A look at why bull markets climb a “wall of worry”, but crashes are fast and brutal. Companies covered VLX, BOOM and CNC.

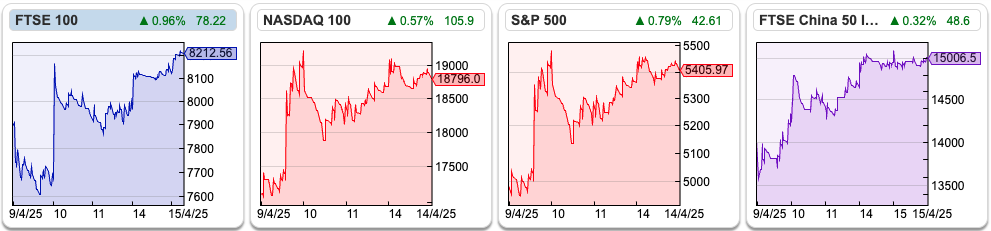

It’s been a wild couple of weeks! Here’s a Sharescope chart of how the major indices have performed since 2nd April. Apologies for the amount of red in the chart…

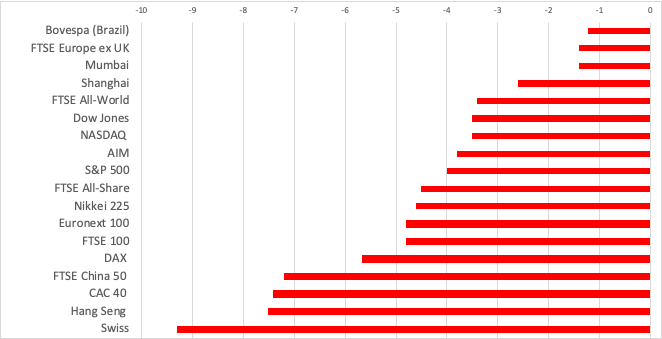

The Vix peaked at over 50 last week, the highest level since the start of the pandemic.

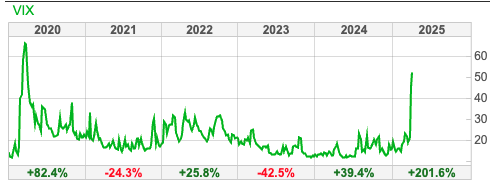

There’s an interesting piece by Byrne Hobart about why market returns tend to be asymmetrical. Bull markets grind slowly higher, climbing a “wall of worry”. Crashes are fast and brutal.

One reason is that winning positions tend to be a steady stream of incrementally good news: if you’re long a growing restaurant chain, your thesis is that the next restaurant location performs similarly to the last one. On the other hand, if you’re short a stock, you generally expect the story to fall apart, which will happen quite fast. Below is the schematic from a Goldman Sachs piece of research that Byrne links to. To be honest, the Goldman Sachs diagram looks a bit dull and theoretical to me, so I’ve livened it up by adding a real-world example (Northern Rock) in red.

A second reason is feedback loops, what George Soros called “reflexivity”. The build-up of leverage in good times means that when volatility hits in bad times, equity – the riskiest part of the capital structure – sees returns magnified in both directions. Mostly, that volatility will show up in sharp one-day declines, but sharp bear market rallies (often described as short squeezes) will happen, too. There were several of these bear market rallies as the financial crisis progressed from early 2007 to the trough in March 2009. Most people have forgotten, but in 2008, after Lehman Brothers filed for bankruptcy, there was a +13% jump in the S&P 500 in the final days of October. We’ve seen that recently with the Nasdaq100 and S&P500 up +8% in the last 5 days.

For now, my thinking is that the effects of Trump’s policies will take months (possibly years) to be felt, not weeks. So I am sitting on my hands – in other words, I don’t think this is like the sell-off in Feb/Mar 2020, when Central Banks stepped in with trillions of liquidity to support markets at the beginning of the pandemic. I am cautiously biding my time before putting cash to work.

This week, I look at Volex FY Mar trading update, which saw some huge swings intraday as investors struggled to interpret the “ahead of market expectations” headline. I also look at podcasting company Audioboom and Concurrent, which has been benefiting from the recent rise in defence contracts.

Volex FY Mar Trading Update

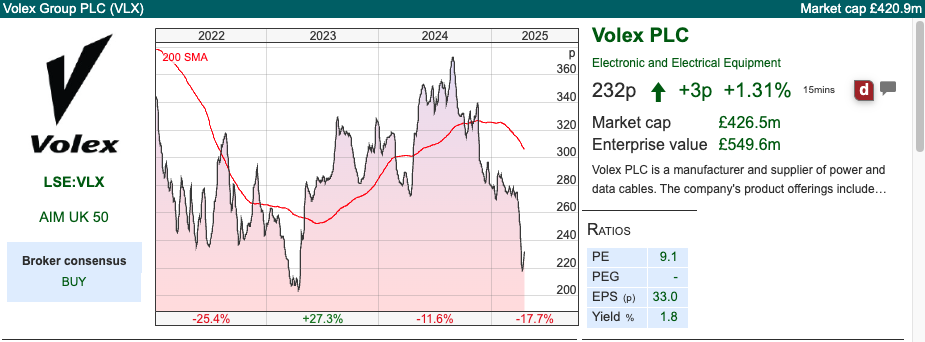

This copper cables, power and data transmission products company headlined their RNS with “growth and profit ahead of market expectations” while the share price responded by falling -10% when the markets opened, then reversing this to be up +20% later the same day, before then falling back again to close +12%. Presumably, that reaction was driven by trends in wider markets, which were particularly volatile on the day of VLX’s RNS.

However, I noted in 2021 that VLX management announced an “ahead” RNS, but then the share price traded slightly down. In last week’s RNS, management wrote that they expect FY Mar 2025 revenue to be at least $1.06bn, up +16% including acquisitions, or +8% on an organic constant currency basis. In January, they wrote that organic revenue growth would be high single digits, while maintaining margins of 9-10%. They now expect to be at the top end of the margin guidance, with underlying operating profits of at least $100m “well ahead of the top end of market estimates”. The RNS suggested a range for underlying operating profits of $96-$98m, so circa 3-4% ahead of that range.

In summary, last week’s RNS is ahead in the sense that some analysts appear not to have updated forecasts following VLX’s 27th January trading statement. The results were top of the range, but not ahead, if you compare this morning’s RNS with the 27th Jan guidance.

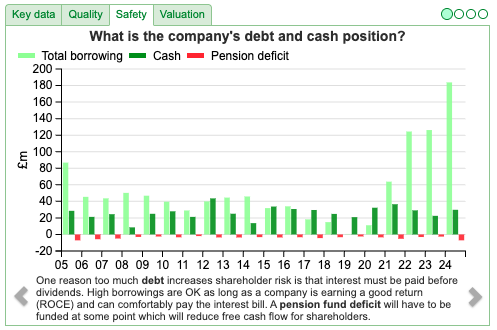

Balance sheet: Net debt / underlying EBITDA is 1.1x, down from 1.3x at H1 Sept 2024. They call this ratio “covenant leverage”, and they make several adjustments, including for lease liabilities, but also pro-rated for acquisitions. I think that’s fair enough, but I’m always intrigued when management use different wording for ratios involving net debt (ie net bank debt, which can exclude deferred consideration for acquisitions). The chart below shows that there has been a step change in the company’s borrowing since the pandemic.

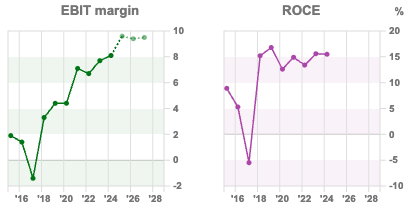

That growth in net debt is because VLX has grown by acquisitions, particularly in Turkey, most recently Murat Ticaret for $195m, in part funded with a £60m placing at 275p per share and €42m of deferred consideration and the rest via an increase in net debt. Management claim an ROCE of 18.9% ex goodwill, which for an acquisitive company is a bit like saying “we are very profitable, if you ignore the premiums we’ve paid for our past acquisitions”. ShareScope shows a 3-year average cash ROIC of 8.0%.

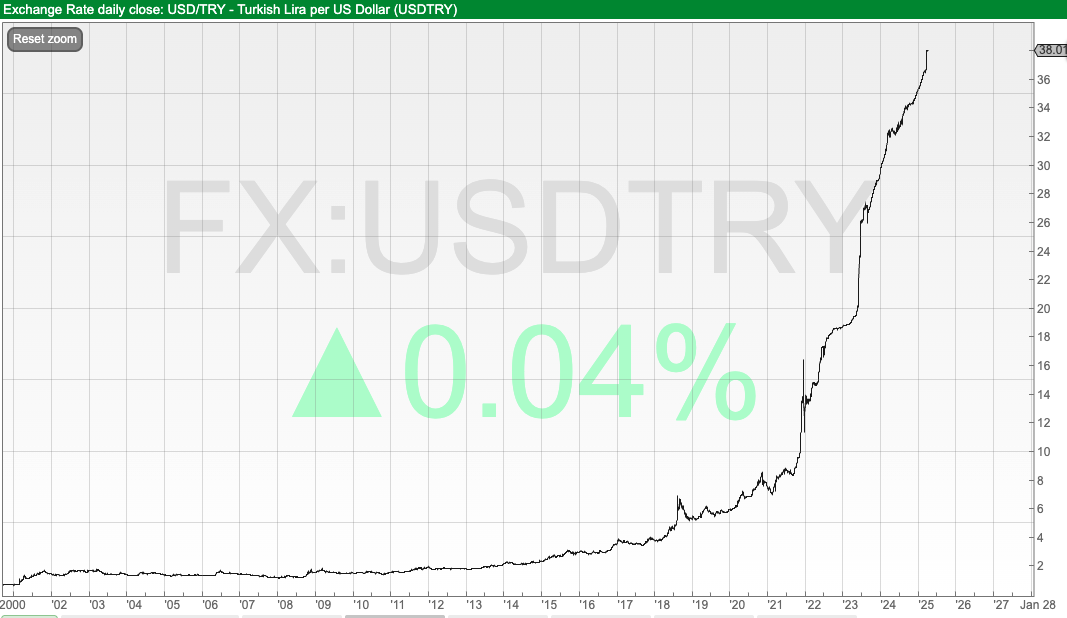

As of Sept 2024, the company had $254m of goodwill and intangibles on the face of the balance sheet, so around ¾ of shareholders’ equity of $353m is intangibles. The track record over the past few years looks OK. However, using Western capital markets to fund acquisitions in Turkey is not risk-free. The Turkish Lira continues to decline, as investors worry about country risk.

Tariffs: VLX shares had already fallen over -20% from when Trump announced his tariffs. The company comments: “The majority of Volex’s products represent essential components within complex supply chains. In many instances, Volex is either the sole provider or one of the very few qualified manufacturers capable of meeting demanding technical and operational requirements, fostering strong customer reliance. Incremental costs arising from tariff changes are expected to be passed through to customers, underscoring the robustness of Volex’s competitive positioning.”

Valuation: VLX is trading on 9x FY Mar 2026F PER and an EV/EBITDA of just over 5x the same year. That looks undemanding, so if management can continue to execute, we could see some multiple expansion. The risk is that management chase bigger and bigger deals until eventually one of those deals goes wrong.

Opinion: Nat Rothschild, the Exec Chair, owns 25%; Ruffer used to be a shareholder but now doesn’t own a disclosable stake. The shares did very well from 2016, rising by around 15x to peak in late 2021 at almost £5 per share.

Since then, performance has struggled, like many UK stocks, the valuation has de-rated rather than anything going fundamentally wrong. I think I would wait for the dust to settle to understand how Trump’s tariffs might affect the business. The valuation multiples suggest VLX is good value, but a company that manufactures in a low-cost economy with a weak currency is just the sort of investment case which might be negatively affected by a reversal in global trade.

AudioBoom Q1 Trading Update

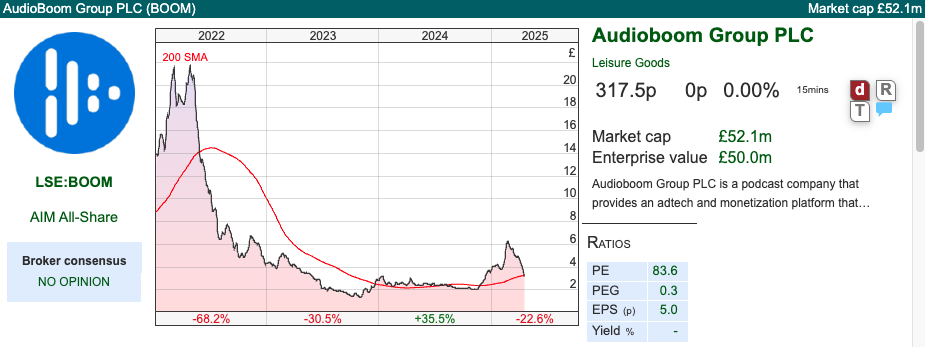

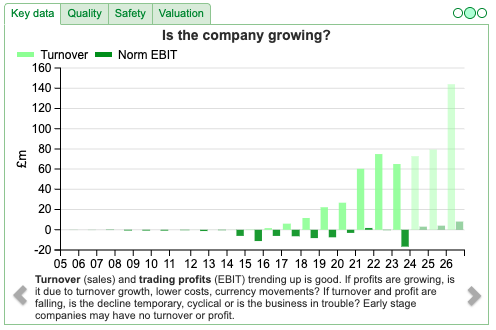

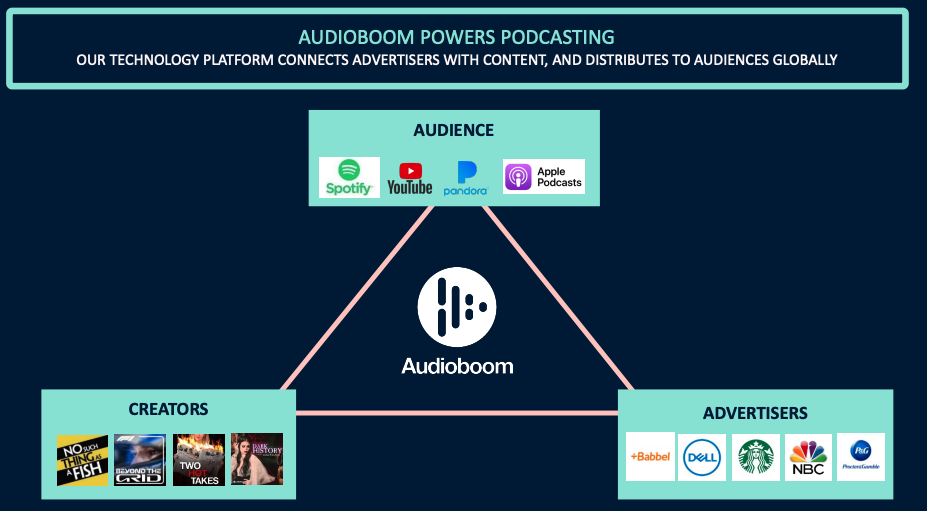

This podcast advertising company did very well during the pandemic, with the share price up over 20x. However, like many pandemic winners, gravity reasserted itself, and the shares fell -95% in the following couple of years. BOOM has struggled to generate profitable growth since 2014 when it came to market, it has only reported a profit once (PBT £1.7m) in FY Dec 2021. Excluding “onerous contracts”, the group also reported a profit in FY Dec 2024, however, I don’t think that bad deals signed in previous years should be excluded from statutory PBT. Looking at the FY 2024 balance sheet shows negative retained earnings of £52m, within shareholders’ equity of £4.2m. Cash was $4.3m at the end of March.

Q1 revenue was up +1% y-o-y to $17m, while the company led with the headline that adjusted EBITDA profit was up 10x, but still less than $1m. Management’s adjusted EBITDA “profit” excludes interest, tax, depreciation, amortisation, share-based payments, non-cash foreign exchange movements, material one-off items and onerous contract provisions and losses incurred.

Onerous contract provisions were taken following an advertising market downturn in 2023. Lower sales revenue resulted in BOOM needing to pay its share of advertising revenue to satisfy a small number of podcaster Minimum Guarantees (MGs) with which it had signed revenue share contracts, which led to losses for the group.

On tariffs: direct impact should be minimal, as the group’s advertising inventory is created and held locally, plus most employees are residents in the USA, so there should be limited impact from the UK government’s NIC increases. One of the problems with tariffs is that it’s the indirect, second and third-order effects that are hard to analyse though. For instance, we could now be facing an advertising downturn.

Outlook: Cavendish have published a 23-page note, but leave estimates for FY Dec 2025F unchanged, and introduces FY 2026F, which implies +9% revenue growth for both years. They are forecasting a reported PBT of $1.7m 2025F doubling to $3.4m 2026F. That does imply that as BOOM turns profitable, there’s some operational gearing as the business scales. Despite no changes to forecasts, the share price fell -16% on the morning of the results (versus AIM down -2.5%).

Valuation: The shares are trading on 20x PER Dec 2025F, falling to 14x PER the following year. That equates to 0.9x sales, so if management can demonstrate operational gearing and sustained profit growth, that could be good value.

Opinion: As you would expect from a company that specialises in podcasts, Stuart Last, the CEO, is on a podcast. It does look like the company won’t need to come back to investors yet again for more cash and is now growing profitably. If you think we might see a bull market at some point, this could be an interesting one to own. I’m put off by management’s voluntary disclosure (adj EBITDA “profits”), and also think that this could be hit by another advertising downturn if there’s stagflation in the USA. Will follow with interest, and might change my mind. For now, I’ll sit on my hands.

Concurrent FY Dec 2024 Results

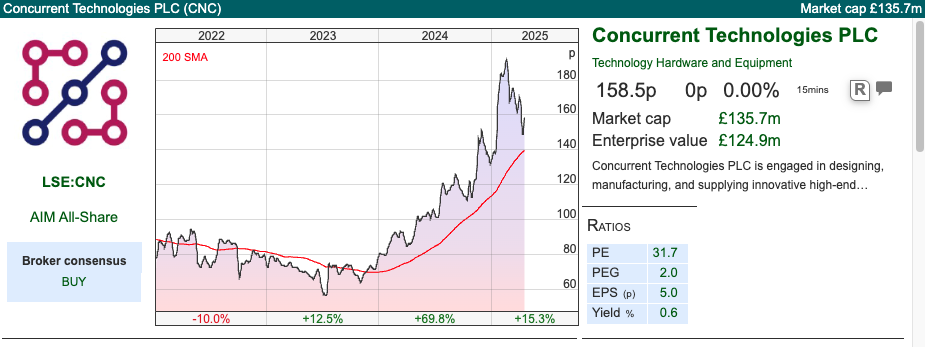

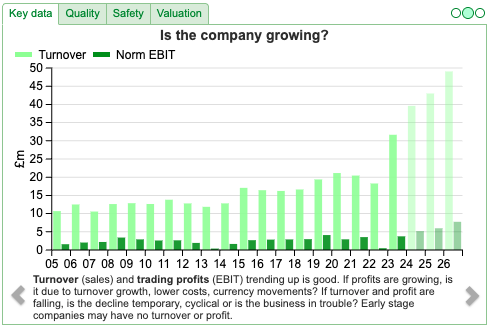

This military, aerospace, and industrial Single Board Computer (SBC) systems company specialises in ‘rugged’ products. That means their systems are reliable in harsh environments, either high or low temperatures, humid conditions or similar. The track record from before Putin’s invasion of Ukraine shows that they have struggled to generate top-line growth.

More recently, they’ve enjoyed a boost from increased defence spending, so FY Dec 2024 revenue was up +27% to £40m and statutory PBT was up +49% to £5.2m. The shares were up by +70% last year as it became clear that revenue growth was likely to continue in the coming years. The defence sector is now 87% of revenue.

2023 results have been re-stated, with EPS last year 4.06p rather than 4.98p originally reported. That flatters reported EPS growth, if we use the figure originally reported, then EPS growth was just +10% y-o-y.

They had net cash of £13.7m at the end of December. One thing to notice is that the company struggled recently with cash conversion, and receivables are around 20% of revenues. Sharescope shows the 3-year average CashRoCI was negative, and the 3-year average FCF conversion was -143%.

However, management comment that historically bad debts have been close to nil, and customers (presumably governments with defence budgets) do pay what is owed. So, rather than bad debts, the worry is that the growth puts strain on working capital.

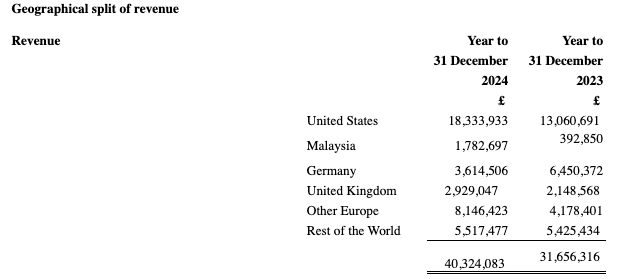

Outlook: Management talk of growing momentum and “notwithstanding the significant uncertainty created by new tariffs”, they currently expect FY Dec to be in line with market expectations. Cavendish say that the only reason they haven’t increased forecasts is because of current tariff uncertainty. The broker is forecasting +7% sales growth this year, doubling to +14% growth in FY Dec 2026F. Cavendish also point out that the biggest risk to forecasts is customers delaying orders while they seek to understand the full implications of tariffs on supply chains. The US is 45% of the group revenue and grew by +40% last year, so it is a key market.

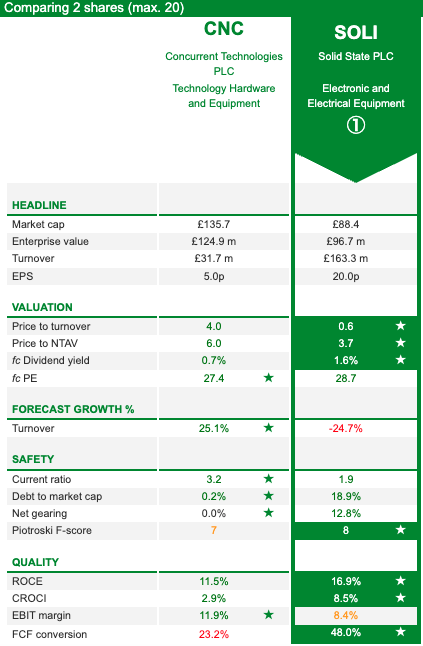

Valuation: The shares are on 19x PER FY Dec 2026F, though it’s important to understand how much of the EPS growth is due to a low tax charge from R&D tax credits. On an EV/EBITDA basis, they are on 11x FY Dec 2026F. In this market, that is comparatively expensive.

Opinion: I last covered CNC in Jan 2023, when the share price was 78p. Hopefully, management can continue to take advantage of the current trends of reshoring and rising defence spending, then this looks like it could be a decent story about medium-term growth. As the share price has doubled, it’s no longer a bargain though.

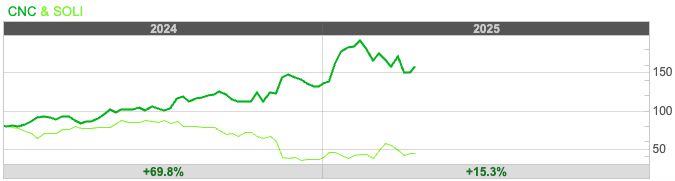

It’s also worth comparing the CNC investment case with Solid State, which fell -53% in 2024. Solid State also makes rugged computers for the defence sector, and has been enjoying the favourable tailwind from defence spending. However, SOLI warned at the end of last year that a recent order would be delayed. So I don’t think this is a sector where you should pay a multiple of over 20x earnings, even if there’s been impressive growth in recent years, because there’s always a risk that a lumpy contract is delayed or cancelled and the share price “tanks”.

Notes

Bruce owns shares in Solid State

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 16/4/2025 | VLX, BOOM, CNC | When narratives crash

It’s been a wild couple of weeks! Here’s a Sharescope chart of how the major indices have performed since 2nd April. Apologies for the amount of red in the chart…

The Vix peaked at over 50 last week, the highest level since the start of the pandemic.

There’s an interesting piece by Byrne Hobart about why market returns tend to be asymmetrical. Bull markets grind slowly higher, climbing a “wall of worry”. Crashes are fast and brutal.

One reason is that winning positions tend to be a steady stream of incrementally good news: if you’re long a growing restaurant chain, your thesis is that the next restaurant location performs similarly to the last one. On the other hand, if you’re short a stock, you generally expect the story to fall apart, which will happen quite fast. Below is the schematic from a Goldman Sachs piece of research that Byrne links to. To be honest, the Goldman Sachs diagram looks a bit dull and theoretical to me, so I’ve livened it up by adding a real-world example (Northern Rock) in red.

A second reason is feedback loops, what George Soros called “reflexivity”. The build-up of leverage in good times means that when volatility hits in bad times, equity – the riskiest part of the capital structure – sees returns magnified in both directions. Mostly, that volatility will show up in sharp one-day declines, but sharp bear market rallies (often described as short squeezes) will happen, too. There were several of these bear market rallies as the financial crisis progressed from early 2007 to the trough in March 2009. Most people have forgotten, but in 2008, after Lehman Brothers filed for bankruptcy, there was a +13% jump in the S&P 500 in the final days of October. We’ve seen that recently with the Nasdaq100 and S&P500 up +8% in the last 5 days.

For now, my thinking is that the effects of Trump’s policies will take months (possibly years) to be felt, not weeks. So I am sitting on my hands – in other words, I don’t think this is like the sell-off in Feb/Mar 2020, when Central Banks stepped in with trillions of liquidity to support markets at the beginning of the pandemic. I am cautiously biding my time before putting cash to work.

This week, I look at Volex FY Mar trading update, which saw some huge swings intraday as investors struggled to interpret the “ahead of market expectations” headline. I also look at podcasting company Audioboom and Concurrent, which has been benefiting from the recent rise in defence contracts.

Volex FY Mar Trading Update

This copper cables, power and data transmission products company headlined their RNS with “growth and profit ahead of market expectations” while the share price responded by falling -10% when the markets opened, then reversing this to be up +20% later the same day, before then falling back again to close +12%. Presumably, that reaction was driven by trends in wider markets, which were particularly volatile on the day of VLX’s RNS.

However, I noted in 2021 that VLX management announced an “ahead” RNS, but then the share price traded slightly down. In last week’s RNS, management wrote that they expect FY Mar 2025 revenue to be at least $1.06bn, up +16% including acquisitions, or +8% on an organic constant currency basis. In January, they wrote that organic revenue growth would be high single digits, while maintaining margins of 9-10%. They now expect to be at the top end of the margin guidance, with underlying operating profits of at least $100m “well ahead of the top end of market estimates”. The RNS suggested a range for underlying operating profits of $96-$98m, so circa 3-4% ahead of that range.

In summary, last week’s RNS is ahead in the sense that some analysts appear not to have updated forecasts following VLX’s 27th January trading statement. The results were top of the range, but not ahead, if you compare this morning’s RNS with the 27th Jan guidance.

Balance sheet: Net debt / underlying EBITDA is 1.1x, down from 1.3x at H1 Sept 2024. They call this ratio “covenant leverage”, and they make several adjustments, including for lease liabilities, but also pro-rated for acquisitions. I think that’s fair enough, but I’m always intrigued when management use different wording for ratios involving net debt (ie net bank debt, which can exclude deferred consideration for acquisitions). The chart below shows that there has been a step change in the company’s borrowing since the pandemic.

That growth in net debt is because VLX has grown by acquisitions, particularly in Turkey, most recently Murat Ticaret for $195m, in part funded with a £60m placing at 275p per share and €42m of deferred consideration and the rest via an increase in net debt. Management claim an ROCE of 18.9% ex goodwill, which for an acquisitive company is a bit like saying “we are very profitable, if you ignore the premiums we’ve paid for our past acquisitions”. ShareScope shows a 3-year average cash ROIC of 8.0%.

As of Sept 2024, the company had $254m of goodwill and intangibles on the face of the balance sheet, so around ¾ of shareholders’ equity of $353m is intangibles. The track record over the past few years looks OK. However, using Western capital markets to fund acquisitions in Turkey is not risk-free. The Turkish Lira continues to decline, as investors worry about country risk.

Tariffs: VLX shares had already fallen over -20% from when Trump announced his tariffs. The company comments: “The majority of Volex’s products represent essential components within complex supply chains. In many instances, Volex is either the sole provider or one of the very few qualified manufacturers capable of meeting demanding technical and operational requirements, fostering strong customer reliance. Incremental costs arising from tariff changes are expected to be passed through to customers, underscoring the robustness of Volex’s competitive positioning.”

Valuation: VLX is trading on 9x FY Mar 2026F PER and an EV/EBITDA of just over 5x the same year. That looks undemanding, so if management can continue to execute, we could see some multiple expansion. The risk is that management chase bigger and bigger deals until eventually one of those deals goes wrong.

Opinion: Nat Rothschild, the Exec Chair, owns 25%; Ruffer used to be a shareholder but now doesn’t own a disclosable stake. The shares did very well from 2016, rising by around 15x to peak in late 2021 at almost £5 per share.

Since then, performance has struggled, like many UK stocks, the valuation has de-rated rather than anything going fundamentally wrong. I think I would wait for the dust to settle to understand how Trump’s tariffs might affect the business. The valuation multiples suggest VLX is good value, but a company that manufactures in a low-cost economy with a weak currency is just the sort of investment case which might be negatively affected by a reversal in global trade.

AudioBoom Q1 Trading Update

This podcast advertising company did very well during the pandemic, with the share price up over 20x. However, like many pandemic winners, gravity reasserted itself, and the shares fell -95% in the following couple of years. BOOM has struggled to generate profitable growth since 2014 when it came to market, it has only reported a profit once (PBT £1.7m) in FY Dec 2021. Excluding “onerous contracts”, the group also reported a profit in FY Dec 2024, however, I don’t think that bad deals signed in previous years should be excluded from statutory PBT. Looking at the FY 2024 balance sheet shows negative retained earnings of £52m, within shareholders’ equity of £4.2m. Cash was $4.3m at the end of March.

Q1 revenue was up +1% y-o-y to $17m, while the company led with the headline that adjusted EBITDA profit was up 10x, but still less than $1m. Management’s adjusted EBITDA “profit” excludes interest, tax, depreciation, amortisation, share-based payments, non-cash foreign exchange movements, material one-off items and onerous contract provisions and losses incurred.

Onerous contract provisions were taken following an advertising market downturn in 2023. Lower sales revenue resulted in BOOM needing to pay its share of advertising revenue to satisfy a small number of podcaster Minimum Guarantees (MGs) with which it had signed revenue share contracts, which led to losses for the group.

On tariffs: direct impact should be minimal, as the group’s advertising inventory is created and held locally, plus most employees are residents in the USA, so there should be limited impact from the UK government’s NIC increases. One of the problems with tariffs is that it’s the indirect, second and third-order effects that are hard to analyse though. For instance, we could now be facing an advertising downturn.

Outlook: Cavendish have published a 23-page note, but leave estimates for FY Dec 2025F unchanged, and introduces FY 2026F, which implies +9% revenue growth for both years. They are forecasting a reported PBT of $1.7m 2025F doubling to $3.4m 2026F. That does imply that as BOOM turns profitable, there’s some operational gearing as the business scales. Despite no changes to forecasts, the share price fell -16% on the morning of the results (versus AIM down -2.5%).

Valuation: The shares are trading on 20x PER Dec 2025F, falling to 14x PER the following year. That equates to 0.9x sales, so if management can demonstrate operational gearing and sustained profit growth, that could be good value.

Opinion: As you would expect from a company that specialises in podcasts, Stuart Last, the CEO, is on a podcast. It does look like the company won’t need to come back to investors yet again for more cash and is now growing profitably. If you think we might see a bull market at some point, this could be an interesting one to own. I’m put off by management’s voluntary disclosure (adj EBITDA “profits”), and also think that this could be hit by another advertising downturn if there’s stagflation in the USA. Will follow with interest, and might change my mind. For now, I’ll sit on my hands.

Concurrent FY Dec 2024 Results

This military, aerospace, and industrial Single Board Computer (SBC) systems company specialises in ‘rugged’ products. That means their systems are reliable in harsh environments, either high or low temperatures, humid conditions or similar. The track record from before Putin’s invasion of Ukraine shows that they have struggled to generate top-line growth.

More recently, they’ve enjoyed a boost from increased defence spending, so FY Dec 2024 revenue was up +27% to £40m and statutory PBT was up +49% to £5.2m. The shares were up by +70% last year as it became clear that revenue growth was likely to continue in the coming years. The defence sector is now 87% of revenue.

2023 results have been re-stated, with EPS last year 4.06p rather than 4.98p originally reported. That flatters reported EPS growth, if we use the figure originally reported, then EPS growth was just +10% y-o-y.

They had net cash of £13.7m at the end of December. One thing to notice is that the company struggled recently with cash conversion, and receivables are around 20% of revenues. Sharescope shows the 3-year average CashRoCI was negative, and the 3-year average FCF conversion was -143%.

However, management comment that historically bad debts have been close to nil, and customers (presumably governments with defence budgets) do pay what is owed. So, rather than bad debts, the worry is that the growth puts strain on working capital.

Outlook: Management talk of growing momentum and “notwithstanding the significant uncertainty created by new tariffs”, they currently expect FY Dec to be in line with market expectations. Cavendish say that the only reason they haven’t increased forecasts is because of current tariff uncertainty. The broker is forecasting +7% sales growth this year, doubling to +14% growth in FY Dec 2026F. Cavendish also point out that the biggest risk to forecasts is customers delaying orders while they seek to understand the full implications of tariffs on supply chains. The US is 45% of the group revenue and grew by +40% last year, so it is a key market.

Valuation: The shares are on 19x PER FY Dec 2026F, though it’s important to understand how much of the EPS growth is due to a low tax charge from R&D tax credits. On an EV/EBITDA basis, they are on 11x FY Dec 2026F. In this market, that is comparatively expensive.

Opinion: I last covered CNC in Jan 2023, when the share price was 78p. Hopefully, management can continue to take advantage of the current trends of reshoring and rising defence spending, then this looks like it could be a decent story about medium-term growth. As the share price has doubled, it’s no longer a bargain though.

It’s also worth comparing the CNC investment case with Solid State, which fell -53% in 2024. Solid State also makes rugged computers for the defence sector, and has been enjoying the favourable tailwind from defence spending. However, SOLI warned at the end of last year that a recent order would be delayed. So I don’t think this is a sector where you should pay a multiple of over 20x earnings, even if there’s been impressive growth in recent years, because there’s always a risk that a lumpy contract is delayed or cancelled and the share price “tanks”.

Notes

Bruce owns shares in Solid State

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.