The Trader: Nvidia’s fall and the RNS layout

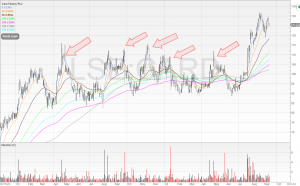

In this article, Michael looks at the ramifications for Nvidia’s fall and his RNS layout. What a week. Nvidia took a dive on news of DeepSeek which, if we’re to believe is true, is able to compete with ChatGPT-4 and Claude for a fraction of the resources. It might not look much. But that drop