Updated: August 2024

If you are reading this, the chances are that you’ve decided to take control of your investments or are doing so already.

You may have been investing for some time but feel you could do better.

Many of you may be new to investing, or have previously left the management of your money to professionals, and are thinking of taking the plunge and going it alone.

Is this the right thing to do?

Can you really be trusted to grow the value of your savings?

There’s a massive financial industry out there that will say “no” to both these questions.

Our view is that anyone can be their own portfolio manager if they want to be.

That said, it is not easy.

You have to be prepared to allocate your time to researching investments and have the right temperament to go it alone.

The good news is…

- The internet has made it a lot easier for individuals to manage their own money.

- Information about a company’s finances is freely available.

- There is also a wealth of other information out there which is easily accessible to all investors nowadays, not just professional investors.

- You don’t need a high IQ to get a satisfactory performance from your portfolio, just lots of common sense and an ability to stay calm will suffice.

But there’s no escaping from the fact that to be a good investor takes discipline and a lot of hard work.

Managing your own money in the wrong way is the road to financial misery.

Your broker’s website will often provide you with a company’s financial statements for the last few years at no extra cost. But it’s what you do with that information that matters, not the fact that you have it.

This is why ShareScope was created.

My name is Phil Oakley and I spent thirteen years earning a living as a professional investment analyst.

A large part of my working days were spent wading through company accounts and crunching numbers.

It would often take me weeks of putting numbers into spreadsheets and performing long financial calculations before I began to understand the company I was studying.

With ShareScope, all this work can be done in a fraction of the time it used to take me.

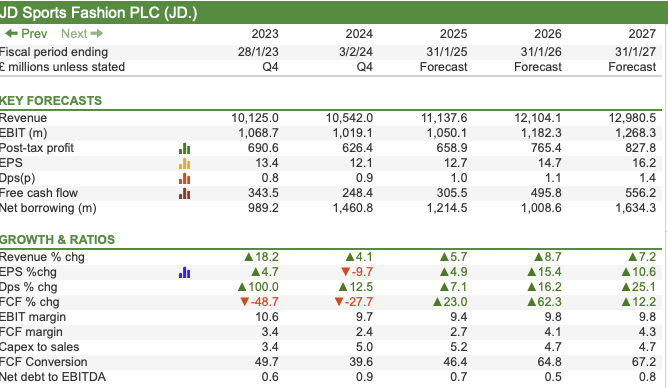

Within a matter of minutes, I can know a company’s financial performance for the last twenty years, how the stock market has priced its shares during that time and what its future profits are expected to be.

I’ve had a picture of the company painted for me.

That’s because ShareScope has calculated many important numbers for me and turned the financial data that is available in lots of places into valuable information that isn’t.

It allows me to do other things as well.

I can see how many shares the directors own and whether they have been buying or selling recently

I can read the latest financial news and stock market chatter about the company and check when the next dividend will be paid or the next announcement is due.

In short, I don’t have to go anywhere else to learn about a company and its shares. Instead of slaving away for hours, ShareScope has done all the hard work and calculations for me. It is my own personal stock market analyst.

That would be pretty good if that’s all that ShareScope did but there are more clever and useful things it can do.

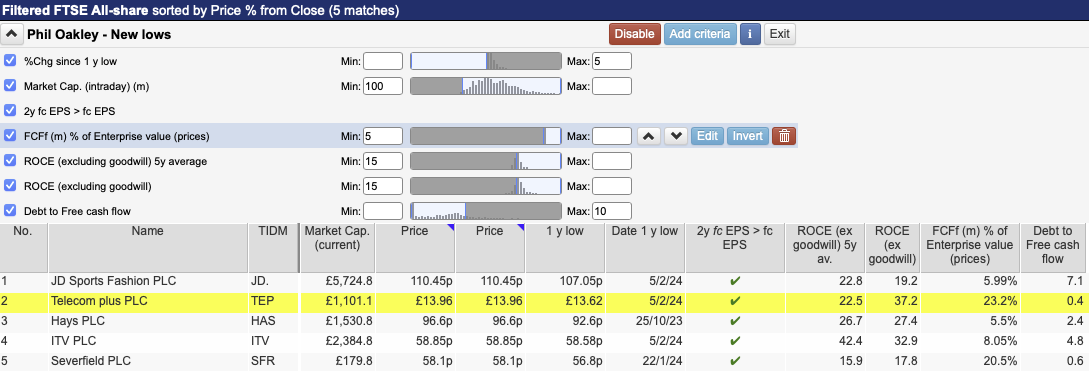

The software allows you to screen the UK, US, Canadian and European stock markets for shares that meet set criteria. This allows you to perhaps look for things that other investors are not which may give you an edge.

You can search through thousands of different shares in as simple or as complicated a way as you want. If there’s a share that matches what you are looking for, ShareScope will find it for you.

For example, you can look for shares that are really depressed and out of favour which are hitting new lows. Then you can check out their finances and see how cheap or expensive the shares are all at the same time. There are literally hundreds of different combinations you can use to look for winning investments.

If you find a share that interests you, ShareScope allows you to set an alarm for when it meets a certain price, or when an announcement is made or a director has bought or sold shares. When an alarm is triggered, ShareScope sends you an email to let you know. This means you don’t have to spend all day chained to a computer screen or have to trawl the internet to find things out. You can get on with more useful things instead.

Once you’ve set up your portfolio you can monitor it in ShareScope. You can apply lots of clever tools to it to keep you informed and make sure that it is doing what you want it to do. And you don’t need to be at home or in an office to keep an eye on things. As long as you have an internet connection, you can check out your portfolio on your smartphone or tablet device from anywhere in the world.

ShareScope is not just about shares either. It gives information on investment funds, bonds, exchange-traded funds (ETFs), commodities and lots of economic data. If you want to chart data and put it into a document or presentation for your fellow investors you can do that. You can email it to your friends if you like.

You don’t need to have ShareScope in order to learn from this guide but you will need ShareScope if you want to put it into practice.

Put it this way, if I were a professional investment analyst today, I would want to use ShareScope for everything.

It gives you, the private investor, everything you need to get better results – for an extremely modest price. Professional investors can pay tens of thousands of pounds per year for tools of this quality.

I use ShareScope to manage my pension and Isa investments and am constantly amazed at what it will do. I also know that over the coming months and years, it will become even better and do more clever and helpful things. I think it’s something that every investor should use.

However, with ShareScope you will get more than just a piece of clever investment software. The problem with lots of software is that no one really tells you how to use it. We don’t want ShareScope users to feel that they’ve been left to fend for themselves.

So what will this guide show you?

With this investment analysis manual, I’ll be using my experience to teach you how to understand company finances, how to value shares and how to practise certain types of investing. I’ll be telling you what to look out for and how you can avoid simple mistakes.

On top of this, there’s lots of articles and educational materials on the ShareScope website. These will offer further guidance, often using topical examples, to help you put theory into practice.

I hope that you will find this Step-by-Step guide to Investing useful.

Good investing!

Phil Oakley

Next: Chapter 2 – Balance sheets

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.