A look at how an Annual Review could help improve your investment process (for instance, avoid catching falling knives!) Companies covered TRST, PEEL and APN.

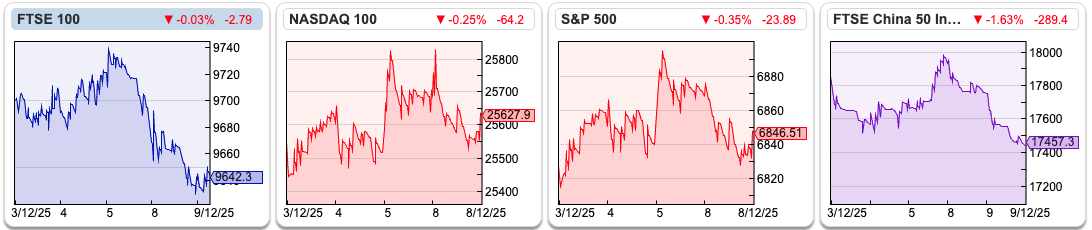

The “Santa Rally” has not yet appeared, with the FTSE 100 down -0.6% to 9,642 over the last 5 trading days. The Nasdaq100 and the S&P500 were up +1% and 0.5% respectively over the same time period. The best performing international index was Brazil Bovespa +32%, while the worst was AIM +4%.

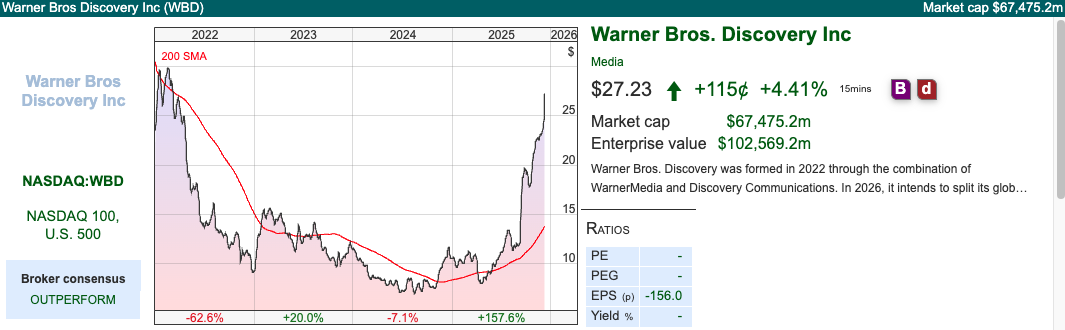

In the US, Netflix and Paramount have launched bids Warner Bros. Discovery. The two bids aren’t quite equivalent, so despite Paramount offering a higher price per share than Netflix’s offer, WBD’s board has recommended Netflix’s offer. When you see these types of competitive and hostile bid situations, for instance Royal Bank and Barclays bidding for ABN Amro, it tends to indicate we are within six months of a market top. That’s probably true of US markets, though definitely not AIM.

I came across an interesting podcast/YouTube interview by Jim O’Shaugnessy and Tiageo Forte. O’Shaugnessy was an early quant and author of What Works on Wall Street. He looked at decades of data and argues in favour of “trending value”, that is, investments that are attractive on fundamentals (low PER, cash, profitable) but not “catching a falling knife”. You could draw a parallel with Cockney Rebel’s bowls, which seems to me a similar idea.

I found this episode particularly interesting on doing a personal Annual Review. Most people who work in banking and finance really dislike their Annual Review. Department heads sitting in corner offices calling you in for a one-way conversation, telling you to try harder and blaming you for problems caused by institutional failure. Alternatively, at a different bank, I was given positive feedback, paid a nice bonus, then went on holiday, only to find management had hired a team from another bank to replace me. Rather than a box ticking exercise, Tiageo Forte suggests that a review can be a useful exercise to do on yourself: celebrate what went well, areas that you’d like to change. He recommends avoiding goal setting, and instead suggests looking at your own processes and routines, figuring out what you can improve.

As it happens, I’m up +42% so far this year, unadjusted for dividends which would probably be +46% total return. That performance is despite losing a painful amount of money in Argentex in May and a disappointing “takeunder” of OCN at a c. 45% discount to NAV. My +42% gain comes after a couple of difficult years: I was down -2% in 2024 and -4% 2023, so my three-year track record probably lags others.

The performance was driven by my large positions in Games Workshop up +47%, Bank of Georgia +99%, Georgia Capital up +143% which together make up around half of my portfolio. I’ve held these shares for a decade and a half. FDEV was my best peformer +161%, but didn’t contribute significantly because I bought it 450p and the price fell close to £1 per share before recovering this year. Good idea, bad timing. My worst performers were VNET and sustainable fund manager IPX. Thus, I would like to avoid catching any more “falling knives” and should look for more trending value.

This week, I look at the short seller attack on Trustpilot, Peel Hunts H1 results and Applied Nutrition, which looks to be a promising Growth at a Reasonable Price (GaaRP) story.

Trustpilot short seller attack

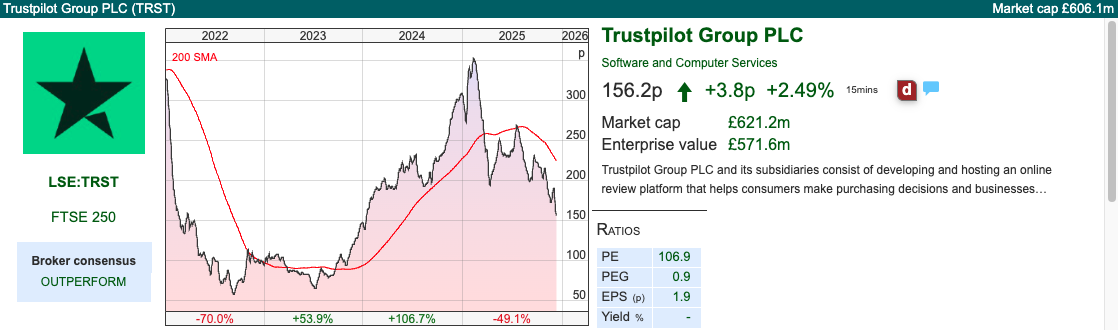

Trustpilot shares dropped by a third following a US based short seller published a 43 page short dosier, accusing the group of “mafia” style extortion and not doing enough to remove obviously fake reviews. The shares then rebounded +15% the following day.

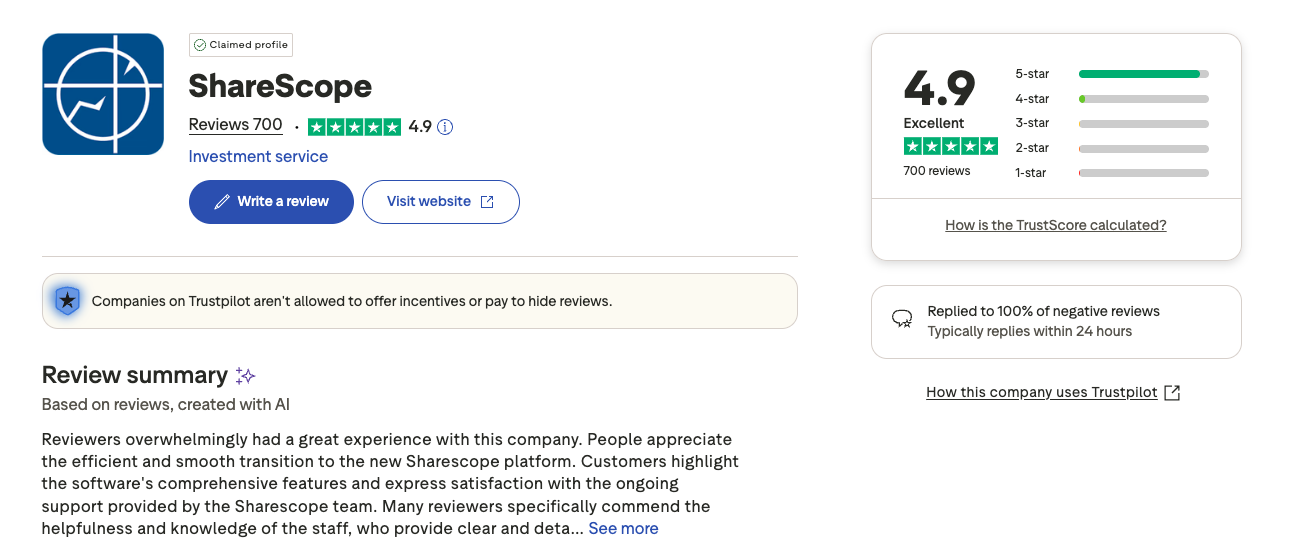

Maynard wrote up Trustpilot’s business model a couple of years ago. At the time, ShareScope didn’t pay Trustpilot, yet we still had overwhelming positive reviews (2 out of 358 were below 3 stars). Now ShareScope has 700 reviews, with the rating 4.9 which is “excellent”.

Summarising the Grizzly Research short dossier, they haven’t found questionable accounting; instead they are criticising the business model, which they say amounts to extortion. My experience of using Trustpilot doesn’t align with this, so I think the report has failed to hit its intended mark.

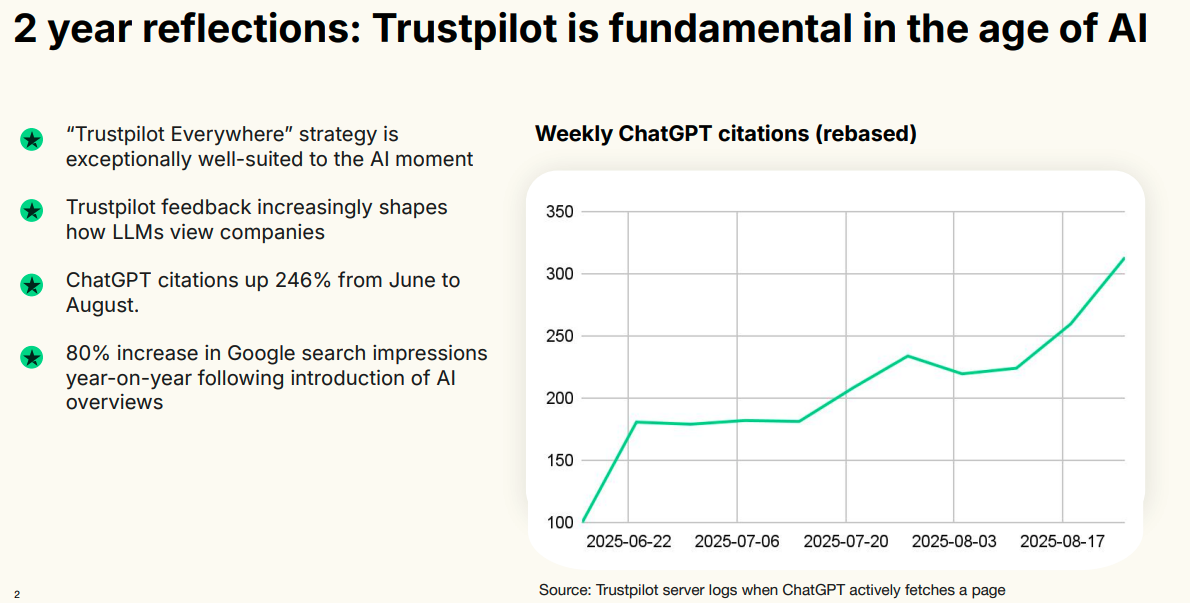

More generally though, there is a risk that AI disrupts the TRST business model. That’s definitely a possibility, but TRST’s reviews ought to be valuable for AI, as long as they have been written by real customers. That’s certainly the story management are trying to tell with this slide from their H1 June results (published in September).

In my view the greatest risk is FUTR and MONY, both of which I mentioned a couple of weeks ago. The cheap valuation of YouGov, the market research company with 26m panel members, could also be signalling problems ahead. Some AI startups are attempting to disrupt YOU’s panels business, offering “Synthetic Focus Groups” that a brand owner can ask an AI (configured to act like a “35-year-old suburban soccer mom”) what it thinks of a product.

Valuation: The difference is that TRST trades on 36x PER Dec 2026F, dropping to 28x the following year. They are on 3x sales (de-rating from mid teens price/sales a couple of years ago, as the Sharescope chart below shows) and 16x EV/EBITDA Dec 2026F.

That compares to YouGov on a PER of 6.5x Jul 2027F and 4x EV/EBITDA and 0.7x sales also Jul 2027F.

Opinion: I love a good turnaround situation, with a founder returning to a business that’s lost its way. So, with Stephan Shakespeare returning to YOU in February this year, I am warmer to the YOU investment case than TRST, particularly given the valuation. My working hypothesis is that in a world of “bot farms” generating fake content, verified human data becomes a scarce asset, therefore more valuable. Having said that, neither TRST or YOU look like “trending value”, so I will avoid for now.

Peel Hunt H1 Sept 2025

I covered stockbroker Cavendish in October last year, suggesting that the investment case might make sense if you were upbeat about the prospects of AIM over the following 12 months. Now, at the end of 2025 perhaps timing is more fortuitous? In any case, PEEL reported H1 Sept revenues +38% to £74m and PBT up 10x to £11.5m. They had cash of £13.6m on their balance sheet, which they’ve included as a bullet point on the first page, but I can see on the face of the balance sheet there’s a £6m “long term” loan listed in current liabilities, so presumably that needs to be repaid and net cash was £7m at the end of September. I dislike management teams that draw attention to cash in their financial highlights, without mentioning any offsetting debt. It’s like a friend boasting about how wealthy their BTL property portfolio has made them, while ignoring the amount of borrowing they’ve taken on.

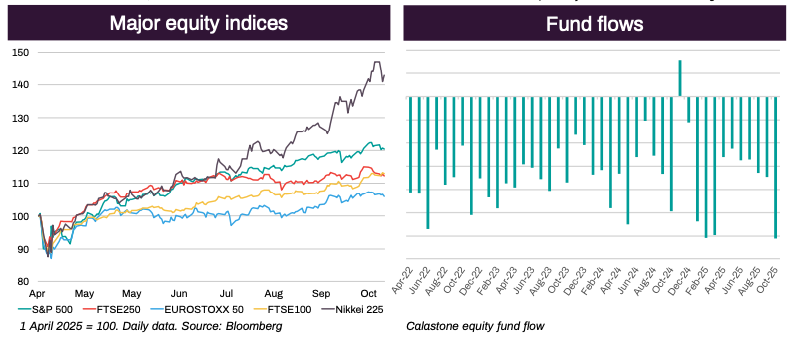

Outlook: Brokers tend to be perennially optimistic about their “pipelines”. Management confirm FY Mar 2026F expectations and mention several large investment banking transactions that have already completed. Performance of their Execution Services business is down from the highs of H1, but has been “robust” they say. That said, the chart above shows Japanese and US stocks have continued to outperform UK and Eurozone peers, while money has continued to flow out of the UK funds, since January 2022, with the exception of one month at the end of last year. So it feels like we’re still a long way from a bull market that would propel the share price back towards its Sept 2021 IPO level of 228p.

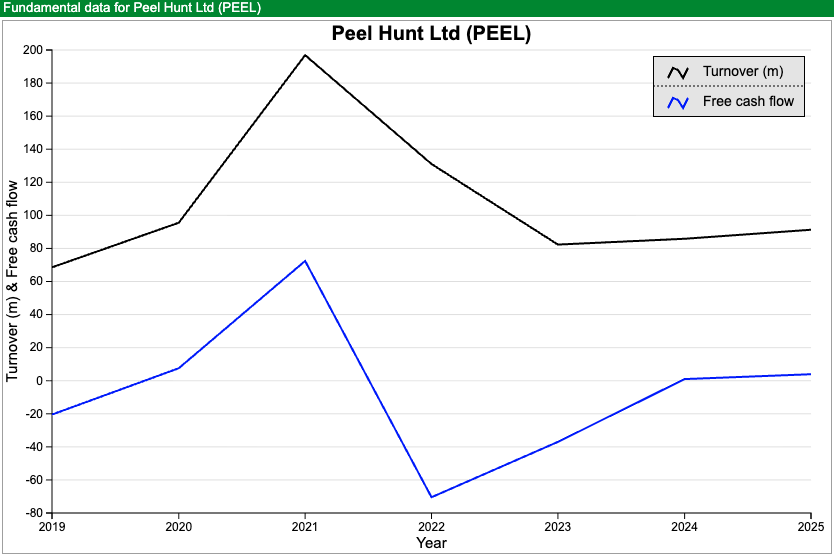

Cashflow: One area to note is that although profits are up strongly, cash from operations is down by a third to £435K. Partly that’s driven by a £13m net increase in securities held for trading. However, Sharescope fundamental data suggests that the group hasn’t generated meaningful free cash flow since 2021.

Valuation: PEEL is trading on a PER 10x Mar 2027F, and 1.1x sales the same year. That compares to Cavendish 6x PER Mar 2027F, and 0.6x sales. I would have thought the way to play this is to keep an eye on market conditions, particularly secondary capital raisings and invest if that activity begins to pick up.

Opinion: My view though is that PEEL and CAV are inferior businesses to fund managers like POLR, JUP, IPX, LIO and PMI. Both brokers and UK fund managers have been harmed by outflows but there’s more of an annuity-like stream of income for the fund managers. You can see that in the peak-to-trough falls in revenue from PEEL, which collapsed down -58% from FY Mar 2021 to Mar 2023 and is only just recovering. IPX has reported stable revenues FY Sept 2021 v FY 2025, yet the share price of the latter has collapsed almost -90% from a peak of over £14 per share to £1.50. I’m long IPX and don’t feel the need to buy PEEL or CAV.

Applied Nutrition FY July Trading Update

This sports nutrition brand, which makes protein shakes and similar, IPO’ed last year announced an “ahead of expectations” RNS. That is a rare bird: a recent IPO that is performing well. Management now expect FY Jul 2026 results to exceed current market consensus (£122m revenue, £34.4m adj EBITDA, according to the RNS) by approximately 10%.

History: Applied Nutrition was founded in 2014 by Thomas Ryder. The group’s first product was a premium all-in-one nutritional supplement designed for athletes seeking to maximise muscle mass. JD Sports bought just under a third of the company from him in 2021. The UK is the largest market, but they are seeking to expand internationally with a European distributor, plus Asia, the Middle East and US expansion are mentioned in the prospectus.

The shares listed in October last year at 140p, with selling shareholders receiving £154m for 45% of the company, valuing the group on admission at around £350m market cap. The selling shareholders were Thomas Ryder and Steven Granite who are the founder/management and JD Sports, the FTSE 100 retailer who sold down their 31% stake to 5% at the IPO. Thomas Ryder still owns over 30% of the company and JD Sports, have now up’ed their stake to just below 10% according to Sharescope. Peter Cowgill former Executive Chair of JD Sports is a non Exec and Andy Bell (of AJ Bell) is non Exec Chair.

Approximately 9% of revenue in FY Jul 2024 came from direct to consumer (D2C) sales via the Group’s UK website, its US website, and through Amazon and eBay. Instead, the group relies on retailers and distributors (B2B), the 10 largest retailers accounted for 50% of sales.

Comparison with Science in Sport: This is a similar business to Science in Sport, which was listed for around 10 years, but was a poor investment which I was fortunate to avoid. I had followed SIS with interest, as it appeared on my “attractive gross margin, growing revenue, but loss-making at an operating profit level” screen. The idea was that as the business scaled, operational gearing combined with revenue growth should have generated higher returns. A nice theory, but SIS management were poor at execution. Among other problems, SIS shares were briefly suspended in mid 2023 because management couldn’t get the FY Dec results published within 6 months. Eventually SIS received a bid at 34p per share from Private Equity firm bd-capital in April this year, valuing the loss-making company at £82m or 1.6x sales.

APN looks to have better momentum and stronger management, but worth highlighting that sports nutrition is a competitive space with low barriers to entry.

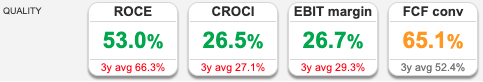

Valuation: The shares are trading on a PER of 18x Jul 2027F and EV/EBITDA of 12x. That’s before the EPS upgrades flow through, so perhaps 16x-17x is likely the new multiple. The gross margin is 46%, in line with what SIS was reporting, but APN has a better track record of converting that gross margin to EBIT margins, as Sharescope’s quality indicators reveal.

Opinion: Looks like a good Growth at a Reasonable Price (GaaRP) investment. Impressive that we are seeing ahead of expectations RNS so early in the FY Jul 2026F reporting period. I’ve noticed my female friends in their 30’s have taken up weight lifting, boxing, running and protein shakes. If APN can execute, this does seem to be an area where consumers are happy to spend their disposable income.

Bruce Packard

@bruce_packard

Notes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 10/12/2025 | TRST, PEEL, APN | FTSE 10,000?

A look at how an Annual Review could help improve your investment process (for instance, avoid catching falling knives!) Companies covered TRST, PEEL and APN.

The “Santa Rally” has not yet appeared, with the FTSE 100 down -0.6% to 9,642 over the last 5 trading days. The Nasdaq100 and the S&P500 were up +1% and 0.5% respectively over the same time period. The best performing international index was Brazil Bovespa +32%, while the worst was AIM +4%.

In the US, Netflix and Paramount have launched bids Warner Bros. Discovery. The two bids aren’t quite equivalent, so despite Paramount offering a higher price per share than Netflix’s offer, WBD’s board has recommended Netflix’s offer. When you see these types of competitive and hostile bid situations, for instance Royal Bank and Barclays bidding for ABN Amro, it tends to indicate we are within six months of a market top. That’s probably true of US markets, though definitely not AIM.

I came across an interesting podcast/YouTube interview by Jim O’Shaugnessy and Tiageo Forte. O’Shaugnessy was an early quant and author of What Works on Wall Street. He looked at decades of data and argues in favour of “trending value”, that is, investments that are attractive on fundamentals (low PER, cash, profitable) but not “catching a falling knife”. You could draw a parallel with Cockney Rebel’s bowls, which seems to me a similar idea.

I found this episode particularly interesting on doing a personal Annual Review. Most people who work in banking and finance really dislike their Annual Review. Department heads sitting in corner offices calling you in for a one-way conversation, telling you to try harder and blaming you for problems caused by institutional failure. Alternatively, at a different bank, I was given positive feedback, paid a nice bonus, then went on holiday, only to find management had hired a team from another bank to replace me. Rather than a box ticking exercise, Tiageo Forte suggests that a review can be a useful exercise to do on yourself: celebrate what went well, areas that you’d like to change. He recommends avoiding goal setting, and instead suggests looking at your own processes and routines, figuring out what you can improve.

As it happens, I’m up +42% so far this year, unadjusted for dividends which would probably be +46% total return. That performance is despite losing a painful amount of money in Argentex in May and a disappointing “takeunder” of OCN at a c. 45% discount to NAV. My +42% gain comes after a couple of difficult years: I was down -2% in 2024 and -4% 2023, so my three-year track record probably lags others.

The performance was driven by my large positions in Games Workshop up +47%, Bank of Georgia +99%, Georgia Capital up +143% which together make up around half of my portfolio. I’ve held these shares for a decade and a half. FDEV was my best peformer +161%, but didn’t contribute significantly because I bought it 450p and the price fell close to £1 per share before recovering this year. Good idea, bad timing. My worst performers were VNET and sustainable fund manager IPX. Thus, I would like to avoid catching any more “falling knives” and should look for more trending value.

This week, I look at the short seller attack on Trustpilot, Peel Hunts H1 results and Applied Nutrition, which looks to be a promising Growth at a Reasonable Price (GaaRP) story.

Trustpilot short seller attack

Trustpilot shares dropped by a third following a US based short seller published a 43 page short dosier, accusing the group of “mafia” style extortion and not doing enough to remove obviously fake reviews. The shares then rebounded +15% the following day.

Maynard wrote up Trustpilot’s business model a couple of years ago. At the time, ShareScope didn’t pay Trustpilot, yet we still had overwhelming positive reviews (2 out of 358 were below 3 stars). Now ShareScope has 700 reviews, with the rating 4.9 which is “excellent”.

Summarising the Grizzly Research short dossier, they haven’t found questionable accounting; instead they are criticising the business model, which they say amounts to extortion. My experience of using Trustpilot doesn’t align with this, so I think the report has failed to hit its intended mark.

More generally though, there is a risk that AI disrupts the TRST business model. That’s definitely a possibility, but TRST’s reviews ought to be valuable for AI, as long as they have been written by real customers. That’s certainly the story management are trying to tell with this slide from their H1 June results (published in September).

In my view the greatest risk is FUTR and MONY, both of which I mentioned a couple of weeks ago. The cheap valuation of YouGov, the market research company with 26m panel members, could also be signalling problems ahead. Some AI startups are attempting to disrupt YOU’s panels business, offering “Synthetic Focus Groups” that a brand owner can ask an AI (configured to act like a “35-year-old suburban soccer mom”) what it thinks of a product.

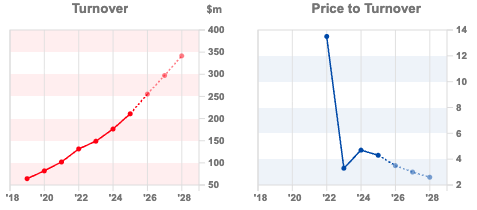

Valuation: The difference is that TRST trades on 36x PER Dec 2026F, dropping to 28x the following year. They are on 3x sales (de-rating from mid teens price/sales a couple of years ago, as the Sharescope chart below shows) and 16x EV/EBITDA Dec 2026F.

That compares to YouGov on a PER of 6.5x Jul 2027F and 4x EV/EBITDA and 0.7x sales also Jul 2027F.

Opinion: I love a good turnaround situation, with a founder returning to a business that’s lost its way. So, with Stephan Shakespeare returning to YOU in February this year, I am warmer to the YOU investment case than TRST, particularly given the valuation. My working hypothesis is that in a world of “bot farms” generating fake content, verified human data becomes a scarce asset, therefore more valuable. Having said that, neither TRST or YOU look like “trending value”, so I will avoid for now.

Peel Hunt H1 Sept 2025

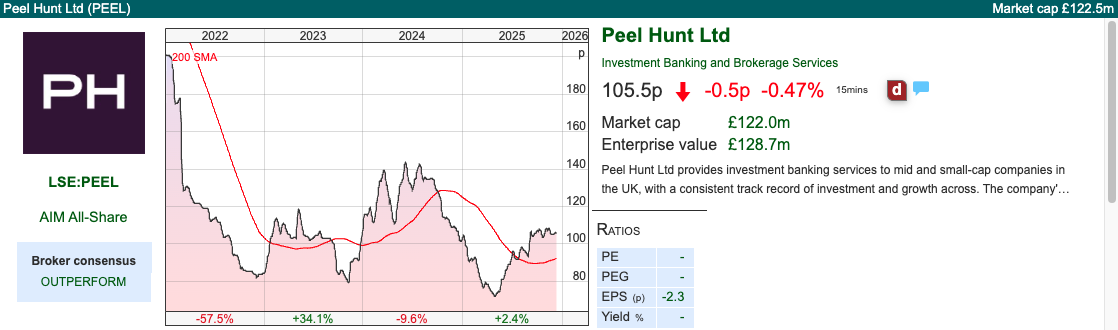

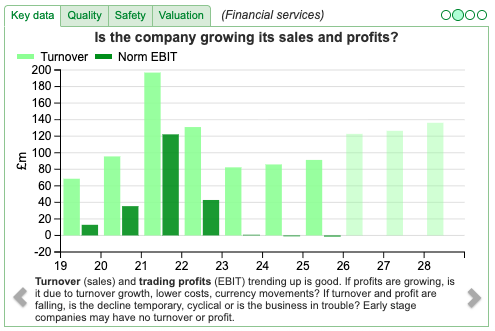

I covered stockbroker Cavendish in October last year, suggesting that the investment case might make sense if you were upbeat about the prospects of AIM over the following 12 months. Now, at the end of 2025 perhaps timing is more fortuitous? In any case, PEEL reported H1 Sept revenues +38% to £74m and PBT up 10x to £11.5m. They had cash of £13.6m on their balance sheet, which they’ve included as a bullet point on the first page, but I can see on the face of the balance sheet there’s a £6m “long term” loan listed in current liabilities, so presumably that needs to be repaid and net cash was £7m at the end of September. I dislike management teams that draw attention to cash in their financial highlights, without mentioning any offsetting debt. It’s like a friend boasting about how wealthy their BTL property portfolio has made them, while ignoring the amount of borrowing they’ve taken on.

Outlook: Brokers tend to be perennially optimistic about their “pipelines”. Management confirm FY Mar 2026F expectations and mention several large investment banking transactions that have already completed. Performance of their Execution Services business is down from the highs of H1, but has been “robust” they say. That said, the chart above shows Japanese and US stocks have continued to outperform UK and Eurozone peers, while money has continued to flow out of the UK funds, since January 2022, with the exception of one month at the end of last year. So it feels like we’re still a long way from a bull market that would propel the share price back towards its Sept 2021 IPO level of 228p.

Cashflow: One area to note is that although profits are up strongly, cash from operations is down by a third to £435K. Partly that’s driven by a £13m net increase in securities held for trading. However, Sharescope fundamental data suggests that the group hasn’t generated meaningful free cash flow since 2021.

Valuation: PEEL is trading on a PER 10x Mar 2027F, and 1.1x sales the same year. That compares to Cavendish 6x PER Mar 2027F, and 0.6x sales. I would have thought the way to play this is to keep an eye on market conditions, particularly secondary capital raisings and invest if that activity begins to pick up.

Opinion: My view though is that PEEL and CAV are inferior businesses to fund managers like POLR, JUP, IPX, LIO and PMI. Both brokers and UK fund managers have been harmed by outflows but there’s more of an annuity-like stream of income for the fund managers. You can see that in the peak-to-trough falls in revenue from PEEL, which collapsed down -58% from FY Mar 2021 to Mar 2023 and is only just recovering. IPX has reported stable revenues FY Sept 2021 v FY 2025, yet the share price of the latter has collapsed almost -90% from a peak of over £14 per share to £1.50. I’m long IPX and don’t feel the need to buy PEEL or CAV.

Applied Nutrition FY July Trading Update

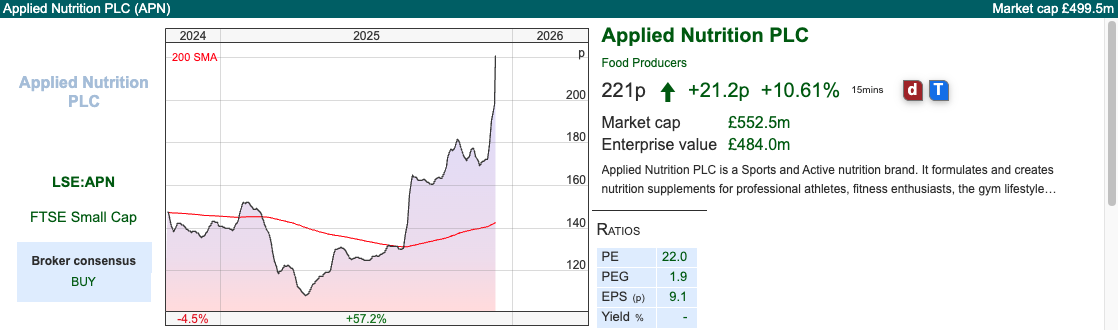

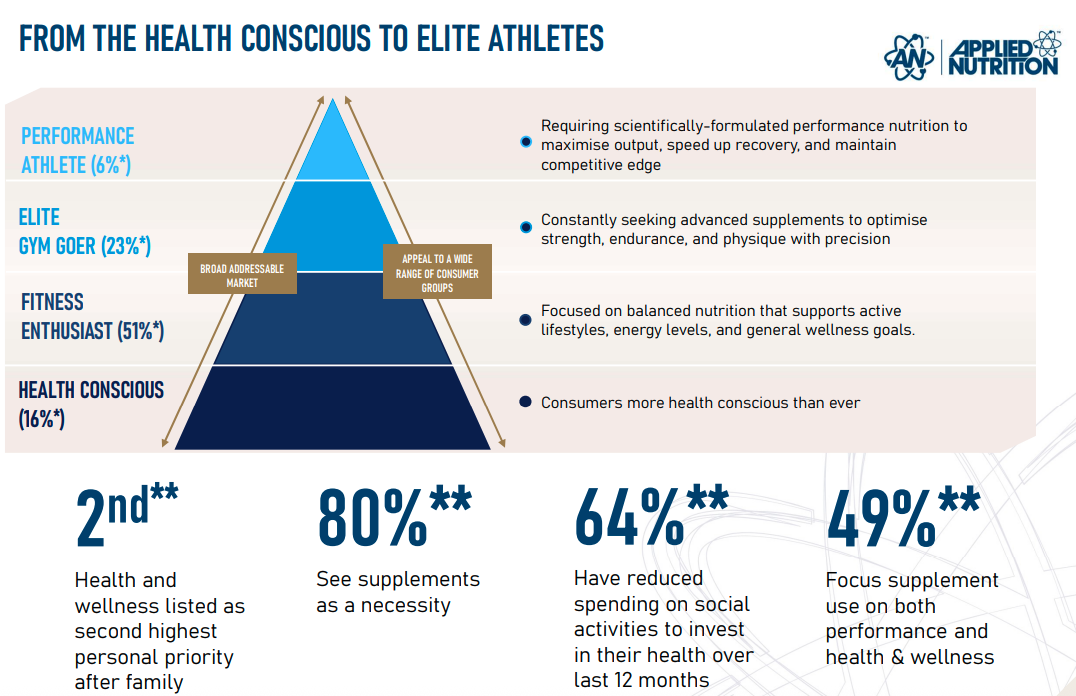

This sports nutrition brand, which makes protein shakes and similar, IPO’ed last year announced an “ahead of expectations” RNS. That is a rare bird: a recent IPO that is performing well. Management now expect FY Jul 2026 results to exceed current market consensus (£122m revenue, £34.4m adj EBITDA, according to the RNS) by approximately 10%.

History: Applied Nutrition was founded in 2014 by Thomas Ryder. The group’s first product was a premium all-in-one nutritional supplement designed for athletes seeking to maximise muscle mass. JD Sports bought just under a third of the company from him in 2021. The UK is the largest market, but they are seeking to expand internationally with a European distributor, plus Asia, the Middle East and US expansion are mentioned in the prospectus.

The shares listed in October last year at 140p, with selling shareholders receiving £154m for 45% of the company, valuing the group on admission at around £350m market cap. The selling shareholders were Thomas Ryder and Steven Granite who are the founder/management and JD Sports, the FTSE 100 retailer who sold down their 31% stake to 5% at the IPO. Thomas Ryder still owns over 30% of the company and JD Sports, have now up’ed their stake to just below 10% according to Sharescope. Peter Cowgill former Executive Chair of JD Sports is a non Exec and Andy Bell (of AJ Bell) is non Exec Chair.

Approximately 9% of revenue in FY Jul 2024 came from direct to consumer (D2C) sales via the Group’s UK website, its US website, and through Amazon and eBay. Instead, the group relies on retailers and distributors (B2B), the 10 largest retailers accounted for 50% of sales.

Comparison with Science in Sport: This is a similar business to Science in Sport, which was listed for around 10 years, but was a poor investment which I was fortunate to avoid. I had followed SIS with interest, as it appeared on my “attractive gross margin, growing revenue, but loss-making at an operating profit level” screen. The idea was that as the business scaled, operational gearing combined with revenue growth should have generated higher returns. A nice theory, but SIS management were poor at execution. Among other problems, SIS shares were briefly suspended in mid 2023 because management couldn’t get the FY Dec results published within 6 months. Eventually SIS received a bid at 34p per share from Private Equity firm bd-capital in April this year, valuing the loss-making company at £82m or 1.6x sales.

APN looks to have better momentum and stronger management, but worth highlighting that sports nutrition is a competitive space with low barriers to entry.

Valuation: The shares are trading on a PER of 18x Jul 2027F and EV/EBITDA of 12x. That’s before the EPS upgrades flow through, so perhaps 16x-17x is likely the new multiple. The gross margin is 46%, in line with what SIS was reporting, but APN has a better track record of converting that gross margin to EBIT margins, as Sharescope’s quality indicators reveal.

Opinion: Looks like a good Growth at a Reasonable Price (GaaRP) investment. Impressive that we are seeing ahead of expectations RNS so early in the FY Jul 2026F reporting period. I’ve noticed my female friends in their 30’s have taken up weight lifting, boxing, running and protein shakes. If APN can execute, this does seem to be an area where consumers are happy to spend their disposable income.

Bruce Packard

@bruce_packard

Notes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.