A look at stimulus coming from the People’s Bank of China and deficit spending by Western governments, both of which seem expansionary. Companies covered: IPO, OMG and ABDP.

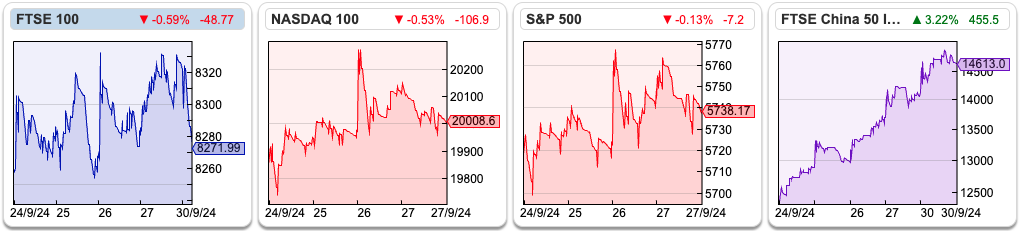

The FTSE 100 was flat last week, bouncing around 8,270. In the USA, the Nasdaq100 and S&P500 were both up less than +1%. China on the other hand bounced strongly with the FTSE China 50 was up +20% in the last five days and the CSI 300 (Shanghai) +16%. This is the largest rally in the Chinese stock market since the financial crisis. That follows the People’s Bank of China government announcing that they would be buying shares to support the stock market, help for the troubled property sector and other stimulus measures. XIN0 is now up +35% YTD, making it the best performing stockmarket this year. For comparison the S&P500 is up +20%, FTSE 100 +8%, while AIM is the worst performing major indices -2% YTD.

This news also helped large cap luxury to bounce, LVMH was up +19%, Burberry +18%, Watches of Switzerland, which I wrote about here, +22% all since the 20th Sept. I had suggested that WOSG valuation seemed attractive, but the shares lacked a near-term catalyst.

One commentator who is very good at helping to understand global liquidity trends is Mike Howell at CrossBorder Capital. He believes that China’s “Red Capitalism” is no longer working, because the US and Europe will no longer run large trade imbalances. At the margin stimulus from the PBC may help, but fundamentally the CCP needs to rethink the export-led growth model and rely more on the Chinese consumer. He thinks there’s more stimulus to come from the PBC, and we could see commodity prices rise strongly in response.

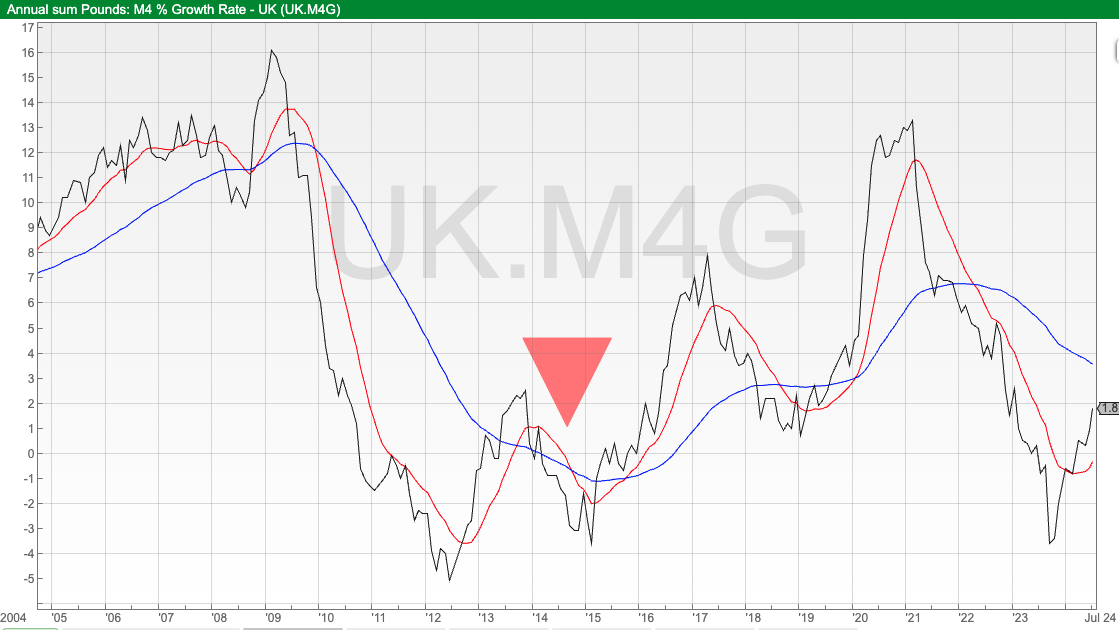

He also points out that Western government deficits are increasingly being funded at the short end of the yield curve, which is the equivalent of “printing money”. To explain in more detail, when governments fund at the long end the natural buyers of bonds are pension funds, other Central Banks, SWFs, insurance companies etc. That doesn’t increase money supply, these buyers are swapping cash for long dated assets, but when government issue short-term paper, that paper is bought by banks. That leads to an increase in bank balance sheets and money supply measures like M4. It’s possible to track UK money supply (UK.M4G) using Sharepad.

The chart shows that as the pandemic ended, money supply began to decline trend. However, UK M4 troughed in September last year, and has begun rising again. This is very different to the story that QE has finished and Central Banks have begun shrinking their balance sheets – which is true, but misses the bigger picture.

He says the same trend of deficits funded by short-term money creation is happening in the US too, where the deficit is forecast to increase to 6.7% of GDP in 2025F. European countries are also likely to increase deficits and money creation to fund welfare spending that will increase with ageing demographics. All of this implies we could see another bout of “unexpected” inflation at some point. Hence gold +29% YTD at $2,664 per ounce is at all-time highs. I would also expect AIM shares to benefit from this trend, in part because of the exposure to the mining sector and in part because the index has underperformed and AIM shares look good value. Last week we saw an approach for Learning Technologies Group, share price +30%, from a US Private Equity company Atlantic Park. I last wrote about LTG at the beginning of August.

This week I look at IP Group H1 results, Oxford Metrics profit warning and AB Dynamics “ahead of expectations” H2 RNS.

IP Group H1 results

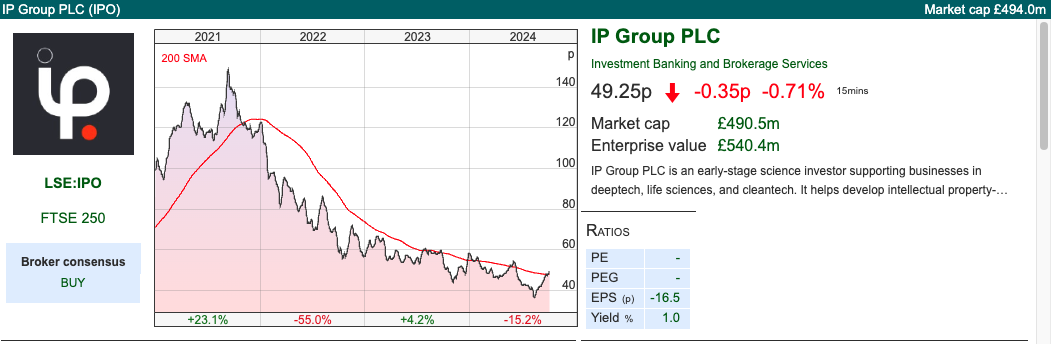

This venture capital firm backs UK university spin-outs, and was an early investor in the likes of Ceres Power (hydrogen), Avacta (biotech diagnostics) and most recently Oxford Nanopore (DNA sequencing). Previously I had seen IP as a way to benefit from the re-opening of the IPO market, but management have been able to achieve some cash exit with trade sales, for instance Garrison Technology to US based cybersecurity company Everfox for just under £43m. There have been some other small disposals too in H1, all of which have been completed at or above carrying values. Management say further exits are expected should take place “at or above 2023 carrying values”.

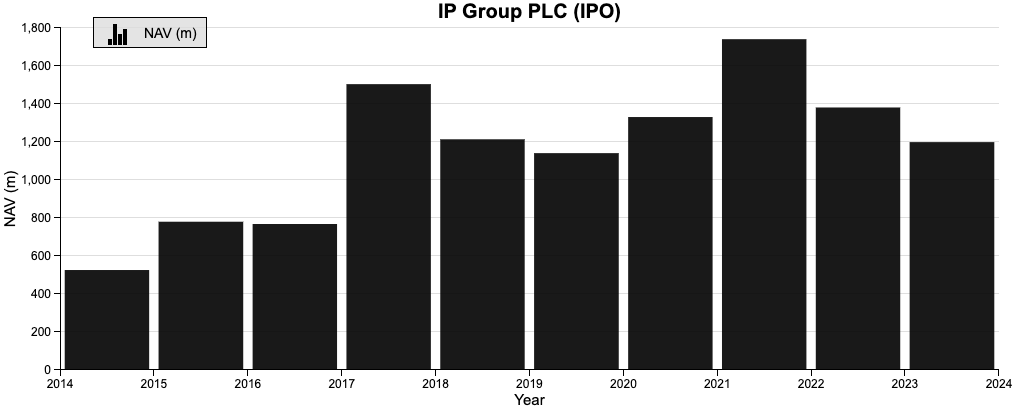

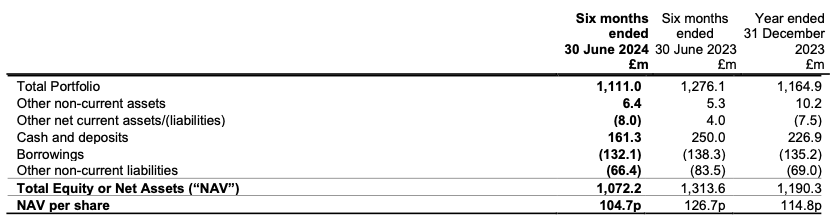

That is important because NAV per share was 105p (or £1.07bn), so at 49p the shares trade at a greater than 50% discount to NAV, suggesting investor scepticism that the company has valued its portfolio of companies at market prices.

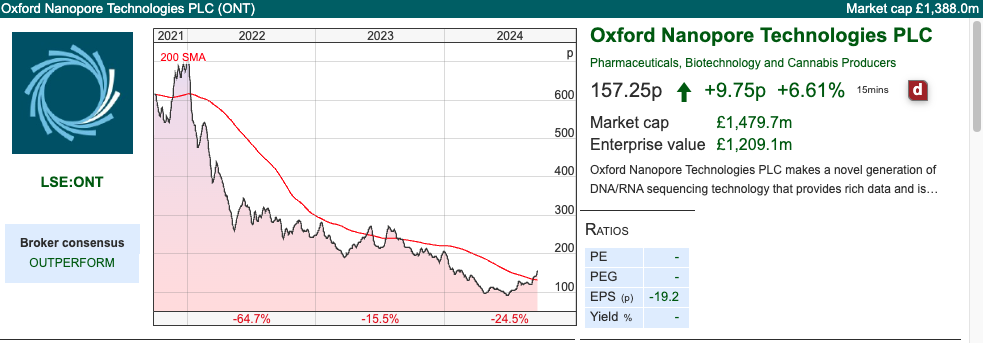

That scepticism is partly justified, as NAV has been declining in recent years, from a peak of 167p (or £1.7bn) in FY Dec 2021. However, over 40% of the NAV writedown has come from Oxford Nanopore (ONT), which was a success for IP Group. ONT listed on the LSE at £6 per share (£3.4bn market cap), delivering a fair value gain of almost £300m and a cash realisation of £84m to IP Group. IP retained a 10% stake, at the time valued at £340m. However, since 2021, like many IPOs of that vintage, ONT share price performance has been poor, falling -87% from peak to trough, and IP Group has been marking down the value of their holding, which has hit group NAV.

There’s a certain irony that investors are sceptical towards IPO’s fair value accounting, yet the damage to NAV has been done by a holding after listing on public markets. As of June 30, ONT was valued at £79m on IPO’s balance sheet, resulting in a £261m NAV writedown since 2021.

Valuation: Aside from the £1.11bn of portfolio investments, management cite £161m of gross cash, increasing by a further £41m received from exits after June. However, many of the portfolio companies are loss making and not funded through to break even, so most of that cash will need to be reinvested rather than distributed to shareholders.

There’s also £132m of borrowing and a further £66m of other liabilities, so the company doesn’t have a strong net cash position. Within the 105p of NAV, ONT is 8p, and unlisted companies like Feature Space (fraud prevention) 11p, Hysata (green hydrogen) 8p, Oxa (autonomous vehicle software) 6p, and first light (nuclear fusion) 5p. They say 27p of NAV is clinical-stage biotechs undergoing phase II or III trials.

Even so, the company has been buying back shares, returning £95m to shareholders since 2021 and announced a further £10m buyback at the results. Whenever the discount to NAV exceeds 20%, they expect to do buybacks.

Opinion: To my mind the buybacks signal confidence both in future exits and management’s fair value assumptions. The chart seems to be forming a nice bowl, and I can imagine that in a bull market this could do very well. It looks like there may have been a forced seller, as Liontrust previously owned 5% but are no longer on the register. I’m tempted to open a starter position.

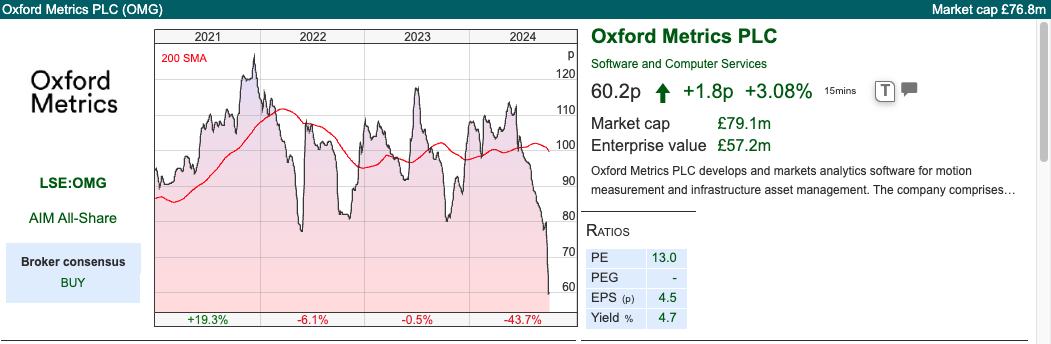

Oxford Metrics H2 Sept profit warning

This software company that does motion sensor technology and has Guy’s Hospital, George Lucas’ special effects company Industrial Light & Magic and NASA as customers, announced a profit warning for FY 30 Sept. The announcement is particularly disappointing as management reiterated FY Sept expectations in June and said: “>90% visibility of full-year revenues and a growing sales pipeline ahead of this time last year.”

The RNS highlights some interesting themes around communication. For instance, management will often try to persuade investors that problems are temporary and easily resolvable – so I think that the investment case is worth a closer look, cross checking the story versus the numbers.

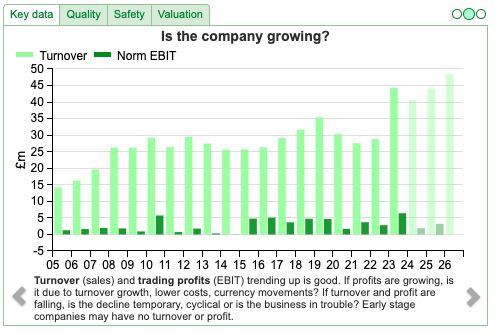

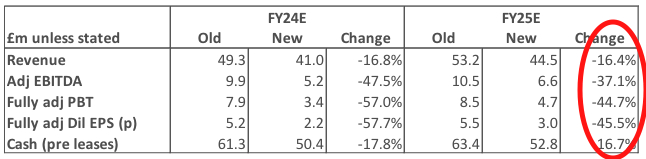

First of all, revenue is now expected to be in the £40-£42m range (a -16% reduction from previous FY Sept 2024F forecasts). Adj PBT “materially below current market expectations” – Progressive have slashed their adj PBT forecast by -57% to £3.4m. In 2022, the company sold an unprofitable division: Yotta, for £52m and aside from a couple of small acquisitions held on to the cash (c. £50m in last week’s RNS). They continue to pursue a number of M&A opportunities in the smart manufacturing space, but following the profit warning, cash now represents 63% of the market cap – management may come under pressure from investors to buy back shares. I noted on the Sharepad chat that some large prints had gone through on the day of the profit warning, which looked like one of the institutions on the register (Harwood 12.55%, Aviva 10%, Sensing Systems Inc 9.4%, Cavendish AM 5.7%, Ruffer 4.6% amongst others) could be exiting.

There was a Capital Markets Day in April 2024, and the company has a plan to increase FY Sept 2021 revenues by 2.5x to at a pre-tax margin of 15%. That would imply increasing from £27.5m to £70m revenues by the end of FY Sept 2026F. This target wasn’t reiterated in last week’s RNS, and Progressive are now forecasting £44m of revenue FY Sept 2025F.

Explanation: The RNS says that the group has a healthy pipeline, but that buying cycles have been extended and customers are exercising greater caution. Engineering (20% of H1 revenues) and Life Sciences (33% of H1 revenues) are now expected to be below FY Sept 2023 – despite at the H1 stage these growing +57% and +38% respectively. That implies a very weak H2. Entertainment, which includes computer games, was down -23% at the H1 stage (£8.5m or 36% of H1 revenues), hasn’t recovered and may have deteriorated further.

The RNS says that: “A number of opportunities in the pipeline have now shifted into the new financial year.” If so, we might expect to see FY Sept 2024F numbers hit, but FY 2025F unchanged or even increased. That hasn’t happened though. Progressive have also cut next year’s revenue number by -16% and adj PBT number by -45%, suggesting that there could be something more fundamental than just a few months delay in the pipeline. For instance, perhaps OMG is losing market share to a better (AI-enabled?) competitor, or the cautious behaviour of buyers is driven by pessimism about end markets.

More detail will be provided on 3rd Dec, when the group announces FY results.

Valuation: The shares are trading on 20x Sept 2025F and 17x the following year. That seems expensive, but adjusting for the £50m of cash, results in a PER below 10x. The shares are trading on 1.7x Sept 2025F sales.

Opinion: I own this, and last wrote about it in Oct 2023. My initial reaction to last week’s profit warning was to think about averaging down, as the company has such a strong cash position. Seeing Progressive’s forecast changed for FY Sept 2025F does make me nervous though. This ought to be a high quality company, gross margin was 69% at the H1 stage. On balance, I will remain positive but wanted to highlight the risks.

AB Dynamics H2 Ahead of Expectations

This automotive testing company with a 31st Aug year end, announced an ahead of expectations H2 and a small acquisition. Management expect revenues to exceed £110m, implying +9% revenue growth. Adj operating profit, is expected to be ahead (range given in RNS was £17.3m to £18.8m) implying at least +14% growth. Net cash at the end of August was £28.6m (down slightly versus $32m Aug 2023). That decline shouldn’t be anything to worry about, the company paid out £6m in H1, to fund the final performance payment of a prior acquisition: Ansible Motion and also pays a dividend of just over £1m.

The company is also acquiring Bolab, for a maximum total consideration of €11m. Management expects this will generate c. €4m of forecast revenue and adj operating profit of c. €0.8m. So a valuation multiple of just under 3x sales and 20x PER.

ABDP revenue has almost doubled from FY Aug 2020, but much of that has been driven by acquisitions. Currently there’s £70m of goodwill and other intangibles on the balance sheet, which is more than half of net assets £127m.

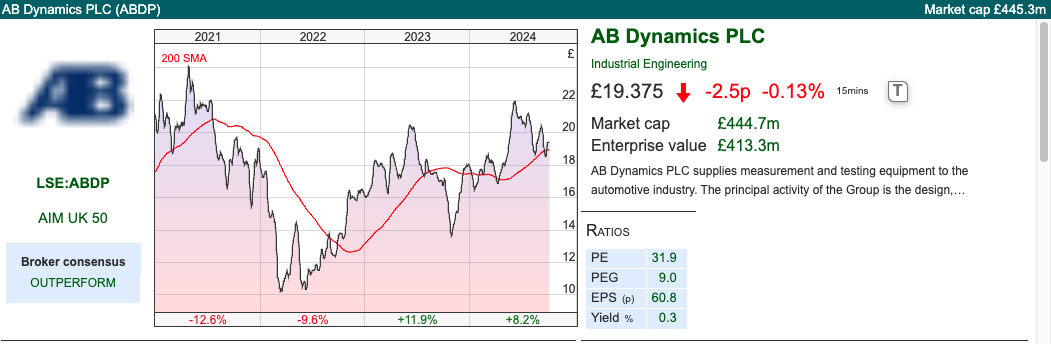

Valuation: AB Dynamics are trading on a PER of 28x Aug 2025F and 25x the following year. That seems expensive, but before the pandemic the company was reporting an EBIT margin greater than 20%, versus 7% more recently. So perhaps that high PER valuation is anticipating some improvement in margin back to historic levels?

Opinion: This is an example of a 20x bagger stock that has lost its way since the pandemic. AB floated in 2013 at 86p per share, reporting revenue of £12m and operating profit was £2m. The shares hit a high of over £26 in December 2019, but are now trading below £20. Maynard wrote it up in more detail here. The chart looks to be forming a triangle (higher lows, lower highs) – given the positive guidance I think this is more likely to break out on the upside. I haven’t taken a position though.

Notes

Bruce owns shares in Oxford Metrics.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 1/10/2024 | IPO, OMG, ABDP | Stimulus from the East, M4 from the West

The FTSE 100 was flat last week, bouncing around 8,270. In the USA, the Nasdaq100 and S&P500 were both up less than +1%. China on the other hand bounced strongly with the FTSE China 50 was up +20% in the last five days and the CSI 300 (Shanghai) +16%. This is the largest rally in the Chinese stock market since the financial crisis. That follows the People’s Bank of China government announcing that they would be buying shares to support the stock market, help for the troubled property sector and other stimulus measures. XIN0 is now up +35% YTD, making it the best performing stockmarket this year. For comparison the S&P500 is up +20%, FTSE 100 +8%, while AIM is the worst performing major indices -2% YTD.

This news also helped large cap luxury to bounce, LVMH was up +19%, Burberry +18%, Watches of Switzerland, which I wrote about here, +22% all since the 20th Sept. I had suggested that WOSG valuation seemed attractive, but the shares lacked a near-term catalyst.

One commentator who is very good at helping to understand global liquidity trends is Mike Howell at CrossBorder Capital. He believes that China’s “Red Capitalism” is no longer working, because the US and Europe will no longer run large trade imbalances. At the margin stimulus from the PBC may help, but fundamentally the CCP needs to rethink the export-led growth model and rely more on the Chinese consumer. He thinks there’s more stimulus to come from the PBC, and we could see commodity prices rise strongly in response.

He also points out that Western government deficits are increasingly being funded at the short end of the yield curve, which is the equivalent of “printing money”. To explain in more detail, when governments fund at the long end the natural buyers of bonds are pension funds, other Central Banks, SWFs, insurance companies etc. That doesn’t increase money supply, these buyers are swapping cash for long dated assets, but when government issue short-term paper, that paper is bought by banks. That leads to an increase in bank balance sheets and money supply measures like M4. It’s possible to track UK money supply (UK.M4G) using Sharepad.

The chart shows that as the pandemic ended, money supply began to decline trend. However, UK M4 troughed in September last year, and has begun rising again. This is very different to the story that QE has finished and Central Banks have begun shrinking their balance sheets – which is true, but misses the bigger picture.

He says the same trend of deficits funded by short-term money creation is happening in the US too, where the deficit is forecast to increase to 6.7% of GDP in 2025F. European countries are also likely to increase deficits and money creation to fund welfare spending that will increase with ageing demographics. All of this implies we could see another bout of “unexpected” inflation at some point. Hence gold +29% YTD at $2,664 per ounce is at all-time highs. I would also expect AIM shares to benefit from this trend, in part because of the exposure to the mining sector and in part because the index has underperformed and AIM shares look good value. Last week we saw an approach for Learning Technologies Group, share price +30%, from a US Private Equity company Atlantic Park. I last wrote about LTG at the beginning of August.

This week I look at IP Group H1 results, Oxford Metrics profit warning and AB Dynamics “ahead of expectations” H2 RNS.

IP Group H1 results

This venture capital firm backs UK university spin-outs, and was an early investor in the likes of Ceres Power (hydrogen), Avacta (biotech diagnostics) and most recently Oxford Nanopore (DNA sequencing). Previously I had seen IP as a way to benefit from the re-opening of the IPO market, but management have been able to achieve some cash exit with trade sales, for instance Garrison Technology to US based cybersecurity company Everfox for just under £43m. There have been some other small disposals too in H1, all of which have been completed at or above carrying values. Management say further exits are expected should take place “at or above 2023 carrying values”.

That is important because NAV per share was 105p (or £1.07bn), so at 49p the shares trade at a greater than 50% discount to NAV, suggesting investor scepticism that the company has valued its portfolio of companies at market prices.

That scepticism is partly justified, as NAV has been declining in recent years, from a peak of 167p (or £1.7bn) in FY Dec 2021. However, over 40% of the NAV writedown has come from Oxford Nanopore (ONT), which was a success for IP Group. ONT listed on the LSE at £6 per share (£3.4bn market cap), delivering a fair value gain of almost £300m and a cash realisation of £84m to IP Group. IP retained a 10% stake, at the time valued at £340m. However, since 2021, like many IPOs of that vintage, ONT share price performance has been poor, falling -87% from peak to trough, and IP Group has been marking down the value of their holding, which has hit group NAV.

There’s a certain irony that investors are sceptical towards IPO’s fair value accounting, yet the damage to NAV has been done by a holding after listing on public markets. As of June 30, ONT was valued at £79m on IPO’s balance sheet, resulting in a £261m NAV writedown since 2021.

Valuation: Aside from the £1.11bn of portfolio investments, management cite £161m of gross cash, increasing by a further £41m received from exits after June. However, many of the portfolio companies are loss making and not funded through to break even, so most of that cash will need to be reinvested rather than distributed to shareholders.

There’s also £132m of borrowing and a further £66m of other liabilities, so the company doesn’t have a strong net cash position. Within the 105p of NAV, ONT is 8p, and unlisted companies like Feature Space (fraud prevention) 11p, Hysata (green hydrogen) 8p, Oxa (autonomous vehicle software) 6p, and first light (nuclear fusion) 5p. They say 27p of NAV is clinical-stage biotechs undergoing phase II or III trials.

Even so, the company has been buying back shares, returning £95m to shareholders since 2021 and announced a further £10m buyback at the results. Whenever the discount to NAV exceeds 20%, they expect to do buybacks.

Opinion: To my mind the buybacks signal confidence both in future exits and management’s fair value assumptions. The chart seems to be forming a nice bowl, and I can imagine that in a bull market this could do very well. It looks like there may have been a forced seller, as Liontrust previously owned 5% but are no longer on the register. I’m tempted to open a starter position.

Oxford Metrics H2 Sept profit warning

This software company that does motion sensor technology and has Guy’s Hospital, George Lucas’ special effects company Industrial Light & Magic and NASA as customers, announced a profit warning for FY 30 Sept. The announcement is particularly disappointing as management reiterated FY Sept expectations in June and said: “>90% visibility of full-year revenues and a growing sales pipeline ahead of this time last year.”

The RNS highlights some interesting themes around communication. For instance, management will often try to persuade investors that problems are temporary and easily resolvable – so I think that the investment case is worth a closer look, cross checking the story versus the numbers.

First of all, revenue is now expected to be in the £40-£42m range (a -16% reduction from previous FY Sept 2024F forecasts). Adj PBT “materially below current market expectations” – Progressive have slashed their adj PBT forecast by -57% to £3.4m. In 2022, the company sold an unprofitable division: Yotta, for £52m and aside from a couple of small acquisitions held on to the cash (c. £50m in last week’s RNS). They continue to pursue a number of M&A opportunities in the smart manufacturing space, but following the profit warning, cash now represents 63% of the market cap – management may come under pressure from investors to buy back shares. I noted on the Sharepad chat that some large prints had gone through on the day of the profit warning, which looked like one of the institutions on the register (Harwood 12.55%, Aviva 10%, Sensing Systems Inc 9.4%, Cavendish AM 5.7%, Ruffer 4.6% amongst others) could be exiting.

There was a Capital Markets Day in April 2024, and the company has a plan to increase FY Sept 2021 revenues by 2.5x to at a pre-tax margin of 15%. That would imply increasing from £27.5m to £70m revenues by the end of FY Sept 2026F. This target wasn’t reiterated in last week’s RNS, and Progressive are now forecasting £44m of revenue FY Sept 2025F.

Explanation: The RNS says that the group has a healthy pipeline, but that buying cycles have been extended and customers are exercising greater caution. Engineering (20% of H1 revenues) and Life Sciences (33% of H1 revenues) are now expected to be below FY Sept 2023 – despite at the H1 stage these growing +57% and +38% respectively. That implies a very weak H2. Entertainment, which includes computer games, was down -23% at the H1 stage (£8.5m or 36% of H1 revenues), hasn’t recovered and may have deteriorated further.

The RNS says that: “A number of opportunities in the pipeline have now shifted into the new financial year.” If so, we might expect to see FY Sept 2024F numbers hit, but FY 2025F unchanged or even increased. That hasn’t happened though. Progressive have also cut next year’s revenue number by -16% and adj PBT number by -45%, suggesting that there could be something more fundamental than just a few months delay in the pipeline. For instance, perhaps OMG is losing market share to a better (AI-enabled?) competitor, or the cautious behaviour of buyers is driven by pessimism about end markets.

More detail will be provided on 3rd Dec, when the group announces FY results.

Valuation: The shares are trading on 20x Sept 2025F and 17x the following year. That seems expensive, but adjusting for the £50m of cash, results in a PER below 10x. The shares are trading on 1.7x Sept 2025F sales.

Opinion: I own this, and last wrote about it in Oct 2023. My initial reaction to last week’s profit warning was to think about averaging down, as the company has such a strong cash position. Seeing Progressive’s forecast changed for FY Sept 2025F does make me nervous though. This ought to be a high quality company, gross margin was 69% at the H1 stage. On balance, I will remain positive but wanted to highlight the risks.

AB Dynamics H2 Ahead of Expectations

This automotive testing company with a 31st Aug year end, announced an ahead of expectations H2 and a small acquisition. Management expect revenues to exceed £110m, implying +9% revenue growth. Adj operating profit, is expected to be ahead (range given in RNS was £17.3m to £18.8m) implying at least +14% growth. Net cash at the end of August was £28.6m (down slightly versus $32m Aug 2023). That decline shouldn’t be anything to worry about, the company paid out £6m in H1, to fund the final performance payment of a prior acquisition: Ansible Motion and also pays a dividend of just over £1m.

The company is also acquiring Bolab, for a maximum total consideration of €11m. Management expects this will generate c. €4m of forecast revenue and adj operating profit of c. €0.8m. So a valuation multiple of just under 3x sales and 20x PER.

ABDP revenue has almost doubled from FY Aug 2020, but much of that has been driven by acquisitions. Currently there’s £70m of goodwill and other intangibles on the balance sheet, which is more than half of net assets £127m.

Valuation: AB Dynamics are trading on a PER of 28x Aug 2025F and 25x the following year. That seems expensive, but before the pandemic the company was reporting an EBIT margin greater than 20%, versus 7% more recently. So perhaps that high PER valuation is anticipating some improvement in margin back to historic levels?

Opinion: This is an example of a 20x bagger stock that has lost its way since the pandemic. AB floated in 2013 at 86p per share, reporting revenue of £12m and operating profit was £2m. The shares hit a high of over £26 in December 2019, but are now trading below £20. Maynard wrote it up in more detail here. The chart looks to be forming a triangle (higher lows, lower highs) – given the positive guidance I think this is more likely to break out on the upside. I haven’t taken a position though.

Notes

Bruce owns shares in Oxford Metrics.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.