Bruce suggests that if you’re looking for uncorrelated investment returns, you are better to invest your own money, rather than give it to a poker-playing long-short hedge fund manager. Stocks covered BGO, KWS and DUKE.

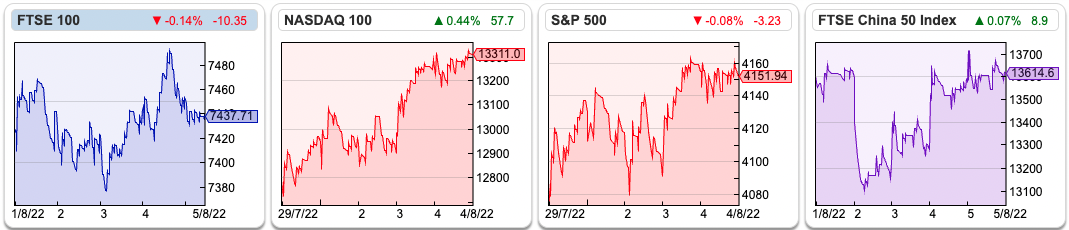

The FTSE 100 was flat last week at 7,438. The Nasdaq100 continued to show good momentum +2.9%, but the S&P500 was only up +0.5%. Brent crude was down -7% last week to $97 per barrel. Despite there being much talk of energy prices driving inflation, the oil price is down -24% from its peak of $128 per barrel in early March, just after Putin invaded Ukraine. The US 10y government bond yield was 2.7%, with the 10yr – 2-year spread still c. 35bp negative (normally a sign of impending recession).

The Bank of England raised interest rates by 0.5% to 1.75%, and suggested inflation would now peak at 13% in Q4 this year. The BoE is now forecasting a 15-month recession: Q4 this year and all of next year. Household disposable income is expected to fall sharply in 2022 and 2023. UK 10-year gilt yield was 1.88%. While the US Central Bank has yet to admit that raising rates will cause a recession, the BoE has put in writing what the bond markets have already been telling us for a couple of months.

To cheer readers up, here’s a fun FT article about long short hedge funds losing money. This strategy did very well in the 2000-2003 sell-off but then struggled in the 2007-9 financial crisis and the funds are once again being battered. It’s reassuring to know that hedge funds run by professional finance types, that were supposed to generate uncorrelated returns, have not done any better than low-cost index trackers and probably underperformed many amateur investors too.

At Pali (the broker run by a couple of US billionaires I wrote about here) we used to speak to many long-short funds. As a broker, it can be difficult to reach clients on the phone, and the solution Pali management had, was to encourage us to spend our Thursday and Friday evenings on the pavement outside the Golden Lion pub, on King Street in St James’s, next door to Brevan Howard’s offices or a restaurant/bar called Just St James’s on the corner of the same road. The latter was an impressive building, that used to be a bank (of course) full of marble, but the restaurant didn’t survive financial crisis.

It was much easier to talk with these hedge fund managers face to face over a beer than reach them on the phone. Working at Pali was certainly more fun than working at a French bank. To a certain extent, this is still TP ICAP, the interdealer broker’s, business model. I couldn’t help noticing though how similar all the hedge fund types were, very bright and driven, but they all seemed to think the same way. Pali used to organise a well-attended poker night, and pre-financial crisis it seemed like you couldn’t join a hedge fund unless you played poker.

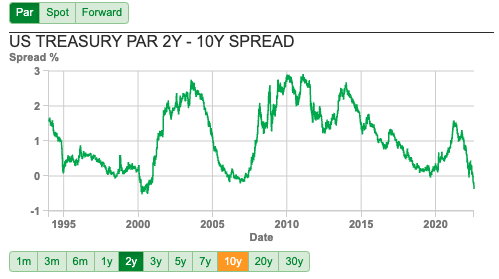

The hedgies all had offices in Mayfair, a form of costly signalling. Presumably, if a hedge fund had had offices in Hoxton (much closer to the City) then the natural assumption would be ‘well, they can’t be any good at managing money, because their offices are in the wrong place.’ That always struck me as troubling, because although they thought of themselves as risk takers; an anthropologist would note how trapped by the conventions they were (same office location, same dress sense, same backgrounds and experience, same investment strategies, same portfolios). Howard Marks put up this simple 2×2 matrix to explain the situation.

Being contrarian doesn’t guarantee you will outperform. Marks, who manages $160bn of assets at Oaktree explains it thus:

If your behaviour and that of your managers is conventional, you’re likely to get conventional results – either good or bad. Only if the behaviour is unconventional is your performance likely to be unconventional …and only if the judgments are superior is your performance likely to be above average.

This is not a new insight, as this quote from JM Keynes shows:

A ‘sound’ banker, alas! is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him.

The reason that herding behaviour persists over time, is that it is safer to fail in an orthodox way. Secondly, in the face of uncertainty, it’s natural human psychology to be guided by the behaviour of others, particularly if those others convey a successful image and are confident in their beliefs. The nature of uncertainty and imperfect information though is that the confident individuals who lead the crowd are as likely to be wrong as anyone else. I always thought that if I started a hedge fund, I’d have the offices in Slough or maybe somewhere by the seaside. I would wear ostentatiously unfashionable shoes and market my office location as a physical demonstration of contrarian thinking – and for precisely that reason I would struggle to persuade any wealthy people or feeder funds to back me.

I’m not surprised that many long-short hedge funds have performed poorly during the recent market sell off. You’ll see more diversity of opinion on Sharepad’s chat function – and if you do find yourself disagreeing with someone else, that’s probably a good thing.

2022 has been a difficult year for investing and may get worse. If you can enjoy thinking for yourself, learn from mistakes and don’t be too worried about orthodoxy and conventions then hopefully it’s not been too bad. Using a tool like Sharepad to generate your own ideas seems much more rational than copying others. Here’s an interview with Cockney Rebel and Michael Taylor, who are both comfortable following their own process and neither fit the St James’s stereotype.

This week I look at Direct Carrier Billing company Bango, computer game localisation Keyword Studios and Duke Royalty.

Bango H1 June Trading Update

This Direct Carrier Billing (DCB) company, with a long history of losses, has put out a trading update for H1. They haven’t said when H1 results will be released, but last year it was early September. A company as complicated as HSBC with revenues of $50bn can release Half Year results in early August, so I’m not sure why it takes BGO so long. I suppose life would be very boring if all companies released results in the first two weeks of August, then no updates until the following year.

H1 revenue growth was +9% to $10.8m, and they point out that they have suffered from having a strong dollar as a reporting currency (Yen is down -15%, Euro down -8%). They don’t give a profit figure, but adj EBITDA has fallen by -7% to $2.6m. There’s some subtle phraseology in the RNS: “the Board is confident Bango will comfortably meet the full year analyst consensus revenue and adjusted EBITDA forecasts for FY22.”

No mention of PBT in that sentence! The shares were down -7% in response to the RNS, which also provides a link to analyst consensus on the BGO website, showing PBT of $670K is forecast for this year, rising to $3.6m Dec 2023F and $7.5m Dec 2024F. I think that they are signalling that while revenue +28% to $26.4m FY Dec 2022F should still be achieved, and adj EBITDA of $8.2m (implying H2 is more than the double H1 figure) that the group may not make any profits at a statutory level. Year-end cash is forecast to be $11m Dec this year, doubling to $22m in Dec 2024F.

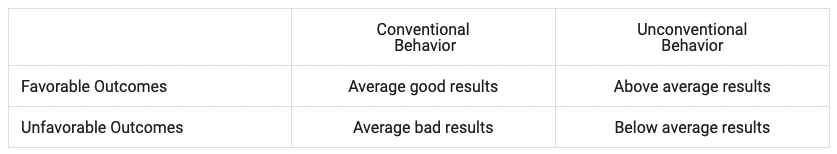

Activity: Similar to Boku last week, Bango is a DCB payment platform that allows mobile users to pay for items (mostly digital content, rather than physical products) with their mobile phone without the need for a credit card or bank account. Instead, users are charged to their mobile phone bill and BGO takes a small percentage of End User Spend (EUS). However, Bango doesn’t have the relationships that Boku has, so BGO’s model is to help smaller app developers target their audience to sell their apps.

Bango packages data that it collects from processing billions of dollars of payments and creates ‘Audiences’ which are users that have paid for a similar type of app in the past. The app developers, select the segment of paying users they wish to target – for example: people who play strategy games in Indonesia – and Bango creates a specific “Audience” of users who spend money in that target segment. Bango applies this Audience to the app developer’s online marketing campaign via platforms such as Facebook & TikTok.

This won’t be for everyone, but I do think it’s worth looking at companies with a long history of losses that are just about to break even and are forecast to achieve strong profit growth. The chart shows that with the exception of FY Dec 2022 when the group made a small profit, they’ve been loss-making all the way back to 2003. A couple of my CSFB telco/tech research analyst contacts were fans several years ago, but I’ve no idea if they still hold it.

Valuation: The only trouble is that despite nearly 20 years of losses, BGO still trades on 6x FY Dec 2022F sales, that drops to 4x sales two years later. On a PER of 19x FY Dec 2024F. If they can deliver on the +25% CAGR revenue growth and that growth is sustainable for a few more years, then this could move from ‘expensive, blue sky, jam tomorrow’ investment case to Growth at a Reasonable Price (GaRP) share.

Opinion: I think DCB is an interesting model to keep an eye on. The trouble is, neither Boku nor Bango look cheap on conventional metrics. If I had to choose, I would prefer Boku, which has more cash following the disposal of their identity business and does seem to have a good ‘moat’ in its core DCB business and perhaps an opportunity in mobile wallets. I don’t own either at the moment though.

Keywords Studio H1 June Trading Update

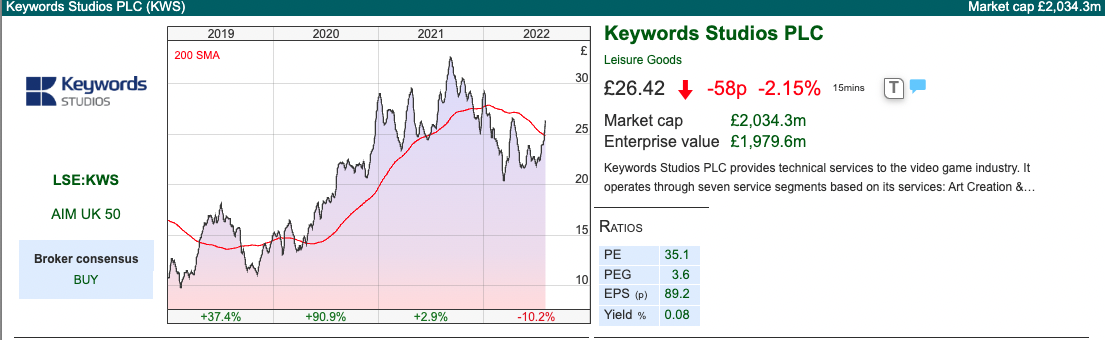

This localisation and computer games support services company announced a ‘comfortably ahead’ of FY Dec expectations RNS. Given the acquisitive nature of the group, I have some sympathy with them not being able to put out H1 results in August. They’ve made around 70 acquisitions since they IPO’ed in 2013. Last week they announced they’d bought Mighty Games Group for AUD$10m maximum consideration and that Forgotten Empires LLC ($32.5m maximum consideration, announced at the time of their Capital Markets Day in early June) had completed.

On an organic basis, revenues were up +22% in H1. They talk about organic growth and margins moderating to c. +15%. That compares to margins of 17% in H1 2022. They report in Euros, but earn a substantial amount of revenue in US dollars. PBT of €54m +35% y-o-y, has enjoyed a c.1% benefit from dollar strength. I feel like the sentence about +15% growth and margins, is deliberately vague, are they implying organic growth is going to slow to +8% in H2? It strikes me that management could clearly state what expectations are that they are comfortably ahead of, and perhaps they are choosing not to in order to have some ‘wiggle room’? Organic growth has fluctuated between +10% in 2018 and rising to +19% in 2021.

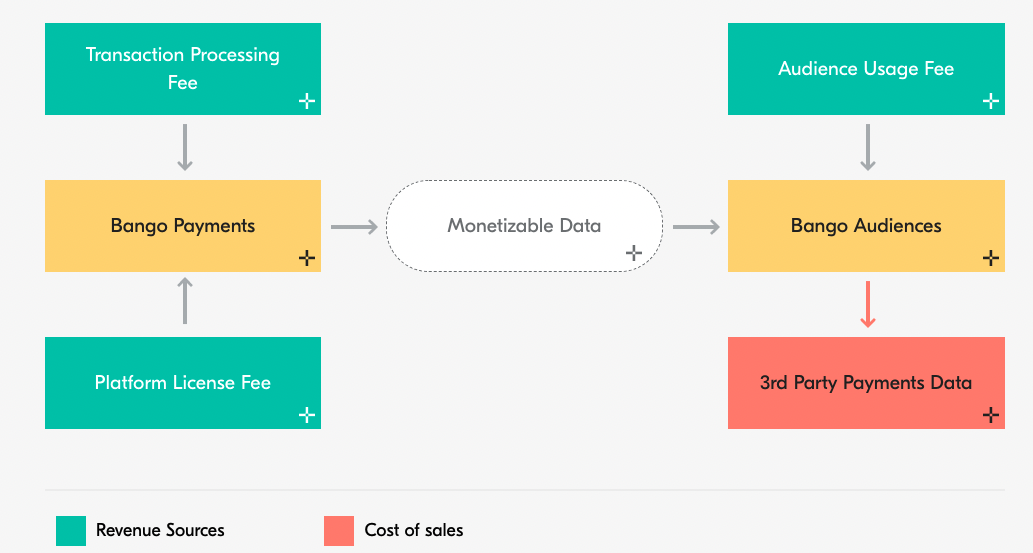

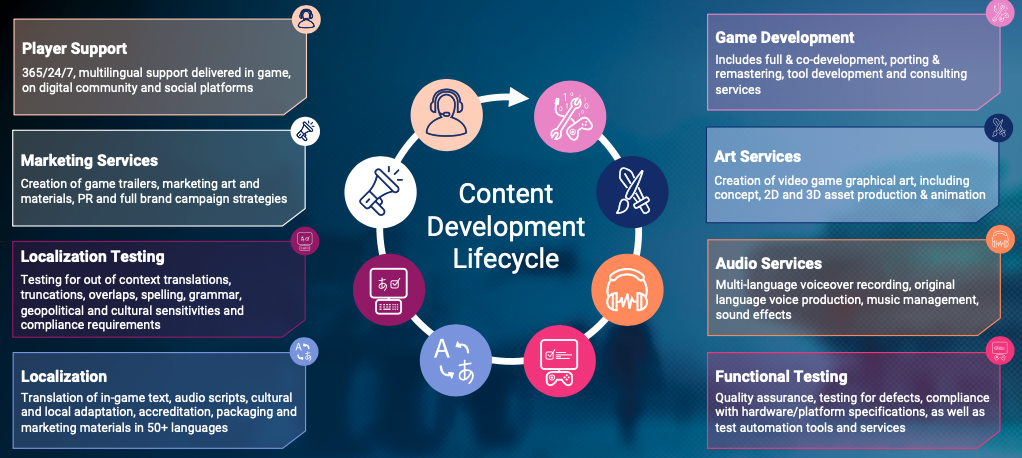

The company held a Capital Markets Day at the start of June. Often this can be a precursor to a fundraising or large acquisition, however, KWS had €121m of net cash at the end of June and €150m of undrawn Revolving Credit Facility (RCF). I’ve taken the slide below from the CMD presentation to show that KWS has now gone well beyond their original business of localisation and translation, providing art services, marketing, player support and similar:

They now work with 23 of the top 25 games companies by revenue and 10 of the top 10 publishers for mobile. That’s important because mobile tends to have a different business model of ‘free to play’ supplemented by game purchases – there’s some concern that the large console publishers missed an opportunity because they couldn’t see how that model could work. KWS seems to be agnostic and can benefit from both traditional console and PC game markets and mobile, the latter has been the growth area.

The total market is around $240bn, of which $35bn is spent on video game content and $11bn is outsourced. So although KWS has grown revenues to $512bn FY Dec 2021, the market is still highly fragmented and there’s plenty more room for growth. Keywords say in their presentation that the outsourced game services market is currently growing at c. +10% per annum (compared to the group’s +15% organic growth rate).

Valuation: The shares are trading on 32x PER FY Dec 2022F falling to 27x FY Dec 2024F. I note that Sharepad shows 3-year average RoCE is 12.5% and CRoCI is 8.9%, so that PER rating is asking a lot. The past decade investors have been willing to pay high multiples for growth, but I do wonder if rising interest rates will mean that multiples for companies like KWS will contract.

Opinion: One of my worst ‘sell’ decisions ever. I bought them at below £2 and sold at £8 – because I thought the shares were expensive and was worried about the challenges of managing a global organisation of creative types. I thought I was being conservative but the shares then doubled, then doubled again to peak at £32. Well done to management for proving me wrong.

Duke Royalty Q1 June Trading Update

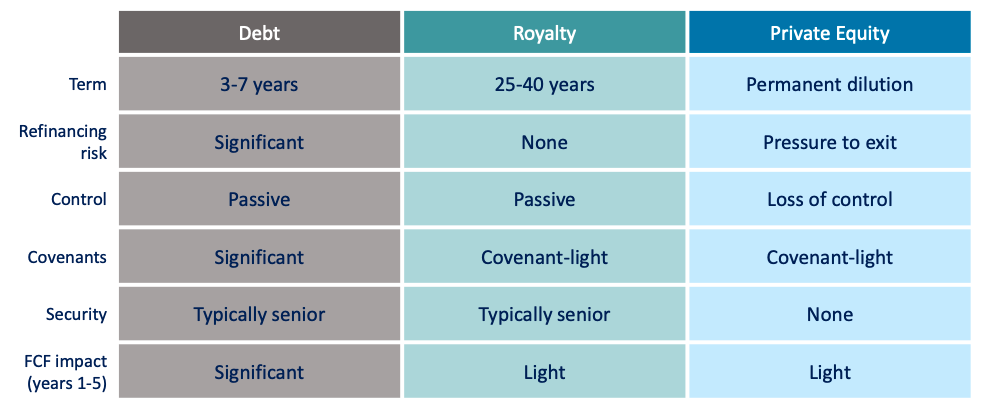

This royalty finance company with a March year-end announced normalised Q1 (Apr-Jun) revenue of £5.1m, that’s a +78% increase on Q1 last year. On a sequential basis (ie Q1 v Q4) revenue increased +9%. The ‘normalised’ revenue figure they quote excludes cash gains on sales (which seems sensible) and redemptions premiums (the borrower can redeem the royalty at the initial principal plus c.20% buyout premium.) Royalty financing is an attractive option to private companies that are in need of capital to grow but whose owners wish to maintain equity control of their business. Below is the slide management put up to explain how royalty financing compares with debt and private equity financing.

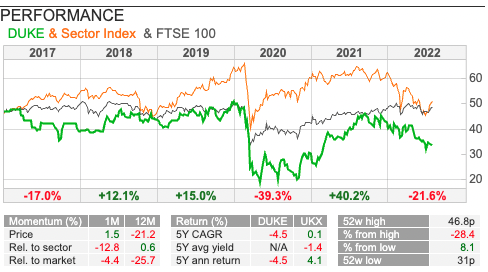

Sharepad shows an attractive dividend yield of 7.3%. I have pointed out previously that this is not a typical yield stock paying out excess capital, instead, management needs to come back to investors for more money to fund growth. So management are paying out a dividend with one hand, but I said a couple of years ago they will ask for capital back with the other hand. Sure enough, they paid out £9m in dividends over the last couple of years, but have raised £55m cumulatively from investors in April 2021 and May this year, both at a placing price 35p. That £55m represents 65% of the starting market cap, which rather puts the 7% annual dividend yield into context. There’s no deception, management are open about what they are doing, but the investment proposition is different from say Somero (yield 6%) or Games Workshop (4% yield) which both pay out excess cash and can fund growth from internal resources.

That said, the growth has been impressive. Duke listed on AIM reversing into a cash shell in March 2016 at 40p, valuing the company at £18m. The market cap is now £139m, 8x higher and revenue has increased 11x from less than £2m in FY Mar 2018 to £18.4m FY Mar 2022. Duke is now financing 48 separate businesses across Europe.

They’ve announced the quarterly revenue figures in last week’s RNS, but this is another company that takes a long time to release final results, with a full p&l, cash flow and balance sheet. Last year FY Mar 2021 results were released in September.

Valuation: The shares are trading on a PER 10x FY Mar 2023F falling to 9x the following year. P/NTAV is 1.0x for an RoE of 8.2%. That’s theoretically correct, a company just about making its cost of equity is only worth book value, even if the growth has been very strong. However, it’s worth pondering if this business scales in the same way as a fund manager like Impax AM (growing revenue, fixed costs therefore operational gearing) meaning increasing returns and higher RoE as it grows larger. Alternatively, it could scale like a bank, not enjoying much benefit from scale and just becoming riskier as it grows larger – as demonstrated by Fred Goodwin.

Opinion: The shares sold off steeply at the beginning of the pandemic, hitting a low of 18p. It strikes me that we are at a risky point in the cycle to own a speciality finance company. As noted in the intro the Bank of England is talking about the UK being in recession for all of 2023. If I had to own a company providing finance to SMEs, I think I would go for Funding Circle, which has less risk on its balance sheet but has sold off very steeply as investors have questioned the viability of their model. Neither investment case looks particularly attractive at the moment though.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 08/08/22|BGO, KWS, DUKE|The orthodoxy of St James’s

Bruce suggests that if you’re looking for uncorrelated investment returns, you are better to invest your own money, rather than give it to a poker-playing long-short hedge fund manager. Stocks covered BGO, KWS and DUKE.

The FTSE 100 was flat last week at 7,438. The Nasdaq100 continued to show good momentum +2.9%, but the S&P500 was only up +0.5%. Brent crude was down -7% last week to $97 per barrel. Despite there being much talk of energy prices driving inflation, the oil price is down -24% from its peak of $128 per barrel in early March, just after Putin invaded Ukraine. The US 10y government bond yield was 2.7%, with the 10yr – 2-year spread still c. 35bp negative (normally a sign of impending recession).

The Bank of England raised interest rates by 0.5% to 1.75%, and suggested inflation would now peak at 13% in Q4 this year. The BoE is now forecasting a 15-month recession: Q4 this year and all of next year. Household disposable income is expected to fall sharply in 2022 and 2023. UK 10-year gilt yield was 1.88%. While the US Central Bank has yet to admit that raising rates will cause a recession, the BoE has put in writing what the bond markets have already been telling us for a couple of months.

To cheer readers up, here’s a fun FT article about long short hedge funds losing money. This strategy did very well in the 2000-2003 sell-off but then struggled in the 2007-9 financial crisis and the funds are once again being battered. It’s reassuring to know that hedge funds run by professional finance types, that were supposed to generate uncorrelated returns, have not done any better than low-cost index trackers and probably underperformed many amateur investors too.

At Pali (the broker run by a couple of US billionaires I wrote about here) we used to speak to many long-short funds. As a broker, it can be difficult to reach clients on the phone, and the solution Pali management had, was to encourage us to spend our Thursday and Friday evenings on the pavement outside the Golden Lion pub, on King Street in St James’s, next door to Brevan Howard’s offices or a restaurant/bar called Just St James’s on the corner of the same road. The latter was an impressive building, that used to be a bank (of course) full of marble, but the restaurant didn’t survive financial crisis.

It was much easier to talk with these hedge fund managers face to face over a beer than reach them on the phone. Working at Pali was certainly more fun than working at a French bank. To a certain extent, this is still TP ICAP, the interdealer broker’s, business model. I couldn’t help noticing though how similar all the hedge fund types were, very bright and driven, but they all seemed to think the same way. Pali used to organise a well-attended poker night, and pre-financial crisis it seemed like you couldn’t join a hedge fund unless you played poker.

The hedgies all had offices in Mayfair, a form of costly signalling. Presumably, if a hedge fund had had offices in Hoxton (much closer to the City) then the natural assumption would be ‘well, they can’t be any good at managing money, because their offices are in the wrong place.’ That always struck me as troubling, because although they thought of themselves as risk takers; an anthropologist would note how trapped by the conventions they were (same office location, same dress sense, same backgrounds and experience, same investment strategies, same portfolios). Howard Marks put up this simple 2×2 matrix to explain the situation.

Being contrarian doesn’t guarantee you will outperform. Marks, who manages $160bn of assets at Oaktree explains it thus:

If your behaviour and that of your managers is conventional, you’re likely to get conventional results – either good or bad. Only if the behaviour is unconventional is your performance likely to be unconventional …and only if the judgments are superior is your performance likely to be above average.

This is not a new insight, as this quote from JM Keynes shows:

A ‘sound’ banker, alas! is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him.

The reason that herding behaviour persists over time, is that it is safer to fail in an orthodox way. Secondly, in the face of uncertainty, it’s natural human psychology to be guided by the behaviour of others, particularly if those others convey a successful image and are confident in their beliefs. The nature of uncertainty and imperfect information though is that the confident individuals who lead the crowd are as likely to be wrong as anyone else. I always thought that if I started a hedge fund, I’d have the offices in Slough or maybe somewhere by the seaside. I would wear ostentatiously unfashionable shoes and market my office location as a physical demonstration of contrarian thinking – and for precisely that reason I would struggle to persuade any wealthy people or feeder funds to back me.

I’m not surprised that many long-short hedge funds have performed poorly during the recent market sell off. You’ll see more diversity of opinion on Sharepad’s chat function – and if you do find yourself disagreeing with someone else, that’s probably a good thing.

2022 has been a difficult year for investing and may get worse. If you can enjoy thinking for yourself, learn from mistakes and don’t be too worried about orthodoxy and conventions then hopefully it’s not been too bad. Using a tool like Sharepad to generate your own ideas seems much more rational than copying others. Here’s an interview with Cockney Rebel and Michael Taylor, who are both comfortable following their own process and neither fit the St James’s stereotype.

This week I look at Direct Carrier Billing company Bango, computer game localisation Keyword Studios and Duke Royalty.

Bango H1 June Trading Update

This Direct Carrier Billing (DCB) company, with a long history of losses, has put out a trading update for H1. They haven’t said when H1 results will be released, but last year it was early September. A company as complicated as HSBC with revenues of $50bn can release Half Year results in early August, so I’m not sure why it takes BGO so long. I suppose life would be very boring if all companies released results in the first two weeks of August, then no updates until the following year.

H1 revenue growth was +9% to $10.8m, and they point out that they have suffered from having a strong dollar as a reporting currency (Yen is down -15%, Euro down -8%). They don’t give a profit figure, but adj EBITDA has fallen by -7% to $2.6m. There’s some subtle phraseology in the RNS: “the Board is confident Bango will comfortably meet the full year analyst consensus revenue and adjusted EBITDA forecasts for FY22.”

No mention of PBT in that sentence! The shares were down -7% in response to the RNS, which also provides a link to analyst consensus on the BGO website, showing PBT of $670K is forecast for this year, rising to $3.6m Dec 2023F and $7.5m Dec 2024F. I think that they are signalling that while revenue +28% to $26.4m FY Dec 2022F should still be achieved, and adj EBITDA of $8.2m (implying H2 is more than the double H1 figure) that the group may not make any profits at a statutory level. Year-end cash is forecast to be $11m Dec this year, doubling to $22m in Dec 2024F.

Activity: Similar to Boku last week, Bango is a DCB payment platform that allows mobile users to pay for items (mostly digital content, rather than physical products) with their mobile phone without the need for a credit card or bank account. Instead, users are charged to their mobile phone bill and BGO takes a small percentage of End User Spend (EUS). However, Bango doesn’t have the relationships that Boku has, so BGO’s model is to help smaller app developers target their audience to sell their apps.

Bango packages data that it collects from processing billions of dollars of payments and creates ‘Audiences’ which are users that have paid for a similar type of app in the past. The app developers, select the segment of paying users they wish to target – for example: people who play strategy games in Indonesia – and Bango creates a specific “Audience” of users who spend money in that target segment. Bango applies this Audience to the app developer’s online marketing campaign via platforms such as Facebook & TikTok.

This won’t be for everyone, but I do think it’s worth looking at companies with a long history of losses that are just about to break even and are forecast to achieve strong profit growth. The chart shows that with the exception of FY Dec 2022 when the group made a small profit, they’ve been loss-making all the way back to 2003. A couple of my CSFB telco/tech research analyst contacts were fans several years ago, but I’ve no idea if they still hold it.

Valuation: The only trouble is that despite nearly 20 years of losses, BGO still trades on 6x FY Dec 2022F sales, that drops to 4x sales two years later. On a PER of 19x FY Dec 2024F. If they can deliver on the +25% CAGR revenue growth and that growth is sustainable for a few more years, then this could move from ‘expensive, blue sky, jam tomorrow’ investment case to Growth at a Reasonable Price (GaRP) share.

Opinion: I think DCB is an interesting model to keep an eye on. The trouble is, neither Boku nor Bango look cheap on conventional metrics. If I had to choose, I would prefer Boku, which has more cash following the disposal of their identity business and does seem to have a good ‘moat’ in its core DCB business and perhaps an opportunity in mobile wallets. I don’t own either at the moment though.

Keywords Studio H1 June Trading Update

This localisation and computer games support services company announced a ‘comfortably ahead’ of FY Dec expectations RNS. Given the acquisitive nature of the group, I have some sympathy with them not being able to put out H1 results in August. They’ve made around 70 acquisitions since they IPO’ed in 2013. Last week they announced they’d bought Mighty Games Group for AUD$10m maximum consideration and that Forgotten Empires LLC ($32.5m maximum consideration, announced at the time of their Capital Markets Day in early June) had completed.

On an organic basis, revenues were up +22% in H1. They talk about organic growth and margins moderating to c. +15%. That compares to margins of 17% in H1 2022. They report in Euros, but earn a substantial amount of revenue in US dollars. PBT of €54m +35% y-o-y, has enjoyed a c.1% benefit from dollar strength. I feel like the sentence about +15% growth and margins, is deliberately vague, are they implying organic growth is going to slow to +8% in H2? It strikes me that management could clearly state what expectations are that they are comfortably ahead of, and perhaps they are choosing not to in order to have some ‘wiggle room’? Organic growth has fluctuated between +10% in 2018 and rising to +19% in 2021.

The company held a Capital Markets Day at the start of June. Often this can be a precursor to a fundraising or large acquisition, however, KWS had €121m of net cash at the end of June and €150m of undrawn Revolving Credit Facility (RCF). I’ve taken the slide below from the CMD presentation to show that KWS has now gone well beyond their original business of localisation and translation, providing art services, marketing, player support and similar:

They now work with 23 of the top 25 games companies by revenue and 10 of the top 10 publishers for mobile. That’s important because mobile tends to have a different business model of ‘free to play’ supplemented by game purchases – there’s some concern that the large console publishers missed an opportunity because they couldn’t see how that model could work. KWS seems to be agnostic and can benefit from both traditional console and PC game markets and mobile, the latter has been the growth area.

The total market is around $240bn, of which $35bn is spent on video game content and $11bn is outsourced. So although KWS has grown revenues to $512bn FY Dec 2021, the market is still highly fragmented and there’s plenty more room for growth. Keywords say in their presentation that the outsourced game services market is currently growing at c. +10% per annum (compared to the group’s +15% organic growth rate).

Valuation: The shares are trading on 32x PER FY Dec 2022F falling to 27x FY Dec 2024F. I note that Sharepad shows 3-year average RoCE is 12.5% and CRoCI is 8.9%, so that PER rating is asking a lot. The past decade investors have been willing to pay high multiples for growth, but I do wonder if rising interest rates will mean that multiples for companies like KWS will contract.

Opinion: One of my worst ‘sell’ decisions ever. I bought them at below £2 and sold at £8 – because I thought the shares were expensive and was worried about the challenges of managing a global organisation of creative types. I thought I was being conservative but the shares then doubled, then doubled again to peak at £32. Well done to management for proving me wrong.

Duke Royalty Q1 June Trading Update

This royalty finance company with a March year-end announced normalised Q1 (Apr-Jun) revenue of £5.1m, that’s a +78% increase on Q1 last year. On a sequential basis (ie Q1 v Q4) revenue increased +9%. The ‘normalised’ revenue figure they quote excludes cash gains on sales (which seems sensible) and redemptions premiums (the borrower can redeem the royalty at the initial principal plus c.20% buyout premium.) Royalty financing is an attractive option to private companies that are in need of capital to grow but whose owners wish to maintain equity control of their business. Below is the slide management put up to explain how royalty financing compares with debt and private equity financing.

Sharepad shows an attractive dividend yield of 7.3%. I have pointed out previously that this is not a typical yield stock paying out excess capital, instead, management needs to come back to investors for more money to fund growth. So management are paying out a dividend with one hand, but I said a couple of years ago they will ask for capital back with the other hand. Sure enough, they paid out £9m in dividends over the last couple of years, but have raised £55m cumulatively from investors in April 2021 and May this year, both at a placing price 35p. That £55m represents 65% of the starting market cap, which rather puts the 7% annual dividend yield into context. There’s no deception, management are open about what they are doing, but the investment proposition is different from say Somero (yield 6%) or Games Workshop (4% yield) which both pay out excess cash and can fund growth from internal resources.

That said, the growth has been impressive. Duke listed on AIM reversing into a cash shell in March 2016 at 40p, valuing the company at £18m. The market cap is now £139m, 8x higher and revenue has increased 11x from less than £2m in FY Mar 2018 to £18.4m FY Mar 2022. Duke is now financing 48 separate businesses across Europe.

They’ve announced the quarterly revenue figures in last week’s RNS, but this is another company that takes a long time to release final results, with a full p&l, cash flow and balance sheet. Last year FY Mar 2021 results were released in September.

Valuation: The shares are trading on a PER 10x FY Mar 2023F falling to 9x the following year. P/NTAV is 1.0x for an RoE of 8.2%. That’s theoretically correct, a company just about making its cost of equity is only worth book value, even if the growth has been very strong. However, it’s worth pondering if this business scales in the same way as a fund manager like Impax AM (growing revenue, fixed costs therefore operational gearing) meaning increasing returns and higher RoE as it grows larger. Alternatively, it could scale like a bank, not enjoying much benefit from scale and just becoming riskier as it grows larger – as demonstrated by Fred Goodwin.

Opinion: The shares sold off steeply at the beginning of the pandemic, hitting a low of 18p. It strikes me that we are at a risky point in the cycle to own a speciality finance company. As noted in the intro the Bank of England is talking about the UK being in recession for all of 2023. If I had to own a company providing finance to SMEs, I think I would go for Funding Circle, which has less risk on its balance sheet but has sold off very steeply as investors have questioned the viability of their model. Neither investment case looks particularly attractive at the moment though.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.