A look at the movements at the long end of the government bond yield curve, and the implications for equity investors. Companies covered GBG, CER and PCIP.

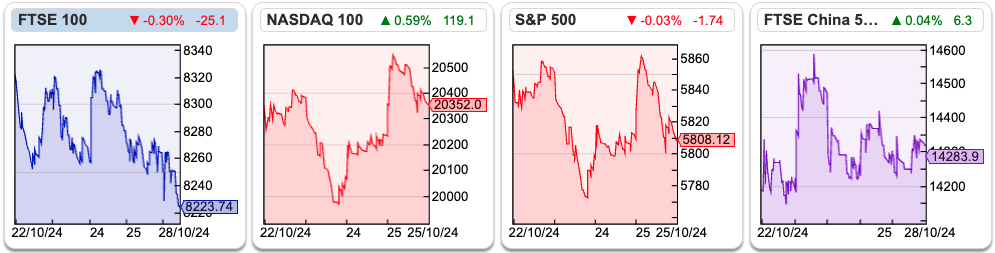

The FTSE 100 was down -1% last week to 8,223. The Nasdaq100 was flat, while the S&P500 was down -1%. The price of palladium was up +9% last week, while gold was up +1.6%. G$ is up +32% YTD and S$ is up +44% YTD, well ahead of the other precious metals (Palladium and Platinum are both up less than +3% YTD). The UK and US 10Y government bonds are both currently yielding around 4.2%.

I have spent the last couple of weeks out and about in The City of London meeting people. Former colleagues, journalists, tennis partners, university and school friends; it is much more fun to gather ideas in The Old Doctor Butler’s Head than spend time on Twitter. No one I met disagreed with my suggestion from a few weeks ago that we could see a structural shift in government funding, away from defined benefit pension funds, Central Bank QE and Sovereign Wealth Funds towards banks. The implication is that the long end of the yield curve should rise, in both the US and UK. If developed market banks are going to be lending more money to governments, that means they’ll be lending proportionately less to the productive economy, corporates, SMEs and individuals’ mortgages. Capital could become scarce.

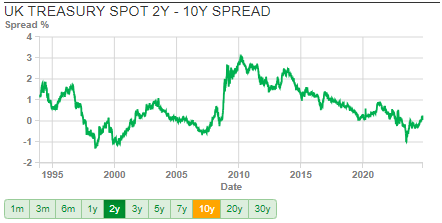

On Sharepad you can find yield curve data, with the ticker UKTSY10, and clicking on the financials tab. The chart below shows that the UK yield curve is currently flat, 2-year is trading at the same level as the 10-year. In the US, the 10-year (USTSY10) has risen by 66 basis points to 4.3% since mid-September.

One implication is that investors should start paying more for companies with net cash, which are likely to be at an advantage. It also suggests that sectors that benefited from declining bond yields should be avoided: commercial property and private equity funds spring to mind. Blackstone’s President Jonathan Gray is quoted in the FT saying that large government deficits leading to a rising cost of capital could be a separate risk, apart from inflation. That is, government bond prices could sell off (yields rise) even while inflation expectations remain under control.

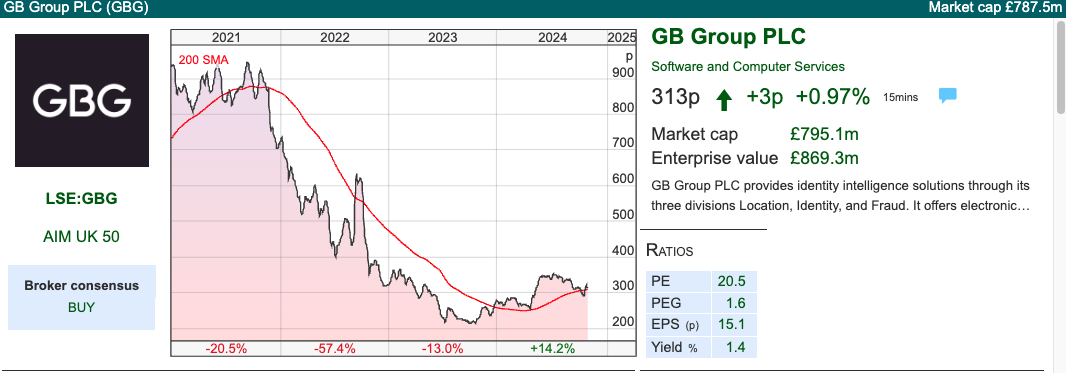

This week revisit the investment case on 3 technology stocks GB Group, Cerillion and PCI PAL which I haven’t looked at in a couple of years. I don’t own any of these stocks, if I had to choose one to hold for 3-5 years, I think PCI PAL has the most potential. GB Group also looks to be at an interesting point in its recovery.

GB Group H1 Sept Trading Update

This identity checking and fraud prevention software company reiterated its FY Mar 2025F outlook. Clearly, some investors had been sceptical, as the share price reacted by rising +11% on the morning of the RNS. They expect to report H1 revenue +4.5% on a constant currency basis, to £137m. Due to sterling strength/dollar weakness, it falls to +3.4% on a reported basis.

The business has 3 divisions: i) Identity: 56% of group revenue, 27% contribution margin ii) Location: 29% of group revenue, 40% contribution margin iii) Fraud (prevention): 15% of group revenue, 27% contribution margin. The first two are growing at +6.8% constant currency together, while Fraud saw revenue decline by a high single digit. Management say that this relates to timing differences in customer renewal cycles. I’ve noted previously that management teams will often try to suggest a decline is a temporary problem or timing difference, while problems can in reality be structural. I don’t feel confident assessing which it is for GB Group but historically Fraud had been reporting +15% CAGR revenue growth for the last 3 years until FY Mar 2024.*

Balance sheet: Management bought Acuant, a US identity and fraud prevention company, in November 2021 for £555m. That left them with year-end net debt of £157m in Nov 2021, versus £969m of goodwill and intangible assets and negative tangible equity. Net debt has now fallen to £72m, and intangibles and goodwill have reduced to £742m. That follows £55m of impairments in last year’s accounts and £125m the year before. Interestingly management said the 2024 impairment was due to rising Central Bank interest rates, which increased the discount rate applied to future cashflows. That is the first time that I’ve come across goodwill impairments due to movement in the long bond yield and discount rates, rather than a fundamental reassessment of the value of a prior year acquisition. In any case, GBG’s net tangible assets remain negative. Reassuringly, net operating cashflow was £43m FY Mar 2024, with cash used in investing (ie capex and similar) less than £1m.

Private Equity Target? In September 2022 there was an approach from a US private equity bidder GTCR, which meant the share price rose to almost 650p. However, GTCR failed to make a formal offer by the Takeover Panel rules deadline, so the deal fell through. A month later in October 2022, there was a nasty profit warning, with the shares halving in value. It is worth noting the highly cash-generative model and gross margin of around 70% means that this company is of interest to P.E. firms.

Comparison with Intercede: GBG are in the same sector as Intercede, which was up +66% last year and +80% YTD. I note however that Cavendish’s last published IGP target price was 140p, versus a peak earlier this year over 200p. It’s always a little awkward for the house broker when the share price of a house stock exceeds a sensible valuation. Understandably the analyst at Cavendish has put his previous target price of 140p on IGP “under review”, perhaps trying to (subtly) signal that the share price performance +80% YTD has run ahead of the fundamental story. On current forecasts IGP trades on a PER FY Mar 2025F and 2026F of just under 40x. Unlike GBG, Intercede has net cash of £16m, so on an EV/EBITDA basis it trades on 26x, versus 11x the same ratio for GBG.

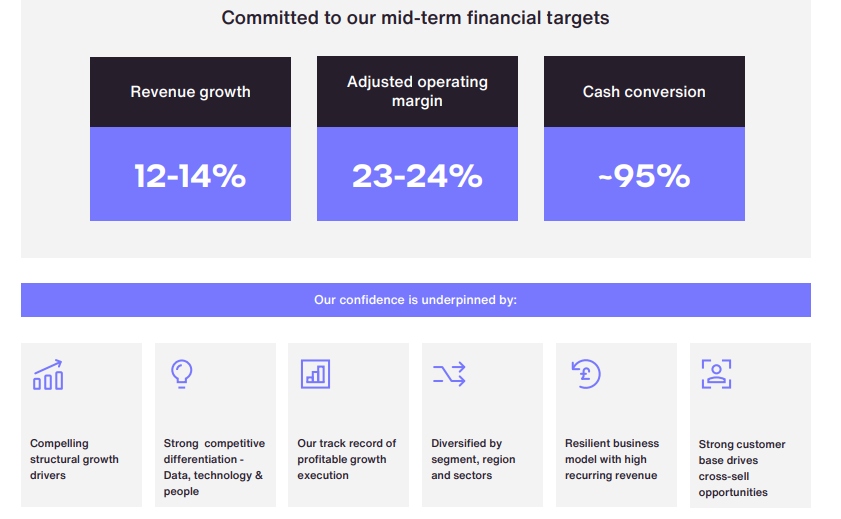

Outlook: In January 2023 GBG management hosted a Capital Markets Day, suggesting 12-14% revenue growth and above 23% adj operating margin. That compares to the 21% adj operating margin delivered in H1 to September. Since the CMD, there’s been a new Chief Exec (Dev Dihman) appointed who is expected to deliver on what the previous Chief Exec had presented. The most recent RNS said GB Group expect mid-single-digit FY Mar 2025F revenue growth, leading to high single-digit growth in adjusted operating profit this year. In other words, the margin target looks achievable, but revenue growth is more challenging.

Valuation: That puts the shares on 18x Mar 2025F dropping to 16x the following year. On a price/revenue basis, they’re on 2.6x Mar 2026F versus IGP on 6x revenue the same year. Even adjusting for cash / net debt, that is still a significant discount versus Intercede.

Opinion: This is a stock that I am warm to. The debt burden is not too onerous, and there could be an upside if management can get close to hitting the medium-term revenue growth revenue target. Often companies that take goodwill impairment writedowns for prior year acquisitions that have disappointed are punished, but that can present a good entry point. Arguably there’s less risk now that management have admitted that they overpaid in 2021, right at the top of the market.

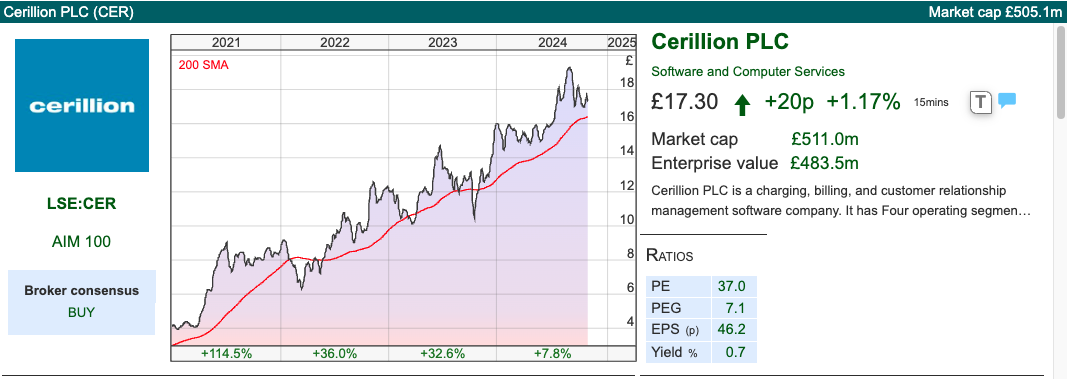

Cerillion FY Sept 2024 trading update

This billing and Customer Relationships Manager software company has 23 bagged since the shares listed on AIM in 2016 at 76p. Both Maynard and I wrote about it a couple of years ago, admiring the buoyant share price but wondering if the profit growth was sustainable. As it happens: yes it was and we should have been less sceptical. Still, I think it’s worth revisiting investments that you decide to avoid, as a learning exercise to see what we missed and so readers who do own it, can examine whether now might be the right time to take some profits or if it has further to go.

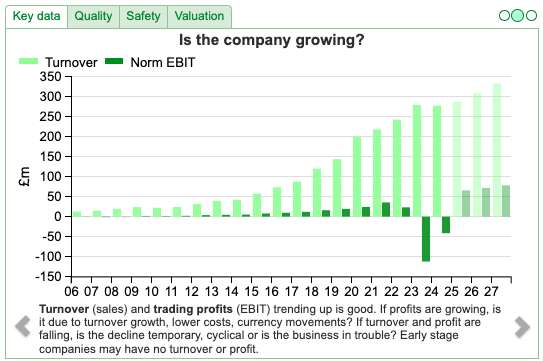

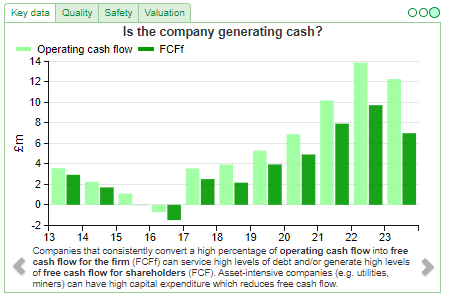

Management expects FY Sept 2024F revenue to be up +12% to c. £44m and adj PBT to be “comfortably ahead” of the consensus market forecast of £17.9m. Net cash at the end of Sept increased by £5.1m to £29.8m. Whenever I see a relatively small increase in net cash relative to profits, I like to dig into what is going on. Using Sharepad’s “Cash” tab we can see that last year CER paid tax of £3m and £2.9m of dividends, so a retained profit of £12m versus an increase in cash of just £5.1m. The difference is explained by accrued income, management recognising revenues and profits on multi-year contracts before the invoice is raised, and the client settles up with the cash then received. Both Maynard and I drew attention to this in our previous articles, but you can also see it on Sharepad with a red Beneish M score and cash conversion of 54.5%.

That was one reason for caution, as booking revenue ahead of cash was a significant issue for the support services sector a few years ago. The other reason for caution was the relatively low amount of recurring revenue versus having to win new business, albeit from existing customers. I’m pleased to say neither of those concerns have yet been justified, and the share price has gone from strength to strength. The declining trend in both Operating cashflow and FCFf remains at the back of my mind though.

Valuation: The shares are trading on 32x PER Sept 2025F, and a FCF yield of 2.6% the same year. That strikes me as very expensive in this market, with no room for disappointment.

Opinion: Well done to holders. I was too cautious on this one and management have done a phenomenal job (Louis Hall the co-founder in the late 1990’s still owns just over 30%). Focusing on cashflow and accounting can help investors avoid mistakes, but you can also miss the occasional multi-bagger. There have been many investors caught out by the likes of Netflix, Nike and Tesla, because of accounting issues. If demand for the product is growing strongly, the accounting becomes less relevant to the investment case, until the wheels come off (Cisco). CER’s track record is enviable, but if the company stumbles I would expect the shares to be badly punished so need some convincing to still be a buyer, or even a holder, at these levels.

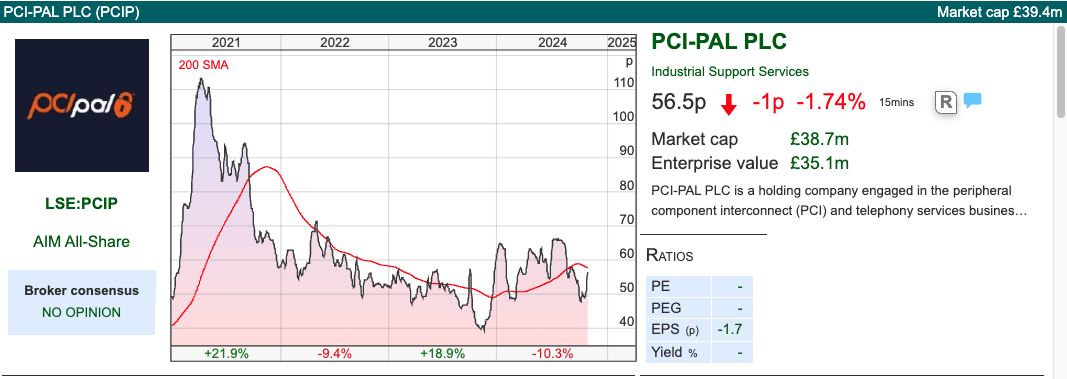

PCI-PAL FY results June 2024

This technology company allows client companies to securely take payment data over the phone or in a ‘webchat’ (using a URL that opens in a different browser window). This means that the call centre worker doesn’t see the customer’s payment data or credit card details. There’s a 2-minute demo video here.

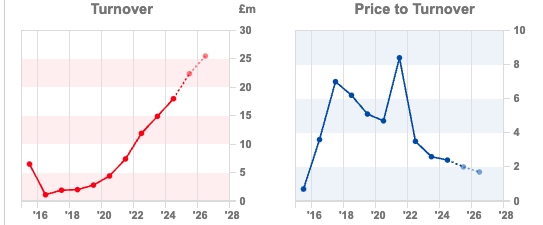

PCIP reported FY June revenues +20% to £18m and a statutory loss before tax of £1.7m. That is “in-line” with an August trading update, but a £0.7m miss versus expectations at the start of the year. It sounds like this was genuinely deferred revenue timing difference though, as the £0.7m will now be added to the FY Jun 2025F expectations. The auditing process also took longer than expected, so the timing of the announcement of these results was delayed.

There has been a 3 year court case, with a competitor Sycurio, bringing a patent infringement case against them. I wrote about this in 2022 – management had been spending money on legal costs (£4.3m gross as of June this year) but hadn’t taken a provision as they believed Sycurio’s case was “opportunistic”. The case finally came to trial in June, with the High Court ruling in PCIP’s favour: ie that Sycurio’s claim was invalid – the judgement was reinforced by the Court of Appeal. There’s been a settlement with Sycurio, but the details remain confidential.

Net cash at the end of June was £4.3m helped by a placing of £3.3m at 56p per share in March. Management have received back their UK court case costs, but there’s no concept of cost recovery in US patent disputes. Cavendish have group net cash growing to £5m by Jun 2026F.

Outlook: The outlook statement sounds upbeat. Cavendish, their broker, have adj PBT of £0.8m Jun 2025F (remember though £0.7m of deferred revenue from this year within that figure). There’s not much evidence of operational gearing as profits drop the following year despite revenue forecast to grow +14%. That’s surprising given the gross margin is c. 90%, but Cavendish point out that there is substantial opex, and if management beat their broker’s “conservative” forecast then we will see that further revenue growth drop straight through to the bottom line. Management also pointed out on the InvestorMeetCompany call, that the £0.7m of revenue deferred into FY Jun 2025F distorts both the current year and the 2025F v 2026F growth rate.

Valuation: I don’t usually quote broker’s target prices – but Cavendish’s 125p TP implies 4x EV/Sales, which seems reasonable. So there could be plenty of upside if management execute well. One thing to flag is that it is unusual to see a company’s valuation de-rate, while gross margin has been increasing from 43% in 2018 to 90% currently. The company is forecast to continue to grow revenue at double-digit rates per annum. The PER ratio is around 60x for Jun 2025F, however, that reflects a low EBIT margin. The shares are trading on 2x sales, which could represent good value if the profits do come through with more revenue growth.

Opinion: I like it. I think the relative strength, with the shares up +17% through October is a good signal. I’m not sure what the competitive landscape looks like, secure payments for call centres is likely to be a hard fought battleground, in my view. That said, PCIP is growing revenue at low teens rates and has expanded the gross margin to 90%, so they must have something that is valued by their customers.

Notes

*There were a couple of acquisitions, Acuity and Cloudcheck which completed in Nov 2021 and Jan 2022. I’m assuming that the 3-year growth rate management are quoting is organic, but it’s possible that it has been boosted by these acquisitions around 3 years ago.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 29/10/2024 | GBG, CER, PCIP | Moving the long end of the curve

A look at the movements at the long end of the government bond yield curve, and the implications for equity investors. Companies covered GBG, CER and PCIP.

The FTSE 100 was down -1% last week to 8,223. The Nasdaq100 was flat, while the S&P500 was down -1%. The price of palladium was up +9% last week, while gold was up +1.6%. G$ is up +32% YTD and S$ is up +44% YTD, well ahead of the other precious metals (Palladium and Platinum are both up less than +3% YTD). The UK and US 10Y government bonds are both currently yielding around 4.2%.

I have spent the last couple of weeks out and about in The City of London meeting people. Former colleagues, journalists, tennis partners, university and school friends; it is much more fun to gather ideas in The Old Doctor Butler’s Head than spend time on Twitter. No one I met disagreed with my suggestion from a few weeks ago that we could see a structural shift in government funding, away from defined benefit pension funds, Central Bank QE and Sovereign Wealth Funds towards banks. The implication is that the long end of the yield curve should rise, in both the US and UK. If developed market banks are going to be lending more money to governments, that means they’ll be lending proportionately less to the productive economy, corporates, SMEs and individuals’ mortgages. Capital could become scarce.

On Sharepad you can find yield curve data, with the ticker UKTSY10, and clicking on the financials tab. The chart below shows that the UK yield curve is currently flat, 2-year is trading at the same level as the 10-year. In the US, the 10-year (USTSY10) has risen by 66 basis points to 4.3% since mid-September.

One implication is that investors should start paying more for companies with net cash, which are likely to be at an advantage. It also suggests that sectors that benefited from declining bond yields should be avoided: commercial property and private equity funds spring to mind. Blackstone’s President Jonathan Gray is quoted in the FT saying that large government deficits leading to a rising cost of capital could be a separate risk, apart from inflation. That is, government bond prices could sell off (yields rise) even while inflation expectations remain under control.

This week revisit the investment case on 3 technology stocks GB Group, Cerillion and PCI PAL which I haven’t looked at in a couple of years. I don’t own any of these stocks, if I had to choose one to hold for 3-5 years, I think PCI PAL has the most potential. GB Group also looks to be at an interesting point in its recovery.

GB Group H1 Sept Trading Update

This identity checking and fraud prevention software company reiterated its FY Mar 2025F outlook. Clearly, some investors had been sceptical, as the share price reacted by rising +11% on the morning of the RNS. They expect to report H1 revenue +4.5% on a constant currency basis, to £137m. Due to sterling strength/dollar weakness, it falls to +3.4% on a reported basis.

The business has 3 divisions: i) Identity: 56% of group revenue, 27% contribution margin ii) Location: 29% of group revenue, 40% contribution margin iii) Fraud (prevention): 15% of group revenue, 27% contribution margin. The first two are growing at +6.8% constant currency together, while Fraud saw revenue decline by a high single digit. Management say that this relates to timing differences in customer renewal cycles. I’ve noted previously that management teams will often try to suggest a decline is a temporary problem or timing difference, while problems can in reality be structural. I don’t feel confident assessing which it is for GB Group but historically Fraud had been reporting +15% CAGR revenue growth for the last 3 years until FY Mar 2024.*

Balance sheet: Management bought Acuant, a US identity and fraud prevention company, in November 2021 for £555m. That left them with year-end net debt of £157m in Nov 2021, versus £969m of goodwill and intangible assets and negative tangible equity. Net debt has now fallen to £72m, and intangibles and goodwill have reduced to £742m. That follows £55m of impairments in last year’s accounts and £125m the year before. Interestingly management said the 2024 impairment was due to rising Central Bank interest rates, which increased the discount rate applied to future cashflows. That is the first time that I’ve come across goodwill impairments due to movement in the long bond yield and discount rates, rather than a fundamental reassessment of the value of a prior year acquisition. In any case, GBG’s net tangible assets remain negative. Reassuringly, net operating cashflow was £43m FY Mar 2024, with cash used in investing (ie capex and similar) less than £1m.

Private Equity Target? In September 2022 there was an approach from a US private equity bidder GTCR, which meant the share price rose to almost 650p. However, GTCR failed to make a formal offer by the Takeover Panel rules deadline, so the deal fell through. A month later in October 2022, there was a nasty profit warning, with the shares halving in value. It is worth noting the highly cash-generative model and gross margin of around 70% means that this company is of interest to P.E. firms.

Comparison with Intercede: GBG are in the same sector as Intercede, which was up +66% last year and +80% YTD. I note however that Cavendish’s last published IGP target price was 140p, versus a peak earlier this year over 200p. It’s always a little awkward for the house broker when the share price of a house stock exceeds a sensible valuation. Understandably the analyst at Cavendish has put his previous target price of 140p on IGP “under review”, perhaps trying to (subtly) signal that the share price performance +80% YTD has run ahead of the fundamental story. On current forecasts IGP trades on a PER FY Mar 2025F and 2026F of just under 40x. Unlike GBG, Intercede has net cash of £16m, so on an EV/EBITDA basis it trades on 26x, versus 11x the same ratio for GBG.

Outlook: In January 2023 GBG management hosted a Capital Markets Day, suggesting 12-14% revenue growth and above 23% adj operating margin. That compares to the 21% adj operating margin delivered in H1 to September. Since the CMD, there’s been a new Chief Exec (Dev Dihman) appointed who is expected to deliver on what the previous Chief Exec had presented. The most recent RNS said GB Group expect mid-single-digit FY Mar 2025F revenue growth, leading to high single-digit growth in adjusted operating profit this year. In other words, the margin target looks achievable, but revenue growth is more challenging.

Valuation: That puts the shares on 18x Mar 2025F dropping to 16x the following year. On a price/revenue basis, they’re on 2.6x Mar 2026F versus IGP on 6x revenue the same year. Even adjusting for cash / net debt, that is still a significant discount versus Intercede.

Opinion: This is a stock that I am warm to. The debt burden is not too onerous, and there could be an upside if management can get close to hitting the medium-term revenue growth revenue target. Often companies that take goodwill impairment writedowns for prior year acquisitions that have disappointed are punished, but that can present a good entry point. Arguably there’s less risk now that management have admitted that they overpaid in 2021, right at the top of the market.

Cerillion FY Sept 2024 trading update

This billing and Customer Relationships Manager software company has 23 bagged since the shares listed on AIM in 2016 at 76p. Both Maynard and I wrote about it a couple of years ago, admiring the buoyant share price but wondering if the profit growth was sustainable. As it happens: yes it was and we should have been less sceptical. Still, I think it’s worth revisiting investments that you decide to avoid, as a learning exercise to see what we missed and so readers who do own it, can examine whether now might be the right time to take some profits or if it has further to go.

Management expects FY Sept 2024F revenue to be up +12% to c. £44m and adj PBT to be “comfortably ahead” of the consensus market forecast of £17.9m. Net cash at the end of Sept increased by £5.1m to £29.8m. Whenever I see a relatively small increase in net cash relative to profits, I like to dig into what is going on. Using Sharepad’s “Cash” tab we can see that last year CER paid tax of £3m and £2.9m of dividends, so a retained profit of £12m versus an increase in cash of just £5.1m. The difference is explained by accrued income, management recognising revenues and profits on multi-year contracts before the invoice is raised, and the client settles up with the cash then received. Both Maynard and I drew attention to this in our previous articles, but you can also see it on Sharepad with a red Beneish M score and cash conversion of 54.5%.

That was one reason for caution, as booking revenue ahead of cash was a significant issue for the support services sector a few years ago. The other reason for caution was the relatively low amount of recurring revenue versus having to win new business, albeit from existing customers. I’m pleased to say neither of those concerns have yet been justified, and the share price has gone from strength to strength. The declining trend in both Operating cashflow and FCFf remains at the back of my mind though.

Valuation: The shares are trading on 32x PER Sept 2025F, and a FCF yield of 2.6% the same year. That strikes me as very expensive in this market, with no room for disappointment.

Opinion: Well done to holders. I was too cautious on this one and management have done a phenomenal job (Louis Hall the co-founder in the late 1990’s still owns just over 30%). Focusing on cashflow and accounting can help investors avoid mistakes, but you can also miss the occasional multi-bagger. There have been many investors caught out by the likes of Netflix, Nike and Tesla, because of accounting issues. If demand for the product is growing strongly, the accounting becomes less relevant to the investment case, until the wheels come off (Cisco). CER’s track record is enviable, but if the company stumbles I would expect the shares to be badly punished so need some convincing to still be a buyer, or even a holder, at these levels.

PCI-PAL FY results June 2024

This technology company allows client companies to securely take payment data over the phone or in a ‘webchat’ (using a URL that opens in a different browser window). This means that the call centre worker doesn’t see the customer’s payment data or credit card details. There’s a 2-minute demo video here.

PCIP reported FY June revenues +20% to £18m and a statutory loss before tax of £1.7m. That is “in-line” with an August trading update, but a £0.7m miss versus expectations at the start of the year. It sounds like this was genuinely deferred revenue timing difference though, as the £0.7m will now be added to the FY Jun 2025F expectations. The auditing process also took longer than expected, so the timing of the announcement of these results was delayed.

There has been a 3 year court case, with a competitor Sycurio, bringing a patent infringement case against them. I wrote about this in 2022 – management had been spending money on legal costs (£4.3m gross as of June this year) but hadn’t taken a provision as they believed Sycurio’s case was “opportunistic”. The case finally came to trial in June, with the High Court ruling in PCIP’s favour: ie that Sycurio’s claim was invalid – the judgement was reinforced by the Court of Appeal. There’s been a settlement with Sycurio, but the details remain confidential.

Net cash at the end of June was £4.3m helped by a placing of £3.3m at 56p per share in March. Management have received back their UK court case costs, but there’s no concept of cost recovery in US patent disputes. Cavendish have group net cash growing to £5m by Jun 2026F.

Outlook: The outlook statement sounds upbeat. Cavendish, their broker, have adj PBT of £0.8m Jun 2025F (remember though £0.7m of deferred revenue from this year within that figure). There’s not much evidence of operational gearing as profits drop the following year despite revenue forecast to grow +14%. That’s surprising given the gross margin is c. 90%, but Cavendish point out that there is substantial opex, and if management beat their broker’s “conservative” forecast then we will see that further revenue growth drop straight through to the bottom line. Management also pointed out on the InvestorMeetCompany call, that the £0.7m of revenue deferred into FY Jun 2025F distorts both the current year and the 2025F v 2026F growth rate.

Valuation: I don’t usually quote broker’s target prices – but Cavendish’s 125p TP implies 4x EV/Sales, which seems reasonable. So there could be plenty of upside if management execute well. One thing to flag is that it is unusual to see a company’s valuation de-rate, while gross margin has been increasing from 43% in 2018 to 90% currently. The company is forecast to continue to grow revenue at double-digit rates per annum. The PER ratio is around 60x for Jun 2025F, however, that reflects a low EBIT margin. The shares are trading on 2x sales, which could represent good value if the profits do come through with more revenue growth.

Opinion: I like it. I think the relative strength, with the shares up +17% through October is a good signal. I’m not sure what the competitive landscape looks like, secure payments for call centres is likely to be a hard fought battleground, in my view. That said, PCIP is growing revenue at low teens rates and has expanded the gross margin to 90%, so they must have something that is valued by their customers.

Notes

*There were a couple of acquisitions, Acuity and Cloudcheck which completed in Nov 2021 and Jan 2022. I’m assuming that the 3-year growth rate management are quoting is organic, but it’s possible that it has been boosted by these acquisitions around 3 years ago.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.