Although I am much more of a trader myself as I rely on trading profits to pay my bills, I do think investors have much to be gained learning from the art of short selling stocks. There are several reasons that will be explained in this article, but first it is important to understand what exactly shorting is.

What is shorting

Put simply, shorting is selling something you don’t own with the obligation of returning it back at a later date. How can you sell something you don’t own? Well, first the stock needs to be borrowed from somewhere in order to sell it.

To explain shorting a little better – imagine that I borrowed your mobile phone and sold it at the pawn shop for £100. Despite me selling it, I would still owe you the same mobile phone whenever you wished for it to be returned.

Fast forward a year, and your mobile phone manufacturer has churned out a new model en masse, and the price of your model has dropped 20% to £80. I decide to buy the mobile phone back, and return it to you – settling my obligation to give back what I had borrowed from you.

We can see how that through selling and buying back at a lower price I have pocketed £20 despite never owning the asset (the mobile phone) in the first place.

Now, let’s say that the new model turned out to be a complete flop as reliability issues were a huge problem, and everyone believed that the penultimate model (your model) was vastly better. If this belief then pushed the price to £150 I would still be obliged to return the mobile phone and so I would need to buy back what I had sold and return it – this time at a loss of £50.

But what if your model was scarce, and I had to pay £300 to buy the mobile back? That means I’m 200% in the hole! I only stood to gain £100 maximum, as the maximum any asset can fall is 100%, but I’ve now had to stump up several times what I owe to settle my obligation. I’ve lost more than what I originally bet.

Imagine that! Hypothetically, one’s losses when shorting are unlimited. But that really isn’t the case.

Due to new ESMA regulation, all retail spread bet accounts are protected by not being allowed to go into negative equity. There are tougher margin restrictions now, but when shorting in the UK, unless you’re listed as a professional, your maximum loss is 100%.

Why does shorting get a bad reputation?

This psychological fear of “unlimited losses” is partly to blame for the distrust toward short selling stocks. People say “I’m not a natural shorter”, and I get that people don’t feel comfortable, but I’m not a natural trader. I had to read lots of books, make my own mistakes, and put the time in required to be able to do what I do. Sadly, I wasn’t born a natural trader. I had to learn it – and anyone can.

Anyone can learn to short sell stocks – in essence you are literally betting on the underlying asset to go up or down. We’re looking at lines on a chart. It’s nothing more or less, and that’s all there is to it, really.

Shorting also gets a bad rep because people believe that short selling is bad and value destructive. I can see that point – certainly brokers who short sell stocks on the basis of insider information and then use the placings to cover, despite the fact that there is supposed to be a Chinese wall (a Chinese wall prevents price sensitive information crossing over from one department to another – if the trading desk knew of a placing then they would be incentivised to trade on it!), or people who take a short position then either ‘leak’ or make up negative stories (e.g. that the company is about to do a placing i.e. issue more shares) rumour to encourage people to sell is wrong.

But what about simply taking the other side of the trade? If you like a business, you may go long of it. If you don’t like the business, and think it’s terrible, then you might be inclined to go short of it.

Having a bear view can definitely provide a tonic to the rampant bullishness which is often found in various stocks. Arguably, a market that bans any opposing views is not really a market at all.

Why is shorting good?

Shorting offers an alternative opinion. You might not like it, but a world where only one view prevails leads to one big groupthink. You may’ve seen it on bulletin boards, where opposing views are stamped out, and you may also have seen London listed CEOs call for a ban on shorting.

This is odd, because a business that can be affected by shorting is not a viable business – it’s a cash raising story-telling business. What’s the best way to raise cash? Create a good story and ramp it to high heaven. This pumps up valuations to levels way above their intrinsic value, and therein lies the opportunity for bears.

It makes little sense to go after profitable and self-sustaining business, unless those very profits are dubious as in the case of Muddy Waters’ short attack on Burford Capital recently. An investor in a well-run business who has done their homework has nothing to worry about. Shorting brings balance to the market.

Why does shorting matter to investors?

I believe that investors would benefit from understanding the process of shorting stocks. There are several reasons for this. Firstly, shorting identifies low quality businesses. Whereas investors might find low quality businesses as a result of looking for high quality businesses, shorters actively seek out rubbish.

If you know the signs to look out for, for example, lack of profits being converted into cash, deteriorating revenue and margins, an increase in supply of the stock that has been suppressing the price, then it can help one be aware of the signs in their own investments. It’s certainly better to sell too early than to sell too late.

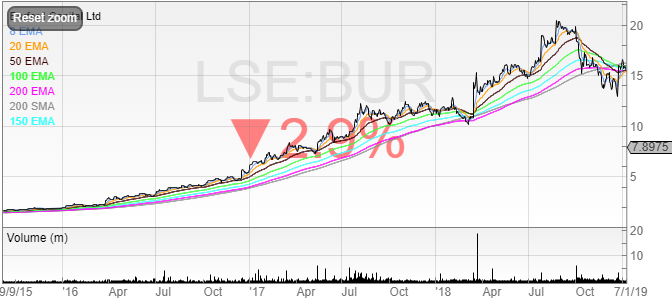

Consider Burford Capital. A few weeks ago it was the darling of the market. My tweet that I would be shorting the stock if it broke the key level most likely did not go down too well at the time, but within a week the stock had collapsed 70%. I couldn’t have known that Muddy Waters would launch a devastating broadside on the stock, but the signs were there.

Let’s take a look at the chart.

Burford Capital had a fantastic run from 2015 all the way through to the start of 2019, with the stock appearing to falter (as many stocks and not only darlings did) in October 2018. However, Burford Capital continued to struggle.

It slipped below all of the moving averages, and for months did not set a new high. This was the first warning. Stocks that do not set new highs and consolidate for an extended period of time are possible stage three candidates.

We looked at the four stages of a stock in my last article, and those who read it could have picked up that Burford was not acting too healthily.

All of the moving averages were now starting to point downwards, and the stock had found resistance at the 200 simple moving average.

On the release of what seemed excellent news, the stock gapped up and promptly dumped hard on large volume. That was a clear sign that institutions were unwinding positions, and this told me that if I want to trade the trend of the large money then I need to be short. This was another sign that investors should’ve considered to reduce their position or exit the stock completely.

It looked like the trend was changing, and all that was needed was a confirmation of a break of support. Unfortunately, that support was broken, and not long after the infamous report was released.

Finding shorts with SharePad

To find shorts, we want to find stocks making all-time lows, 52 week lows, and again we look at volumes. This is because the 52 week low filter will show us stocks that are making lows but have not yet broken down into an all-time low.

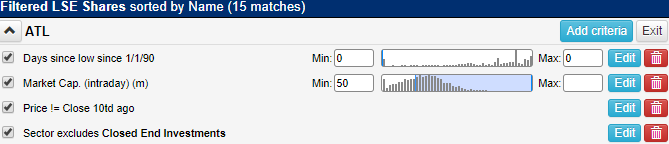

(You can run this screen for yourself by selecting the “Michael Taylor 30/08/19: ATL” filter within SharePad’s Filter Library. Simply go to: Filter -> Apply filter -> Library)

To search for all time lows, we want to create a filter to search for that. I have included a market cap criterion too, because I don’t want to be shorting stocks below £50m. This is because of illiquidity. When shorting, we don’t want stocks that are too illiquid because then the spread is so wide.

It doesn’t matter how big the market cap is to me when shorting, because stocks tend to fall faster than they rise. As they say, greed climbs a wall of worry, but fear takes the express elevator downwards.

Whilst it is true that the maximum gain is 100% when shorting, we want to be shorting higher up rather than when the stock has fallen considerably. This is because when we are shorting closer towards the start of a move then we are protecting ourselves.

Shorting a company worth £50 million and a company worth £300 million is completely different. To lose 100% of our company the small company need only increase £50 million of value, whereas the latter would need to find £300 million of value. The larger the company, the lower our risk of large wipe-out as we are protecting ourselves with its size.

Again, I have included the price not equal to the price ten days ago criterion. This is because I don’t want illiquid stocks that haven’t moved, and I’ve also excluded Closed End Investments again for the same reason – I don’t want to see them.

Using this filter will generate a multitude of stocks that are now trading at their all-time lows. We may not want to short them straight away, but it will give us some ideas of stocks that – if they rebound – we can short them as they break that low level.

Just like in breakouts, we want to be shorting at the last point of resistance, or in this case, support.

Here is a recent example of a stock that popped up on my ATL filter a few weeks ago:

Card Factory was another one, that I highlighted in my shorting guide.

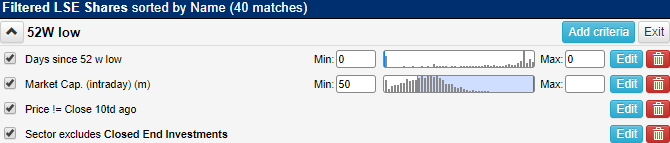

Searching 52 week lows

By filtering for 52 week lows we find stocks that are trending downwards but have not yet broken their all-time low. These stocks offer an opportunity to find trades that are approaching the last level of support.

(You can run this screen for yourself by selecting the “Michael Taylor 30/08/19: 52W low” filter within SharePad’s Filter Library. Simply go to: Filter -> Apply filter -> Library)

We’ll see more stocks appear in this filter, because 52 week low does not mean necessarily mean the all-time low. A stock can be at the all-time low and obviously be a 52 week low too – but it’s not true the other way around.

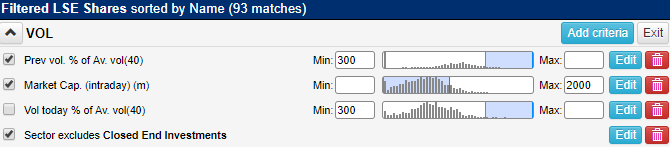

Again, we want to be looking at volume. This filter has been modified slightly since the last article as searching for “previous volume” was searching for the previous day, and not the last trading session.

To correct this, I have added a “Vol today” criterion, which, if used on the same day, will show the results of that day’s trading session.

(You can run this screen for yourself including the optional ‘Vol today’ criteria by selecting the “Michael Taylor 26/07/19: VOL” filter within SharePad’s Filter Library. Simply go to: Filter -> Apply filter -> Library)

Volumes speak volumes in my opinion, as wherever there is an increase of shares swapping hands then it’s clear that there is demand in doing business at that level. This can mark levels as significant resistance or support, or show that there is a potential change in trend, up or down.

Another great thing about volume is that it will show any profit warnings that have been missed from the RNS feed, as volumes will be higher that day. This then gives me the heads up to trade the bounce (but that is for another article).

The narrative can provide the idea

Very often, just as long ideas can be picked up on in everyday life, so too can short ideas.

Superdry stores always empty? The clothes aren’t fashionable anymore, and the only person who wears it is your Dad’s friend who thinks he’s the epitome of cool? Take a look at the chart.

It’s not doing great, and if the chart breaks that low not seen since 2012 then that would offer a nice risk/reward trade.

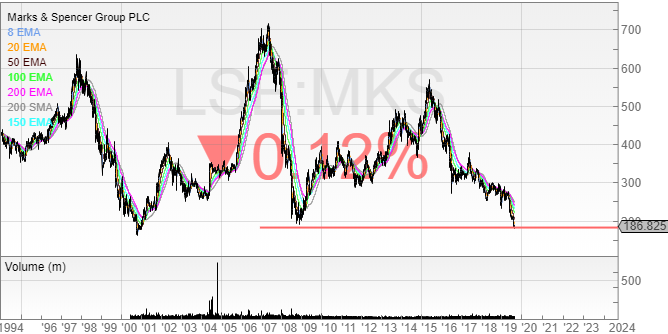

Marks & Spencer – terrible clothes? Overpriced stores, and a shop only your Great Grandma liked?

Identifying the narrative can find the idea, but we must rely on the chart for all of our decisions. Marks & Spencer is now trading near extremely significant lows, and if that level breaks at 183p then it has a long way to fall. It’s a company worth $4 billion at the moment, but what could it be in a year or two?

Domino’s Pizza (DOM)

Domino’s Pizza. A master franchisor, selling delicious pizzas. Or is it? First of all, the pizzas are terribly overpriced. In fact, I don’t know a single person who has ever purchased a pizza that was full price (if that’s you – sorry, you’re a sucker).

At least Domino’s is doing well because of the profits their franchisees make. Or are they? Actually, most of Domino’s profits come from selling ingredients to their franchisees. Not the actual profits from the pizzas.

Now, that’s a headscratcher. If Domino’s make most of their profit on product then how is it any different to Herbalife? Herbalife is a global health nutrition company that makes most of its profits from selling products to distributors and then recruiting more downstream distributors to sell product to, who then repeat the cycle. Herbal life was subject to sustained interest from shorters. It sounds like a ponzi scheme (I’m not going to say that it is because I don’t want to get sued – I’ll leave that decision to you – but Bill Ackman did say it in Netflix’s Betting on Zero).

I don’t believe that Domino’s is dodgy, but I do believe they have problems.

The company has clearly enjoyed the first mover advantage, but it now owns 54% of the market. How much more can it grow? With increased competition, a lack of a real moat, and pressure on consumer discretionary spend, the narrative is there.

Domino’s wants to split territories and increase more units, but that is going to upset franchisees and cannibalise sales.

Let’s look a bit closer.

We can clearly see from technical analysis that the trend is now down, the stock is well off its highs, and we are seeing the stock bounce off that level repeatedly at 220p.

That level has now become significant, and a break of it would tell me that the trend has changed. Investors should be asking themselves serious questions here. What is the risk/reward at this price now looking like? The business is at risk of going ex-growth, and the story a few years ago of rapid expansion is no longer the case. As a shorter, both the narrative and the technical analysis are marrying up, and I’ll be short if that level breaks.

Towards the end of the Dotcom bubble prices were sustained by true believers and dreamers, who were willing to bid up a stock several fold if it even mentioned the world “internet” – even though many analysts were highly sceptical if those forecasted future cash flows would ever materialise.

Many tried to short the market and lost their shirts because they were too early, and they learned at great cost that trying to call tops is an expensive hobby. This put many a trader out of business even though in the fullness of time they were indeed correct.

As the famous economist John Maynard Keynes is supposed to have said: “Markets can stay irrational longer than you can stay solvent”.

Conclusion

Understanding how a shorter thinks can benefit investors. Knowing what they look for, and why, can help investors to identify the clues that the business may be changing for the worse and that the technical analysis is suggesting to sell.

Prices always move for a reason. We might not know what that reason is, but we’ll find out (as was the case with Burford) soon enough. Ignore the chart at your own peril.

Michael Taylor

If you enjoyed this article, Michael has written more articles and a free book on investing in the UK stock market, available to download from his website at www.shiftingshares.com. The website itself is a free resource which he hopes both traders and investors will find useful, along with summaries of relevant stock market related books.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.