Bruce looks at the performance of large cap sectors YTD, and suggests rules of thumb for trying to time the turn in different sectors. Companies covered NFC, ASY, SMV, BGO and BOKU.

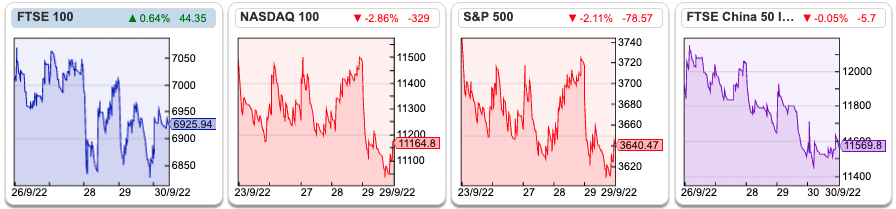

The FTSE 100 was down -3.3% last week, falling below the 7,000 level. The S&P and Nasdaq100 were both down -1.3%. The UK 10y government bond yield had a volatile week, but finished at 4.04% after the Bank of England stepped into prevent forced selling by Liability Driven Investors. Earlier it had peaked at 4.4%, the highest yield since the financial crisis. The US 10y bond yield also rose to 3.69%.

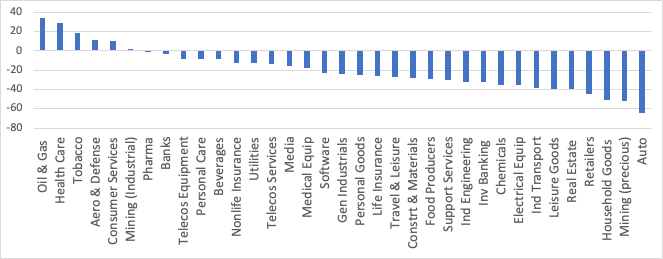

I hope readers aren’t letting the volatility in markets get to them. I have downloaded the large cap FTSE sectors performance from SharePad to see how banks, pharma, miners and telcos have done so far this year. ‘Blue chip’ companies ought to be less volatile and trading in them more liquid, so far the FTSE 350 is down -11% YTD, compared to AIM -35%.

Unsurprisingly oil & gas is the best performer up +33% YTD. Shell is still only trading on 4x forecast earnings and BP is on 3x PER according to SharePad. I know some readers will find the oil & gas sector distasteful, but the alternative is buying our fossil fuels from state owned oil companies in parts of the world that don’t necessarily like us. Similarly the Aerospace & Defense sector +11% YTD has enjoyed a shift in ESG perceptions following the Ukraine war. BAE Systems +51% is the best performing stock in the FTSE 100 so far this year.

Despite the recent sell-off, UK banks are still in the top quartile of outperformance, down -3% YTD helped by dollar earners HSBC and Standard Chartered. Between 2000-2003 the bank sector outperformed the wider market, because valuations were low, consolidation was taking place and most importantly the banks were well capitalised. That meant although bad debts were rising, most banks could absorb the losses. The two exceptions were Lloyds, which bought Scottish Widows at the top of the market and Abbey, which bought Enron and similar corporate bonds.

As long as investors are confident bad debts are not going to force rights issues or dividend cuts, banks can outperform in a recession, it’s happened before. Note too, the divergence with the Real Estate sector, down -40% YTD with performance in the bottom quartile. FTSE 100 housebuilders Barratt Developments and Persimmon are both down almost -60% YTD too.

Although larger companies have outperformed, there have still been plenty of disappointments. Supermarkets like Tesco and Sainsbury’s ought to have been ‘defensive’ but are both off c. -30%. Ocado -71% YTD is the worst performing stock in the FTSE 100 this year. I avoid clothes retailers because fashions change and few brands enjoy a durable competitive advantage: Superdry trebled in value shortly after its IPO, but is down from a peak of £20 to now trade at £1. Before that there was French Connection and Ted Baker (both now delisted after falling -95% from their peak valuation). Even online retailers ASOS and Boohoo share prices are down more than 90% peak to trough.

My former colleague who still works as a retail analyst, suggested at the start of the year an interesting rule of thumb: ignore valuation and wait for companies to report positive sales growth. Both Boohoo (-70% YTD) and Next (-41% YTD) reported last week and expect sales to fall in H2. Probably after Christmas it will be worth bargain hunting for cheap retail shares though.

The precious metals mining sector -52% YTD has performed very badly. Some of that is the gold price -9% YTD, which has failed to respond to higher inflation and global instability. Platinum, used in diesel catalytic converters, is down -12%. Hydrogen fuel cell technology may require platinum in Proton Exchange Membranes (PEM) so perhaps platinum miners could be a more interesting hydrogen angle than speculative shares like Ceres Power -62% or ITM Power -72% YTD?

Below I look at Next Fifteen’s H1 results and the bid for advertising firm M&C Saatchi. Plus Smoove’s “profit warning” (there were no profits forecast before the warning) last week and Andrews Sykes, Direct Carrier Billing companies Bango and Boku H1 results.

Next Fifteen H1 to July

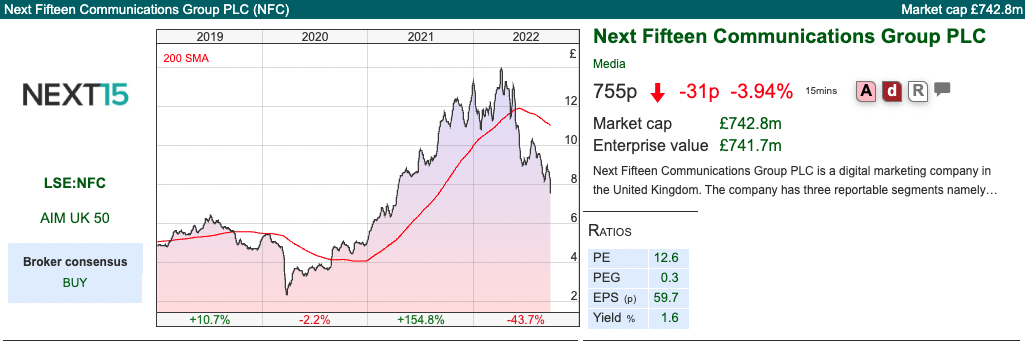

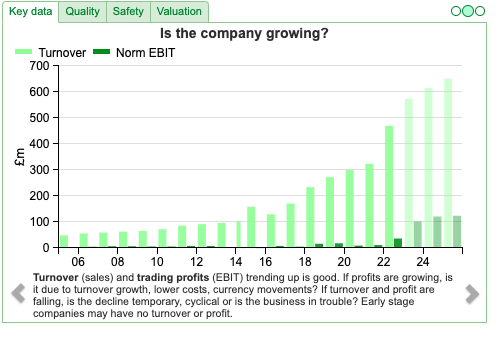

This management consultancy that specialises in data analysis and marketing technology announced H1 result to July. They carry out market research, track opinion about brands, analyse transaction data to discover insights and trends, use data to predict consumer behaviour. Using SharePad to go back to 2007-9 we can see that NFC revenue grew and it remained profitable through the last recession; though it’s also a larger organisation with many acquisitions and revenue 6x higher than a decade ago. I also notice $163bn Accenture is down -38% YTD, so it seems likely consulting fees are under pressure.

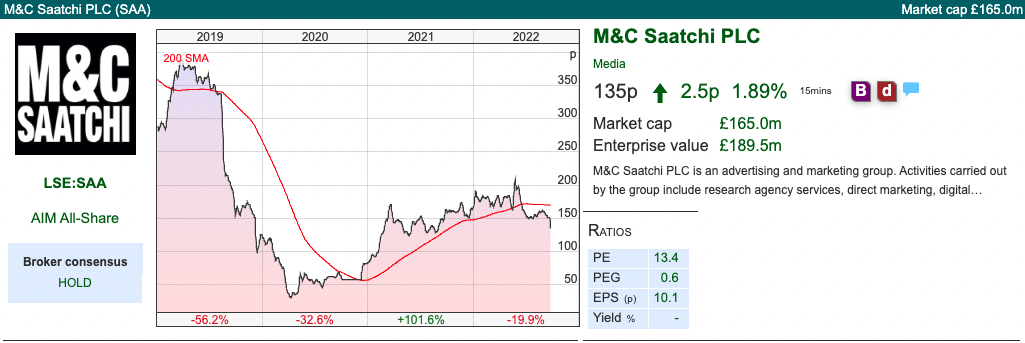

NFC are currently in a bid contest with AdvancedAdvT (Vin Murria, an M&C Saatchi non Exec) to take over M&C Saatchi (market cap £182m), the advertising agency. In January AdvancedAdvT and Vin Murria made an approach, when this was rejected they launched a hostile 209p per share offer for M&C Saatchi. Then in May 2022 NFC launched a recommended offer, which valued the business at approximately £310m or a PER of 14x M&C’s 2023 forecast earnings. At the time that represented a 19% premium to AdvancedAdvT’s offer, although since making the offer Next Fifteen share price fell -41% from 1274p to 755p currently. The exchange ratio was set at 0.1637 new Next Fifteen share plus 40p in cash, currently worth 164p v M&C’s share price of 135p. After the share price dropped M&C Saatchi’s board withdrew its recommendation of NFC’s offer. NFC still wants to go through the deal though and they expect a expect a resolution one way or the other before the end of this calendar year. AdvancedAdvT offer of 209p remained at the same level, though it was for owning 54-59% of the cash shell, not a cash offer.

So that is the background, which puts NFC H1 July results in context. The results themselves look very strong, with Adjusted Net Revenue +65% to £274m, and Adjusted PBT +73% to £61m. There are eight adjustments to reduce the Adjusted PBT figure to £8.5m statutory PBT, including a £40.7m charge for contingent consideration from previous acquisitions, which the company says mainly relates to an earnout payable to Mach49. In March this year they made another acquisition Engine UK for an enterprise value of £77.5m, with £61.7m paid on completion in cash. They funded this with debt and a placing at 1110p per share, raising £50m.

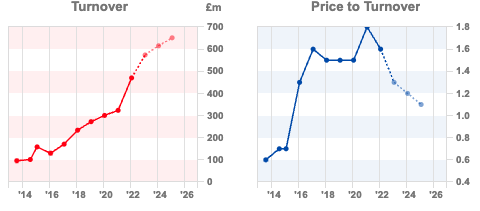

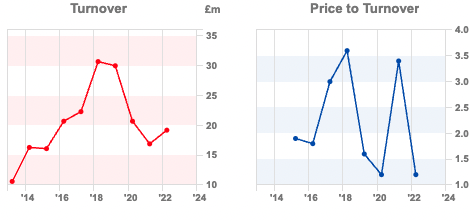

Organic revenue growth was +31%, which is encouraging that there’s been no evidence of a slowdown yet. The company earns 53% of revenue from the USA, plus they bill a further 7% of clients in US dollars, so received a £12m benefit in the half from the weak pound / strong dollar. The chart below shows NFC’s impressive turnover growth, interesting it never received a p/turnover rating above 2x even in the bull market.

Net debt (ex lease liabilities) was £18m. They have agreed a £60m Revolving Credit Facility (RCF) with HSBC and Bank of Ireland. Despite an £11.6m goodwill amortisation charge going through the p&l at H1, the balance sheet is top heavy with £285m of intangible assets, so net of that shareholders equity is £182m negative. There’s also £183m of contingent consideration and £12.4m of share purchase obligations. In other words, net debt is not a worry, but there are significant earn-out obligations. Ironically earn-out liabilities to staff is what caused M&C Saatchi problems a couple of years ago, when the shares sold off to 30p.

Valuation: NFC shares are trading on 8.5x 2024F PER and 1.2x sales the same year. Those forecasts don’t include M&C Saatchi. Although performance in the first half was strong, and the outlook statement was upbeat, there must be some doubt about how sensitive forecasts are to the macro environment.

Opinion: So far NFC management have done very well, the long term track record (chart above) going back two decades is impressive. The revenue environment may become more difficult in the next 6-12 months. NFC’s shares are down -44% YTD, if the deal fails to complete that may turn out to be better for the investment case, rather than face integration risk in a difficult market. For now though, I’d avoid.

Smoove profit warning

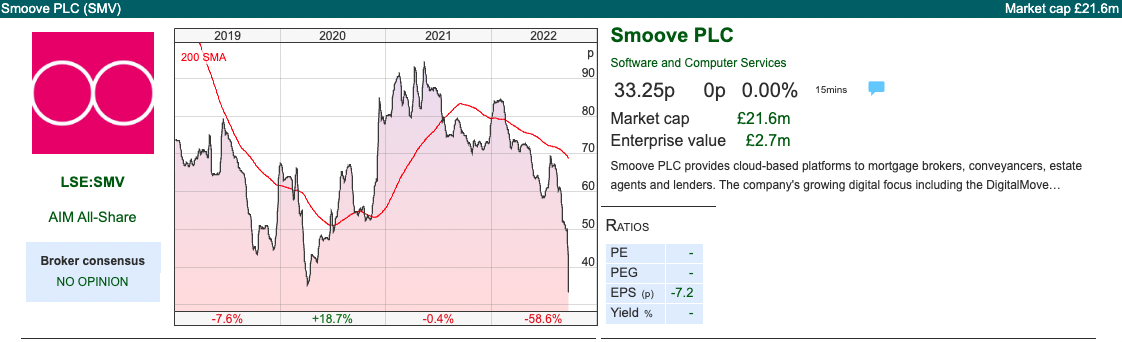

This e-conveyancing company with a March year end put out an AGM statement / profit warning less than a month after their FY results RNS. I’ve called it a profit warning because the shares fell -33% in response to the RNS, but there were no forecasts from their broker. It’s hard to disappoint versus non-existent forecasts, but Smoove has managed it.

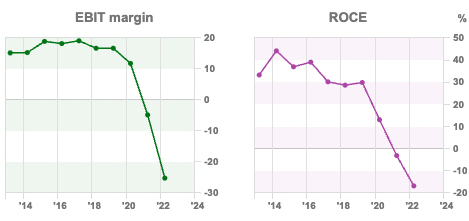

Last week’s statement warned that the Group’s gross profit for the first 5 months of trading is unchanged compared to the prior year. That’s because there’s been a change in mix towards the lower margin re-mortgaging business, rather than higher margin first time buyers. That does make sense, and is likely an industry trend, but the reaction has been savage. At the start of the year I thought that the £23m of net cash that they were carrying would mean the shares were defensive in a market sell-off. Unfortunately the shares have fallen -59% as investors have questioned the loss making core business, as demonstrated by the nose diving EBIT margin and Return on Capital Employed.

The cash came from selling Conveyancing Alliance Limited (CAL) in November 2020 for £27m. The balance has now fallen to £16.9m at the end of August, versus a market cap of £22m. In other words, the business is trading at close to net cash. Net tangible book value (shareholders equity less intangibles) is £19m. Meaning this is one of Ben Graham’s ‘net net’ stocks, trading close to both equity and cash.

Last month, I wrote up the FY Mar 2022 results in more detail here. Their PR confirmed last week that the company will hold a Capital Markets Day in October or November when they will begin giving forecast guidance and also do a demonstration of the product and a strategy update.

Valuation: The current valuation is almost certainly wrong. Either the company can come up with a profitable business model or it will burn through its cash balances over the next couple of years, then fail. It looks like it will be loss making this year, and probably next year too. Medium term though I do think the idea of disrupting the mortgage conveyancing market is a good opportunity.

The shares were worth 160p at their peak, and has traded at 3.5x revenue when the company was profitable and had a good story around their new product DigitalMove. Now they are trading at net cash, it highlights how cheap some segments of AIM have become. I note that Harwood Capital bought shares after the recent fall and now owns 12.7%. Kestrel Partners own 29.5%.

Opinion: This is tricky, because management have been reluctant to make their case in investor presentations. That in itself may be significant. Until the start of this year, the UK mortgage market has enjoyed a helpful tail wind with stamp duty holidays and interest rate cuts, but Smoove failed to benefit. House prices were still growing at double digit rates in August, but mortgage approvals (a lead indicator) are now falling. Conditions are going to be much more difficult in the next two years, so SMV needs to take market share in a shrinking market. That’s possible, but management need to i) have a good story to tell investors ii) execute the plan.

I own the shares and am not going to cut my losses because I think the low valuation is reflecting past disappointment, rather than future turnaround potential. I’m aware that may turn out to be a mistake.

Andrews Sykes H1 results to June

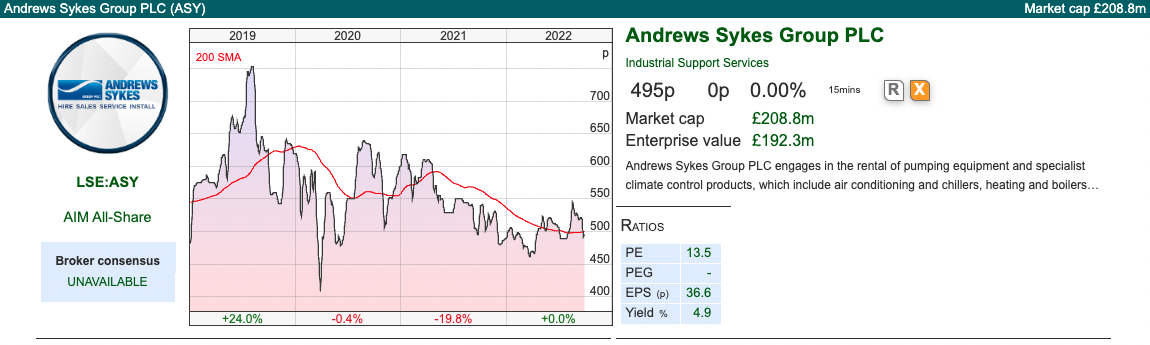

This is another company carrying large cash balances and with no forecasts, but for rather different reasons. The 102 year old Chairman Jacques Gaston Murray doesn’t believe in paying brokers to make forecasts, and is very conservative when it comes to ASY’s balance sheet. Andrews Sykes was the last company that Jeremy wrote about for Sharepad, suggesting it was a stock that in 10 years time he would be warmly remembered for.

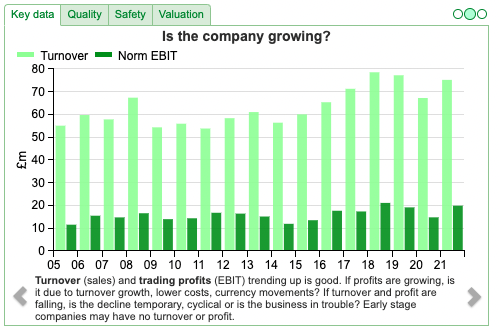

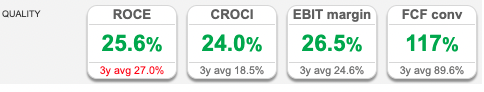

The results themselves look satisfactory, but equipment hire isn’t benefitting from a recovery as much as I’d hoped. Revenue was up +6% to £37.9m and PBT was up +12% to £8.5m for H1 to June. Cash increased by £10m versus last June to £34m. In terms of geography, UK revenue grew +2% (well below the rate of inflation) but Europe was up +17%, driven by Italy where revenues almost doubled. They also have a UAE business in the Gulf, which recorded revenue growth of +6%, despite a challenging environment they say. The long term track record shows that despite high 3 year average RoCE of 27%, the company has struggled to grow the top line.

Outlook: The hot temperatures in July and August mean that there has been strong demand for ASY’s air conditioning units and chillers. In the longer term, optimism is tempered with the observation about heightened energy costs and macro uncertainty affecting demand. That sounds fair enough, though isn’t particularly helpful – I think you just have to assume that this is a long term, family owned business who won’t take too many risks.

As you would expect for a company that began life in Queen Victoria’s reign, there’s a defined benefit pension scheme on the balance sheet. Unusually it’s £9m in surplus (on an IAS 19 basis), and there was a £2.6m below the line item in ‘other comprehensive income’ as the discount rate has risen. That reduced the value of future liabilities, from £42m in December to £31m at the end of June, while plan assets also fell back by £8m to £40.6m.

Despite that surplus, they are still making a £1.3m per annum contribution to the pension scheme, which sounds to me overly cautious. Presumably they will agree with the Trustees no further contributions are needed soon, which would give profits a boost. The business has no bank debt, but they do quote a ‘net funds’ figure of £21.7m, which is the £34m cash figure net of lease obligations of £12.7m.

Ownership: The family trust EOI Sykes Sarl owns almost 90% of the shares. That means the bid offer spreads are very wide for a £200m market cap company, so it’s not for traders. But if you have a holding period of between 5-10 years holding it could make sense.

Valuation: Assuming FY EPS grows in line with the first half, shares are trading on 12x 2022F PER. The FY dividend in 2021 was 23p, and so far this year they have declared an interim dividend of 11.9p plus a special dividend of 16.6p, implying a yield of 5.8% even before the final dividend (12.5p last year) has been announced. Assuming the final dividend is similar to last year, that would imply a yield of 8.4%.

Opinion: I rather like the cautious management, £34m of cash on balance sheet represents 16% of the market cap. The fully funded pension surplus and dividend income are also an attraction. The bid offer spread may put shorter term investors off, but this is a share that I enjoy owning.

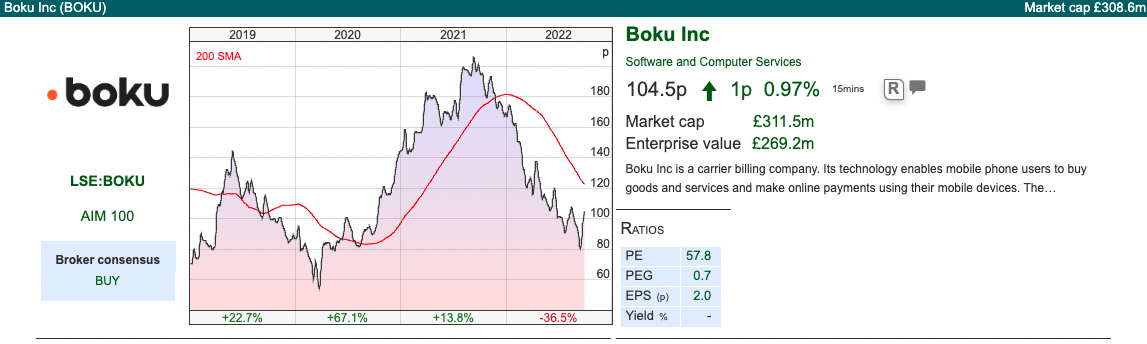

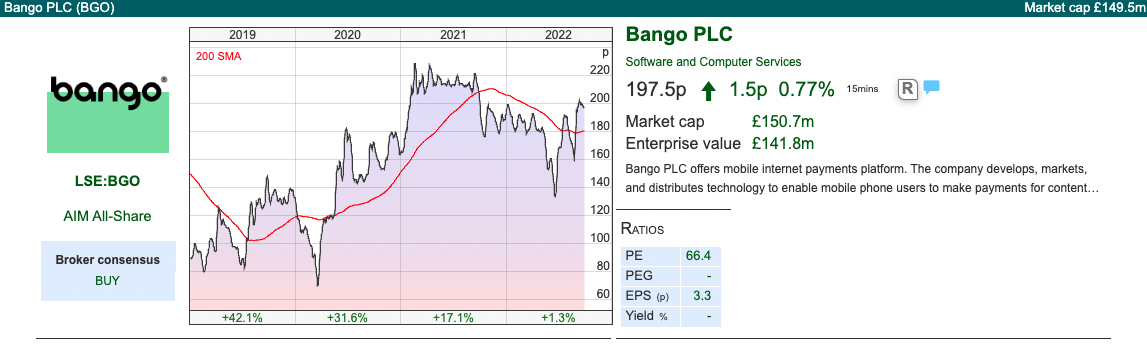

Boku and Bango H1 June

Both these Direct Carrier Billing which report in US dollars released results last week. I last looked at Boku in early in August and Bango a couple of weeks later. Boku’s H1 to June revenues were flat at $30m, currency adjusted revenue was +7% y-o-y. There is a large exceptional gain because they sold their Identity division for $24.6m and group cash is now $67.8m. Similar to Smoove though, I think management will use most of that cash to try to grow the business, rather than return it to shareholders.

Bango grew revenues +9% to $10.8m, so they would have reported mid teens revenue growth on a constant currency basis. They acquired NTT DOCOMO in August, which they expect to deliver $16m of revenue in FY Dec 2023F. Loss before tax was $1.2m – and the company has a track record of almost two decades of losses. Forecasts are for $5m of PBT in 2023F and $16m in 2024F.

Valuation: Boku is trading on 26x 2023F PER and 5.1x sales the same year. Bango is trading on a PER of 25x 2023F, though that drops to 9x 2024F assuming the earnings from NTT DOCOMO come through as management expects. That equates to just over 3x sales.

Opinion: The Bango share price has held up well, supported by their acquisition. I’ve always felt that it is worth keeping an eye out for companies with many years of losses that are about to turn profitable.

Boku -37% YTD needs to demonstrate that it’s foray into the e-wallets space, can make a return. I hesitate to suggest that with $67m of cash, or 20% of its market cap, Boku ought to be defensive after what happened to Smoove – but I do think more cash is generally better than less cash on the balance sheet.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in Smoove and Andrews Sykes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 03/10/22 |NFC, ASY, SMV, BGO & BOKU| A look at large caps

Bruce looks at the performance of large cap sectors YTD, and suggests rules of thumb for trying to time the turn in different sectors. Companies covered NFC, ASY, SMV, BGO and BOKU.

The FTSE 100 was down -3.3% last week, falling below the 7,000 level. The S&P and Nasdaq100 were both down -1.3%. The UK 10y government bond yield had a volatile week, but finished at 4.04% after the Bank of England stepped into prevent forced selling by Liability Driven Investors. Earlier it had peaked at 4.4%, the highest yield since the financial crisis. The US 10y bond yield also rose to 3.69%.

I hope readers aren’t letting the volatility in markets get to them. I have downloaded the large cap FTSE sectors performance from SharePad to see how banks, pharma, miners and telcos have done so far this year. ‘Blue chip’ companies ought to be less volatile and trading in them more liquid, so far the FTSE 350 is down -11% YTD, compared to AIM -35%.

Unsurprisingly oil & gas is the best performer up +33% YTD. Shell is still only trading on 4x forecast earnings and BP is on 3x PER according to SharePad. I know some readers will find the oil & gas sector distasteful, but the alternative is buying our fossil fuels from state owned oil companies in parts of the world that don’t necessarily like us. Similarly the Aerospace & Defense sector +11% YTD has enjoyed a shift in ESG perceptions following the Ukraine war. BAE Systems +51% is the best performing stock in the FTSE 100 so far this year.

Despite the recent sell-off, UK banks are still in the top quartile of outperformance, down -3% YTD helped by dollar earners HSBC and Standard Chartered. Between 2000-2003 the bank sector outperformed the wider market, because valuations were low, consolidation was taking place and most importantly the banks were well capitalised. That meant although bad debts were rising, most banks could absorb the losses. The two exceptions were Lloyds, which bought Scottish Widows at the top of the market and Abbey, which bought Enron and similar corporate bonds.

As long as investors are confident bad debts are not going to force rights issues or dividend cuts, banks can outperform in a recession, it’s happened before. Note too, the divergence with the Real Estate sector, down -40% YTD with performance in the bottom quartile. FTSE 100 housebuilders Barratt Developments and Persimmon are both down almost -60% YTD too.

Although larger companies have outperformed, there have still been plenty of disappointments. Supermarkets like Tesco and Sainsbury’s ought to have been ‘defensive’ but are both off c. -30%. Ocado -71% YTD is the worst performing stock in the FTSE 100 this year. I avoid clothes retailers because fashions change and few brands enjoy a durable competitive advantage: Superdry trebled in value shortly after its IPO, but is down from a peak of £20 to now trade at £1. Before that there was French Connection and Ted Baker (both now delisted after falling -95% from their peak valuation). Even online retailers ASOS and Boohoo share prices are down more than 90% peak to trough.

My former colleague who still works as a retail analyst, suggested at the start of the year an interesting rule of thumb: ignore valuation and wait for companies to report positive sales growth. Both Boohoo (-70% YTD) and Next (-41% YTD) reported last week and expect sales to fall in H2. Probably after Christmas it will be worth bargain hunting for cheap retail shares though.

The precious metals mining sector -52% YTD has performed very badly. Some of that is the gold price -9% YTD, which has failed to respond to higher inflation and global instability. Platinum, used in diesel catalytic converters, is down -12%. Hydrogen fuel cell technology may require platinum in Proton Exchange Membranes (PEM) so perhaps platinum miners could be a more interesting hydrogen angle than speculative shares like Ceres Power -62% or ITM Power -72% YTD?

Below I look at Next Fifteen’s H1 results and the bid for advertising firm M&C Saatchi. Plus Smoove’s “profit warning” (there were no profits forecast before the warning) last week and Andrews Sykes, Direct Carrier Billing companies Bango and Boku H1 results.

Next Fifteen H1 to July

This management consultancy that specialises in data analysis and marketing technology announced H1 result to July. They carry out market research, track opinion about brands, analyse transaction data to discover insights and trends, use data to predict consumer behaviour. Using SharePad to go back to 2007-9 we can see that NFC revenue grew and it remained profitable through the last recession; though it’s also a larger organisation with many acquisitions and revenue 6x higher than a decade ago. I also notice $163bn Accenture is down -38% YTD, so it seems likely consulting fees are under pressure.

NFC are currently in a bid contest with AdvancedAdvT (Vin Murria, an M&C Saatchi non Exec) to take over M&C Saatchi (market cap £182m), the advertising agency. In January AdvancedAdvT and Vin Murria made an approach, when this was rejected they launched a hostile 209p per share offer for M&C Saatchi. Then in May 2022 NFC launched a recommended offer, which valued the business at approximately £310m or a PER of 14x M&C’s 2023 forecast earnings. At the time that represented a 19% premium to AdvancedAdvT’s offer, although since making the offer Next Fifteen share price fell -41% from 1274p to 755p currently. The exchange ratio was set at 0.1637 new Next Fifteen share plus 40p in cash, currently worth 164p v M&C’s share price of 135p. After the share price dropped M&C Saatchi’s board withdrew its recommendation of NFC’s offer. NFC still wants to go through the deal though and they expect a expect a resolution one way or the other before the end of this calendar year. AdvancedAdvT offer of 209p remained at the same level, though it was for owning 54-59% of the cash shell, not a cash offer.

So that is the background, which puts NFC H1 July results in context. The results themselves look very strong, with Adjusted Net Revenue +65% to £274m, and Adjusted PBT +73% to £61m. There are eight adjustments to reduce the Adjusted PBT figure to £8.5m statutory PBT, including a £40.7m charge for contingent consideration from previous acquisitions, which the company says mainly relates to an earnout payable to Mach49. In March this year they made another acquisition Engine UK for an enterprise value of £77.5m, with £61.7m paid on completion in cash. They funded this with debt and a placing at 1110p per share, raising £50m.

Organic revenue growth was +31%, which is encouraging that there’s been no evidence of a slowdown yet. The company earns 53% of revenue from the USA, plus they bill a further 7% of clients in US dollars, so received a £12m benefit in the half from the weak pound / strong dollar. The chart below shows NFC’s impressive turnover growth, interesting it never received a p/turnover rating above 2x even in the bull market.

Net debt (ex lease liabilities) was £18m. They have agreed a £60m Revolving Credit Facility (RCF) with HSBC and Bank of Ireland. Despite an £11.6m goodwill amortisation charge going through the p&l at H1, the balance sheet is top heavy with £285m of intangible assets, so net of that shareholders equity is £182m negative. There’s also £183m of contingent consideration and £12.4m of share purchase obligations. In other words, net debt is not a worry, but there are significant earn-out obligations. Ironically earn-out liabilities to staff is what caused M&C Saatchi problems a couple of years ago, when the shares sold off to 30p.

Valuation: NFC shares are trading on 8.5x 2024F PER and 1.2x sales the same year. Those forecasts don’t include M&C Saatchi. Although performance in the first half was strong, and the outlook statement was upbeat, there must be some doubt about how sensitive forecasts are to the macro environment.

Opinion: So far NFC management have done very well, the long term track record (chart above) going back two decades is impressive. The revenue environment may become more difficult in the next 6-12 months. NFC’s shares are down -44% YTD, if the deal fails to complete that may turn out to be better for the investment case, rather than face integration risk in a difficult market. For now though, I’d avoid.

Smoove profit warning

This e-conveyancing company with a March year end put out an AGM statement / profit warning less than a month after their FY results RNS. I’ve called it a profit warning because the shares fell -33% in response to the RNS, but there were no forecasts from their broker. It’s hard to disappoint versus non-existent forecasts, but Smoove has managed it.

Last week’s statement warned that the Group’s gross profit for the first 5 months of trading is unchanged compared to the prior year. That’s because there’s been a change in mix towards the lower margin re-mortgaging business, rather than higher margin first time buyers. That does make sense, and is likely an industry trend, but the reaction has been savage. At the start of the year I thought that the £23m of net cash that they were carrying would mean the shares were defensive in a market sell-off. Unfortunately the shares have fallen -59% as investors have questioned the loss making core business, as demonstrated by the nose diving EBIT margin and Return on Capital Employed.

The cash came from selling Conveyancing Alliance Limited (CAL) in November 2020 for £27m. The balance has now fallen to £16.9m at the end of August, versus a market cap of £22m. In other words, the business is trading at close to net cash. Net tangible book value (shareholders equity less intangibles) is £19m. Meaning this is one of Ben Graham’s ‘net net’ stocks, trading close to both equity and cash.

Last month, I wrote up the FY Mar 2022 results in more detail here. Their PR confirmed last week that the company will hold a Capital Markets Day in October or November when they will begin giving forecast guidance and also do a demonstration of the product and a strategy update.

Valuation: The current valuation is almost certainly wrong. Either the company can come up with a profitable business model or it will burn through its cash balances over the next couple of years, then fail. It looks like it will be loss making this year, and probably next year too. Medium term though I do think the idea of disrupting the mortgage conveyancing market is a good opportunity.

The shares were worth 160p at their peak, and has traded at 3.5x revenue when the company was profitable and had a good story around their new product DigitalMove. Now they are trading at net cash, it highlights how cheap some segments of AIM have become. I note that Harwood Capital bought shares after the recent fall and now owns 12.7%. Kestrel Partners own 29.5%.

Opinion: This is tricky, because management have been reluctant to make their case in investor presentations. That in itself may be significant. Until the start of this year, the UK mortgage market has enjoyed a helpful tail wind with stamp duty holidays and interest rate cuts, but Smoove failed to benefit. House prices were still growing at double digit rates in August, but mortgage approvals (a lead indicator) are now falling. Conditions are going to be much more difficult in the next two years, so SMV needs to take market share in a shrinking market. That’s possible, but management need to i) have a good story to tell investors ii) execute the plan.

I own the shares and am not going to cut my losses because I think the low valuation is reflecting past disappointment, rather than future turnaround potential. I’m aware that may turn out to be a mistake.

Andrews Sykes H1 results to June

This is another company carrying large cash balances and with no forecasts, but for rather different reasons. The 102 year old Chairman Jacques Gaston Murray doesn’t believe in paying brokers to make forecasts, and is very conservative when it comes to ASY’s balance sheet. Andrews Sykes was the last company that Jeremy wrote about for Sharepad, suggesting it was a stock that in 10 years time he would be warmly remembered for.

The results themselves look satisfactory, but equipment hire isn’t benefitting from a recovery as much as I’d hoped. Revenue was up +6% to £37.9m and PBT was up +12% to £8.5m for H1 to June. Cash increased by £10m versus last June to £34m. In terms of geography, UK revenue grew +2% (well below the rate of inflation) but Europe was up +17%, driven by Italy where revenues almost doubled. They also have a UAE business in the Gulf, which recorded revenue growth of +6%, despite a challenging environment they say. The long term track record shows that despite high 3 year average RoCE of 27%, the company has struggled to grow the top line.

Outlook: The hot temperatures in July and August mean that there has been strong demand for ASY’s air conditioning units and chillers. In the longer term, optimism is tempered with the observation about heightened energy costs and macro uncertainty affecting demand. That sounds fair enough, though isn’t particularly helpful – I think you just have to assume that this is a long term, family owned business who won’t take too many risks.

As you would expect for a company that began life in Queen Victoria’s reign, there’s a defined benefit pension scheme on the balance sheet. Unusually it’s £9m in surplus (on an IAS 19 basis), and there was a £2.6m below the line item in ‘other comprehensive income’ as the discount rate has risen. That reduced the value of future liabilities, from £42m in December to £31m at the end of June, while plan assets also fell back by £8m to £40.6m.

Despite that surplus, they are still making a £1.3m per annum contribution to the pension scheme, which sounds to me overly cautious. Presumably they will agree with the Trustees no further contributions are needed soon, which would give profits a boost. The business has no bank debt, but they do quote a ‘net funds’ figure of £21.7m, which is the £34m cash figure net of lease obligations of £12.7m.

Ownership: The family trust EOI Sykes Sarl owns almost 90% of the shares. That means the bid offer spreads are very wide for a £200m market cap company, so it’s not for traders. But if you have a holding period of between 5-10 years holding it could make sense.

Valuation: Assuming FY EPS grows in line with the first half, shares are trading on 12x 2022F PER. The FY dividend in 2021 was 23p, and so far this year they have declared an interim dividend of 11.9p plus a special dividend of 16.6p, implying a yield of 5.8% even before the final dividend (12.5p last year) has been announced. Assuming the final dividend is similar to last year, that would imply a yield of 8.4%.

Opinion: I rather like the cautious management, £34m of cash on balance sheet represents 16% of the market cap. The fully funded pension surplus and dividend income are also an attraction. The bid offer spread may put shorter term investors off, but this is a share that I enjoy owning.

Boku and Bango H1 June

Both these Direct Carrier Billing which report in US dollars released results last week. I last looked at Boku in early in August and Bango a couple of weeks later. Boku’s H1 to June revenues were flat at $30m, currency adjusted revenue was +7% y-o-y. There is a large exceptional gain because they sold their Identity division for $24.6m and group cash is now $67.8m. Similar to Smoove though, I think management will use most of that cash to try to grow the business, rather than return it to shareholders.

Bango grew revenues +9% to $10.8m, so they would have reported mid teens revenue growth on a constant currency basis. They acquired NTT DOCOMO in August, which they expect to deliver $16m of revenue in FY Dec 2023F. Loss before tax was $1.2m – and the company has a track record of almost two decades of losses. Forecasts are for $5m of PBT in 2023F and $16m in 2024F.

Valuation: Boku is trading on 26x 2023F PER and 5.1x sales the same year. Bango is trading on a PER of 25x 2023F, though that drops to 9x 2024F assuming the earnings from NTT DOCOMO come through as management expects. That equates to just over 3x sales.

Opinion: The Bango share price has held up well, supported by their acquisition. I’ve always felt that it is worth keeping an eye out for companies with many years of losses that are about to turn profitable.

Boku -37% YTD needs to demonstrate that it’s foray into the e-wallets space, can make a return. I hesitate to suggest that with $67m of cash, or 20% of its market cap, Boku ought to be defensive after what happened to Smoove – but I do think more cash is generally better than less cash on the balance sheet.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in Smoove and Andrews Sykes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.