For a year now, Richard has been scrutinising companies and awarding them ‘strikes’ for complications that make them tricky to analyse and potentially unpredictable as investments. Now he’s combed the entire market, he reveals all the shares that didn’t strike out.

It’s a year since I started the 5 Strikes project, which means I have evaluated (very briefly) every UK-domiciled share listed in London (excluding investment trusts) that has earned positive cash flow in aggregate over the previous three years.

Today I am sharing the list of shares that scored less than three strikes.

One new share beats the cut

To my mind, these shares have the fewest complications and are, therefore, most likely to be straightforward to analyse.

They have profitable track records, modest or no debt, and they have lived within their means – by which I mean they have grown without having to issue great globs of new shares.

Only one company has passed all the criteria and published an annual report since my last article. There is sometimes a delay between when I write the article and when it is published, though, so there may be more by the time you read this! I will reveal them next time.

The company that passed is RELX, the information, data, and analytics behemoth formerly known as academic and professional publisher Reed Elsevier.

RELX caught my attention recently because it was profiled in the Financial Times. The company is the top-performing FTSE 100 company in the indexes’ history. Erik Engstrom, its chief executive of fifteen years, is also one of the highest paid. But the “unflashy Swede” flies economy class, and eats at Itsu. Head office only contains 100 people, and hasn’t been refurbished in 25 years.

This is the paragraph that really caught my attention though:

One top shareholder described him as “one of the great incrementalists of UK business”, adding: “His real talent has been to plough an incredibly consistent furrow. It’s been a very steady deliberate strategy of investing organically, taking content sets in print formats and digitalising them.”

Really big businesses cannot turn on a dime. To stay relevant they must be constantly adapting and, over the long-term, evolution can turn into revolution. Maybe that is what is going on at RELX.

All the shares that beat the cut

Of the 1,442 shares listed on the stockmarket (excluding investment trusts) only 463 of them currently pass the cashflow/domicile filter. Only 142 of them have scored less than three strikes.

That’s still too many shares to research, so in the coming year, I will become a harsher critic, awarding strikes with abandon.

In the meantime, I am afraid I might break the Internet with the enormity of my table. It is ordered by date of flotation so the most established firms are first.

Age before beauty

Compelling research shows that seasoned shares, firms that have existed longest, make the best investments.

Date of floatation is not a perfect proxy for the age of a company, because companies may have existed for a long time before they floated, but an ancient IPO is, at least, a guarantee the company has been in existence for a long time.

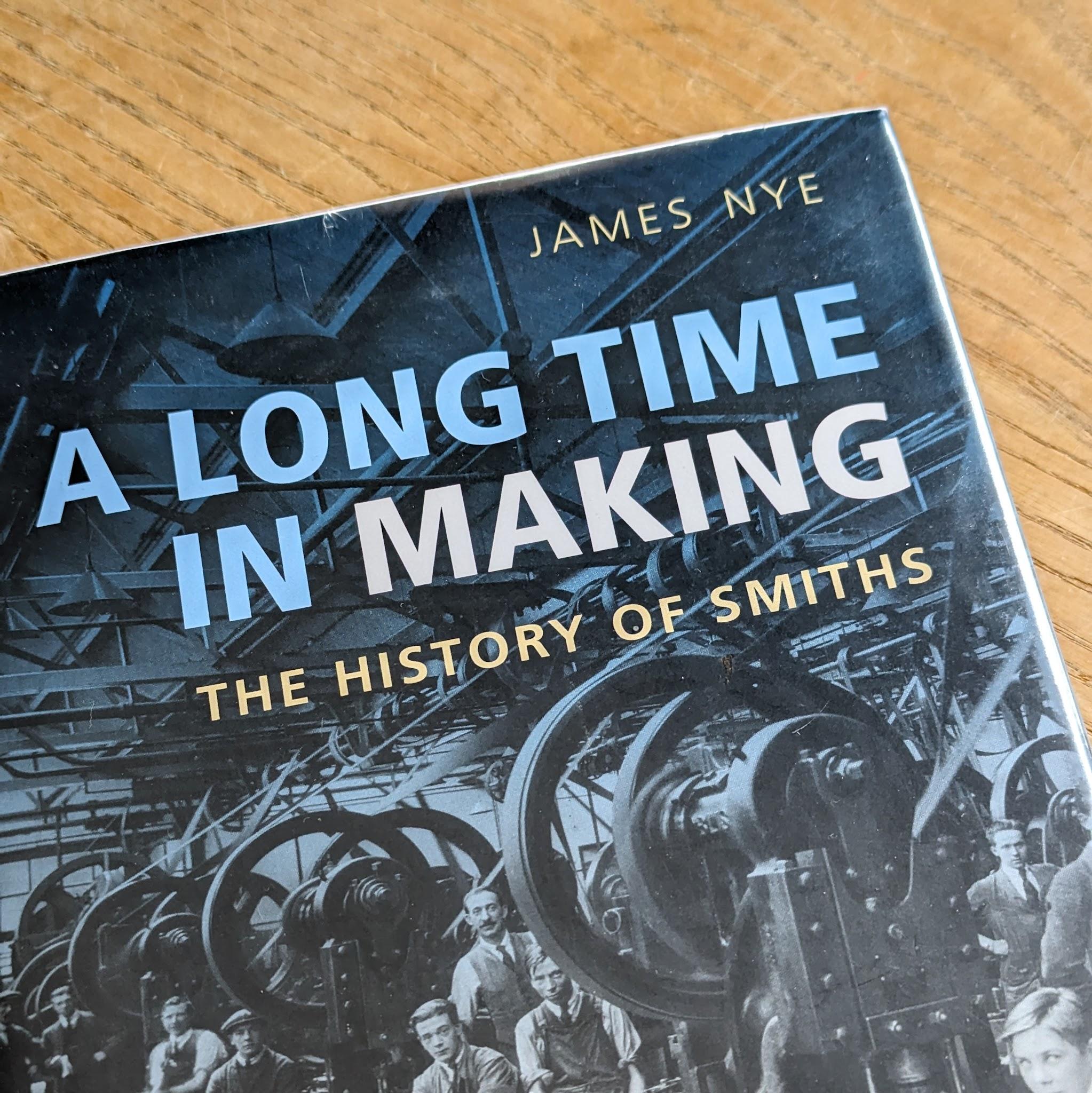

The first share in the list, Smiths, is a giant engineering conglomerate that earned over £9 billion turnover in 2023. It has been listed since 1914, but it traces its origins to a family-owned jeweller and watchmaker established in London in 1851.

Amazon reviewers like the company’s biography. It is called “A Long Time Coming: The History of Smiths”. The Kindle eBook is priced rather fancifully, but I managed to pick up a second-hand copy of the hardback for a tenner.

Let’s hope Smiths is not a long time in the researching. A Long Time in the Making: The History of Smiths.

Smiths’ turnover puts it in the same league as RELX, which floated in 1948 and traces its history back to the nineteenth century too.

Researching big companies can be exhausting, unless they retain and communicate a focused business model and a coherent strategy. After verifying the numbers, that is what I would be looking for…

Notes to table:

# – Number of strikes

## – An ‘X’ in this column means the share struck out after further analysis

Notes – ‘sp’ is a link to SharePad coverage, ‘ii’ is a link to an article on interactive investor

For an explanation of the strikes, see our guide to 5 Strikes: How the system works, and what the strikes mean

| Name | Float Date | Strikes | # | ## | Notes |

|---|---|---|---|---|---|

| Smiths | 1/1/1914 | – Holdings – Growth | 2 | ||

| Tate & Lyle | 9/12/1938 | – Holdings | 1 | ||

| Eleco | 26/7/1939 | – Holdings – Shares | 2 | ||

| Unilever | 11/8/1939 | ? Holdings – Growth | 1 | ||

| James Halstead | 1/1/1947 | – Growth | 1 | ii | |

| Senior | 16/2/1947 | ? Acquisitions – Debt – ROCE | 2 | ||

| Next | 12/3/1948 | – Growth – Debt | 2 | ii | |

| RELX | 21/4/1948 | – Holdings – Debt ? Growth | 2 | ||

| TClarke | 8/9/1949 | – Holdings – CROCI | 2 | ||

| 4imprint | 5/11/1953 | – | 0 | ii | |

| PZ Cussons | 26/11/1953 | – Holdings – Growth | 2 | ii | |

| Bunzl | 20/6/1957 | ? Holdings – Debt | 1 | ii | |

| Johnson Service | 23/5/1958 | – Shares – | 2 | ||

| Goodwin | 18/8/1958 | – CROCI – Growth | 2 | ii | |

| Inchcape | 31/10/1958 | – Holdings | 1 | ||

| Spirax-Sarco Engineering | 15/5/1959 | – Holdings | 1 | ||

| MJ Gleeson | 1/7/1960 | – CROCI – ROCE | 2 | ||

| Me International | 1/1/1962 | – Growth | 1 | ||

| Thorpe (F W) | 1/1/1965 | – | 0 | ii | |

| Latham (James) | 3/3/1965 | – CROCI | 1 | ii | |

| MS International | 24/3/1965 | ? CROCI ? ROCE – Growth | 2 | ||

| RS | 14/6/1967 | – Holdings – Shares | 2 | ||

| Rotork | 23/7/1968 | – Holdings | 1 | ||

| Barratt Developments | 4/12/1968 | – Holdings – CROCI | 2 | ||

| Hill & Smith | 26/3/1969 | – CROCI – Holdings | 2 | ||

| Barr (AG) | 2/4/1970 | – Growth | 1 | ||

| Halma | 18/1/1972 | – Holdings | 1 | ||

| Bodycote | 28/1/1972 | – Holdings ? CROCI ? ROCE ? Growth | 2 | ||

| Vp | 1/1/1973 | – CROCI – Debt | 2 | ||

| Nichols | 25/3/1973 | – | 0 | ||

| Castings | 25/3/1973 | – Growth – ROCE | 2 | ||

| Bellway | 21/5/1979 | – Holdings – CROCI | 2 | ||

| Oxford Instruments | 12/10/1983 | – Holdings – Growth | 2 | ii | |

| Greggs | 27/4/1984 | – Holdings | 1 | ||

| Aptitude Software | 2/5/1984 | – Holdings | 1 | ||

| Renishaw | 16/11/1984 | – CROCI | 1 | ii | |

| Berkeley | 16/12/1985 | – CROCI – Growth | 2 | ||

| Clarkson | 30/6/1986 | – ROCE – Shares | 2 | ||

| Colefax | 5/7/1988 | – Growth – ROCE | 2 | ||

| Christie | 14/7/1988 | – | 0 | X | sp |

| Hays | 26/10/1989 | – Holdings – Shares | 2 | ||

| Sage | 14/12/1989 | – Holdings | 1 | ||

| Jet2 | 1/7/1991 | – CROCI – Shares | 2 | ii | |

| Porvair | 20/2/1992 | ? Holdings | 0 | ii | |

| Howden Joinery | 17/7/1992 | – Holdings | 1 | ii | |

| Wetherspoon (JD) | 30/10/1992 | – Debt – ROCE | 2 | ||

| Cranswick | 13/7/1993 | – Shares | 1 | ||

| Redrow | 17/5/1994 | – Holdings – CROCI | 2 | ||

| Bloomsbury Publishing | 23/6/1994 | – Shares | 1 | ii | |

| Associated British Foods | 1/8/1994 | – CROCI – Growth | 2 | ||

| Games Workshop | 6/10/1994 | – Holdings | 1 | ii | |

| Morgan Sindall | 28/10/1994 | – Holdings – CROCI | 2 | ||

| Churchill China | 1/11/1994 | – CROCI | 1 | ii | |

| Character | 22/6/1995 | – CROCI – Growth | 2 | ||

| Wilmington | 6/12/1995 | – Holdings | 1 | ||

| Victrex | 21/12/1995 | – Holdings – Growth | 2 | ii | |

| Solid State | 26/6/1996 | – Acquisitions – Shares | 2 | ii | |

| JD Sports Fashion | 22/10/1996 | – Shares | 1 | ||

| Netcall | 18/12/1996 | – ROCE – Shares | 2 | ||

| Computacenter | 29/5/1998 | – | 0 | ||

| Liontrust Asset Management | 21/7/1999 | – Shares | 1 | ||

| Domino’s Pizza | 24/11/1999 | – Debt | 1 | ||

| Next 15 | 6/12/1999 | – Shares | 1 | ||

| London Security | 30/12/1999 | – Holdings | 1 | 80% controlling interest | |

| Iomart | 19/4/2000 | – ROCE – Shares | 2 | ||

| Robert Walters | 13/7/2000 | – CROCI | 1 | ||

| Telecom plus | 26/7/2000 | – | 0 | ||

| Arcontech | 4/12/2000 | – Holdings – Growth | 2 | ||

| Pebble Beach Systems | 6/12/2000 | – Debt -Turnaround | 2 | ||

| Compass | 2/2/2001 | – Holdings – Debt | 2 | sp | |

| PageGroup | 2/4/2001 | – Holdings | 1 | ||

| IMPAX Asset Management | 19/6/2001 | – Growth | 1 | ||

| Renew | 29/10/2001 | – Holdings – Shares | 2 | ||

| Andrews Sykes | 24/12/2001 | – Shares | 1 | 87% controlling interest | |

| Advanced Medical Solutions | 30/4/2002 | – ? CROCI ? ROCE ? Shares | 1 | ii | |

| Intertek | 29/5/2002 | – Holdings | 1 | ||

| Burberry | 18/7/2002 | – Holdings – Growth | 2 | ||

| Judges Scientific | 7/1/2003 | – Acquisitions | 1 | ii | |

| InterContinental Hotels | 15/4/2003 | – Holdings – Debt | 2 | ||

| PayPoint | 24/9/2004 | – Holdings – Growth | 2 | ||

| Jarvis Securities | 23/12/2004 | – CROCI – Growth | 2 | ||

| Brooks Macdonald | 11/3/2005 | – Holdings | 1 | ||

| YouGov | 25/4/2005 | – Shares | 1 | ii | |

| IG | 4/5/2005 | – Holdings – Shares | 2 | ||

| Tristel | 1/6/2005 | – Shares | 1 | ii | |

| Anpario | 30/6/2005 | ? Holdings ? CROCI ? Shares | 1 | ii | |

| SThree | 11/11/2005 | – Holdings | 1 | ||

| Dewhurst | 22/2/2006 | – Growth | 1 | ii | |

| Cohort | 8/3/2006 | – ROCE | 1 | ii | |

| Rightmove | 15/3/2006 | – Holdings | 1 | ||

| City of London Investment | 11/4/2006 | – Growth – Shares | 2 | ||

| Ashmore | 17/10/2006 | – Growth | 1 | ||

| Dunelm | 24/10/2006 | – Debt | 1 | ||

| LSL Property Services | 21/11/2006 | – Growth – ROCE | 2 | ||

| Polar Capital | 6/2/2007 | – Growth – Shares – Accounting | 2 | ||

| Norcros | 16/7/2007 | – Holdings – Shares | 2 | ||

| Moneysupermarket.com | 31/7/2007 | – | 0 | ||

| Record | 27/11/2007 | – | 0 | ||

| Animalcare | 15/1/2008 | – Growth – ROCE | 2 | ||

| Science | 8/7/2008 | – Shares | 1 | ||

| SDI | 8/12/2008 | – Acquisitions – Shares | 2 | sp | |

| M Winkworth | 12/11/2009 | – | 0 | ||

| Dotdigital | 29/3/2011 | – Holdings – Shares | 2 | ||

| Learning Technologies | 15/6/2011 | – Acquisitions – Shares | 2 | ||

| Belvoir | 21/2/2012 | – Shares | 1 | sp | |

| Property Franchise | 18/12/2013 | – Shares | 1 | ||

| Bioventix | 29/4/2014 | – | 0 | ||

| Card Factory | 15/5/2014 | – Holdings – Debt | 2 | ||

| Shoe Zone | 23/5/2014 | – Growth – Debt | 2 | X | |

| Volution | 18/6/2014 | – | 0 | ||

| FDM | 20/6/2014 | – | 0 | sp | |

| Gamma Communications | 10/10/2014 | – Holdings | 1 | ||

| Quartix | 6/11/2014 | – | 0 | ii | |

| Fevertree Drinks | 7/11/2014 | – | 0 | ||

| Mortgage Advice Bureau | 12/11/2014 | – | 0 | ||

| Focusrite | 11/12/2014 | – Acquisitions | 1 | ii | |

| Auto Trader | 19/3/2015 | – | 0 | ii | |

| Gateley | 8/6/2015 | – | 0 | sp (listed law firms) | |

| Kainos Ltd | 10/7/2015 | ? IPO | 0 | sp | |

| On The Beach | 22/9/2015 | ? ROCE | 1 | sp | |

| Softcat | 13/11/2015 | – Holdings – Growth | 2 | ii | |

| CMC Markets | 5/2/2016 | – CROCI – Growth | 2 | ||

| Cerillion | 18/3/2016 | – IPO | 1 | sp | |

| Hollywood Bowl | 21/9/2016 | – IPO – Debt | 2 | ii | |

| Luceco | 17/10/2016 | – Float date | 2 | China dependency | |

| Warpaint London | 30/11/2016 | – IPO – ROCE | 2 | ||

| Alpha International | 7/4/2017 | – Shares | 1 | ||

| Alfa Financial Software | 26/5/2017 | – Growth – Float date | 2 | ||

| Tatton Asset Management | 6/7/2017 | – IPO | 1 | ||

| Alpha Financial Markets | 11/10/2017 | – IPO – Shares | 2 | ||

| Bakkavor | 16/11/2017 | – IPO – Debt | 2 | ||

| Keystone Law | 27/11/2017 | – IPO | 1 | ii, sp | |

| IntegraFin | 27/2/2018 | – IPO ? CROCI ? ROCE | 2 | ? Accounting | |

| Fintel | 4/4/2018 | – IPO – Shares | 2 | ||

| Cake Box | 27/6/2018 | – IPO | 1 | sp | |

| AJ Bell | 7/12/2018 | – IPO ? Holdings | 1 | ||

| Watches Of Switzerland | 30/5/2019 | – IPO – Debt | 2 | ||

| Airtel Africa | 28/6/2019 | – IPO – Debt | 2 | ||

| FRP Advisory | 6/3/2020 | – IPO – Shares | 2 | ||

| Ninety One | 16/3/2020 | – IPO – Growth | 2 | ||

| Fonix Mobile | 12/10/2020 | – IPO – CROCI | 2 |

Source: SharePad and Richard Beddard

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.