Michael Taylor explores why so many traders fail by blurring short-term trades with long-term investments, and introduces his M2M versus T2H framework to define each clearly. In Part I, he explains how aligning timeframe, risk and discipline with the right strategy is critical to consistent performance.

Most traders fail because they don’t know what game they’re playing.

You’ve probably done it before.

You enter a position intending it to be a quick scalp, watch it go against you, then suddenly decides it’s a “long-term investment”. This mental gymnastics is how people end up taking multi-R losses on things that were supposed to be short-term holds.

Especially when they are already invested in the stock or have an emotional connection to it.

It becomes easy to simply think “It’ll go back up again so I’ll just hold”.

The reality is simple. Not every trade deserves the same treatment. Some are quick singles to first base. Others are swings for the fence.

Knowing the difference before you click buy is what separates consistent traders from those who donate their capital to the market.

I categorise my trades into two buckets: M2M (Move 2 Move) and T2H (Trade 2 Hold).

I got this from Mike Bellafiore’s excellent books (both worth reading). The former are short-term tactical plays. The latter are positions I’m prepared to sit with for months. Understanding which you’re doing – and sticking to it – is absolutely critical.

What are M2M trades?

M2M trades are short-term positions designed to capture a specific move. Think of them as getting to first base in baseball.

You’re not trying to hit a home run. You’re trying to get on base and bank a profit.

These are typically holding periods of a few days to a couple of weeks. You’re looking for a defined catalyst, a clear technical setup, or a short-term imbalance in supply and demand.

Examples include:

- RNS reaction trades where you buy in the opening auction on good news

- Surprise profit warning shorts where the stock gaps down and continues to sell off

- Breakouts from tight ranges that you exit into strength

- Puke trades where you buy capitulation and flip it quickly

The key characteristic of M2M trades is that you have a specific reason for entry and a specific exit plan. You’re trying to exploit a temporary edge.

Quite often, the M2M trades I take may go higher. It’s rare I’m printing the high. My goal is to nail down profits into strength.

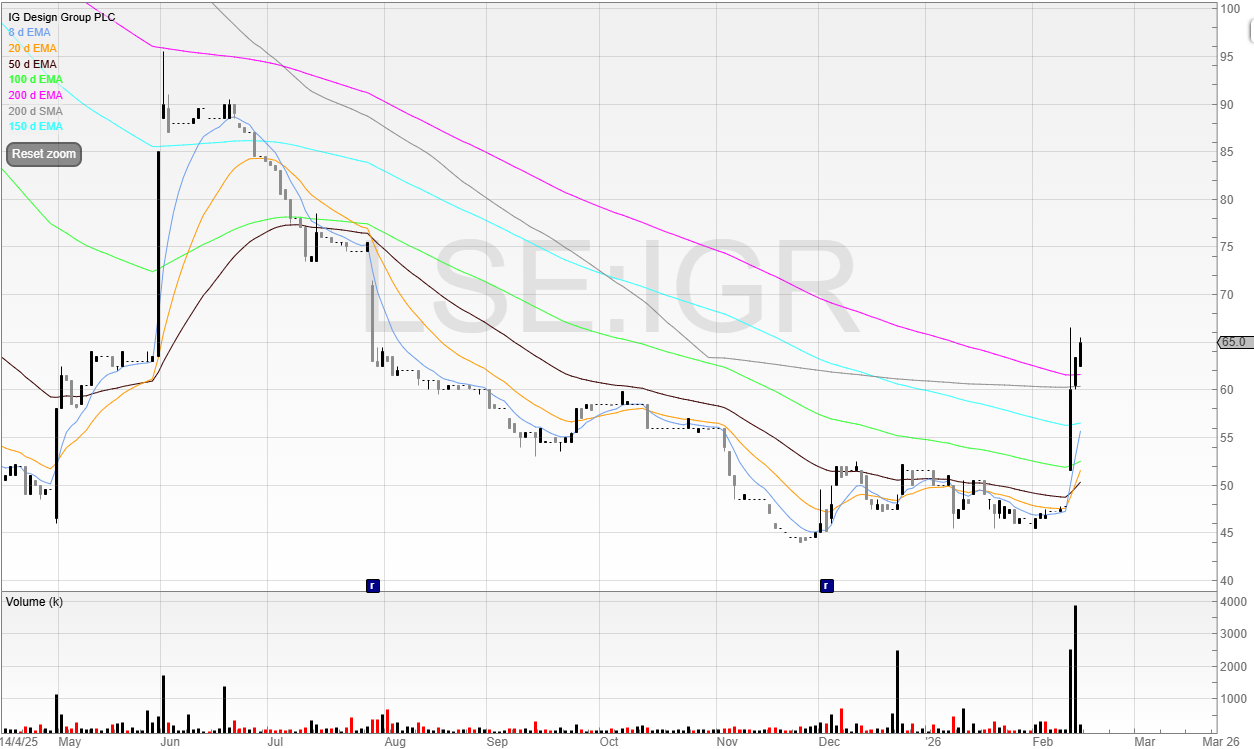

Here’s an example this week: IG Design.

I didn’t execute on this trade, as I deemed 54p a risk (and wanted 50p) but had I taken it, I would’ve been exiting a good chunk around 60p.

The stock put out its first ahead of expectations update, and based on the share price action, it was clear that this was unexpected news.

The stock has continued to print higher, so even if I had sold, the stock would’ve been higher than my sell price.

The discipline required for M2M

M2M trades require tight stops precisely because they’re short-term plays. If the catalyst doesn’t materialise, or if the technical setup fails, you need to be out quickly. The entire premise of the trade was a short-term edge. If that edge disappears, so should you.

I typically use tighter stops on my M2M trades. Sometimes tighter if the setup is very specific. The risk-reward might be 1:2 or 1:3. You’re not looking for ten-baggers here. You’re looking for consistent, steady winners that you can grind out.

Position sizing on M2M trades is also different. Depending on the stock and liquidity, will depend on the position size. Something like IG Design is not that liquid, but whereas Rolls-Royce you can buy as much as you want and you won’t move the price.

The shorter holding period means less overnight risk, less exposure to surprise RNSs, and quicker feedback on whether the trade thesis is working.

What are T2H positions?

T2H trades are completely different. These are the longer-term trades and potential home run swings. These are the positions where you’ve identified a structural trend or a company with genuine growth prospects, and you’re prepared to sit through volatility to capture a larger move.

Holding periods are typically months, sometimes over a year. These aren’t about catching a quick 10% pop. These are about finding a stock in a stage two uptrend and riding it for 50%, 100%, or more.

The classic T2H setup for me is a small-cap that’s broken out of a multi-year base, showing strong earnings growth, with a clear technical uptrend confirmed.

Filtronic has been an excellent winner for me.

Could you have traded that M2M style? Absolutely. I did several times. But the big money was in recognising it as a potential T2H situation and letting it run.

The patience required for T2H

T2H trades test your discipline in a different way to M2M trades. With M2M, the challenge is cutting losses quickly. With T2H, the challenge is sitting through pullbacks and not taking profits too early.

I’ve botched this plenty of times over the years. I’ll identify a great T2H setup, buy it, watch it rally 20%, then sell because a quick profit is always attractive. Meanwhile, the stock goes on to double without me.

The solution is to use wider stops on T2H positions and a different exit strategy. The key here is to use wider stops and use trailing or trend stops on the way up. If a stock is in a stage two uptrend, the last slice may be held it until it breaks the trend. That might mean sitting through 15-20% pullbacks if the overall structure remains intact.

I might risk the same 1% on a T2H trade, but because my stop is wider, my position size is smaller. This means I can weather more volatility without getting stopped out prematurely.

Now that we’ve covered M2M and T2H, in my next article we’ll look at how to categorise these and deploy them.

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Free investing course coming soon!

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.