Bruce remembers a former colleague, who preferred face to face interactions and was rarely at his desk during the afternoon (clue: he wasn’t in the metaverse either). Plus comments on Standard Chartered, HeiQ and Franchise Brand’s bid for Filta.

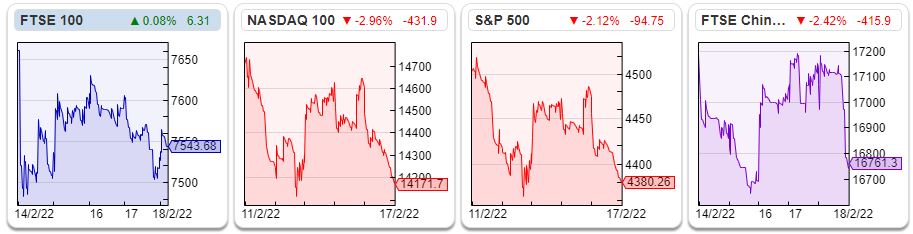

The FTSE was down -1.5% to 7,543 last week. The Nasdaq100 was down -0.6% and the S&P500 was down -0.9% following some big moves in the AdTech sector after Google announced that they would limit tracking data. This means that less data will be shared with advertisers across Android devices, as part of its “Privacy Sandbox” initiative. The changes won’t be made for 2 years, but share prices reacted with the likes of Digital Turbine selling off more than -10% before recovering to finish the week down only -1%. In the last 3 months Tremor has fallen -15% and The Trade Desk is now down -25%.

The US 10Y bond yield held its level above 2%, while the price of oil, as measured by Brent Crude was $90 per barrel. More surprising, given the fears of war in Ukraine, is that gold at $1,862 per ounce, is up just +2% so far this year.

I heard last week that a former work colleague has died. I first worked with Dr Kevin Lapwood, at ING and a few years later he offered me a job at Seymour Pierce (a firm also sadly no longer here), then Capital Access (a financial PR firm). Kevin had a prodigious ability to drink alcohol, and would disappear after lunch, leaving his jacket draped over his chair. But unlike most people alcohol seem to improve his ability to listen and soak up information – when a Head of Research complained that he wasn’t at his desk in the afternoon, he explained as if to a toddler: “Look! The company spend all this money having an expensive office on London Wall, yet you want people to stay chained to their desks, even if they’re just doing their shopping on Amazon. The City of London is a financial centre because people leave the office and mix face to face.”

Pandemic notwithstanding, that observation still holds true and you wouldn’t find Lappers working for a bank in the Metaverse.

Though I have passed the Chartered Financial Analyst exams, I learnt much more useful knowledge from Kevin discussing financial analysis in the pub. I assume that if he had stayed at his desk in the afternoon, and had a more subservient view toward management hierarchy, then he would have earned larger bonuses and retired early. But that conventional measure of success ignores that he genuinely enjoyed the broking lifestyle. His most recent note was last month, on Hydrogen Utopia, which converts plastic waste into hydrogen and is listed on Aquis Exchange. So farewell Kevin. I hope as the pandemic wanes we seen more face-to-face events in pubs and restaurants, like this one in the West Midlands.

This week I revisit the investment case on HeiQ, following the steep share price falls in the second half of last year. Plus the recommended offer for Filta, from Franchise Brands, but I start with Standard Chartered, the first UK bank to report FY results.

Bank results have become beyond parody. Last Friday NatWest RNS led with the headline:

“Income across the UK and RBSI retail and commercial businesses, excluding notable items, increased by 1.4% compared with 2020 principally reflecting balance sheet growth although this was offset by a 61.5% reduction in NatWest markets income.”

I’ll try to simplify things and produce a summary of what’s going on next week, but there’s always a chance that my head explodes.

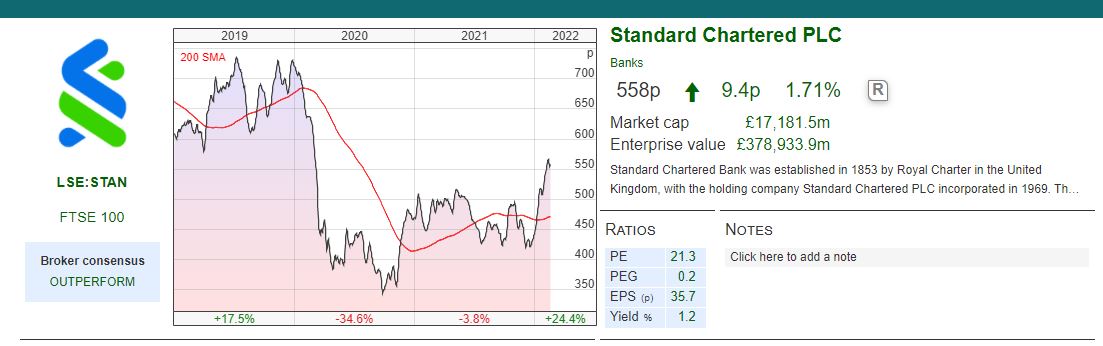

Standard Chartered FY Dec results

Standard Chartered, which earns 80% of its profit from Asia (mainly Hong Kong, Singapore, Korea and India) reported FY results last Thursday. The Annual Report is almost 500 pages long, another indication just how complicated banks have become. It’s possible that they’ve hidden some bad stuff in note 40, on page 428, related party transactions in the Marshall Islands, that an analyst will discover in a month’s time.

The shares were up +25% since the start of the year, but these results disappointed with the price falling -5% on the morning of the RNS, before then recovering lost ground. The share price reaction suggests initial disappointment with the weak Q4 numbers, with Net Interest Margin down to 1.19%, credit trading falling -50% Q4-v-Q4 2020 and higher impairments leading to a statutory Q4 loss of $208m (v analyst expectations of Q4 $288m profit).

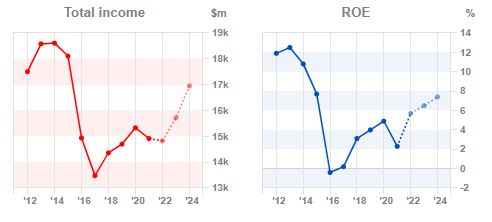

Reported v targets STAN are targeting 8-10% revenue growth (of which roughly a third will be driven by rising inflation and interest rates, and two thirds underlying performance) out to 2024F. That compares to a 1% decline in revenue FY 2021 and a 3% increase in costs on a constant currency basis. FY underlying PBT was up +61% to $3.9bn, helped by an 89% reduction in the credit impairment charge from 2020 (what used to be called bad debts) to $263m.

Their other target is 10% Return on Tangible Equity by 2024F versus 6.0% at the FY 2021 (NatWest reported 9.4% RoTE helped by a £1.3bn impairment release). If STAN can sustain that level of return then that would imply that the shares ought to be trading on tangible book value of $12.77 (or 945p at today’s exchange rate) +80% upside to today’s share price.

China Exposure One thing to note is that though Sharepad shows 40.8% of income comes from China and North Asia, the bulk of this is Hong Kong rather than mainland China. HK revenue was $3.4bn FY 2021 (23% of group total versus 7% for Mainland China). At $1.2bn underlying PBT, STAN makes 8x more profit in Hong Kong than China.

That said the bank has $4bn of direct exposure to China Commercial Real Estate counterparties (that’s 1.3% of total loans, but 10% of tangible equity.) $3.1bn of this exposure is to property developers whose cashflows have been particularly impacted by Chinese Govt policy changes to deleverage the property sector. As a result of what they call “ongoing uncertainties affecting this sector”, management took a $95m credit impairment.

They also own a 16% stake in China Bohai Bank, worth $1.9bn on STAN’s balance sheet. This bank IPO’ed in July 2020 and the HK bank’s share price is at 52 week lows and the current market cap of $4.1bn USD (32bn Hong Kong dollars) implies that the stake is now worth c. $660m versus $1.9bn on STAN’s balance sheet. In itself that’s not significant enough to cause problems, but it does make you wonder what other assets the bank might not be writing down to market value. There could be other more significant effects from a slowdown in China and large write offs. In total credit impaired loans are currently 2.7% of gross loans to customers $304bn.

Share buyback They announced a $750m buyback and the FY dividend increasing +33% from 2020 to 12 cents per share ($350m), giving a dividend yield of 1.7%. They expect to return more than $5bn (or 23% of the current market cap) to shareholders over the next three years in the form of dividends and buybacks.

Opinion Central Banks raising interest rates from their very low levels ought to benefit banks’ net interest margins, as long as credit risk doesn’t cause problems. Investors in London listed banks face a choice between the Scylla of UK residential property exposure (Barclays, Lloyds, NatWest) versus the Charybdis of China exposure (STAN, HSBC). We will be able to compare progress by the end of next week.

HeiQ

This Swiss headquartered textiles and materials company, that sells chemicals and consumer goods, announced a partnership with Hugo boss, to support development of a cellulose yarn called HeiQ AeoniQ. I commented last October that a brief scan of the company’s “News” tab on SharePad shows plenty of RNS’s about partnerships, contract wins and small acquisitions but no trading update saying that the market’s expectations were too high, until the warning in late September when the share price fell almost 40%.

Last week’s RNS says that Directors expect FY Dec results to be “well in line” with market expectations (Progressive are forecasting FY Dec 2021F revenue of $51m and adj PBT of $3.3m). The share price was up +8% on the morning of the RNS.

Arguably this RNS does contain market sensitive information, because it says that Hugo Boss is investing $5m into HeiQ’s subsidiary, which values the subsidiary at $200m. That compares to a market cap of £120m (or $165m) for all of HeiQ. Hugo Boss will also invest a further $4m, subject to completion of specific project milestones and they also own a call option that means they can buy more of HeiQ AeoniQ LLC at the same implied valuation as the initial equity investment. The second half of the RNS said that the LYCRA Company whose history goes back to 1958 and owns the Lycra trademark, has acquired the rights to act as exclusive distributor for HeiQ AeoniQ, paying a low single-digit million fee to HeiQ.

I’m sure that HeiQ management would like us to believe that if the subsidiary is worth $200m, then the whole of HeiQ should be more than that $200m valuation. The problem with this is that as we saw with THG and Softbank’s call option to buy a 19.9% stake in THG’s Ingenuity subsidiary for $1.6bn, it’s relatively easy to invest a small amount to imply large valuation. But investors treated this “call option implied valuation” with a large amount of scepticism, THG’s current market cap is £1.6bn, so it’s very hard to see why Softbank would exercise its right to buy less than 20% of THG’s subsidiary for $1.6bn.

HeiQ anticipates delivering the first HeiQ AeoniQ yarns in H2 2022. It does sound like an impressive substitute for polyester and nylon, which rely on the oil industry and take centuries to degrade. HeiQ AeoniQ material is expected to consume 99% less water than cotton and is designed to be recyclable, rather than ending up in landfill.

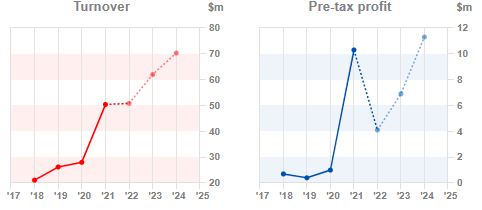

Broker forecasts Progressive Research’s most recently published forecasts are for $51m revenue FY 2021, growing +22% this year and +13% next year. Adj PBT is forecast to fall from $11.5m 2020 to $3.3m 2021F following the group’s profit warning last year. That implies 2c EPS 2021F, doubling to 4c EPS 2022F and 7c in 2023F.

Valuation The shares are trading on 18x Progressive’s EPS 2023F estimates. Despite the sell off, that still seems rather high for a company that disappointed so badly six months ago. FY Dec results are scheduled for publication towards the end of April 2022. I do worry that if it takes four months to prepare results, the company does not have good financial reporting controls, the market cap is only £120m, so it really shouldn’t be that complicated. Even UK banks can report their results by the end of February.

Opinion I hope that HeiQ succeeds, because I think the fashion world does need more sustainable fabrics. The emphasis is on management to show that they can deliver what they say they can, and that will rebuild trust with investors over the next year or two. For me, it’s still an “avoid” now.

Filta / Franchise Brands acquisition

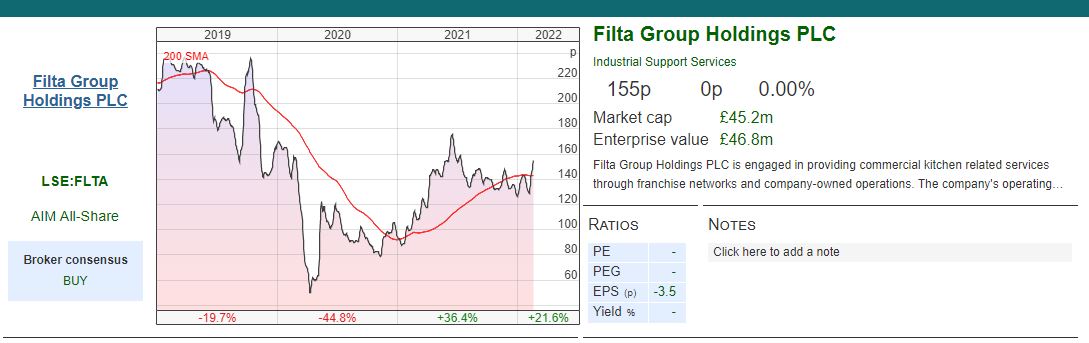

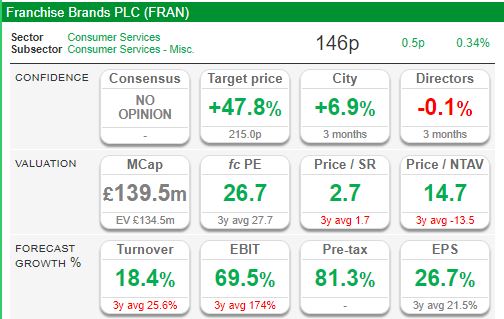

Filta, the franchise business that focuses on commercial kitchens, including re-cycling used cooking fat has received an all share offer from Franchise Brands. Filta shareholders receive 1.157 Franchise Brand shares (worth 147.5p on 15 Feb, the closing price before the deal was announced). That means that each Filta share (closing price 158.5p) receives approximately 171p or an 8% premium.

Filta shares are up +26% so far this year, and the press release points out that the premium is 30% if you take the FRAN volume weighted average price (VWAP) over the last 30 days. Gresham House AM, which owns 19.6% of Filta has given irrevocable undertakings to accept the offer, and in all 62% including Filta management, have given their irrevocable undertakings. They need 75% acceptance for this to go through, so I think that’s very likely.

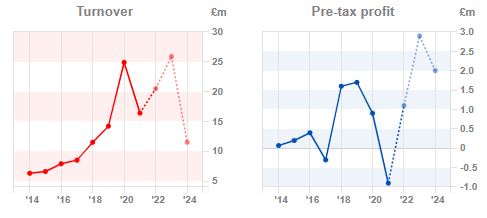

Valuation The deal values Filta at £50m market cap. That is 2.5x Filta’s forecast 2021F revenue and 50x 2021F post tax profit, though that drops to 20x 2022F. FLTA has struggled to make a profit through the pandemic, as it relies on commercial kitchens and people eating out – which obviously wasn’t happening during the various lockdowns. The charts below show Filta’s progress and forecast recovery in PBT; at first glance FRAN’s offer looks fair to both sides.

The RNS talks about cost savings, for example operational and administrative costs, plus the costs of being a public company (broker fees, payments to lawyers and AIM etc). If we assume 20% of Filta’s admin expenses of £7.5m might be cut, that gives £1.5m of savings (taxed and then capitalised at 20x) gives a synergy value of £20m. That is purely from cost savings, if Filta can grow revenue and also enjoy the operational gearing from the investment that FRAN management have put into their systems, then there could be additional benefits.

The other aspect of the deal is to note that FRAN management are using paper, not cash or debt. Before the deal was announced FRAN shares were trading on almost 30x forecast earnings, and 2.8x price to sales. So I think you can make the case that FRAN is trading on a premium rating and using its own paper as an acquisition currency makes sense.

Opinion According to the most recent trading statement Filta had £0.7m of net cash at the end of December, and FRAN had £9m of cash at the same time. I’m particularly wary of debt funded acquisitions, because I’ve seen so many go wrong. But there’s no debt, and this looks sensible and likely to go through. With any deal there’s execution risk, but I’ve been impressed by Franchise Brand’s management’s track record. I don’t own shares in either company, but I’ve had my eye on FRAN over the last year hoping that some price weakness might create a buying opportunity.

Bruce Packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bruce, I do enjoy your columns – they are excellent. I never knew Lappers, tho’ it sounds as though I would have liked him a lot. But your column reminded me of the untimely early death of another bon viveur (also of Seymour Pierce), namely Ratty. I miss his entertainment value.

Many years ago I invested in a new wonder material called Tencel, made from eucalyptus if memory serves. Where is it now?

Your work is very good and I appreciate you and hopping for some more informative posts. Thank you for sharing great information to us.

online casino real money