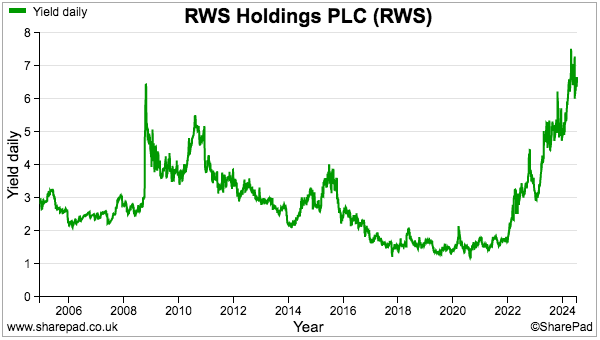

RWS has lifted its dividend for 19 consecutive years yet the shares currently offer a 6.5% yield. Maynard Paton studies the translation group’s acquisition history, profit adjustments and management changes.

An illustrious dividend history and a worthwhile yield have brought RWS to my attention. The language-translation group presently offers:

- An unbroken record of dividend increases since its 2003 flotation;

- A despondent share price that provides a 6.5% yield;

- Forecasts for further growth, albeit tempered by significant profit adjustments and unnerving management changes, and;

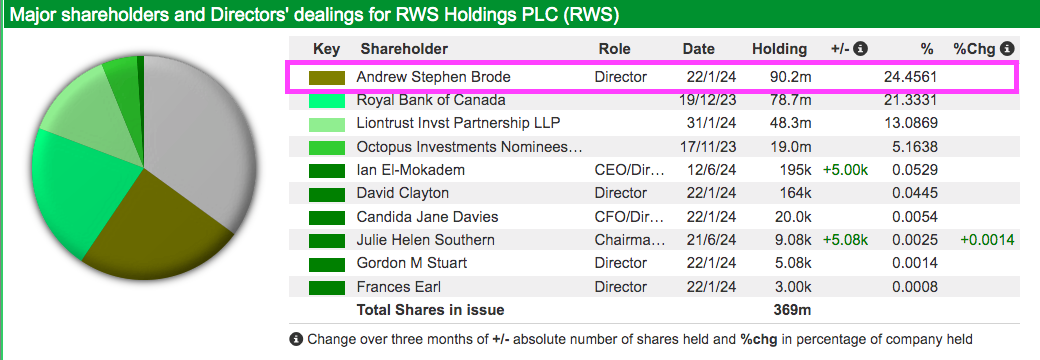

- A long-time board member with a £170 million investment who has never sold a share.

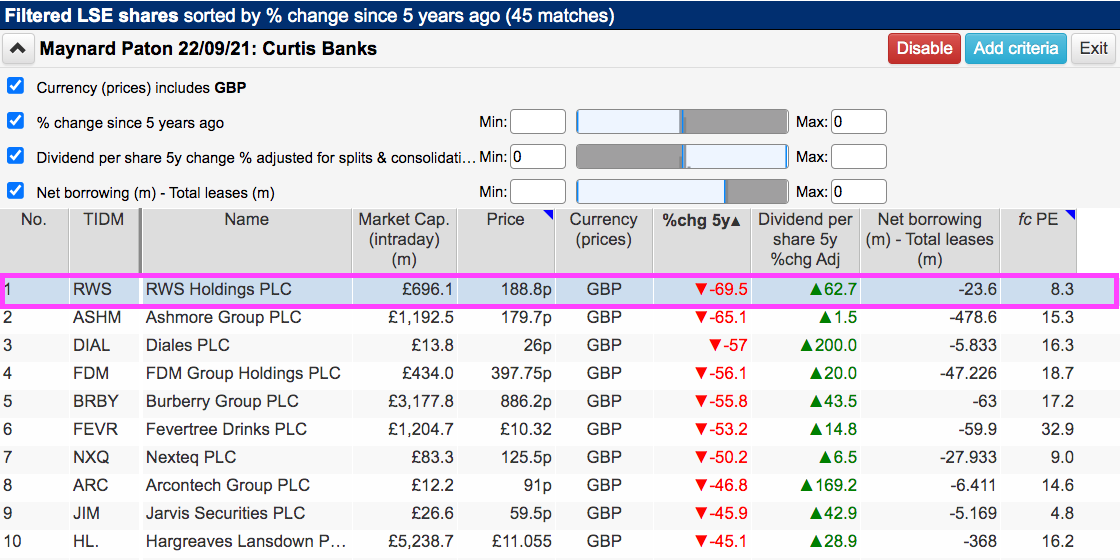

I pinpointed RWS after revisiting a SharePad filter that shortlisted companies where the last five years had shown their dividends going up but their share prices going down:

(You can run this screen for yourself by selecting the “Maynard Paton 22/09/21: Curtis Banks” filter within SharePad’s comprehensive Filter Library. My instructions show you how.)

SharePad returned 45 companies, including Hargreaves Lansdown, Fever-Tree Drinks, James Halstead, AB Dynamics and Dotdigital.

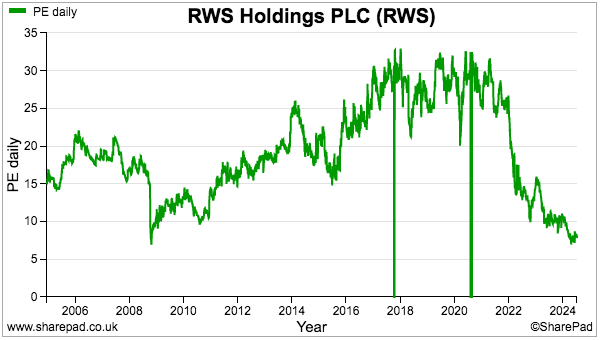

I selected RWS because its shares had fallen the furthest among the shortlist. I also noted the group’s forecast P/E was a modest 8x.

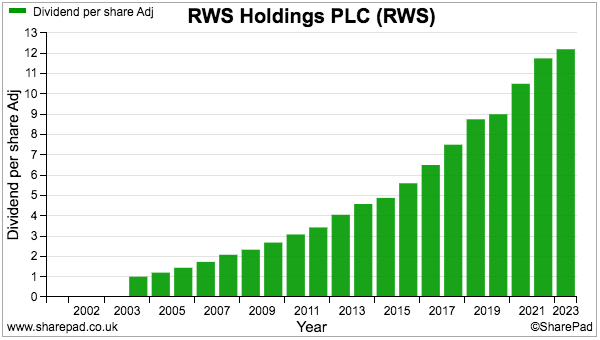

Not only has RWS’s dividend increased during the last five years, the payout has been lifted every year for a remarkable 19 years!

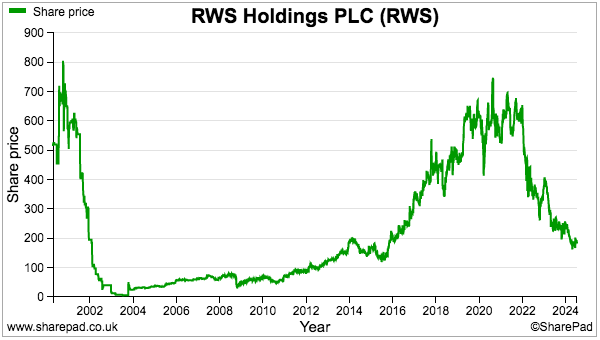

But the rising dividend has not stopped the shares plummeting to 189p, which supports a £696 million market cap:

(Note: RWS joined AIM during 2003 by reversing into a failed cash shell when the share price was approximately 25p. The 2000-2002 spike and crash within the chart above can therefore be safely ignored!)

Let’s take a closer look.

Introducing RWS

Randall Woolcott Services was established during 1982 following the merger of MH Randall & Partners, a language-translation company, and Woolcott & Co, a patent-search business.

The merged group subsequently enjoyed significant growth — both organic and through a series of acquisitions — to become the world’s premier supplier of patent translations.

Translating patents ought to form a good business. After all, multinationals dependent on patents for success will never want rivals to copy their inventions through a language loophole.

Customers may therefore not be too sensitive on translation pricing, and translators able to combine specialist patent, technical and language knowledge could charge handsomely for their skills.

Such commercial attractions probably put RWS on the radar of serial entrepreneur Andrew Brode, who acquired a 75% stake in the group during 1995.

Between the mid-1980s and Mr Brode’s investment, RWS had tripled sales to £10 million and quadrupled profit to £1 million. Ten years after Mr Brode’s investment, sales had tripled again to £31 million while profit had quintupled to £5 million.

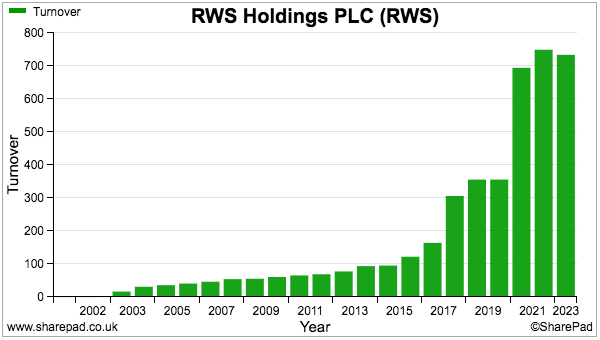

RWS’s growth has continued as a quoted company. SharePad shows revenue surging beyond £700 million:

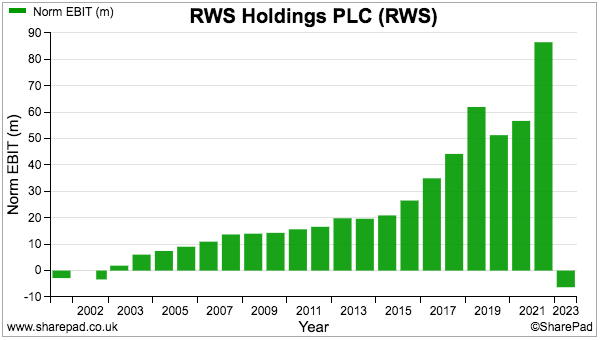

Profit meanwhile had jumped towards £90 million before turning into a loss during 2023:

RWS’s expansion during recent years has been driven by acquisitions that have sadly not always performed to expectations. In particular, that 2023 loss was due to a £62 million goodwill write-down.

The acquisitions have led to various profit adjustments, and RWS presents a generous version of underlying profit versus the one shown by SharePad within the profit chart above.

The acquisition strategy was established to diversify RWS from its patent-translation heritage. For several decades the EU worked on a ‘unitary’ scheme that would avoid the need to create separate patents for member countries. The system was finally introduced during 2023 and has led to less demand for patent translations.

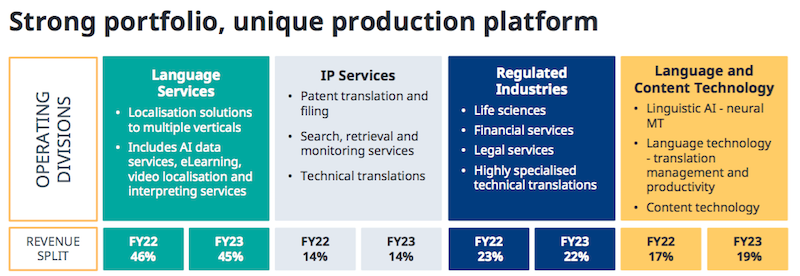

RWS now describes itself as a “unique, world-leading provider of technology-enabled language, content and intellectual property services” and, last year, patent translations represented only 14% of revenue.

The other 86% was generated by a vast array of other translation and language-type services — including supplying automated translations for video subtitles, creating multilingual websites and delivering bespoke expert translations for regulatory purposes:

More than half of revenue is now generated from clients in the US, and the blue-chip customer list includes 18 of Fortune’s top 20 ‘Most Admired Companies’ and 18 of the world’s top 20 patent filers.

Acquisitions and return on equity

RWS’s diversification strategy includes the following acquisitions:

- Document Service Center (technical translations, 2008): £7 million;

- Inovia (patent filing services, 2011): £19 million;

- Corporate Translations (life-science translations, 2016): £47 million;

- LUZ (medical/regulatory translations, 2017): £70 million;

- Moravia (internal corporate translations, 2017): £251 million;

- Iconic Translation Machines (neural machine translations, 2020): £9 million;

- Webdunia (translation and ‘localisation’ services, 2020): £17 million;

- SDL (various language software/services, 2020): £626 million;

- Liones (documentation software, 2022): £15 million, and;

- Propylon (content-management software, 2023): £29 million.

The total spend on acquisitions has surpassed £1 billion, which itself tells a story given RWS’s market cap is £696 million.

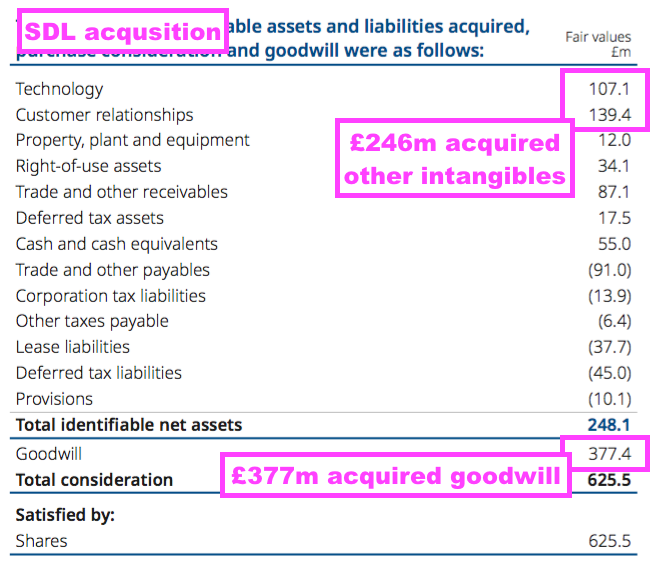

The aforementioned £62 million goodwill impairment acknowledged not every acquisition has worked out as expected. The 2023 results did not specify which purchases the impairment concerned, but certainly, the purchase valuation applied to SDL seemed ambitious.

The SDL deal was funded entirely by RWS issuing shares, which at the time of the announcement were 741p and valued SDL at £854 million — some 34 times SDL’s adjusted trailing earnings of £25 million.

By the time the SDL purchase was completed, RWS’s shares were 550p and the acquisition price was therefore reduced to £626 million. The 2021 annual report even mentioned the deal had collected an AIM award:

“The acquisition has been a real landmark for the Group and we were delighted to be awarded “Best use of AIM”, at the 2021 AIM Awards, for the SDL acquisition.”

Based on the deal’s original terms, RWS’s 189p share price now values SDL at £215 million — versus SDL goodwill of £377 million and other acquired intangibles of £246 million:

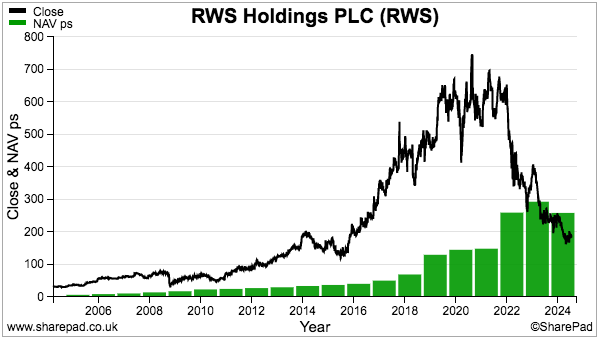

In fact, total goodwill and other acquired intangibles within the 2023 results came to £930 million — well above the £696 million market cap. SharePad confirms the 189p shares trade 27% below the 259p per-share book value:

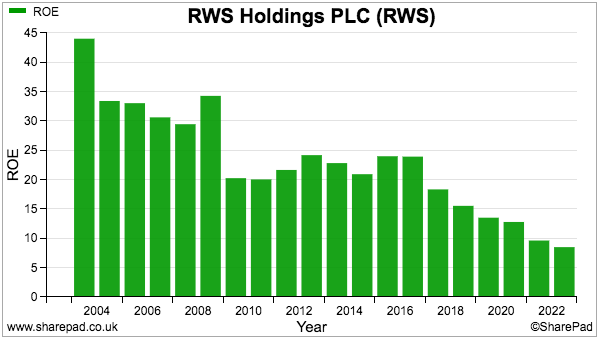

The market’s suspicion towards RWS’s acquisitions and the real value of the group’s goodwill and intangibles may well be caused by the deteriorating return on equity (ROE). This SharePad chart is very instructive:

ROE reduced from more than 30% to a modest 8.5% points to dramatically lower returns following the bumper acquisition spend.

And if you account for the £230 million charged as acquisition amortisation/impairment during the last ten years, the ROE reduces further to a lacklustre 7%.

Profit adjustments and cash conversion

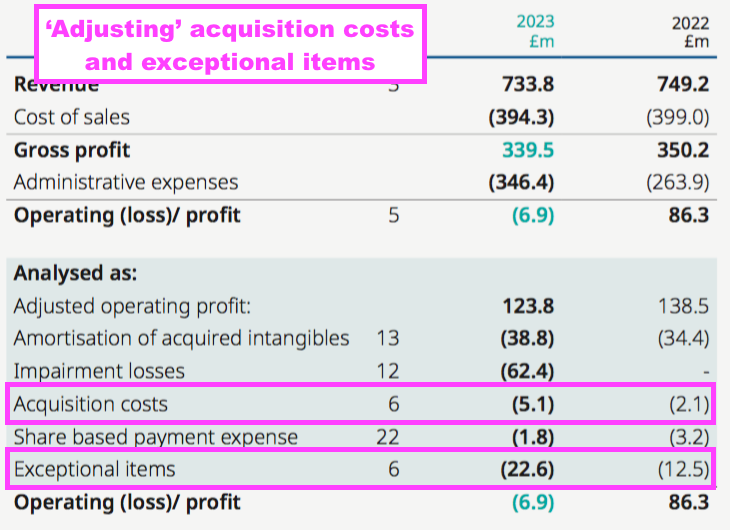

RWS excludes acquisition costs and exceptional items from its adjusted profit:

Acquisition costs have been recorded for each of the last eight years and total £35 million. Exceptional items — mostly restructure and reorganisation charges — have meanwhile been recorded for the last four years and total £52 million.

Whether such significant and regular expenses should be deemed as ‘adjusting’ might also explain why the shares trade on that P/E of 8x.

I calculate the acquisition costs and restructure/reorganisation expenses would have reduced RWS’s declared adjusted profit by approximately 15% since 2018.

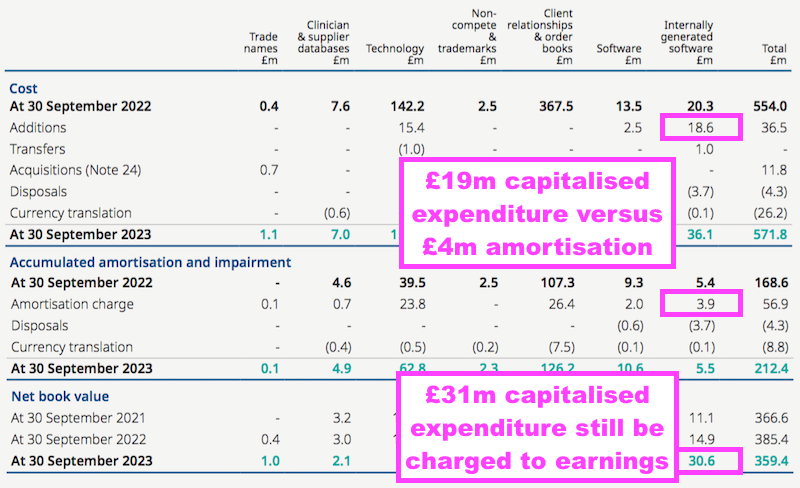

Another profit consideration is RWS’s capitalised expenditure on software development.

Last year the group diverted development costs of £19 million onto the balance sheet…

… and the associated amortisation charge was only £4 million.

The carrying value of such development expenditure is £31 million, which, had it all been expensed as incurred, would have reduced RWS’s declared adjusted operating profit by a further 5% since 2018.

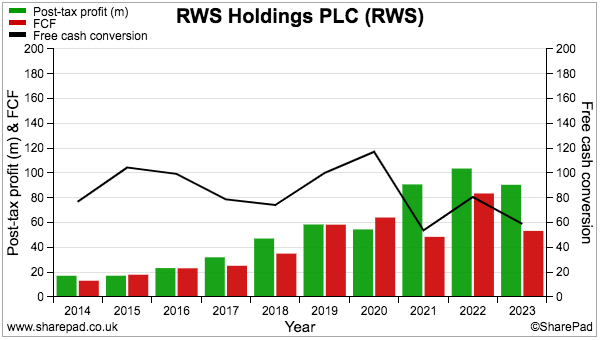

The acquisition costs, exceptional items and capitalised expenditure go some way to explain why cash conversion has averaged only 64% during the last three years:

Profit margin, workforce and AI

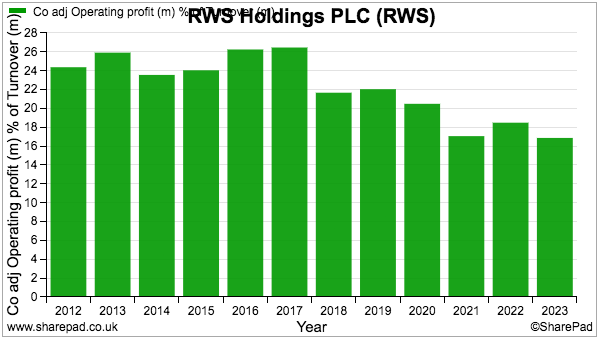

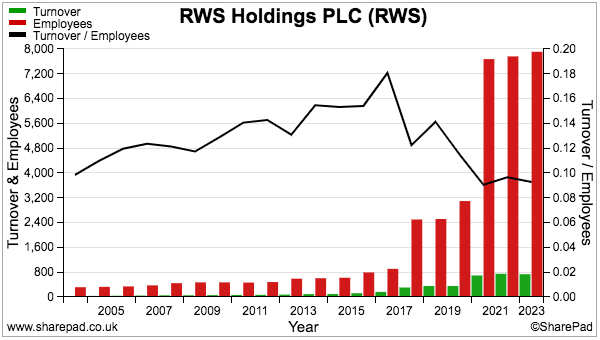

The following SharePad charts underline how the acquired businesses have not enjoyed the favourable economics of RWS’s original patent-translation service.

The group’s adjusted profit margin had reached a very healthy 26% but has since weakened to 17%:

Revenue per employee has meanwhile halved to around £90,000:

The reduced workforce productivity no doubt reflects RWS’s broadening of translation services, and the lower value applied by clients for translating corporate websites versus translating product patents.

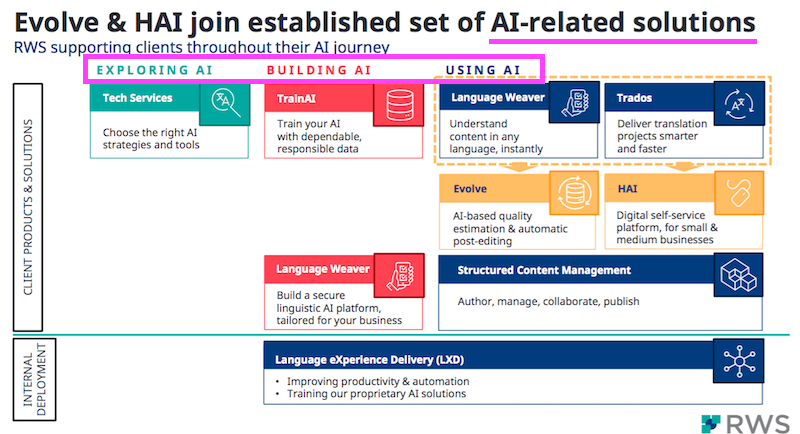

Another likely explanation for lower revenue per employee is a greater IT headcount. The aforementioned capitalisation of development spend has signalled substantial software development and a three-hour, 126-page PowerPoint presentation dedicated to AI last year indicates where the money is being spent:

Whether RWS will become a beneficiary or casualty of AI-generated translations is something I must leave you to ponder.

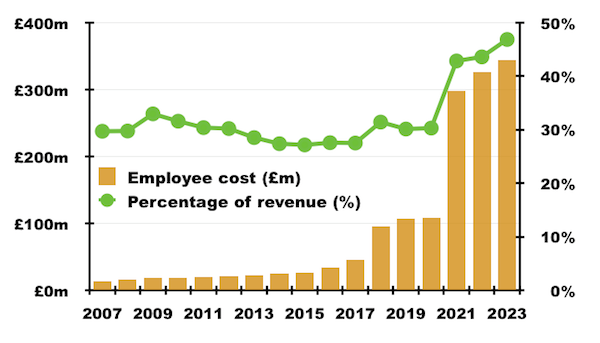

But what is not in doubt is employees are taking a greater share of revenue. Last year total staff expenses of £344 million absorbed 47% of the top line, versus only 27% ten years prior:

Boardroom

Changes within RWS’s boardroom have created some unease.

After two decades serving as executive chairman, the aforementioned Andrew Brode stepped down to become a non-exec last year. Mr Brode turns 84 this year and relinquishing his executive duties may reflect some retirement planning.

Mr Brode retains a £170m/24% shareholding…

…and SharePad data backs up his claim of having never sold a share:

“I’m known in the City for the fact that I have never sold a single share… I tell all my mentees that equity is blood and don’t sell unless you have to.”

Whether Mr Brode remains happy never to have sold a share is hard to say — the recent 189p price was first achieved during late 2013. Mr Brode may also rue vague private-equity interest that emerged — and then disappeared — when the shares traded at 350p during 2022.

Mr Brode’s new role coincides with a more adverse management change: chief executive Ian El-Mokadem this year announced his departure from the group:

Mr El-Mokadem was appointed RWS’s boss during 2021 just nine months after the bumper SDL purchase. Previous chief executive Richard Thompson had served as an executive since 2012 and led the SDL purchase — but seemingly did not fancy the subsequent integration.

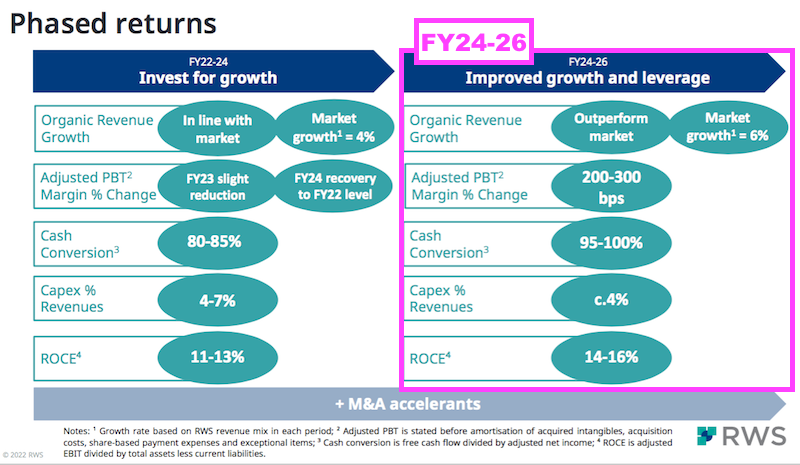

You do have to wonder whether something sinister is brewing within RWS following the SDL purchase. Mr Thompson jumped ship months after buying SDL while Mr El-Mokadem served three years integrating SDL before deciding to exit. I note Mr El-Mokadem’s departure is timed before he embarks on the “improved growth and leverage” phase he cited for 2024, 2025 and 2026:

A worry of course is the replacement chief executive decides Mr El-Mokadem’s financial targets are too ambitious…

…and reshapes the group with a ‘kitchen sink’ approach to the accounts and forecasts.

Forecasts and verdict

First-half results published during June were not spectacular, with revenue down 4% and adjusted earnings down 14%. Mr El-Mokadem nonetheless claimed the group “had an encouraging start to H2 [that is] currently pointing to a performance in line with market expectations for the full year.”

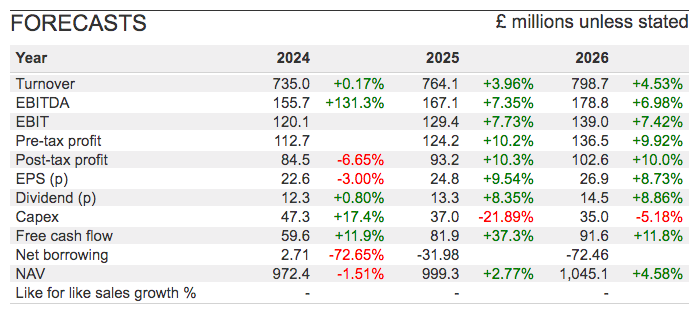

SharePad reveals the following forecasts:

H2 growth of approximately 5% is required for RWS to meet the 2024 projections.

The chart below shows how the P/E has de-rated from 25-30x to 8x:

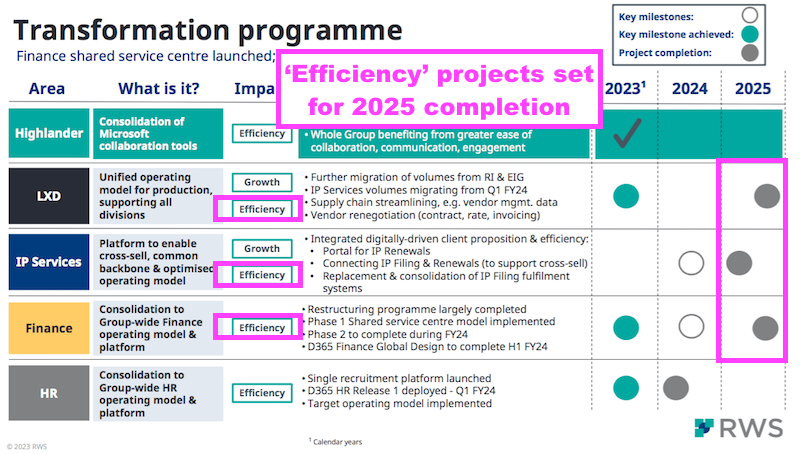

Whether the profit forecasts beyond 2024 will be met to underpin the 8x multiple seems likely to depend on the successor to Mr El-Mokadem. An immediate task for the next boss will be to finish streamlining all the acquisitions; an RWS presentation listed a number of ongoing ‘efficiency’ projects due for completion during 2025:

Once the streamlining is complete, RWS’s inherent profit margin, ROE, cash conversion and workforce productivity should become clear…

…assuming that is, the next boss does not revive the aggressive acquisition plan nor goes for broke on AI.

The saving grace amid the deteriorating ROE, profit adjustments and leadership change is the dividend, which was lifted 2% at the recent half-year and looks set to extend that 19-year run of increases.

SharePad confirms a 6.5% dividend yield:

Right now RWS appears somewhat of an operational mess, and I would for now await the new chief exec — and not risk the possibility of a strategic upheaval — before taking the share any further. But at least the group’s balance sheet is not stretched and the 189p shares may already reflect lots of bad news.

Probably the strongest buy signal may one day emerge from Mr Brode, who, while having never sold a share, has never purchased a share either. Reinvesting some of his £11 million annual dividend into RWS should give the all-clear to undecided investors.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in RWS.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.