Bruce takes a look at how liquidity trends in international government bond markets might be spilling over to equities markets. Companies covered: JMAT, CML, SAA and SFOR

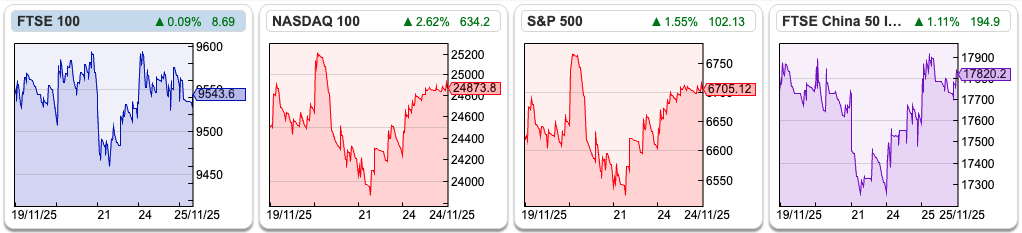

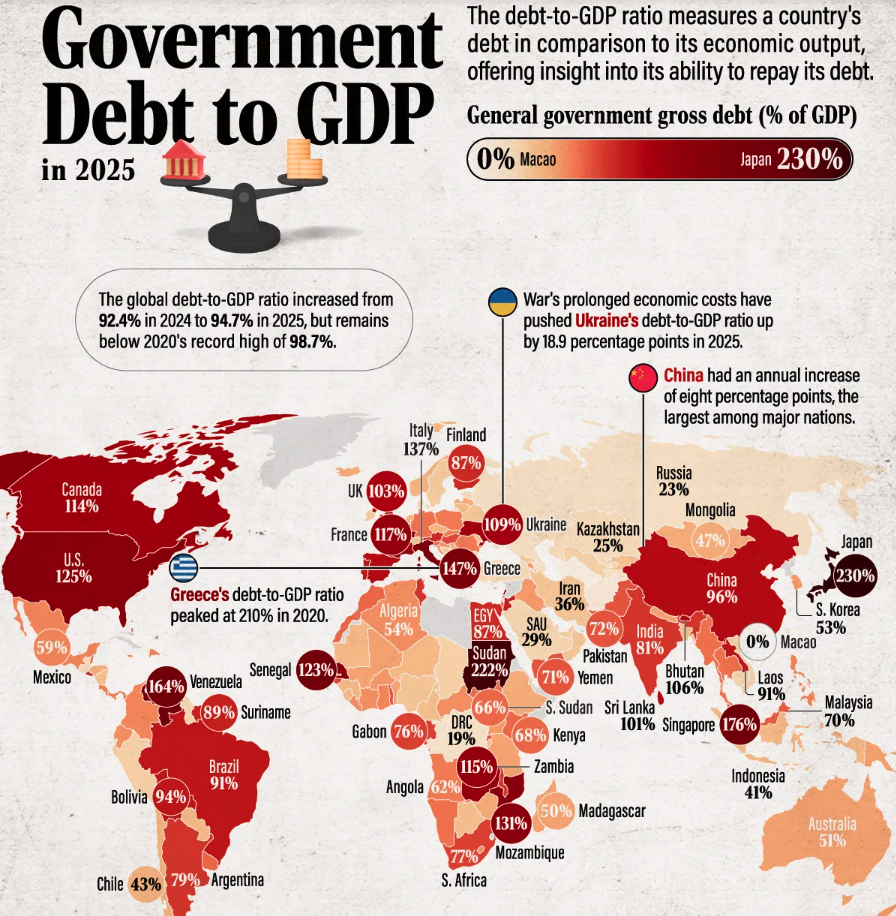

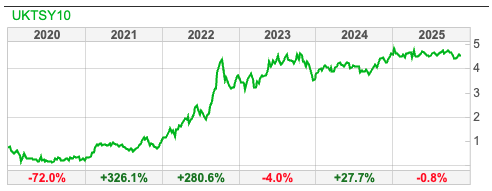

The FTSE 100 ended flat over the last 5 trading days, and is now up +17% YTD. The Nasdaq100 and S&P500 also recovered strongly at the start of the week, after an earlier sell-off, were up c. +0.5% over the same time period. Bitcoin continued to fall though and is now down around -30% from its early October peak to $87K. UK Government bond yields have also been volatile over the last couple of months, which seems to be driven by uncertainty about this week’s budget. In the spirit of the budget, I have been looking into international comparisons of Government debt, on sites like The Visual Capitalist.

UK Government debt is currently 103% of GDP, compared to 125% in the USA and 230% in Japan. Something I was unaware of, until recently, is that the UK has index-linked just under a quarter of its government borrowing. Goldbugs tend to assert confidently that governments will “inflate away their liabilities”, but that will be much harder when a quarter of the debt outstanding is inflation protected. Hence, the Chancellor’s emphasis on getting UK inflation under control while UK 10 year gilt yields are above 4.5%. Former hedge fund manager Russell Clark suggests that bond yields will continue to rise across most developed economies, at which point governments will need to choose between policies favouring either workers or large corporations.

UK Government debt is currently 103% of GDP, compared to 125% in the USA and 230% in Japan. Something I was unaware of, until recently, is that the UK has index-linked just under a quarter of its government borrowing. Goldbugs tend to assert confidently that governments will “inflate away their liabilities”, but that will be much harder when a quarter of the debt outstanding is inflation protected. Hence, the Chancellor’s emphasis on getting UK inflation under control while UK 10 year gilt yields are above 4.5%. Former hedge fund manager Russell Clark suggests that bond yields will continue to rise across most developed economies, at which point governments will need to choose between policies favouring either workers or large corporations.

The most recent data shows UK consumer price index (CPI) rising at +3.6% in October, down from September’s +3.8%. On Sharescope the ticker is UK.CPI. Unfortunately, food price inflation accelerated to +4.9%, from +4.5% the previous month, which tends to hit the poorest households hardest and is likely to be a vote loser.

For contrast, the USA has just 10% of its government debt is inflation protected, while less than 2% of Japanese government debt is inflation protected. Japan’s 230% debt to GDP ratio has looked an outlier for many years, so many hedge funds have lost money trying to short JGBs that the trade has become known as the “Widow Maker”. Now, a new Prime Minister, Sanae Takaichi has announced large spending plans, the JGB 10 year yield has risen to its highest level in two decades. The Japanese government bond yield has risen higher than the S&P500 dividend yield, which hasn’t happened since the dot.com bubble in the late 1990’s. Russell Clark suggests that this isn’t sustainable, and the S&P500 dividend yield needs to rise (ie S&P500 index fall). In absolute terms, Japan is the third largest government debt market at 8.9% ($10 trillion) of the global government debt market. So, I recommend keeping an eye on the weak Yen and rising JGB yields, as this could signal an end to the benign liquidity conditions US markets have been enjoying over the past couple of years.

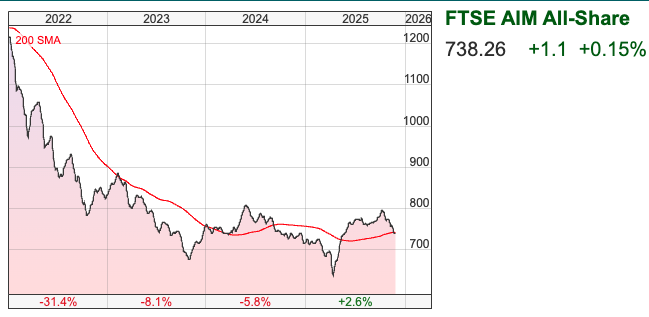

Returning to the UK: AIM has fallen by 8% since the beginning of October, testing the 200 moving average, as UK domestic investors fear more tax grabs. That’s a shame, because I was hoping that the UK, having not experienced a bubble, might be a safe haven. So far, that hasn’t been the case, but if the budget proves less depressing than expectations, perhaps we could yet see a “Santa Rally” in December?

This week I look at Johnson Matthey, maker of platinum catalytic converters, with some hydrogen assets. I suggest that CML Microsystems might have reached a bottom, though much depends on the success of their new product range of semiconductors. I finish with a brief comment on advertising and marketing companies M&C Saatchi and S4 Capital, which may already be seeing disruption from AI.

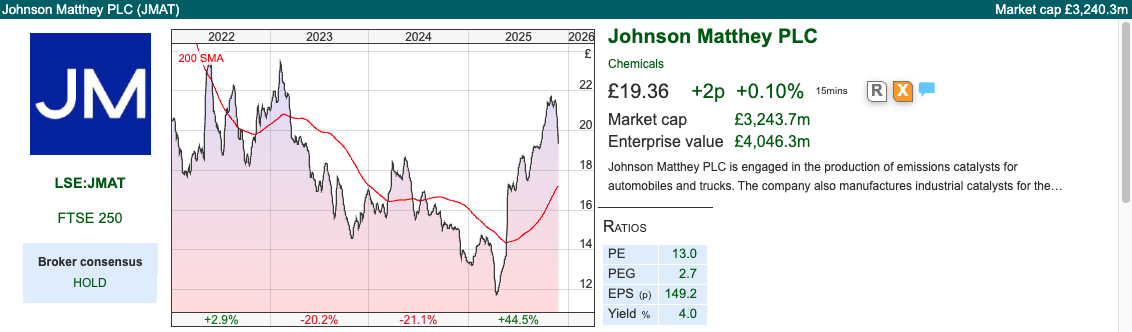

Johnson Matthey H1 Sept

Messy results from this industrial conglomerate, having announced the sale of its Catalyst Technologies business to Honeywell for £1.8bn. The exit multiple of 13x EV/EBITDA compares to 7.5x for the group as a whole. The division was a licensing business that helped convert “blue hydrogen” (that is, from natural gas, but capturing the carbon emissions) using fuel cell technology, with end markets including energy, but also fertilizer, food additives and paint.

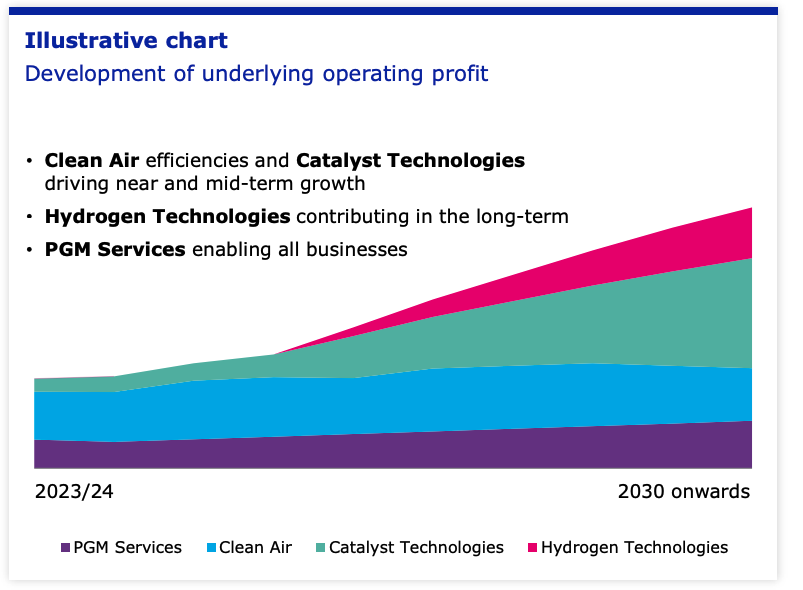

The sale was announced last May and should complete during the first half of next year, when JMAT will return £1.4bn (above £8 per share) to shareholders. Judging by an illustrative chart that management showed a year before the disposal, the business they are selling (in green below) was expected to be a major contribution to future growth.

On a “continuing underlying” basis sales were down -9% to £1.279bn but PBT was up +33% to £110m. Net debt stood at £971m at the end of September, at 2.0x EBITDA above management’s target of 1.5x – 1.0x.

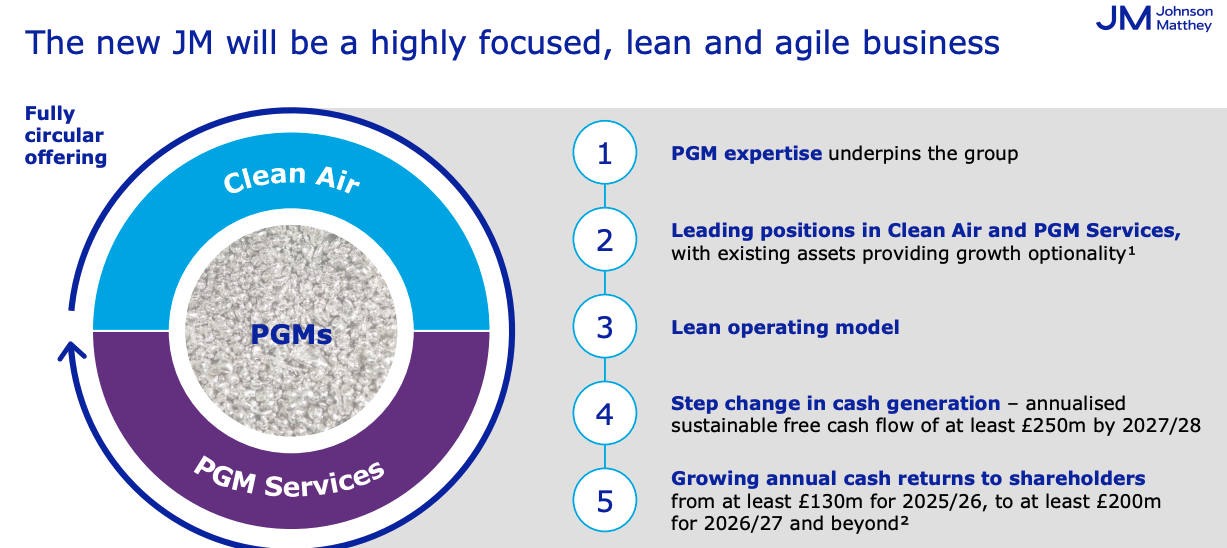

Following the disposal, JMAT will be focused on Clean Air (FY Mar 2025 sales £2.3bn, operating margin 11.8%) and PGM Services (Platinum Group Metals, FY sales £0.48bn, operating margin 31.4%). The former is mainly diesel catalytic converters for internal combustion engines, so is cash generative but vulnerable if Electric Vehicles sales accelerate. The chart above shows that this division (in blue) was expected to slowly shrink, and last week’s RNS reveals sales down -7% y-o-y, but operating profit up +11% as the margin improved to 12.4%.

The PGM services business benefits from the strength in PGMs, with sales up +7% and operating profit up +33%, again as a result of margin improvement. They expect a £20m gain (+13%) FY Mar 2026F versus the previous year if the current high PGMs continue to FY Mar 2026F.

While JMAT sold the Blue Hydrogen division to Catalyst Technologies, they kept a green hydrogen division: hardware to electrolyse water using renewable power to create hydrogen, using a Polymer Electrolyte Membrane (PEM, which requires platinum, I think). This was loss making on sales of £23m at H1, but they expect this green Hydrogen Technologies business to achieve operating profit breakeven in the current financial year.

Outlook: FY Mar 2026F outlook unchanged, though with a H2 weighting. They expect underlying operating PBT at “the higher end of mid single digits” (presumably 6 to 8%). Medium term targets are for mid single digit CAGR in operating profits, with a focus on sustainable free cashflow of at least £250m FY Mar 2028F and cash returns to shareholders of at least £200m.

Valuation: The shares are trading on 12x PER Mar 2026, rising to 13x the following year. That equates to 7x EV/EBITDA, as analysts have now factored in the disposal, revenue and EBITDA decline into Mar 2026F forecasts.

Opinion: Low growth, cash generative story, with some option value for the unprofitable green hydrogen business. I would imagine that management are probably correct: diesel engine sales (and hence catalytic converters) won’t decline quite as steeply as many investors believe. Some of the value has been recognised since the announcement in May, however, the investment case around capital return could be a good source of steady returns if you’re worried about some of the frothier parts of global markets.

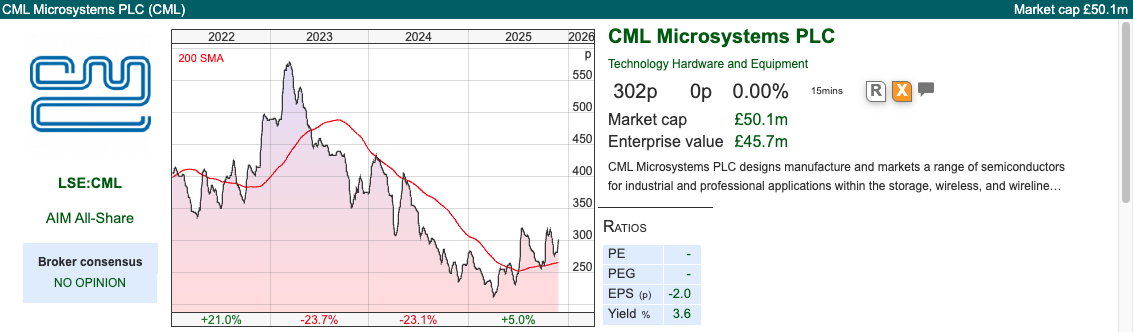

CML Microsystems H1 Sept Results

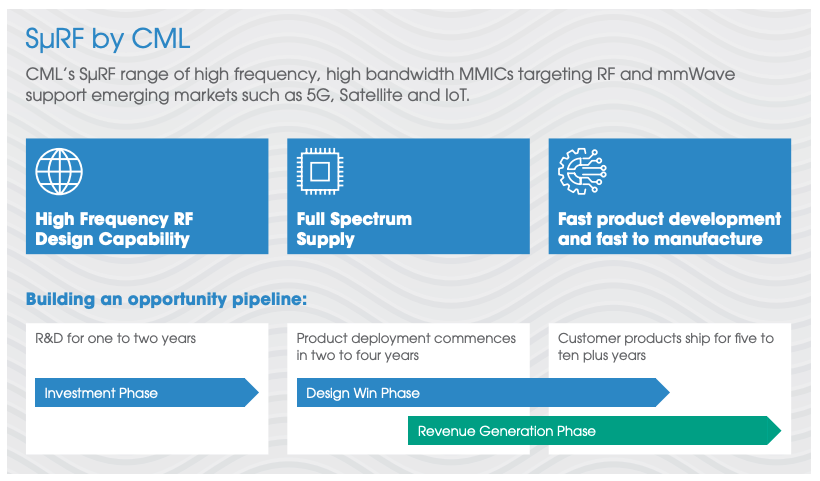

This mixed-signal, RF and microwave semiconductor company reported H1 revenues down -27% to £9.2m, which they say should represent a cyclical low of end market destocking. That may be the case, last August and November, management were saying that they expected customers to improve their inventory levels. The group’s SμRF product range is expected to drive revenue in 5G, satellites and IoT and was approximately 20% of FY Mar 2025 revenue, but has gone backwards in H1.

In July this year they signed an agreement to dispose of surplus land at the Group’s headquarters for a total of £7m. There was a £3.4m exception gain on property disposal (cash received was £4m) recorded in this H1, without which statutory LBT would have been £890K, versus PBT £815K the previous H1 Sept 2024. The remaining £3m cash payment is due in March 2026. Management don’t bother to split out this exceptional gain in the financial highlights to reveal a £1.7m negative swing in operating profits versus H1 last year.

Having disposed of an IoT subsidiary in 2021 for £33m, CML still has net cash of £10.7m, so the balance sheet is fine with the pension scheme in surplus. That said, there’s £14.6m of goodwill and intangible assets on the balance sheet, plus a further £17.9m of capitalised development expense. Together those items equate to £32.5m (or 66%) of shareholders’ equity of £49.4m. The capitalised value of development costs is flagged in the “key audit matters”. The Annual Report says that the payroll costs not being expensed through the p&l, but added to the balance sheet, are amortised over 6 years.

Also this July, management announced a $30m contract win to be delivered over 12 years. The contract was with a Global Navigation Satellite System (GNSS) equipment manufacturer. Shore Capital has published a detailed 27 page research note, available for free on Research Tree, saying that satellite communications (or satcom) represent a high-growth opportunity for CML’s SμRF products. CML’s “specialised compound semiconductor components – such as high-performance power amplifiers, low noise amplifiers and RF front-end modules – are critical components for reliable, high-frequency signal transmission and reception in satellite communications. The products are designed to meet the stringent requirements of satellite systems, including high linearity, efficiency and durability in harsh environments, helping satellite operators deliver robust connectivity across wide coverage areas.”

I’ve read the relevant section of the note a couple of times, and it’s not clear to me how similar CML’s satellite broadband is compared to Filtronic’s technology, which is used for communications with Low Earth Orbit (LEO) satellites.

Outlook: Management expect H2 Mar 2026F to deliver material sequential revenue growth and a return to pre-exceptional operating profitability for that period (NB they don’t say FY profits though). Shore have not published any forecasts for FY Mar 2026F, presumably at the request of management.

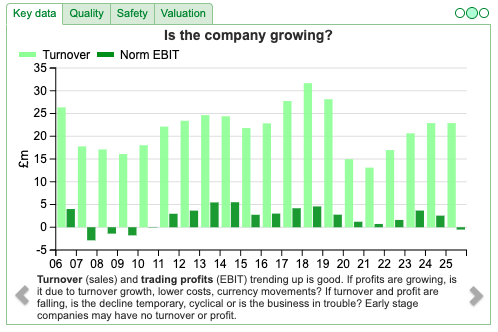

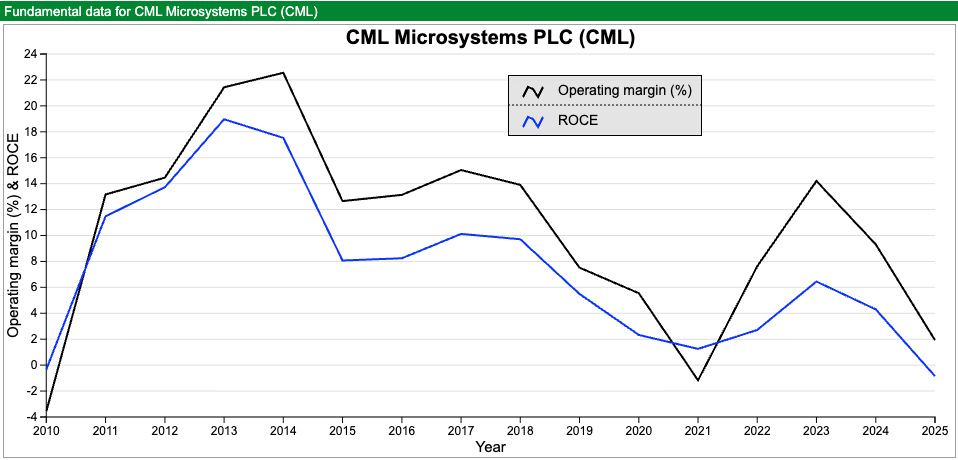

Valuation: The shares are trading on 12x historic EV/EBITDA and a historic PER of 30x, if you exclude a £1.65m goodwill impairment last year. The long term track record of operating margins and RoCE suggests that we are indeed close to a cyclical low, which I find odd given all the money that’s been thrown at technology investing since the pandemic. There’s a 5p interim dividend, flat on last year, implying 11p FY dividend, implying a dividend yield of 3.6%.

Opinion: The shares bounced +40% in July in reaction to the good news of property gains and contract wins, but since then have failed to sustain momentum. You could argue that semiconductor design is a similar investment case to computer games companies like FDEV: CML must spend money in advance to develop their SμRF product range, hoping that they have a hit with customers on their hands. The development costs on the balance sheet tell you what they’ve spent, but we have no idea about the future sales. Given the lack of forecasts, neither do management, it seems. The next six months will give us a strong signal. I own it, and am keeping my fingers crossed.

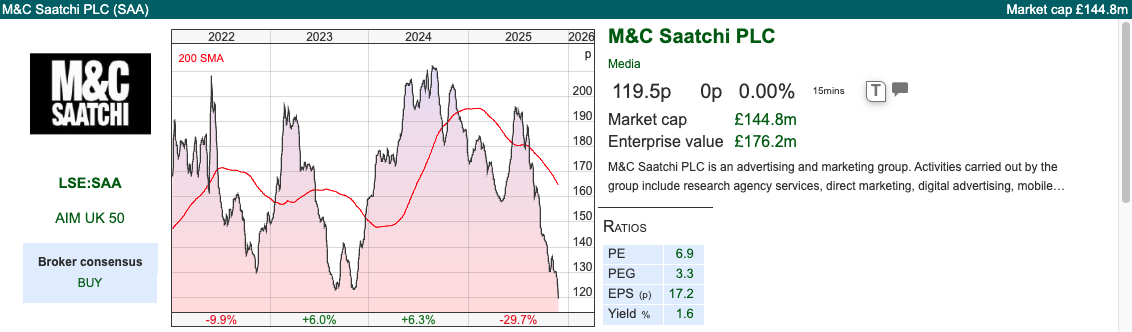

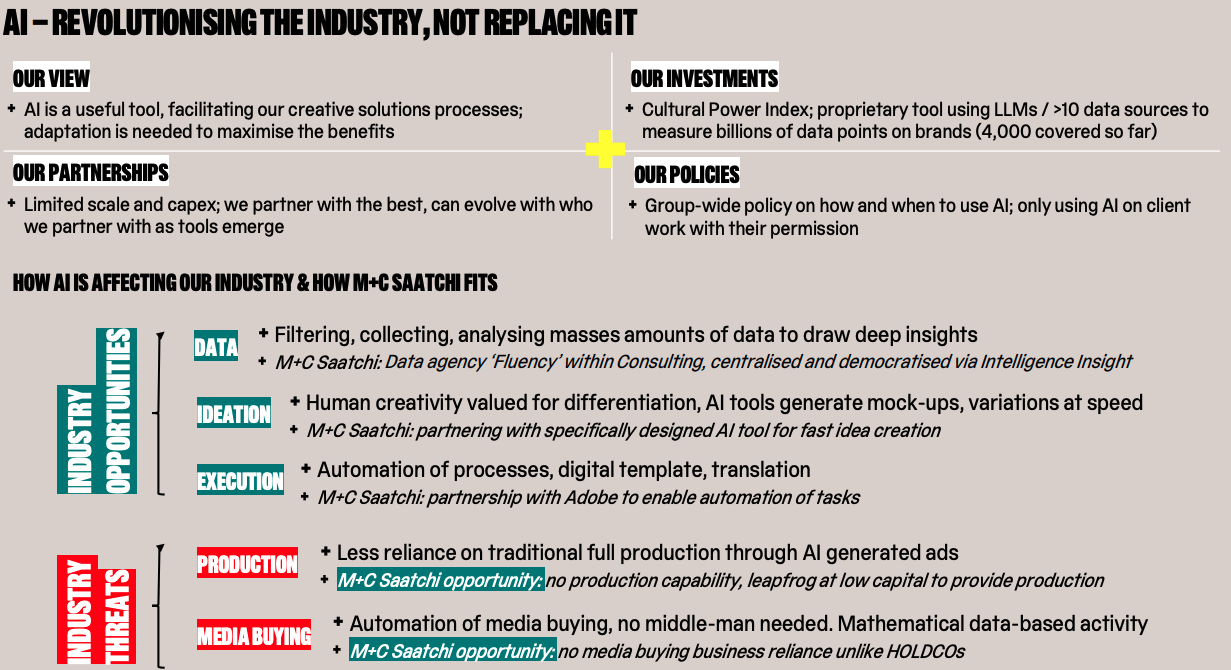

M&C Saatchi FY Dec profit warning

Both M&C Saatchi and Sir Martin Sorrell’s S4 Capital put out profit warnings at the start of the week. It’s hard to believe that AI is not going to create more losers than winners, in the way that high street travel agents, physical book and music shops selling Pink Floyd albums became a thing of the past. In response to investor concerns, management have claimed that AI is a useful tool, which they can adapt to and benefit from.

Instead, SAA has blamed the US Government shutdown for a difficult H2, management now expect FY like-for-like revenue decline of -7% and PBT between £26m – £28m. Previously, they had said “in line with the prior year” which was £30.5m. There’s no mention of the cash position in the trading update, but at the half year stage it was £9m on a statutory basis.

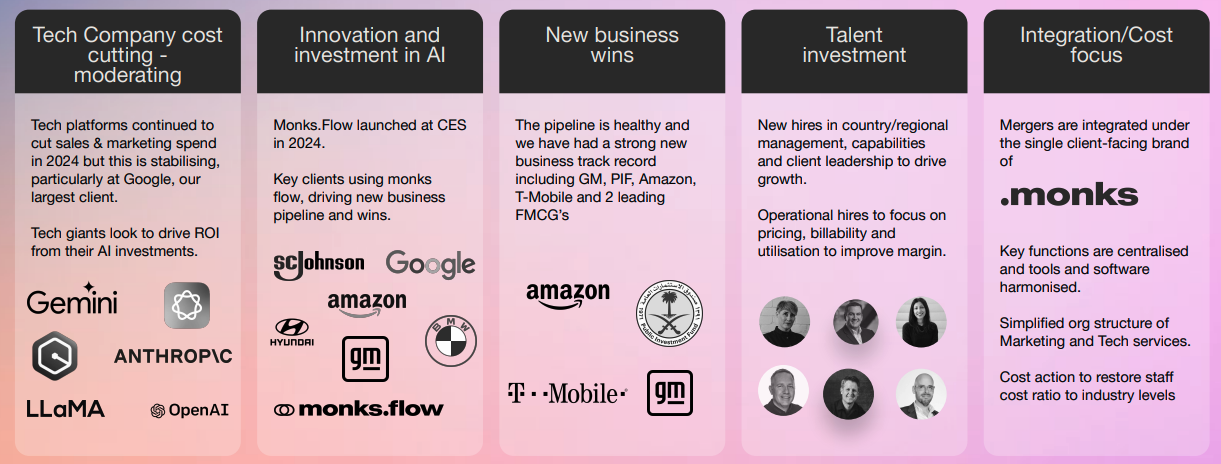

S4 Capital also announced a profit warning, saying like-for-like revenue would decline by just under -10%. They blame this on lower project-based revenue and client caution. They expect net debt to be between £100m and £140m (versus £143m December last year).

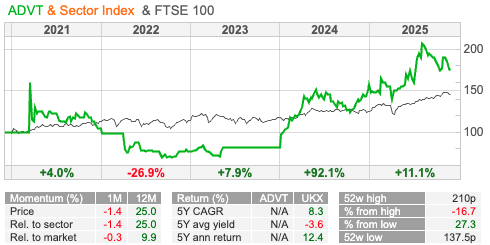

Remember that in 2022 there was a bidding war between Vin Muria’s AdvancedADVT cash vehicle and NextFifteen, which both thought M&C Saatchi was worth around £2 per share. But both offers lapsed, as not enough shareholders voted in favour. Since then SAA has halved in value, and NFG is down -80%, while S4 Capital has fallen -95%. Vin Muria must be thanking her lucky stars, as ADVT has been acquiring smaller SaaS companies and digital transformation platforms and ADVT shares have doubled in value.

Valuation: SFOR is trading on just 3x Dec 2026F, suggesting some scepticism towards next year’s forecasts. SAA, with a stronger balance sheet is on a PER of 8x the same year, while NFG is on a PER of 6x Jan 2027F. In summary, the whole sector looks cheap, but beware that it could be “cheap for a reason”. That said, expectations are now so low that any sign of recovery and these could really bounce hard.

Opinion: Management will often try to persuade investors that the reasons for a profit warning are temporary economic weakness or similar, rather than a structural decline caused by substitution, new competition or technology disruption. I’m cautious and would also avoid price comparison websites and specialist media groups, such as MONY and FUTR.

A couple of years ago the investment case for SFOR was based on digital disruption of more traditional marketing companies like WPP, with a more data driven approach. Now, the digital-only disrupters might themselves have been disrupted by AI technology. Welcome to the machine!

Bruce Packard

@bruce_packard

Notes

Bruce owns shares in CML

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 26/11/2025 | JMAT, CML, SAA, SFOR | The outlook for Government Debt

Bruce takes a look at how liquidity trends in international government bond markets might be spilling over to equities markets. Companies covered: JMAT, CML, SAA and SFOR

The FTSE 100 ended flat over the last 5 trading days, and is now up +17% YTD. The Nasdaq100 and S&P500 also recovered strongly at the start of the week, after an earlier sell-off, were up c. +0.5% over the same time period. Bitcoin continued to fall though and is now down around -30% from its early October peak to $87K. UK Government bond yields have also been volatile over the last couple of months, which seems to be driven by uncertainty about this week’s budget. In the spirit of the budget, I have been looking into international comparisons of Government debt, on sites like The Visual Capitalist.

The most recent data shows UK consumer price index (CPI) rising at +3.6% in October, down from September’s +3.8%. On Sharescope the ticker is UK.CPI. Unfortunately, food price inflation accelerated to +4.9%, from +4.5% the previous month, which tends to hit the poorest households hardest and is likely to be a vote loser.

For contrast, the USA has just 10% of its government debt is inflation protected, while less than 2% of Japanese government debt is inflation protected. Japan’s 230% debt to GDP ratio has looked an outlier for many years, so many hedge funds have lost money trying to short JGBs that the trade has become known as the “Widow Maker”. Now, a new Prime Minister, Sanae Takaichi has announced large spending plans, the JGB 10 year yield has risen to its highest level in two decades. The Japanese government bond yield has risen higher than the S&P500 dividend yield, which hasn’t happened since the dot.com bubble in the late 1990’s. Russell Clark suggests that this isn’t sustainable, and the S&P500 dividend yield needs to rise (ie S&P500 index fall). In absolute terms, Japan is the third largest government debt market at 8.9% ($10 trillion) of the global government debt market. So, I recommend keeping an eye on the weak Yen and rising JGB yields, as this could signal an end to the benign liquidity conditions US markets have been enjoying over the past couple of years.

Returning to the UK: AIM has fallen by 8% since the beginning of October, testing the 200 moving average, as UK domestic investors fear more tax grabs. That’s a shame, because I was hoping that the UK, having not experienced a bubble, might be a safe haven. So far, that hasn’t been the case, but if the budget proves less depressing than expectations, perhaps we could yet see a “Santa Rally” in December?

This week I look at Johnson Matthey, maker of platinum catalytic converters, with some hydrogen assets. I suggest that CML Microsystems might have reached a bottom, though much depends on the success of their new product range of semiconductors. I finish with a brief comment on advertising and marketing companies M&C Saatchi and S4 Capital, which may already be seeing disruption from AI.

Johnson Matthey H1 Sept

Messy results from this industrial conglomerate, having announced the sale of its Catalyst Technologies business to Honeywell for £1.8bn. The exit multiple of 13x EV/EBITDA compares to 7.5x for the group as a whole. The division was a licensing business that helped convert “blue hydrogen” (that is, from natural gas, but capturing the carbon emissions) using fuel cell technology, with end markets including energy, but also fertilizer, food additives and paint.

The sale was announced last May and should complete during the first half of next year, when JMAT will return £1.4bn (above £8 per share) to shareholders. Judging by an illustrative chart that management showed a year before the disposal, the business they are selling (in green below) was expected to be a major contribution to future growth.

On a “continuing underlying” basis sales were down -9% to £1.279bn but PBT was up +33% to £110m. Net debt stood at £971m at the end of September, at 2.0x EBITDA above management’s target of 1.5x – 1.0x.

Following the disposal, JMAT will be focused on Clean Air (FY Mar 2025 sales £2.3bn, operating margin 11.8%) and PGM Services (Platinum Group Metals, FY sales £0.48bn, operating margin 31.4%). The former is mainly diesel catalytic converters for internal combustion engines, so is cash generative but vulnerable if Electric Vehicles sales accelerate. The chart above shows that this division (in blue) was expected to slowly shrink, and last week’s RNS reveals sales down -7% y-o-y, but operating profit up +11% as the margin improved to 12.4%.

The PGM services business benefits from the strength in PGMs, with sales up +7% and operating profit up +33%, again as a result of margin improvement. They expect a £20m gain (+13%) FY Mar 2026F versus the previous year if the current high PGMs continue to FY Mar 2026F.

While JMAT sold the Blue Hydrogen division to Catalyst Technologies, they kept a green hydrogen division: hardware to electrolyse water using renewable power to create hydrogen, using a Polymer Electrolyte Membrane (PEM, which requires platinum, I think). This was loss making on sales of £23m at H1, but they expect this green Hydrogen Technologies business to achieve operating profit breakeven in the current financial year.

Outlook: FY Mar 2026F outlook unchanged, though with a H2 weighting. They expect underlying operating PBT at “the higher end of mid single digits” (presumably 6 to 8%). Medium term targets are for mid single digit CAGR in operating profits, with a focus on sustainable free cashflow of at least £250m FY Mar 2028F and cash returns to shareholders of at least £200m.

Valuation: The shares are trading on 12x PER Mar 2026, rising to 13x the following year. That equates to 7x EV/EBITDA, as analysts have now factored in the disposal, revenue and EBITDA decline into Mar 2026F forecasts.

Opinion: Low growth, cash generative story, with some option value for the unprofitable green hydrogen business. I would imagine that management are probably correct: diesel engine sales (and hence catalytic converters) won’t decline quite as steeply as many investors believe. Some of the value has been recognised since the announcement in May, however, the investment case around capital return could be a good source of steady returns if you’re worried about some of the frothier parts of global markets.

CML Microsystems H1 Sept Results

This mixed-signal, RF and microwave semiconductor company reported H1 revenues down -27% to £9.2m, which they say should represent a cyclical low of end market destocking. That may be the case, last August and November, management were saying that they expected customers to improve their inventory levels. The group’s SμRF product range is expected to drive revenue in 5G, satellites and IoT and was approximately 20% of FY Mar 2025 revenue, but has gone backwards in H1.

In July this year they signed an agreement to dispose of surplus land at the Group’s headquarters for a total of £7m. There was a £3.4m exception gain on property disposal (cash received was £4m) recorded in this H1, without which statutory LBT would have been £890K, versus PBT £815K the previous H1 Sept 2024. The remaining £3m cash payment is due in March 2026. Management don’t bother to split out this exceptional gain in the financial highlights to reveal a £1.7m negative swing in operating profits versus H1 last year.

Having disposed of an IoT subsidiary in 2021 for £33m, CML still has net cash of £10.7m, so the balance sheet is fine with the pension scheme in surplus. That said, there’s £14.6m of goodwill and intangible assets on the balance sheet, plus a further £17.9m of capitalised development expense. Together those items equate to £32.5m (or 66%) of shareholders’ equity of £49.4m. The capitalised value of development costs is flagged in the “key audit matters”. The Annual Report says that the payroll costs not being expensed through the p&l, but added to the balance sheet, are amortised over 6 years.

Also this July, management announced a $30m contract win to be delivered over 12 years. The contract was with a Global Navigation Satellite System (GNSS) equipment manufacturer. Shore Capital has published a detailed 27 page research note, available for free on Research Tree, saying that satellite communications (or satcom) represent a high-growth opportunity for CML’s SμRF products. CML’s “specialised compound semiconductor components – such as high-performance power amplifiers, low noise amplifiers and RF front-end modules – are critical components for reliable, high-frequency signal transmission and reception in satellite communications. The products are designed to meet the stringent requirements of satellite systems, including high linearity, efficiency and durability in harsh environments, helping satellite operators deliver robust connectivity across wide coverage areas.”

I’ve read the relevant section of the note a couple of times, and it’s not clear to me how similar CML’s satellite broadband is compared to Filtronic’s technology, which is used for communications with Low Earth Orbit (LEO) satellites.

Outlook: Management expect H2 Mar 2026F to deliver material sequential revenue growth and a return to pre-exceptional operating profitability for that period (NB they don’t say FY profits though). Shore have not published any forecasts for FY Mar 2026F, presumably at the request of management.

Valuation: The shares are trading on 12x historic EV/EBITDA and a historic PER of 30x, if you exclude a £1.65m goodwill impairment last year. The long term track record of operating margins and RoCE suggests that we are indeed close to a cyclical low, which I find odd given all the money that’s been thrown at technology investing since the pandemic. There’s a 5p interim dividend, flat on last year, implying 11p FY dividend, implying a dividend yield of 3.6%.

Opinion: The shares bounced +40% in July in reaction to the good news of property gains and contract wins, but since then have failed to sustain momentum. You could argue that semiconductor design is a similar investment case to computer games companies like FDEV: CML must spend money in advance to develop their SμRF product range, hoping that they have a hit with customers on their hands. The development costs on the balance sheet tell you what they’ve spent, but we have no idea about the future sales. Given the lack of forecasts, neither do management, it seems. The next six months will give us a strong signal. I own it, and am keeping my fingers crossed.

M&C Saatchi FY Dec profit warning

Both M&C Saatchi and Sir Martin Sorrell’s S4 Capital put out profit warnings at the start of the week. It’s hard to believe that AI is not going to create more losers than winners, in the way that high street travel agents, physical book and music shops selling Pink Floyd albums became a thing of the past. In response to investor concerns, management have claimed that AI is a useful tool, which they can adapt to and benefit from.

Instead, SAA has blamed the US Government shutdown for a difficult H2, management now expect FY like-for-like revenue decline of -7% and PBT between £26m – £28m. Previously, they had said “in line with the prior year” which was £30.5m. There’s no mention of the cash position in the trading update, but at the half year stage it was £9m on a statutory basis.

S4 Capital also announced a profit warning, saying like-for-like revenue would decline by just under -10%. They blame this on lower project-based revenue and client caution. They expect net debt to be between £100m and £140m (versus £143m December last year).

Remember that in 2022 there was a bidding war between Vin Muria’s AdvancedADVT cash vehicle and NextFifteen, which both thought M&C Saatchi was worth around £2 per share. But both offers lapsed, as not enough shareholders voted in favour. Since then SAA has halved in value, and NFG is down -80%, while S4 Capital has fallen -95%. Vin Muria must be thanking her lucky stars, as ADVT has been acquiring smaller SaaS companies and digital transformation platforms and ADVT shares have doubled in value.

Valuation: SFOR is trading on just 3x Dec 2026F, suggesting some scepticism towards next year’s forecasts. SAA, with a stronger balance sheet is on a PER of 8x the same year, while NFG is on a PER of 6x Jan 2027F. In summary, the whole sector looks cheap, but beware that it could be “cheap for a reason”. That said, expectations are now so low that any sign of recovery and these could really bounce hard.

Opinion: Management will often try to persuade investors that the reasons for a profit warning are temporary economic weakness or similar, rather than a structural decline caused by substitution, new competition or technology disruption. I’m cautious and would also avoid price comparison websites and specialist media groups, such as MONY and FUTR.

A couple of years ago the investment case for SFOR was based on digital disruption of more traditional marketing companies like WPP, with a more data driven approach. Now, the digital-only disrupters might themselves have been disrupted by AI technology. Welcome to the machine!

Bruce Packard

@bruce_packard

Notes

Bruce owns shares in CML

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.