A look at how different asset classes have responded to the US election result, and whether there might be some inconsistent thinking therein. Companies covered: ZTF, TCAP and SFOR, plus a brief look at the AQX bid approach.

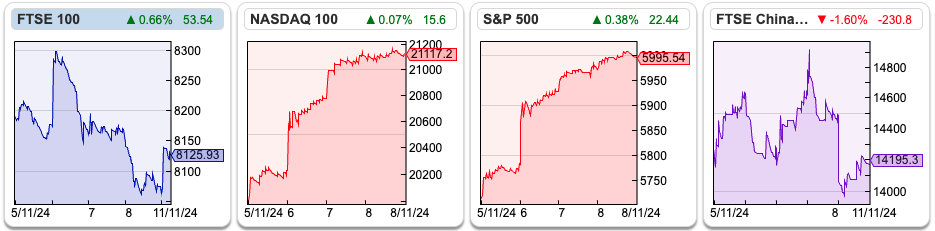

The FTSE 100 was down around -0.5% last week to 8,125. In the US, the Nasdaq100 and S&P500 reacted well, both up +5%, to Donald Trump’s re-election. Some of the reaction to the US election result looks contradictory, for instance Bitcoin (Sharepad ticker BTCUSD) up +9% to over $82,000, while the US dollar has been strong recently and KBW Regional Banks Index (Sharepad ticker KRE) was also up +11%. I would have thought a boost to crypto would be negative for the US dollar and traditional banks. The US 10Y government bond yield (USTSY10) has jumped over 60 basis points since mid-September and now stands at 4.3%, I think anticipating Trump’s economic plans will lead to more deficit spending and maybe the economy overheating.

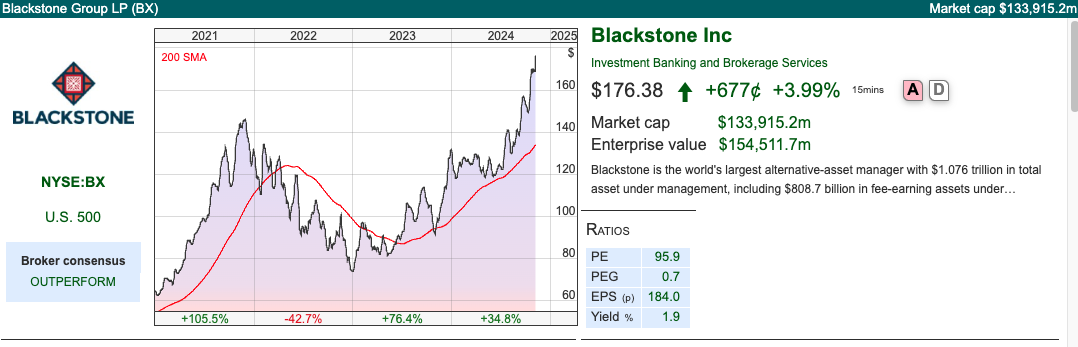

One sector that could be troubled by rising real wages and government bond yields is Private Equity, versus less indebted, publicly listed businesses. This blog highlights the growth rate in PE has been astonishing: in 2000, PE firms collectively managed $579 billion, by 2022, this figure surged to about $7.8 trillion. Blackstone started in 1985 with $400,000, their first fund was $850m of commitments, which required meeting 488 prospective investors; of which just 33 invested. BX now has a market cap of $133bn and manages over $1 trillion. It seems to me that an obvious loser from higher long bond yields is Private Equity, as the cost of debt rises it becomes harder to use leverage to amplify returns. Yet Blackstone is up +35% YTD, it would be ironic if Trump’s policies turned out to be bad news for any billionaire Private Equity barons who backed him.

Meanwhile UK equity funds continued to see outflows, with October’s £2.7bn net outflow a record high, according to data source Calastone. The gross outflow from active funds was £3.3bn, offset by £0.6bn of flows into passive. Although UK focused funds bore the brunt of the selling, global funds also saw their first outflows in more than 2 years. Presumably that was driven by investors correctly anticipating that the government would raise CGT in the budget. Encouragingly Calastone said that selling dropped 40% overnight after the rise in CGT took effect. The AIM market was up around +4% on the day of the budget, so I now think we could see a relief rally.

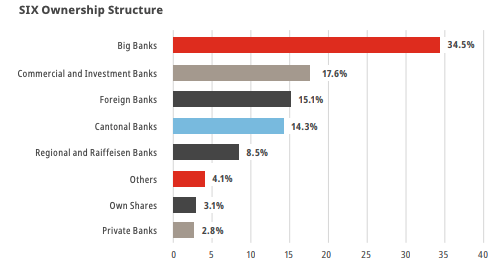

At the start of this week, Aquis Exchange announced that it had received a cash bid at 727p, a 120% premium to the closing price. The bid is from SIX (formerly SWX) the Swiss Stock Exchange. Interestingly, SIX is owned by its customers, mainly banks.

Well done to holders, I had been following Aquis and last wrote about it in September, saying I was warm to the stock as the valuation had become more reasonable. Unfortunately, I sat on my hands as everything seemed to be falling over the last month or so and I missed out on buying the shares.

This week, I take a look at materials group Zotefoams, interdealer broker TP ICAP and revist S4 Capital’s disappointing results.

Zotefoams FY Dec Trading Update

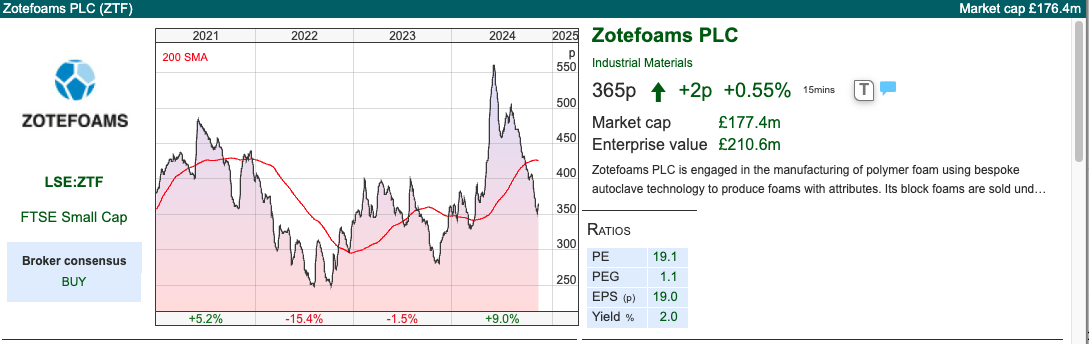

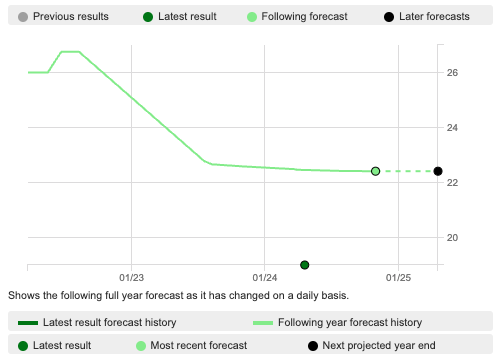

This plastics and foam materials company has fallen -36% since the start of June, but announced profits for FY Dec would be “in-line” with expectations (£145.5m revenue and adj PBT of £14.9m). The sell-off over the last 4 months is surprising given that management said on 22nd May that “the Board’s full year expectations are unchanged”. Sharepad shows that the most recent forecast has been flat, so it looks like the valuation has de-rated on concerns that were not specified in the RNS, perhaps raw materials pricing increases or there was a fear that management expectations for H2 were too optimistic.

Alternatively, a new Chief Exec, Ronan Cox, started in May. It’s not unheard of for a new Chief Executive to spend the first 6-12 months of his tenure making downbeat comments in private meetings with fund managers, to lower future expectations, even if there are no changes to broker EPS forecasts. A PR strategy that Antonio Horta-Osario followed at Lloyds Bank, and the new UK government seems to be imitating.

ZTF Q3 sales are up +54% to £40m versus Q3 last year, so perhaps some doubt about H2 was justified, but the bounce has come through. The company has two divisions, with roughly equal sales, but much higher margin High Performance Products, including the foam that Nike uses in sports’ shoes. The RNS says that footwear volumes are up +60% YTD, benefiting from an Olympic year, and they expect a more normal year in 2025F.

The second division is Polyolefin foams, used in packaging together with construction and industry. At the H1 stage, this division was reporting revenue down -8% and PBT down by more than a third. They say that Polyolefin volumes have recovered to be up +1% overall, with a decline in Germany offset by +18% growth in the USA.

One interesting area is the ongoing investment in ReZorce, a circular packaging technology with patent protection, that could offer a circular solution for the 300 billion unit per annum drinks carton market. Although households’ soft drinks cartons are collected in recycled waste, the reality is that between 50%-75% end up in landfill or an incinerator. The mixed material nature of cartons means that they are uneconomic to recycle. Zotefoam’s solution recycles cartons back into the same type of packaging.

However, the commercial scale production of ReZorce requires significant capital investment, so ZTF have been looking for a partner that will help fund the development since May. There’s no further update in last week’s RNS, so this looks like it is not a clear-cut opportunity.

Outlook: Management expect “significant” revenue growth in FY Dec 2024F (H1 was +13% at constant currency, and +15% is forecast). However, the following year Dec 2025F forecast revenue growth falls below +3%, presumably as the benefits of the Olympics for footwear foam sales are not repeated. Margins are expected to be stable (Sharepad shows gross margin of 32%, operating margin of 12% last year).

Valuation: The shares are trading on 12x PER Dec 2025F, dropping to 11x PER the following year. Net debt was not mentioned in the RNS, but was £45m (or 1.7x EBITDA) at Jun 2024, and on an EV/EBITDA basis the shares trade on just below 7x. The chart above shows that the price/sales ratio has de-rated significantly, despite top line growth.

Opinion: I last covered this in 2022, when at 324p I suggested that the share price was “about right”. Two years later, and I feel the most obvious catalyst is tangible progress on the ReZorce business. RoCE at 12% and EBIT margins of 15% are healthy, but this is a cyclical business so we could be close to a peak with a decline in the coming years. 2025F doesn’t sound very exciting, but perhaps there’s scope to beat expectations when the new Chief Exec starts to deliver?

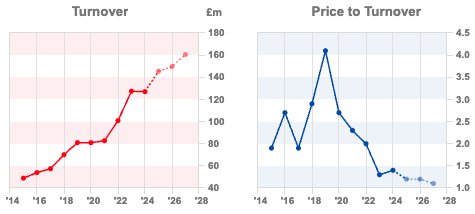

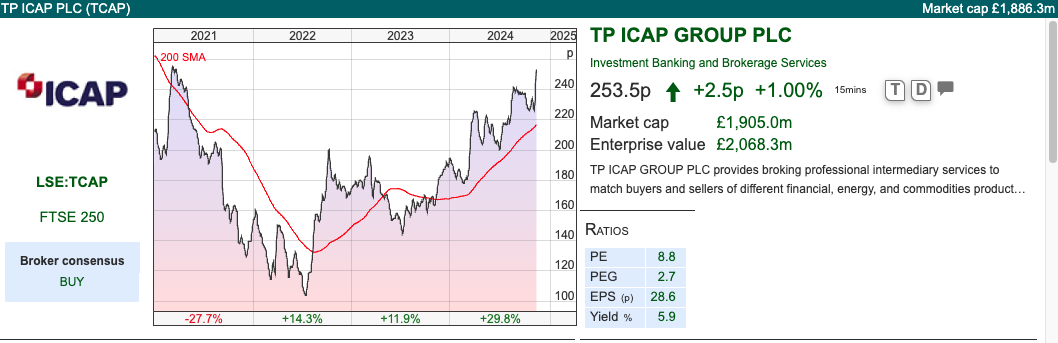

TP ICAP Q3 Sept Trading Update

This interdealer broker reported Q3 revenues up +9% (or +3% on a 9M v 9M basis), helped by a very strong quarter in Liquidnet +28%, which is the US block trading business they bought at the end of 2020. That’s good news as the company paid around $600m for the Liquidnet, with a rights issue at 140p per share only to see revenues fall -20% after the acquisition completed. Liquidnet was 15% of group revenue and 17% of group EBIT at H1.

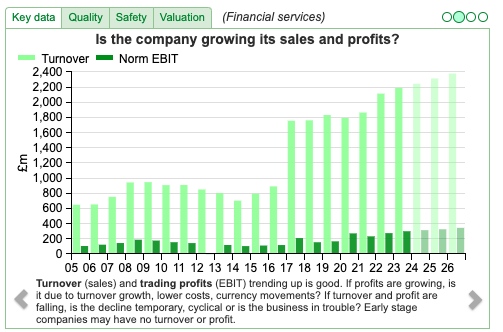

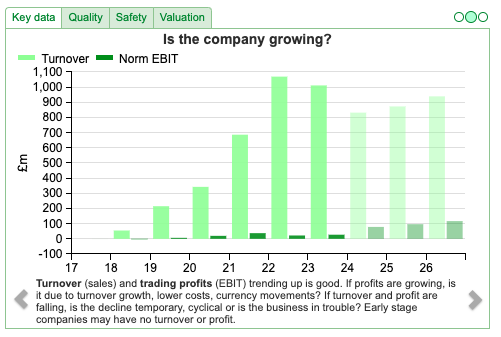

NB TCAP was formed in 2016 with the merger between Tullett Prebon and ICAP, hence the jump in turnover and profits in the chart below. The merger created around £1.4bn of intangible assets on the balance sheet.

Outlook: Management said last week that they are comfortable with FY adj EBIT expectations (Sharepad shows FY Dec 2024F EBIT of £314m, implying +5% growth). Around 60% of revenues and 40% of costs are in dollars though, which means TCAP ought to benefit from the recent strength in the dollar (up +4% versus GBP in the last month).

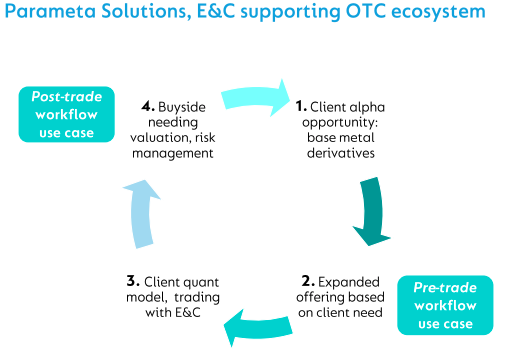

Activist: In March 2023 Justin Hughes, an activist hedge fund manager took a position with total return swaps and urged management to stop buying other companies, instead they should look to sell businesses. He argued that Parameta, the group’s data subsidiary could be worth £1.5bn on its own. At the time TCAP’s market cap was around £1.2bn. Parameta is less than 10% of group revenue, but has a 40% EBIT margin and is growing at +10% a year.

At the FY results in March this year, management said they would look at “strategic options” for the division, including a possible spin-off with a US listing, but TCAP maintaining a majority stake. They haven’t changed the wording of that statement since the H1 results, but buoyant US market conditions with the S&P500 up +21% YTD shouldn’t be an impediment to any “strategic options”. Presumably, management would receive cash from spinning off Parameta, which could then be used to buyback shares, placating Justin Hughes.

Valuation: The shares are trading on a PER of 8x 2025F and 7x 2026F. The company has also announced 3 consecutive buybacks of £30m at H1 2023, FY 2023 and H1 2024. Meanwhile the dividend yield is above 6%, despite the shares rising +30% YTD.

Opinion: I have owned this for a couple of years and also pitched it on the BASH at David Stredder’s Mello. Aside from the obvious catalyst of a Parameta spin-out, the core Global Broking business that facilitates OTC trading has been in decline (revenue down -3%, profits down -12% at H1) and there’s potential for conditions to improve. In Q3 we saw Global Broking revenue up +8%, helped by the rates business +15% benefiting from interest rate volatility. I think that could continue for the rest of the year, and there’s a possibility of an “ahead of expectations” RNS, so I will continue to hold.

S4 Capital Q3 Sept Trading Update

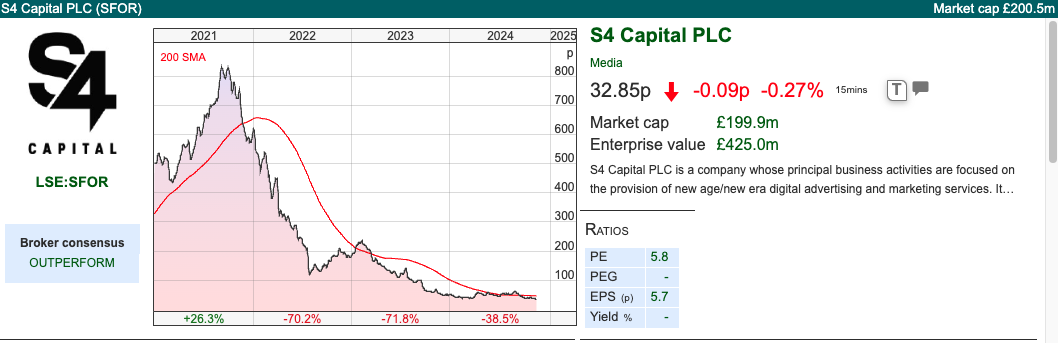

Yet more disappointment from S4 Capital, Sir Martin Sorrell’s acquisitive digital advertising venture, which reported Q3 results last week. I last wrote about SFOR in 2022 when the shares were down -65% from its peak. I concluded that the outlook statement was too bullish and the risk felt on the downside, but perhaps it could present an opportunity in future. Since then the share price has fallen another -90%, but perhaps now it could be worth another look?

Q3 revenues were down -15%, or -13% on a like-for-like basis. FY revenues are expected to be down a similar low teens amounts. Year end net debt is expected to be in the range of £150m to £190m, which equates to around 2.0-2.3x EBITDA. At H1 stage the business lost £17m before tax.

Acquisition liabilities: In the past I have drawn attention to how the accounting works for past acquisitions. The H1 results show that deferred equity consideration arising from business combinations stood at £72m. That has had a dilutive impact with the share count increasing each year to stand at 614m this June. The H1 analyst presentation suggests that there’s a further 57m share dilution coming in 2025F.

Ownership: Sir Martin Sorrell holds one B share, which allows him to appoint or replace one Director, plus he has a veto on other appointments and removals from the Board. No shareholder resolutions can be proposed without his consent and he also has a veto on acquisitions. This “golden share” structure was introduced to prevent Sir Martin being forced out of the company, which is what happened at WPP when shareholders voted against his £70m pay package in 2016 and there were suggestions he had used his corporate credit card for personal expenses (allegations he denied). He is currently SFOR’s largest ordinary shareholder with 8.9% of the shares. Other institutions that were on the share register a couple of years ago (Rathbones IM 4.9%, Canaccord WM 4.8% and Jupiter 4.8%) have sold down their stakes.

Valuation: The shares are trading on a PER of 5x Dec 2025F, dropping below 4x the following year. This business represents £1.1bn of invested capital, of which under £200m is net debt. That compares to an enterprise value of £425m – in other words, every pound raised and invested in acquisitions is now worth 39p. That looks optically cheap but this does feel to me like “catching a falling knife”.

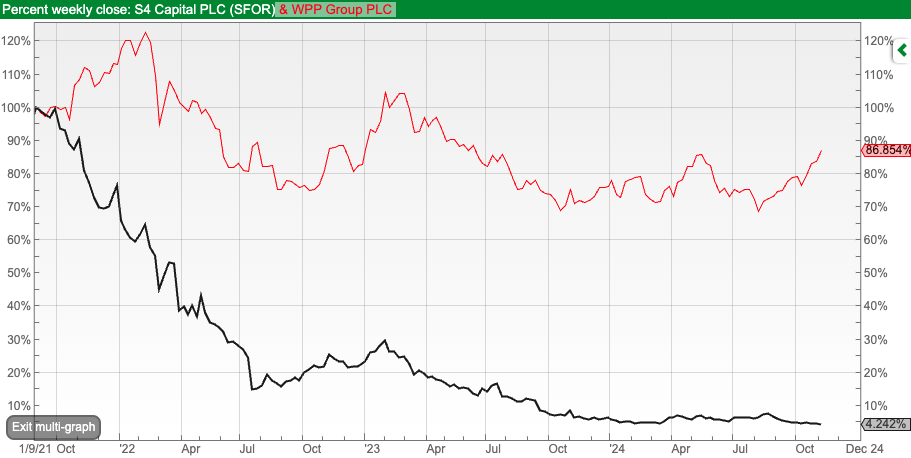

I’m being unkind, but I have used SharePad’s multi-graph feature to compare the share price performance of WPP (down -14%) to SFOR (down -96%) since Sept 2021.

Opinion: Sir Martin Sorrell’s second act has been even less successful than Roger Waters’ post Pink Floyd solo albums. The business has been loss-making for every year of its existence, and if he had funded its expansion with more debt, I think it probably would have failed by now. My concern is that there’s been no recession in the US or UK, yet SFOR has struggled to make a profit, while revenue is declining. The analyst pack suggests that Artificial Intelligence and LLMs can be used to make marketing and digital ad spend more effective – but so far, there’s no evidence of that dropping through in the financials. I’ll revisit it if it looks like management can turn things around, but I’d rate performance currently as last wrote about it in September

Bruce Packard

Notes

Bruce owns shares in TCAP

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 12/11/2024 | ZTF, TCAP, SFOR, AQX | Public stockmarkets and Private Equity

A look at how different asset classes have responded to the US election result, and whether there might be some inconsistent thinking therein. Companies covered: ZTF, TCAP and SFOR, plus a brief look at the AQX bid approach.

The FTSE 100 was down around -0.5% last week to 8,125. In the US, the Nasdaq100 and S&P500 reacted well, both up +5%, to Donald Trump’s re-election. Some of the reaction to the US election result looks contradictory, for instance Bitcoin (Sharepad ticker BTCUSD) up +9% to over $82,000, while the US dollar has been strong recently and KBW Regional Banks Index (Sharepad ticker KRE) was also up +11%. I would have thought a boost to crypto would be negative for the US dollar and traditional banks. The US 10Y government bond yield (USTSY10) has jumped over 60 basis points since mid-September and now stands at 4.3%, I think anticipating Trump’s economic plans will lead to more deficit spending and maybe the economy overheating.

One sector that could be troubled by rising real wages and government bond yields is Private Equity, versus less indebted, publicly listed businesses. This blog highlights the growth rate in PE has been astonishing: in 2000, PE firms collectively managed $579 billion, by 2022, this figure surged to about $7.8 trillion. Blackstone started in 1985 with $400,000, their first fund was $850m of commitments, which required meeting 488 prospective investors; of which just 33 invested. BX now has a market cap of $133bn and manages over $1 trillion. It seems to me that an obvious loser from higher long bond yields is Private Equity, as the cost of debt rises it becomes harder to use leverage to amplify returns. Yet Blackstone is up +35% YTD, it would be ironic if Trump’s policies turned out to be bad news for any billionaire Private Equity barons who backed him.

Meanwhile UK equity funds continued to see outflows, with October’s £2.7bn net outflow a record high, according to data source Calastone. The gross outflow from active funds was £3.3bn, offset by £0.6bn of flows into passive. Although UK focused funds bore the brunt of the selling, global funds also saw their first outflows in more than 2 years. Presumably that was driven by investors correctly anticipating that the government would raise CGT in the budget. Encouragingly Calastone said that selling dropped 40% overnight after the rise in CGT took effect. The AIM market was up around +4% on the day of the budget, so I now think we could see a relief rally.

At the start of this week, Aquis Exchange announced that it had received a cash bid at 727p, a 120% premium to the closing price. The bid is from SIX (formerly SWX) the Swiss Stock Exchange. Interestingly, SIX is owned by its customers, mainly banks.

Well done to holders, I had been following Aquis and last wrote about it in September, saying I was warm to the stock as the valuation had become more reasonable. Unfortunately, I sat on my hands as everything seemed to be falling over the last month or so and I missed out on buying the shares.

This week, I take a look at materials group Zotefoams, interdealer broker TP ICAP and revist S4 Capital’s disappointing results.

Zotefoams FY Dec Trading Update

This plastics and foam materials company has fallen -36% since the start of June, but announced profits for FY Dec would be “in-line” with expectations (£145.5m revenue and adj PBT of £14.9m). The sell-off over the last 4 months is surprising given that management said on 22nd May that “the Board’s full year expectations are unchanged”. Sharepad shows that the most recent forecast has been flat, so it looks like the valuation has de-rated on concerns that were not specified in the RNS, perhaps raw materials pricing increases or there was a fear that management expectations for H2 were too optimistic.

Alternatively, a new Chief Exec, Ronan Cox, started in May. It’s not unheard of for a new Chief Executive to spend the first 6-12 months of his tenure making downbeat comments in private meetings with fund managers, to lower future expectations, even if there are no changes to broker EPS forecasts. A PR strategy that Antonio Horta-Osario followed at Lloyds Bank, and the new UK government seems to be imitating.

ZTF Q3 sales are up +54% to £40m versus Q3 last year, so perhaps some doubt about H2 was justified, but the bounce has come through. The company has two divisions, with roughly equal sales, but much higher margin High Performance Products, including the foam that Nike uses in sports’ shoes. The RNS says that footwear volumes are up +60% YTD, benefiting from an Olympic year, and they expect a more normal year in 2025F.

The second division is Polyolefin foams, used in packaging together with construction and industry. At the H1 stage, this division was reporting revenue down -8% and PBT down by more than a third. They say that Polyolefin volumes have recovered to be up +1% overall, with a decline in Germany offset by +18% growth in the USA.

One interesting area is the ongoing investment in ReZorce, a circular packaging technology with patent protection, that could offer a circular solution for the 300 billion unit per annum drinks carton market. Although households’ soft drinks cartons are collected in recycled waste, the reality is that between 50%-75% end up in landfill or an incinerator. The mixed material nature of cartons means that they are uneconomic to recycle. Zotefoam’s solution recycles cartons back into the same type of packaging.

However, the commercial scale production of ReZorce requires significant capital investment, so ZTF have been looking for a partner that will help fund the development since May. There’s no further update in last week’s RNS, so this looks like it is not a clear-cut opportunity.

Outlook: Management expect “significant” revenue growth in FY Dec 2024F (H1 was +13% at constant currency, and +15% is forecast). However, the following year Dec 2025F forecast revenue growth falls below +3%, presumably as the benefits of the Olympics for footwear foam sales are not repeated. Margins are expected to be stable (Sharepad shows gross margin of 32%, operating margin of 12% last year).

Valuation: The shares are trading on 12x PER Dec 2025F, dropping to 11x PER the following year. Net debt was not mentioned in the RNS, but was £45m (or 1.7x EBITDA) at Jun 2024, and on an EV/EBITDA basis the shares trade on just below 7x. The chart above shows that the price/sales ratio has de-rated significantly, despite top line growth.

Opinion: I last covered this in 2022, when at 324p I suggested that the share price was “about right”. Two years later, and I feel the most obvious catalyst is tangible progress on the ReZorce business. RoCE at 12% and EBIT margins of 15% are healthy, but this is a cyclical business so we could be close to a peak with a decline in the coming years. 2025F doesn’t sound very exciting, but perhaps there’s scope to beat expectations when the new Chief Exec starts to deliver?

TP ICAP Q3 Sept Trading Update

This interdealer broker reported Q3 revenues up +9% (or +3% on a 9M v 9M basis), helped by a very strong quarter in Liquidnet +28%, which is the US block trading business they bought at the end of 2020. That’s good news as the company paid around $600m for the Liquidnet, with a rights issue at 140p per share only to see revenues fall -20% after the acquisition completed. Liquidnet was 15% of group revenue and 17% of group EBIT at H1.

NB TCAP was formed in 2016 with the merger between Tullett Prebon and ICAP, hence the jump in turnover and profits in the chart below. The merger created around £1.4bn of intangible assets on the balance sheet.

Outlook: Management said last week that they are comfortable with FY adj EBIT expectations (Sharepad shows FY Dec 2024F EBIT of £314m, implying +5% growth). Around 60% of revenues and 40% of costs are in dollars though, which means TCAP ought to benefit from the recent strength in the dollar (up +4% versus GBP in the last month).

Activist: In March 2023 Justin Hughes, an activist hedge fund manager took a position with total return swaps and urged management to stop buying other companies, instead they should look to sell businesses. He argued that Parameta, the group’s data subsidiary could be worth £1.5bn on its own. At the time TCAP’s market cap was around £1.2bn. Parameta is less than 10% of group revenue, but has a 40% EBIT margin and is growing at +10% a year.

At the FY results in March this year, management said they would look at “strategic options” for the division, including a possible spin-off with a US listing, but TCAP maintaining a majority stake. They haven’t changed the wording of that statement since the H1 results, but buoyant US market conditions with the S&P500 up +21% YTD shouldn’t be an impediment to any “strategic options”. Presumably, management would receive cash from spinning off Parameta, which could then be used to buyback shares, placating Justin Hughes.

Valuation: The shares are trading on a PER of 8x 2025F and 7x 2026F. The company has also announced 3 consecutive buybacks of £30m at H1 2023, FY 2023 and H1 2024. Meanwhile the dividend yield is above 6%, despite the shares rising +30% YTD.

Opinion: I have owned this for a couple of years and also pitched it on the BASH at David Stredder’s Mello. Aside from the obvious catalyst of a Parameta spin-out, the core Global Broking business that facilitates OTC trading has been in decline (revenue down -3%, profits down -12% at H1) and there’s potential for conditions to improve. In Q3 we saw Global Broking revenue up +8%, helped by the rates business +15% benefiting from interest rate volatility. I think that could continue for the rest of the year, and there’s a possibility of an “ahead of expectations” RNS, so I will continue to hold.

S4 Capital Q3 Sept Trading Update

Yet more disappointment from S4 Capital, Sir Martin Sorrell’s acquisitive digital advertising venture, which reported Q3 results last week. I last wrote about SFOR in 2022 when the shares were down -65% from its peak. I concluded that the outlook statement was too bullish and the risk felt on the downside, but perhaps it could present an opportunity in future. Since then the share price has fallen another -90%, but perhaps now it could be worth another look?

Q3 revenues were down -15%, or -13% on a like-for-like basis. FY revenues are expected to be down a similar low teens amounts. Year end net debt is expected to be in the range of £150m to £190m, which equates to around 2.0-2.3x EBITDA. At H1 stage the business lost £17m before tax.

Acquisition liabilities: In the past I have drawn attention to how the accounting works for past acquisitions. The H1 results show that deferred equity consideration arising from business combinations stood at £72m. That has had a dilutive impact with the share count increasing each year to stand at 614m this June. The H1 analyst presentation suggests that there’s a further 57m share dilution coming in 2025F.

Ownership: Sir Martin Sorrell holds one B share, which allows him to appoint or replace one Director, plus he has a veto on other appointments and removals from the Board. No shareholder resolutions can be proposed without his consent and he also has a veto on acquisitions. This “golden share” structure was introduced to prevent Sir Martin being forced out of the company, which is what happened at WPP when shareholders voted against his £70m pay package in 2016 and there were suggestions he had used his corporate credit card for personal expenses (allegations he denied). He is currently SFOR’s largest ordinary shareholder with 8.9% of the shares. Other institutions that were on the share register a couple of years ago (Rathbones IM 4.9%, Canaccord WM 4.8% and Jupiter 4.8%) have sold down their stakes.

Valuation: The shares are trading on a PER of 5x Dec 2025F, dropping below 4x the following year. This business represents £1.1bn of invested capital, of which under £200m is net debt. That compares to an enterprise value of £425m – in other words, every pound raised and invested in acquisitions is now worth 39p. That looks optically cheap but this does feel to me like “catching a falling knife”.

I’m being unkind, but I have used SharePad’s multi-graph feature to compare the share price performance of WPP (down -14%) to SFOR (down -96%) since Sept 2021.

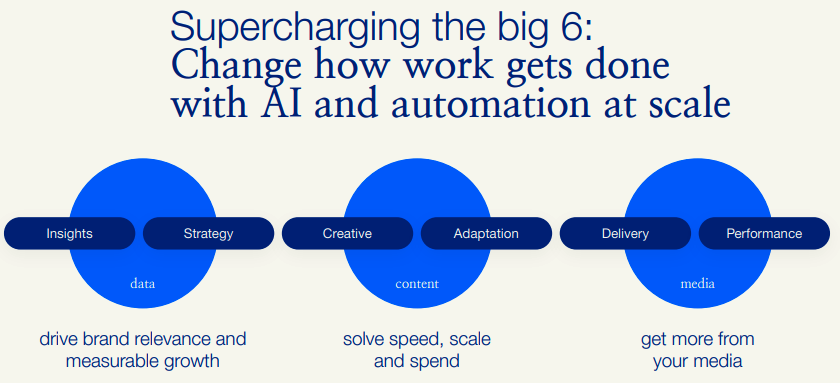

Opinion: Sir Martin Sorrell’s second act has been even less successful than Roger Waters’ post Pink Floyd solo albums. The business has been loss-making for every year of its existence, and if he had funded its expansion with more debt, I think it probably would have failed by now. My concern is that there’s been no recession in the US or UK, yet SFOR has struggled to make a profit, while revenue is declining. The analyst pack suggests that Artificial Intelligence and LLMs can be used to make marketing and digital ad spend more effective – but so far, there’s no evidence of that dropping through in the financials. I’ll revisit it if it looks like management can turn things around, but I’d rate performance currently as last wrote about it in September

Bruce Packard

Notes

Bruce owns shares in TCAP

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.