Quartix’s vehicle-tracking services have delivered consistently attractive financial ratios. Maynard Paton spotlights how new customers and a good-value workforce are counterbalancing pricing pressures and rising costs.

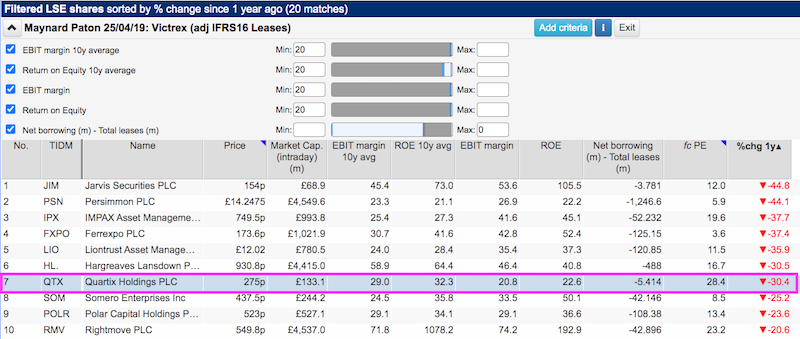

Today I have revisited a SharePad screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE above 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net borrowings of less than zero (i.e. net cash):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within SharePad’s comprehensive Filter Library. My instructions show you how.)

This time the filter returned 20 matches, including Rightmove, Hargreaves Lansdown, IG Group and Games Workshop.

I selected Quartix because it was among the worst share-price performers over the last year. Let’s take a closer look.

The history of Quartix

A “£1 a day” marketing campaign ensured Quartix’s first vehicle-tracking system enjoyed a successful launch back in 2002.

Founded a year earlier by Andy Walters, Dominie Walters, Ken Giles and Andy Kirk, Quartix had installed 1,250 tracking devices for 165 commercial customers by the end of 2003.

These days the company serves approximately 25,000 businesses through more than 235,000 vehicle trackers. The equipment not only provides real-time vehicle locations but through clever software also creates journey reports, optimises route planning, calculates vehicle utilisation and analyses driver behaviour.

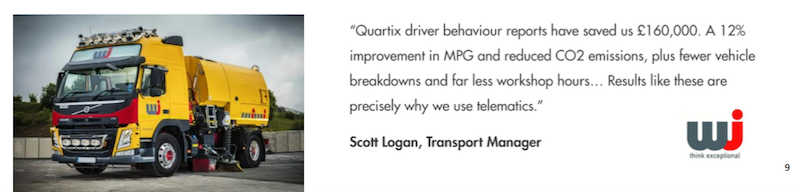

Customers enjoy improved staff productivity and reduced motoring costs, with Quartix’s system typically employed by small- and medium-sized businesses that run between three and 50 vehicles.

This road-markings specialist for example has saved £160,000 through Quartix’s driver-behaviour reports that have prompted a 12% improvement in fuel usage:

Quartix’s website includes case studies of customers who offer water services, waste collection, crane hire, residential plumbing, garden landscaping, office security, vehicle recovery and portaloo deliveries.

Manufacturing is undertaken by a specialist sub-contractor while tracker fittings are performed through a network of independent installers. Sales are generated primarily through telephone marketing with customers attracted by competitive pricing, ease of installation, straightforward software and high service levels.

Growth within the UK has been complemented by ventures into France (2010), the United States (2014) and Germany, Spain and Italy (2019). Overseas operations now account for approximately 40% of the group’s revenue and installed trackers.

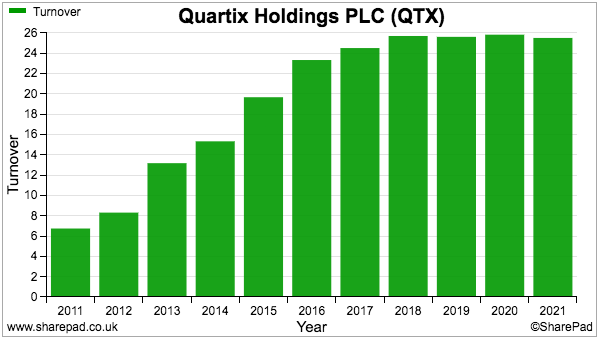

Quartix joined AIM during 2014 and the headline financial progress has not always been spectacular.

Between 2018 and 2021, revenue stalled at £25 million:

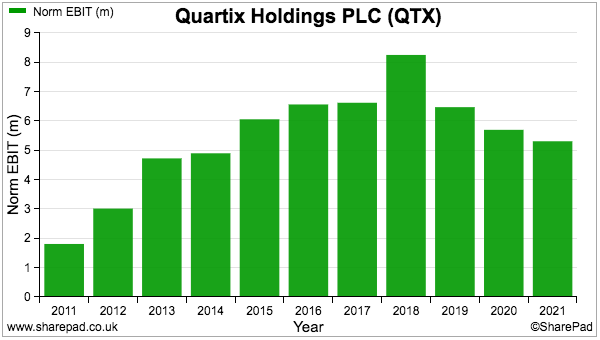

Operating profit meanwhile peaked during 2018 at £8 million:

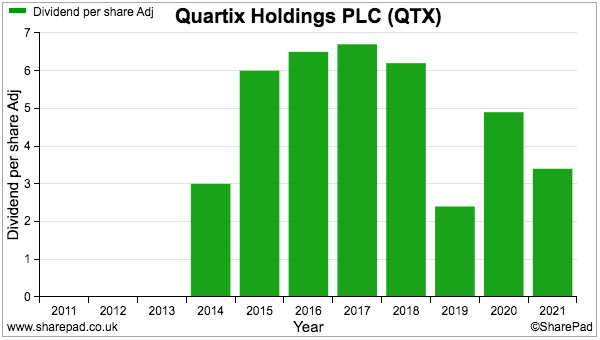

And ordinary dividends have fluctuated due to the payout policy being aligned to cash flow (companies typically align dividends to earnings, which often vary less from year to year than cash flow):

At least loyal shareholders have been comforted by special dividends. Extra payouts during 2016, 2018, 2020 and 2021 have totalled a welcome 32p per share.

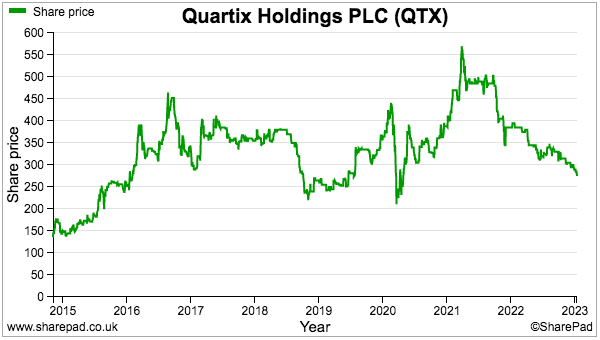

The shares floated at 116p and briefly surpassed 550p during 2021:

The recent 275p supports a £133 million market cap.

KPIs and revenue per vehicle

Quartix’s headline progress masks an important underlying change to the business.

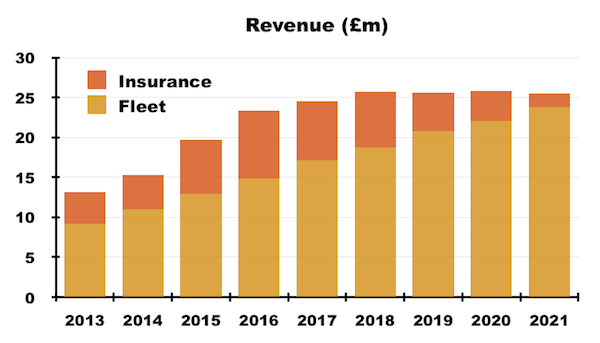

During 2010 Quartix began supplying telematics systems to car insurers to monitor the driving habits of their higher-risk policyholders.

Such services were by 2016 generating Quartix revenue of £8 million, but the decision to exit the insurance market due to unsatisfactory margins has since reduced such income to less than £2 million:

Revenue from the core ‘fleet’ telematics services has in contrast managed to advance from £15 million to £24 million over the same time.

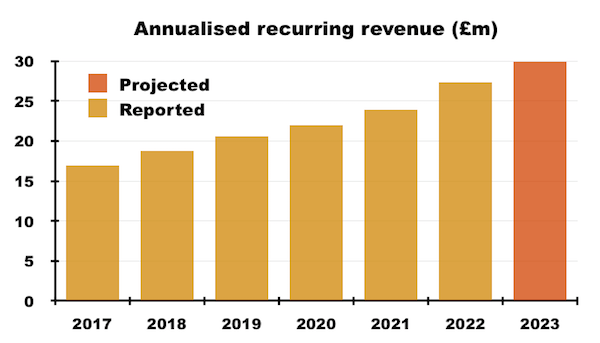

Customer subscription payments underpin an annualised recurring revenue calculation, which includes the expected income from recently installed telematic devices that have to date contributed little (or no) recognised revenue.

A trading statement earlier this month said annualised recurring revenue had surpassed £27 million during 2022, with the group’s target for 2023 being £30 million:

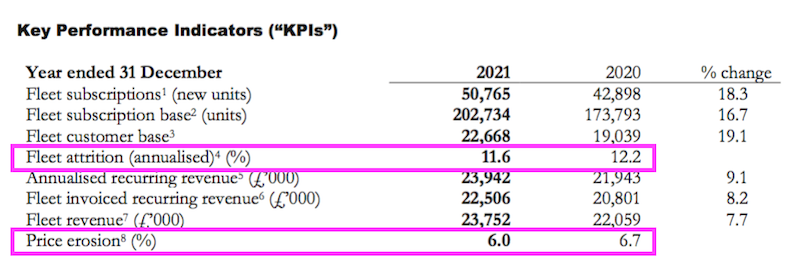

Quartix does have to work hard to lift its revenue. The annual report commendably lists two key performance indicators — ‘attrition’ and ‘price erosion’ — that persistently hold back progress:

‘Attrition’ represents the proportion of vehicle subscriptions that cease every year, and has gradually increased from approximately 10% to almost 12% since the flotation.

‘Price erosion’ meanwhile reflects the decrease to the average subscription charge, and exceeded 9% when first disclosed for 2019 but was 6% for 2021.

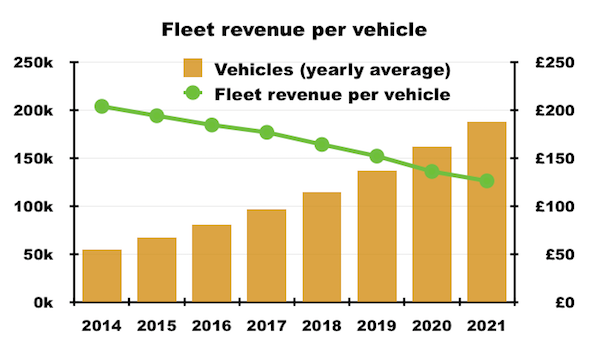

A ‘price erosion’ KPI suggests Quartix lacks an immense competitive advantage. Further analysis of Quartix’s stats shows revenue per vehicle-tracking subscription declining almost 40% to £126 since 2014:

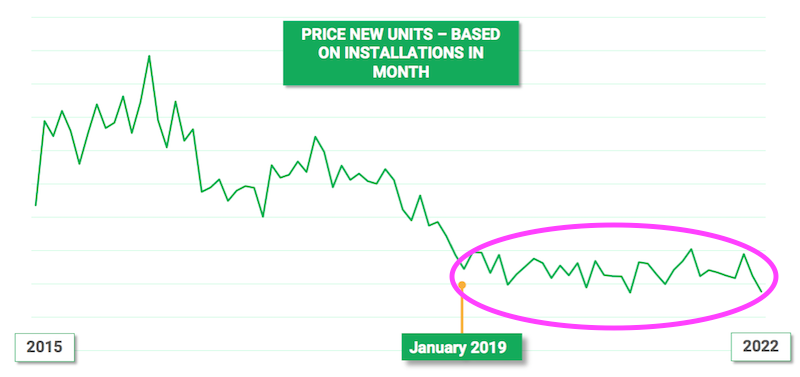

Investor presentations have disclosed prices for new customers stabilising during the last three years, which imply the price erosion is caused by customers renewing at lower prices:

The obvious worry of course is existing customers renew at a lower price because they don’t think that much of the service.

Mind you, a customer is more likely to renew at a lower price, and a customer on a lower price is better than no customer at all.

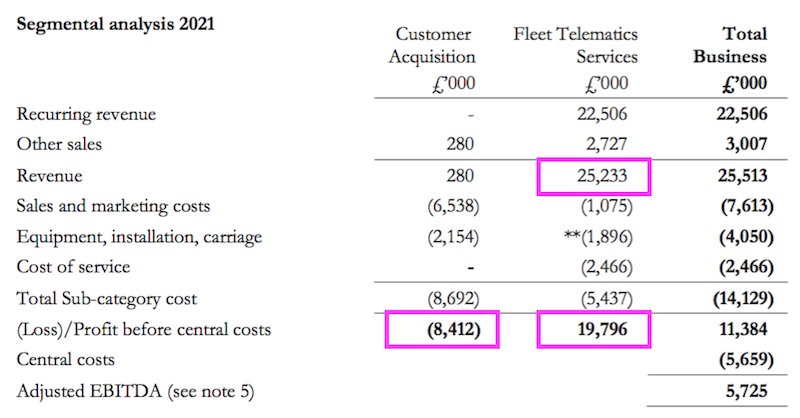

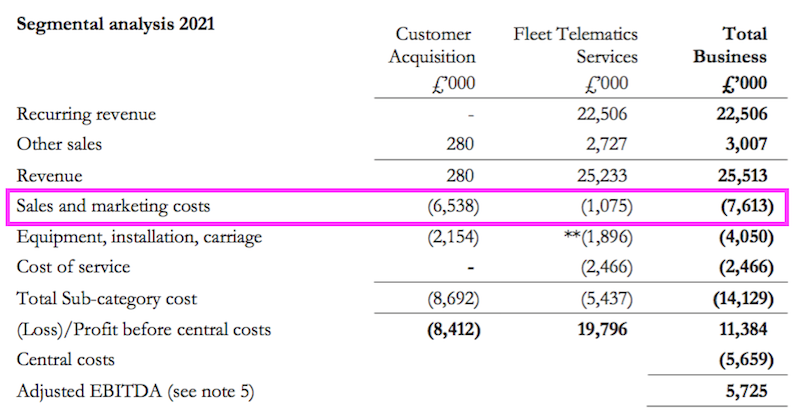

Quartix’s profitability may not be too affected by lower renewal payments. The 2021 annual report differentiates between the cost of acquiring new customers and the ongoing profit from existing customers:

Converting almost £20 million profit — before customer-acquisition costs and central costs — from customer income of £25 million underlines the lucrative economics of regular telematic payments.

The £8.4 million spent acquiring new customers during 2021 led to almost 51,000 new vehicle trackers being installed that year — implying Quartix spent £166 to acquire each new customer vehicle.

Given the aforementioned £126 collected per average vehicle-tracking subscription, Quartix may only make money from customers during their second year.

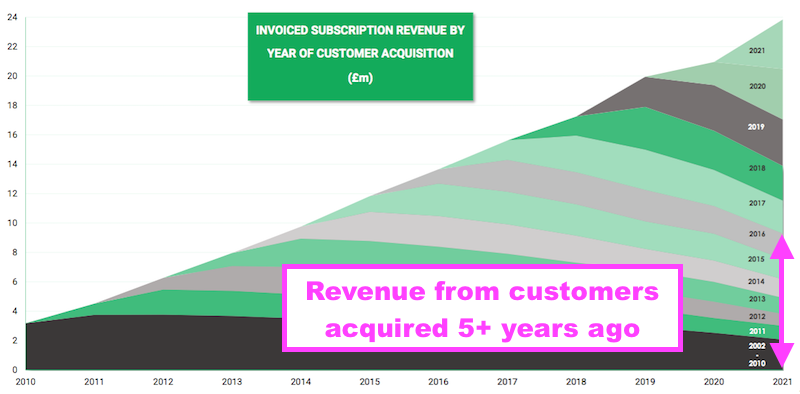

At least customers can be very loyal. Although the presentation slide below does show older subscriptions falling away over time, significant income is still collected from customers joining more than five years ago:

Margin, employee costs, ROE and goodwill

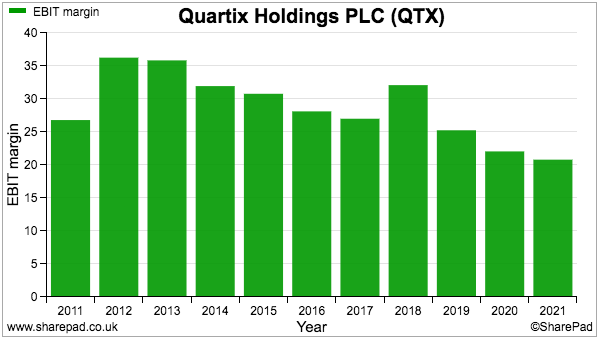

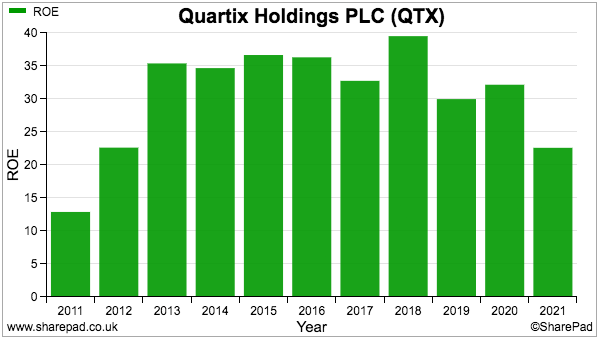

The SharePad charts below confirm Quartix does indeed boast a ten-year history of operating margin and ROE consistently exceeding 20%:

Both measures have declined during recent years.

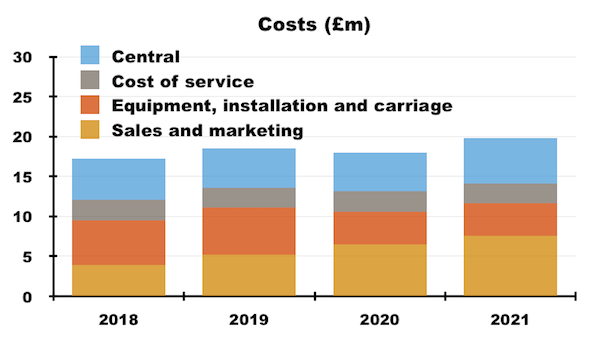

The segmental analysis from the annual report shows sales and marketing costs of £7.6 million absorbing 30% of revenue:

Such costs have almost doubled since 2018 and help explain the margin contraction:

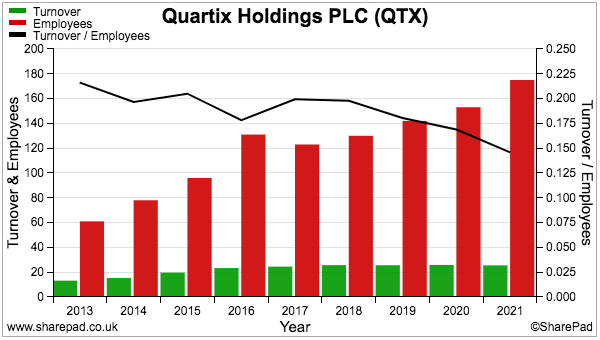

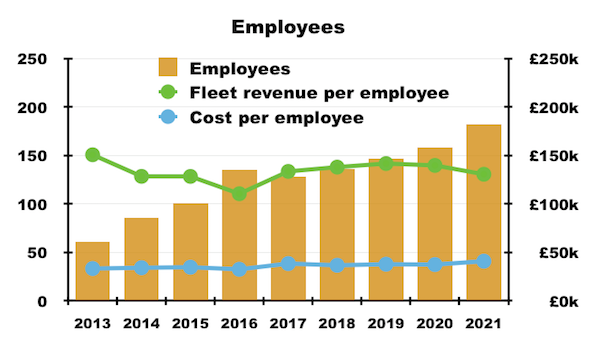

A significant part of sales and marketing will include the telesales employees. And total revenue per employee has notably deteriorated over time:

Strip out the insurance-related services that have been wound down during the last few years, and revenue per employee has in fact been reasonably stable at approximately £140,000:

Note the relatively low cost per employee — less than £41,000 for 2021, which does seem remarkable for an IT/software-type business. Quartix operates from Newtown in mid-Wales, which would seem an advantageous location for good-value workforces:

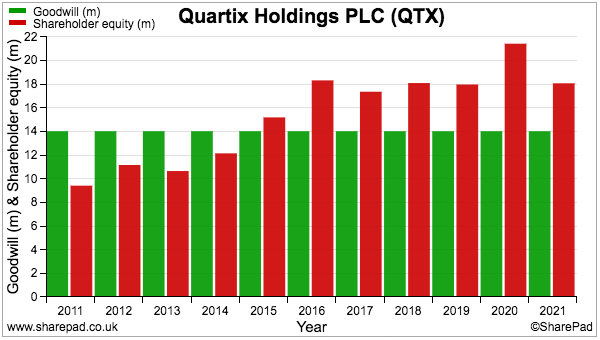

Quartix’s ROE calculations are influenced significantly by goodwill.

Created through a 2008 corporate re-jig, the group’s goodwill represents £14 million of net shareholder equity of £18 million:

Exclude this legacy accounting item and net assets are just £4 million, which is extremely impressive given adjusted annual earnings have bobbed around the £5 million mark.

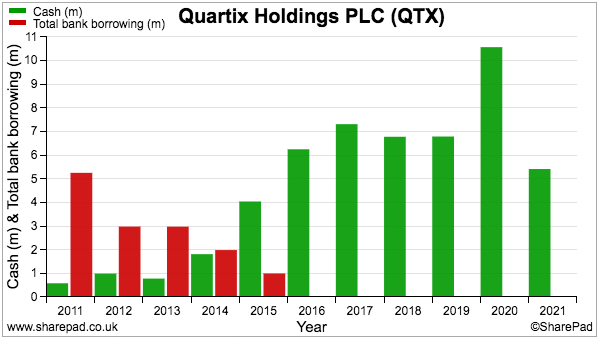

Even more impressive is Quartix’s tangible assets are dominated by cash:

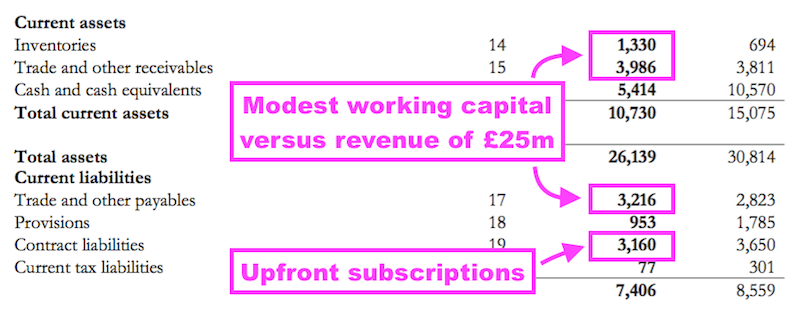

The cash position is helped by upfront customer payments, which are accounted for as contract liabilities in the annual report:

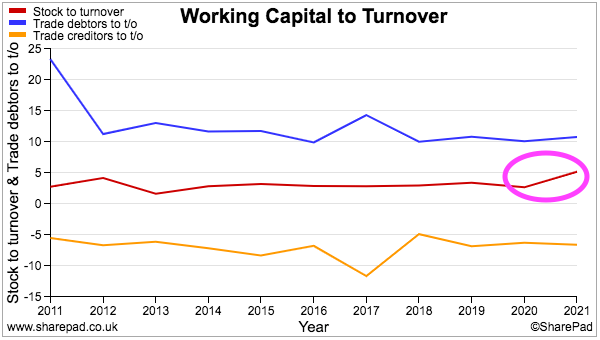

The business carries relatively little stock while receivables (money owed to Quartix) are mostly balanced by payables (money owed by Quartix).

Working-capital levels versus revenue appear commendably consistent:

That said, a build-up of stock during 2021 — from 2% to 5% of revenue to ensure sufficient component supplies — did lead to lower cash conversion:

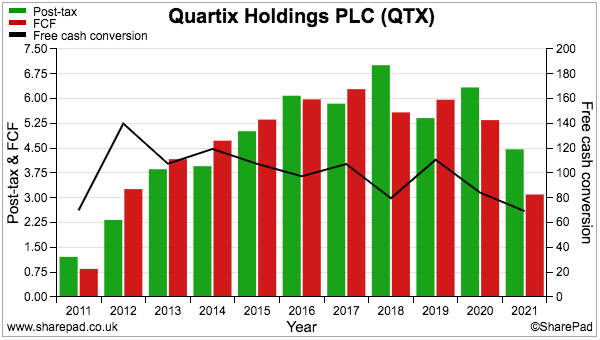

But upfront subscription payments have in the past helped convert a wonderful 100% or so of reported earnings into free cash.

Quartix’s dividend policy commendably includes considering a special dividend if the gross cash position exceeds £2 million. And the accounts are reassuringly free of acquisitions, bank debt and capitalised R&D.

Employees and management

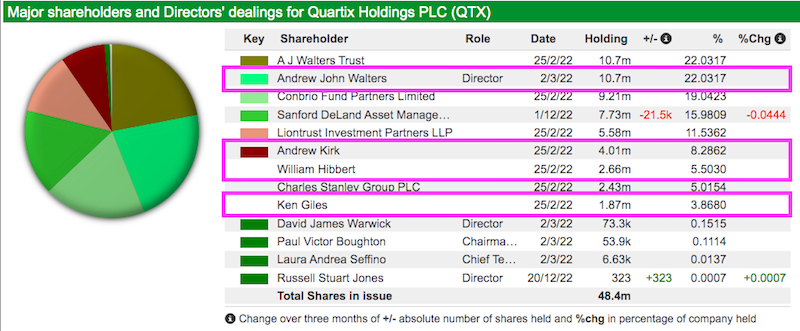

Co-founder Andy Walters remains Quartix’s largest shareholder with a 22%/£29 million family investment:

Two other co-founders and an early employee control a further 18%/£23 million. Such significant insider ownership goes some way to explain the aforementioned history of special dividends.

But the co-founders sadly no longer work as board executives, with Mr Walters set to leave the company during the next few months after 20 years at the helm. Note that Mr Walters raised £29 million after selling 40% of his shareholding two years ago at 401p.

Quartix’s chief executive and finance director were both appointed during 2021, with the chief exec having established the UK’s most successful vehicle-tracking distributor back in 2002.

For years Mr Walters collected a basic wage of less than £100,000 as chief exec, but those days of ‘thin cat’ pay have now disappeared with the new recruits on £150,000-plus. Neither the new chief exec nor the new finance director own any shares, while the chief technology officer has only an £18,000 investment.

A replacement LTIP announced during December revealed what the executives are now aiming to achieve: three-year compound growth of at least 7.5% for both annualised recurring revenue and free cash flow, and at least 10% for total shareholder return.

2022 performance and accounting change

A trading statement the other week confirmed next month’s annual results would meet broker forecasts and show revenue of £27.3 million and adjusted Ebitda of £5.8 million.

The statement implied 2022 revenue had advanced 9%, with a 7% increase during the first half followed by a 10% increase during the second.

But adjusted Ebitda for 2022 advanced only 1%, with a 6% decline during the first half followed by an 8% increase during the second.

Confusing matters with adjusted Ebitda is an accounting change. Starting from next month’s results, Quartix will more closely match initial contract costs with the associated revenue:

“For many years the Company has applied a very conservative accounting policy of immediately expensing hardware and associated installation and carriage costs. The Company is implementing a new policy for 2022 which will recognise these incremental costs over their expected contract term, on a systematic basis that more accurately reflects the revenue stream generated by them.”

The impact for 2022 is to increase adjusted Ebitda by £0.4 million:

“The approximate impact of this in 2022 is in the region of £0.4m increase in adjusted EBITDA compared with previous reporting methodology for the year, which will be reflected in the 2022 figures in the Annual Report.”

The guided £5.8 million adjusted Ebitda figure presumably includes this extra £0.4 million — that forecasts published before the announcement would of course not have included!

Without the accounting re-jig, adjusted Ebitda would have declined by 5% during the second half and 6% during the full year.

The commentary also suggested sales and marketing costs continue to eat into margins:

“The Company made further incremental investments into its sales and marketing channels during 2022 to drive further growth in ARR and the subscription base, following the successful investment made in 2021. Initiatives in 2023 will continue to focus on reducing customer acquisition costs as well as in tools to improve sales efficiency.”

All told, the tone of the latest statement reflected Quartix’s recent financial trends, which are:

- Impressive levels of new tracker installations (+16% for 2022) converting into…

- Less impressive but worthwhile advances to recognised revenue (+9% for 2022) due to pricing pressures, converting into…

- Flat profit progress due to greater expenses to capture new customers.

The latest statement was also the first from Quartix to use the word “switch”, which could mean new customers may now have to be won from other suppliers to keep the growth momentum going:

“In the UK our value-based strategy of excellent service at a competitive price will drive our capability to switch customers from their existing suppliers in addition to winning new adopters of telematics technology.”

Valuation and summary

Unfortunately for ‘quality’ investors, the 50% share-price decline since the 550p high of 2021 has not yet created a compelling bargain.

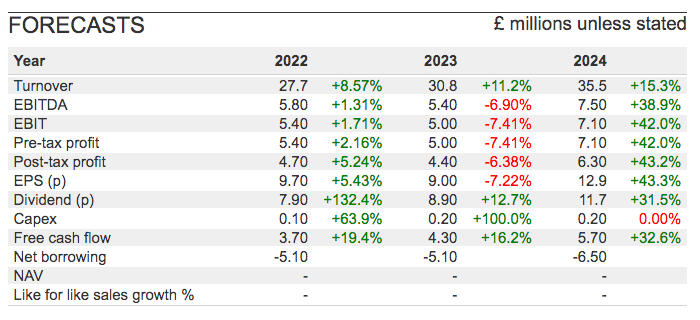

Earnings forecasts for 2024 place the 275p shares on a 21x multiple, which is based on a hefty 40%-plus projected profit rebound from 2023:

The present rating clearly reflects the advantages of the group’s upfront subscription revenue, low capital requirements, debt-free balance sheet, respectable history and genuine overseas expansion prospects.

For now at least, the sensible course of action would be to mark Quartix as a watch-list stock. The business ought to remain fundamentally attractive, but will its vehicle-tracking economics deteriorate over time as customers pay less and costs keep rising? The group’s super ratios could arguably be due to simply operating with good-value staff in Wales.

Plus company founders do tend to time their retirements quite well, and the appointment of fresh leadership may be a signal fresh thinking is required to maintain the KPI momentum.

As the new executives bed in, the upcoming year of forecast flat earnings might well see the shares de-rate to a more appealing level. The direction of Quartix’s margin and ROE could meanwhile indicate whether the group’s competitive position remains intact.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Mark Atkinson. He does not own shares in Quartix.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.