We have covered many aspects of trading in previous articles, such as Why You Should Be Using R, Exit Strategies, and How To Avoid Blowing Your Account, and having had conversations with recent traders it is clear that knowing your market in what you trade is a necessary criterion.

This article will introduce new traders to the UK’s London Stock Exchange and its various components, and how to navigate them.

Trading platforms

There are two trading platforms on the London Stock Exchange: SETS (which stands for Stock Exchange Electronic Trading System – yes, I know, it should really be SEETS), and SETSqx which is the same as SETS with Quotes and Crosses added on it. I’m not sure if the LSE thought it would be cool to use an ‘X’ to refer to ‘crosses’, but if they did – it’s not.

SETS

SETS is the London Stock Exchange’s flagship trading platform, and it allows us to place our orders directly onto the order book and provide liquidity to the market in a specific price and size. This can be done with any broker offering Direct Market Access, and how to do it is described in detail in my book.

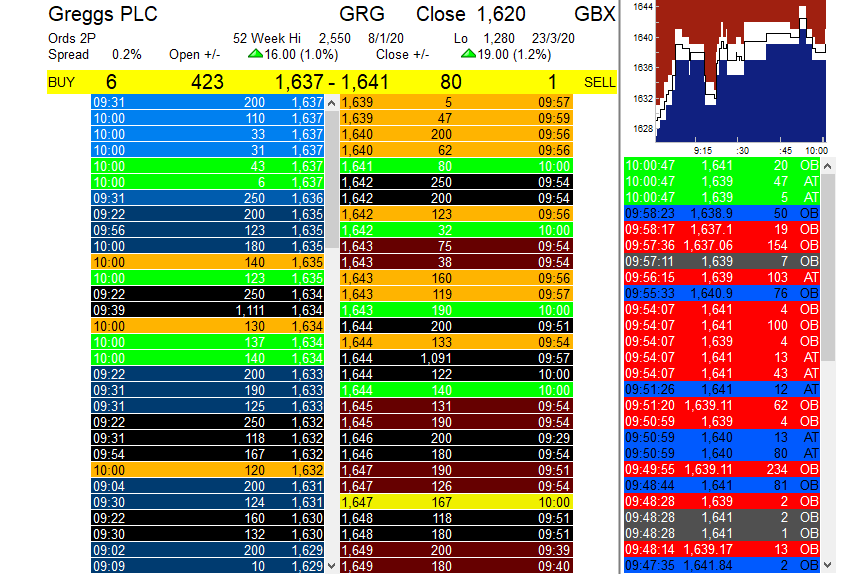

For example, here is a Level 2 screen from my ShareScope Pro of Greggs plc (LSE: GRG).

If we wanted to buy 1,000 shares of Greggs but only at 1600p, we would place our order onto the orderbook and it would show on Level 2 (so long as your broker routes the trade to LSE and not another exchange such as CHIX or BATS).

This would mean that we would only be filled up to 1,000 shares at a price no higher than 1600p, and the order would work until the end of the day (assuming it is a Limit Day order).

I would recommend using Limit Day orders because with a Good Till Cancelled order (GTC), the order is live until we pull it – if we forget about the order, it could be that we are eventually filled a position we did not wish to either buy or sell.

SETSqx

SETSqx is where smaller companies trade and where we must deal through market makers in order to buy and sell. There are several auctions throughout the day however these offer limited liquidity.

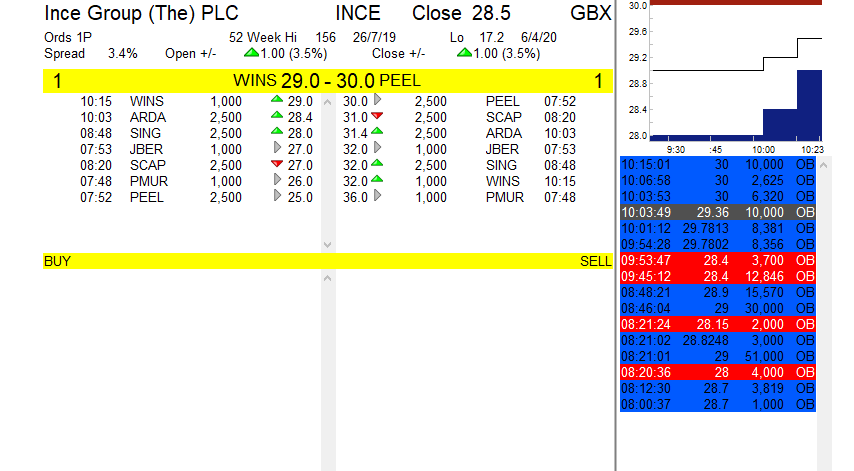

Here is an example of a Level 2 screen from a SETSqx traded stock, Ince Group plc (LSE: INCE).

We can see the market maker codes (WINS, ARDA, SING) and next to this the round number is the Exchange Market Size, or Normal Market Size as it was once called and still referred to – these being the 1,000, 2,500, and 2,500 numbers next to WINS, ARDA, and SING.

What this means is that the market maker will deal in this size at the price specified. However, this only refers to telephone dealing – the market makers are not obliged to honour their prices and sizes when dealing online.

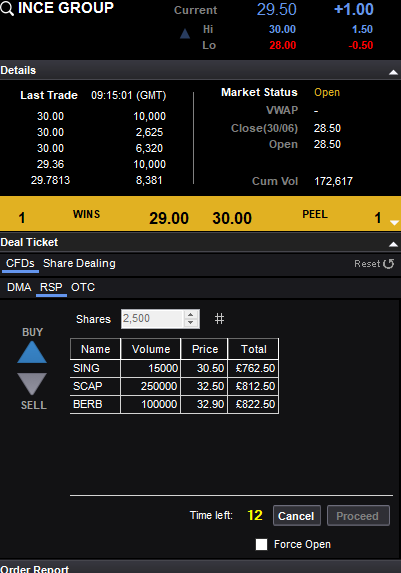

For example, here is an RSP screenshot from IG Index. I have requested a quote for 2,500 shares to buy, and despite PEEL offering 2,500 shares at a price of 30p, they are nowhere to be seen on the RSP.

This shows that what we see on Level 2, is not actually the reality of what is in the market.

For new traders, they may believe that because they have Level 2, they now have an overview of the market in real time. And whilst that may be true on SETS traded stocks – for SETSqx stocks it is simply not true.

Market Makers

Market makers are there to make a market and are obliged to provide a two-way price during the opening hours of the market from 08:00 until 16:30. However, they are also there to make a profit.

The market makers operate by controlling the spread, which is the price of dealing in the market. This is how they make their money, as the financial turn on the buying and selling when dealing with us is their reward for making the spread.

In thinly traded stocks, the spread is naturally wider, as market makers wish to deter buyers and take on market risk, therefore they wish to be compensated for that risk appropriately.

However, when stocks see plenty of action and volume, the spreads narrow because the most competitive market maker gets the financial turn, and when many turns are available it is their greed their narrows the spread.

We need to be careful when dealing with market makers, as dealing above the Normal Market Size carries risk. We may not be able to sell our shares without affecting the price. Therefore, we always need to be careful about liquidity in the stock, and factor in any potential slippage on our trades.

Market makers will often use a tree shake on SETSqx stocks too.

Here is a Level 2 screen of Victoria Carpets plc (LSE: VCP).

It looks like the market makers are about to move the price down, as two of them have revised their pricing downwards. We can see this by the arrows, and the time showing when they moved.

However, if we click on the RSP to request a quote, we can see that we have several market makers who are keen to buy our stock at 255p or better – which isn’t what Level 2 suggests.

And if we now request a quote to buy, we can see that there is no stock available to buy despite Berenberg (JBER) having moved up their ask price to 265p.

Dropping bids and going stop hunting is a classic market maker trick. Make sure your stop losses are not too close so that you could be shaken out quite easily.

And finally, if anyone has any requests of what you’d like me to cover in my articles – please do let me know and email me at michael@shiftingshares.com.

Michael Taylor

You can contact Michael and get your free copy of Ten Habits of Highly Profitable Traders from www.shiftingshares.com

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.