I am probably jinxing it now, but owning shares in Howden Joinery has never lost me sleep.

I was reminded of this fact earlier in March when Howdens published its annual report for the year to December 2020. The front cover sports a picture of a smiling builder picking up a packaged kitchen part.

Despite the pandemic and a fall in profit, this year’s annual report has the same calming effect it does every year, and not just because of the pictures. Howdens explains the business very well, and quietly delivers on the promise.

Why Howdens makes me 🙂

This article is not going to be exclusively about Howdens, but it would be cruel to leave readers who are unfamiliar with the business without an inkling of its strategy.

Howdens only sells kitchens to small builders. When it was founded in 1995 this was a unique approach. Other fitted kitchen suppliers served the public from showrooms and trade customers from a counter, often at the side of the same building.

Serving two kinds of customer creates a problem though. It means a retail customer can nip round the corner and find out how much more she is paying, which is unlikely to make her happy or any builder she subsequently contracts.

Unburdened by trying to please everyone, Howdens set about developing a business model entirely around the builder, giving him enough credit to complete a job and get paid before settling his account, ensuring near 100% stock availability so jobs are not delayed, and siting its depots out of town where there is less traffic and the rent is cheap.

Focusing on trade customers makes sense because they are fitting kitchens all the time, generating repeat business with Howdens, unlike retail customers who may wait decades before gutting their kitchens again.

Howdens is a classic roll-out, growing by opening new depots every year. As the UK fills up with Howdens depots it is turning its attention to France. While we can discuss how much more risky an EU operation is, especially in these febrile times, Howdens says the French market is very similar to the UK market back in 1995.

In other words, it has no major trade-only suppliers (aka direct competition).

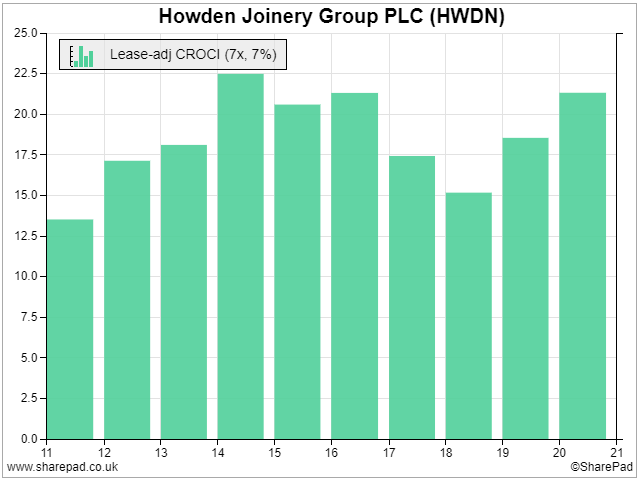

Rolling-out a successful business format is low risk and high return, a fact illustrated most clearly by one of the most reliable of financial statistics: Howden’s Cash Return on Capital Invested (CROCI):

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| CROCI(%) | 14 | 17 | 18 | 22 | 21 | 21 | 17 | 15 | 19 | 21 |

Source: SharePad (Custom table or Financials > Ratios)

I have been a bit cunning with the start date in this table. Before 2012 Howdens was still dealing with the hangover from having been part of MFI, a giant furniture chain that went bust in 2008. Howdens was left with a legacy of stores it did not need and leases it had to pay, which dampened the firm’s performance until it had got rid of most of them.

Since then, Howdens has not only earned a high return in cash on capital – the average is 19% over the last ten years – but returns have been very consistent. It does not consume enormous amounts of cash some years, and release it in others, one reason shareholders might have trouble sleeping at night.

You may be wondering why I have used cash flow and not profit to determine Howdens’ returns. Profit is another reason investors lose sleep at night, because it is more easily manipulated.

Are there any other Howdens out there?

After the year we have just been through, owning shares in companies that help us sleep at night seems like a particularly good idea.

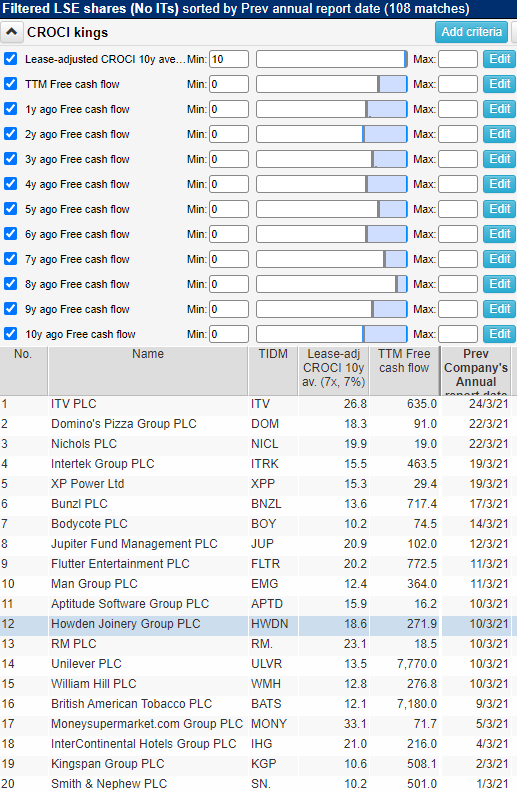

High CROCI is easy. Stable less so. There are two ways we can perform the evaluation. The first is very simple. We can just filter just one criterion:

- 10y average CROCI > 10%

This will return the high CROCI firms we are interested in, and for stability we can eyeball the financial chart:

Source: SharePad (Financial charts)

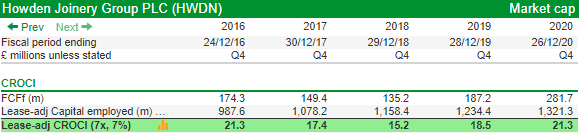

Or we can look at the data. I use a custom table that shows CROCI’s two components, Free cash flow to the Firm (FCFf), and capital employed. That way we also gain a quick impression of whether cash flow is increasing, which suggests the company is putting its prodigious returns to good use.

Source SharePad (Custom table). SharePad data goes back for yonks, I have shown five years so it fits nicely on the page

My one criterion filter returns 172 matches. That is the number of companies that earned a ten year average CROCI of over 10%. That is few enough matches for me. While we could demand a higher CROCI and shorten the list, it would risk ruling out some firms earning very stable returns.

But averages can hide all manner of sins, and while occasional large inflows of cash might not keep us awake at night, large outflows might. We can filter out companies with high returns that have, at some point in the last decade, experienced a cash outflow by stipulating that Free cash flow was positive in every single year.

This brings back 108 matches, 20 of them published annual reports in March:

Source: SharePad. I have added a column to the filter results so I can sort it by the publication date of the companies’ previous annual reports.

Provisionally, I have divided these high CROCI shares into two categories.

CROCI kings

These are companies exhibiting high and stable CROCI that has translated over the years into greater cash flow as they have expanded. Such companies are likely to be rolling-out products or services incrementally. We still need to investigate them – to reassure ourselves they have not saturated the market, or attracted new competition – but the signs are good.

Going by the numbers, my CROCI kings are selected only from companies that have published annual reports in the last month:

- Aptitude software – A supplier of financial management software to large companies, formerly Microgen

- Bunzl – Distributes consumables to organisations across Europe and North America.

- Howden Joinery – Supplier of fitted kitchens and bathrooms to small builders (see above)

- Intertek – Global quality assurance company. Tests, inspects, and certifies products, processes and services across diverse industries

- Domino’s Pizza – A sub-franchise of the global takeaway pizza chain, it further sub-licenses the right to operate stores in the UK and Ireland

- Intercontinental Hotels – Owner of Intercontinental, Holiday Inn, Crowne Plaza and a number of other big hotel franchises

- Unilever – Owns dozens of food and household product brands. My favourite will always be Cornetto

- XP Power – Manufactures power converters for machines used in industry and healthcare

CROCI conundrums

High CROCI is reassuring, but if it is also highly variable the story is likely to be complicated and it will be more difficult to determine whether a company is successfully investing cash to grow.

They may well be making good investments, but it is going to take more effort to find out.

Going by the numbers again, these are my CROCI conundrums:

- Bodycote – Heat treats metal components for planes, cars and industry to make them stronger

- British American Tobacco – Manufactures cigarettes

- ITV – A programme maker and broadcaster that makes less than half of its money from advertising these days

- Flutter – Sports betting company

- Jupiter Fund Management – Active fund manager

- Kingspan – Manufacturer of insulation panels and other products for the building envelope

- Man Group – Fund manager, mainly for institutions

- Moneysupermarket – Price comparison site for insurance, home services like broadband, and mortgages, loans and credit cards

- Nichols – Owner of Vimto and marketer and distributor of soft drinks

- RM – Distributor of classroom materials, supplier of IT software and services, and supplier of assessment software

- Smith & Nephew – Manufactures diverse medical devices, used in orthopedics, sports medicine and Ear Nose and Throat (ENT)

- William Hill – Betting company

Richard Beddard

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.