Bumper contracts leading to rapid profit growth have prompted MS International to multi-bag during the last five years. Maynard Paton assesses the defence group’s sudden resurgence, fluctuating cash flow, old-school board and 13x P/E.

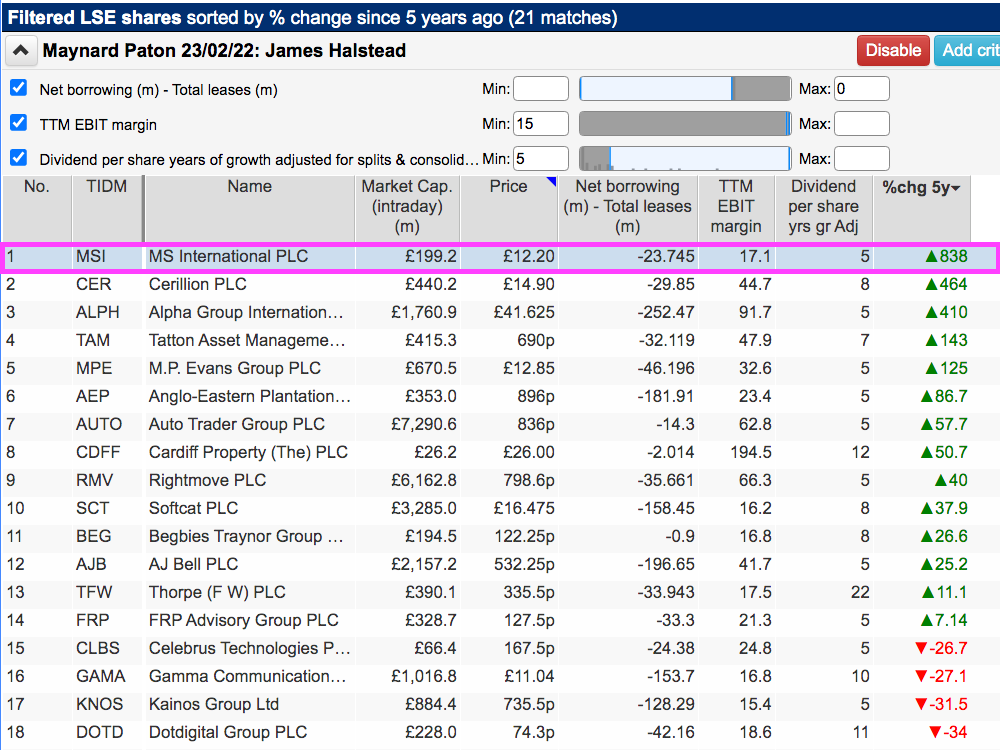

This month I have gone ‘back to basics’ by employing an old screen that identifies companies with strong balance sheets, robust margins and rising dividends.

I must admit I was disappointed my three ‘quality’ criteria returned only 21 names:

(You can run this screen for yourself by selecting the “Maynard Paton 23/02/22: James Halstead” filter within ShareScope’s majestic Filter Library. My instructions show you how.)

Among the 21 names were Cerillion, DotDigital, James Halstead, Rightmove and Tatton Asset Management.

The exact filters I applied for this search were:

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations);

- A trailing 12-month operating margin of 15% or more, and;

- A minimum five-year record of annual dividend improvements.

I added an extra column to the screening results to sort the 21 names on five-year share-price performance.

I selected MS International because its shares had surged an amazing 838% since July 2020:

Let’s take a closer look.

Introducing MS International

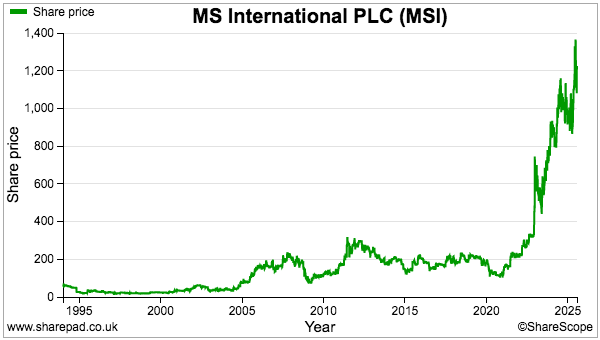

MS International (MSI) joined the stock market during 1965 but waited until late 2022 before truly catching the attention of investors. The preceding 57 years sadly encompassed a rather humdrum corporate performance.

Established in 1960 as Mining Supplies, the group initially manufactured shearers and conveyors for coal mining in the UK, Australia, South Africa and the United States.

Diversification into electrical engineering occurred during 1980 through the purchase of Laurence Scott, which brought with it a small defence subsidiary that had manufactured searchlights during the first world war and submarine torpedo systems during the second world war.

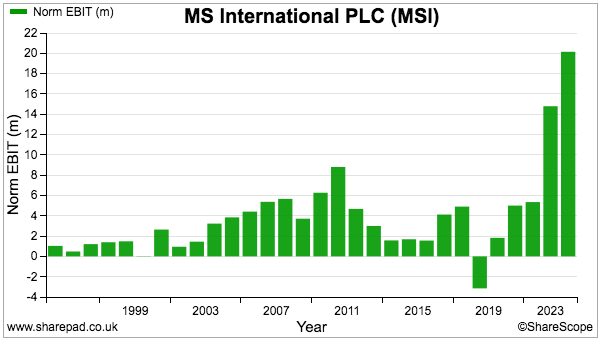

Underlining the group’s lacklustre long-term progress, ShareScope indicates MSI reporting an operating profit of £2.4 million for 1985…

…and some 20 years would then pass before operating profit could be sustained close to £3 million:

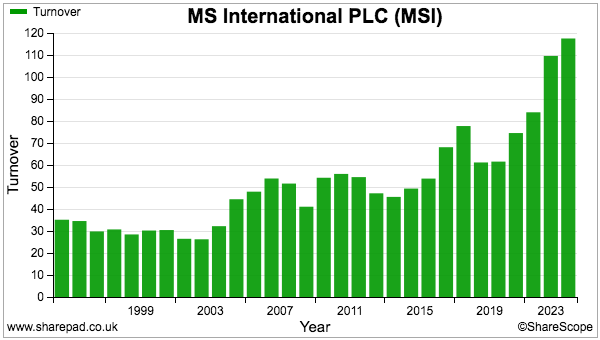

Revenue has previously exhibited a similar stagnation, with the top line bobbing around £30 million for 15 years before surpassing £40 million during 2006:

Take off during 2022 was prompted initially by half-year results that showed interim revenue up 27% to £42 million and a pre-tax profit of £3.6 million — at the time the highest interim profit for at least ten years.

The profit revival was due to bumper progress within MSI’s forgings division, but the most interesting commentary concerned the group’s defence division.

MSI referred to a “unique” mobile gun system that was attracting “considerable attention“:

“We continue to develop new military products and during the period launched our first land-based mobile gun system incorporating our unique ‘counter-drone’ capability. I am very encouraged to report that this new gun system has already attracted considerable attention in the international market.”

The 2022 interims also noted the US Navy was taking an increasingly greater interest in a naval gun system:

“Pleasingly, our participation in the United States Navy’s multi-phased programme of ‘weapon approval procedures’ with respect to our 30mm Naval Gun System, continues to progress through their comprehensive testing procedures. We are encouraged with their observations to date. A great prize, still for us to win!”

Then a few days before Christmas 2022, MSI announced a £22 million order for the “unique” mobile gun system, which is mounted on a military support vehicle and can be controlled remotely:

MSI subsequently disclosed during 2023 a trio of contracts worth up to $89 million to supply and maintain naval gun systems for the US Navy:

Defence-related revenue was at the time running at approximately £30 million, and MSI understandably described the wave of new contracts as a “significant upward step-change in the development of the company“.

MSI’s shares traded at approximately 330p ahead of all this positive newsflow, but reached £9 following the US Navy announcements and have since rallied to £12 to support a £200m market cap as the new contracts have converted into revenue and profit in particular.

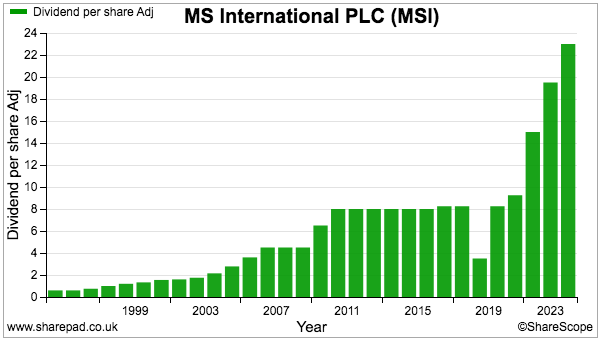

Indeed, the group’s 2025 results showed operating profit up 39% to almost £19 million — versus only £5 million for 2023. The 2025 dividend was meanwhile set at 23p per share — equivalent to group earnings during 2018 and 2019!

Defence division

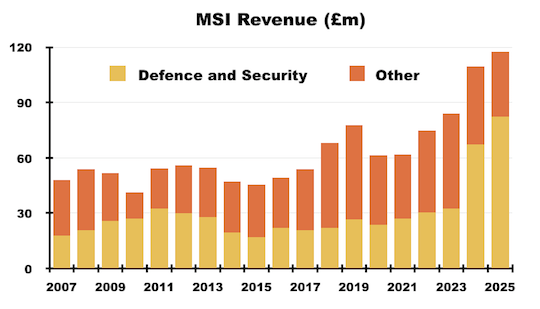

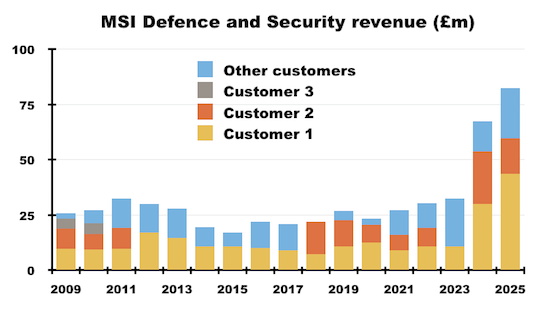

The small defence subsidiary that was formerly part of Laurence Scott has expanded to dominate MSI’s financials. Revenue from the group’s ‘Defence and Security’ division supported 70% of total sales during 2025:

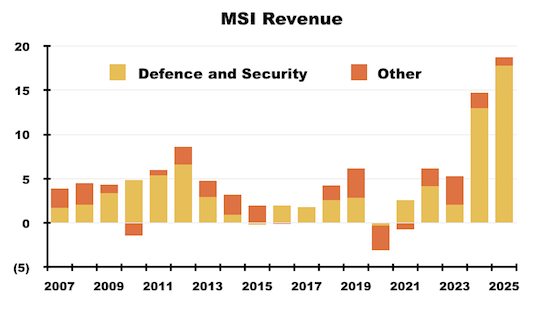

Profit from Defence and Security meanwhile represented 95% of 2025 total profit:

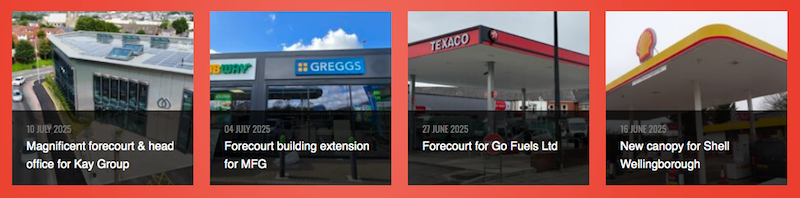

‘Other’ revenue and profit is generated mostly from MSI’s forgings and petrol-station ‘superstructure’ divisions, the former being a “world leader in fork-arms manufacturing“…

…and the latter being the “leading specialist in the design, manufacture and installation of forecourt structures throughout the UK“:

The other month, MSI decided its Defence and Security operation should become its “primary focus” and revealed offers had been invited for the rest of the group.

The incoming bids were said not to have represented an “attractive proposition“… and the group now reckons the smaller subsidiaries “continue to have considerable potential“!

However, the potential of the Defence and Security division ought to be far greater than for sales of fork-arms and petrol-station canopies.

Indeed, MSI’s take-off in 2022 coincided with the conflict in Ukraine that has led to generally greater global spending on defence. As MSI noted during June:

“A very positive development for us is the intensifying focus on defence spending internationally and the recognition by NATO Governments that spending 5% of GDP on defence is an objective given the uncertainties and hostilities in the world.“

Although MSI also admitted order growth in the short term may slow, the medium- and long-term prospects for its Defence and Security division were described as “better today than ever before.”

For example, the initial £22 million contract for that “unique” mobile gun system was followed swiftly by a further £54 million order that appeared to be placed by countries within the Middle East.

In addition, MSI’s 2024 results highlighted a remarkable £100-plus million order intake for its naval gun systems, with the Royal Navy and the German Navy placing orders alongside the aforementioned US Navy contracts.

MSI in fact claimed the naval-gun workload would establish the group as the “primary supplier of small calibre naval-weapon systems to three of the major ‘NATO’ navies.”

Approvals by the UK, US and German military certainly support the notion of MSI supplying first-class equipment and enjoying a worthwhile competitive advantage… and perhaps customers having to pay handsomely for such first-class kit.

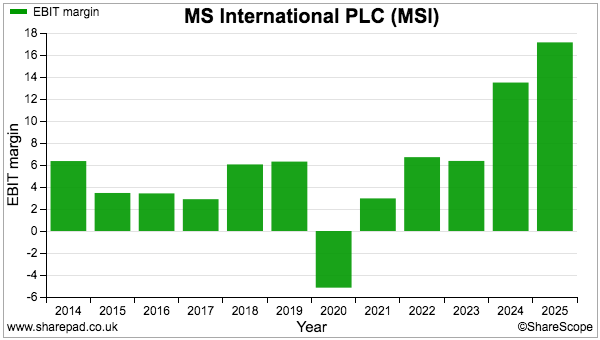

Indeed, during 2025, the Defence and Security division delivered an £18 million profit on revenue of £82 million — equivalent to a robust 21% divisional margin.

Note that MSI’s recent success has been in the making for some time. The naval gun system, currently selling so well, was mentioned within the 2015 results:

“The Group’s current order book remains very strong. While marginally lower at year-end than that the GBP46m reported for 2014, it has since increased following the award of a follow-on two year contract by the UK MoD for the maintenance and support of MSI-DS 30mm naval gun systems and associated ancillary equipment in the RN fleet. Although the exact value of that contract is confidential, I can reveal that it is in excess of GBP12m.”

In fact, MSI’s long history of humdrum progress might arguably suggest MSI’s defence equipment was simply a top-notch solution awaiting a suitable conflict that would prise open defence budgets to eventually increase sales!

Note, too, how MSI’s Defence and Security revenue has always been skewed towards a handful of major customers.

Since 2009, at least 30% of revenue within the division has been derived from a single customer — with the proportion at 53% for 2025:

Be aware that the largest customer one year may not be the largest customer the next year:

“The Group’s largest customer, which is reported in the ‘Defence and Security’ division, contributed 37.1% to the Group’s revenue (2024 – 27.4% from a different customer).“

As such, MSI’s revenue and profit could be subject to significantly favourable — and unfavourable! — fluctuations due to the timing and duration of different orders from different clients.

Financials

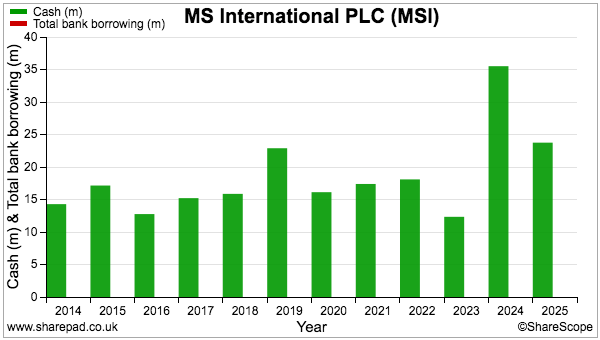

Confirming my initial screening results, MSI’s accounts have enjoyed a decent net cash position since at least 2014:

And assisted by the aforementioned lucrative orders for gun systems, the group’s margin last year reached 17%:

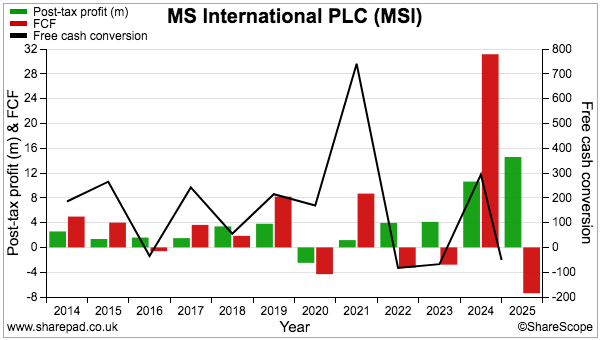

The financials are not perfect, though, and those large contracts do lead to irregular cash conversion:

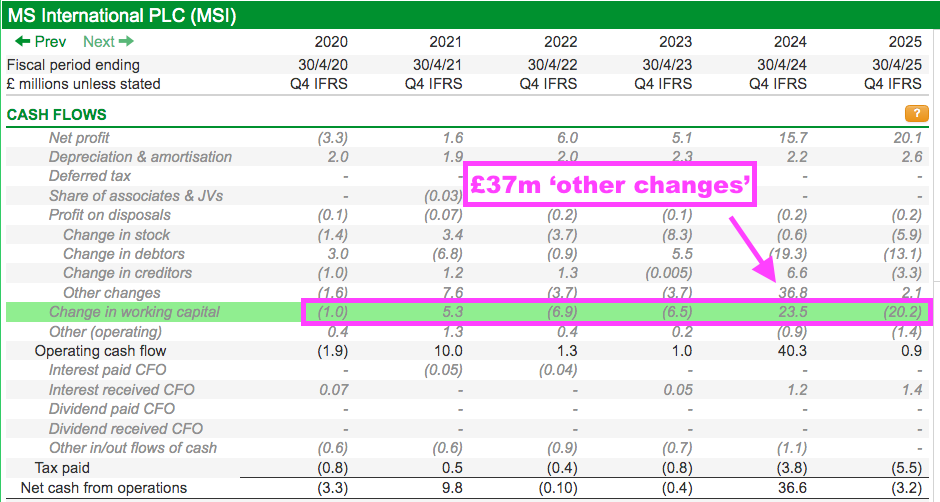

Free cash flow has been negative for four of the last six years, and ShareScope shows sizeable working-capital movements:

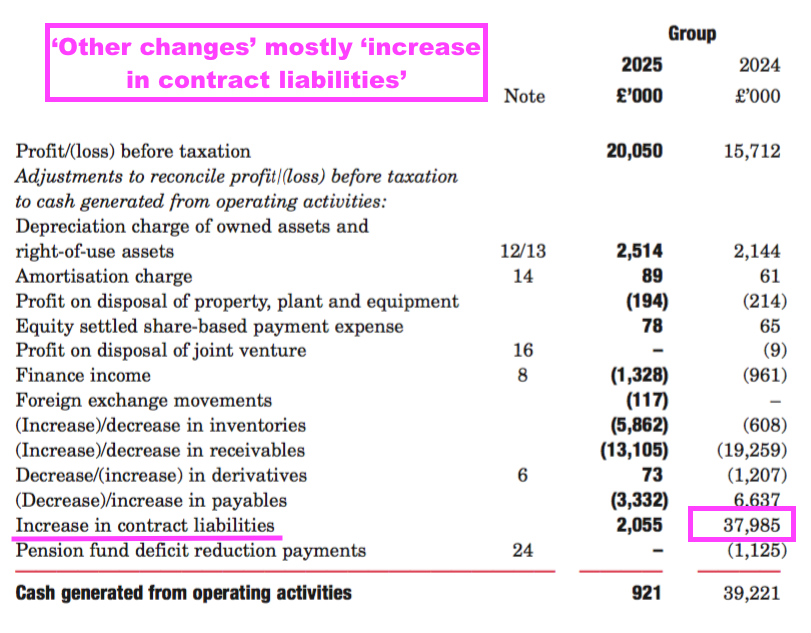

ShareScope reveals a substantial ‘Other changes’ entry for 2024, which the 2025 accounts confirm as a movement to ‘contract liabilities’:

‘Contract liabilities’ include upfront customer payments for equipment yet to be delivered by the group.

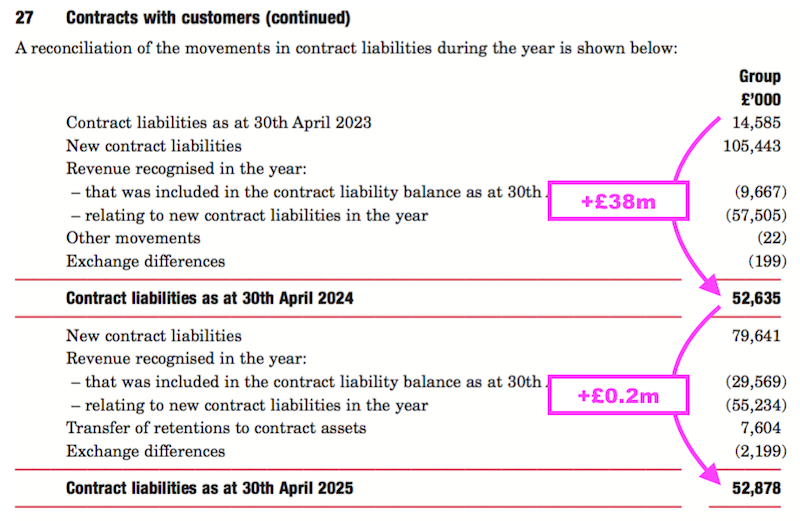

Cash flow for 2024 was bolstered by a net £38 million addition to contract liabilities, with 2025 witnessing a minimal increase:

The minimal increase to contract liabilities for 2025 suggests orders may have stabilised for the time being.

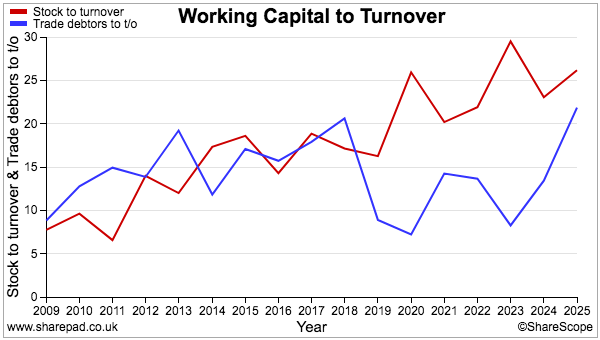

MSI’s contract liabilities are offset on the balance sheet by not insignificant levels of stock (£31 million) and trade debtors (£26 million) — both of which are now equivalent to more than 20% of revenue:

Stock in particular has increased over time as a proportion of revenue, perhaps reflecting the longer manufacturing lead times for defence-related equipment.

While MSI’s working-capital demands can create adverse cash movements, the group’s cash management appears very commendable. Very unusually for a UK quoted small-cap, the latest results explicitly expressed the group “sought to maximise interest income”:

“The Group’s central treasury function has sought to maximise interest income on positive bank balances and has been successful in generating £1.35m (2024 – £1.18m) of interest during the year. This has been the result of favourable interest rates on transactional bank accounts and the use of overnight and 32 day notice deposit accounts.“

I calculated that the rate of interest received during 2025 was approximately 3.8%, which is well beyond what most other AIM shares earn from their banks.

Other accounting entries of note include freehold properties, which are carried at an up-to-date £24 million valuation, and a defined-benefit pension scheme, which is almost entirely invested in bonds worth £19 million and does not appear an obvious ‘black hole‘.

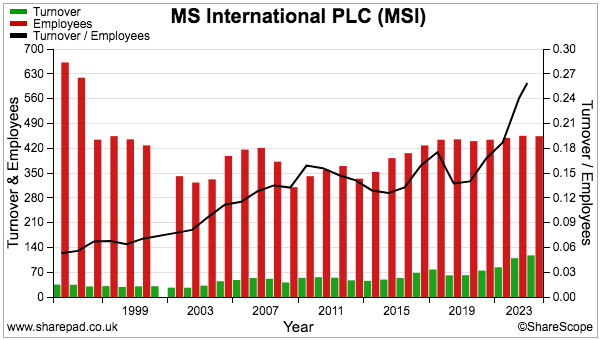

Probably MSI’s most impressive ShareScope chart tracks revenue per employee:

Despite the long-term humdrum performance, the group has managed to improve its workforce productivity over time. Keeping the headcount at approximately 450 during the last seven years — while at the same time increasing revenue by 50% — is very creditable.

Boardroom

MSI’s boardroom is extremely ‘old school’ and will not win any awards for corporate governance.

The prime director is Michael Bell, who joined MSI during 1972, became a board member during 1980 and was appointed executive chairman during 1987. Mr Bell has retained his position ever since, not least because MSI’s articles remarkably allow the chairman to avoid a re-election vote at the AGM!

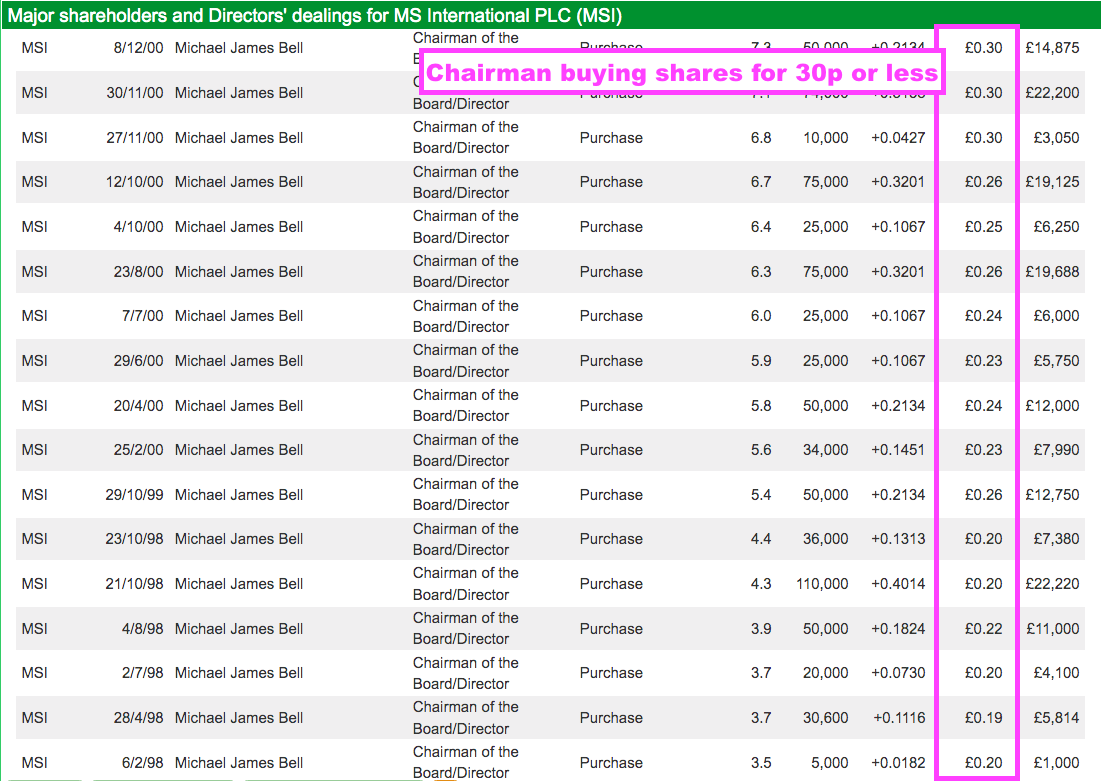

Consistent share purchases stretching back to the 1990s…

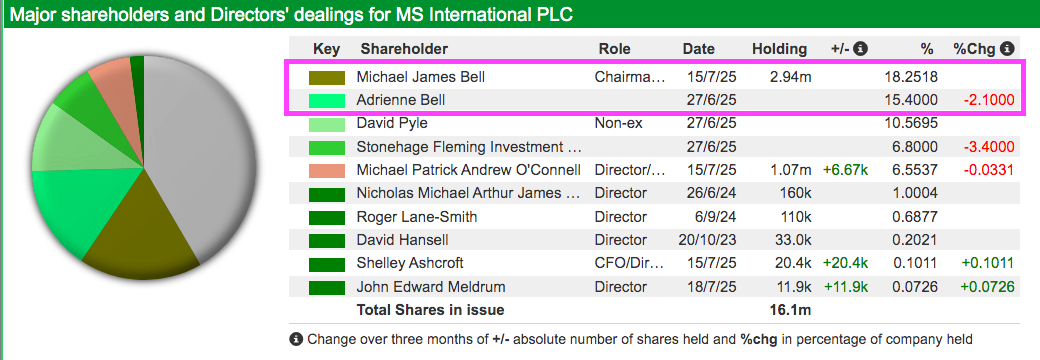

…helped propel Mr Bell’s shareholding from 3% to 29%. However, a “personal settlement” during 2019 now sees Mr Bell with an 18% (£36 million) holding and his (presumably ex-) wife with a 15% (£30 million) holding:

Other notable shareholders include David Pyle, a former MSI director with a 10% stake (£20 million), and Michael O’Connell, an MSI board member since 1985 with a 7% position (£13 million).

Most of MSI’s board members are getting any younger, with Mr Bell 79 years old, Mr O’ Connell 75 years old, and the group’s two non-executives aged 79 and 80.

At least board appointments this year included the 39-year-old finance director and the 56-year-old managing director of the defence subsidiary.

The board is completed by executive Nicholas Bell, who is 50 years old and, I presume, is the chairman’s son and will eventually take on the lead board role.

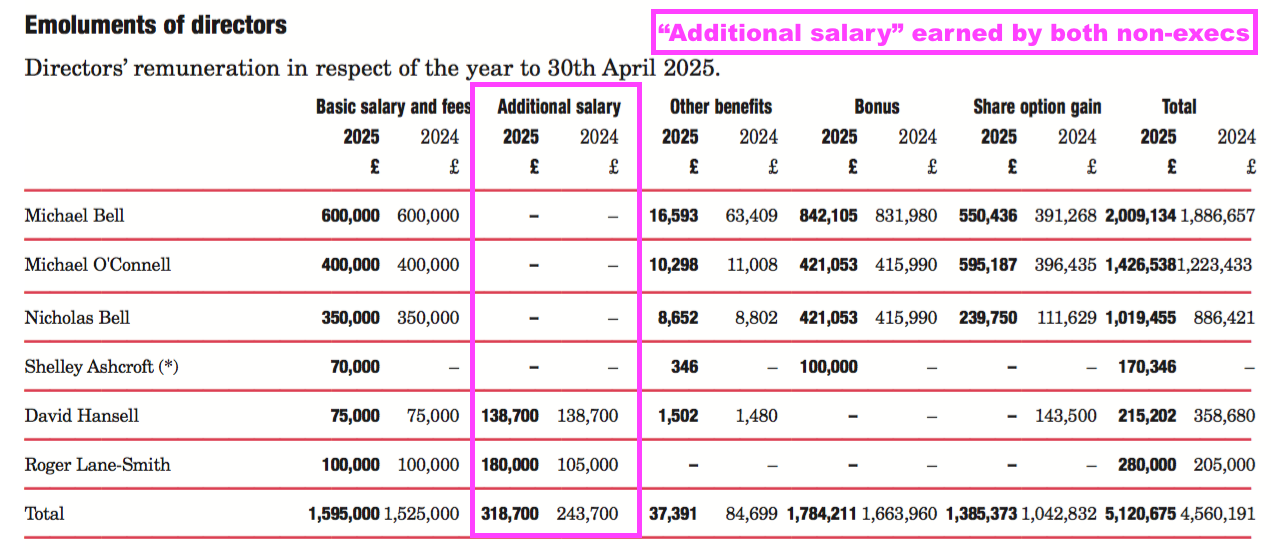

Note that both non-execs are not exactly independent — the pair each earn a highly unusual “additional salary” for their ‘executive’ duties:

One of the non-execs has served in his role since 1983 — versus a best-practice limit of nine years — while the other is a former managing director of the group’s defence subsidiary.

Board pay can’t be described as ‘thin cat’, with Michael Bell collecting a handy £600k salary and £800k-plus bonus during both 2024 and 2025.

I doubt shareholders will be complaining too much about director remuneration following MSI’s share-price surge. But Mr Bell’s past pay has not always correlated well to shareholders’ income.

Between 2012 and 2022, for example, Mr Bell’s salary gained 57% (and his bonuses totalled £900k) while the dividend advanced only 16%.

A notable board member of the past is Lord John Lee of Trafford, the prominent private investor, who served as a non-exec between 1990 and 1997 and still retains an MSI shareholding.

Summary

MSI’s ‘old school’ board probably explains why the group does not commission broker research, undertake webinars or publish presentations.

Anyone wishing to delve beyond the annual reports and company websites is pointed towards the AGM, which the group says is the “main forum for dialogue and discussion with private investors” and takes place in a Doncaster hotel during August.

The rocketing share price implies a number of savvy investors have already unearthed this winner, including a very informed Substacker (write-ups here and here) who correctly predicted 2025 earnings would be 90p per share.

Those 90p per earnings mean the £12 shares trade on a 13x multiple, which does not seem too extreme given the hefty profit expansion of the last few years.

Mind you, earnings are subject to the size and timing of a handful of contracts… which does make progress vulnerable to delayed orders. I dare say growth rates for the next few years will not be steady.

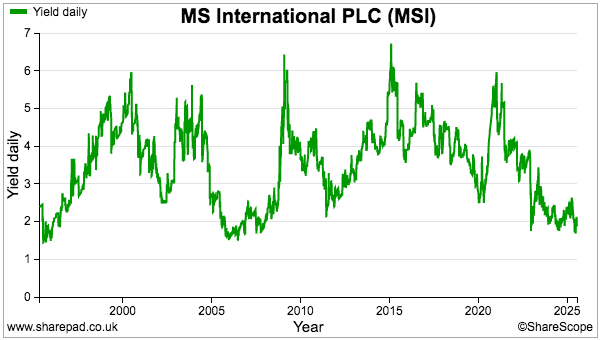

In addition, the aforementioned 23p per share dividend — almost 4x covered by earnings — seems strong evidence of future cash flow being suppressed by significant working-capital investment. The shares yield less than 2%:

Rather than fine-tuning estimates for 2026 and considering MSI’s near-term valuation, prospective investors should instead consider whether the group is at the start of a major transformation that will continue for some time.

You see, the stock market has a habit of harbouring companies that go nowhere for years…

…until they enjoy a break-through moment that leads to dramatic success and a multi-bagger share price that goes far higher for far longer than anybody expects. Names such as Games Workshop, Goodwin and Filtronic immediately come to mind.

MSI has clearly found itself suddenly with the right defence equipment in the right defence climate… and the profits earned today can now be reinvested in further R&D to compound tomorrow’s growth.

A final question to ponder is whether the veteran board is truly capable of maximising MSI’s potential after decades of overseeing more modest progress. I suspect after waiting so long to hit the big time, the directors will be very keen to maintain MSI’s rapid growth for as long as possible.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in MS International.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.