This month’s funds update looks at gold’s powerful long-term record and rising investor optimism.

We also revisit a UK digital infrastructure trust and explore why Japanese equities are dazzling under new leadership.

I couldn’t resist starting this monthly funds update on gold – and long-term data on its returns. For the record, I believe $ 5,000 is a realistic target over the next few years. We also observe that, despite lofty valuations, equity investors, especially in the US, remain in a bullish mood. As are Japanese investors following the rise to power of the country’s first female, conservative PM. We revisit a firm favourite: a UK-listed investment trust that is making solid progress in the digital infrastructure space.

Gold after the sell-off

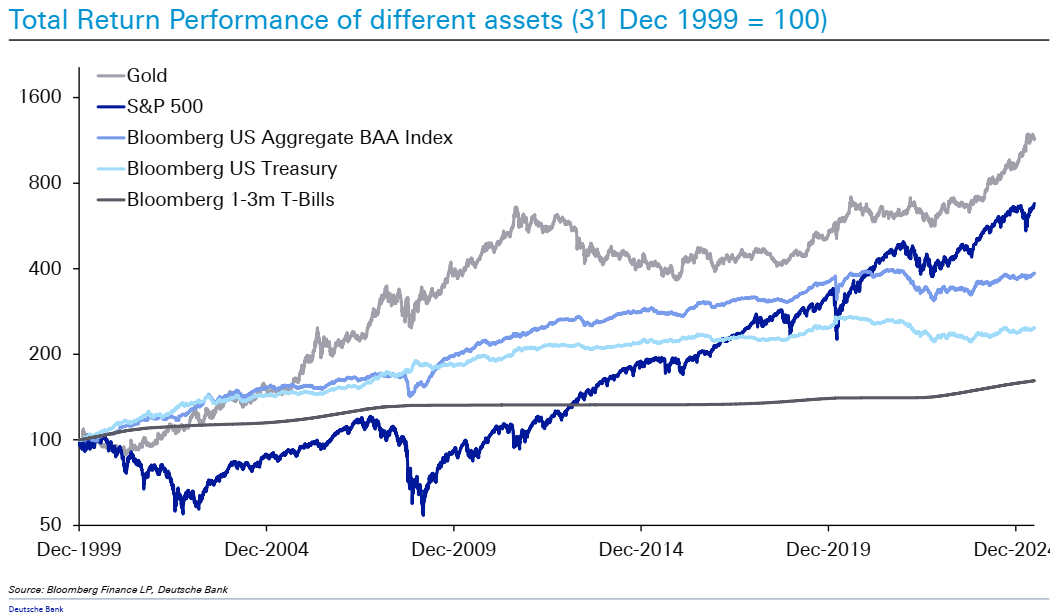

Gold prices may have declined over the last few weeks, but it is worth noting that, according to strategists at Deutsche Bank, gold has been the standout performer of the 21st century so far. it’s returned more than 11 times its value from end-1999, with the S&P 500 “only” up 6.8 times…

Equity Investors still seem bullish

Evidence is growing that investors, both private and institutional, are becoming more bullish, although the US government shutdown has caused some frayed nerves. One key indicator is institutional sentiment, which is now at a 28-year high and at the highest level since November 2007, according to State Street. Record high prices for U.S. stock markets have boosted the value of equities, while the lack of a meaningful pullback in yields has capped returns for bonds. Both of these factors, plus institutional investor preferences, play a role in current allocations.

|

Source: State Street Markets and Daily Chartbook.

That positive vibe is echoed in the world of private investors, especially in the USA. The most-watched sentiment indicator is from the AAII, the American Association of Individual Investors. The latest data point, from the beginning of October, suggests that 42.9% of individual investors surveyed are bullish (up from 41.7% the previous week), while 39.2% are bearish. Switching to Wall Street analysts, most remain Bullish, as the S&P 500 bottom-up one-year target price increased to 7,358 (a 10.0% projection) from last month’s 7,194.

Now, as a self-confessed contrarian, I’d be tempted to put another spin on this positive vibe shift. It strikes me that investors might be a tad complacent and that all it takes is for one key narrative – say AI – to suffer a structural blow, and we could see a sharp reversal. Then again, I’ve thought that way for a while now, and I’ve been dead wrong!

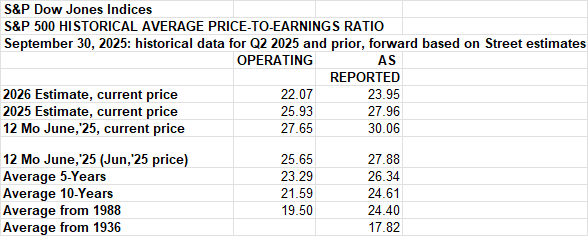

Those of us of a more bearish disposition, when it comes to equities, tend to like to harp on about exceptional US equity valuations as proof that ‘something wicked this way comes’. The slight snag is that valuations on US equities, though indeed rich, are not extraordinarily high. The table below, from the index firm S&P Dow Jones, shows rolling valuations over various periods for the benchmark S&P 500 index. Depending on your exact metric (2025 estimate for operating vs the as-reported metric), the current PE multiple is around 27.96. That compares to a five-year average of 26.34, or 24.61 over the last ten years. So, high, yes, but not crazily so.

Cordiant – still growing steadily.

One of my favourite core long-term holdings is the digital infrastructure fund Cordiant, an investment trust. A few weeks ago, in mid-September, the fund announced its first-quarter trading update. As expected, it was very positive. In aggregate, the portfolio generated revenues and EBITDA of £85.3m and £41.3m in the first quarter of the financial year (to 30 June 2025), which represent increases of 9.0% and 9.6% respectively on the prior comparable period (pro forma, constant currency basis). Q1 EBITDA increased by 9.6% to £41.3 million (constant currency, pro forma basis) while Q1 revenue rose by 9.0% to £85.3 million. The increase in EBITDA was primarily driven by positive performance at business units such as CRA, Emitel and Speed Fibre, including contributions from contract wins, cost control, the beneficial effects of contractual and other price escalators on revenue, and the addition of Datacenter United (DCU) to the portfolio in March 2025.

Turning to the dividend, the target of 4.35p per share per annum is well covered by both EBITDA (4.7x). and adjusted funds from operations (1.7x). The trust now operates in five geographies across Europe and the US, and is reasonably well diversified across three sectors, fibre (34% of revenue), data centres/cloud (15%) and towers, with the latter subdivided into mobile (12%), digital TV (29%) and digital radio infrastructure (10%)

Key Portfolio Developments:

- CRA secured permits and began work on a major data centre in Prague.

- CRA’s expanded DAB+ radio network in the Czech Republic is fully let.

- Cordiant syndicated part of its stake in Datacenter United, returning €20 million and bringing in a new co-investment partner.

- Speed Fibre acquired BT Communications Ireland Ltd, becoming a leading wholesale network provider in Ireland.

- CRA monetised real estate by selling a site for £6.3 million under a sale and leaseback deal.

I’d also draw attention to two other numbers: Net leverage is 4.6x LTM EBITDA and 40.8% of gross asset value, which is considered prudent compared to industry peers. In terms of alignment, the Directors and investment managers increased their shareholdings, now owning 2.1% of the company’s shares. One caution: the most challenging business seems to be the Hudson Interexchange data centre, which only boasted low revenue growth and is still loss-making.

My bottom line? Digital infrastructure investment fund, Cordiant, remains a core holding for me. The £750m market cap fund (with net assets of around £1 billion) has seen its discount decrease from a recent high of just under 40% to its current 25%. I think that discount could go lower, and I see no rational reason why it couldn’t go as low as 15%. NAV returns over the last year were 8%, and over 3 years, 34%. The share price has increased by 16% over the last year and 27% during the previous three years.

Japanese equities dazzle with new PM

(Bysource 内閣広報室|Cabinet Public Affairs Office, CC BY 4.0, https://commons.wikimedia.org/w/index.php?curid=177216312)

Japan has been in the news in recent weeks, mainly because of a big political change – a new female PM, Takaichi Sanae. I was in Japan at the very end of October while Trump was visiting, and Takaichi Sanae (PM after 65 men preceded her, congrats!) was clearly very happy to meet the great world leader himself.

Her LDP is now in power with allies in the Japan Innovation Party. The heavy-metal and motorcycle-loving, conservative-leaning, Thatcher-adoring Takaichi has been brought in due to political instability and the LDP’s poor electoral performance. Most commentators expect her to ease fiscal policy further, adding to the already hefty deficit, via a supplementary budget that might include subsidies to offset higher energy costs. There’ll also be more spending on defence and energy security (restarting nuclear power stations) and pressure on the Bank of Japan to keep the overnight call rate on hold at 0.50% for longer.

Bloomberg reports that after a series of failed leadership bids, this time the veteran LDP leader “has focused more on day-to-day concerns, advocating for refundable tax credits and a higher income-tax threshold for low earners, and spoken about the need to spend responsibly. She said she’d prioritize inflation measures that could be implemented quickly, punted again on Yasukuni and called for cooperation between the government and BOJ”. One note of catuion though: Bloomberg also reports that our very own Lix Truss hailed Takaichi’s victory as a “pushback against economic stagnation, excessive migration and the diminution of national sovereignty” in a post on X. Maybe leave that one off her list of congrats…

One area where the new PM might be able to make real progress is Japan’s long journey toward greater corporate accountability and stock market reform. Her mentor and predecessor Abe’s three arrows of reform didn’t achieve as much as many wanted in corporate reform. Still, the progress to date has been real and corporate transformation is proceeding at a pace: across the MSCI Japan index for instance, dividends per share have compounded at around 11–12% annually – and surged to nearly 20% over the past 12 months – showing clear evidence that this progress is structural. Also in the first half of 2025, Japanese corporate M&A reached $140 billion, which is more than triple the same period last year and the highest first-half total on record.”

One area of policy-led structural reform where Japan has made significant progress is the participation of local investors in local stock markets. Locals are interested in investing. The government’s new NISA savings scheme, which encourages tax-free investing, has also given retail investors a fresh incentive to put their money to work.

Starting in 2024, the NISA scheme increased tax-free investment limits to ¥18 million, removed fixed holding periods, and allowed participants to combine types of investments, making long-term stockholding more attractive to households. The revamped NISA has driven record inflows into Japanese equities, with estimates indicating approximately $14 billion in new money annually, either directly or via equity-trust structures. Roughly half of the funds in NISA accounts have been invested in domestic equities so far. Traditionally, Japanese households parked over ¥1,100 trillion ($7.5 trillion) in cash and bank deposits, but rising inflation has made equities more appealing, with NISA providing a practical pathway for retail investors to enter the market.

That local interest has combined with massive equity inflows from foreign investors to push the Japanese markets forward. In standard currency terms (accounting for weakness of the yen), the Nikkei is way ahead of US stocks this year. It has gained 51% in dollar terms since the low set the day before the US announced a 90-day moratorium on the Liberation Day tariffs. Despite the sustained gains in Japanese equities over the last few years Japanese valuations remain low (compared to the US). In fact, for the first time in two decades, you can actually get a better yield from 10-year Japanese Government Bonds than from dividends in the S&P 500.

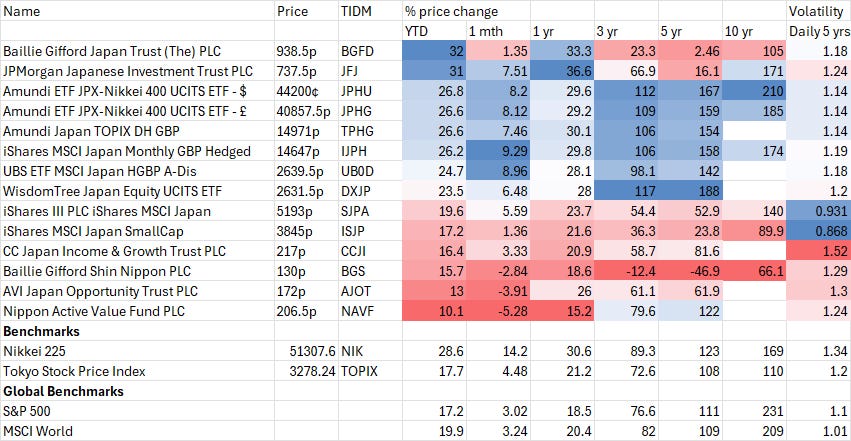

The heat map-focused table below shows returns for UK-listed Japanese equity funds, including both investment trusts and ETFs. In the graphic below, I’ve also included returns for the main Japanese equity benchmarks and for their US and global equivalents.

In simple terms, Japanese equities have consistently outperformed global and US equities year to date, over the last 12 months, the last three years, and the last five years. The heat map-focused table below shows returns for UK-listed Japanese equity funds, including both investment trusts and ETFs. In the graphic below, I’ve also included returns for the main Japanese equity benchmarks and for their US and global equivalents. In simple terms, Japanese equities have consistently outperformed global and US equities year to date, as well as over the last 12 months, the last three years, and the last five years.

The standout star for 2025 so far has been Baillie Gifford Japan Trust, up 32% year-to-date, alongside JPMorgan’s Japanese investment trust. Both of these well-known funds have benefited from increased investor interest in Japan’s large-cap tech sector. By contrast, the UK funds focused on smaller-cap companies – and shareholder activism, such as Nippon Active Value and AVI Japan, have lagged far behind this year, although they are still ahead over the 3- and 5-year timelines.

I’d also highlight one ETF that I think deserves closer attention: the Amundi JPX Nikkei 400 ETF, which tracks a relatively new equity benchmark. This index is designed to enhance the appeal of Japanese corporations to foreign investors and encourage them to adopt global investment standards, such as the efficient use of capital and investor-focused management. Unlike older indices that primarily focus on market capitalisation (like TOPIX) or stock price (like the Nikkei 225), the JPX Nikkei 400 selects companies based on a combination of quantitative and qualitative factors, placing a significant emphasis on quality and profitability. To get into the index, companies must meet certain screening criteria and are then scored based on the following:

Quantitative Indicators (80% weight):

· 3-year average Return on Equity (ROE)

· 3-year cumulative Operating Profit

Market Capitalisation (20% weight, less significant than the others)

· Qualitative Factors (Supplemental Score):

· Appointment of independent directors

· Adoption or scheduled adoption of IFRS (International Financial Reporting Standards)

· Disclosure of English earnings information and/or corporate governance reports

In short, it is designed to be a benchmark for companies that demonstrate high profitability and good corporate governance. The Amundi ETF tracking this index has produced some excellent results in recent years, ranking in the top quartile in terms of fund returns on most metrics over 1, 3, and 5 years. In my view, this is a core fund for anyone looking to build Japanese exposure. The fund has a TER of just 0.18%, and there’s even a sterling hedged version (daily hedged) that eliminates currency risk. The ticker for this fund is JPHG.

David Stevenson

Twitter: @advinvestor

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.