 to Jun

This support services company, that distributes hard hats and disposable cutlery announced H1 results, with revenue growth less than +1% to £5.9bn. PBT was up +7% to £317m, though that includes 12 acquisitions so far this year, including two announced last week. The company would have seen revenues go backwards by £26m if it hadn’t been for all the deal-making.

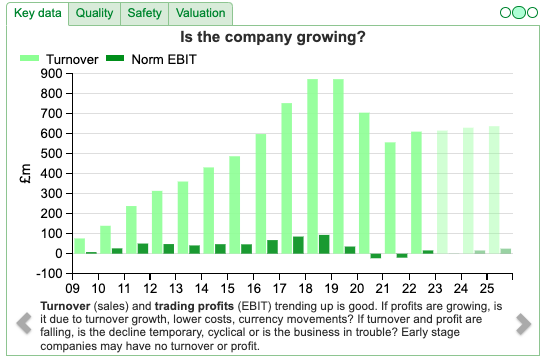

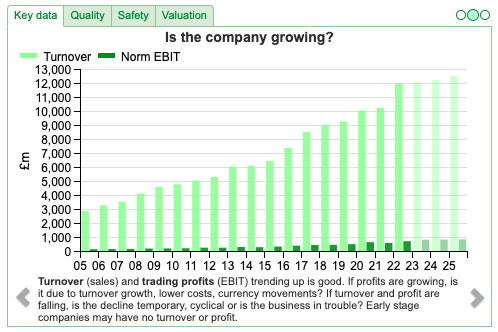

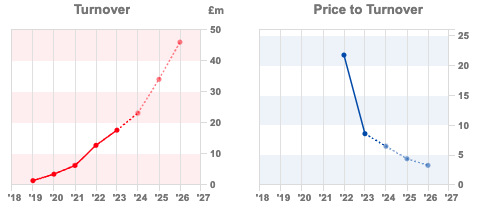

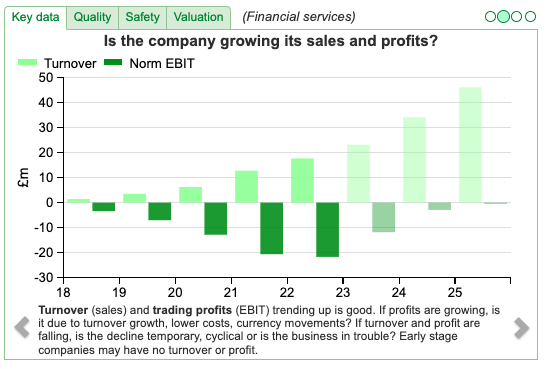

That said the track record over the decades is impressive, from a subscale and unfocused conglomerate in the 1990s to a much more tightly run distribution company making low-risk “bolt-on” acquisitions in fragmented markets, that can be plugged into BNZL’s local distribution network. Boring can equate to compounding returns. The Sharepad chart below shows Turnover and EBIT back to 2005, £2.9bn and £200m respectively. However, Sharepad’s financial tabs actually goes back much further, and has financial measures back to 1985, when BNZL’s turnover was £787m and EBIT was just £24m.

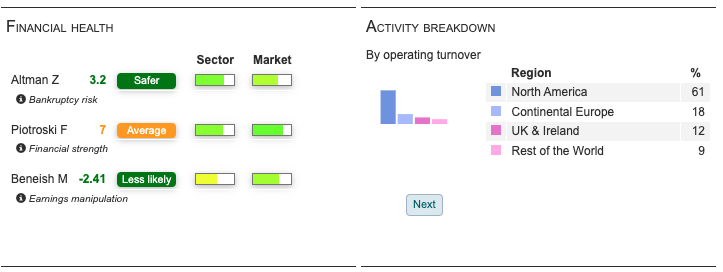

BNZL are internationally diversified, with around 10% of revenue coming from the UK, the USA is by far their biggest market with c. 60% of revenue. Sharepad’s financial health indicators are also positive, although they haven’t been updated for the most recent acquisitions yet.

Balance Sheet: Intangible assets are just over £3bn, so this is a company operating with negative tangible assets. That’s fine, as long as cashflow continues, which it does. Cash generated from operating activities was £410m on an after tax basis, with just £26m fixed assets capex. Net debt at £1bn was 1.1x EBITDA, and fell versus Dec 2022 figure despite the acquisitions this year.

Outlook: Last week they increased their FY Dec 2023F adjusted operating profit guidance, driven by a “meaningful increase in operating margin expectations”. They now expect adjusted operating profit to be moderately higher than achieved last year. So “meaningful increase” in margin actually equals “moderately higher” absolute profit. Note too, that Sharepad calculates the EBIT margin at 6.4%, versus the company’s alternative performance measure (7.4% in both FY Dec and H1 Jun).

They also expect higher revenue, but that’s been driven by the announced acquisitions. On an organic basis, they expect a slight decline. Deferred consideration from recent acquisitions was £140m which is recorded on the face of the balance sheet, but the future contingent considerations of £80m is in the notes. That is in accordance with accounting standards, but it’s worth bearing in mind that fair value of these liabilities can rise. I have drawn attention to this for companies like K3 Capital, and also Tracsis last week.

Valuation: The shares are trading on 16x PER FY Dec 2024F dropping to 15x PER the following year. That seems reasonable, but not particularly appealing for a business that is relying on acquisitions to grow.

Opinion: Bunzl is a rather dull company, in my view, unlikely to set pulses racing. However, these types of companies can compound away and generate significant returns over the years. Ashtead, Spirax-Sarco, Croda and Halma are all good examples. A more worrying analogy though is with Capita, and a decade earlier, Rentokil, which also compounded away, until they didn’t.

Rentokill’s share price fell from just below £6 in the late 1990s to 30p in the 2008 financial crisis. Capita’s share price has now fallen from a peak above £8 in 2015 to below 20p. So even with dull compounders, you can’t just expect them to deliver year after year, without double-checking whether risk is increasing, or acquisition-led growth is masking trouble in the core business. There are lessons to be learned from successful multi-baggers and even more valuable lessons from ones that go wrong. I am not saying that BNZL is in either camp, but I prefer looking for companies that are much earlier than BNZL in their growth cycle, so will avoid.

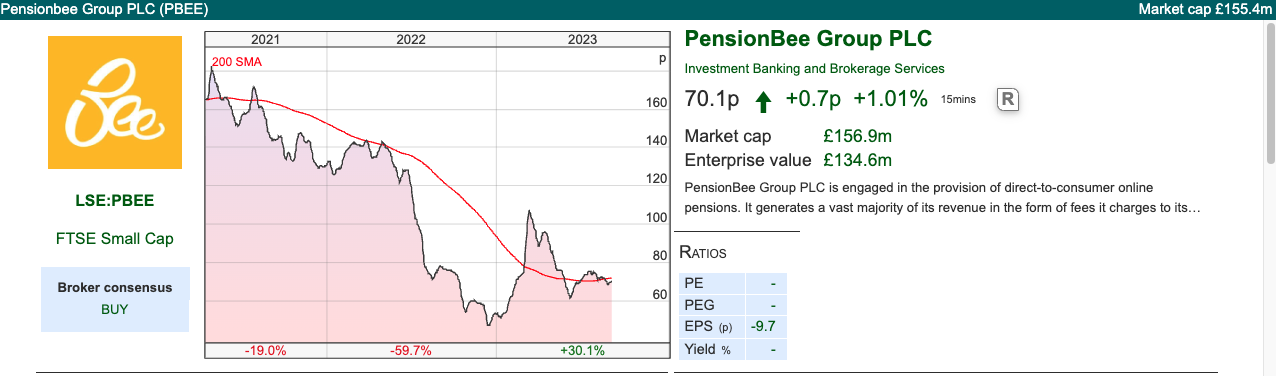

PensionBee H1 Jun

This pensions FinTech that listed at 170p in April 2021 on the main market, announced H1 Jun results. It caught my eye partly because they sponsor Brentford FC (the Bees) left-sleeve men’s first-team kit. PBEE continue to be loss-making, though Loss Before Tax has narrowed from £17m H1 Jun last year to £9m H1 Jun this year.

They have £14m of cash, down from £29m H1 last year, so they need to hit breakeven within the next 6-12 months to avoid coming back to shareholders for more money or using debt to fund growth.

Revenue is up +32% to £11m and Assets under Administration (AuA) is up +38% to £3.7bn. Even if you have no interest in PBEE, it’s worth pondering what effect this level of growth might have on the larger platforms like HL., which has £132bn of AuA and 1.7m customers. AJB has £69bn of AuA and just under half a million customers. A traditional Wealth Manager like RAT has £60bn of AuA and 68,000 clients.

PBEE’s customer proposition is to help customers consolidate their disparate pensions into a low-cost PensionBee Personal Pension. The company complements its digital offering (i.e. website and app) with dedicated customer account managers, known as “BeeKeepers”, who offer both online and telephone support to customers. That sounds great in theory, but this seems to be an offering which appeals to less poorer (or perhaps younger) customers than the other platforms. PBEE report much smaller balances, on average £18K, versus almost £80K at Hargreaves Lansdown.

PensionBee charges an ongoing annual management fee between 50bp and depending on the plan chosen, with no minimum pension size requirements. That doesn’t look particularly attractive compared to HL. who charge 45bp and AJ Bell 25bp.

History: PensionBee was co-founded in 2014 by Romi Savova (ex-Goldman Sachs and Morgan Stanley), the current Chief Exec and Jonathan Lister Parsons, its current CTO, to simplify pension savings in the UK, following a difficult pension transfer experience for Romi Savova using traditional platforms. They partnered with BlackRock and State Street who manage the pensions, then later with LGEN to offer a responsible investment option. State Street became a minority shareholder in 2017. In April 2021 the company raised £55m at 170p, with under £5m going to selling shareholders. This valued the market cap on admission at £365m versus revenues of just £6m, implying a historic price-to-revenue multiple of 60x.

Ownership: Sharepad shows that Romi Savova still owns 36% of the shares and Jonathan Lister Parsons 6%. State Street have 3.9%, which they bought pre-IPO, and Norges Bank 3.5% is the only other institution that has a disclosable stake.

Valuation: The shares are trading on 4.5x revenue FY Dec 202F revenue. They are targeting EBITDA margins of 50% in the long term, versus -100% in FY Dec 2022. That’s beyond the explicit forecast period, Sharepad shows 4% EBITDA margin in FY Dec 2025. For comparison Sharepad shows HL. have an EBITDA margin of above 50%, and AJ Bell just under 40%.

Opinion: The customer value proposition doesn’t look significantly better than the existing platforms unless I am missing something? I consolidated my various pensions into a single SIPP at Hargreaves Lansdown, then later moved to Interactive Investors, because the fixed monthly fee worked out better value for me. I can see from a marketing perspective PBEE might appeal to a younger, more diverse demographic but I’m not going to pay an eye-watering price/sales multiple for a company using investors’ cash to fund a large marketing budget to buy market share.

Conclusion

Bruce owns shares in FDEV, Impax, Games Workshop and Superdry

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 05/09/23 | SDRY, BNZL, PBEE | Emotional dividends

If the price of trophy assets like football clubs are wildly above intrinsic value, perhaps there’s a way for less wealthy investors to benefit from the same theme? Companies covered SDRY, BNZL and PBEE.

The FTSE 100 was up +2.4% at 7,511 last week. The index is exactly flat on 5 years, though what 5 years it has been with a high just over 8,000 in February this year and a low of below 5,200 in March 2020. The Nasdaq 100 was up +3.7% and S&P500 +2.5. The FTSE China 50 index was even stronger +5.7%, suggesting that some liquidity from the PBOC is fuelling that market.

I wrote a couple of weeks ago how flows of cross-border funds are creating price distortions in trophy assets like football teams. Aswath Damodaran, the Stern School of Business Professor of Finance, has published a post on this, saying that the top 20 Premier League teams are worth around $30bn. In fact, I’m rather dubious of Damodaran’s numbers, because it was widely reported in October 2021 that Saudi Arabia paid £300m to buy Newcastle Town FC, Everton FC are currently for sale for £600m apparently. Damodaran thinks the lowest paid price for a Premier League team is $1.5bn or £1.2bn at the current exchange rate.

That said, I think he is directionally right and I reproduce his whole table below, which I have taken from Damodaran’s website.

One interesting difference is the contrast between the highest and lowest-priced teams across leagues. In the NFL teams with the most losses, who finish bottom of the table are not relegated. This is great for the owners, though it removes some of the drama for spectators.

Damodaran makes the obvious point that financial considerations like Return on Capital Employed often don’t play much of a role in the billionaire team owners’ thinking. A more interesting suggestion he has is that the role of the Chief Exec/Founder of any listed business is to convert the investment case into a trophy asset, where shareholders generally aren’t really thinking about financial considerations. He suggests that Tesla (the share price up +99% YTD) is more of a trophy asset than a financial investment. Elon Musk seems to have figured out how to create a ‘fanbase’ of shareholders. Damodaran says that he has exchanged emails with Tesla investors who:

“have not only invested a large proportion of their wealth in the company, but have done so because they want to be part of what they see as a historical disruptor, one that will upend the way we not only drive, but live. The implication then is that Tesla will trade at prices that are difficult to justify, given the company’s financials, that it will attract a subset of investors who receive emotional dividends from owning the stock.” [my emphasis]

Tesla, of course, does not pay financial dividends, so emotional dividends are the next best thing. Perhaps the trick for the rest of us, is to use Sharepad to invest in businesses before they become “trophy assets”, and sell to trophy hunters at a price wildly above intrinsic value? If readers have thoughts on what makes a potential trophy asset, please do post in the chat.

My suggestions would be an environmentally positive story, so either Impax or one of the hydrogen stocks? Or life sciences and health (like KOO) wouldn’t it be great to tell your friends that you had backed a company that had helped young people with mental health problems?*

The Fevertree “hero’s journey” story, an 18-month adventure researching the archives in the British Library to facing the wrong end of a Kalashnikov in the Congolese jungle strikes me as adding a premium to the investment case, as well as the drink itself. Another suggestion is Games Workshop, which has a fan club of shareholders, as well as customers. I like to buy shares in businesses with attractive valuations, however, my best investments have come from identifying a good story too, as investors pay up for the emotional dividends they receive from ownership.

This week I look at Bunzl, which certainly isn’t a trophy asset but has quietly compounded away and PensionBee. I start though with Superdry’s disappointing Full Year April results.

*I am sceptical about this, and don’t own KOO, but would be delighted for them to prove me wrong. I do own GAW and IPX. The “hero’s journey” is a phrase taken from the anthropologist Joseph Campbell, who heavily influenced Hollywood storytelling, particularly George Lucas.

Superdry FY April Results

This fashion retailer briefly asked to have its shares suspended last week, as they couldn’t comply with the 4-month deadline to publish their audited FY results to April by the end of August. They then published results on Friday 1st September. These delays seem to be more frequent now that auditors are working from home, however, Superdry has been plagued by difficulties in its financial control and reporting systems going back years.

They say that the disposal of their Asian business has completed and they have received the proceeds of $50m, or around £34 million net of transaction costs and taxation. This is clearly material, I have no idea why they didn’t announce it earlier. They also did an equity raise in May this year raising £12m at 76p per share. So, they’ve received £45m in cash since their April year end, which compares to a current market cap for SDRY group of just £55m!

The results for FY April showed revenues +2.1% to £622m, but a huge statutory loss of £148m, around 3x the current market cap. To put that loss into context, in January they were still saying that they were expecting FY Apr 2023 PBT to be between £10-20m, then at the end of January downgraded this to “broadly breakeven”. So, the January sales and start to this year have been seriously disappointing. The negative adjustments are impairments of store assets of £43m for 141 stores, or 66% of the entire estate, now have an impairment charge against them. Germany and the UK are mentioned in the commentary. The second large write-down deferred tax assets from £66m to nil. Both of these items are non-cash, but leave them with negative equity of £53m, or £96m negative book value after deducting intangible assets at the end of April. They had net debt of £26m at the end of April, versus £1m at the same time last year.

FY April 2023 results are very backward looking, they also released a Q1 trading update, with group revenue falling -18%, with the damage being done by their Wholesale division -50%.

Valuation: The shares are trading on a distressed valuation, and I think this is 50/50 if it can survive until the end of next financial year. That said, if management can save the business there’s plenty of upside. This is another share that is reflecting a high degree of uncertainty, in 18 months’ time the share price will be either much higher or the business might have failed, in my view.

Opinion: The worrying thing for me is that these results have been so poor without the UK entering into a recession. I think the next two trading updates will be very important for “uncertainty reduction” i.e. deciding if management can save the situation. I bought at the start of the year and theoretically, I should now either cut my losses or increase my position size. I’m certainly not going to do the latter, instead, I will wait to see how Christmas trading and January sales go. After that, I will make a decision whether to cut my losses. By that time, I may well have lost more than half my investment, however, a -50% loss is better than a -100% loss.

Bunzl H1 to Jun

This support services company, that distributes hard hats and disposable cutlery announced H1 results, with revenue growth less than +1% to £5.9bn. PBT was up +7% to £317m, though that includes 12 acquisitions so far this year, including two announced last week. The company would have seen revenues go backwards by £26m if it hadn’t been for all the deal-making.

That said the track record over the decades is impressive, from a subscale and unfocused conglomerate in the 1990s to a much more tightly run distribution company making low-risk “bolt-on” acquisitions in fragmented markets, that can be plugged into BNZL’s local distribution network. Boring can equate to compounding returns. The Sharepad chart below shows Turnover and EBIT back to 2005, £2.9bn and £200m respectively. However, Sharepad’s financial tabs actually goes back much further, and has financial measures back to 1985, when BNZL’s turnover was £787m and EBIT was just £24m.

BNZL are internationally diversified, with around 10% of revenue coming from the UK, the USA is by far their biggest market with c. 60% of revenue. Sharepad’s financial health indicators are also positive, although they haven’t been updated for the most recent acquisitions yet.

Balance Sheet: Intangible assets are just over £3bn, so this is a company operating with negative tangible assets. That’s fine, as long as cashflow continues, which it does. Cash generated from operating activities was £410m on an after tax basis, with just £26m fixed assets capex. Net debt at £1bn was 1.1x EBITDA, and fell versus Dec 2022 figure despite the acquisitions this year.

Outlook: Last week they increased their FY Dec 2023F adjusted operating profit guidance, driven by a “meaningful increase in operating margin expectations”. They now expect adjusted operating profit to be moderately higher than achieved last year. So “meaningful increase” in margin actually equals “moderately higher” absolute profit. Note too, that Sharepad calculates the EBIT margin at 6.4%, versus the company’s alternative performance measure (7.4% in both FY Dec and H1 Jun).

They also expect higher revenue, but that’s been driven by the announced acquisitions. On an organic basis, they expect a slight decline. Deferred consideration from recent acquisitions was £140m which is recorded on the face of the balance sheet, but the future contingent considerations of £80m is in the notes. That is in accordance with accounting standards, but it’s worth bearing in mind that fair value of these liabilities can rise. I have drawn attention to this for companies like K3 Capital, and also Tracsis last week.

Valuation: The shares are trading on 16x PER FY Dec 2024F dropping to 15x PER the following year. That seems reasonable, but not particularly appealing for a business that is relying on acquisitions to grow.

Opinion: Bunzl is a rather dull company, in my view, unlikely to set pulses racing. However, these types of companies can compound away and generate significant returns over the years. Ashtead, Spirax-Sarco, Croda and Halma are all good examples. A more worrying analogy though is with Capita, and a decade earlier, Rentokil, which also compounded away, until they didn’t.

Rentokill’s share price fell from just below £6 in the late 1990s to 30p in the 2008 financial crisis. Capita’s share price has now fallen from a peak above £8 in 2015 to below 20p. So even with dull compounders, you can’t just expect them to deliver year after year, without double-checking whether risk is increasing, or acquisition-led growth is masking trouble in the core business. There are lessons to be learned from successful multi-baggers and even more valuable lessons from ones that go wrong. I am not saying that BNZL is in either camp, but I prefer looking for companies that are much earlier than BNZL in their growth cycle, so will avoid.

PensionBee H1 Jun

This pensions FinTech that listed at 170p in April 2021 on the main market, announced H1 Jun results. It caught my eye partly because they sponsor Brentford FC (the Bees) left-sleeve men’s first-team kit. PBEE continue to be loss-making, though Loss Before Tax has narrowed from £17m H1 Jun last year to £9m H1 Jun this year.

They have £14m of cash, down from £29m H1 last year, so they need to hit breakeven within the next 6-12 months to avoid coming back to shareholders for more money or using debt to fund growth.

Revenue is up +32% to £11m and Assets under Administration (AuA) is up +38% to £3.7bn. Even if you have no interest in PBEE, it’s worth pondering what effect this level of growth might have on the larger platforms like HL., which has £132bn of AuA and 1.7m customers. AJB has £69bn of AuA and just under half a million customers. A traditional Wealth Manager like RAT has £60bn of AuA and 68,000 clients.

PBEE’s customer proposition is to help customers consolidate their disparate pensions into a low-cost PensionBee Personal Pension. The company complements its digital offering (i.e. website and app) with dedicated customer account managers, known as “BeeKeepers”, who offer both online and telephone support to customers. That sounds great in theory, but this seems to be an offering which appeals to less poorer (or perhaps younger) customers than the other platforms. PBEE report much smaller balances, on average £18K, versus almost £80K at Hargreaves Lansdown.

PensionBee charges an ongoing annual management fee between 50bp and depending on the plan chosen, with no minimum pension size requirements. That doesn’t look particularly attractive compared to HL. who charge 45bp and AJ Bell 25bp.

History: PensionBee was co-founded in 2014 by Romi Savova (ex-Goldman Sachs and Morgan Stanley), the current Chief Exec and Jonathan Lister Parsons, its current CTO, to simplify pension savings in the UK, following a difficult pension transfer experience for Romi Savova using traditional platforms. They partnered with BlackRock and State Street who manage the pensions, then later with LGEN to offer a responsible investment option. State Street became a minority shareholder in 2017. In April 2021 the company raised £55m at 170p, with under £5m going to selling shareholders. This valued the market cap on admission at £365m versus revenues of just £6m, implying a historic price-to-revenue multiple of 60x.

Ownership: Sharepad shows that Romi Savova still owns 36% of the shares and Jonathan Lister Parsons 6%. State Street have 3.9%, which they bought pre-IPO, and Norges Bank 3.5% is the only other institution that has a disclosable stake.

Valuation: The shares are trading on 4.5x revenue FY Dec 202F revenue. They are targeting EBITDA margins of 50% in the long term, versus -100% in FY Dec 2022. That’s beyond the explicit forecast period, Sharepad shows 4% EBITDA margin in FY Dec 2025. For comparison Sharepad shows HL. have an EBITDA margin of above 50%, and AJ Bell just under 40%.

Opinion: The customer value proposition doesn’t look significantly better than the existing platforms unless I am missing something? I consolidated my various pensions into a single SIPP at Hargreaves Lansdown, then later moved to Interactive Investors, because the fixed monthly fee worked out better value for me. I can see from a marketing perspective PBEE might appeal to a younger, more diverse demographic but I’m not going to pay an eye-watering price/sales multiple for a company using investors’ cash to fund a large marketing budget to buy market share.

Conclusion

Bruce owns shares in FDEV, Impax, Games Workshop and Superdry

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.