A review of investing ideas for 2025, including AVAP and AT. plus financials WISE and FCH. Also covered TMG’s disposal of its US operations.

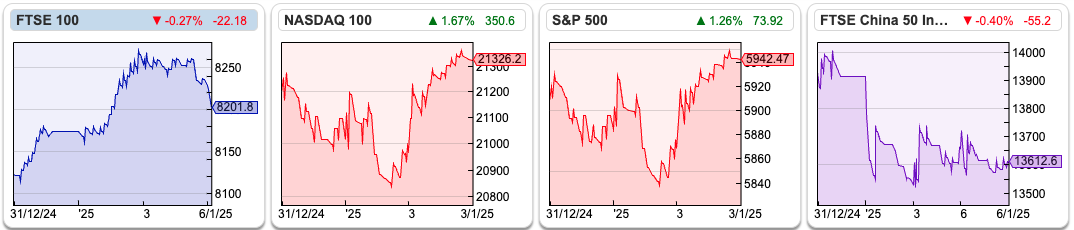

The FTSE 100 didn’t see much of a “Santa Rally”, down -1% since the start of December. Nasdaq100 and S&P500 were up +1.9% and down -1.5%, despite enjoying a very strong 2024 (+27% and +25% respectively). The Chinese indices, such as the FTSE China 50 (XIN0) and the CSI 300 (Shanghai) have started the year weakly, down -2.6% and -5.3% in the last 5 days. My feeling is that markets are becoming increasingly uncorrelated, which this year could well turn out to be a positive for investing in UK indices like the FTSE and AIM.

Review of 2024 ideas

Last year I crowd-sourced some ideas from readers. Several people including Glasshalfull and Carcosa suggested Equals looked like it could continue to perform well, even if a firm offer for the company didn’t materialise. Following a long, convoluted process of Put Up or Shut Up (PUSU) deadline extensions, the company has now received a firm offer. As there was bid speculation in 2023 already in the price, the shares have only risen +11% last year, but that’s still not too bad in a difficult market.

Importantly too, when I bumped into Gordon / Glasshalfull at Mello in Spring, he was sceptical that the turnaround at Argentex would go as smoothly as Equals management had achieved. I should have listened to him because AGFX, which I own, was down -68% last year.

Several people, including Rhomboid and Cockerhoop, have been long-term fans of both Goodwin +32% and Games Workshop +35%. Well done to them. I’m always a little wary of re-posting investors’ performance figures from Twitter/X because I haven’t independently validated these numbers and I don’t know if the figures are net of CGT. That said, investors like Cockerhoop +25% last year and Carcosa +14% last year, seem knowledgeable and credible, as they share their thinking, which is often more interesting than a direct “tip” with no backup analysis.

Some ideas for 2025

All of the ideas below are just meant to be starting points. The idea is to use Sharescope to follow up and research the stocks people have mentioned.

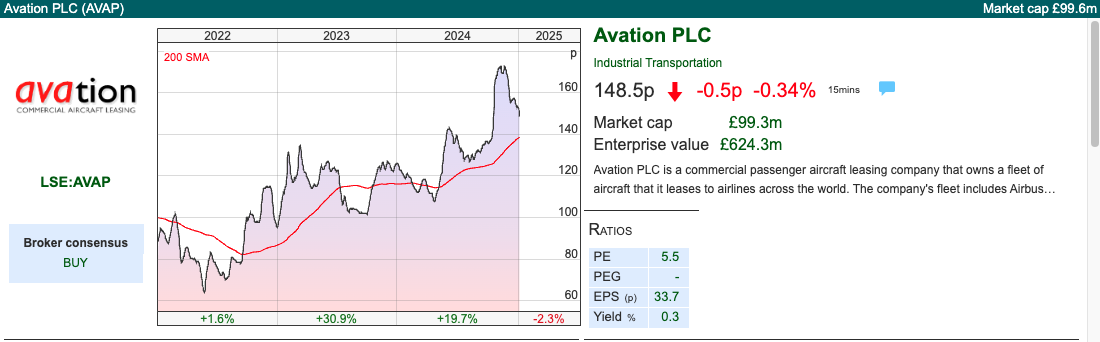

In November last year, Carcosa suggested that I have a detailed look at the aircraft leasing business Avation, which I belatedly did here. This was up +20% last year and he thinks that it could continue to do well, now the balance sheet has been de-risked. There’s an activist investor now exiting their position, which is creating an overhang, but management have been buying back shares (10% of the register). As a retired commercial airline pilot, I get the impression that he enjoys posting on this bulletin board about the different types of leasing contracts and really getting “into the weeds” of the company. Or taking a step back and avoiding too much detail, we can see that AVAP‘s last reported NAV was 285p, so the shares still trade at a hefty 50% discount to book value. The dividend yield is currently less than 1%, but with a payout ratio of around 10%, presumably, there will be scope to increase the dividend at some point in the future.

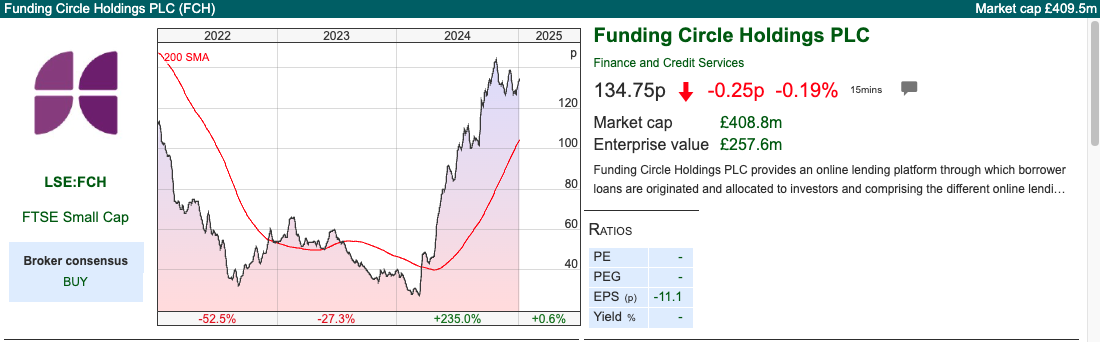

Another idea he suggests for 2025 is Funding Circle, the SME funding platform, which I also bought in March last year. I should have had a higher conviction and bought more, given the share price almost quadrupled last year. At the H1 Jun results, published in September, the company had £164m of cash, or 50% of the current market cap. So far management have bought back £50m of shares, and I’m assuming that once the business turns profitable they can continue to return money to shareholders. They spent £22m on marketing in H1, which equates to 28% of revenue. At some point that marketing budget might drop as brand awareness increases and SME borrowers share by word of mouth the advantages of the FCH model (such as a straightforward loan application and decision typically within 48 hours) versus a traditional bank.

Carcosa’s other suggestions were MPAC, BOOM, FTC and GHH. He notes that these are popular among the FinTwit/X community. However, he suggested that for him these are lower conviction ideas and might turn out to be short-term trades. I also own GHH, which was down -12% last year. I opened a starter position, but won’t increase my conviction level unless there are obvious signs of a turnaround. There have been a couple of “false dawns” before in this specialist photonics and lenses business, which is down -65% from its July 2021 peak.

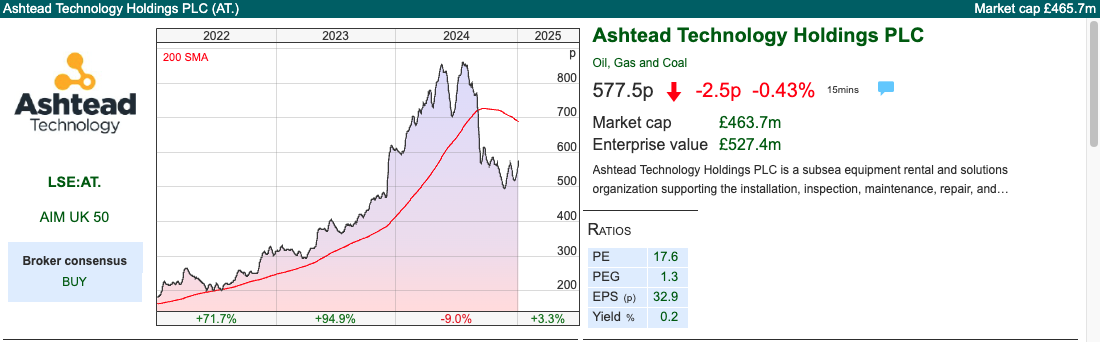

Finally, he mentioned Ashtead Technology, which does subsea equipment for the offshore energy sector, both the traditional oil industry and renewables (wind farms). However the oil and gas revenue is 2.5x the size of the renewables business and also grew +71% H1 Jun 2024, so if energy prices look weak then we could see earnings hit. The shares are trading on a PER of 13x Dec 2025F dropping to 11x the following year.

Cockney Rebel has suggested On The Beach, Card Factory, Audioboom, Liontrust, IG Design, Goodwin and Avon Technology. Assuming he’s mirrored his UKStockChallenge portfolio performance, he was up +45% in 2024. Well done to him.

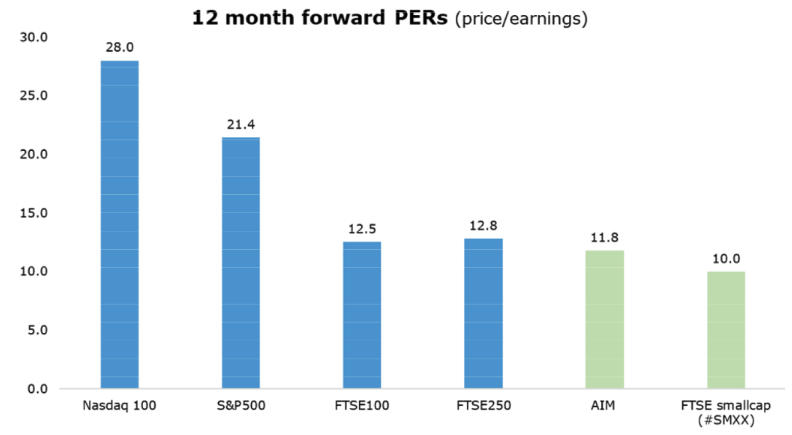

Paul Hill, at Vox Markets, has suggested 20 ideas for 2025: ELCO, AOM, IXI, AGFX, TRB, CML, MBH, MPAC, VLG, WATR, ESYS, VCT, CVSG, AVG, GHH, TRCS, FIN, SUP, ONC, HVO. Of those, I also own AOM, CML and GHH. Paul has also published a 50 slide presentation outlining his thinking, including the slide below showing the PER multiple comparison between US (expensive) and UK (cheap) markets.

Earnings growth in the US has averaged 7.5% CAGR versus 4% in the UK, so it is understandable that investors might be prepared to pay a higher price for higher growth. However, it’s hard to see how the US PER multiple can keep expanding over 30x, or the UK to continue to de-rate below 10x.

A couple of days ago Jamie Ward appeared on Vox Markets, highlighting the similarities between WISE and Amazon. I agree, and recycled my Hargreaves Lansdown gains into WISE a few months ago. He suggested DCC as his pick for 2025, which has been in the FTSE 100 for a decade, but few investors are familiar with the investment case. For a multi-year potential multibagger he suggests WISE.

Portfolio Review

I led this article with other people’s ideas in part because I had a difficult 2024, down -2%. That’s despite my two largest positions, Games Workshop and Bank of Georgia rising +35% and +18% respectively. The trouble has been caused by positions 3,4 and 5 doing very badly: SDI -34%, Sylvania Platinum -45% and Impax AM -55%. These companies have all been long-term multibaggers for me, and I averaged down too early into SDI and Impax, which has compounded the poor performance. That said, I don’t think any of these companies is fundamentally broken, so I expect a recovery this year.

Notably, Sylvania has cash of $95m (£76m) or over 70% of its market cap, and Impax has £91m (28% of market cap) of cash. I’ve already had a good start to 2025, with The Mission Group announcing a £17m disposal and £1.5m buyback, rising +19% on the morning of the RNS, which I write up in more detail below.

Currently, my top 5 positions represent 56% of my portfolio, which is significantly lower than previous years. I feel confident averaging down if a company has a reasonable balance sheet, for instance in 2023 I bought more Frontier Developments, which bounced +56% in 2024, Creighton’s +48% and Hargreaves Lansdown +50% after receiving a bid last year. With the benefit of hindsight, I should have timed my original entry points better, but the decision to stick with companies going through a sticky patch seems to be vindicated by last year’s recoveries.

More recently I have increased my position in Georgia Capital at 906p, which has since bounced +30% despite the ongoing political protests in Tbilisi. Another stock I bought into a couple of times last year, was Close Brothers with the shares fell -70%. I think the share price is wrong, but too risky to average down into again until we see some progress on how the historic car loans regulation resolves. I avoid averaging down into companies with precarious balance sheets, or unquantifiable risks.

TMG Disposal

The end of December / start of January tends to be a quiet time for company RNS updates. However, The Mission Group, which got into trouble in H2 2023 by over-stretching their balance sheet with £25m of debt on 31st Dec 2023, just as a downturn in marketing spend hit, updated on their “Value Restoration Plan”.

Management announced that they had sold a US subsidiary, April Six, for £17.4m gross. The proceeds will be used to pay down bank debt, which stood at £17m on 30th Dec 2024. £6.5m of bank debt will remain after the sale, because they receive £10m in cash and then in June this year an “earn out” of the lesser of i) £4.2m ii) 7x EBITDA for the 3 months between 1st Dec and end of February.

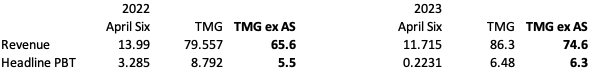

The board has announced a £1.5m buyback and expects to return to paying dividends in 2026. The way management have presented the information, it doesn’t look like they’ll be much of a hit to earnings as April Six barely made a profit last year. In 2022 April Six made £3.3m of PBT, or over a third of group profits, so it’s possible that we could see a significant cut to earnings if management had been relying on a strong recovery to achieve their FY Dec 2024F EPS.

A trading update is scheduled for 20th January, so we will have to wait until then to know with more certainty whether the forecast EPS of 5.3p will be achieved.

Valuation: EPS peaked at 8p in FY Dec 2019, so assuming a “normalised” EPS of 6p is achievable next year that would put the shares on a PER ratio of below 5x. That looks simply too cheap, given the balance sheet has now been fixed and management are buying back shares.

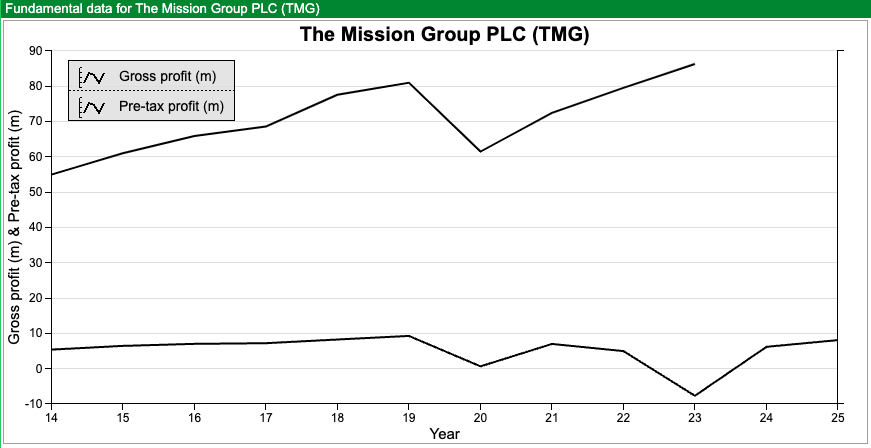

One thing to note with the historic chart in Sharepad’s “Summary Tab” is not comparing apples with apples. Historically Sharepad records total income (turnover or billings), whereas company management encourage analysts to forecast “operating income” or “revenue” (which Sharepad calls gross profit), which is net of “cost of sales”, effectively income that is re-billed to the client. So the chart below, with profit margins forecast to rebound from the loss-making FY Dec 2023, is a better comparison.

Opinion: The shares peaked at above £1 per share just before the pandemic. Management have got themselves into a muddle a couple of times by making acquisitions and taking on too much debt. I would like to see them learn from this experience, and demonstrate organic revenue and profit growth. I have owned the shares for over a decade. I’m not selling here, but it’s another one that I regret not selling as soon as the pandemic hit.

Intelligence…

I’ll avoid suggesting any investment ideas myself. Instead, my recommendation for 2025 is a podcast from the same production company who make The Rest is History. Goalhanger, the production company, are slowly expanding their successful format into Politics and Sport. I recommend though The Rest is Classified, with some hair-raising stories of the CIA going looking for Osama bin Laden with rucksacks full of cash in Afghanistan and Kermit Roosevelt bringing about “regime change” in Iran. On a similar theme, I also recommend Jay Newman’s (former distressed debt hedge fund manager) book Undermoney.

Izzy Kaminska at The Blind Spot has been digging into the overlapping worlds of espionage and investing: working on the interpretation of incomplete and imperfect information. This could be a theme that becomes mainstream in 2025.

~

Notes

Bruce owns shares in TMG, AOM, CML, GHH, FCH and WISE

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 7/1/2025 | AVAP, AT, WISE, FCH | UK optimism for 2025?

The FTSE 100 didn’t see much of a “Santa Rally”, down -1% since the start of December. Nasdaq100 and S&P500 were up +1.9% and down -1.5%, despite enjoying a very strong 2024 (+27% and +25% respectively). The Chinese indices, such as the FTSE China 50 (XIN0) and the CSI 300 (Shanghai) have started the year weakly, down -2.6% and -5.3% in the last 5 days. My feeling is that markets are becoming increasingly uncorrelated, which this year could well turn out to be a positive for investing in UK indices like the FTSE and AIM.

Review of 2024 ideas

Last year I crowd-sourced some ideas from readers. Several people including Glasshalfull and Carcosa suggested Equals looked like it could continue to perform well, even if a firm offer for the company didn’t materialise. Following a long, convoluted process of Put Up or Shut Up (PUSU) deadline extensions, the company has now received a firm offer. As there was bid speculation in 2023 already in the price, the shares have only risen +11% last year, but that’s still not too bad in a difficult market.

Importantly too, when I bumped into Gordon / Glasshalfull at Mello in Spring, he was sceptical that the turnaround at Argentex would go as smoothly as Equals management had achieved. I should have listened to him because AGFX, which I own, was down -68% last year.

Several people, including Rhomboid and Cockerhoop, have been long-term fans of both Goodwin +32% and Games Workshop +35%. Well done to them. I’m always a little wary of re-posting investors’ performance figures from Twitter/X because I haven’t independently validated these numbers and I don’t know if the figures are net of CGT. That said, investors like Cockerhoop +25% last year and Carcosa +14% last year, seem knowledgeable and credible, as they share their thinking, which is often more interesting than a direct “tip” with no backup analysis.

Some ideas for 2025

All of the ideas below are just meant to be starting points. The idea is to use Sharescope to follow up and research the stocks people have mentioned.

In November last year, Carcosa suggested that I have a detailed look at the aircraft leasing business Avation, which I belatedly did here. This was up +20% last year and he thinks that it could continue to do well, now the balance sheet has been de-risked. There’s an activist investor now exiting their position, which is creating an overhang, but management have been buying back shares (10% of the register). As a retired commercial airline pilot, I get the impression that he enjoys posting on this bulletin board about the different types of leasing contracts and really getting “into the weeds” of the company. Or taking a step back and avoiding too much detail, we can see that AVAP‘s last reported NAV was 285p, so the shares still trade at a hefty 50% discount to book value. The dividend yield is currently less than 1%, but with a payout ratio of around 10%, presumably, there will be scope to increase the dividend at some point in the future.

Another idea he suggests for 2025 is Funding Circle, the SME funding platform, which I also bought in March last year. I should have had a higher conviction and bought more, given the share price almost quadrupled last year. At the H1 Jun results, published in September, the company had £164m of cash, or 50% of the current market cap. So far management have bought back £50m of shares, and I’m assuming that once the business turns profitable they can continue to return money to shareholders. They spent £22m on marketing in H1, which equates to 28% of revenue. At some point that marketing budget might drop as brand awareness increases and SME borrowers share by word of mouth the advantages of the FCH model (such as a straightforward loan application and decision typically within 48 hours) versus a traditional bank.

Carcosa’s other suggestions were MPAC, BOOM, FTC and GHH. He notes that these are popular among the FinTwit/X community. However, he suggested that for him these are lower conviction ideas and might turn out to be short-term trades. I also own GHH, which was down -12% last year. I opened a starter position, but won’t increase my conviction level unless there are obvious signs of a turnaround. There have been a couple of “false dawns” before in this specialist photonics and lenses business, which is down -65% from its July 2021 peak.

Finally, he mentioned Ashtead Technology, which does subsea equipment for the offshore energy sector, both the traditional oil industry and renewables (wind farms). However the oil and gas revenue is 2.5x the size of the renewables business and also grew +71% H1 Jun 2024, so if energy prices look weak then we could see earnings hit. The shares are trading on a PER of 13x Dec 2025F dropping to 11x the following year.

Cockney Rebel has suggested On The Beach, Card Factory, Audioboom, Liontrust, IG Design, Goodwin and Avon Technology. Assuming he’s mirrored his UKStockChallenge portfolio performance, he was up +45% in 2024. Well done to him.

Paul Hill, at Vox Markets, has suggested 20 ideas for 2025: ELCO, AOM, IXI, AGFX, TRB, CML, MBH, MPAC, VLG, WATR, ESYS, VCT, CVSG, AVG, GHH, TRCS, FIN, SUP, ONC, HVO. Of those, I also own AOM, CML and GHH. Paul has also published a 50 slide presentation outlining his thinking, including the slide below showing the PER multiple comparison between US (expensive) and UK (cheap) markets.

Earnings growth in the US has averaged 7.5% CAGR versus 4% in the UK, so it is understandable that investors might be prepared to pay a higher price for higher growth. However, it’s hard to see how the US PER multiple can keep expanding over 30x, or the UK to continue to de-rate below 10x.

A couple of days ago Jamie Ward appeared on Vox Markets, highlighting the similarities between WISE and Amazon. I agree, and recycled my Hargreaves Lansdown gains into WISE a few months ago. He suggested DCC as his pick for 2025, which has been in the FTSE 100 for a decade, but few investors are familiar with the investment case. For a multi-year potential multibagger he suggests WISE.

Portfolio Review

I led this article with other people’s ideas in part because I had a difficult 2024, down -2%. That’s despite my two largest positions, Games Workshop and Bank of Georgia rising +35% and +18% respectively. The trouble has been caused by positions 3,4 and 5 doing very badly: SDI -34%, Sylvania Platinum -45% and Impax AM -55%. These companies have all been long-term multibaggers for me, and I averaged down too early into SDI and Impax, which has compounded the poor performance. That said, I don’t think any of these companies is fundamentally broken, so I expect a recovery this year.

Notably, Sylvania has cash of $95m (£76m) or over 70% of its market cap, and Impax has £91m (28% of market cap) of cash. I’ve already had a good start to 2025, with The Mission Group announcing a £17m disposal and £1.5m buyback, rising +19% on the morning of the RNS, which I write up in more detail below.

Currently, my top 5 positions represent 56% of my portfolio, which is significantly lower than previous years. I feel confident averaging down if a company has a reasonable balance sheet, for instance in 2023 I bought more Frontier Developments, which bounced +56% in 2024, Creighton’s +48% and Hargreaves Lansdown +50% after receiving a bid last year. With the benefit of hindsight, I should have timed my original entry points better, but the decision to stick with companies going through a sticky patch seems to be vindicated by last year’s recoveries.

More recently I have increased my position in Georgia Capital at 906p, which has since bounced +30% despite the ongoing political protests in Tbilisi. Another stock I bought into a couple of times last year, was Close Brothers with the shares fell -70%. I think the share price is wrong, but too risky to average down into again until we see some progress on how the historic car loans regulation resolves. I avoid averaging down into companies with precarious balance sheets, or unquantifiable risks.

TMG Disposal

The end of December / start of January tends to be a quiet time for company RNS updates. However, The Mission Group, which got into trouble in H2 2023 by over-stretching their balance sheet with £25m of debt on 31st Dec 2023, just as a downturn in marketing spend hit, updated on their “Value Restoration Plan”.

Management announced that they had sold a US subsidiary, April Six, for £17.4m gross. The proceeds will be used to pay down bank debt, which stood at £17m on 30th Dec 2024. £6.5m of bank debt will remain after the sale, because they receive £10m in cash and then in June this year an “earn out” of the lesser of i) £4.2m ii) 7x EBITDA for the 3 months between 1st Dec and end of February.

The board has announced a £1.5m buyback and expects to return to paying dividends in 2026. The way management have presented the information, it doesn’t look like they’ll be much of a hit to earnings as April Six barely made a profit last year. In 2022 April Six made £3.3m of PBT, or over a third of group profits, so it’s possible that we could see a significant cut to earnings if management had been relying on a strong recovery to achieve their FY Dec 2024F EPS.

A trading update is scheduled for 20th January, so we will have to wait until then to know with more certainty whether the forecast EPS of 5.3p will be achieved.

Valuation: EPS peaked at 8p in FY Dec 2019, so assuming a “normalised” EPS of 6p is achievable next year that would put the shares on a PER ratio of below 5x. That looks simply too cheap, given the balance sheet has now been fixed and management are buying back shares.

One thing to note with the historic chart in Sharepad’s “Summary Tab” is not comparing apples with apples. Historically Sharepad records total income (turnover or billings), whereas company management encourage analysts to forecast “operating income” or “revenue” (which Sharepad calls gross profit), which is net of “cost of sales”, effectively income that is re-billed to the client. So the chart below, with profit margins forecast to rebound from the loss-making FY Dec 2023, is a better comparison.

Opinion: The shares peaked at above £1 per share just before the pandemic. Management have got themselves into a muddle a couple of times by making acquisitions and taking on too much debt. I would like to see them learn from this experience, and demonstrate organic revenue and profit growth. I have owned the shares for over a decade. I’m not selling here, but it’s another one that I regret not selling as soon as the pandemic hit.

Intelligence…

I’ll avoid suggesting any investment ideas myself. Instead, my recommendation for 2025 is a podcast from the same production company who make The Rest is History. Goalhanger, the production company, are slowly expanding their successful format into Politics and Sport. I recommend though The Rest is Classified, with some hair-raising stories of the CIA going looking for Osama bin Laden with rucksacks full of cash in Afghanistan and Kermit Roosevelt bringing about “regime change” in Iran. On a similar theme, I also recommend Jay Newman’s (former distressed debt hedge fund manager) book Undermoney.

Izzy Kaminska at The Blind Spot has been digging into the overlapping worlds of espionage and investing: working on the interpretation of incomplete and imperfect information. This could be a theme that becomes mainstream in 2025.

~

Notes

Bruce owns shares in TMG, AOM, CML, GHH, FCH and WISE

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.