Screening for shares with a consistently high margin and ROE leads to model portfolio specialist Tatton Asset Management. Maynard Paton reviews the small-cap’s impressive financials, efficient workforce, owner-aligned founder and bold growth target.

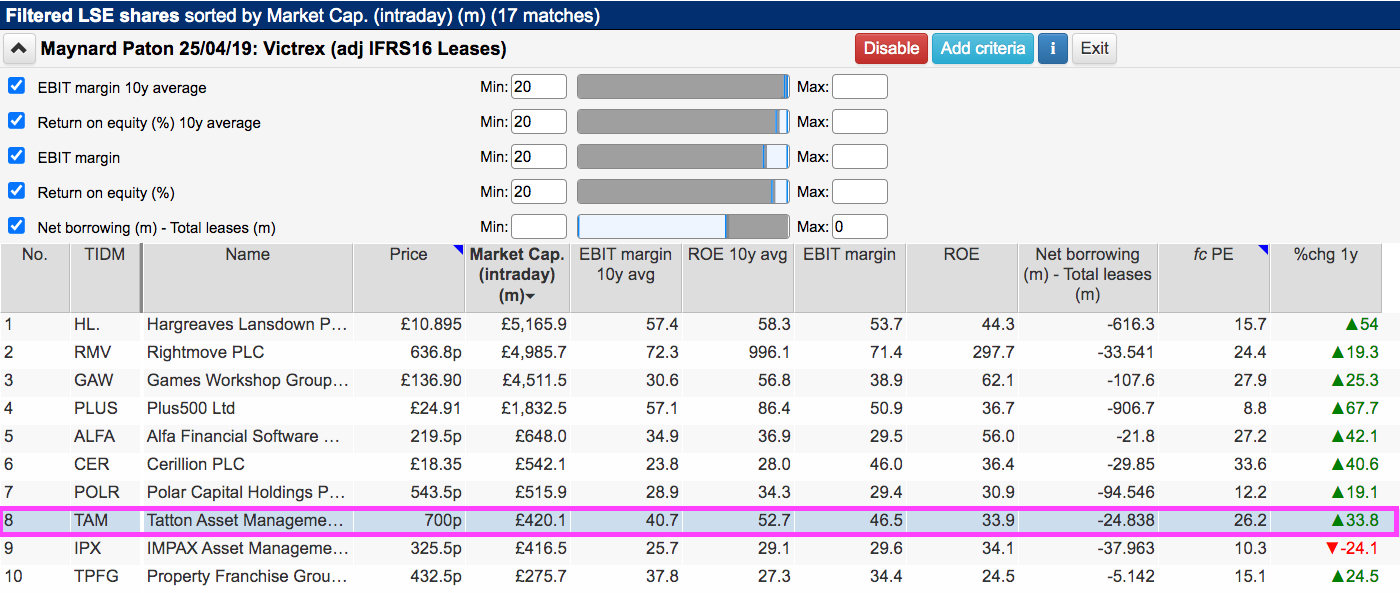

Today I have revisited a ShareScope screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE of at least 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within SharePad’s terrific Filter Library. My instructions show you how.)

This time the filter returned 17 matches, including Rightmove, Games Workshop, Cerillion, Property Franchise and six other shares I have studied for ShareScope.

I selected Tatton Asset Management because its impressive 40%-plus margin was the highest among the remaining seven names.

Let’s take a closer look.

Introducing Tatton Asset Management

“My father was involved in financial services. He worked for the Pru and I naturally fell into the industry and then fell in love with it. And I love IFAs. They’re just great, great people. They’re very, very genuine people who look after their clients in a stunning way. And they’re easy to work with. We have literally been an IFA support-services business for the majority of my 30-odd years in the industry.”

So recounted Paul Hogarth during this interview about why he started Tatton during 2007.

Initially providing compliance services to financial advisers, Tatton used a joint venture in 2009 to offer multi-manager funds to IFAs.

By 2013 the group had taken full control of its discretionary fund-management service and today claims to be the country’s largest provider of ‘model portfolios’ to IFAs and their clients.

‘Model portfolios’ allow ordinary investors the benefits of discretionary fund management without the greater cost of a totally bespoke service.

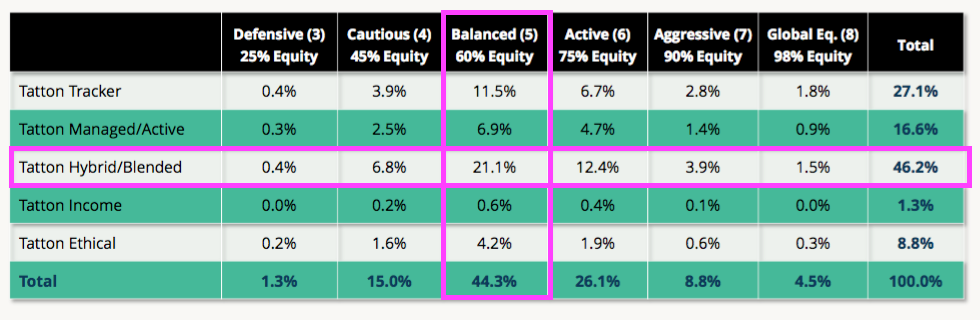

Through an IFA, clients can select from a range of 45 Tatton-managed model-portfolio choices based on three primary categories:

- Risk: for example, aggressive, balanced or cautious;

- Style: for example, managed, tracker or income, and;

- Allocation: either a UK or global bias.

The bulk of clients tend to plump for a ‘balanced’ proportion of equities and/or a ‘blended’ mix of actively managed and tracker funds:

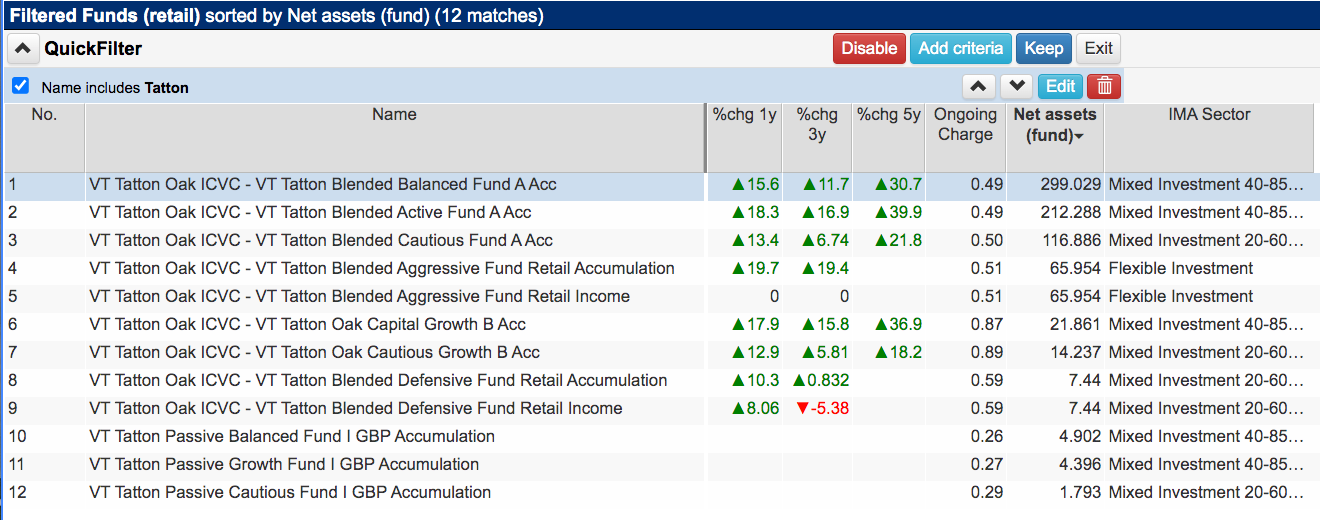

Note that Tatton does offer a bespoke portfolio service alongside a limited range of ‘model funds’ that can be purchased without an IFA:

Every so often Tatton’s investment experts re-jig the model portfolios to ensure the asset allocation remains appropriate for the risk profile of the clients.

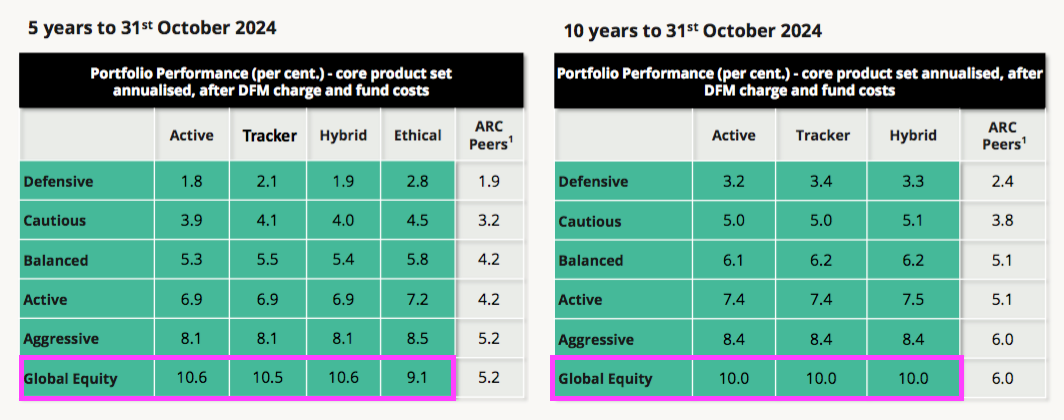

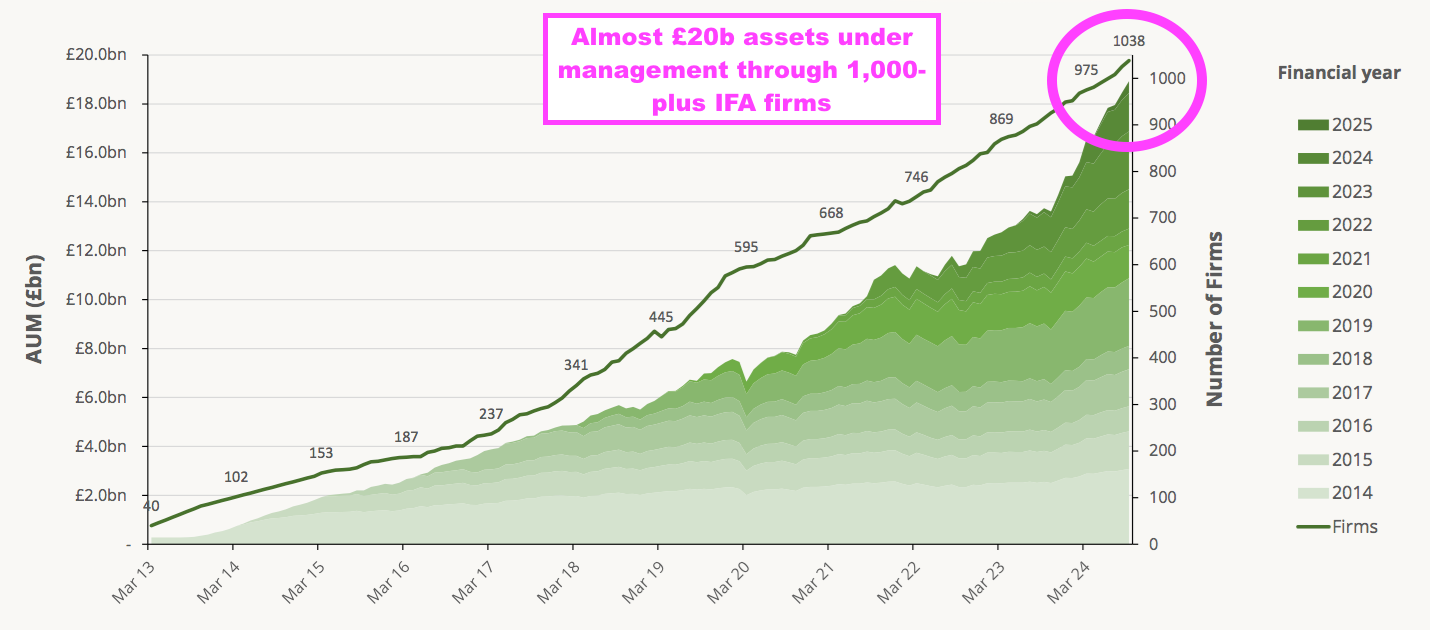

Tatton claims its portfolios have outperformed industry peers over time, with 10% compound returns generated over both five and ten years for those clients going ‘all in’ on equities:

For perspective, the last five and ten years have witnessed global shares — as measured by the iShares MSCI World Acc (SWDA) ETF — deliver 12% annualised returns. The FTSE 100 — as measured by the iShares FTSE 100 Acc (CUKX) ETF — has meanwhile delivered 6% annualised returns.

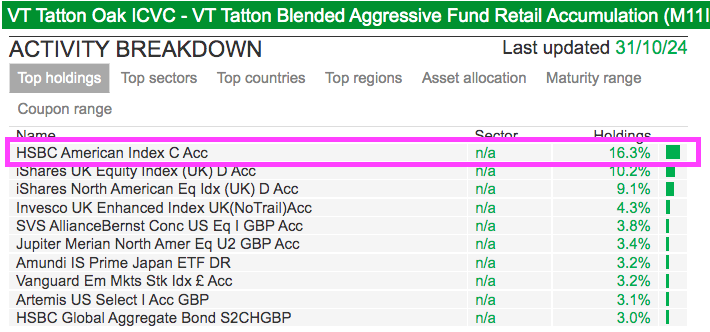

The Tatton funds listed on ShareScope generally show the HSBC American Index Acc as a prominent holding:

This HSBC fund is dominated by US tech wonder-stocks such Apple, NVIDIA, Microsoft and so on…

…which I dare say has propelled Tatton’s model portfolios higher despite weightings to UK shares, bonds, cash and other Nasdaq-lagging assets.

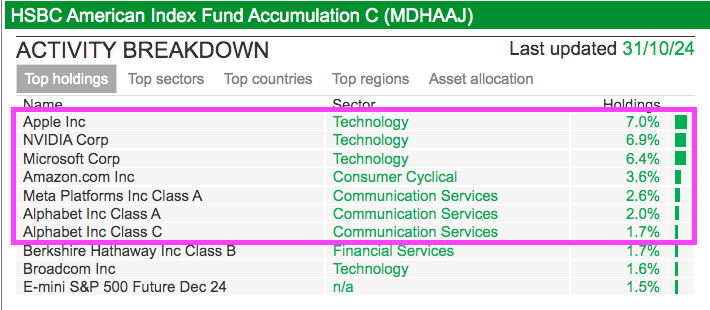

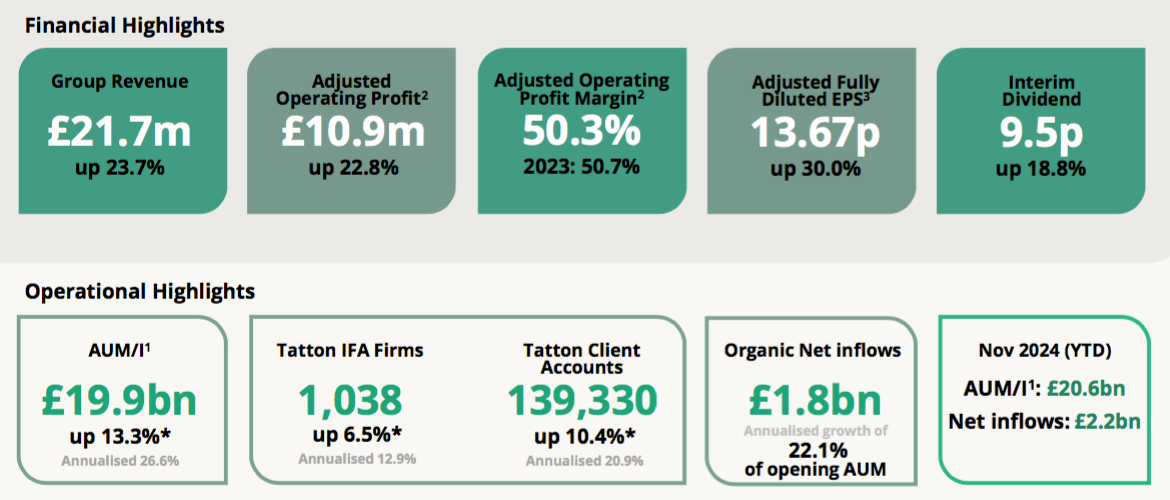

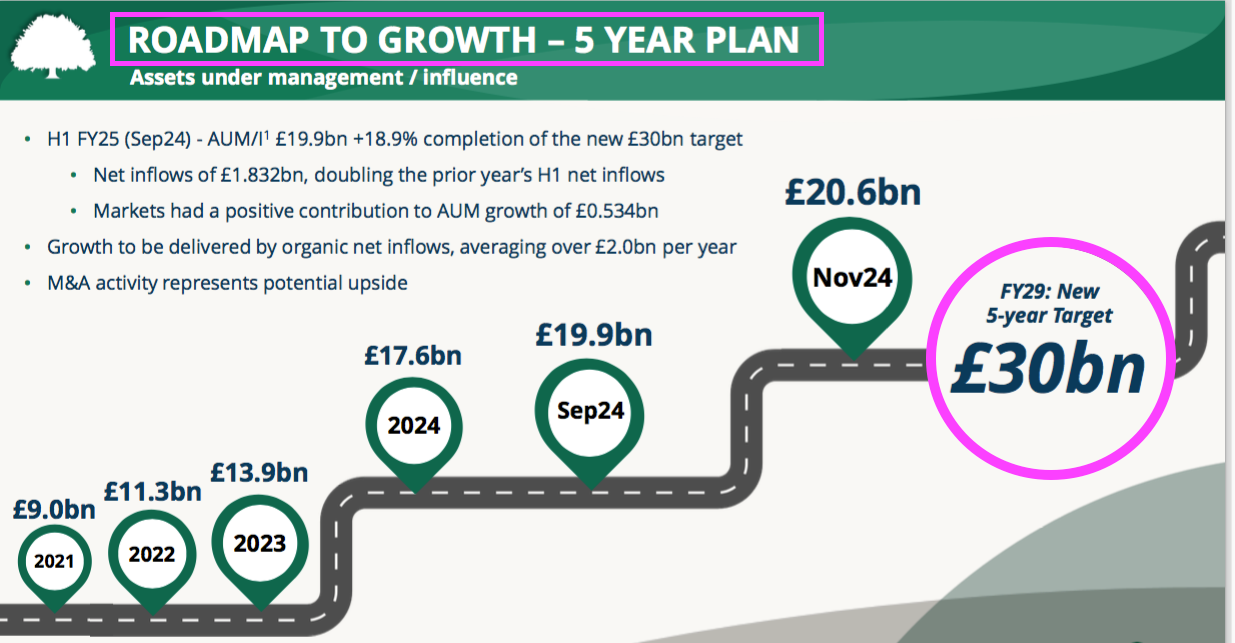

IFAs and/or their clients have been very enamoured with their Tatton returns. During the last 12 years, the number of IFA firms employing the group’s discretionary management has surpassed 1,000 to take assets under management to £20 billion:

The chart above also suggests early IFA customers have kept their clients with Tatton, with the group claiming annual client ‘attrition’ to other providers of just 1%.

Very impressively, Tatton has enjoyed regular inflows of new client money:

Collecting new money of £2.3 billion during the year to March 2024 was particularly commendable given the wider malaise within the fund-management sector that has prompted hefty outflows at the likes of Impax, Jupiter and Liontrust.

Alongside the peer-beating investment returns, other factors attracting IFAs and their clients include Tatton’s integration with a variety of wealth-management platforms…

…and the 0.15% flat annual fee applied to all model portfolios.

According to Mr Hogarth, the 0.15% fee was dictated by early conversations with IFAs. They wanted to pay only 0.5% management fees, and with the platforms taking 0.35% or so, Tatton was left with 0.15%. Mr Hogarth explained the situation during that aforementioned interview:

“In today’s world where the regulator and the IFA want to drive down the cost of investing, it’s so important that the service comes at the right price. And they told us what that price had to be. Amazingly, they said, we need to be able to buy your services and the platform services for 50 basis points.

So if you’re any higher, then that’s not going to work. And of course, the platforms were around about 35 basis points at the time. So a bit of simple maths, we had to come in at 15.“

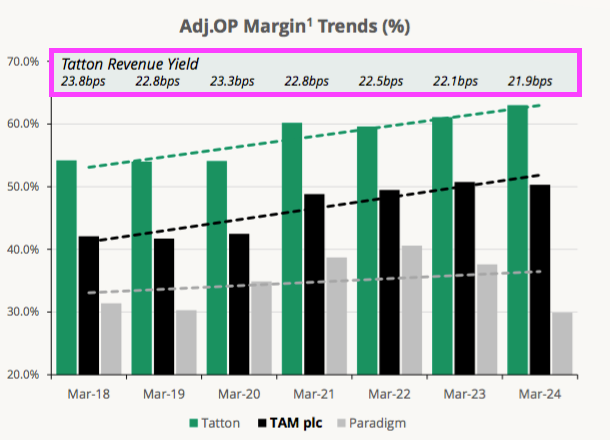

Tatton says its 0.15% model-portfolio fee compares well with the approximately 0.18% industry average. The group’s traditional funds meanwhile charge a 0.3% annual fee while the bespoke service charges at least 0.375%. The overall fee is approximately 0.22%, which has impressively been maintained since 2018:

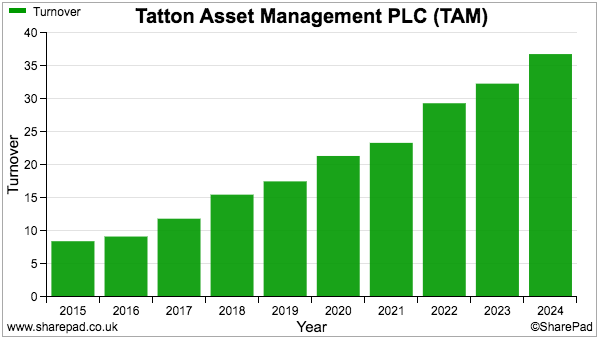

The greater assets under management have led to a wonderful financial performance. The group joined AIM during 2017, after which revenue advanced from £12 million to £37 million…

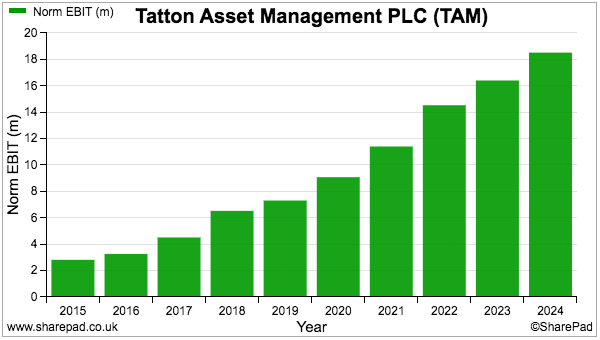

…while adjusted operating profit has increased from less than £5 million to almost £19 million:

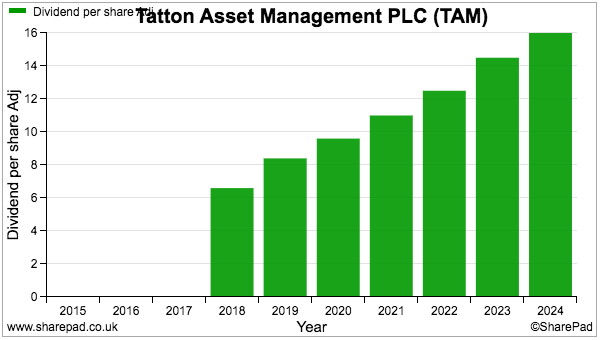

The dividend has exhibited regular increases, too:

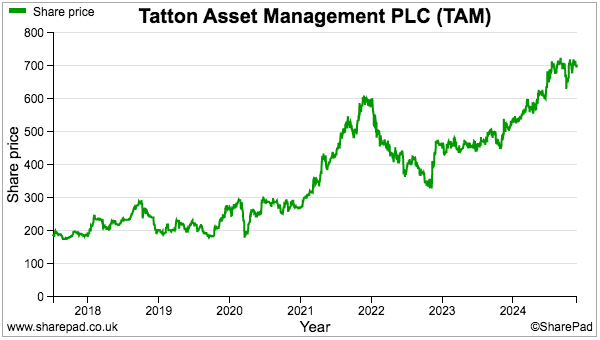

The shares floated at 156p and the recent 700p supports a £420 million market cap:

Operating margin

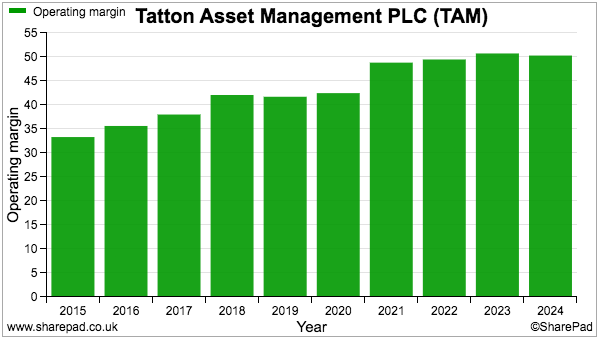

Tatton’s operating margin scored extremely well on my initial filter:

The group’s adjusted margin has topped 40% since the flotation and reached an amazing 50% last year.

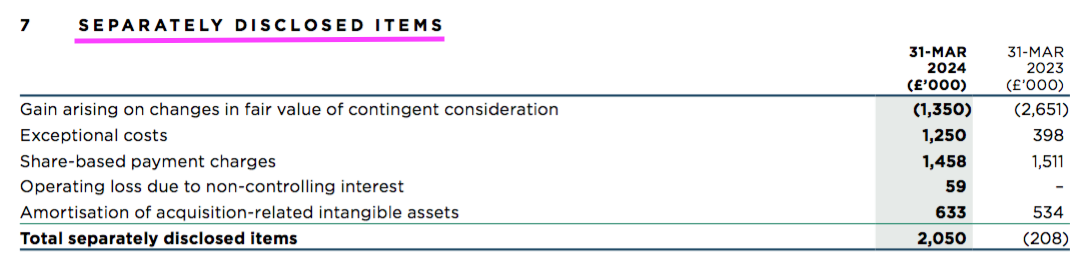

Note that Tatton’s adjusted profit does overlook a variety of regular ‘separately disclosed items’:

Notable exclusions from adjusted profit include share-based payments, which have totalled a significant £11 million since the flotation and would have lowered adjusted profit by an average of 13% had they not been excluded.

Repeat exceptional items — related mostly to very minor acquisitions and joint ventures — are also ignored by the adjusted-profit calculation.

Still, Tatton’s margin would have averaged 35% over the last ten years with every cost and credit included — suggesting the business does undertake an inherently lucrative activity.

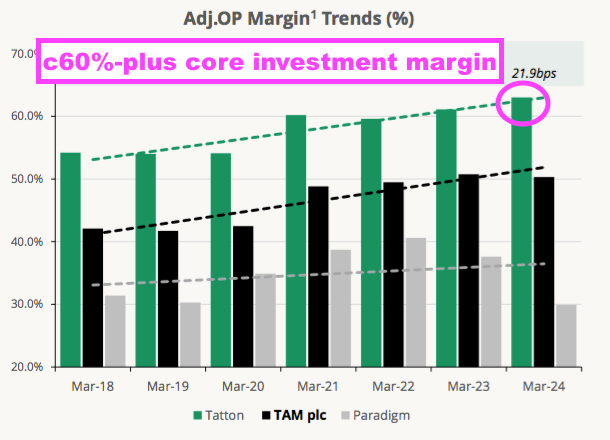

Indeed, Tatton owns a small mortgage and consultancy division that masks a 60%-plus adjusted operating margin at the core model-portfolio operation:

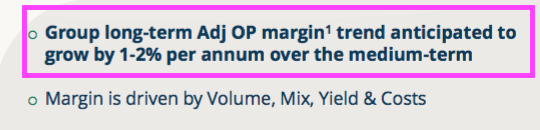

Bolstered by the prospects of greater client money, Tatton reckons its adjusted operating profit could increase by 1-2% per annum over the medium term:

Employees

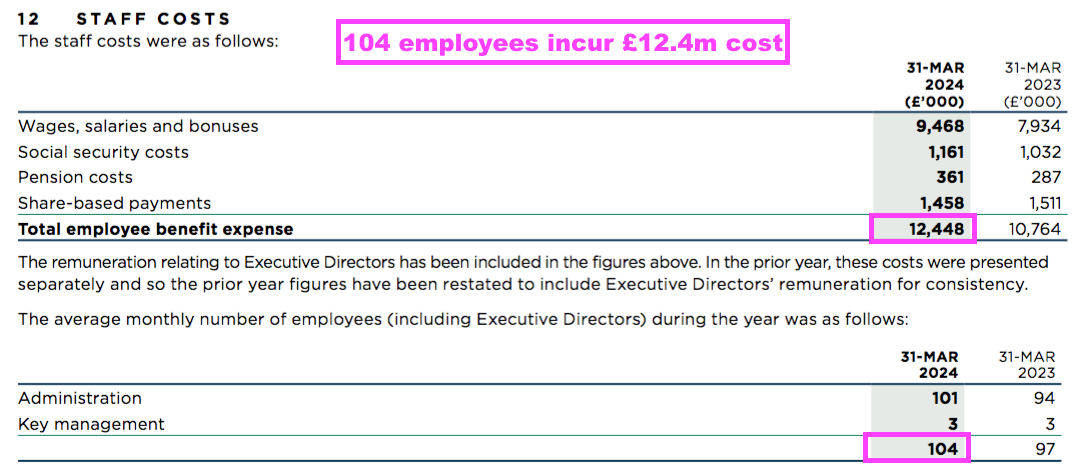

Employees are Tatton’s largest expense, and the group’s high margin is supported primarily by a very efficient workforce.

Last year for example, Tatton’s total staff cost was £12.4 million and absorbed 34% of revenue:

True, £12.4 million divided by the 104 headcount gives £120k per person, which suggests very generous remuneration all round. But the average staff member last year generated revenue of £354k…

…which combined with limited other expenses then leaves shareholders with that very strong margin.

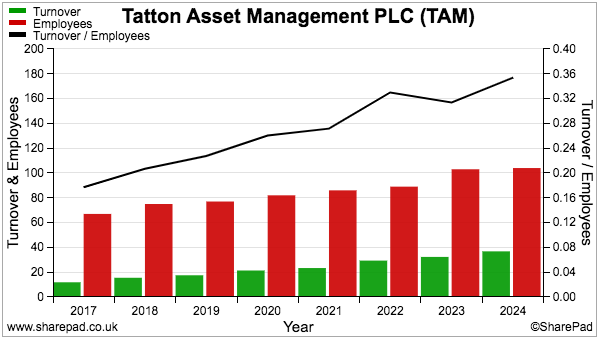

Tatton’s rising revenue per employee — the measure has almost doubled since 2017 — is genuine evidence of a truly ‘scalable’ business.

The group’s website suggests the investment department is staffed by a dozen senior employees, who presumably have implemented all the model-portfolio investment decisions that have out-performed most competitors and attracted so much client money.

How wedded these dozen employees are to Tatton is not clear. But if they truly are ace asset allocators, the risk is they start demanding much greater salaries that may i) reduce Tatton’s super margin, or; ii) prompt them to leave for a higher-paying rival.

I dare say the aforementioned share-based payments totalling £11 million have helped keep the investing talent on board. The last annual report showed 2.6 million outstanding nil-cost options, which would create an £18 million windfall if they all vested at the recent 700p share price.

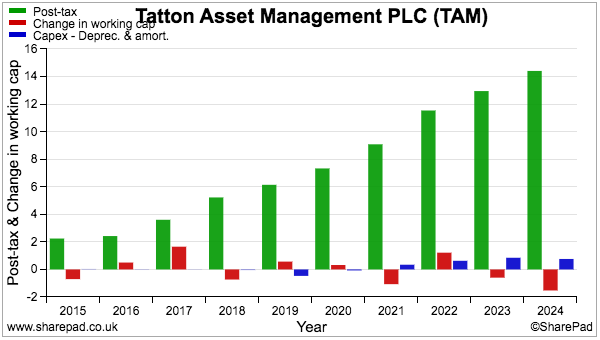

Cash flow and ROE

Other parts of Tatton’s accounts appear in very good order.

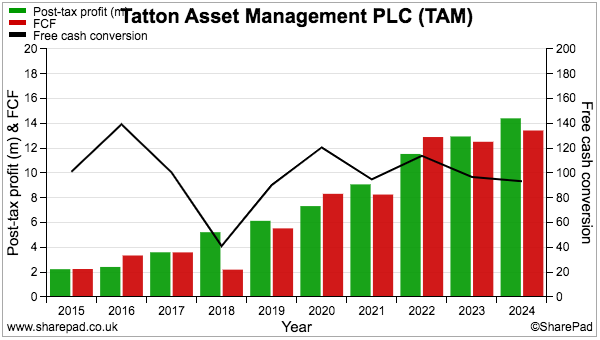

Aside from a blip during 2018, annual earnings have always converted into free cash at a rate of greater than 90%:

The welcome cash generation is due to Tatton’s:

- Minimal working capital requirements (clients pay fees monthly and no stock is carried), and;

- Small capital expenditure being adequately expensed against earnings (total office fittings and equipment are just £150k):

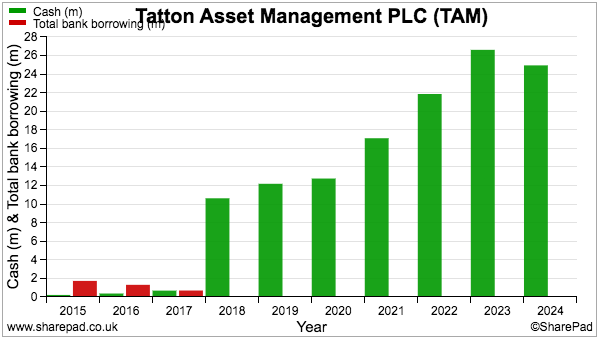

The cash generation has ensured Tatton’s cash position has piled higher over time:

The flotation raised £10 million and, despite paying aggregate dividends of £40 million and spending £5 million buying shares to mitigate option grants, net cash has now reached £25 million.

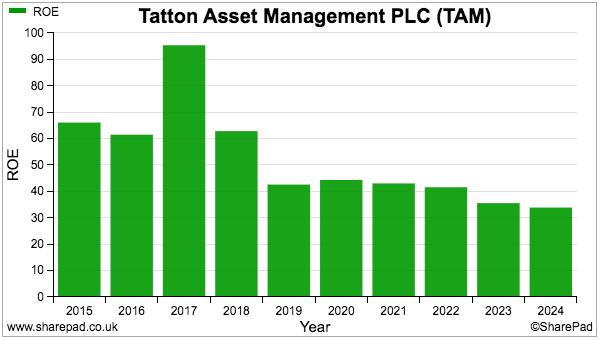

Alongside the cash, Tatton’s balance sheet is comprised mostly of goodwill and acquired intangible assets of approximately £14 million. Exactly what returns such intangibles have created are difficult to calculate, but ShareScope’s 30%-plus ROE suggest the group is a fundamentally asset-light operation:

The declining ROE figure is due to the cash piling higher and collecting very little interest in return.

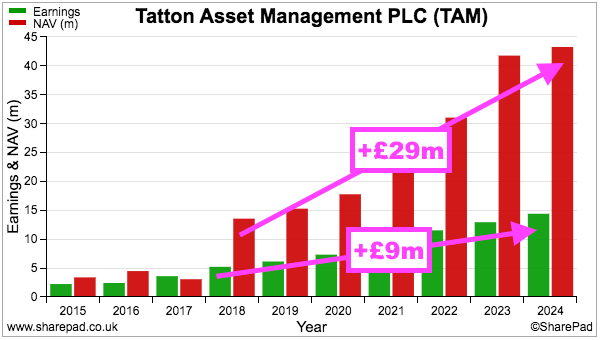

For extra perspective, ShareScope shows earnings rising from £5 million to £14 million since 2018, while shareholders’ equity has climbed from £14 million to £43 million:

Adding an extra £9 million profit by retaining £29 million suggests Tatton has reinvested its earnings at a wonderful 30% return.

Boardroom

The aforementioned Paul Hogarth remains on Tatton’s board as chief executive:

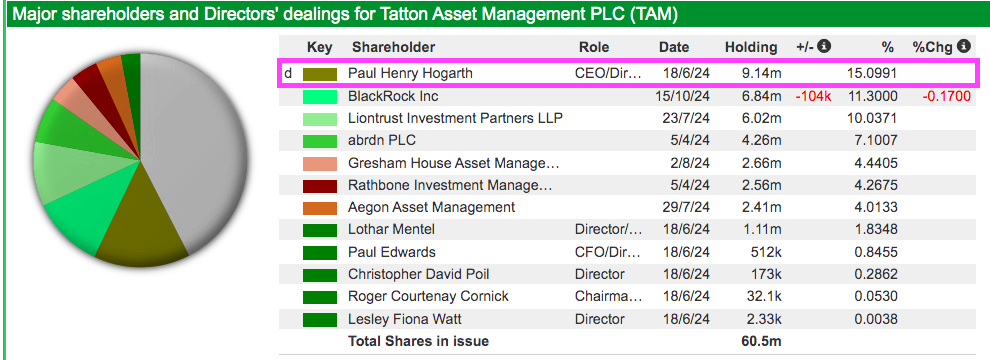

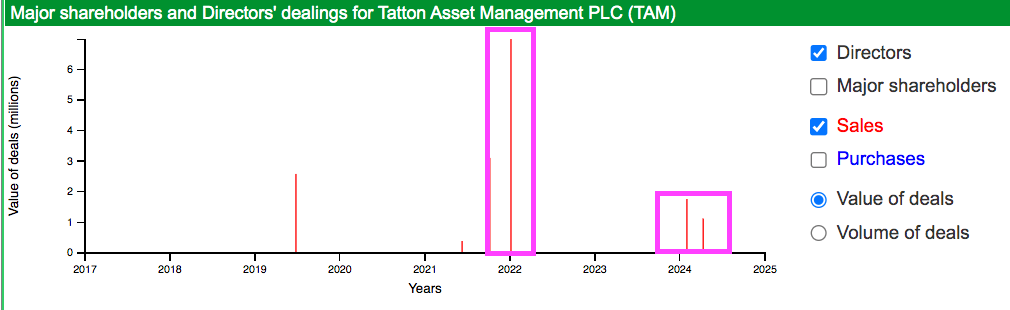

The group’s impressive financial performance is perhaps not surprising given Mr Hogarth has the ‘owner’s eye’ through a 15%/£64 million shareholding:

Although Mr Hogarth reduced his holding by 60% at the flotation, he has subsequently cut his holding by just 13% — raising a total £10 million by selling at 529p, 561p and 590p:

Despite the share sales, Mr Hogarth’s stake still pays him a useful £1.6 million annual dividend income — much greater than his £342k annual salary and further evidence of his ‘owner’s eye’.

Mr Hogarth’s basic salary has in fact remained at £342k since 2019 while his bonuses have been kept under control at an average 64% of his pay.

A skim of Tatton’s corporate governance report does not unearth anything obviously outrageous. Mind you, the non-exec chairman attracted a 17% protest vote at this year’s AGM for reasons that are not clear to me.

Probably the main boardroom issue facing Tatton investors is succession planning. Mr Hogarth is 65 years old and will be a tough act to follow.

Valuation

Half-year results published last month showed incoming client money of £1.8 billion that helped lift revenue by 24%, adjusted profit by 23% and the dividend by 19%:

The results reiterated the group’s ambition for client money to increase by 50% to £30 billion by 2029:

Reasons supporting Tatton’s optimism include:

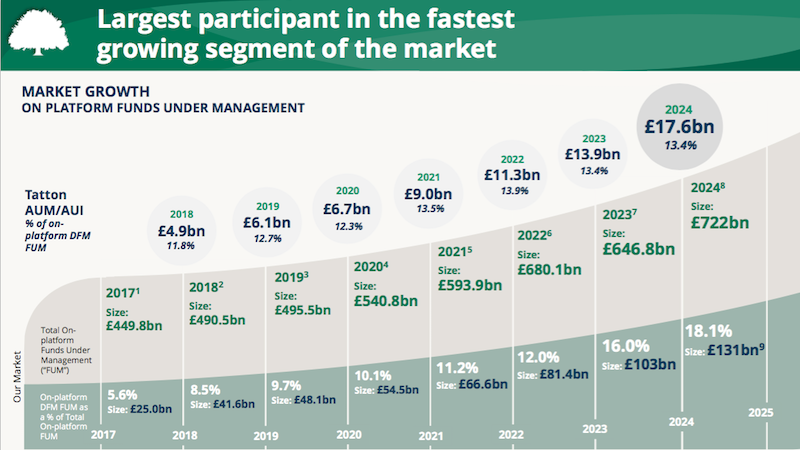

- Further industry growth: Since 2017, the entire investing platform sector has witnessed client money advance 60% to £722 billion, with discretionary-managed platform money up a staggering five-fold to £131 billion.

- Greater IFA custom: IFAs employing Tatton on average place client money of less than £20 million with the group, which could increase towards the average IFA’s £40 million held on all platforms.

- New regulation: The FCA’s Consumer Duty rules seem more favourable towards lower-cost model portfolios versus higher-cost wealth managers.

Underlining the £30 billion client-money target is Tatton successfully achieving its earlier £15 billion target, which was set during 2021 when client money was only £9 billion.

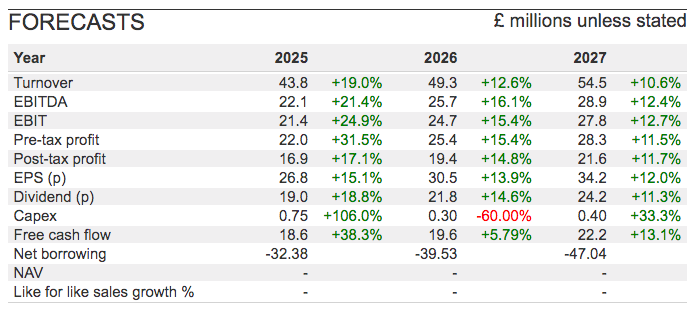

Brokers have translated Tatton’s ambition into the following upbeat forecasts:

The 700p shares understandably trade at a premium, with the near-term P/E at 26x for 2025, which reduces to 23x for 2026 and 20x for 2027.

Should client money reach £30 billion by 2029, I estimate revenue could be £60 million, adjusted profit could be £35 million and earnings could be £26 million — the latter implying a P/E of 16x five years out.

Summary

Tatton must be among the very best companies I have studied during my six years analysing shares for ShareScope.

Anyone smart enough to have bought at the float will have enjoyed a brilliant record of growth underpinned by attractive financials and that incredible profit margin. And if the £30 billion client-money target is anything to go by, superior ‘scalable’ expansion looks assured for the rest of the 2020s, too.

For what I understand, IFAs are now more than happy to delegate managing client money to a model-portfolio supplier such as Tatton, especially if the investment performance is steady and respectable.

But can Tatton’s positive investment performance continue? A particular risk is what happens if/when the portfolio gains falter and client returns stagnate (or worse).

After all, a fair amount of past performance appears driven by client exposure to those Nasdaq mega-caps, and I do wonder whether Tatton’s experts will be able to reduce that exposure at the right time.

Still, I doubt Mr Hogarth will be worrying too much about market gyrations. He has argued Tatton’s long-term success really boils down to working very closely with IFAs:

“It’s just listening to IFAs. Because we’ve worked so close with IFAs for so long, we understand what makes them tick. We understand what they want. The biggest single reason that Tatton has been so successful is that the investment management has been designed for IFAs by IFAs. We’ve partnered with them rather than just being another financial institution.”

As such, I would view any substantial share-price setback due to a wobbly Nasdaq, slowing expansion and/or nervous clients as a potential buying opportunity for a quality business.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Tatton Asset Management.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.