Below is a list of common trading psychology problems that I’ve compiled from my own trading journey. I see them as the main problems that would affect the results of my own systematic approach or delay the learning process by chasing red herrings. I have had to overcome all of them over the years though sometimes a couple of them can creep back in when I let my guard down so having a hard copy printed out as part of my rules will help keep me in lane ready for the next time I’m about to venture off-piste to do something stupid.

My Style

Different approaches and rules can contradict each other due to the lane we choose to do business in. For this article try and get inside the mind of a position trader who is aiming to capture a trend that lasts months to years. If you hear yourself saying “Yeah But” try and ignore it as you need to think like a trend follower and avoid opinions based on a different approach to get the most out of what I will cover. When capturing trends. we deal with the reality of price and avoid trade tampering caused by opinions. Swing or momentum trades are about rotation on a faster timeframe and trend, or position trades will be aiming to capture more of an available move on a slower timeframe. All methods are aimed at capturing price appreciation unlike what I would call a true investing style that incorporates dollar cost averaging and dividend reinvestment. The methods will also be better suited to different types of stocks. For those who are not familiar with this concept then revisit Stock Selection and Staying in Lane for a recap of how I approach stock selection.

Many of the problems covered below will have a contradictory “yeah But” from a different style viewpoint and even trend followers who are trying to capture the same trend will have different opinions so for my style I’ll also add a “trading truth” based on price to counter the argument.

Can’t Buy the High – Waiting for the Retrace That Never Happens

Looking for the Lowest Price – not having the psychology to buy a 52-week high. All the biggest winners will trade at 52-week highs. Many of them won’t retrace while the reward to risk is in your favour. I want to be positioned in the shares that are moving now. This is where the best will be found before they go on to become the biggest winners. A key point here is before they go on to become a big winner as the herd has a tendency to get on board the trend just before it reaches its final destination.

“Yeah But” What if the new high doesn’t fit the valuation model you use? Food for thought, Boohoo Group was trading at a PE of over 40 before it went on a 600% run and has since lost over 70% of its value after the PE ratio had fallen to 15 so be very careful betting against trend and price. I’m in the camp of price follows growth though it doesn’t mean something that has no growth cannot trend. I just like to weigh most of my portfolio in the growth stocks. If you have some proven criteria for your methodology and a signal doesn’t meet that criteria, move on. We need to bring the pool of stocks down to a manageable amount and we can’t be in everything.

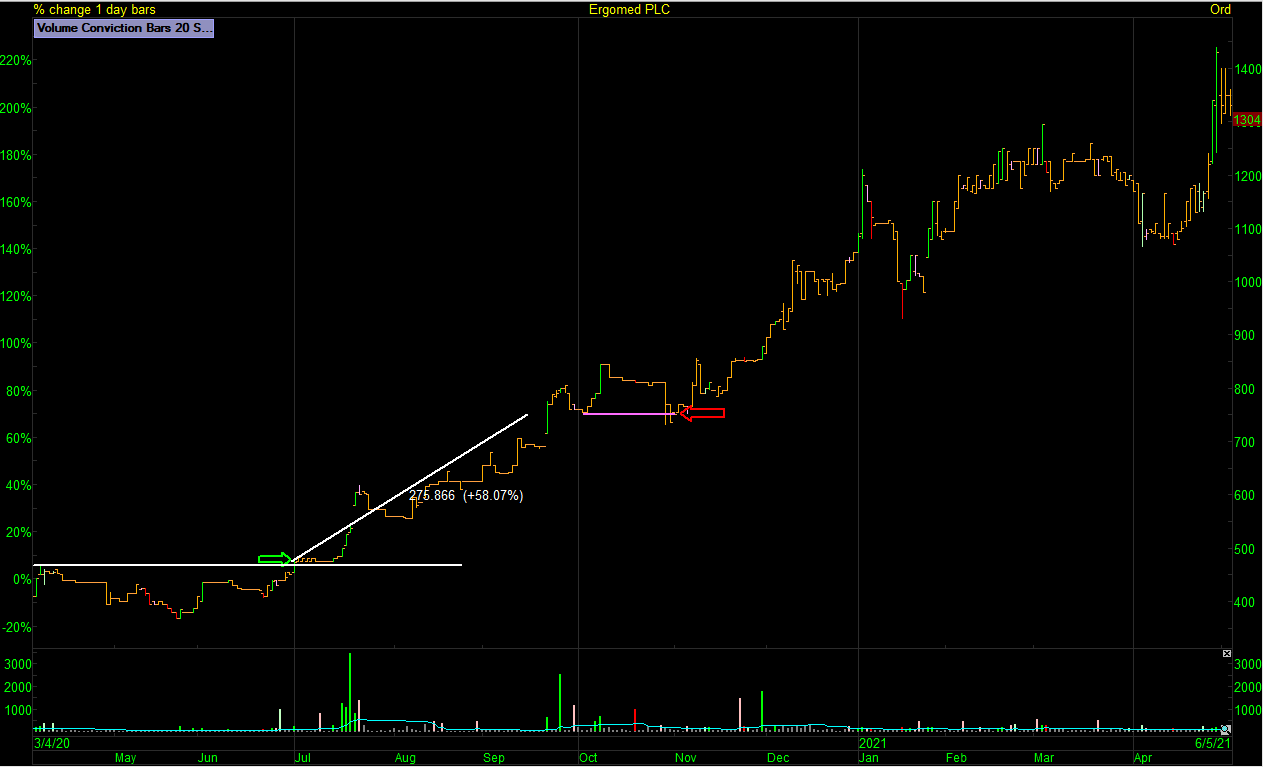

Ergomed – The Reality of Price. Rising stocks have to trade new highs.

Ergomed – The trend that followed

Can’t Pull the Trigger

Waiting until your idea is overextended from your trigger before having the nerve to buy.

I like to enter trades as they move out of squeeze areas of consolidation. That is where my reward to risk is found. I will take that trade like a robot if it triggers and fits my conditions. Intraday price action will not have any effect on my decisions. All decisions are made when the market is closed. When a new sector move or theme is starting to build and find traction I will see it in the screening sessions and in the charts before any media outlet will pick up on it. Price is real and although I might question a short-term move the trends that gain steam will keep hitting the screens to the extent where I can’t ignore them. This is where I need to have confidence in my methodology to pull the trigger in good reward-to-risk opportunities from the start of a potential trend.

Fear of Missing Out (FOMO)

Buying overextended story stocks because the news is so good it’s only going up. Where do I start? Boohoo -90% move off highs. BOOM -80% move off highs. Best of the Best PLC -89% move off highs. 3D Printing, Graphene, Battery Metals. The list goes on and on. The story was so good just before the top but when those trends emerged it was radio silence. If you’re hearing about the story now, then chances are, you already missed the meat of the move which takes you to the previous point of pulling the trigger on an overextended move.

Another common FOMO is loading up after the market is rallying. Using all your allocated portfolio capital at the same time. Buying like the market’s going to the moon. It’s always safer to let the setups come to you and as they start to work in your favour and as you lock in heat through trailing a sensible sell order you can start to add more. Always building on success.

Signal to Noise. Reward to risk is found at the signal and by the time the media catch on it’s as good as over for reward to risk. Adding to what we’ve covered above try and mind surf Bitcoin and the USD moves remembering where the media caught onto the story and where anyone who can draw a meaningful horizontal trend line can position before the move. Zoom out those charts before zooming in.

Bitcoin – Signal where bitcoin broke out and after the move, we got the noise.

USD (UUP) – Signal where UUP broke out and after a large move we get the noise.

Front Running the Trigger

I have a setup trigger for a reason. Every winning trade has triggered the setup. 100% of the winners triggered the entry setup. Some losing trades also triggered.

The important thing to remember is that every idea that didn’t trigger the breakout setup was a loser. 100% of them. Front running or what we call a cheat entry can work out fine but should be used more cautiously. You don’t want too many paper cuts so building on success again is key.

Inventing Trades (No Trigger No Trade)

The endless waiting on the setup to trigger. Always waiting on something. You must become an expert at waiting. When the setup finally triggers you should already have a trading plan and spreadsheet entry ready with how you’re going to play the trade. All you need to do is punch the buy price in and calculate your position. Don’t invent trades through boredom and also don’t randomly position size.

Games Workshop – No Trigger No Trade.

Let’s recap If Games Workshop is going higher it needs to trade that new 52-week high. If it cannot then it will be a loser. All positions taken in my lane during the consolidation period or as we now know topping pattern would have failed if I didn’t wait for the breakout.

Snatching at Winners (A Profit is a Profit) or Strangling Trades

The most common line you will hear in investing circles is “a profit is a profit” as soon as they get into a good trade. Usually, as soon as it makes its first move they start selling or defending the profit by strangling it with a creative stop. The top excuse to sell a winner early is nearly always “it’s overbought”. Other common reasons are its fully valued now or the classic, a magazine says take profit. Losers will buy on the slim promise of “news in the pipeline” and then hunt for any excuse to sell a winner early. The inability to hold a winner is the most common problem I see in trading. If you study past trades that you closed for any other reason than a system sell, you will see how much money is potentially being left on the table—trading truth. On average losers will come fast and winners will take time to become big winners. The trouble is investors get three quick losers and then their focus goes on achieving break even rather than making big gains (the reason they started trading) this usually leads to death by a thousand cuts and treading water in good market conditions when you should be hitting it out of the park. All winners have to be sold at some point but if you’re cutting your best winners before they can reach multiples of your initial risk you have a problem. Cut your losers short and let your winners run. There’s a huge debate on lowering risk by volatility targeting and I’m in the camp that doesn’t like to do it especially early in the trend—trading truth. Big winners are going to be volatile on the account. It’s the best problem to have. It means you rode an outlier. Vol targeting on big winners is not going to destroy your expectancy to the extent that selling or derisking a big trend early in its move would so if I’m going to tamper with a winner then tampering with a historically large winner for my results isn’t going to be a disaster.

Ergomed – A profit is a profit? Exiting the trend with the view to buying back at a lower price.

Ergomed pulls back less than its spread from your sell then continues on its journey without you.

Strangling Trades (Locking In Profit) or what I like to call the timeframe spiral.

I put my trades in a lane. If the stock fits the trend template for catching larger moves I put it in what I call trend mode. Trend mode has a wide enough trailing stop to let the position breathe as I know all the best trends I’ve ridden or studied over the years will need to consolidate on the journey and that means giving it the room it needs for the lane I put it in. A very common trait I see is after a strong move when price is more likely to consolidate investors who use trailing stops like to switch lanes. They like the feeling of locking in gains on a swing or momentum timeframe using a daily moving average or a meaningless stop distance so they exit the trend early. They set the satnav for Eurodisney but exit at Flamingo Land and then live to regret it. The trouble with the market is the first time you do it you will look like a wizard saving a few basis points but when that monster trend comes along and you see how much saving pennies costs you in real time day after day, only then will you reevaluate your trade tampering stop loss.

Ergomed has a nice unrealized profit on the table so you trail a tighter sell order and exit early.

Final Note

I have made all of these mistakes many times and still do make some of them to this day. I usually know when I’m doing it too. Knowing that I might be tampering and accepting the outcome works for me as It’s usually a case of when my market risk model needs to override my positions. The key is to keep it to a minimum and find a balance that doesn’t impact my performance over time. If a methodology or edge is so slim that it can’t soak up a few off-piste mistakes then you need to ask, is it really a robust strategy after all? Thankfully trend following is an extremely robust strategy and hopefully, some of the examples above can help you study and improve on your own lanes of investing.

Jason Needham

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.