A look at Larry Fink’s letter to BlackRock shareholders. The US asset manager has $11.6 trillion of AuM, and saw $281bn of inflows in Q4 alone. Companies covered AVON, BWY, VTY and FRAN.

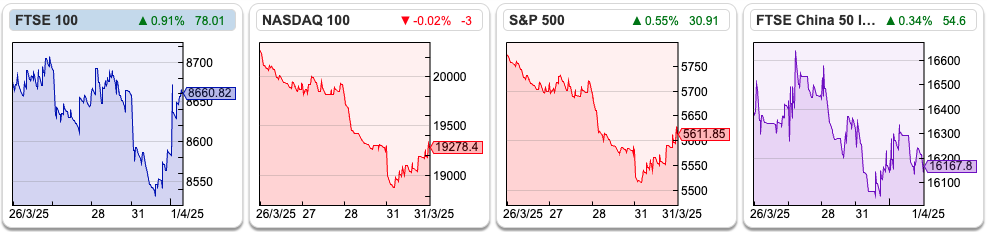

The FTSE 100 was flat over the last 5 days, at 8680. US indices had a difficult week, with the Nasdaq100 down -4.5% and S&P 500 -2.7%. Precious metals were up, including Platinum was up +4.9% to $1010, Gold +3.6% to $3120. Before the financial crisis, Platinum used to trade above $2000 an ounce and a significant premium to the gold price. The reversal suggests Central Bank buying has driven the gold price in recent years, whereas industrial uses of platinum (catalytic converters) have become less important.

By the time this piece is published, we will know more about “Liberation Day Tariffs”. So far, Trump has picked fights with neighbours (Mexico, Canada) and allies (the EU, Denmark and Japan) rather than China. The best-performing commodities last quarter were copper and steel, both up +26% YTD, which hardly suggests a global recession. That commodity performance may have been distorted by traders rushing to import commodities into the US before tariffs are applied though.

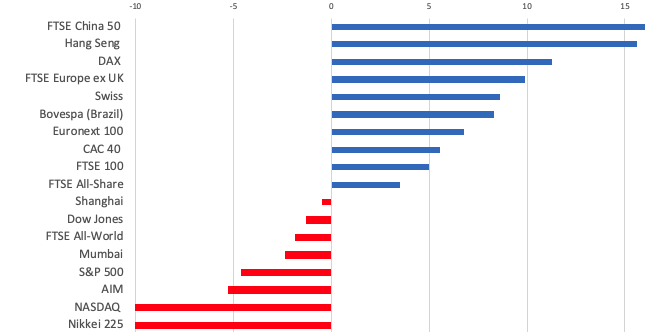

I have used Sharescope to look at the performance of the major stock market indices since the 1st of January, with Japan’s Nikkei 225 the worst-performing market, down -10.7%. AIM, down -5.2% is sandwiched by the two US indices, Nasdaq down -10.4% and S&P500 down -4.6%.

The best performers have been the FTSE China 50, up +16.2%, and Hong Kong’s Hang Seng +15.6%, but note too that the Shanghai composite, which contains smaller Chinese stocks, is in negative territory. Europe, ex the UK and Germany (DAX), have also performed well.

Performance of major indices in a graph.

Warren Buffett’s letter to shareholders gains much attention, but other high-profile Chief Execs have also started writing their own letters. For instance, there’s this from Stripe founders, Patrick and John Collison, and Jamie Dimon, of JP Morgan, writes a letter too. So far, I have found the most interesting to be Larry Fink’s, of $11 trillion AuM BlackRock.

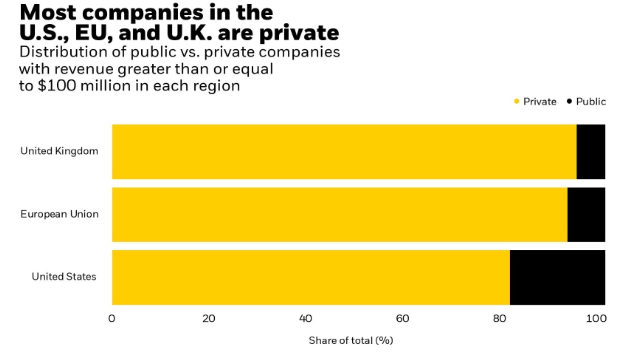

The whole 27-page letter is worth reading, though one chart that jumped out at me was this one below, which shows that over 80% of large companies in the US are private (ie not listed on the stock exchange). The percentage is even higher in the EU and UK :

He sees this as a significant opportunity for BlackRock, but also points out that currently, most investors are not able to own shares in companies generating the majority of the economic growth. That in turn, may explain some of the current dissatisfaction with capital markets.

This week, I look at Avon Technologies, the defence company where management have performed an impressive turnaround, plus housebuilders Bellway and Vistry. Then I finish up with Franchise Brands, which looks to have stabilised after a valuation de-rating over the last 18 months.

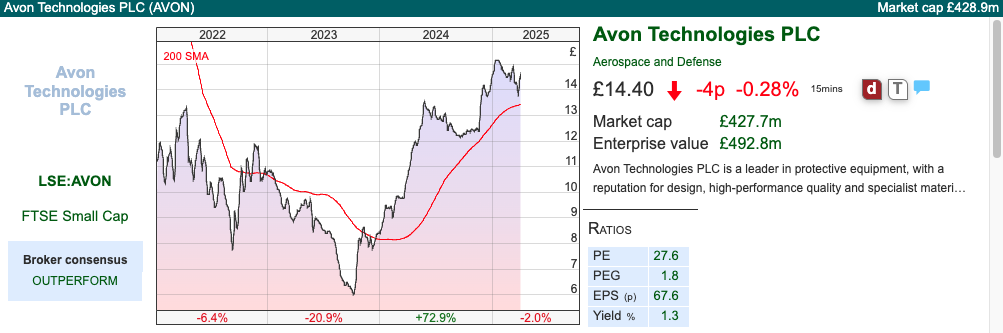

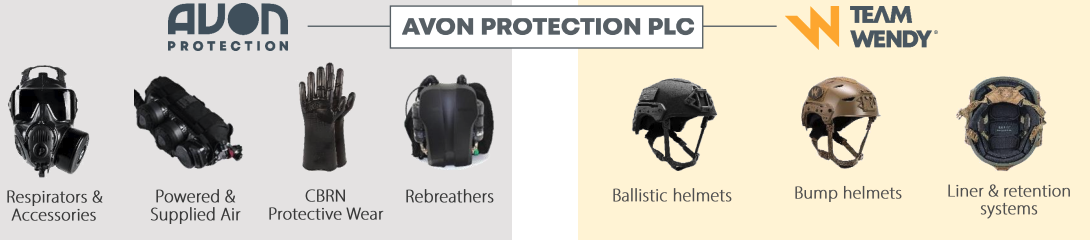

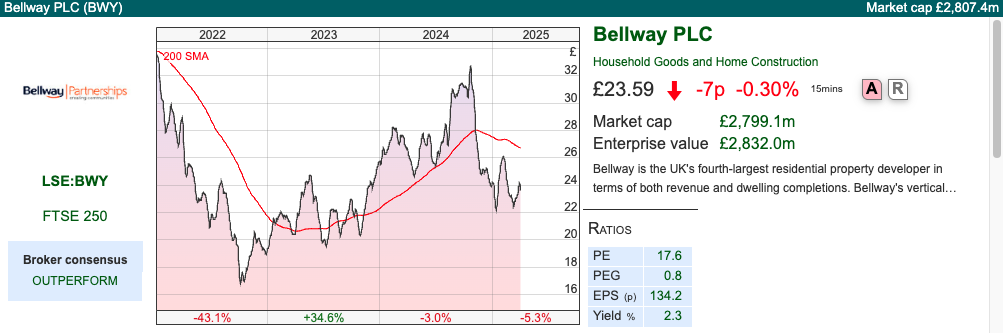

Avon Technologies Q2 trading statement

This military grade respiratory system (Avon Protection) and helmets (Team Wendy) company announced an upgrade to FY Sept 2025F expectations. They had already announced in July last year that they were winning a follow-on order from the US Defense Logistics Agency worth $20m. Then last week’s RNS mentions two new European NATO orders for delivery to Ukrainian forces. Hence, revenue growth and profit margins will be higher than expected; previously, Sharescope was showing +8% revenue growth and EPS +7%. New guidance is for revenue growth in excess of +10% and operating margin above 12% (previous guidance 11.5%).

History: The company used to be called Avon Rubber and has been around for 140 years, originally making bicycle tyres and conveyor belts. The shares were a multi-bagger following the financial crisis, and the price peaked at £45 per share at the end of 2020. However, management made a poor acquisition of a US body armour business, which was supposed to generate $40m of revenue FY Sept 2022, but they failed to get the product approvals and the business was closed down. They made a $47m impairment charge for this in FY Sept 2021.

AVON continued to struggle after that, with revenue declining -7.5% and another goodwill impairment charge of $23m two years later in FY Sept 2023. This was related to another poor acquisition, this time a helmet business. That -7% y-o-y revenue to £243m might not sound particularly serious, but when Maynard looked at the company in Jan 2021, forecasts were for FY Sept 2023 revenue of £315m, so that’s a -23% decline versus expectations. Similarly, PBT was originally forecast to be £60m that same year, but the company ended up reporting a £20m loss FY Sept 2023. The share price fell to around £6 per share at the end of 2023, an 87% decline from its peak.

Refocusing on the business, plus an increase in defence spending, has meant new contract wins have reinvigorated the share price, which has been recovering nicely to above £14. There was a Capital Markets Day in early 2024, which talked about revenue growth of at least +5% CAGR, 14-16% operating margin, >17% ROIC, 1-2x net debt/EBITDA. Well done to readers who spotted the turnaround.

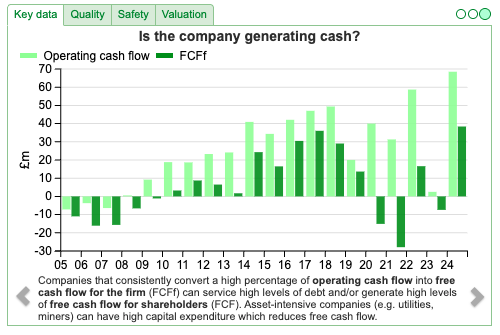

Below is a long-term chart of global defence spending from the 2024 CMD presentation. The chart shows that defence spending rose in the decade following 11 Sept 2001, but then began to decline again after the financial crisis.

Valuation: EPS forecasts are implying +16% growth this year and +34% next year, which puts AVON trading on a PER if 18x FY Sept 2026F, 11x EV/EBITDA the same year. The contract win announcements are encouraging, but that implied growth and high teens PER now suggests little room for disappointment.

Opinion: I think we need to think carefully about whether demand might be pulled forward from future years, and so not extrapolate a temporary trend too far into the future. Presumably, once soldiers have a new helmet, the head protection lasts a long time, and they don’t need to be replaced very often. Avon themselves expected demand for helmets and respirators to only grow at 3-4% CAGR to 2028, so implicitly, revenue growth of +10% this year is not sustainable. For that reason, I’d be cautious about opening a new position now, and if it dipped below the 200-day moving average probably sell if I owned it. But well done to anyone who doubled their money, correctly timing the turnaround.

Bellway H1 Jan Results

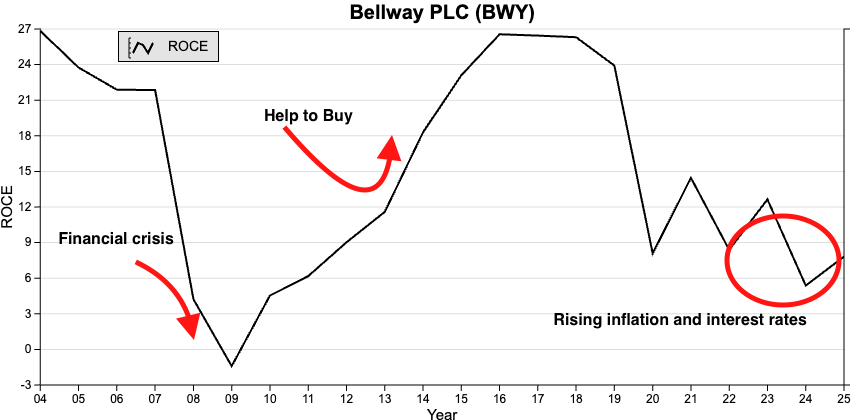

I tend to avoid writing about house builders; they performed very well following the financial crisis, but that was mainly a result of George Osborne’s terrible Help to Buy scheme. The subsidy ended up helping the owners and sellers of houses, including house builders, rather than first-time buyers. More recently, we have had rising inflation and interest rates, which also put me off the house building sector. The sector has not started the year well, despite Central Bank rate cuts, but perhaps now might be a good time to revisit the investment case?

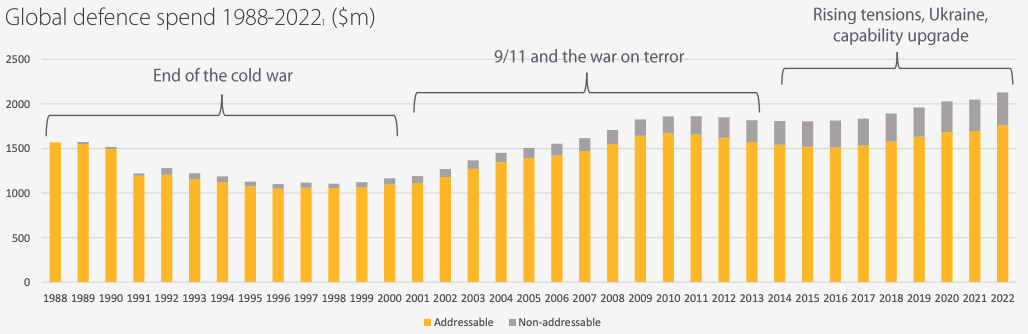

Bellway reported revenue +12% to £1.4bn, housing completions and underlying PBT were also up by +12%. On a statutory basis, PBT was up +20% to £141m, and they had just £8m of net debt at the end of January. They have £530m of committed credit facilities if management did want to increase borrowing to fund activity.

As revenue is growing in line with housing completions, that implies that the average selling price (£311K) hasn’t increased much, which is the case. The average selling price for private houses is £346K (down -1%) and for social housing £178K (down -5%), which then gives the average selling price of £311k.

I noticed on their website that Bellway London are offering to cover buyers’ costs up to £25,000, which implies that although the average selling price might be only down 1%, they are having to offer incentives to buyers, effectively a price reduction by another name.

Outlook: Bellway say that recent trading since the year end has been encouraging and underpins FY July 2025F targets. The average selling price is likely to remain flat, but since the beginning of February, the private reservation rate has risen to 0.76 (versus 0.67 the same 7 weeks of last year). The group expects to build at least 8,500 homes this year, implying +11% growth.

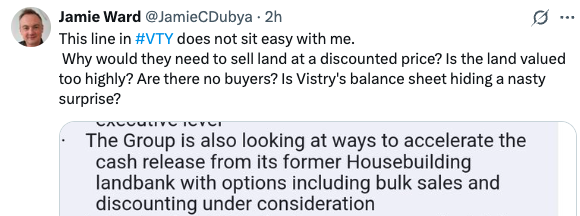

Comparison with Vistry: Affordable housing specialist Vistry also reported FY Dec results last week, with the share price falling -6% on the morning of the results, as current trading (ie Q1 2025) looks weak. Jamie also pointed out on Twitter that management are looking to improve cashflow by selling off some of their LandBank in bulk and/or at discounted prices. That sounds ominous to me as well.

VTY shares are down -56% since last August, as management have reduced EPS expectations 3x in the final quarter of last year, blaming rising build costs and delays to completions.

Valuation: Bellway’s NAV per share is £29.60, so the shares trade at 0.8x book, or a PER of 12x Jul 2026F. RoCE is currently 8.9%, but see Sharescope’s 20-year chart for how cyclical profitability can be in this sector. In FY Jul 2024, revenue fell -30% and PBT was down -62%, so when things stall, they stall badly.

Opinion: You can probably tell I’m not wildly enthusiastic about house builders at any point in the cycle. As I haven’t followed the sector closely, I don’t have much feel for how Bellway compares to the likes of Persimmon and Barratt (now Barratt Redrow). My rule of thumb is that if you believe a cyclical sector will enjoy a recovery, then buy the weakest businesses, as they will benefit disproportionately. Hence, NatWest has done well as the UK banking sector has come back into favour. Similarly, when it is time to buy, I would buy VTY or CRST, rather than Bellway.

That said, I will avoid the whole sector. This is an industry that is likely to generate sub-10 % RoCE through the cycle, unless there’s more government support coming for housebuilders. If I wanted to increase my position in an out-of-favour sector, then rather than house builders, I would buy fund management companies like Impax AM or renewable energy funds like NESF or GRID.

Franchise Brands FY Dec Results

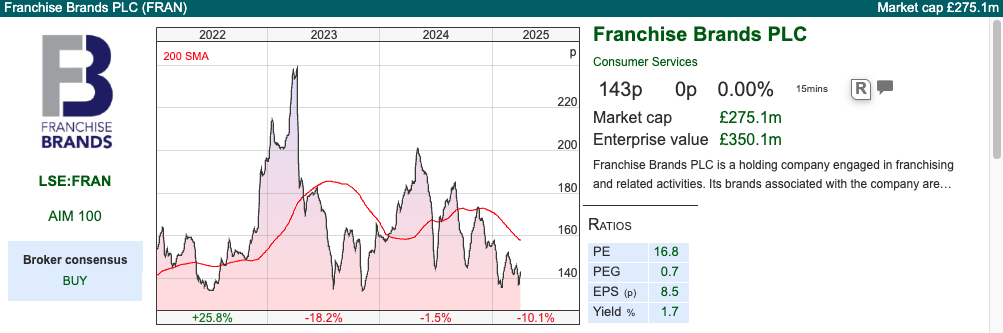

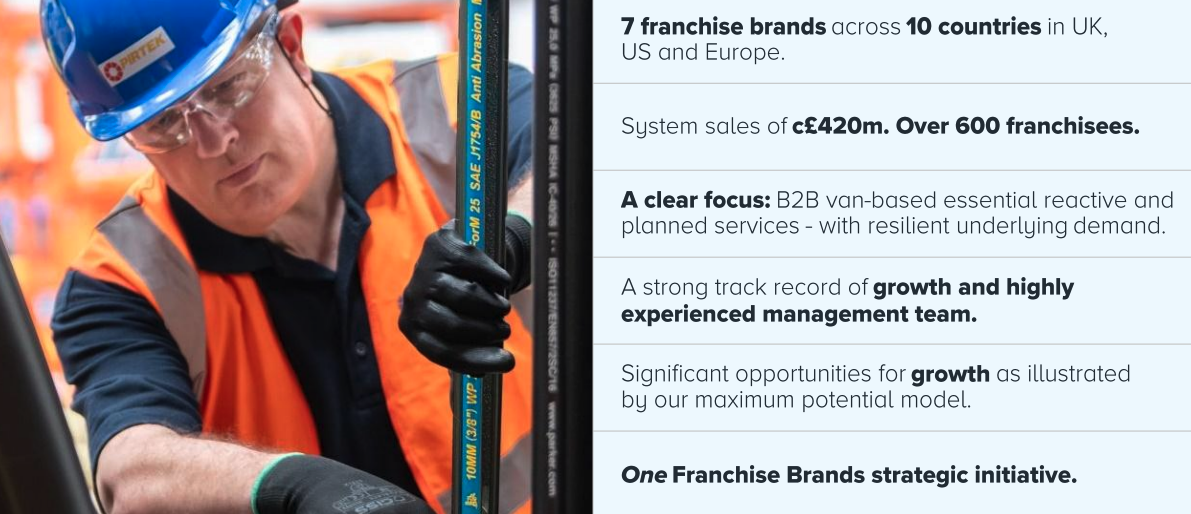

This plumbing and cooking oil (Filta) franchise business, run by the former Domino’s Pizza UK management, was doing very well up until Mar 2023, when they expanded into Europe, buying Pirtek for £212m from a Private Equity seller. They funded £110m of the purchase price with debt, the rest from an equity placing at 180p, and since then the shares are down roughly -40% to 143p.

Management points investors to the System Sales KPI, which is underlying sales of franchisees plus statutory revenue of their own business (called Direct Labour Operations). On this basis, system sales were up +20% to £418m, with Pirtek their largest division growing at +46%. That sounds impressive, but the Pirtek acquisition only completed in H1 2023, so that is a flattering comparison. Instead, on a like-for-like basis, though, Pirtek was only up +2%, and group statutory revenue was flat.

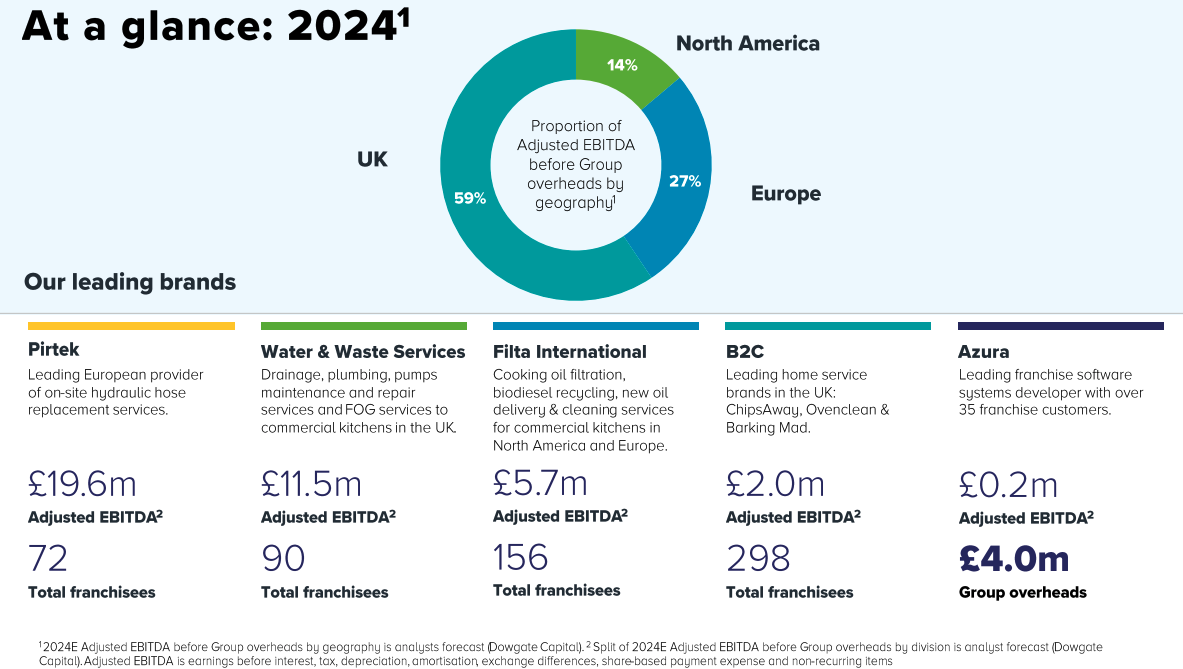

From a geographic perspective, they say that the US system sales have been particularly strong, with the UK and Europe more moderate. NB that North America is the smallest contributor with 14% of adj EBITDA, compared to the UK (59%) and Europe (27%). Group adj EBITDA was flat on an underlying basis, while net debt reduced to £65m.

The underlying trends are not particularly easy to understand, as they have reorganised some divisions of Filta from DLO to franchising, while selling Willow Pumps’ Kent and Sussex franchises. I can see that shifting some activity between franchising and direct labour could make sense, so I don’t think this is done to obscure underlying trends. It does mean that FRAN is more complicated to analyse than a pizza restaurant franchise.

Last week’s RNS announced they would separate the role of CEO and Chair, with Peter Molloy, who has been with the group since 2017, being promoted to CEO. Stephen Hemsley relinquishes the CEO role, but remains Executive Chairman. They have also appointed a CFO, Andrew Mallows, on a permanent basis as CFO and Commercial Director, plus they have created a new non-Board role of Group Finance Director, who is Beth Peace. I haven’t seen a company before with separate people performing the CFO and Group Finance Director roles, but it probably makes sense from their perspective. Possibly it reflects that the group has grown by acquisition, and wants to retain employees with important-sounding job titles?

Outlook: They point to strong cash generation allowing them to de-leverage net debt/EBITDA to below 1.5x by the end of Dec 2025. That’s down from 2.5x Jun 2023. But they also say that discretionary spending is subdued, and the timing of a pickup remains uncertain. Management held a Capital Markets Day in February, suggesting adj EBITDA growth of CAGR between 6% to 15% over the next four years.

Allenby Capital leave their FY Dec 2025F numbers unchanged and introduces FY Dec 2026F, which implies 18% EPS growth this year, slowing to 13% EPS growth next year.

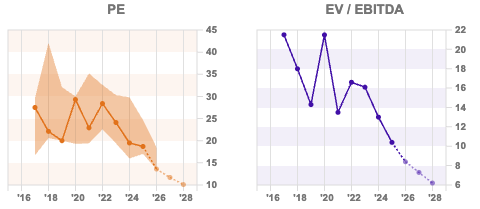

Valuation: On Allenby’s numbers, the shares are trading on 14x Dec 2025F, dropping to 12x Dec 2026F. On an EV/EBITDA basis, that’s 8x Dec 2025F dropping to 6x Dec 2026F. That might not sound particularly good value in this market, but Sharescope’s charts below show a PER de-rating from above 30x and an EV/EBITDA de-rating from high teens.

Opinion: I like the management team, as their track record at Domino’s Pizza UK was phenomenal. Nigel Wray (non-Exec) and Stephen Hemsley still own 12% and 8% respectively. The largest investor is Mark Slater, of Slater Investments, with 15%. Before the pandemic, FRAN demonstrated good growth but tended to look expensive. The shares now look better value, net debt is falling, EPS growing, so I am warm to this. It doesn’t sound like there’s an obvious near-term catalyst, but I might look to buy into the story at some point.

Notes

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 2/4/2025 | AVON, BWY, VTY, FRAN | A letter from Larry

A look at Larry Fink’s letter to BlackRock shareholders. The US asset manager has $11.6 trillion of AuM, and saw $281bn of inflows in Q4 alone. Companies covered AVON, BWY, VTY and FRAN.

The FTSE 100 was flat over the last 5 days, at 8680. US indices had a difficult week, with the Nasdaq100 down -4.5% and S&P 500 -2.7%. Precious metals were up, including Platinum was up +4.9% to $1010, Gold +3.6% to $3120. Before the financial crisis, Platinum used to trade above $2000 an ounce and a significant premium to the gold price. The reversal suggests Central Bank buying has driven the gold price in recent years, whereas industrial uses of platinum (catalytic converters) have become less important.

By the time this piece is published, we will know more about “Liberation Day Tariffs”. So far, Trump has picked fights with neighbours (Mexico, Canada) and allies (the EU, Denmark and Japan) rather than China. The best-performing commodities last quarter were copper and steel, both up +26% YTD, which hardly suggests a global recession. That commodity performance may have been distorted by traders rushing to import commodities into the US before tariffs are applied though.

I have used Sharescope to look at the performance of the major stock market indices since the 1st of January, with Japan’s Nikkei 225 the worst-performing market, down -10.7%. AIM, down -5.2% is sandwiched by the two US indices, Nasdaq down -10.4% and S&P500 down -4.6%.

The best performers have been the FTSE China 50, up +16.2%, and Hong Kong’s Hang Seng +15.6%, but note too that the Shanghai composite, which contains smaller Chinese stocks, is in negative territory. Europe, ex the UK and Germany (DAX), have also performed well.

Performance of major indices in a graph.

Warren Buffett’s letter to shareholders gains much attention, but other high-profile Chief Execs have also started writing their own letters. For instance, there’s this from Stripe founders, Patrick and John Collison, and Jamie Dimon, of JP Morgan, writes a letter too. So far, I have found the most interesting to be Larry Fink’s, of $11 trillion AuM BlackRock.

The whole 27-page letter is worth reading, though one chart that jumped out at me was this one below, which shows that over 80% of large companies in the US are private (ie not listed on the stock exchange). The percentage is even higher in the EU and UK :

He sees this as a significant opportunity for BlackRock, but also points out that currently, most investors are not able to own shares in companies generating the majority of the economic growth. That in turn, may explain some of the current dissatisfaction with capital markets.

This week, I look at Avon Technologies, the defence company where management have performed an impressive turnaround, plus housebuilders Bellway and Vistry. Then I finish up with Franchise Brands, which looks to have stabilised after a valuation de-rating over the last 18 months.

Avon Technologies Q2 trading statement

This military grade respiratory system (Avon Protection) and helmets (Team Wendy) company announced an upgrade to FY Sept 2025F expectations. They had already announced in July last year that they were winning a follow-on order from the US Defense Logistics Agency worth $20m. Then last week’s RNS mentions two new European NATO orders for delivery to Ukrainian forces. Hence, revenue growth and profit margins will be higher than expected; previously, Sharescope was showing +8% revenue growth and EPS +7%. New guidance is for revenue growth in excess of +10% and operating margin above 12% (previous guidance 11.5%).

History: The company used to be called Avon Rubber and has been around for 140 years, originally making bicycle tyres and conveyor belts. The shares were a multi-bagger following the financial crisis, and the price peaked at £45 per share at the end of 2020. However, management made a poor acquisition of a US body armour business, which was supposed to generate $40m of revenue FY Sept 2022, but they failed to get the product approvals and the business was closed down. They made a $47m impairment charge for this in FY Sept 2021.

AVON continued to struggle after that, with revenue declining -7.5% and another goodwill impairment charge of $23m two years later in FY Sept 2023. This was related to another poor acquisition, this time a helmet business. That -7% y-o-y revenue to £243m might not sound particularly serious, but when Maynard looked at the company in Jan 2021, forecasts were for FY Sept 2023 revenue of £315m, so that’s a -23% decline versus expectations. Similarly, PBT was originally forecast to be £60m that same year, but the company ended up reporting a £20m loss FY Sept 2023. The share price fell to around £6 per share at the end of 2023, an 87% decline from its peak.

Refocusing on the business, plus an increase in defence spending, has meant new contract wins have reinvigorated the share price, which has been recovering nicely to above £14. There was a Capital Markets Day in early 2024, which talked about revenue growth of at least +5% CAGR, 14-16% operating margin, >17% ROIC, 1-2x net debt/EBITDA. Well done to readers who spotted the turnaround.

Below is a long-term chart of global defence spending from the 2024 CMD presentation. The chart shows that defence spending rose in the decade following 11 Sept 2001, but then began to decline again after the financial crisis.

Valuation: EPS forecasts are implying +16% growth this year and +34% next year, which puts AVON trading on a PER if 18x FY Sept 2026F, 11x EV/EBITDA the same year. The contract win announcements are encouraging, but that implied growth and high teens PER now suggests little room for disappointment.

Opinion: I think we need to think carefully about whether demand might be pulled forward from future years, and so not extrapolate a temporary trend too far into the future. Presumably, once soldiers have a new helmet, the head protection lasts a long time, and they don’t need to be replaced very often. Avon themselves expected demand for helmets and respirators to only grow at 3-4% CAGR to 2028, so implicitly, revenue growth of +10% this year is not sustainable. For that reason, I’d be cautious about opening a new position now, and if it dipped below the 200-day moving average probably sell if I owned it. But well done to anyone who doubled their money, correctly timing the turnaround.

Bellway H1 Jan Results

I tend to avoid writing about house builders; they performed very well following the financial crisis, but that was mainly a result of George Osborne’s terrible Help to Buy scheme. The subsidy ended up helping the owners and sellers of houses, including house builders, rather than first-time buyers. More recently, we have had rising inflation and interest rates, which also put me off the house building sector. The sector has not started the year well, despite Central Bank rate cuts, but perhaps now might be a good time to revisit the investment case?

Bellway reported revenue +12% to £1.4bn, housing completions and underlying PBT were also up by +12%. On a statutory basis, PBT was up +20% to £141m, and they had just £8m of net debt at the end of January. They have £530m of committed credit facilities if management did want to increase borrowing to fund activity.

As revenue is growing in line with housing completions, that implies that the average selling price (£311K) hasn’t increased much, which is the case. The average selling price for private houses is £346K (down -1%) and for social housing £178K (down -5%), which then gives the average selling price of £311k.

I noticed on their website that Bellway London are offering to cover buyers’ costs up to £25,000, which implies that although the average selling price might be only down 1%, they are having to offer incentives to buyers, effectively a price reduction by another name.

Outlook: Bellway say that recent trading since the year end has been encouraging and underpins FY July 2025F targets. The average selling price is likely to remain flat, but since the beginning of February, the private reservation rate has risen to 0.76 (versus 0.67 the same 7 weeks of last year). The group expects to build at least 8,500 homes this year, implying +11% growth.

Comparison with Vistry: Affordable housing specialist Vistry also reported FY Dec results last week, with the share price falling -6% on the morning of the results, as current trading (ie Q1 2025) looks weak. Jamie also pointed out on Twitter that management are looking to improve cashflow by selling off some of their LandBank in bulk and/or at discounted prices. That sounds ominous to me as well.

VTY shares are down -56% since last August, as management have reduced EPS expectations 3x in the final quarter of last year, blaming rising build costs and delays to completions.

Valuation: Bellway’s NAV per share is £29.60, so the shares trade at 0.8x book, or a PER of 12x Jul 2026F. RoCE is currently 8.9%, but see Sharescope’s 20-year chart for how cyclical profitability can be in this sector. In FY Jul 2024, revenue fell -30% and PBT was down -62%, so when things stall, they stall badly.

Opinion: You can probably tell I’m not wildly enthusiastic about house builders at any point in the cycle. As I haven’t followed the sector closely, I don’t have much feel for how Bellway compares to the likes of Persimmon and Barratt (now Barratt Redrow). My rule of thumb is that if you believe a cyclical sector will enjoy a recovery, then buy the weakest businesses, as they will benefit disproportionately. Hence, NatWest has done well as the UK banking sector has come back into favour. Similarly, when it is time to buy, I would buy VTY or CRST, rather than Bellway.

That said, I will avoid the whole sector. This is an industry that is likely to generate sub-10 % RoCE through the cycle, unless there’s more government support coming for housebuilders. If I wanted to increase my position in an out-of-favour sector, then rather than house builders, I would buy fund management companies like Impax AM or renewable energy funds like NESF or GRID.

Franchise Brands FY Dec Results

This plumbing and cooking oil (Filta) franchise business, run by the former Domino’s Pizza UK management, was doing very well up until Mar 2023, when they expanded into Europe, buying Pirtek for £212m from a Private Equity seller. They funded £110m of the purchase price with debt, the rest from an equity placing at 180p, and since then the shares are down roughly -40% to 143p.

Management points investors to the System Sales KPI, which is underlying sales of franchisees plus statutory revenue of their own business (called Direct Labour Operations). On this basis, system sales were up +20% to £418m, with Pirtek their largest division growing at +46%. That sounds impressive, but the Pirtek acquisition only completed in H1 2023, so that is a flattering comparison. Instead, on a like-for-like basis, though, Pirtek was only up +2%, and group statutory revenue was flat.

From a geographic perspective, they say that the US system sales have been particularly strong, with the UK and Europe more moderate. NB that North America is the smallest contributor with 14% of adj EBITDA, compared to the UK (59%) and Europe (27%). Group adj EBITDA was flat on an underlying basis, while net debt reduced to £65m.

The underlying trends are not particularly easy to understand, as they have reorganised some divisions of Filta from DLO to franchising, while selling Willow Pumps’ Kent and Sussex franchises. I can see that shifting some activity between franchising and direct labour could make sense, so I don’t think this is done to obscure underlying trends. It does mean that FRAN is more complicated to analyse than a pizza restaurant franchise.

Last week’s RNS announced they would separate the role of CEO and Chair, with Peter Molloy, who has been with the group since 2017, being promoted to CEO. Stephen Hemsley relinquishes the CEO role, but remains Executive Chairman. They have also appointed a CFO, Andrew Mallows, on a permanent basis as CFO and Commercial Director, plus they have created a new non-Board role of Group Finance Director, who is Beth Peace. I haven’t seen a company before with separate people performing the CFO and Group Finance Director roles, but it probably makes sense from their perspective. Possibly it reflects that the group has grown by acquisition, and wants to retain employees with important-sounding job titles?

Outlook: They point to strong cash generation allowing them to de-leverage net debt/EBITDA to below 1.5x by the end of Dec 2025. That’s down from 2.5x Jun 2023. But they also say that discretionary spending is subdued, and the timing of a pickup remains uncertain. Management held a Capital Markets Day in February, suggesting adj EBITDA growth of CAGR between 6% to 15% over the next four years.

Allenby Capital leave their FY Dec 2025F numbers unchanged and introduces FY Dec 2026F, which implies 18% EPS growth this year, slowing to 13% EPS growth next year.

Valuation: On Allenby’s numbers, the shares are trading on 14x Dec 2025F, dropping to 12x Dec 2026F. On an EV/EBITDA basis, that’s 8x Dec 2025F dropping to 6x Dec 2026F. That might not sound particularly good value in this market, but Sharescope’s charts below show a PER de-rating from above 30x and an EV/EBITDA de-rating from high teens.

Opinion: I like the management team, as their track record at Domino’s Pizza UK was phenomenal. Nigel Wray (non-Exec) and Stephen Hemsley still own 12% and 8% respectively. The largest investor is Mark Slater, of Slater Investments, with 15%. Before the pandemic, FRAN demonstrated good growth but tended to look expensive. The shares now look better value, net debt is falling, EPS growing, so I am warm to this. It doesn’t sound like there’s an obvious near-term catalyst, but I might look to buy into the story at some point.

Notes

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.