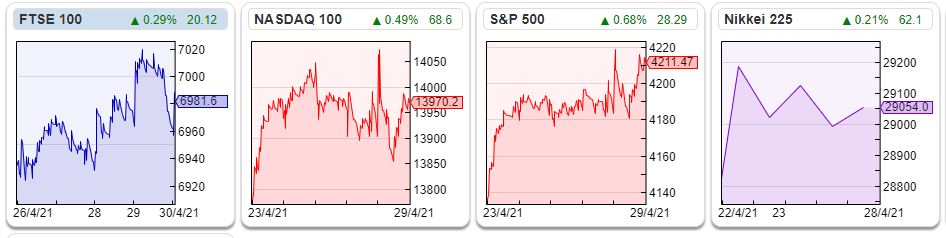

The FTSE 100 was flat this week, struggling to hold its level above 7,000. Nasdaq 100 also was flat at 13,970 with Facebook (+11% over the last 5 days) the best performing stock in the index after reporting Q1 results. Other US tech giants, Alphabet +7% Amazon +5%, and Microsoft -2% over the last 5 days, also reported impressive Q1 results. They are still benefitting from the effects of lockdowns, even as the virus continues to decline in most geographies.

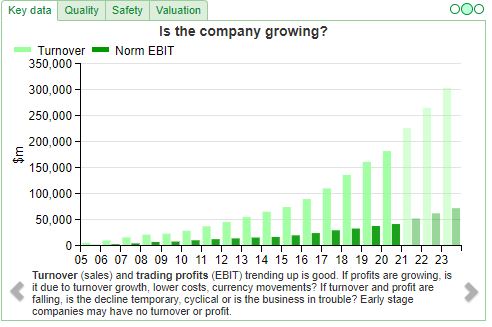

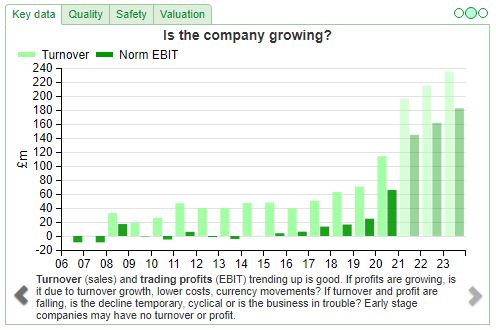

Alphabet (previously known as Google) saw Q1 revenues rise to $55bn, +34% Q1 2021 vs Q1 last year. Diluted EPS was up +27% to $26 for the quarter. 58% of revenue still comes from their core search engine, but YouTube, Cloud and “other” are all growing strongly too. Alphabet’s long-term track record is remarkable, as the chart below shows.

Terry Smith on the other hand prefers Facebook to Alphabet, for the superior ROCE (25% v 17%) mainly because Mark Zuckerberg doesn’t fritter money away on “other bets” which lose Alphabet c. $5-6bn per annum and cloud computing which is also losing $5-6bn per annum. The social network reported Q1 revenues up +48% to $26bn and diluted EPS up +93% to $3.30. I’m surprised, I don’t spend much time on Facebook now. Despite the strong results, longer term there is some worry for Facebook that Apple’s new operating system update, which asks users if they would like to allow apps to track their behaviour, will damage the social network longer term. Google has already decided that it won’t track users’ activity across different apps, because it doesn’t need to. It already has huge amounts of data from its own apps (Search, Maps, Chrome, Gmail, YouTube), so it doesn’t rely on gathering data from others.

I came across an interesting essay by Ben Evans, formerly of Andreesen Horowitz and Mosaic Ventures*, on how to lose a monopoly. He argues cogently that many people are thinking about “moats” in the wrong way. IBM’s industry dominance did not decline because someone built a better mainframe, or even a better PC. Instead it declined because the economics of software were more attractive, and Microsoft were able to take advantage of this in the 1990s. Then in the noughties, Microsoft’s “moat” was not breached by direct competition – most workplaces still use Word, PowerPoint, Excel and Windows operating system – but power shifted all the same. Microsoft share price fell by 70% from the internet bubble high in 2000 to hit a trough of $16 per share in the aftermath of the financial crisis in 2009.

Microsoft lost out to Google (now Alphabet) and Apple, because the internet and iPhone shifted the landscape, making the moat irrelevant. It’s notable that all the phone makers like Nokia, Palm, and Blackberry maker Research in Motion also lost out to Apple and Google too. Back in the late 90s analysts used to talk about “paradigm shift”, a concept popularised by philosopher of science Thomas Kuhn, meaning a new way of looking at the same evidence, a Copernican revolution where people realised that the earth was not the centre of the universe, with the sun revolving round it. Ironically, referring to paradigm shifts has gone out of fashion now, but I think the concept is still enlightening; new data doesn’t change people’s minds, we just see the same evidence from a new perspective.

It took until mid-2016 for Microsoft to recover to its 2000 high point of $58 per share. Over these 16 years, revenue grew from $22bn and PBT from $14bn in 2000 to $91bn and $25bn in 2016, a CAGR in revenue of 9% and 4% in profits. The last 5 years have been much kinder, helped by themes such as cloud computing, and the shares are up 4.5x to $254 per share. This month they reported Q1 revenues +19% to $42bn and diluted EPS +45% to $2.03. The market cap is now $1.9 trillion. But despite that, no one worries too much about the world revolving around Microsoft any more.

This week I look at Tristel’s profit warning, Water Intelligence, HeiQ and Sylvania Platinum results. I think that it’s noteworthy that while US tech companies Alphabet, Facebook, Apple etc are publishing their Q1 updates, some companies on AIM are still publishing the FY Dec results. Water Intelligence is up +85% since the start of the year, and HeiQ is up +79% since its reverse listing in November last year. Nevertheless the fact that both companies take so long to update the market with a full Annual Report, causes me to raise one eyebrow.

Tristel profit warning year to June

This company that distributes chlorine dioxide to clean medical devices warned that sales in the UK have been hurt by lower activity levels in the NHS. There’s little sign of the trend reversing before the company’s June year end and as a consequence they anticipate PBT (before share-based payments) to be around £5m. That £5m compares to £3.4m in H1 and £7.1m in FY to June 2020 PBT, implying a 35% y-o-y fall on the same basis (share-based payments were £435K FY to June 2020). The company has £8m of cash and has committed to a FY dividend of 6.55p.

Looking out to the next financial year, they expect conditions in the UK to improve significantly. This does look like a temporary blip, with ENT, urology etc examinations where the product is used being cancelled due to the virus. However management have been cautious and guided their broker to cut forecasts for FY2022F PBT by 25%.

Historically the high valuation of this company P/E > 50x, Price / NAV > 10x has been justified by talk of expansion into the US market, ongoing since 2014. They say that they have intensified their focus on FDA and EPA regulatory programme and by year-end will have spent £750K on generating the data that US agencies require. I wrote up the company in more detail 6 months ago.

Forecasts Their broker, FinnCap, have cut revenue by 10% and PBT by 31% for FY June 2021F. Notwithstanding management talk of a recovery in the outlook statement – “we remain very confident that sales and profits growth will resume next year” – their broker also cut next year’s numbers. FinnCap cut forecast June 2022F revenue by 6% to £36m and adj PBT -25% to £6m. This gives EPS of 10.5p in 2022F putting the shares on 54x PER, even after the 16% fall in the share price on the morning of the results.

Opinion Profit warnings can provide a buying opportunity, if the problems are temporary. I think that’s the case here, but the problem I have with Tristel is that the shares were very expensive before the warning and, given the cut to next year’s numbers, remained very highly priced. If I was into shorting shares, the better way to play this I think would be to short Medica, which also relies on NHS activity (radiology). Medica shares are up +33% since the start of the year, but I wonder if Tristel’s warning could also be applied to Medica?

Water Intelligence Q1 update

This acquisitive US-based water leak detection business gave a Q1 update, with revenue up +38% to $11.4m, and statutory PBT up +152% to $1.66m. Amazing how when statutory profits are up strongly, companies don’t feel the need to talk about Adjusted EBITDA. That said, the company is buying back its franchises and last year bought back 8 companies, which flatters the reported growth. They haven’t given a figure ex acquisitions, so it’s possible that underlying operations are lacklustre, but is this masked by buying up their former franchises? The company has net debt of $0.5m on 31 March 2021 after having raised $5m (£3.8m) by issuing 808K shares at 475p in October last year. More recently the company has been buying back shares in March this year, at a price close to 600p. Issuing shares at a lower price, then buying them back less than 6 months later at a higher price doesn’t make sense to me.

Director Selling I commented here that Patrick Desouza the Chief Exec also sold £1.9m of shares at 475p “to meet demand from investors” in October. He still remains the largest shareholder, owning over a quarter of the company’s shares. He is also a major shareholder in “Plain Sight” which owns 14% of Water Intelligence.

Valuation On any valuation metric the shares are expensive. Sharepad shows Price/FCF of 35x and forecast PER of 42x FY 2021F. However the valuation ratio I find most troubling is the Price/Tangible book which is 26x. If this was a business growing revenues organically with high ROCE like Games Workshop, the valuation would make sense. Yet this is a business growing by acquisition.

Opinion I find it a little bit odd that the company can produce a Q1 update, but the FY 2020 Annual Report is not yet available on their website. The same goes for Warpaint, who last week announced FY Dec results after their Q1 update.

The 2019 Water Intelligence Annual Report shows a couple of related party transactions and that the company has been buying back franchises, paying around 1x sales versus the Group trading on AIM at 5x sales. I wonder if this growth strategy only works when the company is able to raise equity at a high multiple of tangible book? The company would then invest in assets at a much lower price, arbitraging public market valuation against low valuation for private companies. The shares are up +224% since the start of 2020.

HeiQ FY Dec Results

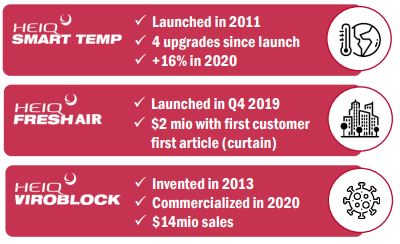

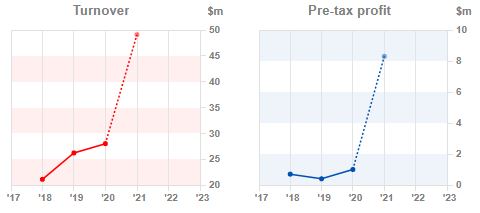

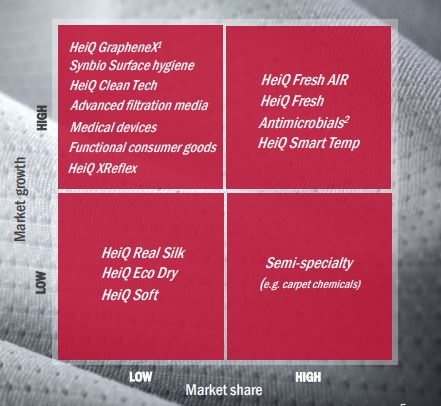

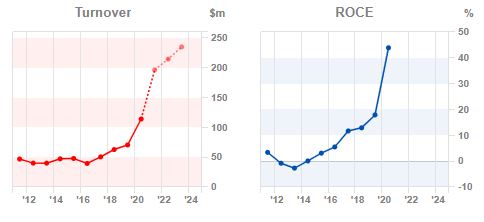

HeiQ, the Schlieren, Switzerland headquartered materials and textiles company, has announced their first set of annual results for FY to Dec as a listed company. They raised $20m and reversed into a listing on the Main Market of the LSE (but not a Premium Listing) in November last year at 112p. HeiQ have announced FY 2020 revenues up +80% to $50.4m and PBT of $7m (up from $1m 2019). Impressively those growth rates were all organic, though the company made acquisitions in Q1 in 2021. The medium term goal is to grow revenue to $300m, ie 6x higher than FY 2020.

The gross margin was up +7% to 56% which was driven by product mix and the company had net cash of $24.1m on the balance sheet at the December year end. As a reminder, the Company is not currently eligible for a Premium Listing under Chapter 6 of the Listing Rules, but did not explain in the prospectus any further details.

Management say that “HeiQ has long been cash generative and high margin”. Adjusted EBITDA increased by 5x to $14m. However cash generated from operating activities was just $1.1m because of an $8.2m increase in inventories and $5.2m increase in receivables. Leon Boros points out on Twitter that free cashflow was actually negative.

On 26th January the company announced that revenue “exceeded market expectations” and operating profit inline. Unusually for a positive update the shares fell -37%, from 237p to 150p following the RNS.

RNS but no Annual Report I’m frustrated that the company can put out a 27 page RNS, but the actual Annual Report with sections containing key audit matters, remuneration report etc is not yet available. I very much enjoyed Steve Clapham’s presentation at the last Mello, where he recommends a quick CTRL + F of the full Annual Report to look for phrases such as i) contingent liabilities ii) related party transactions iii) key audit matters. He then recommends if you’re confused by what the company is communicating on any of these subjects, go no further, stop reading and look at a different Annual Report.

I can understand companies that report results within a month or two of their year end taking longer to publish a full Annual Report on their website, but it seems odd that neither HeiQ nor Water Intelligence are able to publish an Annual Report after 4 months. I note both companies also have come to the UK markets from the US and Switzerland, countries with well-developed and liquid stock markets. Perhaps not a “red flag” but a yellow one?

Outlook statement Q1 is in line with expectations. They have an antivirus product called Viroblock, which they point to contract wins with industrial laundry companies. Cenkos their broker estimate the market for antiviral fabrics at $10bn, and the company reported Viroblock sales of $14m last year (or 28% of FY revenue). They’ve also bought a 51% stake in Chrisal, a Belgium biotech company for €7.5m in March, that makes consumer products with probiotics and synbiotics. Chrisal’s revenue was €5.5m FY 2020 and growing at +62% y-o-y.

Broker forecasts Their broker, Cenkos, put out an 18 page note following the results, increasing 2021F revenue by 14% to $57m though their EPS forecast only rose 2% for the same year, implying some margin pressure and also caused by issuing 1.1m of news shares at 196p for the Chrisal acquisition. The broker also released FY2022F forecasts, revenue up +15% to $66m and EPS +20% 9.09c$. This puts the company on 30x FY 2022F.

Shareholders The Chief Exec Carlo Centonze and a company he controls (Cortegrande) are the largest shareholders with 10.9%. Followed by Amati 6.8%, Miton owns 5.4%, Fidelity 4.2%. Murray Height, the company’s Australia head owns 6.3%

Management speak I listened into the Q&A on InvestorMeetCompany. Management said that trade receivables were high because their customers are based in Asia, where you typically find payment terms of 3 months. There were no material issues about being paid. They said that they were very prudent on inventories (which increased from $3m to $13m in 2020), they have made the strategic decision to increase inventories, because supply chains are very stretched. They anticipate similar levels of receivables and inventories at the end of 2021; they’d hoped for working capital inflows rather than outflows this year.

Opinion It’s in exciting areas: anti-viral fabrics, ESG, graphene, medical devices, patented products and now probiotics. For me though, there are a number of concerns i) lack of explanation why it doesn’t qualify for a Premium Listing ii) why is it on the London Stock Exchange not Zurich? iii) they describe themselves as cash generative, but not backed up by cashflow statement iv) no Annual Report yet. None of these by themselves seem significant, but cumulatively they do suggest caveat emptor.

Sylvania Platinum Q3 to March update

Sylvania, the low cost South African Platinum Group Metals (PGM) operator, which re-treats chrome tailings from mines, announced a Q3 update. Revenue was up +70% to $74.2m and Net Profit doubled to $41.3m. They ended the period with $102.1m of cash balances. The latter figure was somewhat concerning as cash from operations was $58.9 million, but changes in working capital reduced it by $17.1 million, as the company is finding it harder to get paid, as a result of the increase in price of non-Platinum metals in the basket (Rhodium and Palladium, but also Iridium and Ruthenium hit all-time highs in the last quarter).

Sylvania, the low cost South African Platinum Group Metals (PGM) operator, which re-treats chrome tailings from mines, announced a Q3 update. Revenue was up +70% to $74.2m and Net Profit doubled to $41.3m. They ended the period with $102.1m of cash balances. The latter figure was somewhat concerning as cash from operations was $58.9 million, but changes in working capital reduced it by $17.1 million, as the company is finding it harder to get paid, as a result of the increase in price of non-Platinum metals in the basket (Rhodium and Palladium, but also Iridium and Ruthenium hit all-time highs in the last quarter).

At the H1 stage the company saw a $32.4m increase in trade receivables “as a result of the increase in the gross basket price and the four-month payment pipeline in terms of the off-take agreements”. I asked for more details on an InvestorMeetCompany call on 23rd February, who the counterparties were and whether the receivables carried any credit risk. My question wasn’t answered on the call; it seemed like the Chief Exec, Jaco Prinsloo, was reading the questions off the screen, and when he came to one question he physically blanched, looked uncomfortable and deliberately skipped on to the next question. Or perhaps the body language could be a figment of my imagination? Adding the $32m increase in trade receivables for the first 6M of the year to the $17m working capital movement in Q3 suggest the trade debtors is a number to keep an eye on when the FY Annual Report comes out.

Opinion I own the shares and like the story about a lower cost producer in a commodity industry. There are a couple of concerns with country risk (and windfall mining taxes $33.5m payable in June 2021), working capital movements and Run of Mine (ie the raw material that Sylvania processes from host mines) down 30% in the quarter, which led to a fall in recovery efficiency. However, it feels like management are now in control of their own destiny and the $102m of cash (22% of the market cap) means that their balance sheet is rock solid. The shares are on a PE of 10x for a company reporting a ROCE of 44%, which suggests that the concerns are more than priced in.

Bruce Packard

Notes

The author owns shares in Sylvania

*Also checking his LinkedIn profile I discovered that Benedict Evans and I were at school together, but he was the year below me. I probably bullied him, and don’t remember.

Got some thoughts on this week’s commentary? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This post is very simple to read and appreciate without leaving any details out. Great work!

online casino provider