From a pool of more than 200 shares, Richard hones in on software company Kainos (again), fast food favourite Greggs, motor vehicle distributor Inchcape, integrated pet shop and vet group Pets at Home, and defence technology supplier Cohort. On the horizon: posh wallpaper and fabric designer Colefax and Gately, a law firm. Well, maybe not Gately.

These are the dog days of Summer.

My SharePad newsfeed is mostly full of routine share buybacks. Very few companies are publishing results or annual reports.

It’s a good time to take another look at all those shares that have scored less than three strikes and discover whether any gems have slipped through our fingers.

Over 200 shares pass my minimum quality filter. They have been listed for at least eight years, they have earned positive cash flow, and they have spent less than they have earned on acquisitions.

160 of them have published annual reports since 1 March. We’ll focus on them because their results are still fresh. Companies that published before March are closer to their next pass through the 5 Strikes system than their last pass.

11 shares achieved 0 strikes

26 achieved 1 strike

37 achieved 2 strikes

The rest are struck out.

I’ve ordered these candidates by number of strikes so the least problematic are near the top of the table, and then by annual report date, so the most recent head each sub-group.

All the 0’s, 1’s and 2’s

The table includes links to articles mentioning the shares published in the last six months. Be prepared, it’s long:

| Name | TIDM | Prev AR | Strikes | # Strikes | SharePad | ii |

|---|---|---|---|---|---|---|

| Kainos | KNOS | 1/8/24 | 0 | 14 Aug | ||

| Auto Trader | AUTO | 1/7/24 | 0 | 4 Aug | ||

| Cranswick | CWK | 1/7/24 | ? Holdings | 0 | * | |

| Record | REC | 28/6/24 | ? Holdings | 0 | ||

| Bloomsbury Publishing | BMY | 17/6/24 | 0 | 3 Jul | 19 July | |

| London Security | LSC | 21/5/24 | 0 | 19 Jun | ||

| 4imprint | FOUR | 16/4/24 | 0 | 10 May | ||

| Computacenter | CCC | 11/4/24 | ? Growth | 0 | ||

| FDM | FDM | 8/4/24 | 0 | |||

| Nichols | NICL | 28/3/24 | ? Growth | 0 | 24 Apr | |

| Porvair | PRV | 13/3/24 | ? Holdings | 0 | 5 April | |

| Quartix | QTX | 7/3/24 | ? ROCE | 0 | 15 Mar | |

| Cohort | CHRT | 21/8/24 | – ROCE | 1 | ||

| Iomart | IOM | 9/8/24 | – ROCE | 1 | ||

| Games Workshop | GAW | 30/7/24 | – Holdings | 1 | 14 Aug | 30 Aug |

| Latham (James) | LTHM | 24/7/24 | – CROCI ? Growth | 1 | 14 Aug | 16 Aug |

| Gamma Communications | GAMA | 18/7/24 | – Holdings | 1 | 31 Jul | |

| Liontrust Asset Management | LIO | 5/7/24 | – Shares | 1 | ||

| Polar Capital | POLR | 5/7/24 | – Growth | 1 | ||

| Halma | HLMA | 24/6/24 | – Holdings | 1 | 3 Jul | |

| Science | SAG | 21/5/24 | ? ROCE | 1 | 19 Jun | |

| Advanced Medical Solutions | AMS | 14/5/24 | ? Holdings ? ROCE | 1 | 21 June | |

| Andrews Sykes | ASY | 14/5/24 | – Growth | 1 | 5 Jun | |

| Churchill China | CHH | 10/5/24 | – CROCI | 1 | 14 June | |

| Property Franchise Group | TPFG | 8/5/24 | – Shares | 1 | ||

| M Winkworth | WINK | 3/5/24 | – Growth | 1 | 8 May | |

| Mortgage Advice Bureau | MAB1 | 25/4/24 | – Shares | 1 | 8 May | |

| Barr | BAG | 23/4/24 | ? Growth | 1 | 8 May | |

| Hill & Smith | HILS | 18/4/24 | – Holdings ? Acquisitions | 1 | 8 May | |

| PageGroup | PAGE | 12/4/24 | – Holdings ? Growth | 1 | ||

| Greggs | GRG | 10/4/24 | – Holdings | 1 | ||

| Inchcape | INCH | 28/3/24 | – Debt | 1 | ||

| Rightmove | RMV | 22/3/24 | – Holdings | 1 | ||

| Bunzl | BNZL | 15/3/24 | ? Holdings ? Debt ? Growth | 1 | 3 May | |

| Howden Joinery | HWDN | 15/3/24 | – Holdings ? Debt | 1 | 26 Apr | |

| Nexteq | NXQ | 13/3/24 | – CROCI | 1 | ||

| Mony | MONY | 4/3/24 | – Holdings | 1 | 27/3 | |

| SThree | STEM | 4/3/24 | – Holdings | 1 | 27/3 | |

| Gateley | GTLY | 30/8/24 | ? Holdings – Shares ? CROCI | 2 | ||

| Colefax | CFX | 20/8/24 | – CROCI – Growth | 2 | ||

| IG | IGG | 13/8/24 | – Holdings – Growth | 2 | ||

| Berkeley | BKG | 2/8/24 | ? CROCI – Growth | 2 | 14 Aug | |

| PHSC | PHSC | 2/8/24 | – Growth – ROCE | 2 | 14 Aug | |

| MS International | MSI | 12/7/24 | – CROCI – ROCE | 2 | 31 Jul | |

| Severfield | SFR | 2/7/24 | – Growth – ROCE | 2 | ||

| Castings | CGS | 25/6/24 | – Growth – ROCE | 2 | 17 Jul | |

| Oxford Instruments | OXIG | 25/6/24 | – Holdings – Growth | 2 | 12/7 | |

| CMC Markets | CMCX | 20/6/24 | – CROCI – Growth | 2 | ||

| RS | RS1 | 12/6/24 | – Holdings – Shares | 2 | 3 Jul | |

| Pets at Home | PETS | 10/6/24 | – Holdings – ROCE | 2 | 19 Jun | |

| JD Sports Fashion | JD. | 3/6/24 | – Holdings – Shares | 2 | ||

| Card Factory | CARD | 16/5/24 | – Holdings – Debt | 2 | 5 Jun | |

| Fevertree Drinks | FEVR | 9/5/24 | – CROCI – ROCE | 2 | ||

| Next 15 | NFG | 3/5/24 | ? Growth ? ROCE – Shares | 2 | 3 Jul | |

| Next | NXT | 12/4/24 | – Debt ? Growth | 2 | 22 May | |

| Macfarlane | MACF | 5/4/24 | ? Holdings ? Growth – Shares | 2 | 19 Apr | |

| Bodycote | BOY | 4/4/24 | ? Holdings – Growth | 2 | ||

| Michelmersh Brick | MBH | 4/4/24 | – ROCE – Shares | 2 | ||

| Clarkson | CKN | 3/4/24 | ? CROCI – ROCE ? Shares | 2 | ||

| Domino’s Pizza | DOM | 2/4/24 | – Holdings – Debt | 2 | ||

| Spirax | SPX | 2/4/24 | – Holdings – Debt ? Growth | 2 | ||

| Vesuvius | VSVS | 2/4/24 | ? Holdings – Growth ? ROCE | 2 | ||

| IMI | IMI | 28/3/24 | – Debt – Growth | 2 | ||

| Spectris | SXS | 27/3/24 | – Growth ? ROCE | 2 | ||

| Spirent Communications | SPT | 27/3/24 | ? Holdings – Growth – ROCE | 2 | ||

| Jarvis Securities | JIM | 26/3/24 | – CROCI – Growth | 2 | ||

| Rotork | ROR | 26/3/24 | – Holdings – Growth | 2 | ||

| ITV | ITV | 25/3/24 | – Holdings – Growth | 2 | ||

| Hikma Pharmaceuticals | HIK | 22/3/24 | – Debt ? Growth – Shares | 2 | ||

| Intertek | ITRK | 22/3/24 | ? Holdings – Debt ? Growth ? ROCE | 2 | ||

| Aptitude Software | APTD | 21/3/24 | – Holdings – Growth ? ROCE | 2 | ||

| Morgan Sindall | MGNS | 21/3/24 | ? Holdings ? CROCI ? Growth ? ROCE | 2 | ||

| Johnson Service | JSG | 18/3/24 | – Shares – Holdings ? Debt | 2 | ||

| Unilever | ULVR | 14/3/24 | – Growth – Debt | 2 | ||

| BAE Systems | BA. | 7/3/24 | – Holdings – Growth ? ROCE | 2 |

Note on 5 Strikes: This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

The names highlighted in bold are companies that I plan to get to know better.

I’ve made a start on Kainos, the software company, by probing my insecurities about its business model. Principally I fear its growing reliance on the Workday software ecosystem and its possible disruption by Artificial Intelligence (AI).

I must decide whether I can live with these risks for the long-term.

Once a baker, now a fast-food chain, Greggs (- Holdings) probably needs no introduction. It is so ubiquitous in our towns and service stations my first line of enquiry will be its market share and growth strategy.

Alex Sweet writes an excellent Substack newsletter, which featured Greggs last February. Apart from opening more stores, he reports that Greggs anticipates growth from longer opening hours and home deliveries.

Perhaps we should not get hung up on Greggs’ ubiquity. Sweet points out the shops are smaller and more local than those of competitors, so perhaps there needs to be more of them.

Reportedly Greggs is the market leader in fast food breakfasts. Will we eat there morning, noon and night?

Debt and lease obligations have marginally exceeded my arbitrary threshold (25% of capital) at Inchcape (-Debt) for the last two years, but the company fascinates me, not least because it was an early and highly successful investment.

Inchcape failed by a very small margin to be my first ten-bagger when I bought shares in the teeth of the dot.com crash and sold them on the eve of the financial crisis (when it gave up almost all those gains).

I cannot remember why I sold and I’ll take no plaudits, especially as I bought the shares all those years ago partly because my fondly remembered grandfather worked for the company decades before. Another reason, even then, was that it seemed to be a decent business trading at a low price.

Sentiment, though, is not a good reason to buy shares, but this time something else has attracted me to Inchcape. The company sold off its UK car dealership network in April, the last of £2.4 billion in retail revenue divested since 2016, Inchcape says.

It’s a fair bet that Inchcape is responding to ructions in the car supply chain. Many manufacturers are selling, or are planning to sell, directly to us instead of through dealerships.

Dealerships still have a role under the new “agency model”, but instead of stocking cars and setting prices, they are increasingly contracted by the manufacturer to provide services like preparing and handing over new cars, for a fee. The manufacturer owns the customer relationship.

I imagine Inchcape sits between manufacturer and retailer, delivering the vehicles often in far flung places, but judging by the description of the distribution business in Inchcape’s announcement, it’s a bit more complicated than that:

“The distribution value chain includes such elements as product planning, logistics, channel management and aftersales, while retail is specifically focused on car dealerships. The Group’s Distribution business will continue to retain elements of automotive retail within its infrastructure in certain markets, as appropriate, where it drives economic and commercial value for Inchcape and its OEM partners.”

The company’s rationale is to focus on distribution because it is more profitable and cash generative.

I like businesses that adapt, especially if they become less complex as they change. Perhaps Inchcape is one of them.

The company has a long and storied history…

Pets at Home (- Holdings – ROCE), the integrated Pet Shop and veterinary chain, is also unfinished business.

Newly minted

In the last fortnight, only six companies have passed the minimum quality filter, and only three of them have less than three strikes to their name.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Redcentric | RCN | 2/9/24 | – Acquisitions – CROCI – Debt – Growth – ROCE | X |

| System1 | SYS1 | 2/9/24 | – CROCI – Growth – ROCE | 3 |

| Gateley | GTLY | 30/8/24 | ? Holdings – Shares ? CROCI | 2 |

| Intercede | IGP | 29/8/24 | – CROCI – Growth – ROCE – Shares | 4 |

| Cohort | CHRT | 21/8/24 | – ROCE | 1 |

| Colefax | CFX | 20/8/24 | – CROCI – Growth | 2 |

Reminder on 5 Strikes: This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

Cohort (- ROCE) is a gaggle of defence technology companies that I have owned and also held in Interactive Investor’s Share Sleuth model portfolio since 2012.

‘B’ indicates buys in the Share Sleuth model portfolio

The company floated in 2006 as an acquisition vehicle. Powered by the consistently strong performance of one of its first acquisitions, MASS, and somewhat more erratic contributions from other acquisitions, it has been a decent investment during a period of constrained defence spending.

Spending is ramping up as the World gets more warlike. The company reported record results for 2024. And I will be writing it up on Interactive Investor shortly.

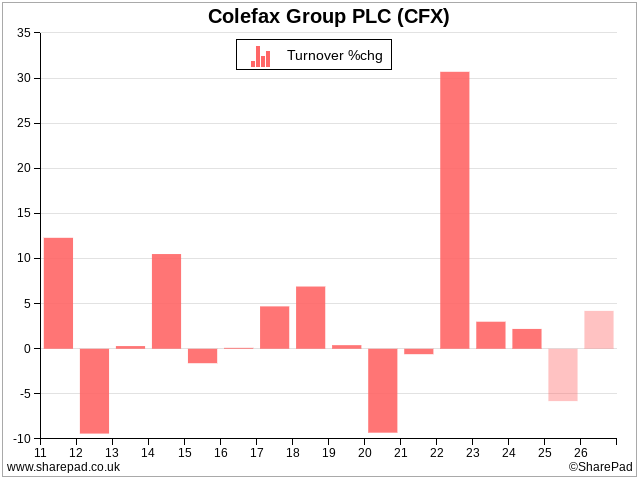

Colefax (- CROCI – Growth) supplies designer wallpaper and fabrics and decorates the kind of house we see pictured in the glossy weekend newspaper supplements.

It owns classic patterns that never seem to go out of fashion and returns oodles of cash to shareholders through dividends and share buybacks.

The generous payouts reflect a paucity of investment opportunities. Launching a new range is expensive and risky, and apparently acquiring them is too.

The result is inconsistent growth linked to the buoyancy of the high-end property market:

Gateley (? Holdings – Shares ? CROCI) is a law firm. I thought Gateley was one of the better-listed law firms, but that set the bar quite low and I am unlikely to investigate it further.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.