A look at the performance of gold, and some dividend yield paying shares which should also benefit from the rising gold price. Companies covered: HAT, CAPD and BGEO.

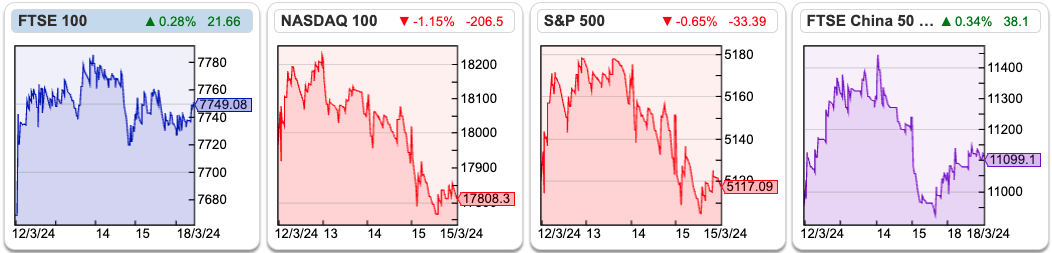

The FTSE 100 was up +1% to 7,749 last week. Meanwhile, Nasdaq100 and S&P500 were down -1.2% and -0.2% respectively. The FTSE China 50 has now bounced +14% since its low in January this year but remains below its 64-day moving average.

I pointed out last week that commodities like natural gas, oil and wheat had been surprisingly weak since their initial spike following Putin’s invasion of Ukraine. Gold on the other hand has begun to perk up: since October last year, the precious metal is up +19% to $2,160. The trend looks favourable with the spot price and the 16-day moving average maintaining a level above the 64-day moving average. One driver of that is likely to be momentum-driven Commodity Trading Advisers like Winton. An additional positive catalyst could be Central Banks beginning to cut interest rates, as investors tend to avoid gold when they can earn above 5% simply by holding cash in the bank.

The relationship is not linear though. Gold did very well in the 1970’s when interest rates and inflation were much higher. Then in the 1990s gold made little progress, but increased in value around 5-6x between 2001 and 2011. In the 1970s, investors saw the precious metal as a store of value at a time when Central Banks had lost their inflation-fighting credibility, but the driver following the bursting of the TMT bubble was interest rate cuts. So that asymmetry (does well if Central Banks lose credibility, but also does well from rate cuts) suggests to me that gaining exposure to the gold price could be an interesting trade for 2024.

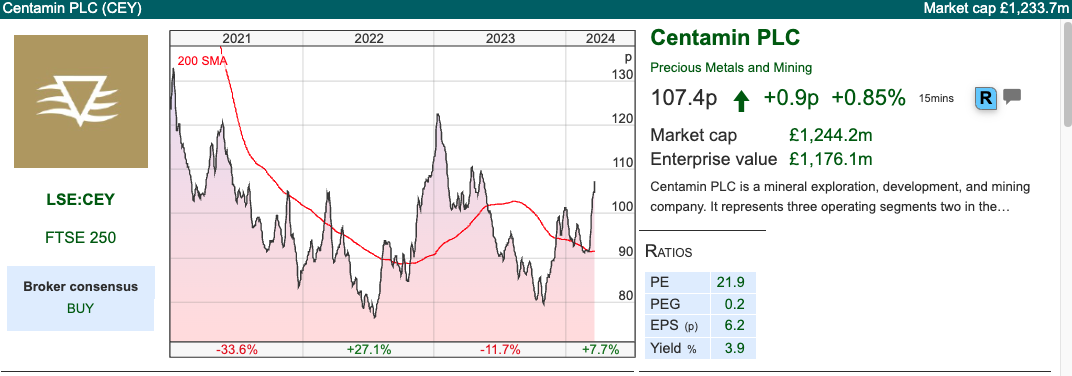

The simplest way to do this would be to buy a gold ETF, however, ETFs don’t generate any yield. A different suggestion is to look at dividend-paying equities. The most obvious is a gold miner like Centamin, which trades on a PER of 9x FY Dec 2024F and yield of 3.5% the same year.

A second alternative though is pawnbroker H&T which I cover below. A third alternative is gold mining services Capital Drilling, which I own and also look at below. Neither HAT nor CAPD have performed well recently, but they have been paying a dividend and if gold does start to strengthen then I would expect to see an upside.

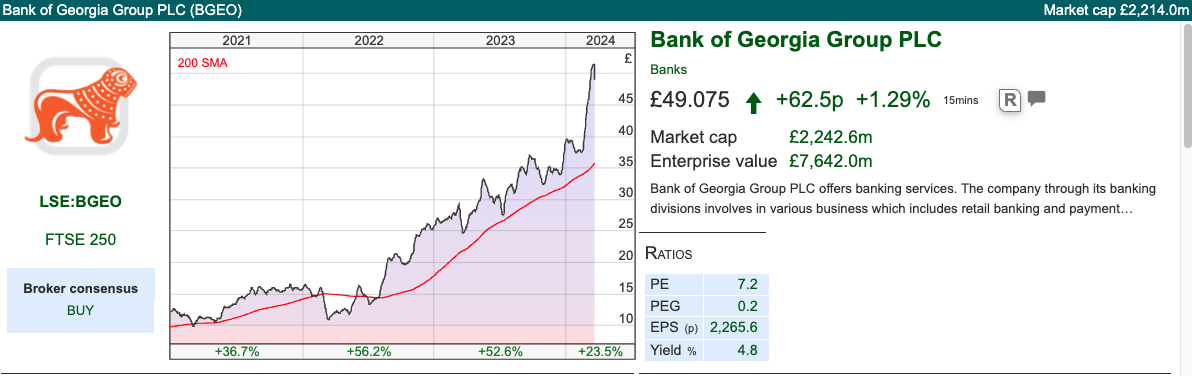

I finish off with a look at last week’s BGEO results. The Georgian bank has been the best-performing stock in the FTSE All Share since Putin invaded Ukraine, but still only trades on 5x PER.

H&T FY Dec Results

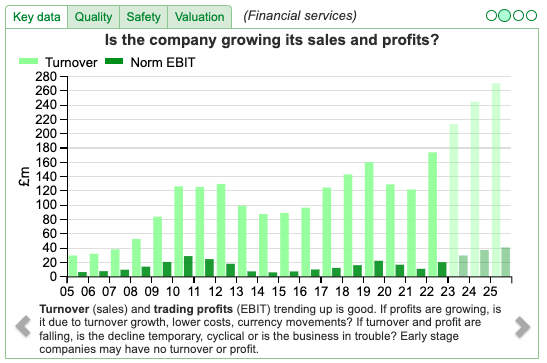

HAT has been listed since 2006 but did double in value up to 2011 when the gold price was strong before the shares more than halved in 2013 as the gold price has been lacklustre in the last 10 years. Last week HAT announced FY Dec revenues +27% to £221m and statutory PBT +39% to £26m. Net debt at the end of December was £32m versus £3m the previous year-end. Although that is up sharply, net debt to EBITDA stood at 0.9x, versus the maximum in their financial covenants of 2.5x, so they are operating well within their limits. The rise in net debt was to fund expansion with £29m invested in the pledge book and £18m capital expenditure.

The group’s main activity is pawnbroking, that is a loan secured against collateral (the pledge). Over 99% of this collateral was precious metals (mainly gold), diamonds and watches. Revenue less impairment was £115m, +37% on the previous year. Taking a longer-term perspective, revenue hasn’t shown much progress since 2012 but is now forecast to grow +14% in FY Dec 2024F and +11% FY Dec 2025F.

The median loan size is £201 (the mean average is more than double that at £428, suggesting a few large loans skew the distribution) and term of the loan is 6 months with a monthly interest rate charged between 2% and 9.99%. If the customer does not repay the loan before the end of the contract, the Group sells the collateral at public auctions or, if the value of the pledge is under £75, is sold through their retail or ‘pawnbroking scrap’ activities (see below). The Loan to Value averages 65% and redemption rates are currently 85%. The bottom has dropped out of the second hand watch market versus a couple of years ago, so the group has reduced the proportion of the pledge book secured on watches to 14% (down from 15% previously).

The retail division sells new and second-hand jewellery, including, items that customers have not been able to redeem. Retail sales were up +8% to £49m (just under a quarter of group revenue). They also have a small foreign currency division, gold purchasing (£8.6m of revenue) and pawnbroking scrap (the items are damaged or slow-moving, and are melted down and sold at the current gold spot price) divisions. They also do money transfers and cheque cashing.

Outlook: Management believe the core pawnbroking service will continue to benefit as customers’ disposable incomes remain under pressure. They are seeing growing demand from customers who are business owners, seeking finance for working capital against pledged personal assets.

They also mention record levels of demand for small-sum, short-term lending, at a time of severely constricted supply. I wonder if they could benefit from problems at Vanquis Bank (which used to be door-step lender Provident Financial), whose share price fell -50% last week after they said income would be ‘materially below’ expectations, due to lower margins coupled with an increased number of customer complaints.

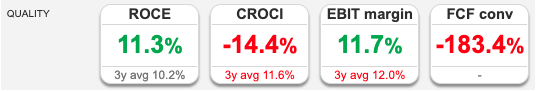

Valuation: The shares are trading on 7x FY Dec 2024F and 6.5x Dec 2025F, based on Hardman’s forecasts. Note the difference between Sharepad’s 11% RoCE and -14% CashRoCI, as HAT has grown the pledge book and invested in capex. The shares look cheap, but I’m not sure that this will ever trade on a rating much above 10x.

Opinion: I last wrote about this share in summer 2022, my concern was the relatively low level of RoCE for a financial that lends at high-interest rates. This is a difficult space to operate in because regulators are keen that vulnerable customers are not exploited. If pawnbroking was banned though, and similar high-interest lenders did not exist, vulnerable people would rely on illegal loan sharks whose collection methods might be more forceful. The dividend yield is forecast to be 5% in 2024F, so this could be a good way to gain exposure to a rising gold price while earning a decent yield, however, I prefer Capital Drilling, for the reasons I outline below.

Capital Drilling FY Dec Results

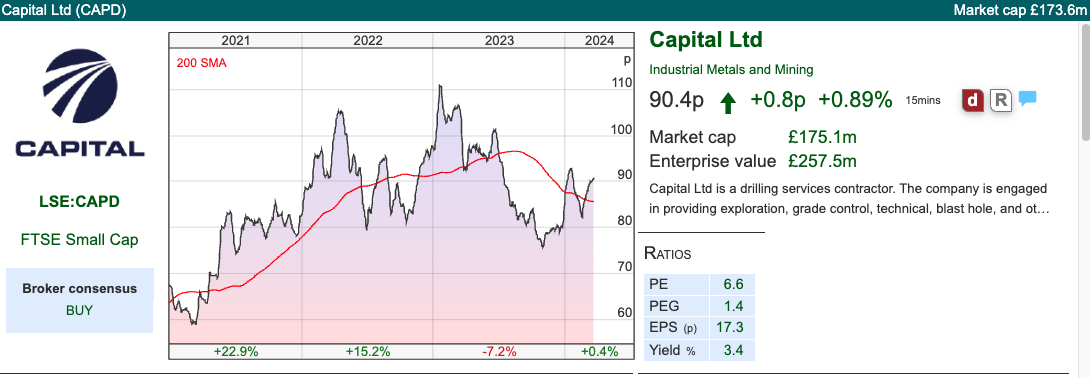

This African mining services company, which provides drilling rigs and PhotonAssay (checking the gold content of gold mine samples) announced FY results in December. Management had already warned in January that revenue would ‘miss’ below previous guidance of $320m-$340m, at $318m. That still represents +10% growth from the previous year. The slowdown reflected subdued activity in West Africa and suspended operations in Sudan, as Drilling revenue was up just +1% to $211m or 2/3 of group total. But the growth is coming from the smaller divisions Mining Services +30%, and Laboratory Services (MSALABS Photon Assay) +41%.

Despite the tough revenue environment, statutory PBT was up +54% to $50m. However, that’s driven by a $20m fair value write-down of assets in 2022, which didn’t recur in 2023. Profit from operations was flat at $60m. Net debt was up +48% to $70m as management increased capex to fund future growth last year.

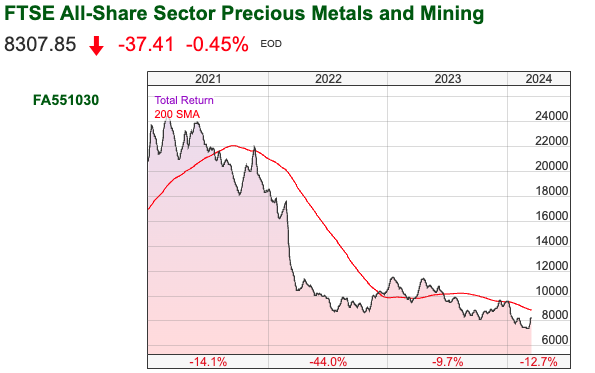

Investments: CAPD will accept equity in gold miners as well as cash for their services. Hence, they have an investment portfolio of $47m of both listed and unlisted gold mining shares. The top 3 holdings, Predictive Discovery, Allied Gold Corp and WIA Gold make up around 85% of the portfolio. Sharepad shows FTSE Precious Metals and Mining Sector has had a difficult 2022 and 2023, but has bounced +12% in the last couple of weeks as the gold price has strengthened. That suggests Capital could receive a double benefit from both increased rig count utilisation but also fair value gains in their investment portfolio of gold miners.

Outlook: CAPD have announced a contract win in Mining Services to develop the Belinga iron ore deposits, which they estimate will generate approximately $30m of revenue per annum once fully operational. MSALABS has a five-year contract with Nevada Gold which they estimate will generate c. $30m of revenues per annum. Management have guided FY Dec 2024 revenue of $355 – 375m, of which $50-$60m should be lab services. That is ahead of Tamesis, their broker’s, previous forecast of $350m, and is +15% growth at the middle of the forecast range.

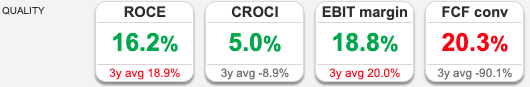

Valuation: The shares are trading on 6.5x PER Dec 2024F and 2025F. On an EV/EBITDA basis (that is factoring in the net debt to the valuation) they are trading on around 3x. That seems remarkably good value for a business that has a 3-year average RoCE of 19%. Again, note the discrepancy between RoCE and CashRoCI, as management have invested capex anticipating demand for drilling rigs to pick up in future years.

Opinion: I have owned this for a couple of years, I think this represents better exposure to rising gold prices than the pawnbroking sector. The forecast dividend yield is 4% Dec 2024F, which is lower than H&T, however, I think the MSALABs business and equity portfolio is a better medium-term story and I am happy to continue holding and may even buy some more.

Bank of Georgia FY Dec Results

I have covered this Tbilisi headquartered bank over the years, for instance here in Nov 2020, when the share price was £12, and more recently in March last year when the shares were £25. These weeklies aren’t supposed to be a ‘tip sheet’ but instead to flag interesting shares so that readers can use Sharepad to do more research. I hope readers did have their interest peaked though as the bank’s shares have quadrupled since I first wrote about them, and BGEO makes an interesting contrast to the other UK banks. Their headquarters on a steep hill overlooking the Mtkvari River looks like this.

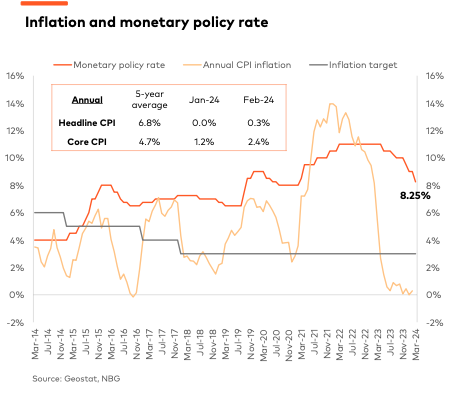

The bank reported revenue +7% to GEL 2.55bn, and PBT up +1% to GEL 1.65bn. BGEO reports an FY Net Interest Margin of 6.5%, more than double the level of a UK bank like Lloyds. Georgian core CPI inflation in 2023 is around 2.4%, so the Central Bank has already started cutting interest rates this year by 50bp in January then another 75bp to 8.25% in March, with further cuts expected.

There was an exceptionally large profitable currency trade and property revaluation gain in 2022, so excluding those items, the top line was growing at around +35% y-o-y.

The group reported a cost-income ratio of just below 30%, which is an impressive level of efficiency, particularly for a universal bank with a branch network. The cost of risk (bad debt charge through the P&L) stood at 70bp (down from 80bp in FY 2022). FY 2023 RoE of 30% was well above the medium-term target of 20%.

International expansion: Around 20 years ago management expanded internationally into Ukraine and Belarus. The Ukrainian bank lost large sums of money and was sold. They still own the Belarusky Narodny Bank (BNB), which had total assets of GEL 1.28bn (£380m) and suffered from a 23% devaluation of the Belarusian Ruble. BNB has a loan/deposit ratio of 0.7x, so it’s not going to be a cause of instability to the parent group. The worst-case scenario is that the GEL150m of equity (£44m) is written down to zero.

In February this year, BGEO management announced they would buy Armenian bank Ameriabank for $304m in cash, financed out of surplus capital. The acquisition price represents 0.65x net asset value as of 31 October 2023 and 2.6x PER 2023, which represents a bargain. Management were asked on the analyst call why the seller was prepared to agree to such a price, and they responded that this was the biggest equity deal in Armenia – there simply weren’t any other buyers who would pay over $300m in cash for an Armenian bank.

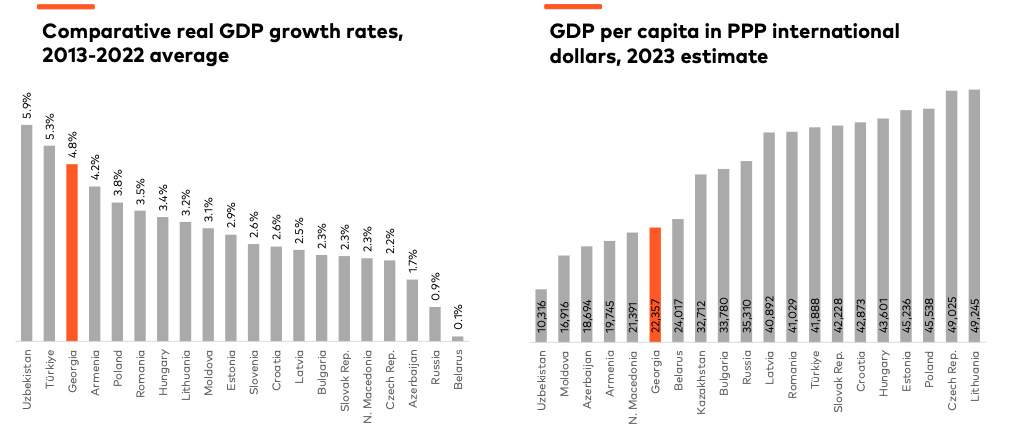

Armenia has a similar population and economic size to Georgia, with both economies showing 4-5% real GDP growth over the last decade, but still, GDP per capita is around $20K, suggesting plenty of room for further progress. There are risks of course, Armenia has just fought and lost a conflict with far wealthier Azerbaijan. Unlike Georgia, which has a concentrated banking system with TBC and BGEO, Armenia has 18 commercial banks operating in the country with the top 3 (including Ameriabank) market share of 43%. Ameriabank is ranked number 1 based on loan portfolio size (20% market share) and second on deposit size (17% market share).

Despite the acquisition, management can still afford to return GEL 100m (£30m) of capital via a buyback in the coming year and pay out around 40% of profits in dividends.

Politics: There’s some political risk as the leader of the ruling Georgian Dream party, Bidzina Ivanishvili made billions in Russia in the 1990s and has put former President Mikhail Saakashvili in prison. If he dies in prison that could spark unrest and instability. The Georgian population generally looks more to Europe as the future, and Russia as the past. Their sympathies are with Ukraine in particular. In addition, many Russians fled to Georgia to avoid fighting in Ukraine, and this has been a short-term boost to the economy. Longer term this may cause social tensions, as Russians are unpopular, not least because the Russian Army still occupies Georgian territories of South Ossetia and Abkhazia, after Putin’s 2008 invasion. With all that in mind, this is not a risk-free investment but I prefer BGEO to any Hong Kong based bank, including Standard Chartered and HSBC.

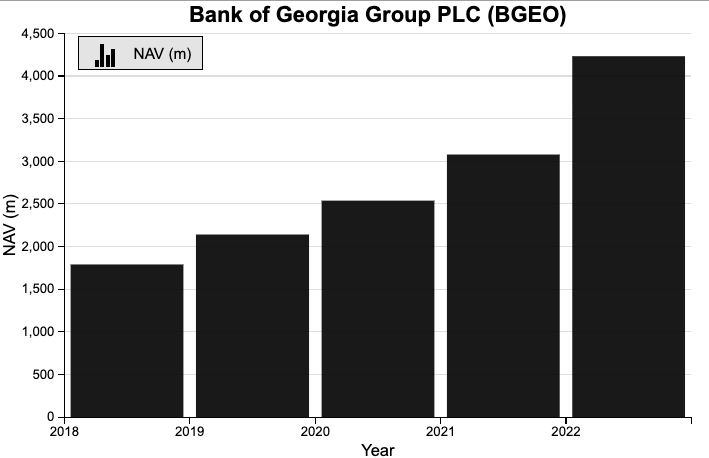

Valuation: BGEO shares are trading on 5x PER Dec 2024F and 2025F, which seems far too low for a bank reporting double-digit loan growth, even if RoE is expected to fall from above 30% currently to around 20%, in my view. Book value per share was GEL114, or £34 per share (implying a price-to-book ratio of 1.47x). Unlike UK banks, BGEO’s per-share book value has increased in value around 3x since 2018, as NAV has grown (see chart above) and management have bought back shares. The total dividend for FY should be GEL 8 per share (£2.37 at the current exchange rate) putting the bank on a yield of 4.7%.

Opinion: This is my second-largest position, and has done well for me over the years. Khvicha Kvaratshelia has been striking fear into right backs in Serie A and the Champions League, he didn’t deserve to be on the losing side against Barcelona last week. Yet Napoli bought him for Eu12m from Dinamo Batumi, I would suggest he’s not the only Georgian asset that has been significantly undervalued in recent years.

Notes

Bruce owns shares in Capital Drilling and Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 19/03/2024 | HAT, CAPD, BGEO | As good as gold?

The FTSE 100 was up +1% to 7,749 last week. Meanwhile, Nasdaq100 and S&P500 were down -1.2% and -0.2% respectively. The FTSE China 50 has now bounced +14% since its low in January this year but remains below its 64-day moving average.

I pointed out last week that commodities like natural gas, oil and wheat had been surprisingly weak since their initial spike following Putin’s invasion of Ukraine. Gold on the other hand has begun to perk up: since October last year, the precious metal is up +19% to $2,160. The trend looks favourable with the spot price and the 16-day moving average maintaining a level above the 64-day moving average. One driver of that is likely to be momentum-driven Commodity Trading Advisers like Winton. An additional positive catalyst could be Central Banks beginning to cut interest rates, as investors tend to avoid gold when they can earn above 5% simply by holding cash in the bank.

The relationship is not linear though. Gold did very well in the 1970’s when interest rates and inflation were much higher. Then in the 1990s gold made little progress, but increased in value around 5-6x between 2001 and 2011. In the 1970s, investors saw the precious metal as a store of value at a time when Central Banks had lost their inflation-fighting credibility, but the driver following the bursting of the TMT bubble was interest rate cuts. So that asymmetry (does well if Central Banks lose credibility, but also does well from rate cuts) suggests to me that gaining exposure to the gold price could be an interesting trade for 2024.

The simplest way to do this would be to buy a gold ETF, however, ETFs don’t generate any yield. A different suggestion is to look at dividend-paying equities. The most obvious is a gold miner like Centamin, which trades on a PER of 9x FY Dec 2024F and yield of 3.5% the same year.

A second alternative though is pawnbroker H&T which I cover below. A third alternative is gold mining services Capital Drilling, which I own and also look at below. Neither HAT nor CAPD have performed well recently, but they have been paying a dividend and if gold does start to strengthen then I would expect to see an upside.

I finish off with a look at last week’s BGEO results. The Georgian bank has been the best-performing stock in the FTSE All Share since Putin invaded Ukraine, but still only trades on 5x PER.

H&T FY Dec Results

HAT has been listed since 2006 but did double in value up to 2011 when the gold price was strong before the shares more than halved in 2013 as the gold price has been lacklustre in the last 10 years. Last week HAT announced FY Dec revenues +27% to £221m and statutory PBT +39% to £26m. Net debt at the end of December was £32m versus £3m the previous year-end. Although that is up sharply, net debt to EBITDA stood at 0.9x, versus the maximum in their financial covenants of 2.5x, so they are operating well within their limits. The rise in net debt was to fund expansion with £29m invested in the pledge book and £18m capital expenditure.

The group’s main activity is pawnbroking, that is a loan secured against collateral (the pledge). Over 99% of this collateral was precious metals (mainly gold), diamonds and watches. Revenue less impairment was £115m, +37% on the previous year. Taking a longer-term perspective, revenue hasn’t shown much progress since 2012 but is now forecast to grow +14% in FY Dec 2024F and +11% FY Dec 2025F.

The median loan size is £201 (the mean average is more than double that at £428, suggesting a few large loans skew the distribution) and term of the loan is 6 months with a monthly interest rate charged between 2% and 9.99%. If the customer does not repay the loan before the end of the contract, the Group sells the collateral at public auctions or, if the value of the pledge is under £75, is sold through their retail or ‘pawnbroking scrap’ activities (see below). The Loan to Value averages 65% and redemption rates are currently 85%. The bottom has dropped out of the second hand watch market versus a couple of years ago, so the group has reduced the proportion of the pledge book secured on watches to 14% (down from 15% previously).

The retail division sells new and second-hand jewellery, including, items that customers have not been able to redeem. Retail sales were up +8% to £49m (just under a quarter of group revenue). They also have a small foreign currency division, gold purchasing (£8.6m of revenue) and pawnbroking scrap (the items are damaged or slow-moving, and are melted down and sold at the current gold spot price) divisions. They also do money transfers and cheque cashing.

Outlook: Management believe the core pawnbroking service will continue to benefit as customers’ disposable incomes remain under pressure. They are seeing growing demand from customers who are business owners, seeking finance for working capital against pledged personal assets.

They also mention record levels of demand for small-sum, short-term lending, at a time of severely constricted supply. I wonder if they could benefit from problems at Vanquis Bank (which used to be door-step lender Provident Financial), whose share price fell -50% last week after they said income would be ‘materially below’ expectations, due to lower margins coupled with an increased number of customer complaints.

Valuation: The shares are trading on 7x FY Dec 2024F and 6.5x Dec 2025F, based on Hardman’s forecasts. Note the difference between Sharepad’s 11% RoCE and -14% CashRoCI, as HAT has grown the pledge book and invested in capex. The shares look cheap, but I’m not sure that this will ever trade on a rating much above 10x.

Opinion: I last wrote about this share in summer 2022, my concern was the relatively low level of RoCE for a financial that lends at high-interest rates. This is a difficult space to operate in because regulators are keen that vulnerable customers are not exploited. If pawnbroking was banned though, and similar high-interest lenders did not exist, vulnerable people would rely on illegal loan sharks whose collection methods might be more forceful. The dividend yield is forecast to be 5% in 2024F, so this could be a good way to gain exposure to a rising gold price while earning a decent yield, however, I prefer Capital Drilling, for the reasons I outline below.

Capital Drilling FY Dec Results

This African mining services company, which provides drilling rigs and PhotonAssay (checking the gold content of gold mine samples) announced FY results in December. Management had already warned in January that revenue would ‘miss’ below previous guidance of $320m-$340m, at $318m. That still represents +10% growth from the previous year. The slowdown reflected subdued activity in West Africa and suspended operations in Sudan, as Drilling revenue was up just +1% to $211m or 2/3 of group total. But the growth is coming from the smaller divisions Mining Services +30%, and Laboratory Services (MSALABS Photon Assay) +41%.

Despite the tough revenue environment, statutory PBT was up +54% to $50m. However, that’s driven by a $20m fair value write-down of assets in 2022, which didn’t recur in 2023. Profit from operations was flat at $60m. Net debt was up +48% to $70m as management increased capex to fund future growth last year.

Investments: CAPD will accept equity in gold miners as well as cash for their services. Hence, they have an investment portfolio of $47m of both listed and unlisted gold mining shares. The top 3 holdings, Predictive Discovery, Allied Gold Corp and WIA Gold make up around 85% of the portfolio. Sharepad shows FTSE Precious Metals and Mining Sector has had a difficult 2022 and 2023, but has bounced +12% in the last couple of weeks as the gold price has strengthened. That suggests Capital could receive a double benefit from both increased rig count utilisation but also fair value gains in their investment portfolio of gold miners.

Outlook: CAPD have announced a contract win in Mining Services to develop the Belinga iron ore deposits, which they estimate will generate approximately $30m of revenue per annum once fully operational. MSALABS has a five-year contract with Nevada Gold which they estimate will generate c. $30m of revenues per annum. Management have guided FY Dec 2024 revenue of $355 – 375m, of which $50-$60m should be lab services. That is ahead of Tamesis, their broker’s, previous forecast of $350m, and is +15% growth at the middle of the forecast range.

Valuation: The shares are trading on 6.5x PER Dec 2024F and 2025F. On an EV/EBITDA basis (that is factoring in the net debt to the valuation) they are trading on around 3x. That seems remarkably good value for a business that has a 3-year average RoCE of 19%. Again, note the discrepancy between RoCE and CashRoCI, as management have invested capex anticipating demand for drilling rigs to pick up in future years.

Opinion: I have owned this for a couple of years, I think this represents better exposure to rising gold prices than the pawnbroking sector. The forecast dividend yield is 4% Dec 2024F, which is lower than H&T, however, I think the MSALABs business and equity portfolio is a better medium-term story and I am happy to continue holding and may even buy some more.

Bank of Georgia FY Dec Results

I have covered this Tbilisi headquartered bank over the years, for instance here in Nov 2020, when the share price was £12, and more recently in March last year when the shares were £25. These weeklies aren’t supposed to be a ‘tip sheet’ but instead to flag interesting shares so that readers can use Sharepad to do more research. I hope readers did have their interest peaked though as the bank’s shares have quadrupled since I first wrote about them, and BGEO makes an interesting contrast to the other UK banks. Their headquarters on a steep hill overlooking the Mtkvari River looks like this.

The bank reported revenue +7% to GEL 2.55bn, and PBT up +1% to GEL 1.65bn. BGEO reports an FY Net Interest Margin of 6.5%, more than double the level of a UK bank like Lloyds. Georgian core CPI inflation in 2023 is around 2.4%, so the Central Bank has already started cutting interest rates this year by 50bp in January then another 75bp to 8.25% in March, with further cuts expected.

There was an exceptionally large profitable currency trade and property revaluation gain in 2022, so excluding those items, the top line was growing at around +35% y-o-y.

The group reported a cost-income ratio of just below 30%, which is an impressive level of efficiency, particularly for a universal bank with a branch network. The cost of risk (bad debt charge through the P&L) stood at 70bp (down from 80bp in FY 2022). FY 2023 RoE of 30% was well above the medium-term target of 20%.

International expansion: Around 20 years ago management expanded internationally into Ukraine and Belarus. The Ukrainian bank lost large sums of money and was sold. They still own the Belarusky Narodny Bank (BNB), which had total assets of GEL 1.28bn (£380m) and suffered from a 23% devaluation of the Belarusian Ruble. BNB has a loan/deposit ratio of 0.7x, so it’s not going to be a cause of instability to the parent group. The worst-case scenario is that the GEL150m of equity (£44m) is written down to zero.

In February this year, BGEO management announced they would buy Armenian bank Ameriabank for $304m in cash, financed out of surplus capital. The acquisition price represents 0.65x net asset value as of 31 October 2023 and 2.6x PER 2023, which represents a bargain. Management were asked on the analyst call why the seller was prepared to agree to such a price, and they responded that this was the biggest equity deal in Armenia – there simply weren’t any other buyers who would pay over $300m in cash for an Armenian bank.

Armenia has a similar population and economic size to Georgia, with both economies showing 4-5% real GDP growth over the last decade, but still, GDP per capita is around $20K, suggesting plenty of room for further progress. There are risks of course, Armenia has just fought and lost a conflict with far wealthier Azerbaijan. Unlike Georgia, which has a concentrated banking system with TBC and BGEO, Armenia has 18 commercial banks operating in the country with the top 3 (including Ameriabank) market share of 43%. Ameriabank is ranked number 1 based on loan portfolio size (20% market share) and second on deposit size (17% market share).

Despite the acquisition, management can still afford to return GEL 100m (£30m) of capital via a buyback in the coming year and pay out around 40% of profits in dividends.

Politics: There’s some political risk as the leader of the ruling Georgian Dream party, Bidzina Ivanishvili made billions in Russia in the 1990s and has put former President Mikhail Saakashvili in prison. If he dies in prison that could spark unrest and instability. The Georgian population generally looks more to Europe as the future, and Russia as the past. Their sympathies are with Ukraine in particular. In addition, many Russians fled to Georgia to avoid fighting in Ukraine, and this has been a short-term boost to the economy. Longer term this may cause social tensions, as Russians are unpopular, not least because the Russian Army still occupies Georgian territories of South Ossetia and Abkhazia, after Putin’s 2008 invasion. With all that in mind, this is not a risk-free investment but I prefer BGEO to any Hong Kong based bank, including Standard Chartered and HSBC.

Valuation: BGEO shares are trading on 5x PER Dec 2024F and 2025F, which seems far too low for a bank reporting double-digit loan growth, even if RoE is expected to fall from above 30% currently to around 20%, in my view. Book value per share was GEL114, or £34 per share (implying a price-to-book ratio of 1.47x). Unlike UK banks, BGEO’s per-share book value has increased in value around 3x since 2018, as NAV has grown (see chart above) and management have bought back shares. The total dividend for FY should be GEL 8 per share (£2.37 at the current exchange rate) putting the bank on a yield of 4.7%.

Opinion: This is my second-largest position, and has done well for me over the years. Khvicha Kvaratshelia has been striking fear into right backs in Serie A and the Champions League, he didn’t deserve to be on the losing side against Barcelona last week. Yet Napoli bought him for Eu12m from Dinamo Batumi, I would suggest he’s not the only Georgian asset that has been significantly undervalued in recent years.

Notes

Bruce owns shares in Capital Drilling and Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.