Bruce looks back at how his and others 2025 investment ideas performed, and offers some more ideas for 2026. Only one stock covered, NXT, the retailer often considered a “bellwether” for the UK economy.

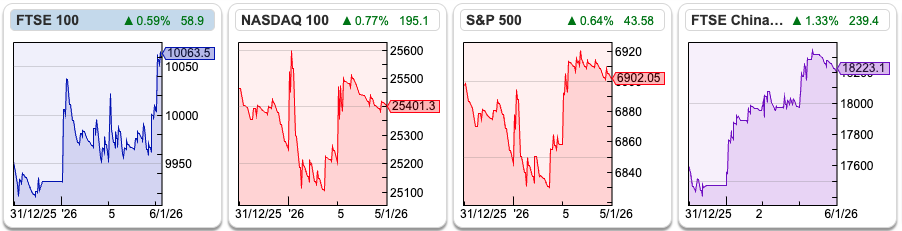

The FTSE 100 was +1.3% since the start of the new year to 10,064. Babcock, Rolls Royce and BAE Systems were the best performers, all up around +9%, suggesting that defence and aerospace could continue to be a theme for 2026. Even if we see some sort of peace in Ukraine, I would imagine that governments will continue to allocate money to spend on defence. In the US, the Nasdaq100 and S&P500 were both up less than +1%, while in Asia the FTSE China 50 and Hang Seng are off to a flyer, up over +4%.

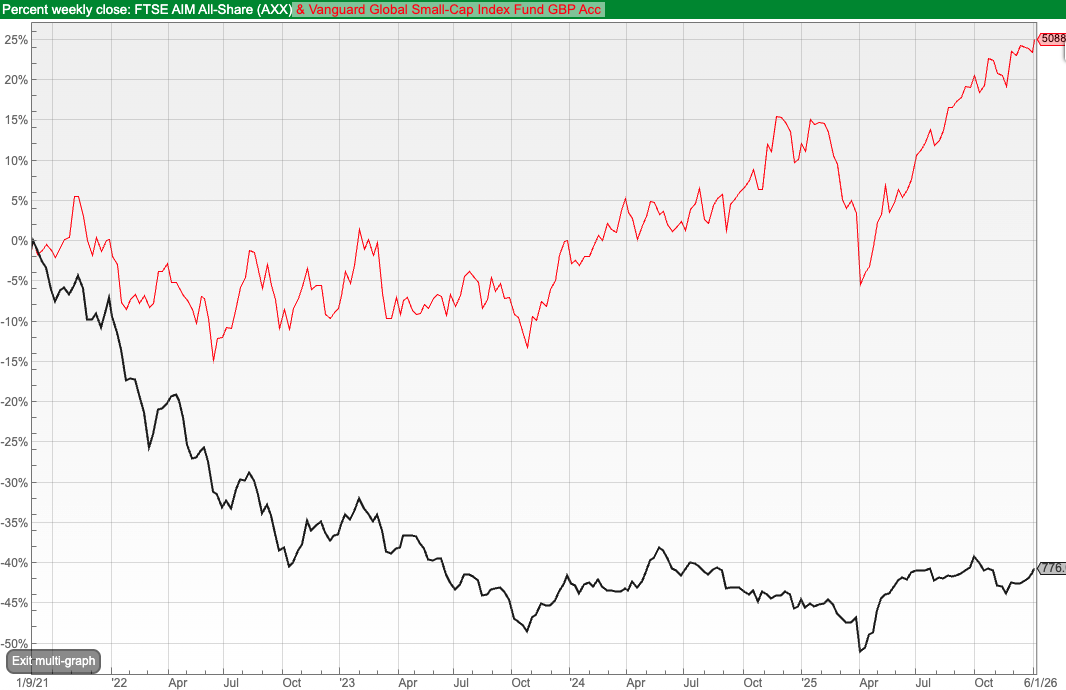

Although there’s a lot of talk about an AI bubble and large cap tech stocks in the US, it is worth noting that Vanguard’s global small cap index continues to hit new highs. ShareScope shows that the forecast PE is around 15x and price to cashflow is around 8x.

That compares to a PER and Price to Cashflow of 25x for the Nasdaq 100, though there’s going to be a lot of cashflow reinvested into AI datacentres with uncertain returns. The AIM 100 is trading on a low teens PER and a P/Cf below 10x. I’ve used ShareScope’s multigraph feature below to show just how badly AXX (in black) has underperformed global small caps (in red) since the UK index peaked in Sept 2021.

This week I look at how the 2025 ideas I published last January have fared, plus summarise what people are buying for 2026. I follow up with a portfolio review and then look at Next trading statement and guidance for the coming year.

Review of 2025 ideas

This time of year there are many newspaper articles with stock picking ideas for the next 12 months. Often the editors don’t review the previous year’s ideas, whereas that’s an important part of the feedback loop for me. Not to throw brickbats at people whose calls haven’t done well, but it’s valuable to think about why an investment case fails to play out. Many “bad ideas” are simply poorly timed “good ideas” – I bought into FDEV and MS International 12-18 months too early. Even Games Workshop fell -20% to below £4 at the end of 2010, a couple of months after I first bought.

Last year I crowd-sourced some ideas from ShareScope users. Carcosa suggested aircraft leasing business Avation and Funding Circle, neither of which have worked, falling -9% and -6% respectively. That’s not a disaster though in a difficult market, he also mentioned Ashtead Technologies which had a nasty profit warning in July as the Trump administration slowed off shore wind project, causing the shares to fall -45% last year. I’ve been pondering whether stocks like IPX and AT., which have suffered from the backlash against sustainability themes, might rebound this year.

Cockney Rebel suggested Goodwin +171%, Audioboom +89%, Avon Technology +23%, though he also had On The Beach -11%, Liontrust -44%, Card Factory -30%, IG Design -66%. His hit rate was 3/7, nevertheless an equal weighted portfolio of his suggestions would have been up +24% helped by Audioboom and Goodwin doing so well. It’s worth reading his whole bumper year end review on Substack, where he talks about his process and the investment case in his 2026 ideas in more detail.

Paul Hill at Vox Markets ideas for 2025 were : ELCO, AOM, IXI, AGFX, TRB, CML, MBH, MPAC, VLG, WATR, ESYS, VCT, CVSG, AVG, GHH, TRCS, FIN, SUP, ONC, HVO. I also had high hopes for Argentex. Unlike many tips published in the mainstream newspapers, we both lost painful sums of money. Following people with “skin in the game” is not a guaranteed success, but at least you know the incentives are aligned and the pain is shared. Presumably, Paul will publish his ideas for 2026 in the coming week.

Some ideas for 2026

All of the ideas below are just meant to be starting points for further research.

Cockney Rebel still likes Goodwin, but adds Saga, Zotefoams, Dialight, Carclo, Marstons and Marshalls, to his “Magnificent 7” this year.

Jamie Ward has suggested Focusrite, which he pitched on the BASH at Mello and also wrote up for Moneyweek. In many ways, the investment case is similar to WINE, which I wrote about in mid-December. Management extrapolated strong revenue growth in the pandemic, failing to realise that the pandemic had temporarily changed behaviour.

Michael Taylor likes Virgin Wines, Peel Hunt, THG and Sylvania Platinum, again written up in Moneyweek. SLP is already a large position for me, as I bought in 2016 and held on, but annoyingly didn’t increase my position size when the shares fell to around 40p at the end of 2024.

I have been keeping off Twitter, so I haven’t messaged anyone I follow this year for their tips. If you’d like to send me any ideas, I’d also appreciate it if you include the thought process that went into your idea(s). “Buy XYZ because it is on a PE ratio of 8x” is less interesting than outlining what you think other people might have missed or underappreciated.

The point of sharing these ideas is to serve as a starting point to using ShareScope. The database is an amazing tool that allows you to filter, cross-check, look at the history and easily keep track of management updates through time. If you have all that analytical power available, then there’s little point in uncritically following other people.

Portfolio Review

I finished the year up +44%, not including dividends. My two largest positions, Games Workshop and Bank of Georgia (now Lion Finance) continue to do well, rising +48% and +97% respectively.

I need to improve my process for when and how to average down. Sylvania Platinum, my fourth largest position after CGEO was up +154%. As I mentioned above, I was too scared to increase my holding: I would have done a lot better if I’d had more conviction. On the other hand, SDI my sixth largest position rose +54% last year, but I made the opposite mistake and was too early when I averaged down in 2024. Similarly, Impax AM has really hurt me because I averaged down too early and the shares fell a further -34% last year. Ouch. I’m not cutting my losses on this one yet, now that the pace of outflows has slowed markedly, from £10 billion in the first half of the year to £2.8 billion in the second. My view is that environmentally focused investing is in an unloved part of the cycle, but will make a return and Impax should benefit from that. If I am wrong and the outflows continue, I’ll lose badly so please DYOR.

My worst performer last year was Argentex, followed by Impax and also Burford, both down -34%. Presumably, sellers of Burford believe that Donald Trump is likely to intervene on behalf of Argentina, in Burford’s $18bn claim for the expropriation of the oil company YPF. My portfolio has now become too unfocused with over 40 stocks, versus just over 20 at the start of the pandemic. So, I need to do a cull at some point. My most disappointing “buy and hold” long-term losers are PZ Cussons, CML and Arcontech, all of which I am reluctant to cut as they always seem to be on the cusp of a turnaround (though I could have written that 1,3 and 5 years ago).

As there’s been little company specific news recently, I briefly comment on “bellwether” Next and ponder whether we might see an uplift if in UK small caps generally.

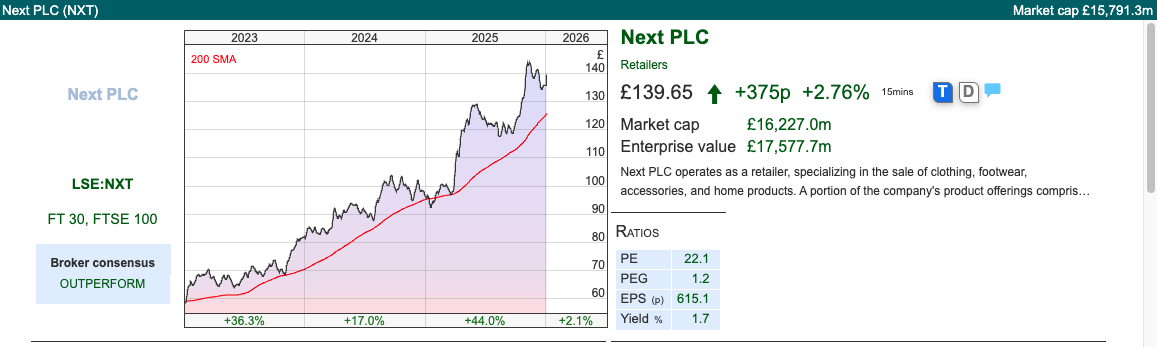

Next – Jan Year End Trading Update

Next continues to do well, despite a tough retailing environment and consumer incomes under pressure. Management put out an RNS saying that in the nine weeks to 27 December, full price sales were up +10.6% versus last year, versus their guidance +7.0%

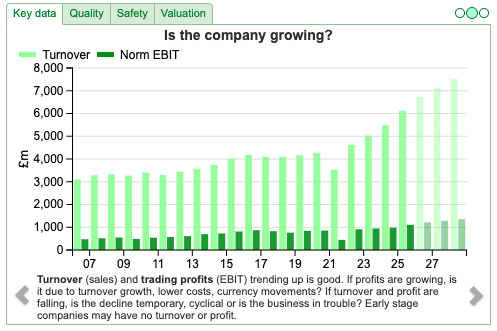

Within that, UK sales were up +5.9%, but International sales were very strong up +38%. Strong growth in International is particularly encouraging, as Next’s overseas online business faces stiff competition from global giants like Zara (Inditex). They attribute the success to profitable marketing expenditure for their overseas direct websites, but say that this is likely to moderate in the coming year. I hadn’t realised how much growth had picked up, pre-pandemic v post pandemic (as the ShareScope chart below shows). So, the international expansion progress should increasingly drive the story.

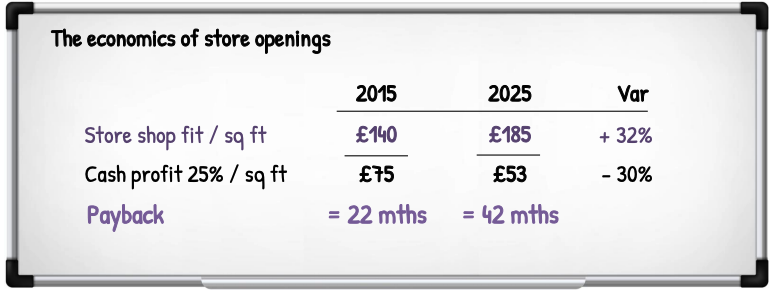

Those positive sales figures feed through to group PBT up +14% and EPS up +16%. As usual, Next management strike a cautious tone for their guidance for FY Jan 2027F, with full price sales and PBT +4.5%. I was interested in this slide that management put up at the H1 results, showing that the economics of store openings had deteriorated significantly since 2015.

People were talking about this sort of thing in the late 1990’s, when internet retail was just getting going. The trend has taken longer to play out, but even in Chiswick High Road, an affluent area of West London, there aren’t many clothes shops. As for bank branches, I noticed that Lloyds Bank on Chiswick High Road had become a discount reseller, the NatWest next door is now becoming a massage parlour. Enjoy this NatWest advert from the late 1990s, about how NatWest wasn’t going to grow so enormous that it forgot about customers and sell-off their branches to become trendy wine bars.

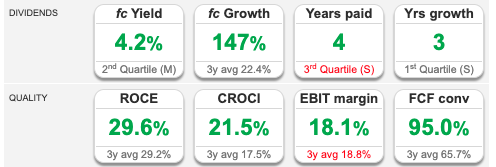

Valuation: Next shares are trading a PER of 16x Jan 2028F, equating to 10.5x EV/EBITDA. That seems about right, the company has grown EPS at 5% CAGR over the last decade, which is an impressive performance versus many struggling competitors, but pedestrian when compared to other sectors.

Opinion: I feel like the time to buy Next is during recessions, when you can pick the retailers you think will survive and wait for the recovery. That certainly worked following the 2007-9 financial crisis (share price 10x) and the pandemic (share price 3x) for Next. This is a sector where consumers like to shop around, so the “moat” is operational excellence and financial discipline, rather than brand. It only takes a few management mis-steps and competitors will be quick to seize the opportunity.

On the broader theme of “Next as a bellwether for the UK economy” – I’m not sure we should read too much into Next’s Jan 2027F cautious guidance. Next management have a track record of under-promising and then over-delivering. Incidentally, I had to google the correct spelling of bellwether, and the word refers to the leading sheep of a flock, with a bell round its neck. In Old English, a wether (weðer) refers specifically to a castrated male sheep, which was less aggressively risk-taking than a ram but more of a leader than the ewes, who tended to be focused on protecting their lambs.

Calstone reported over £3bn of UK equity fund outflows in both October and November, but despite that UK markets are recovering, presumably as individuals and foreign investors take the other side of forced selling by fund managers. The FTSE 100 was up +22% last year, so someone must be buying! AXX has bounced above its 200 day moving average, and the 16 day moving average (red) has crossed over above the 64 day (blue). I am happy being almost fully invested*, and think we should see a good recovery in 2026, as investors look for alternatives to expensive US markets.

Bruce Packard

@bruce_packard

Notes

Not investment advice. I write about my own and others’ investment ideas to showcase ShareScope’s features and tools, which help the investing process.

*I have crystallised some gains from BGEO at the end of December to offset my AGFX loss, and haven’t yet put that cash to work.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

I like the way you select stocks, but for me, your portfolio is likely to be massive and possibly hard to control. I think if you had a selection of say 20 stocks, I would find this more interesting. Thanks all the same though.