Bruce suggests that unemployment, rather than interest rates, will be the driver of banks’ bad debts. Companies covered MANO, and profit warnings from SOM and HOTC, plus Teddy Sagi’s bid for BOTB.

After an entertaining weekend in Russia, one observation from a military friend who was in the Donbass, now in Libya, is that a vicious civil war in Russia would have been a very grimdark future. The situation has resolved by markets’ open on Monday, with Prigozhin moving from Russia to Belarus because he no longer wants “to live under corruption, lies and bureaucracy”. I agree with the sentiment, but I would have chosen a different country.

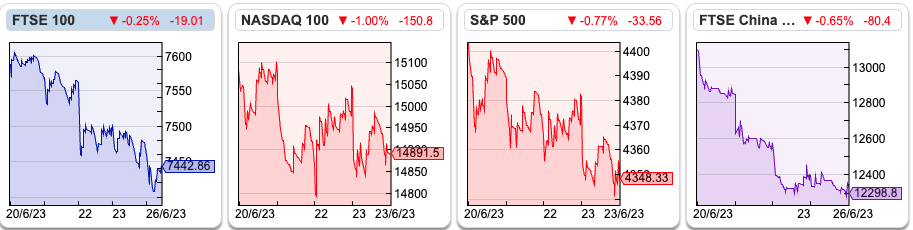

The FTSE 100 fell -1.9% to 7444 over the last 5 trading days. The Nasdaq100 and S&P 500 were down -1.3% and -1.4% respectively over the same time period. AIM Allshare is below its Oct 2022 lows, versus Nasdaq100 which is up +39%.

Last week the Bank of England raised interest rates by 50bp to 5%, high street banks are now offering two-year fixed-rate mortgages at 6.2% versus 2.6% in June 2021, according to The Times (quoting Moneyfacts figures). On the deposit side, my Lloyds savings account is still only offering 1.15%. That suggests Net Interest Margins for the high street banks will be very attractive when they report H1 results at the end of July, assuming that the banks are not seeing deposit outflows. I messaged Lloyds to say that I was moving my money elsewhere unless they could give me an interest rate better than 1.15%. The best they could do was to book me an appointment with someone in the branch who could “help me select their best product”. I had already moved most of my money from that bank account but I thought I’d give them one last chance, which they failed.

UK banks’ -11% since February share prices have not responded well to rising interest rates. Some of the underperformance is likely driven by concerns about credit quality, but the current rate of unemployment is below 4%. Unemployment, rather than interest rates, tends to be the driver of bad debts and on that measure, the UK economy looks healthy relative to history, as Sharepad’s graph going back 40 years shows.

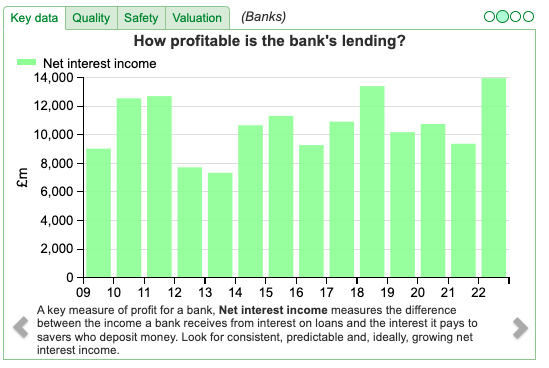

Instead, the banks’ share prices could be reflecting concerns that management are being too greedy on the deposit side of their balance sheets. There’s a delicate balancing act between maintaining healthy net interest margins (NIMs) versus annoying savers so much that banks see deposit outflows. Below is a chart of Lloyds Net Interest Income up +49% in FY Dec 2022 to £14bn; I don’t think that growth is sustainable into 2024F.

Other victims of higher interest rates and falling transaction volumes in the housing market are Rightmove and UK housebuilders’ both down -18% since February, which I discuss with Maynard and a couple of others on this round table discussion podcast.

This week I look at Manolete’s FY March results and Teddy Sagi’s bid for Best of the Best. Also Somero and Hotel Chocolat’s profit warnings.

Manolete FY March Results

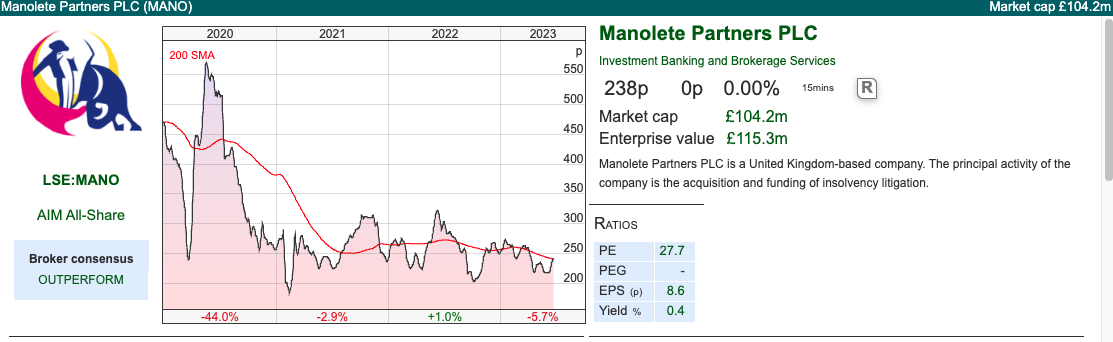

Steve Cooklin the CEO, of this insolvency litigation company presented at Mello in May. He seemed keen to suggest that the outlook was brighter than the recent past, as the company has struggled over the pandemic when the government suspended insolvencies.

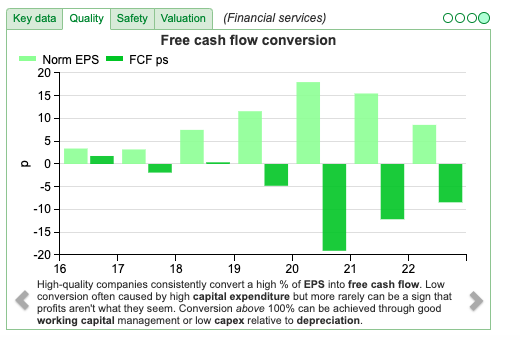

Before the pandemic, MANO reported a RoE of 26% and an EBIT margin of 55%. However, that wasn’t a cash figure, and Sharepad shows that Free Cashflow (FCF) was negative. The discrepancy between accounting profits and cash is because the company settles claims relatively quickly and writes up their fair value – 91% of FY Mar 2020 and 80% of FY 2021 of claims have completed – but individuals (former directors of insolvent companies) tend not to have millions of pounds set aside to pay immediately once a settlement has been agreed. For example, Manolete said in September 2020 that they had won a claim for £15m, of which Manolete’s share of this was £4.1m. To allow the Defendants time to liquidate assets, MANO were to receive the settlement proceeds in stages over the following decade. Hence the difference between EPS and FCF per share, in the chart below. Sharepad also shows FCF conversion of -98% and a Beneish M earnings manipulation score of -2.19 (more likely).

Last week’s results showed the opposite trend, with MANO’s gross cash receipts up +72% to £27m. For the first time in the company’s history, management reported positive net cash income of £1.4m (versus a £3.2m net cash outflow FY Mar 2022). Revenue only increased +2% to £21m and they reported a loss before tax of £4.5m. That loss was partly caused by one large case going against them at trial, and more generally writing down the fair value of open cases in the light of disappointing case settlements.

Outlook: Management are upbeat about the prospects of more insolvencies in the coming year. They also mention a pilot scheme with Barclays in an attempt to recover the UK Governments Bounce Back Loans. This could be an opportunity for MANO as “a significant minority of loans were misappropriated by the owner-managers of those businesses. Those misappropriated BBLs have not been repaid, at a potentially significant cost to the UK taxpayer.” MANO saw good returns from the pilot and is now in discussion with other banks. They are paying Lord Agnew, Minister of State at the Cabinet Office and Her Majesty’s Treasury from 2020 to 2022 with responsibility to counter fraud, to advise them and help open doors.

Valuation: The shares are trading on 5x FY Mar 2023 revenues, which seems expensive for a company that is currently loss-making and has £10m of net debt. That could be justified if the pre-pandemic EBIT margin above 50% can be reached again without fair value accounting shenanigans, or if the revenue outlook really is very strong. However, Sharepad shows forecasts in Mar 2026F of £20m, below the level just reported.

Opinion: When there’s a divergence between cash and accounting profits, investors tend to give much more weight to the cash figure. That said if you believe management, the Mar 2026F forecasts could be too cautious and MANO could make sense as part of a diversified portfolio, as it offers uncorrelated risk and returns. Investors have struggled to value this sector, rightly sceptical of fair value accounting. Burford is up +50% since October while RBGP (formerly Rosenblatt) is hitting new lows, down -64% over the same time period. Uncorrelated risk and returns indeed.

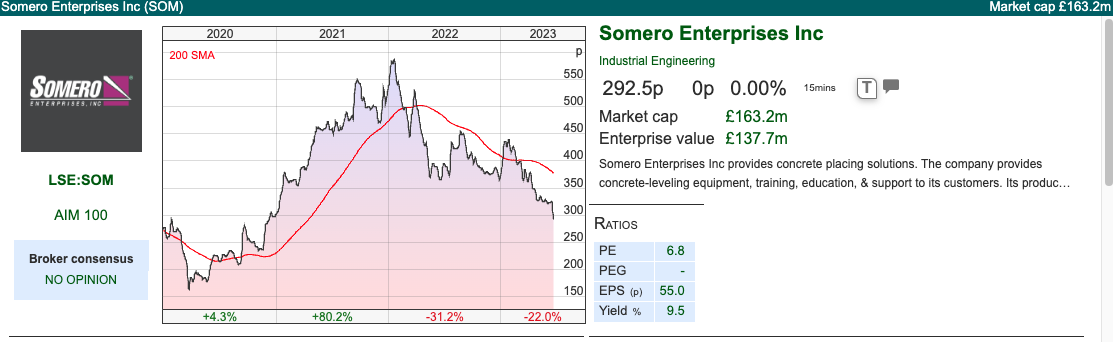

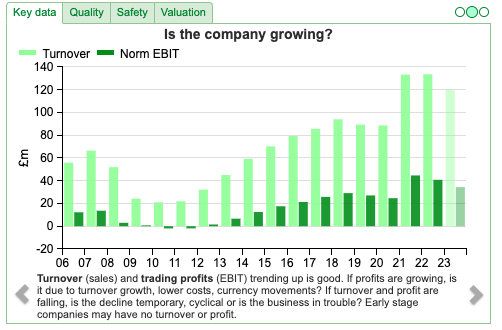

Somero FY Dec profit warning

This concrete screed company strikes me as an interesting example of a cyclical company, trading on an ostensibly attractive valuation, but where the chart looks terrible and the pressure on forecasts is downwards. The share price has fallen from a peak of 590p at the beginning of 2022 and has been weak as investors have worried about headwinds in the construction industry. Last week’s RNS mentions higher interest rates and tighter bank lending standards, and to a lesser extent trouble getting approval for construction projects in the US, resulting in project delays. Although the company is global, c. 75% of sales come from the USA. Fortunately (given the weak China macro-data) management decided to close down their China operations a couple of years ago, so the other exposures are mainly Europe and Australia.

Management now expects FY Dec 2023F revenue will be approximately $120m, implying a -10% fall from FY Dec 2022 revenue of $134m. They talk about a 15-20% fall in H1, implying a pick-up in H2, based on the increased availability of a new machine, the snappily named S-22EZ. That seems very “glass half full” to me, my view is that the effects of more cautious bank lending and higher interest rates are yet to be felt. The share price fell -14% on the morning of the RNS.

Forecasts: Management are suggesting a miss versus consensus of -12% on the revenue line and -16% on the adj EBITDA line. Normally I would expect to see a steeper profit decline for a company with a gross margin in the mid-50s, however, management is responding to the slowing demand by cutting operational costs by -10%. Year end cash forecast at $32m is actually $1m better than previously expected, due to reduced working capital needs.

Valuation: The shares are trading on 8x PER 2023F after FinnCap cut EPS by -17%. Cash is 15% of the market cap, which ought to provide some reassurance. FinnCap their broker are forecasting a dividend of 27c in 2023 (down from 50c in 2021), which puts the shares on a forecast yield of 7.3%.

Opinion: I bought this in 2015, and am regretting not selling 18 months ago. During the financial crisis, Somero’s revenues fell for three years in a row, from $66m FY Dec 2007 to $21m FY Dec 2010. That’s more than a 2/3 decline, so I can see why investors might sell first and ask questions later. In the short term, I would imagine that the outlook could deteriorate further, as the USA is not even in a recession. If we see a couple of years of revenue declines it is not impossible to imagine that the share price could fall another -50% from here.

That said, I own SOM (almost) “for free” as my original entry price was 124p in 2015, and at the current exchange rate, I have received 116p in cumulative dividends. I can’t see the company burning through all of their cash, so I am prepared to wait and would be keen to add to my position when the recession has blown itself out.

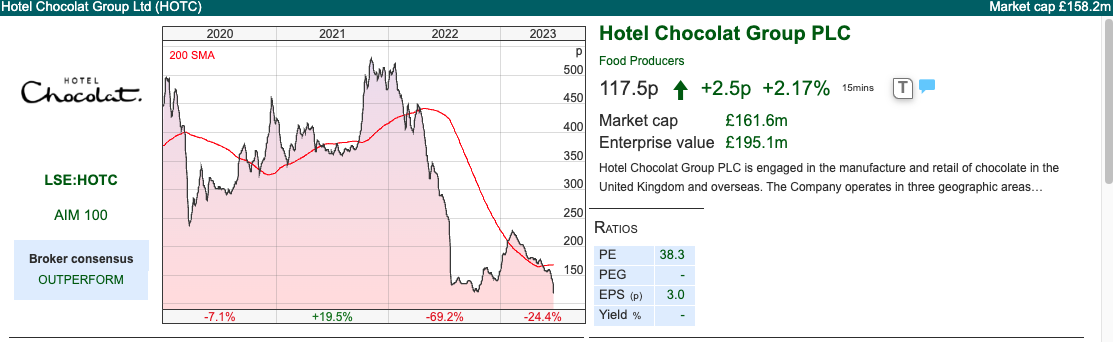

Hotel Chocolate FY Jun profit warning

Hotel Chocolat warned last week that it would make an FY Jun loss, despite sales being in line with expectations (£202m according to the company).

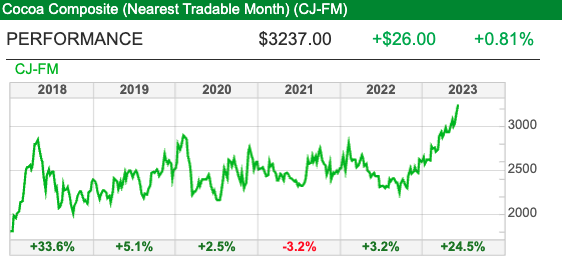

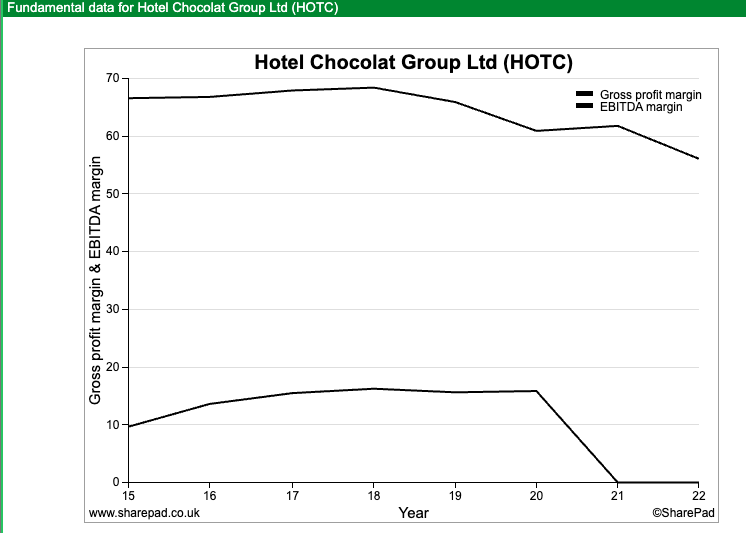

The product is premium priced, with more cacao and less sugar than the supermarket and corner shop chocolate. Cacao is about five times as expensive as sugar. I think margins have come under pressure looking at the cocoa futures price (CJ-FM) which is up +25% YTD. In other words, HOTC seems to be struggling to pass on the rising commodity prices, despite being vertically integrated with its own cocoa plantation in Saint Lucia.

As recently as March, HOTC had been expecting to make a profit of between £4m and £7m. They also expect FY June 2024F to be below current market expectations. It sounds like weakness will continue into the following year, as management have “clarified” that for FY June 2025F guidance for the target of 20% pre-IFRS EBITDA to be achieved towards the end of the year, with the full benefits being achieved through FY June 2026F.

The company raised £40m of new equity in July 2021 at 355p to support growth and international expansion in the USA and Japan. Management then reversed course a year later, without it being particularly clear what has gone wrong. That said, because of the equity raise at a favourable (to HOTC) valuation they still have £19m of cash, down from £28m at the end of December.

Valuation: Richard looked at HOTC valuation at the beginning of the pandemic when lease adjusted RoCE was 12.6%. Assuming that earnings eventually recover to that level would imply PBT of around £20m, which sounds more credible than management’s aspiration for 20% EBITDA margin pre-IFRS 16, which would have equated to c. £30m PBT. Historically the company achieved a peak EBITDA margin of 16% in FY Jun 2018. Taxing £20m of PBT at 25% would imply a PER multiple of 8x following last week’s profit warning.

Opinion: Chocolate brands are supposed to do well in inflationary times, as consumers are prepared to pay for affordable treats, while they cut back on higher priced items like electrical white goods or holidays.

That theory doesn’t seem to be working in practice though; I’ve also noticed that tobacco companies like BATS and IMB, which normally are viewed as stagflation-proof, have done badly since mid-October last year. On the other hand, Coca-Cola (KO) and Fevertree Drinks (FEVR) are on a 24x and 65x PER respectively, despite the price of sugar rising +29% YTD (ie more than cacao).

Best of the Best FY Apr results and takeover

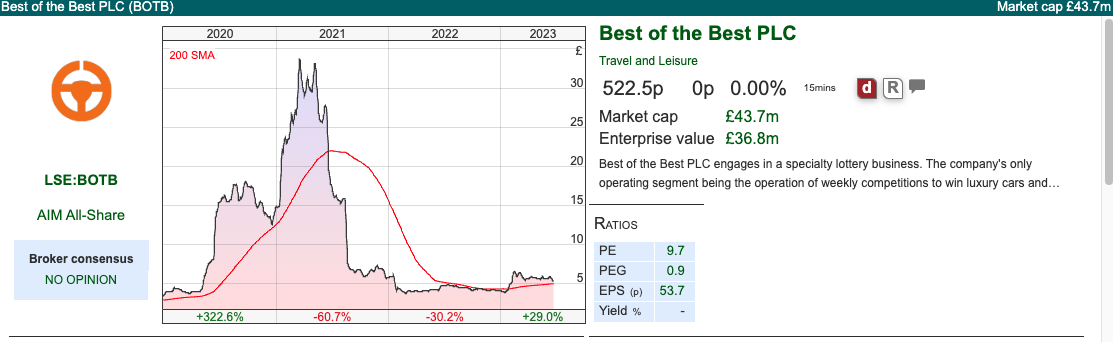

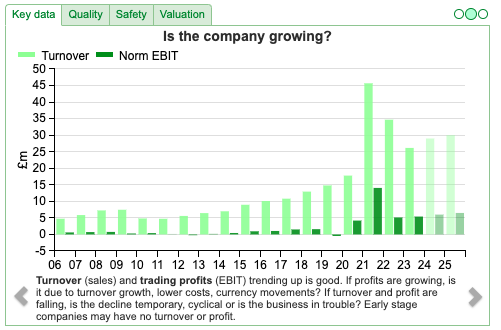

This online car competition business was a pandemic winner, with revenue peaking at £46m FY Apr 2021 but similar to computer games companies, has suffered as customers have spent more time outside socialising in the sunshine. The decline continues this year with FY Apr 2023 revenue down -24% to £26m. Management responded by cutting costs, so PBT was up +8% to £5.5m.

In September last year, Globe Invest Limited (GIL), a Teddy Sagi vehicle, bought a 29.9% stake in the Company at 400p per share and signed of a letter of Intent to enter into a Licensing and Distribution Agreement and a Marketing and Collaboration Agreement. I commented in February that having Teddy Sagi on the shareholder register is not necessarily a positive for minority shareholders. To be clear, he hasn’t done anything wrong, however, the Israeli billionaire’s interests are not perhaps aligned with other shareholders. GIL has announced a cash offer for BOTB at a price of 535p per ordinary share, that represents a discount to the 555p which the shares were trading at before the announcement.

William Hindmarsh, who founded the company in 1999, banked £41m for himself and his family when the company did a placing at £24 per share in March 2021. Rupert Garton, the commercial director, received £12m at the same time. There was then a profit warning in August 2021, and the shares collapsed to 850p, then troughed at 376p at the beginning of this year.

Valuation: The bid values BOTB at less than 9x FY Apr 2024F PER, and 1.7x forecast sales, which seems too cheap for a company with a strong track record, notwithstanding the post pandemic decline. I tend to take broker target prices with a grain of salt, but the last piece of research I can see on FinnCap’s research portal shows a 990p target price. The GIL bid probably undervalues the shares, regardless of the August 2021 and Jan 2022 profit warnings, in my view.

Opinion: Having made tens of millions, I can understand the founder wanting to take a step back. I commented with KAPE, that Teddy Sagi was de-listing the shares on a single-digit PER multiple, just when the business finally was on a roll. He seems to have spotted a similar opportunity with BOTB, it’s a shame the Israeli billionaire appears unwilling to share more of the upside with ordinary shareholders. If readers know of any other AIM listed companies where he is on the shareholder register, please do post in the chat, as I can imagine the same scenario might play out again.

Notes

The author owns shares in Somero and Burford

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 27/06/23 | MANO, SOM, HOTC, BOTB | And Quiet Flows the Don

Bruce suggests that unemployment, rather than interest rates, will be the driver of banks’ bad debts. Companies covered MANO, and profit warnings from SOM and HOTC, plus Teddy Sagi’s bid for BOTB.

After an entertaining weekend in Russia, one observation from a military friend who was in the Donbass, now in Libya, is that a vicious civil war in Russia would have been a very grimdark future. The situation has resolved by markets’ open on Monday, with Prigozhin moving from Russia to Belarus because he no longer wants “to live under corruption, lies and bureaucracy”. I agree with the sentiment, but I would have chosen a different country.

The FTSE 100 fell -1.9% to 7444 over the last 5 trading days. The Nasdaq100 and S&P 500 were down -1.3% and -1.4% respectively over the same time period. AIM Allshare is below its Oct 2022 lows, versus Nasdaq100 which is up +39%.

Last week the Bank of England raised interest rates by 50bp to 5%, high street banks are now offering two-year fixed-rate mortgages at 6.2% versus 2.6% in June 2021, according to The Times (quoting Moneyfacts figures). On the deposit side, my Lloyds savings account is still only offering 1.15%. That suggests Net Interest Margins for the high street banks will be very attractive when they report H1 results at the end of July, assuming that the banks are not seeing deposit outflows. I messaged Lloyds to say that I was moving my money elsewhere unless they could give me an interest rate better than 1.15%. The best they could do was to book me an appointment with someone in the branch who could “help me select their best product”. I had already moved most of my money from that bank account but I thought I’d give them one last chance, which they failed.

UK banks’ -11% since February share prices have not responded well to rising interest rates. Some of the underperformance is likely driven by concerns about credit quality, but the current rate of unemployment is below 4%. Unemployment, rather than interest rates, tends to be the driver of bad debts and on that measure, the UK economy looks healthy relative to history, as Sharepad’s graph going back 40 years shows.

Instead, the banks’ share prices could be reflecting concerns that management are being too greedy on the deposit side of their balance sheets. There’s a delicate balancing act between maintaining healthy net interest margins (NIMs) versus annoying savers so much that banks see deposit outflows. Below is a chart of Lloyds Net Interest Income up +49% in FY Dec 2022 to £14bn; I don’t think that growth is sustainable into 2024F.

Other victims of higher interest rates and falling transaction volumes in the housing market are Rightmove and UK housebuilders’ both down -18% since February, which I discuss with Maynard and a couple of others on this round table discussion podcast.

This week I look at Manolete’s FY March results and Teddy Sagi’s bid for Best of the Best. Also Somero and Hotel Chocolat’s profit warnings.

Manolete FY March Results

Steve Cooklin the CEO, of this insolvency litigation company presented at Mello in May. He seemed keen to suggest that the outlook was brighter than the recent past, as the company has struggled over the pandemic when the government suspended insolvencies.

Before the pandemic, MANO reported a RoE of 26% and an EBIT margin of 55%. However, that wasn’t a cash figure, and Sharepad shows that Free Cashflow (FCF) was negative. The discrepancy between accounting profits and cash is because the company settles claims relatively quickly and writes up their fair value – 91% of FY Mar 2020 and 80% of FY 2021 of claims have completed – but individuals (former directors of insolvent companies) tend not to have millions of pounds set aside to pay immediately once a settlement has been agreed. For example, Manolete said in September 2020 that they had won a claim for £15m, of which Manolete’s share of this was £4.1m. To allow the Defendants time to liquidate assets, MANO were to receive the settlement proceeds in stages over the following decade. Hence the difference between EPS and FCF per share, in the chart below. Sharepad also shows FCF conversion of -98% and a Beneish M earnings manipulation score of -2.19 (more likely).

Last week’s results showed the opposite trend, with MANO’s gross cash receipts up +72% to £27m. For the first time in the company’s history, management reported positive net cash income of £1.4m (versus a £3.2m net cash outflow FY Mar 2022). Revenue only increased +2% to £21m and they reported a loss before tax of £4.5m. That loss was partly caused by one large case going against them at trial, and more generally writing down the fair value of open cases in the light of disappointing case settlements.

Outlook: Management are upbeat about the prospects of more insolvencies in the coming year. They also mention a pilot scheme with Barclays in an attempt to recover the UK Governments Bounce Back Loans. This could be an opportunity for MANO as “a significant minority of loans were misappropriated by the owner-managers of those businesses. Those misappropriated BBLs have not been repaid, at a potentially significant cost to the UK taxpayer.” MANO saw good returns from the pilot and is now in discussion with other banks. They are paying Lord Agnew, Minister of State at the Cabinet Office and Her Majesty’s Treasury from 2020 to 2022 with responsibility to counter fraud, to advise them and help open doors.

Valuation: The shares are trading on 5x FY Mar 2023 revenues, which seems expensive for a company that is currently loss-making and has £10m of net debt. That could be justified if the pre-pandemic EBIT margin above 50% can be reached again without fair value accounting shenanigans, or if the revenue outlook really is very strong. However, Sharepad shows forecasts in Mar 2026F of £20m, below the level just reported.

Opinion: When there’s a divergence between cash and accounting profits, investors tend to give much more weight to the cash figure. That said if you believe management, the Mar 2026F forecasts could be too cautious and MANO could make sense as part of a diversified portfolio, as it offers uncorrelated risk and returns. Investors have struggled to value this sector, rightly sceptical of fair value accounting. Burford is up +50% since October while RBGP (formerly Rosenblatt) is hitting new lows, down -64% over the same time period. Uncorrelated risk and returns indeed.

Somero FY Dec profit warning

This concrete screed company strikes me as an interesting example of a cyclical company, trading on an ostensibly attractive valuation, but where the chart looks terrible and the pressure on forecasts is downwards. The share price has fallen from a peak of 590p at the beginning of 2022 and has been weak as investors have worried about headwinds in the construction industry. Last week’s RNS mentions higher interest rates and tighter bank lending standards, and to a lesser extent trouble getting approval for construction projects in the US, resulting in project delays. Although the company is global, c. 75% of sales come from the USA. Fortunately (given the weak China macro-data) management decided to close down their China operations a couple of years ago, so the other exposures are mainly Europe and Australia.

Management now expects FY Dec 2023F revenue will be approximately $120m, implying a -10% fall from FY Dec 2022 revenue of $134m. They talk about a 15-20% fall in H1, implying a pick-up in H2, based on the increased availability of a new machine, the snappily named S-22EZ. That seems very “glass half full” to me, my view is that the effects of more cautious bank lending and higher interest rates are yet to be felt. The share price fell -14% on the morning of the RNS.

Forecasts: Management are suggesting a miss versus consensus of -12% on the revenue line and -16% on the adj EBITDA line. Normally I would expect to see a steeper profit decline for a company with a gross margin in the mid-50s, however, management is responding to the slowing demand by cutting operational costs by -10%. Year end cash forecast at $32m is actually $1m better than previously expected, due to reduced working capital needs.

Valuation: The shares are trading on 8x PER 2023F after FinnCap cut EPS by -17%. Cash is 15% of the market cap, which ought to provide some reassurance. FinnCap their broker are forecasting a dividend of 27c in 2023 (down from 50c in 2021), which puts the shares on a forecast yield of 7.3%.

Opinion: I bought this in 2015, and am regretting not selling 18 months ago. During the financial crisis, Somero’s revenues fell for three years in a row, from $66m FY Dec 2007 to $21m FY Dec 2010. That’s more than a 2/3 decline, so I can see why investors might sell first and ask questions later. In the short term, I would imagine that the outlook could deteriorate further, as the USA is not even in a recession. If we see a couple of years of revenue declines it is not impossible to imagine that the share price could fall another -50% from here.

That said, I own SOM (almost) “for free” as my original entry price was 124p in 2015, and at the current exchange rate, I have received 116p in cumulative dividends. I can’t see the company burning through all of their cash, so I am prepared to wait and would be keen to add to my position when the recession has blown itself out.

Hotel Chocolate FY Jun profit warning

Hotel Chocolat warned last week that it would make an FY Jun loss, despite sales being in line with expectations (£202m according to the company).

The product is premium priced, with more cacao and less sugar than the supermarket and corner shop chocolate. Cacao is about five times as expensive as sugar. I think margins have come under pressure looking at the cocoa futures price (CJ-FM) which is up +25% YTD. In other words, HOTC seems to be struggling to pass on the rising commodity prices, despite being vertically integrated with its own cocoa plantation in Saint Lucia.

As recently as March, HOTC had been expecting to make a profit of between £4m and £7m. They also expect FY June 2024F to be below current market expectations. It sounds like weakness will continue into the following year, as management have “clarified” that for FY June 2025F guidance for the target of 20% pre-IFRS EBITDA to be achieved towards the end of the year, with the full benefits being achieved through FY June 2026F.

The company raised £40m of new equity in July 2021 at 355p to support growth and international expansion in the USA and Japan. Management then reversed course a year later, without it being particularly clear what has gone wrong. That said, because of the equity raise at a favourable (to HOTC) valuation they still have £19m of cash, down from £28m at the end of December.

Valuation: Richard looked at HOTC valuation at the beginning of the pandemic when lease adjusted RoCE was 12.6%. Assuming that earnings eventually recover to that level would imply PBT of around £20m, which sounds more credible than management’s aspiration for 20% EBITDA margin pre-IFRS 16, which would have equated to c. £30m PBT. Historically the company achieved a peak EBITDA margin of 16% in FY Jun 2018. Taxing £20m of PBT at 25% would imply a PER multiple of 8x following last week’s profit warning.

Opinion: Chocolate brands are supposed to do well in inflationary times, as consumers are prepared to pay for affordable treats, while they cut back on higher priced items like electrical white goods or holidays.

That theory doesn’t seem to be working in practice though; I’ve also noticed that tobacco companies like BATS and IMB, which normally are viewed as stagflation-proof, have done badly since mid-October last year. On the other hand, Coca-Cola (KO) and Fevertree Drinks (FEVR) are on a 24x and 65x PER respectively, despite the price of sugar rising +29% YTD (ie more than cacao).

Best of the Best FY Apr results and takeover

This online car competition business was a pandemic winner, with revenue peaking at £46m FY Apr 2021 but similar to computer games companies, has suffered as customers have spent more time outside socialising in the sunshine. The decline continues this year with FY Apr 2023 revenue down -24% to £26m. Management responded by cutting costs, so PBT was up +8% to £5.5m.

In September last year, Globe Invest Limited (GIL), a Teddy Sagi vehicle, bought a 29.9% stake in the Company at 400p per share and signed of a letter of Intent to enter into a Licensing and Distribution Agreement and a Marketing and Collaboration Agreement. I commented in February that having Teddy Sagi on the shareholder register is not necessarily a positive for minority shareholders. To be clear, he hasn’t done anything wrong, however, the Israeli billionaire’s interests are not perhaps aligned with other shareholders. GIL has announced a cash offer for BOTB at a price of 535p per ordinary share, that represents a discount to the 555p which the shares were trading at before the announcement.

William Hindmarsh, who founded the company in 1999, banked £41m for himself and his family when the company did a placing at £24 per share in March 2021. Rupert Garton, the commercial director, received £12m at the same time. There was then a profit warning in August 2021, and the shares collapsed to 850p, then troughed at 376p at the beginning of this year.

Valuation: The bid values BOTB at less than 9x FY Apr 2024F PER, and 1.7x forecast sales, which seems too cheap for a company with a strong track record, notwithstanding the post pandemic decline. I tend to take broker target prices with a grain of salt, but the last piece of research I can see on FinnCap’s research portal shows a 990p target price. The GIL bid probably undervalues the shares, regardless of the August 2021 and Jan 2022 profit warnings, in my view.

Opinion: Having made tens of millions, I can understand the founder wanting to take a step back. I commented with KAPE, that Teddy Sagi was de-listing the shares on a single-digit PER multiple, just when the business finally was on a roll. He seems to have spotted a similar opportunity with BOTB, it’s a shame the Israeli billionaire appears unwilling to share more of the upside with ordinary shareholders. If readers know of any other AIM listed companies where he is on the shareholder register, please do post in the chat, as I can imagine the same scenario might play out again.

Notes

The author owns shares in Somero and Burford

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.