A look at the valuations achieved by US-listed dog walking apps, Wag and Rover. Companies covered STVG, GRG, CBG and OCN.

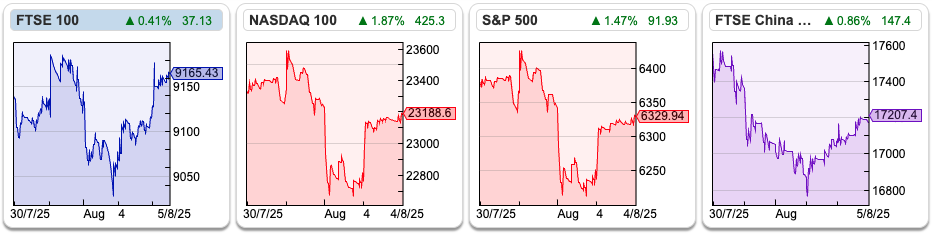

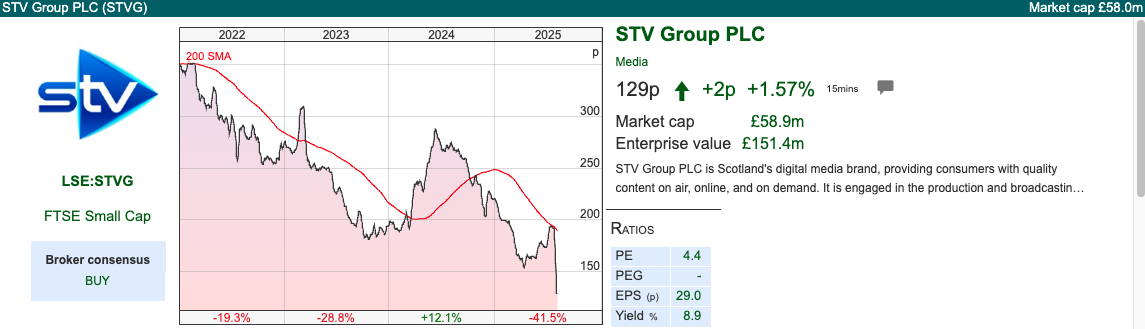

The FTSE 100 continues to hold it’s level above 9,000, but was up less than +0.5% over the last 5 days and currently sits at 9,165. The Nasdaq100 was down -0.7% and S&P500 -0.9%. European and UK banks have enjoyed a strong 18 months, up +73% and +71% respectively since the beginning of 2024, significantly better than both the Nasdaq100 (up +37%) and US regional banks (up +14%) over the same timeframe.

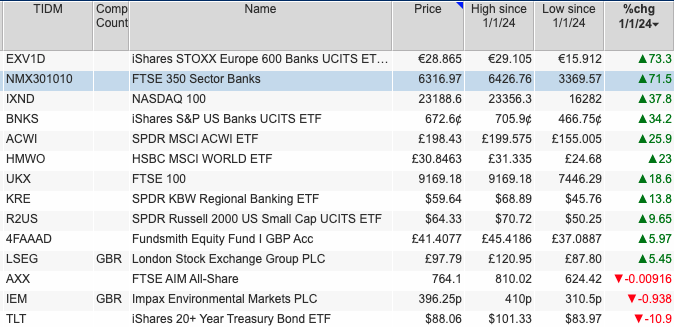

It’s August, when “serious news” tends to be harder to find, so I thought I would write about Wag, the US dog walking app (ticker PET) once valued at $650m, which has filed for bankruptcy via the Chapter 11 process. SoftBank Vision Fund invested $300m in the company at the beginning of 2018. Wag listed on Nasdaq, a 2021 vintage IPO, with the chart below telling a familiar story. If a judge approves Wag’s restructuring plan, Wag’s ownership will be transferred to a company called Retriever. Apparently, Wag had to cut costs as it lost market share to another dog walking app, called Rover.

I enjoyed a couple of quotes from the Wag Chief Executive, who said at the end of 2020, “as the world returns to normal, Wag is adapting to it” and “even though the company was not yet cashflow positive, we had multiple years of runway to weather the storm.” Indeed.

Wag’s competitor, Rover (ticker ROVR), which had listed on Nasdaq via a SPAC, was acquired by Blackstone at a 60% premium to the share price at the end of 2023 for $2.3bn. That $2.3bn valuation equates to 13x 2022 sales for a dog walking app founded in 2011! That’s also a larger market cap than Fevertree. Barking mad if you ask me.

This week I look at STVG profit warning, Greggs H1 results, Close Brothers and Ocean Wilsons merger with Hansa Investment.

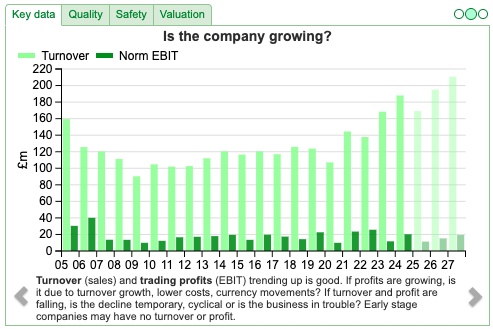

STVG Profit Warning H1 June 2025

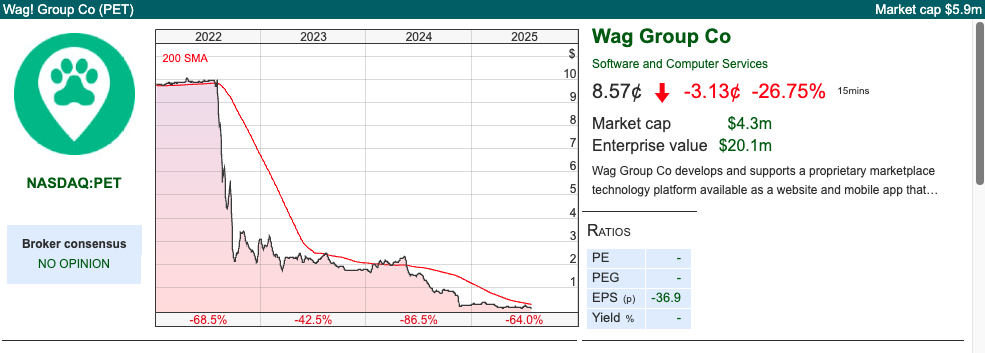

Roy Herbert Thomson (later 1st Baron Thomson of Fleet) once described Scottish Television as a “licence to print money”, according to Wikipedia. However, he said that in the 1950’s, it looks as if the economics of commercial TV have changed since then, with this FT article saying that 20% of those born after 2010 (Gen Alpha) turn on YouTube first on their TV, while over-55’s also doubled their time on the service owned by Google parent Alphabet. So that could be what has driven STVG warning about “further deterioration in the commissioning and advertising markets” meaning FY revenue and profits will be “materially below consensus”. The shares fell -20% in response to their RNS.

FY group revenue is now expected to range between £165m and £180m, implying a -4% to -12% decline. There’s no mention of EPS impact, but Progressive have slashed FY Dec 2025F EPS by -55% to 11p and halved FY Dec 2026F to 16p. They have left the FY DPS unchanged for now at 11p, though the group has “core” net debt of £30m at the end of June. So, I don’t think we can have too much faith in that dividend figure if the situation deteriorates any further.

The group sets out its divisions in a rather confusing way: Broadcast (44% of group revenue) and Digital (10% of group revenue) constitute Advertising (54% of group revenue FY 2024), which was growing at +5% in 2024. Total Advertising Revenue (TAR) is in line with guidance for H1, but the current Q3 is now expected to be down -8% y-o-y.

The remaining 45% of group revenues in 2024 was STV Studios, growing at +26% last year, helped by acquiring stakes in production companies. The Studios division makes programs for other networks, for instance, The Witness for Netflix and Hello Halo for Channel 4. Management blamed the UK macroeconomic backdrop for a significant deterioration in the commissioning market. That can’t be the full story, because ITV is up +10% YTD and small production company Zinc Media is up +38% YTD.

STV Studios FY Dec 2025F revenues is now expected to be in the £75m to £85m range, versus £84m FY Dec 2024. Management will provide a further update on full-year outlook and continued strategic progress at our interim results in September.

Valuation: The shares are on a PER of 8x FY Dec 2026F; however, Progressive are forecasting growth rebounding +38% next year, so there’s plenty of scope for disappointment if that doesn’t happen. If we assume EPS is flat, that would imply 11x PER.

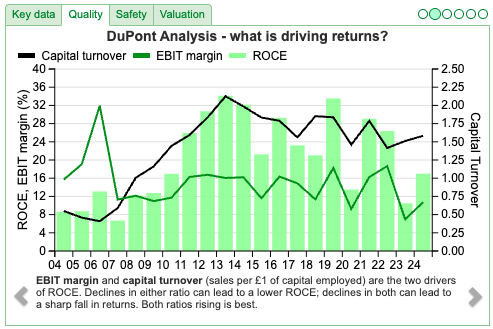

Opinion: A frustrating announcement, blaming the macroeconomic backdrop. I can accept that advertising is sensitive to economic confidence, but you’d think that Netflix and Channel 4 would still be commissioning programs. Instead, it looks as if something company-specific has gone wrong, particularly in the acquisition-led Studios business. RoCE was around 30% in 2019 and 2021, but historically, profitability has swung around wildly, and STVG was loss-making in FY Dec 2023.

I don’t watch much TV, not even Netflix or Amazon Prime, so I wonder if the whole business might be in secular decline? I would avoid and revisit in 6-12 months. I’d like to see improving performance rather than just a high dividend yield to persuade me to buy.

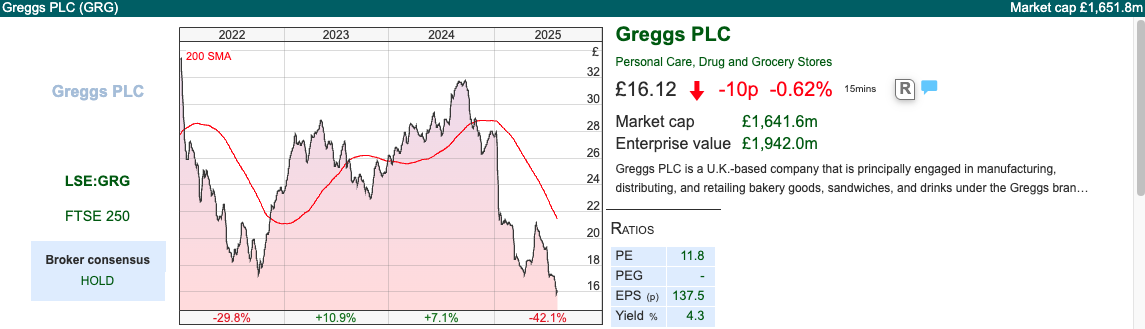

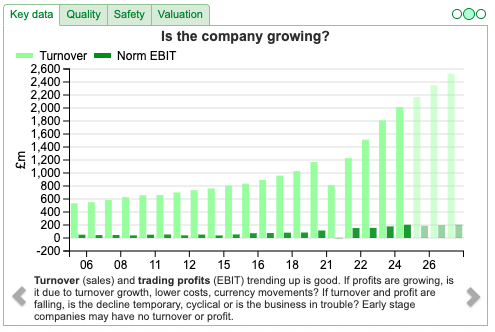

Greggs H1 June 2025 Results

I last wrote about the sausage rolls and prepared food-to-go group in August 2023, when I worried that the shares might go “ex growth” at some point. Back then, the forward PER was just under 20x, and Like-for-Like (LfL) sales were up +16%. Today the PER is 12x, and Like-for-Like sales in company-managed shops grew +2.6%, versus franchise shop LfL +4.8% system sales.

That drop in sales growth does look a little disappointing. In 2021, management declared a plan to double Greggs’ sales in five years from £1.2bn to £2.4bn in FY Dec 2026F. However, Sharescope shows forecasts of £2.35bn, so the -42% share price fall YTD looks harsh, particularly given the track record over the last couple of decades.

Total sales, which include 87 new shop openings, were up +7% to £1.03bn for H1 Jun 2025. PBT was down -14% to £64m, partly caused by lower income earned on cash deposits as funds have been deployed investing in the supply chain and the IFRS 16 lease liabilities charge has increased with the opening of new shops. Excluding those items, operating profit was still down -7%, reflecting reduced footfall cost headwinds. There’s also been 8% wage inflation, mainly driven by the National Living Wage and Rachel Reeve’s employer National Insurance tax.

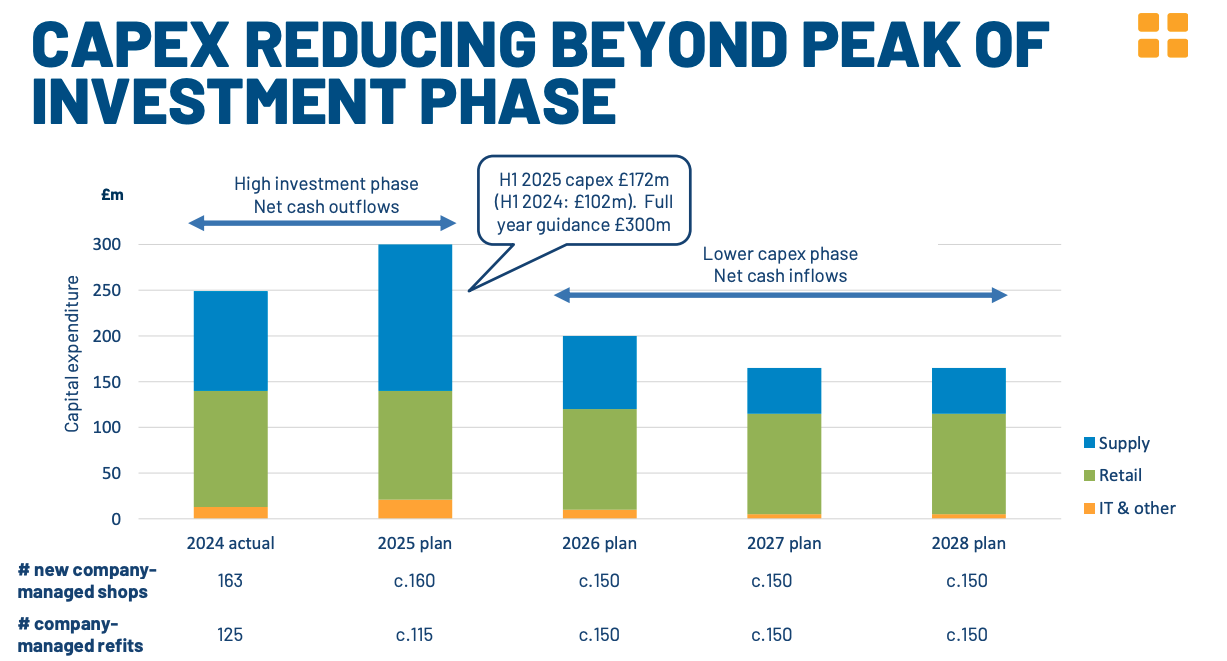

Greggs’ management also suggested the weather (too cold in January, too hot in June) has had a material impact on consumer behaviour. Net debt at the end of June was £2.5m, versus £125m net debt at the end of December, as 2025 is the peak investment year. The analyst presentation shows that £300m of capex outflow this year is expected to fall to £200m next year and then just over £150m in 2027F.

They are aiming for a December year-end net cash position of 3% of revenue, which implies c. £65m.

Outlook: The outlook for cost inflation is unchanged, expectations for FY Dec 2025F “are consistent with the guidance provided in our last trading update on 2 July, i.e. that operating profit could be modestly below the level achieved in 2024.”

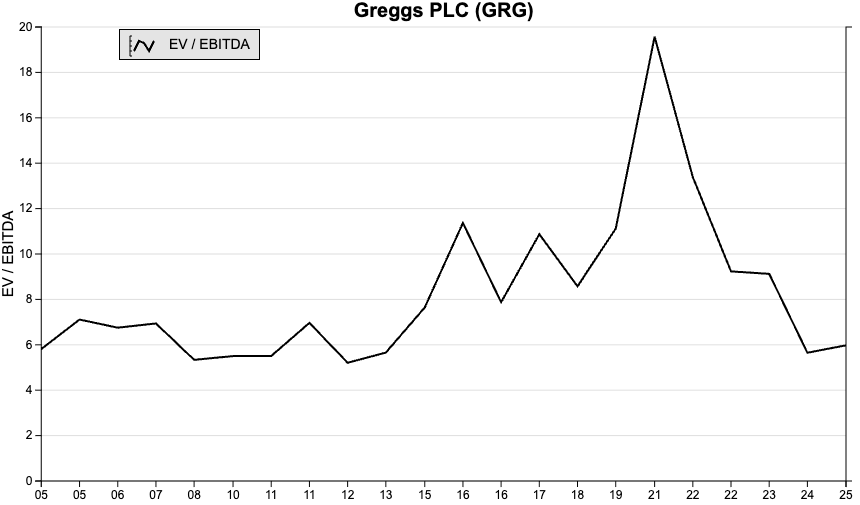

Valuation: The shares have de-rated significantly versus a couple of years ago. They are now trading on 12x Dec 2026F and Dec 2027F. That’s just over 5x EV/EBITDA, in line with the pre-2015 average but down from a peak of 20x the same ratio 5 years ago.

Opinion: I think that it’s too early to buy at this level, and we’re probably 6-12 months away from a bottom. It seems odd to me that LfL sales have been so weak when i) WFH is being discouraged and workers have been returning to the office, ii) pressure on consumer disposable incomes should be alleviating as interest rates and inflation fall.

Perhaps the chart from the BoE Financial Stability Report that I posted a couple of weeks ago squares the circle? That is, Bank of England overnight interest rates are coming down, but given the UK mortgage market is predominantly 2 and 5-year fixed rate deals, we are still seeing “belt-tightening” by those consumers to refinance historically cheaper mortgages. If so, Greggs should see a return to LfL sales growth trend, but I’m not in a hurry to call the bottom now.

Close Brothers’ favourable Supreme Court judgement

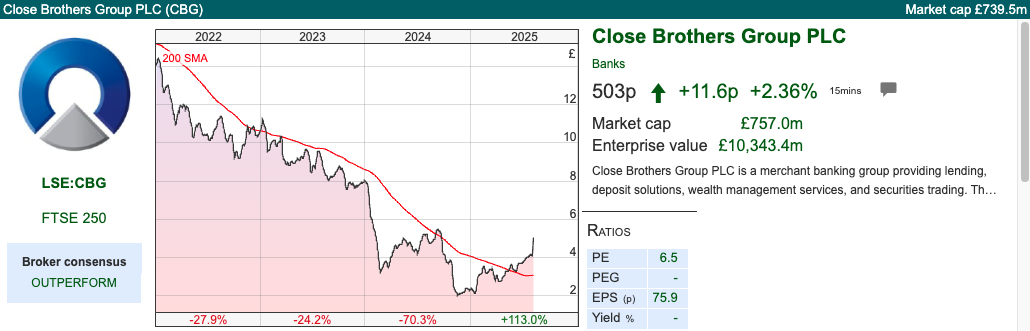

Close Brothers shares enjoyed a strong start to the week after the Supreme Court ruled that car dealers did not have a fiduciary duty to put customers first, reversing a Court of Appeal decision at the end of last year. CBG put out an RNS in response, welcoming the decision, but also highlighting that uncertainty remains over a potential FCA customer redress scheme.

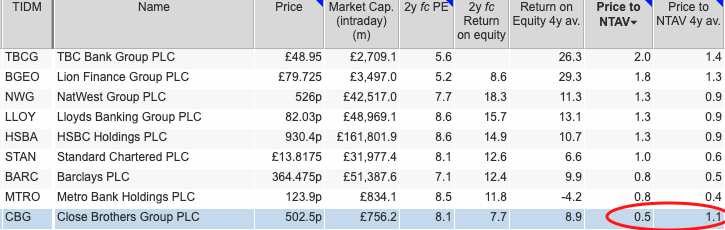

In terms of valuation though, at 503p CBG shares trade on around half the book value of £10 per share, or 0.6x historic tangible book, last reported for January this year. That also compares to a 4-year average of 1.1x tangible book (see table below). So CBG shares still look good value compared to other UK banks, which have re-rated, and are now trading above their 4-year average NTAV, even though CBG’s shares have doubled since January. I bought in and averaged down too early, but am now just below the average price I paid.

At the other end of the valuation spectrum, the London-listed Tbilisi-headquartered banks, TBC and Lion Finance (previously Bank of Georgia) are now on 1.8x-2.0x NTAV. I think that’s probably justified given the more attractive growth prospects and superior track record of RoE in the 25-30% range. For comparison, in the late 1990s when Lloyds was reporting RoE greater than 30%, the shares traded at over 6x tangible book value.

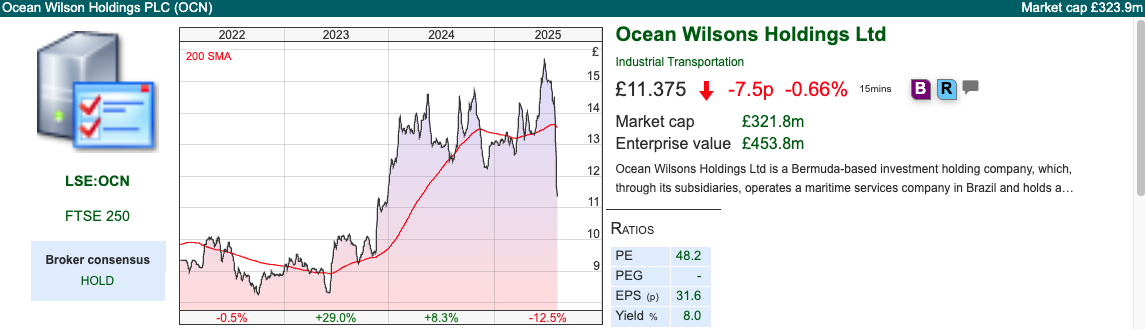

Ocean Wilson’s merger with Hansa Investment

I have resisted the urge to write on listed bitcoin treasury companies, like Smarter Web Company (mkt cap over £600m). Matt Levine at Bloomberg has pointed out that the stockmarket will pay $2 for $1 worth of crypto, and I’m not sure there’s much more to say. Normally, paying double the price for anything is not a road to wealth and certainly isn’t value investing. I thought it would be fun to highlight the reverse situation, where the stockmarket is paying just over 50p for £1 of Ocean Wilson’s assets, though probably for good reason.

The maths: Earlier this year, Ocean Wilsons sold its Brazilian ports subsidiary for just under $600m (roughly £460m), then bought back 20% of its shares in a tender offer at 1543p, costing £109m. That leaves £350m of cash, plus the underperforming hedge funds that management enjoy investing in, worth £250m at the end of March. In total then, Ocean Wilsons has liquid assets (cash plus hedge funds with marketable securities) of around £600m or £21 per share.

Yet stock market investors will only pay around £11.35 per share for Ocean Wilsons, as management have decided to merge OCN into an investment trust that they also control: Hansa, which also trades at a steep discount to book, at an exchange ratio of 1.4925. They have calculated the exchange ratio by dividing Ocean Wilson’s book value (over £20 per share) by Hansa (£13.51 per share). However, this calculation ignores the fact that the bulk of OCN’s assets are cash (£350m is 60%), which wouldn’t trade at a 40% discount to book. Indeed, the remaining £250m of hedge funds, is greater than the current market cap, effectively saying that the market is ascribing negative value to the £250m of underperforming hedge funds that OCN owns.

Investment trusts can trade at large discounts, particularly if they have high fees or “fair value” accounting and hard to value assets. But in this case, it looks as if the stockmarket is valuing OCN cash and securities at a > 40% discount to book, because management are poor at allocating capital and behaving in a way that minority shareholders (and also themselves) less well off. Unlike bitcoin treasury companies, the share price seems to be rational; the behaviour of management, less so.

Below is a picture of William Salomon, on the board of both Ocean Wilsons and Hansa Investment.

Notes

Bruce Packard

Bruce owns shares in Ocean Wilsons, Close Brothers, and Lion Finance

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 06/08/2025 | STVG, GRG, CBG, OCN | Wag the Dog

The FTSE 100 continues to hold it’s level above 9,000, but was up less than +0.5% over the last 5 days and currently sits at 9,165. The Nasdaq100 was down -0.7% and S&P500 -0.9%. European and UK banks have enjoyed a strong 18 months, up +73% and +71% respectively since the beginning of 2024, significantly better than both the Nasdaq100 (up +37%) and US regional banks (up +14%) over the same timeframe.

It’s August, when “serious news” tends to be harder to find, so I thought I would write about Wag, the US dog walking app (ticker PET) once valued at $650m, which has filed for bankruptcy via the Chapter 11 process. SoftBank Vision Fund invested $300m in the company at the beginning of 2018. Wag listed on Nasdaq, a 2021 vintage IPO, with the chart below telling a familiar story. If a judge approves Wag’s restructuring plan, Wag’s ownership will be transferred to a company called Retriever. Apparently, Wag had to cut costs as it lost market share to another dog walking app, called Rover.

I enjoyed a couple of quotes from the Wag Chief Executive, who said at the end of 2020, “as the world returns to normal, Wag is adapting to it” and “even though the company was not yet cashflow positive, we had multiple years of runway to weather the storm.” Indeed.

Wag’s competitor, Rover (ticker ROVR), which had listed on Nasdaq via a SPAC, was acquired by Blackstone at a 60% premium to the share price at the end of 2023 for $2.3bn. That $2.3bn valuation equates to 13x 2022 sales for a dog walking app founded in 2011! That’s also a larger market cap than Fevertree. Barking mad if you ask me.

This week I look at STVG profit warning, Greggs H1 results, Close Brothers and Ocean Wilsons merger with Hansa Investment.

STVG Profit Warning H1 June 2025

Roy Herbert Thomson (later 1st Baron Thomson of Fleet) once described Scottish Television as a “licence to print money”, according to Wikipedia. However, he said that in the 1950’s, it looks as if the economics of commercial TV have changed since then, with this FT article saying that 20% of those born after 2010 (Gen Alpha) turn on YouTube first on their TV, while over-55’s also doubled their time on the service owned by Google parent Alphabet. So that could be what has driven STVG warning about “further deterioration in the commissioning and advertising markets” meaning FY revenue and profits will be “materially below consensus”. The shares fell -20% in response to their RNS.

FY group revenue is now expected to range between £165m and £180m, implying a -4% to -12% decline. There’s no mention of EPS impact, but Progressive have slashed FY Dec 2025F EPS by -55% to 11p and halved FY Dec 2026F to 16p. They have left the FY DPS unchanged for now at 11p, though the group has “core” net debt of £30m at the end of June. So, I don’t think we can have too much faith in that dividend figure if the situation deteriorates any further.

The group sets out its divisions in a rather confusing way: Broadcast (44% of group revenue) and Digital (10% of group revenue) constitute Advertising (54% of group revenue FY 2024), which was growing at +5% in 2024. Total Advertising Revenue (TAR) is in line with guidance for H1, but the current Q3 is now expected to be down -8% y-o-y.

The remaining 45% of group revenues in 2024 was STV Studios, growing at +26% last year, helped by acquiring stakes in production companies. The Studios division makes programs for other networks, for instance, The Witness for Netflix and Hello Halo for Channel 4. Management blamed the UK macroeconomic backdrop for a significant deterioration in the commissioning market. That can’t be the full story, because ITV is up +10% YTD and small production company Zinc Media is up +38% YTD.

STV Studios FY Dec 2025F revenues is now expected to be in the £75m to £85m range, versus £84m FY Dec 2024. Management will provide a further update on full-year outlook and continued strategic progress at our interim results in September.

Valuation: The shares are on a PER of 8x FY Dec 2026F; however, Progressive are forecasting growth rebounding +38% next year, so there’s plenty of scope for disappointment if that doesn’t happen. If we assume EPS is flat, that would imply 11x PER.

Opinion: A frustrating announcement, blaming the macroeconomic backdrop. I can accept that advertising is sensitive to economic confidence, but you’d think that Netflix and Channel 4 would still be commissioning programs. Instead, it looks as if something company-specific has gone wrong, particularly in the acquisition-led Studios business. RoCE was around 30% in 2019 and 2021, but historically, profitability has swung around wildly, and STVG was loss-making in FY Dec 2023.

I don’t watch much TV, not even Netflix or Amazon Prime, so I wonder if the whole business might be in secular decline? I would avoid and revisit in 6-12 months. I’d like to see improving performance rather than just a high dividend yield to persuade me to buy.

Greggs H1 June 2025 Results

I last wrote about the sausage rolls and prepared food-to-go group in August 2023, when I worried that the shares might go “ex growth” at some point. Back then, the forward PER was just under 20x, and Like-for-Like (LfL) sales were up +16%. Today the PER is 12x, and Like-for-Like sales in company-managed shops grew +2.6%, versus franchise shop LfL +4.8% system sales.

That drop in sales growth does look a little disappointing. In 2021, management declared a plan to double Greggs’ sales in five years from £1.2bn to £2.4bn in FY Dec 2026F. However, Sharescope shows forecasts of £2.35bn, so the -42% share price fall YTD looks harsh, particularly given the track record over the last couple of decades.

Total sales, which include 87 new shop openings, were up +7% to £1.03bn for H1 Jun 2025. PBT was down -14% to £64m, partly caused by lower income earned on cash deposits as funds have been deployed investing in the supply chain and the IFRS 16 lease liabilities charge has increased with the opening of new shops. Excluding those items, operating profit was still down -7%, reflecting reduced footfall cost headwinds. There’s also been 8% wage inflation, mainly driven by the National Living Wage and Rachel Reeve’s employer National Insurance tax.

Greggs’ management also suggested the weather (too cold in January, too hot in June) has had a material impact on consumer behaviour. Net debt at the end of June was £2.5m, versus £125m net debt at the end of December, as 2025 is the peak investment year. The analyst presentation shows that £300m of capex outflow this year is expected to fall to £200m next year and then just over £150m in 2027F.

They are aiming for a December year-end net cash position of 3% of revenue, which implies c. £65m.

Outlook: The outlook for cost inflation is unchanged, expectations for FY Dec 2025F “are consistent with the guidance provided in our last trading update on 2 July, i.e. that operating profit could be modestly below the level achieved in 2024.”

Valuation: The shares have de-rated significantly versus a couple of years ago. They are now trading on 12x Dec 2026F and Dec 2027F. That’s just over 5x EV/EBITDA, in line with the pre-2015 average but down from a peak of 20x the same ratio 5 years ago.

Opinion: I think that it’s too early to buy at this level, and we’re probably 6-12 months away from a bottom. It seems odd to me that LfL sales have been so weak when i) WFH is being discouraged and workers have been returning to the office, ii) pressure on consumer disposable incomes should be alleviating as interest rates and inflation fall.

Perhaps the chart from the BoE Financial Stability Report that I posted a couple of weeks ago squares the circle? That is, Bank of England overnight interest rates are coming down, but given the UK mortgage market is predominantly 2 and 5-year fixed rate deals, we are still seeing “belt-tightening” by those consumers to refinance historically cheaper mortgages. If so, Greggs should see a return to LfL sales growth trend, but I’m not in a hurry to call the bottom now.

Close Brothers’ favourable Supreme Court judgement

Close Brothers shares enjoyed a strong start to the week after the Supreme Court ruled that car dealers did not have a fiduciary duty to put customers first, reversing a Court of Appeal decision at the end of last year. CBG put out an RNS in response, welcoming the decision, but also highlighting that uncertainty remains over a potential FCA customer redress scheme.

In terms of valuation though, at 503p CBG shares trade on around half the book value of £10 per share, or 0.6x historic tangible book, last reported for January this year. That also compares to a 4-year average of 1.1x tangible book (see table below). So CBG shares still look good value compared to other UK banks, which have re-rated, and are now trading above their 4-year average NTAV, even though CBG’s shares have doubled since January. I bought in and averaged down too early, but am now just below the average price I paid.

At the other end of the valuation spectrum, the London-listed Tbilisi-headquartered banks, TBC and Lion Finance (previously Bank of Georgia) are now on 1.8x-2.0x NTAV. I think that’s probably justified given the more attractive growth prospects and superior track record of RoE in the 25-30% range. For comparison, in the late 1990s when Lloyds was reporting RoE greater than 30%, the shares traded at over 6x tangible book value.

Ocean Wilson’s merger with Hansa Investment

I have resisted the urge to write on listed bitcoin treasury companies, like Smarter Web Company (mkt cap over £600m). Matt Levine at Bloomberg has pointed out that the stockmarket will pay $2 for $1 worth of crypto, and I’m not sure there’s much more to say. Normally, paying double the price for anything is not a road to wealth and certainly isn’t value investing. I thought it would be fun to highlight the reverse situation, where the stockmarket is paying just over 50p for £1 of Ocean Wilson’s assets, though probably for good reason.

The maths: Earlier this year, Ocean Wilsons sold its Brazilian ports subsidiary for just under $600m (roughly £460m), then bought back 20% of its shares in a tender offer at 1543p, costing £109m. That leaves £350m of cash, plus the underperforming hedge funds that management enjoy investing in, worth £250m at the end of March. In total then, Ocean Wilsons has liquid assets (cash plus hedge funds with marketable securities) of around £600m or £21 per share.

Yet stock market investors will only pay around £11.35 per share for Ocean Wilsons, as management have decided to merge OCN into an investment trust that they also control: Hansa, which also trades at a steep discount to book, at an exchange ratio of 1.4925. They have calculated the exchange ratio by dividing Ocean Wilson’s book value (over £20 per share) by Hansa (£13.51 per share). However, this calculation ignores the fact that the bulk of OCN’s assets are cash (£350m is 60%), which wouldn’t trade at a 40% discount to book. Indeed, the remaining £250m of hedge funds, is greater than the current market cap, effectively saying that the market is ascribing negative value to the £250m of underperforming hedge funds that OCN owns.

Investment trusts can trade at large discounts, particularly if they have high fees or “fair value” accounting and hard to value assets. But in this case, it looks as if the stockmarket is valuing OCN cash and securities at a > 40% discount to book, because management are poor at allocating capital and behaving in a way that minority shareholders (and also themselves) less well off. Unlike bitcoin treasury companies, the share price seems to be rational; the behaviour of management, less so.

Below is a picture of William Salomon, on the board of both Ocean Wilsons and Hansa Investment.

Notes

Bruce Packard

Bruce owns shares in Ocean Wilsons, Close Brothers, and Lion Finance

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.