This final instalment of Michael Taylor’s position sizing series dives into scaling in, scaling out, and keeping emotions in check. He rounds things off with a simple checklist to help you trade smarter and stay in the game longer.

This is the final part if my four-part series on position sizing.

If you’ve not read parts I, II, and III you can do so here.

Scaling in and scaling out

Some traders advocate building positions gradually. This means buying a third of your intended position, waiting for confirmation, then adding more. Others say you should take your full position immediately based on your analysis.

The reality is I am a big fan of both.

However, it depends exactly what type of trade it is.

If I’m trading a M2M trade (Move 2 Move), this is taking an entry with a view to taking profit at an intended exit point.

For example, if I’m buying the breakout at 30p but there is significantly resistance at 40p, ideally I want to be exiting before that.

And if I can get a tight stop which allows me to capture more than 1R, then the trade may be attractive.

These are trades where you capture a move, then you move onto the next one.

But if it’s a Trade 2 Hold (T2H), these are the trades where I’m entering but looking to average up in the next base to capture a trend.

This is where the bulk of my P&L comes from. Longer swing trades that average up and back winners.

They typically have wider stops to account for more volatility. But the goal here is to stack on additional exposure using paper profits to finance more exposure.

If I’m trading a M2M, I want to be taking the trade at my intended entry point.

Waiting for ‘confirmation’ before adding more means I’m getting a worse price and the risk/reward is moving against me.

If I’m trading a breakout, then waiting for confirmation means the price is now closer to my target and even further from my stop.

However, if I am intending to average in a T2H, then I want to be adding a position at the intended entry such as a M2M, but waiting for a new base breakout to form before adding more exposure.

This is a separate trade within a trade.

Scaling out and taking partial profits as a stock rises is different.

If a position gets uncomfortably big, take some off. If you’re up by a big gain then locking in some profit is never a bad idea.

But just accept that you may be cutting your winners too early.

However, as Rothschild is said to have said in Reminiscences of a Stock Operator:

“Old Baron Rothschild’s recipe for wealth winning applies with greater force than ever to speculation. Somebody asked him if making money in the Bourse was not a very difficult matter and he replied that, on the contrary, he thought that it was very easy… “I will tell you my secret if you wish. It is this: I never buy at the bottom and I always sell too soon.””

It is, of course, also better too sell too early than to sell too late.

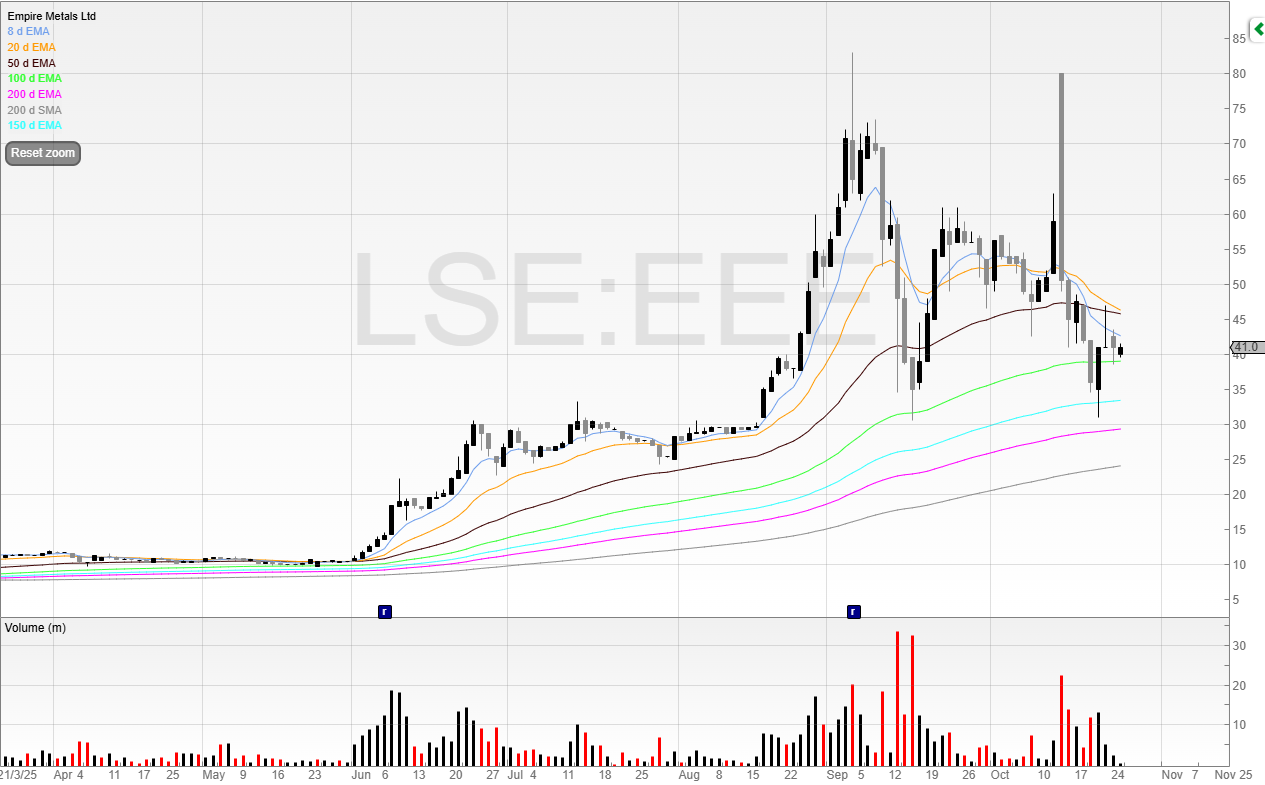

Consider Empire Metals (EEE).

This has been a fantastic winner this year.

But the drawdowns have been tough. Twice in the last two months the stock has been drawn down more than 50%.

It’s far better psychologically to do as Minervini says: Nail your profits down into strength.

Yes, you might sell too high, but you certainly don’t want to be selling too late.

Position sizing saves you

Let’s imagine you have found a stock that you’re convinced will double.

The chart looks solid. The fundamentals are strengthening. Everyone hates the stock so you’re not paying for market heat.

You buy in and risk 1% of your account, but the stock issues a surprise profit warning and gaps down 30%.

The stock gaps through your stop and so you lose more than you intended.

This is painful, and an unavoidable risk

But because you position sized not only for risk but also for the potential for the stock to go to 0p tomorrow (it can happen – not very often but it does – Argentex is a good example this year) your losses are larger than expected but the psychological and physical impact on your capital is minimal.

You are still intact, and you can still keep going.

Sizing too large can have negative detrimental effects on your account, and protecting yourself should be your absolute priority.

Proper position sizing keeps your emotions in check, which in turn stops you from doing dumb things such as revenge trading, and going all in.

Your position sizing checklist

I’ve created this checklist you can use so that you can use this before your next trade.

1. Have you identified your stop-loss based on technical levels, not arbitrary percentages?

Don’t set your stop loss based on a 2:1 or any other number. The market doesn’t care about your risk/reward. Look at what would invalidate the trade and prove your trade wrong.

2. Have you calculated your risk per share (entry price minus stop-loss)?

Look at your intended entry and your intended stop based on the chart like above. Make sure you are using the chart to look at potential exit points rather than picking standard levels. If resistance is at 50p, why would your target be 52p? The trade would then need to chew through that resistance. Better to sell before.

3. Have you determined your maximum risk in pounds based on your current account size and risk percentage?

You can do this with my position size calculator here.

4. Have you divided your maximum risk by your risk per share to get your maximum position size?

5. Have you verified that your position size meets your minimum threshold to keep transaction costs reasonable?

6. Have you adjusted for current market conditions and your recent trading performance?

If you can’t answer yes to all six questions, don’t place the trade. I know it sounds tedious, but this checklist has saved me from countless poor decisions over the years.

Play the long game

Position sizing is boring, repetitive work. Every successful trade starts with the same calculations, the same spreadsheet entries, the same discipline. There’s no shortcut, no app that will do your thinking for you, no indicator that tells you the perfect position size.

But the people who take position managing seriously tend to be the people who continue to trade for many years. The ones who focus on finding the next ten-bagger and worry about position sizing later tend to disappear from the markets within eighteen months.

The market claims its pound of flesh, and over the years many people have been through the revolving doors. Don’t be one of the losers.

Hopefully this four-part guide has been useful, and I’m happy to answer any questions in the comments below!

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Free educational content: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.