Witan – a long term buy and hold globalist fund with a value bias

Investing should really be about simplicity. Take global investing. Nearly every investor should have some exposure to a globally diversified mix of developed world stock markets. How big that exposure depends on your risk tolerance and your own appetite for global diversification. On paper one could in fact boast a simple 2 fund 60/40 portfolio: 60% in global equities via one fund, 40% in global bonds via another single fund. Alternatively, one could make it even simpler for the more adventurous and just invest all your money in one globally diversified, growth oriented equity fund and be done with it. With all the extra time saved searching around for new ideas and checking on bulletin boards, one could then concentrate on say the day job or go on endless holidays paid for by the bumper profits of the last few decades of bullish stockmarkets!

But the task of finding a simple, globally diversified equities fund is not easy. You face one important first choice – active or passive fund. One could for instance simply potter along to a provider of passive funds such as Vanguard, iShares or Lyxor and buy their global equities tracker. In most cases they’d probably be tracking an index such as the MSCI World or MSCI World ACWI index (there are similar variations available from FTSE such as the All World index). These very broad equity indices track all the major developed world stockmarkets based on the market capitalisation of the constituent businesses. The US market will usually dominate (around 55%) followed by Japan, the UK, Germany and France plus a longer tail of national markets.

These global equity index trackers are usually dirt cheap, with total expense ratios of less than 30 basis points (less than 0.30% pa). My hunch is that most investors won’t go far wrong with these simple, inclusive, diversified trackers. Just buy and forget about them for the next few decades.

But there is an alternative which is to use an actively managed fund where a manager takes some key decisions about say risk levels, valuations or perhaps over concentration in one index. This active manager might get those decisions wrong, and steer the fund in the wrong direction, sapping performance. They will also probably charge a bit more for all that cleverness, usually between 40 and 50 basis points (0.4 to 0.5%) above the cost of the index tracker alternative.

Nevertheless, a sensible, capable global equities manager might also be able to provide real ‘value’ add. What do I mean by that? Currently US equities are shooting ahead, and massively outperforming the wider market. Funds such as Scottish Mortgage, another one of our Dynamic 35, have very capably played that massive (tech inspired) trend and made their investors good money by placing a series of concentrated bets. But many of those mega caps, tech names are now, arguably, overpriced and don’t represent good value. A different kind of active manager might decide that there is better value elsewhere and in the long term they MAY be right – remember that eventually most markets mean revert to the long term average.

Which is where Witan Investment Trust enters. It’s a self-managed investment trust which is run by a highly capable overall manager called Andrew Bell. He has some strong views about what’s called asset allocation i.e overall valuations and key trends. Crucially once he has turned those ‘views’ into a strategy he then brings in “best of class” individual fund managers to run a particular mandate. This might mean bringing one manager to run say a portion of emerging markets equity and another to run UK and European equities.

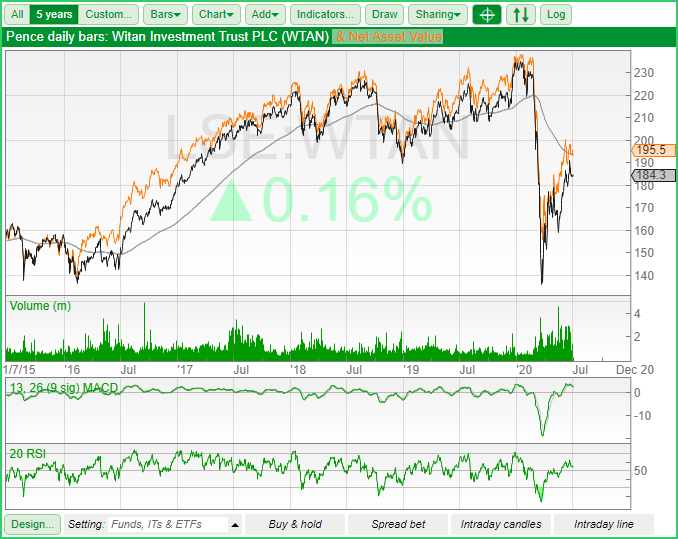

Source: SharePad

So, what we have here is a fund with a distinctive approach:

- It’s a global equities fund targeting long term capital growth but with some annual income via a dividend

- It has a manager who sets the overall strategic framework for asset allocation

- Which is then implemented by a series of sub managers

This is a fairly unique approach with only one other big competitor – Alliance Trust. This runs to a very similar mandate – it has an overall chief investment officer who reports to a self-managed board who then appoints sub managers. It’s a bigger fund by market size but is slightly less colourful in its strategic approach. What I mean by this is that the chief investment officer takes a slightly less opinionated view of key investment decisions and has a slightly less value-oriented approach (which I will explain shortly). That said both Alliance Trust and Witan are remarkably similar and being honest I could very easily see a sensible investor switching back and forth between Witan to Alliance Trust. My own personal preference is for Witan, but Alliance Trust is also an excellent alternative to a passive index tracking global equities ETF.

A multi manager approach

Andrew Bell is Witan’s CEO and he has a fairly distinctive set of core market views. Here’s an excellent summary from a recent research note on the fund from broking firm Numis.

Andrew Bell “believes that there is a possibility that regulation may curtail the growth of technology companies. The shift towards more reflationary fiscal policies in the UK and Europe could benefit growth outside of the US. The growth of shale oil is likely to moderate while scepticism over the sustainability of fossil fuels may lead to policies that encourage producers to pump more oil, keeping prices low. Volatility is likely to persist until the coronavirus disease has been brought under control worldwide. There is no reliable forecasting model for coronavirus and allied to substantial disruption to economic activity, equity investors are unable to quantify risks. There may be contrarian opportunities emerging. Assuming the coronavirus is contained in coming months, a bounce back in activity is a reasonable expectation by the second half of the year, given the significant amount of stimulus already introduced from fiscal policy, as well as lower interest rates and oil prices.”

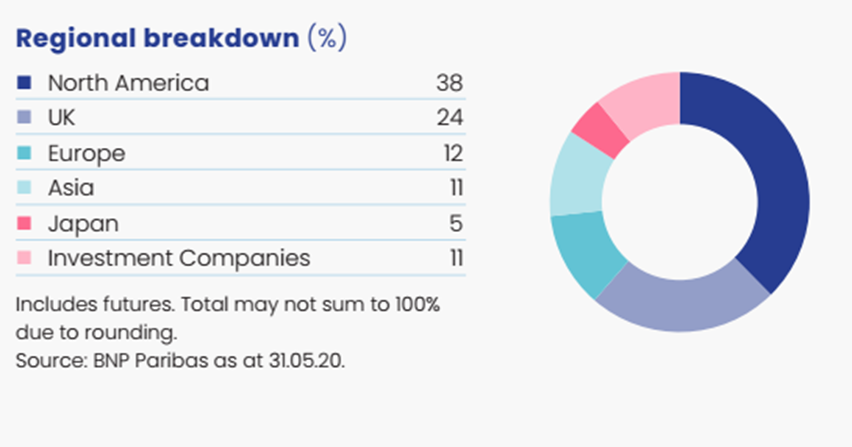

The first chart below starts to flesh out how that set of opinions takes shape as an investment strategy. Witan is probably underweight in US equities, quite possibly because they have become very expensive. It is by contrast overweight to UK equities, which are probably undervalued by comparison. The fund also has a fairly distinctive, opportunistic 11% weighing towards other London listed investment companies such as Syncona (a life sciences VC and another Dynamic 35 member). Andrew buys a series of closed end funds and in addition tops these up with some individual stocks. Alliance Trust by contrast, follows a much more conventional approach and just uses sub fund managers.

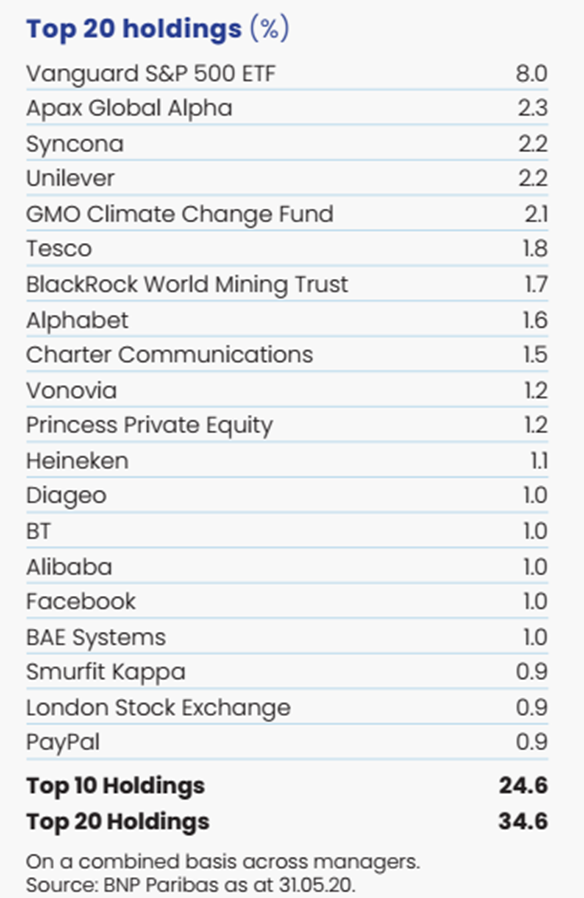

If we were to look at which individual stocks are held by Witan we see a fascinating mix. The biggest direct holding is an US ETF (from Vanguard) followed by Syncona, plus UK listed private equity fund Apax Global Alpha, Unilever and Tesco.

The sheer variety of these individual stocks tells its own tale but the real key to understanding the Witan approach is to look at the managers running individual pots of money for Witan. The table below gives us a manager breakdown. The three biggest pots of capital are with three well known boutique management firms: Lansdowne Partners, Lindsell Train and Veritas. Many investors will also recognise Artemis as another boutique manager. By contrast they probably won’t have heard of Matthews (a US firm with deep expertise in Asia) and the more recently formed GQG Partners (a Florida based emerging markets specialist). Intriguingly one might also recognise the Vanguard S&P 500 ETf which tracks the all-important US mega large caps.

Each of these managers has their own distinctive style. Veritas and Lindsell Train for instance have a strong value bias while the Artemis fund is more recovery/special situations focused. GQG by contrast has a more pronounced growth bias though it likes to style itself as a ‘growth at a reasonable price’ specialist.

I’m usually deeply suspicious of this approach of picking the ‘best in breed’ active fund manager. My sense is that it is very difficult to pull off and even if you do find a great manager, chances are they’ll probably confound all your expectations in the next few years and under perform. That said though, if anyone can find the best managers and then strike the best deals with them, my guess is Witan will top the list (alongside Alliance Trust). Bell is also ruthless is culling in managers who don’t make the grade. In recent years for instance he’s sold out of Crux AM and SW Michell and switched fresh money into Latitude and a small exposure to the GMO Climate Change fund. He has also ditched Pzena IM and reinvested in an ETF. And even with managers he’s decided to keep on board such as Lindsell Train he’s switched strategies and put money to work with them on a global equities focus. So, Bell can be ruthless and very active. Whether this ‘activism’ yields results can in part be measured by the performance of the share price over the long term.

Recent Performance

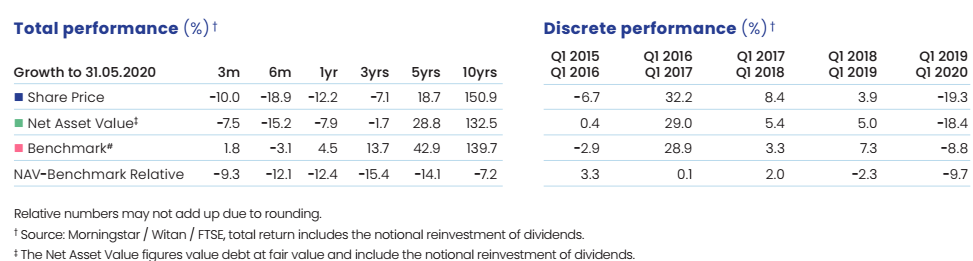

Witan has a solid long-term track record, with NAV total returns of 144% (9.2% pa) since Andrew Bell took charge in early 2010, versus 150% (9.5% pa) for the MSCI AC World (total return in Sterling). The table below maps out performance on a year by year and longer-term basis.

In the last full year’s results for the period through 31 December 2019, fund net asset value increased by 21.3% on a total return basis compared to a rise of 20.3% for the benchmark (30% FTSE All-Share, 25% FTSE AW North America, 20% FTSE AW Asia Pacific, 20% FTSE AW Europe ex UK, 5% FTSE AW Emerging Markets). Seven of the 10 external managers outperformed their benchmark with strong outperformance from both UK managers Artemis (+11.0% outperformance) and Heronbridge (+8.8%).

This year – 2020 – by contrast has been a rather more problematic year for Witan. First off, the fund changed its benchmark – it moved to one that comprises 15% UK (FTSE All Share Index) and 85% Global (FTSE All World Index). That means the benchmark has a larger weighting in the US and less in the UK and Europe.

That shift in the benchmark hasn’t been helped by relative under performance so far this year. In NAV terms, the fund lost -17% to the end of May versus a -5% fall for the benchmark. According to fund analysts at Numis, the new benchmark has a lower UK weighting (19% including the UK’s weight in the FTSE All World, from 30%) and a higher US weighting (46% from 25%), “but the portfolio still had a UK and European bias as the allocations to underlying managers was gradually being changed to reflect the transition towards a more global portfolio. As a result, this detracted from relative performance as the UK and Europe have underperformed the US. Additionally, the global managers also had underweight exposure to the US on valuation grounds, having reduced technology exposure prior to 2020.” In contrast there was good relative performance by Global managers Lindsell Train and Veritas as well as GQG Partners in Emerging Markets.

That recent under performance hasn’t gone unnoticed and the fund’s discount has widened to c.7% of NAV, although that’s been slightly blunted by the fact that the fund has bought back 7.3m shares in 2020, equivalent to 0.9% of share capital.

If needs be, Witan could go a lot further in buying shares – its balance sheet is very strong and getting better by the month. For instance, the board recently served (30 days’) notice for the early redemption of a slug of its bonds, with the aim of replacing that debt with cheaper terms. At current interest rates, the company estimates a £3m pa interest saving, if the £65m bonds were replaced with short-term borrowing.

That lower cost of debt will also help underwrite the steadily increasing dividend payout – it has revenue reserves equivalent to 1.5 years’ dividend which it will use if necessary, to extend its 45-year track record of consecutive dividend growth. It recently announced a first quarterly dividend of 1.34p for the year-ending 31 December 2020, equivalent to one quarter of the prior year full dividend, putting the fund on a historic yield of 3.1%. The fund pays out three equal interim dividends and a final dividend reflecting the balancing amount for the full dividend.

The Bottom Line

Using a measure called the Ongoing Charges Figure (OCF), Witan’s expenses last year were equivalent to 0.79% excluding performance fees (0.75% in 2018) and 0.87% including performance fees (0.83% in 2018). That makes Witan a bit more expensive than Alliance Trust which is running at 0.62%, and much more expensive than say the Vanguard FTSE All World ETF (ticker VWRL) which has an ongoing charge of 0.22%. But I think that extra 50 or so basis points (and 20 extra basis points compared to Alliance Trust) is worth it, because you are buying into a very distinctive approach. I like Andrew Bell’s strong conviction approach and I also like many of the sub managers used by Witan. Another plus is that the fund will actively seek to minimise that discount and will also be determined to keep growing the dividend every year, which can in turn be easily re-invested back into the funds’ shares. So, overall, this is an excellent long term holding and although Witan won’t always beat its benchmark, my hunch is that it will do so most years. For the investor looking for a simple, one size fits all, global equities growth fund, Witan is still the best. That said Alliance Trust – with a very similar approach – could also easily be a replacement.

Broker Views – Numis View:

“Although 2020 has been a tough period for Witan, we regard the fund as an attractive core holding for investors seeking global equity exposure. The fund provides access to a number of leading managers, and has a competitive ongoing charges figure given its multi -manager approach. It is interesting that Witan is seeking to make greater use of stylistically neutral or adaptable managers, rather than those who are more dependent on a style tailwind to generate performance, highlighted by the sale of the Pzena portfolio. We understand that the managers of Witan believe that systemic deep-value investing will become increasing challenged as some industries are disrupted by technology, fiscal or regulatory pressures, as well as ESG factors and consumer trends. That said, the portfolio retains exposure to value investments via managers who buy companies at cheap valuations which may be experiencing temporary headwinds, or take a long-term view on cyclical investment themes. In addition, the managers note that a broader base of stocks, rather than just technology, may participate once there is a wider economic recovery. Andrew Bell and James Hart are responsible for Witan’s manager selection and actively manage the fund’s gearing and asset allocation. In addition, they manage a direct portfolio (c.13% of assets) focused on specialist listed funds. Witan is current trading on a 7% discount to NAV.”

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.