Indicators in the government bond, corporate credit and commodity markets, suggest little contagion from the sell-off in US equities. Companies covered: JUST, SOM and SRC.

–

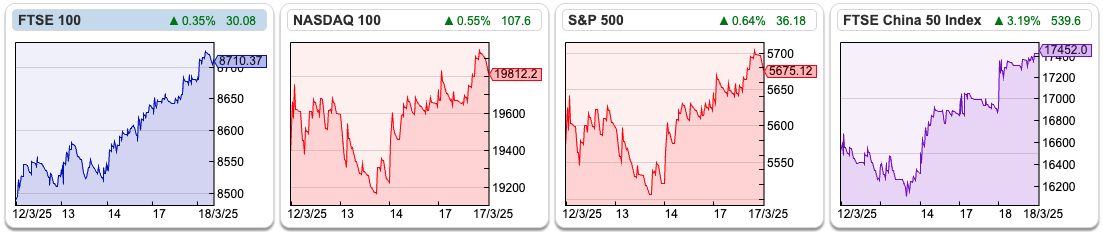

The FTSE 100 was up +2.5% in the last 5 days, to 8,710. Nasdaq100 is now down -5.7% YTD and the Nasdaq Composite is the worst-performing major index, down -7.8%. Meanwhile, the FTSE China 50 is up +25% YTD, so it looks like there are some unintended consequences of some of President Trump’s policies. The VIX, which measures implied volatility in the options market, commonly known as the “fear gauge” rose above 25 last week. Gold has also had a strong start to the year up +14%, and now touching $3000 per ounce.

Former hedge fund manager and now substacker, Russell Clark points out that there are a number of indicators that are signalling this is a “rebalancing” rather than anything more serious. He says that, if it is a recession – it’s not like one I have seen before:

- JGB yields have continued to rise. Typically they start falling well before US recession becomes apparent. Falling JGB yields happened before the 1991 Savings and Loans Crisis, Asian Financial Crisis, Dot Com Bust, GFC, Euro Crisis, China Deval Scare, and even Covid.

- Corporate credit spreads remain low by historical standards. Investors in credit are more finely tuned to recessions, as they lose money when default rates rise. So far, credit markets are not indicating a recession.

- US conference board inflation expectations are also not flagging a recession. They have popped to 6% in the most recent months.

I would add to those indicators that Copper HG-MT is up +23% YTD. This is another recession indicator that has not barked in the night.

Russell Clark concludes that though we should avoid a US recession, involving job losses and falls in GDP, we could still see a financial crisis of sorts. For instance, capital flight from US markets would be bad news for US equity market valuations. It would be great if some of this capital taking flight across the Atlantic came to land in London. The AIM (Sharescope ticker AXX) chart suggests that has yet to happen, with declines continuing from Sept 2021.

This week I look at Just, the lifetime mortgages and retirement solutions company, still trading on a 0.6x tangible book, despite the share price doubling in value in the past couple of years. Also concrete screed company Somero and acquisitive construction materials group SigmaRoc.

JUST FY Dec Results

I last wrote about this lifetime mortgage and retirement solutions company in August 2023 when the share price was 76p. Lifetime mortgages allow older people with little income to borrow against the value of their home, and pay the loan back when they die and their house is sold. Just also buys Defined Benefit pension liabilities from companies, taking on the responsibility of the guaranteed future retirement payments, in exchange for a fee.

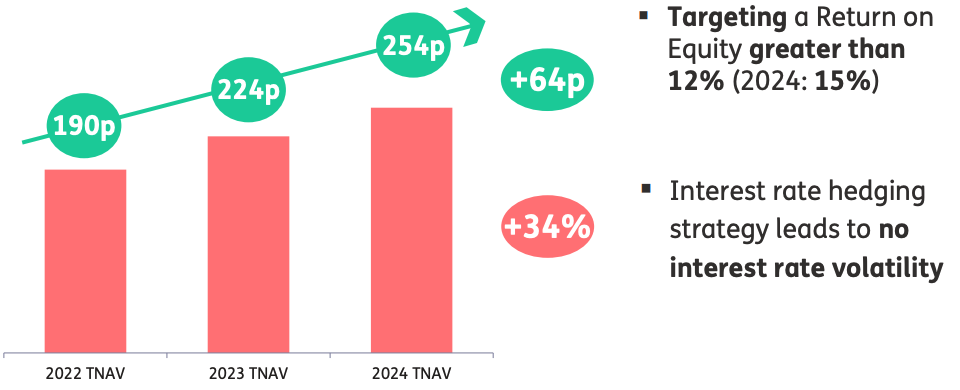

When I last wrote about JUST the shares were trading on a PER of 2.6x future earnings. When you see a company that cheap, it often signals that there is a problem with the earnings, but I’m happy to say that over the last couple of years, the share price has doubled. Tangible book value has also risen +34% to 254p, though the shares still trade on a discount to book.

The company reported Retirement Income Sales +36% to £5.3bn but IFRS statutory PBT was down -34% to £113m. Management point to “underlying operating profit” (first bullet point, in bold in the RNS) up +34% to £504m. Investors seem to have focused on the IFRS statutory number, as the share price reacted by falling -14% on the morning of the results.

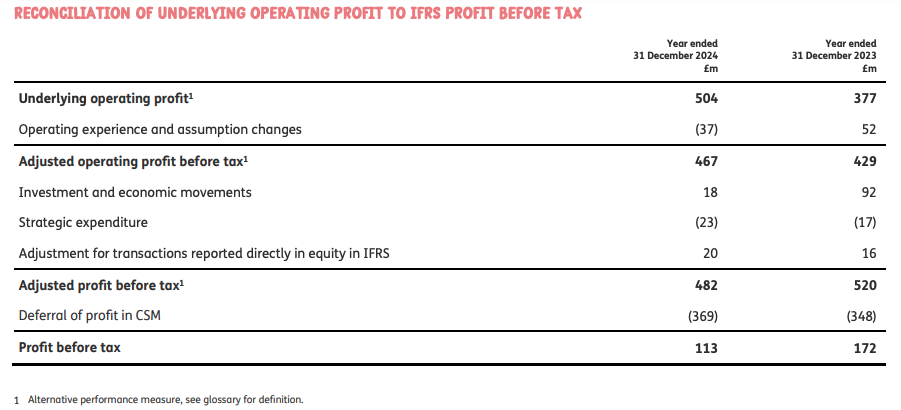

In any case, it seems worth spending some time to understand the significant divergence: i) between trends in underlying +34% and statutory PBT -14% ii) the absolute divergence of almost £400m (the difference between £504m underlying and £113m statutory). Beware though, the complexities of insurance accounting can make the likes of banks, aircraft leasing and litigation finance appear a doddle. Explaining the difference between the £504 and £113m statutory number, management say:

“We incurred operating experience variances, the cost of strengthening the maintenance expense assumption, together with strategic costs as we invest to develop new propositions. These were partially offset by investment and economic profits and adjustments for items accounted for in equity, resulting in an adjusted profit before tax of £481m for 2024 (2023: £520m). After allowing for deferral of profit into the CSM balance sheet reserve, the IFRS profit before tax is £113m.”

The table below makes things a little (but only a little) clearer, so you can compare i) underlying operating profit with ii) adjusted operating PBT against iii) adjusted PBT and iv) PBT. I’ll leave readers to ponder why management feel the need for so many different definitions of profit.

Operating and experience assumptions changes are when an insurance company makes an assumption, for instance on the age when their average customer dies, and then finds that their assumption is too optimistic/pessimistic. People living longer and assumptions on future equity market returns were a huge issue for life insurers like Legal & General, Scottish Widows and Standard Life in the early noughties, creating negative experience write-downs through the P&L. That was a couple of decades ago, so actuaries should have factored in longer life expectancy and more realistic future return assumptions by now, and JUST say they are now assuming marginally higher mortality rates. That seems sensible but also contradicts the £37m above, which is a negative number. Surely if assumed mortality rates are higher (customers not living as long), we should expect a positive experience/assumption change?

The £369m deferral in the Contractual Service Margin (CSM) is a sign that the business is growing, as new business increases, the CSM outweighs the amount of cash that JUST pays out to customers. As long as investors are prepared to give management the benefit of the doubt, that new business written does create value for shareholders rather than just a future problem, that accounting approach seems justified. This can go wrong though, even for someone like Buffett, who made a mistake with asbestos liabilities. It’s hard to tell from the outside, hence insurance companies often trade on a discount to NAV. Perhaps the high CSM charge is what has spooked the market.

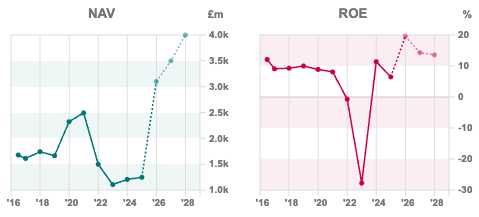

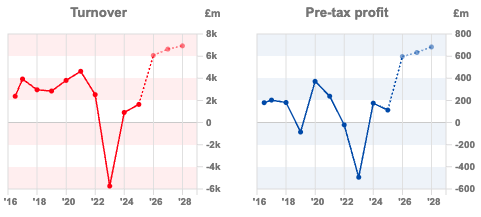

Valuation: The shares are trading on PER of 3.2x Dec 2026F and a Price to tangible NAV 2024A is 0.6x, which seems inconsistent for a company claiming an RoE of 15% (up from 5.4%, 3-year average in 2023). Sharescope shows (above) that NAV is forecast to keep rising sharply. Worth noting though that Tangible Net Asset Value per share is not the same as “book” value for an industrial, widget-bashing company with property, plant and equipment those type of assets (particularly freehold property) tend to hold their value, even in insolvency. Whereas, Sharescope shows that in the past both book value and profits have been volatile. For instance, Just’s TNAV per share fell from £2.30 in Dec 2020 to £1 two years later, as the assumptions embedded in “tangible” book value (which consists of future promises, less financial assets) turned out to be anything but tangible.

Opinion: Tricky one. Maybe that is the opportunity though, as many investors put this type of company in the “too hard” pile. The shares have already doubled, but I think taking the time to understand what is going on could be worthwhile. I don’t own it, but should have bought in 2023. I think it’s important to understand why financial markets put this on such a low valuation, and whether there is a potential to re-evaluate the rating to say 10x PER and 1.4x book. It doesn’t strike me that this will ever trade on a much higher multiple; although lifetime mortgages and retirement solutions are hard to price, customers are price-sensitive because the sums of money are so large. Hence, there’s no economic moat if a competitor decides to price more aggressively.

Somero FY Dec Results

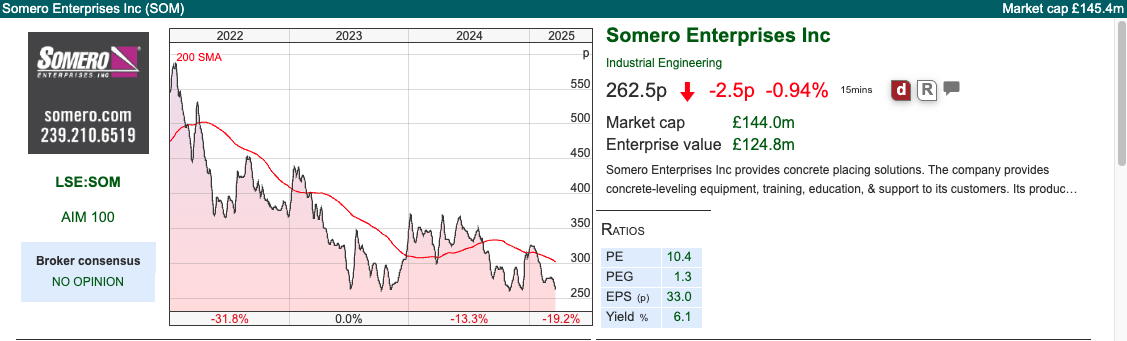

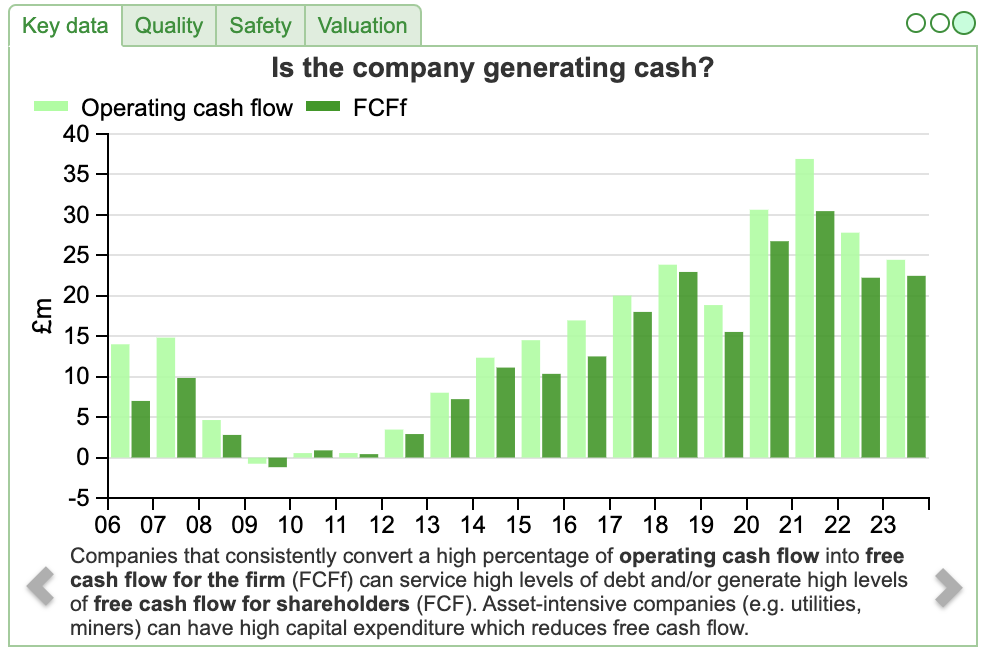

In the past I have made good money investing in some companies with declining revenue and profits, but net cash, a track record of profitability and paying dividends. Somero currently fits that description, with revenue down -10% to $109m and PBT down -28% to $24m FY Dec 2024. But the company had $30m of net cash at the end of last year, and is paying a FY dividend of $c21. The shares are cyclical, and cashflow was negative in 2009 and took several years to recover, as the Sharescope chart below shows.

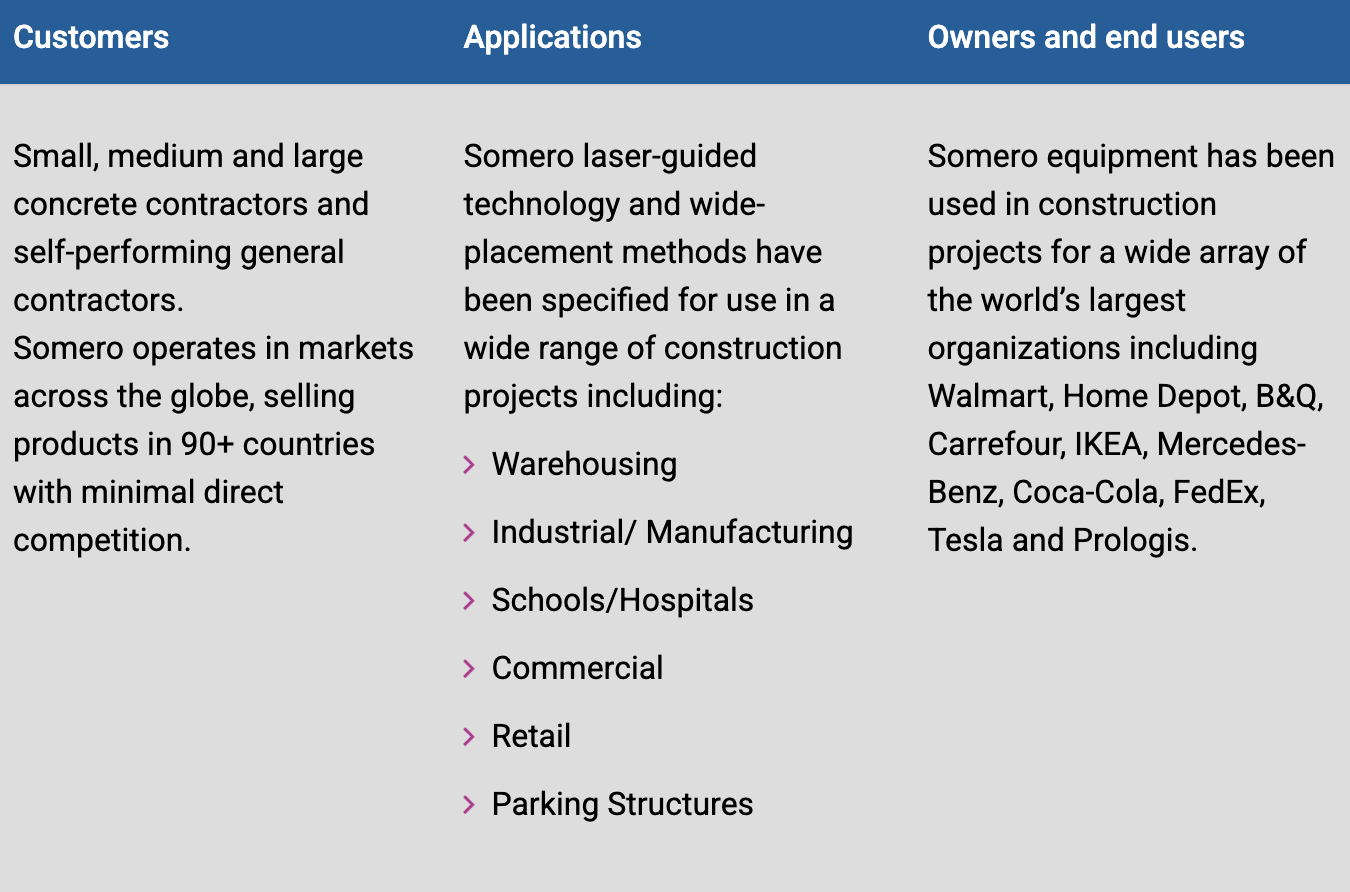

Somero makes laser-guided concrete-levelling equipment, plus offers support for customers in the form of training, and education. They say they operate in 90 countries, but 75% of revenue comes from North America. It would have been nice to see the other geographies picking up even as the US faces difficulties. But revenue was down in Europe, Australia and Rest of the World. This could just be that the world has become more connected, and dependent on the US interest rate cycle, although I did hear suggestions from investors at Mello that there were worries over stronger competition in markets outside the USA. The RNS mentions the increased presence of a Chinese manufacturer.

Outlook: Management say that non-residential construction in the US should remain healthy “in general”, which might imply a message similar to “broadly inline”? In other words, “not quite healthy”?

For instance, in July last year, management also talked about a healthy construction market, while also warning of the impact of higher interest rates, labour shortages, concrete rationing and inclement weather. For contrast, this RNS instead warns about developments in international trade and geopolitical relations, immigration policy, coupled with an ongoing restrictive monetary environment. Rather than try to parse all of these phrases, we can turn to their broker Cavendish, for help. The broker have left their FY 2025F unchanged, which implies +4% revenue growth and flat profits. That’s still 15% below peak revenue in 2022.

Valuation: The shares are trading on a PER just below 10x Dec 2025F. I’m a little concerned that Cavendish haven’t published any 2026F numbers, as there could be the potential to publish a further reduction in profits, without having to reduce forecasts that have never been published!

Opinion: I own it, and have been pondering whether to sell. SOM shares are cyclical, and we haven’t entered a US recession. I’m also concerned about the Chinese competition taking market share. I commented in mid-2023 that the shares were an example of a cyclical company looking cheap, but where the chart looked terrible and there was downward pressure on forecasts. Turns out: I should have paid attention to the chart!

I’m now wondering if it is too late to sell. On the one hand, underlying performance could recover eventually, but the Chinese competitor is a threat, and there’s some possibility of a US recession. I will follow developments and make a decision in a month or two.

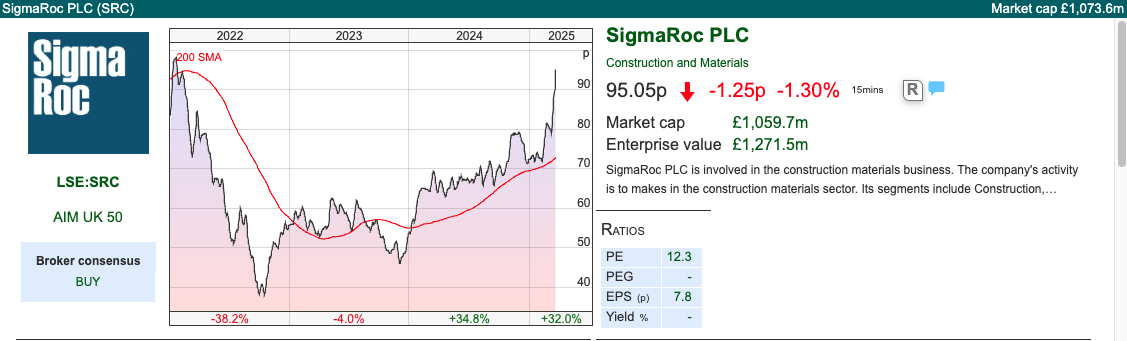

SigmaRoc FY Dec Results

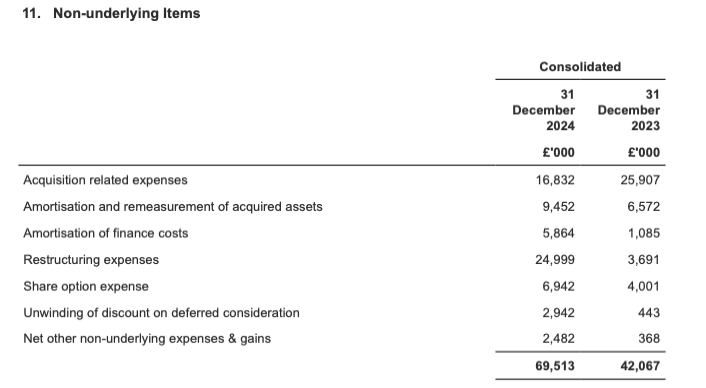

This acquisitive construction materials group (lime and limestone quarries) has been a strong performer last year and momentum has continued into 2025. Statutory revenues were up +72% to £962m and PBT almost doubled to £44m. However, there is a negative “non underlying” adjustment of £70m, which is mainly acquisition-related expenses, amortisation, restructuring and share options, which boosts PBT to £118m.

We can debate whether an acquisitive company should be judged including or excluding these items, I don’t think there’s a right answer. My worry would be that management bite off more than they can chew, with a debt-funded acquisition that goes wrong, rather than the adjustments themselves. Net debt stood at £509m, which is 2.1x EBITDA and 4.3x the company’s definition of Free Cashflow.

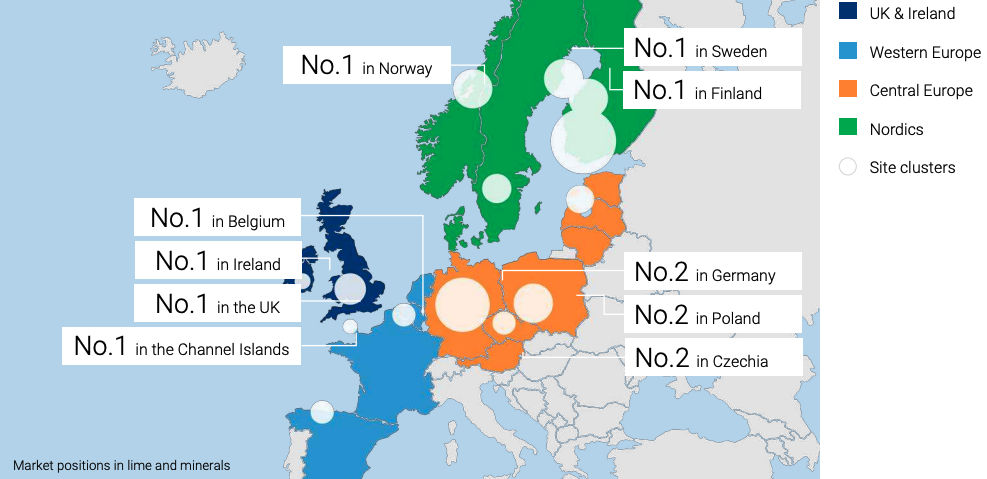

The map below shows that the group now enjoys top or number 2 market positions in 4 clusters of lime and minerals across the UK and Europe.

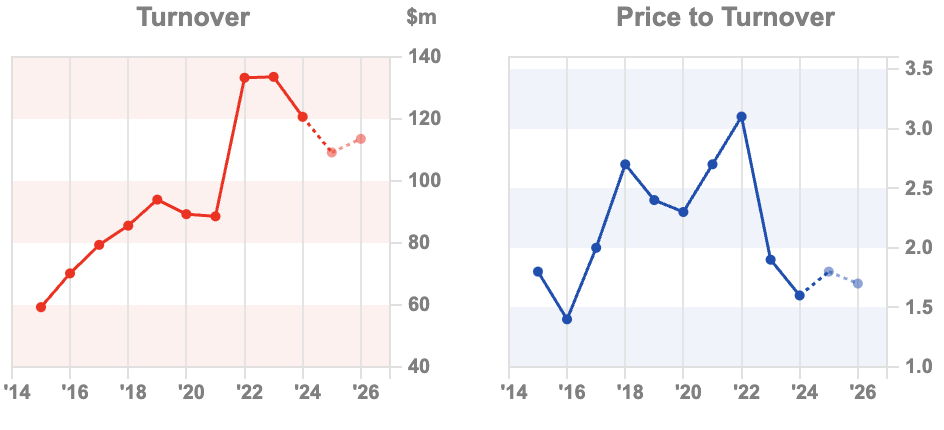

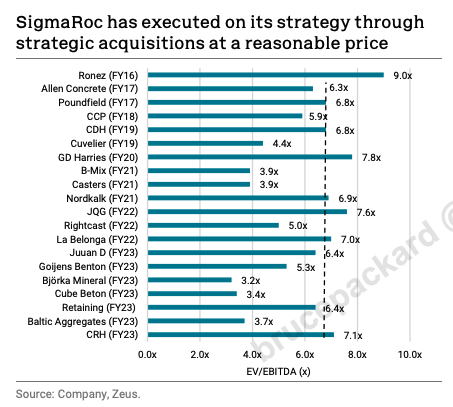

I’ve taken this graph from broker Zeus’ initiation note, which summarises the history of acquisitions over the years at between 3x and 9x EV/EBITDA multiple. The largest deal was the £1bn acquisition of CRH’s lime and limestone assets, in 3 stages, at 7.1x EV/EBITDA. There’s currently £463m of intangible assets on the balance sheet, versus shareholders’ equity of £754m.

Outlook: Management say that 2025 has started positively, and the goal is now to de-gear with Zeus forecasting proforma net debt to fall to 1.2x FY Dec 2026F EBITDA, assuming no further acquisitions. There’s potential for Europe to improve driven by German infrastructure spend and lower interest rates. Zeus have tweaked forecast EPS by around 1% this year and next. They say exposure to residential housing construction markets in UK, Belgium and Germany has been a headwind in the last 12 months, and a material improvement is not forecast in their numbers.

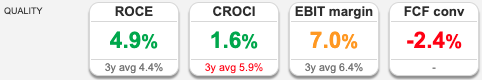

Valuation: The shares are trading on a PER of 10.7x Dec 2025F, and 6x EV/EBITDA the same year. That looks cheap, but on a 4x price/tangible book they look more expensive, because of the intangibles from acquisitions. I would focus on the EV/EBITDA multiple with a company like this, but also be aware that this is a capitally intensive industry, with new plant and equipment costing £67m in capex last year. Sharescope’s quality indicators show that this is a low-margin, low-RoCE-type industry.

Opinion: In 2022 I was nervous about the acquisition-led growth at a time of rising energy prices and interest rates. Management have proved me wrong, and the share price has doubled since then. I noted that “unsexy” industries like concrete can generate good shareholder returns, Breedon was an 8x bagger following the financial crisis. So far, SigmaRoc has delivered, well done to holders. This is likely to be cyclical though, so if the macro environment deteriorates I would sell at the first sign of trouble.

Notes

Bruce Packard

The author owns shares in Somero

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 19/3/2025 | JUST, SOM, SRC | Rebalancing or US recession?

–

The FTSE 100 was up +2.5% in the last 5 days, to 8,710. Nasdaq100 is now down -5.7% YTD and the Nasdaq Composite is the worst-performing major index, down -7.8%. Meanwhile, the FTSE China 50 is up +25% YTD, so it looks like there are some unintended consequences of some of President Trump’s policies. The VIX, which measures implied volatility in the options market, commonly known as the “fear gauge” rose above 25 last week. Gold has also had a strong start to the year up +14%, and now touching $3000 per ounce.

Former hedge fund manager and now substacker, Russell Clark points out that there are a number of indicators that are signalling this is a “rebalancing” rather than anything more serious. He says that, if it is a recession – it’s not like one I have seen before:

I would add to those indicators that Copper HG-MT is up +23% YTD. This is another recession indicator that has not barked in the night.

Russell Clark concludes that though we should avoid a US recession, involving job losses and falls in GDP, we could still see a financial crisis of sorts. For instance, capital flight from US markets would be bad news for US equity market valuations. It would be great if some of this capital taking flight across the Atlantic came to land in London. The AIM (Sharescope ticker AXX) chart suggests that has yet to happen, with declines continuing from Sept 2021.

This week I look at Just, the lifetime mortgages and retirement solutions company, still trading on a 0.6x tangible book, despite the share price doubling in value in the past couple of years. Also concrete screed company Somero and acquisitive construction materials group SigmaRoc.

JUST FY Dec Results

I last wrote about this lifetime mortgage and retirement solutions company in August 2023 when the share price was 76p. Lifetime mortgages allow older people with little income to borrow against the value of their home, and pay the loan back when they die and their house is sold. Just also buys Defined Benefit pension liabilities from companies, taking on the responsibility of the guaranteed future retirement payments, in exchange for a fee.

When I last wrote about JUST the shares were trading on a PER of 2.6x future earnings. When you see a company that cheap, it often signals that there is a problem with the earnings, but I’m happy to say that over the last couple of years, the share price has doubled. Tangible book value has also risen +34% to 254p, though the shares still trade on a discount to book.

The company reported Retirement Income Sales +36% to £5.3bn but IFRS statutory PBT was down -34% to £113m. Management point to “underlying operating profit” (first bullet point, in bold in the RNS) up +34% to £504m. Investors seem to have focused on the IFRS statutory number, as the share price reacted by falling -14% on the morning of the results.

In any case, it seems worth spending some time to understand the significant divergence: i) between trends in underlying +34% and statutory PBT -14% ii) the absolute divergence of almost £400m (the difference between £504m underlying and £113m statutory). Beware though, the complexities of insurance accounting can make the likes of banks, aircraft leasing and litigation finance appear a doddle. Explaining the difference between the £504 and £113m statutory number, management say:

“We incurred operating experience variances, the cost of strengthening the maintenance expense assumption, together with strategic costs as we invest to develop new propositions. These were partially offset by investment and economic profits and adjustments for items accounted for in equity, resulting in an adjusted profit before tax of £481m for 2024 (2023: £520m). After allowing for deferral of profit into the CSM balance sheet reserve, the IFRS profit before tax is £113m.”

The table below makes things a little (but only a little) clearer, so you can compare i) underlying operating profit with ii) adjusted operating PBT against iii) adjusted PBT and iv) PBT. I’ll leave readers to ponder why management feel the need for so many different definitions of profit.

Operating and experience assumptions changes are when an insurance company makes an assumption, for instance on the age when their average customer dies, and then finds that their assumption is too optimistic/pessimistic. People living longer and assumptions on future equity market returns were a huge issue for life insurers like Legal & General, Scottish Widows and Standard Life in the early noughties, creating negative experience write-downs through the P&L. That was a couple of decades ago, so actuaries should have factored in longer life expectancy and more realistic future return assumptions by now, and JUST say they are now assuming marginally higher mortality rates. That seems sensible but also contradicts the £37m above, which is a negative number. Surely if assumed mortality rates are higher (customers not living as long), we should expect a positive experience/assumption change?

The £369m deferral in the Contractual Service Margin (CSM) is a sign that the business is growing, as new business increases, the CSM outweighs the amount of cash that JUST pays out to customers. As long as investors are prepared to give management the benefit of the doubt, that new business written does create value for shareholders rather than just a future problem, that accounting approach seems justified. This can go wrong though, even for someone like Buffett, who made a mistake with asbestos liabilities. It’s hard to tell from the outside, hence insurance companies often trade on a discount to NAV. Perhaps the high CSM charge is what has spooked the market.

Valuation: The shares are trading on PER of 3.2x Dec 2026F and a Price to tangible NAV 2024A is 0.6x, which seems inconsistent for a company claiming an RoE of 15% (up from 5.4%, 3-year average in 2023). Sharescope shows (above) that NAV is forecast to keep rising sharply. Worth noting though that Tangible Net Asset Value per share is not the same as “book” value for an industrial, widget-bashing company with property, plant and equipment those type of assets (particularly freehold property) tend to hold their value, even in insolvency. Whereas, Sharescope shows that in the past both book value and profits have been volatile. For instance, Just’s TNAV per share fell from £2.30 in Dec 2020 to £1 two years later, as the assumptions embedded in “tangible” book value (which consists of future promises, less financial assets) turned out to be anything but tangible.

Opinion: Tricky one. Maybe that is the opportunity though, as many investors put this type of company in the “too hard” pile. The shares have already doubled, but I think taking the time to understand what is going on could be worthwhile. I don’t own it, but should have bought in 2023. I think it’s important to understand why financial markets put this on such a low valuation, and whether there is a potential to re-evaluate the rating to say 10x PER and 1.4x book. It doesn’t strike me that this will ever trade on a much higher multiple; although lifetime mortgages and retirement solutions are hard to price, customers are price-sensitive because the sums of money are so large. Hence, there’s no economic moat if a competitor decides to price more aggressively.

Somero FY Dec Results

In the past I have made good money investing in some companies with declining revenue and profits, but net cash, a track record of profitability and paying dividends. Somero currently fits that description, with revenue down -10% to $109m and PBT down -28% to $24m FY Dec 2024. But the company had $30m of net cash at the end of last year, and is paying a FY dividend of $c21. The shares are cyclical, and cashflow was negative in 2009 and took several years to recover, as the Sharescope chart below shows.

Somero makes laser-guided concrete-levelling equipment, plus offers support for customers in the form of training, and education. They say they operate in 90 countries, but 75% of revenue comes from North America. It would have been nice to see the other geographies picking up even as the US faces difficulties. But revenue was down in Europe, Australia and Rest of the World. This could just be that the world has become more connected, and dependent on the US interest rate cycle, although I did hear suggestions from investors at Mello that there were worries over stronger competition in markets outside the USA. The RNS mentions the increased presence of a Chinese manufacturer.

Outlook: Management say that non-residential construction in the US should remain healthy “in general”, which might imply a message similar to “broadly inline”? In other words, “not quite healthy”?

For instance, in July last year, management also talked about a healthy construction market, while also warning of the impact of higher interest rates, labour shortages, concrete rationing and inclement weather. For contrast, this RNS instead warns about developments in international trade and geopolitical relations, immigration policy, coupled with an ongoing restrictive monetary environment. Rather than try to parse all of these phrases, we can turn to their broker Cavendish, for help. The broker have left their FY 2025F unchanged, which implies +4% revenue growth and flat profits. That’s still 15% below peak revenue in 2022.

Valuation: The shares are trading on a PER just below 10x Dec 2025F. I’m a little concerned that Cavendish haven’t published any 2026F numbers, as there could be the potential to publish a further reduction in profits, without having to reduce forecasts that have never been published!

Opinion: I own it, and have been pondering whether to sell. SOM shares are cyclical, and we haven’t entered a US recession. I’m also concerned about the Chinese competition taking market share. I commented in mid-2023 that the shares were an example of a cyclical company looking cheap, but where the chart looked terrible and there was downward pressure on forecasts. Turns out: I should have paid attention to the chart!

I’m now wondering if it is too late to sell. On the one hand, underlying performance could recover eventually, but the Chinese competitor is a threat, and there’s some possibility of a US recession. I will follow developments and make a decision in a month or two.

SigmaRoc FY Dec Results

This acquisitive construction materials group (lime and limestone quarries) has been a strong performer last year and momentum has continued into 2025. Statutory revenues were up +72% to £962m and PBT almost doubled to £44m. However, there is a negative “non underlying” adjustment of £70m, which is mainly acquisition-related expenses, amortisation, restructuring and share options, which boosts PBT to £118m.

We can debate whether an acquisitive company should be judged including or excluding these items, I don’t think there’s a right answer. My worry would be that management bite off more than they can chew, with a debt-funded acquisition that goes wrong, rather than the adjustments themselves. Net debt stood at £509m, which is 2.1x EBITDA and 4.3x the company’s definition of Free Cashflow.

The map below shows that the group now enjoys top or number 2 market positions in 4 clusters of lime and minerals across the UK and Europe.

I’ve taken this graph from broker Zeus’ initiation note, which summarises the history of acquisitions over the years at between 3x and 9x EV/EBITDA multiple. The largest deal was the £1bn acquisition of CRH’s lime and limestone assets, in 3 stages, at 7.1x EV/EBITDA. There’s currently £463m of intangible assets on the balance sheet, versus shareholders’ equity of £754m.

Outlook: Management say that 2025 has started positively, and the goal is now to de-gear with Zeus forecasting proforma net debt to fall to 1.2x FY Dec 2026F EBITDA, assuming no further acquisitions. There’s potential for Europe to improve driven by German infrastructure spend and lower interest rates. Zeus have tweaked forecast EPS by around 1% this year and next. They say exposure to residential housing construction markets in UK, Belgium and Germany has been a headwind in the last 12 months, and a material improvement is not forecast in their numbers.

Valuation: The shares are trading on a PER of 10.7x Dec 2025F, and 6x EV/EBITDA the same year. That looks cheap, but on a 4x price/tangible book they look more expensive, because of the intangibles from acquisitions. I would focus on the EV/EBITDA multiple with a company like this, but also be aware that this is a capitally intensive industry, with new plant and equipment costing £67m in capex last year. Sharescope’s quality indicators show that this is a low-margin, low-RoCE-type industry.

Opinion: In 2022 I was nervous about the acquisition-led growth at a time of rising energy prices and interest rates. Management have proved me wrong, and the share price has doubled since then. I noted that “unsexy” industries like concrete can generate good shareholder returns, Breedon was an 8x bagger following the financial crisis. So far, SigmaRoc has delivered, well done to holders. This is likely to be cyclical though, so if the macro environment deteriorates I would sell at the first sign of trouble.

Notes

Bruce Packard

The author owns shares in Somero

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.