How confident can we be that the tech companies spending hundreds of billions of capex on LLM will generate adequate returns? Companies covered MANO and AOM.

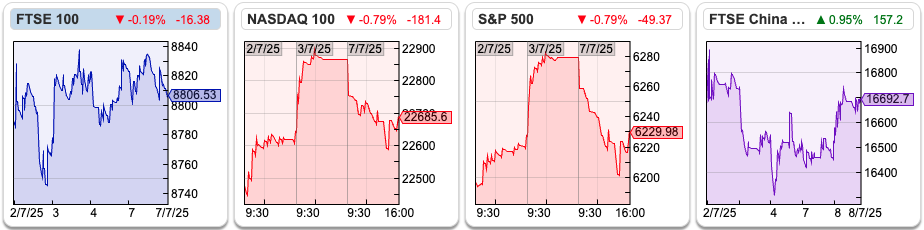

The FTSE 100 was up around +0.5% over the last 5 trading days. In comparison, the Nasdaq100 and S&P500 were up just under +1%. Platinum (PT$) is now the best-performing commodity YTD, up +53% to $1,368 per ounce, which compares to gold (G$) +28% YTD to $3,333 per ounce. I would suggest that if precious metals prices are rising faster than industrial metals like copper, then investors are buying safe haven assets. However, the Nasdaq100 is also at an all-time high and has more than doubled since the start of 2023.

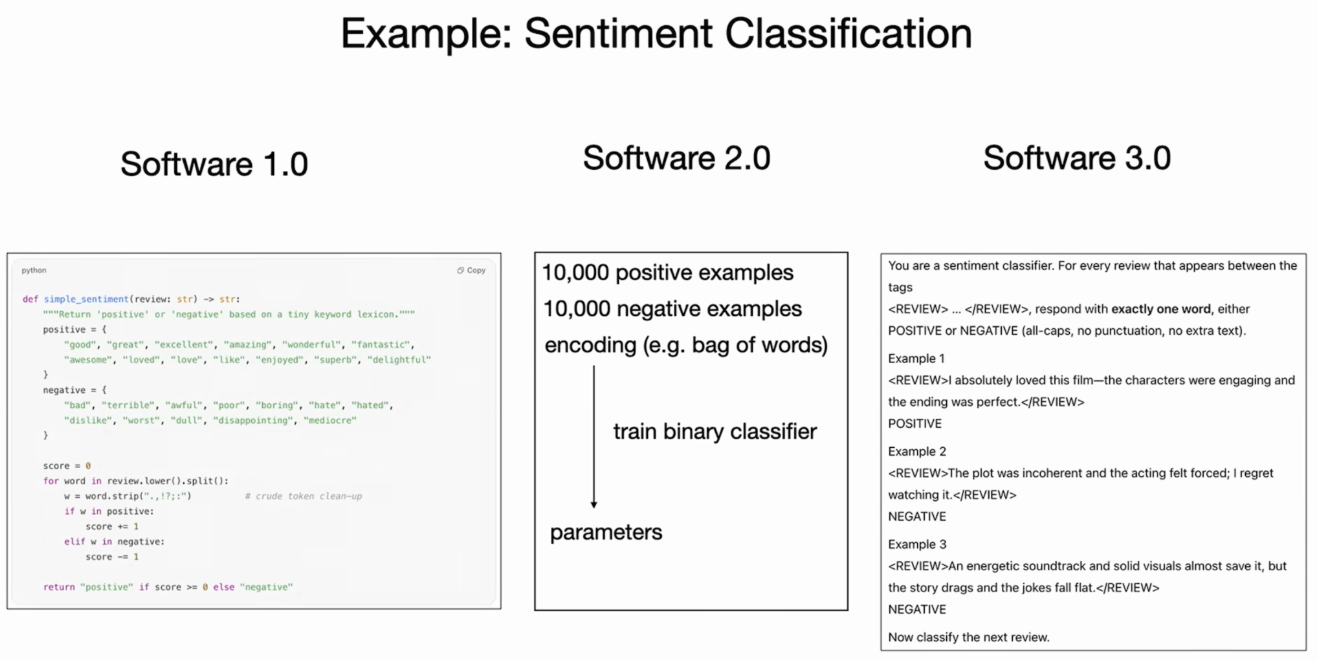

Andrej Karpathy (ex OpenAI and Tesla Artificial Intelligence) has given a fascinating YouTube talk on how programming is changing. He invented the term “vibe coding” to mean that it’s now possible to tell computers what to do in English, rather than having to learn a specific programming language like Python, JavaScript or C++.

Karpathy asks: Are LLMs like ChatGPT like utility companies supplying electricity or water? Or are they like semiconductor “Fab” manufacturers such as Intel? Or are LLMs an “operating system” like Microsoft Windows or Linux? I’ve been chatting with my programmer friends about “vibe coding” tools like Replit or Cursor, which they’re using. Cursor is indifferent to whether you use GPT, Claude 4-sonnet, Gemini 2.5-pro or DeepSeek, so maybe it will be Cursor and Replit which capture the value, not the LLMs.

These are important questions, because this year alone Amazon, Alphabet, Meta and Microsoft are spending $320bn of capex, mostly on datacentres, with no obvious way to earn a financial return on that spend. For instance, OpenAI reports 20m paying customers and is expected to earn around $8-$10bn in revenue this year. If customers are not locked into a relationship with one LLM, then the best analogy for LLMs may be telecom’s infrastructure companies like Global Crossing from the late 1990s. Huge sums of money funded the “plumbing” of the internet, like fibre optic cables beneath the Atlantic, but Global Crossing, WorldCom or Lucent all went bankrupt. The benefit of that investment splurge went to Google, Amazon and perhaps Facebook, not telecoms investors. Often, investors can make gains or avoid losses just by asking the right questions.

For instance, a decade ago, many tech investors questioned whether Apple had lost its innovative edge, and what the next iPhone or iPad would be. A better question would have been: Is Apple now a tech company, reliant on innovation, or a consumer brand, where customers are locked into the ecosystem? If AAPL is a consumer brand, why was it then trading on a PER of less than 11x at the start of 2016? Warren Buffett asked the second and third questions – and did pretty well, before selling halfway through last year.

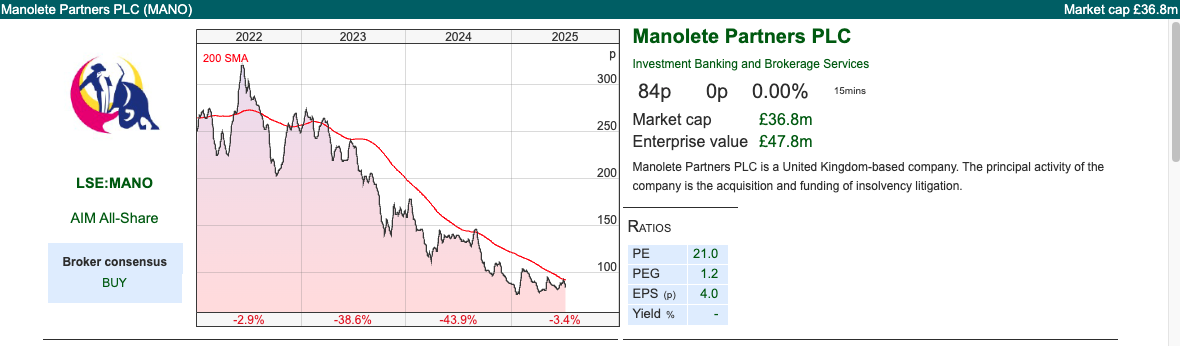

This week I look at insolvency litigation company Manolete and Decision Intelligence company, ActiveOps. Both companies look expensive on a simple PE ratio, but I’m attracted by the hopes of some operational gearing at both companies, combined with growing revenue.

Manolete FY Mar Results

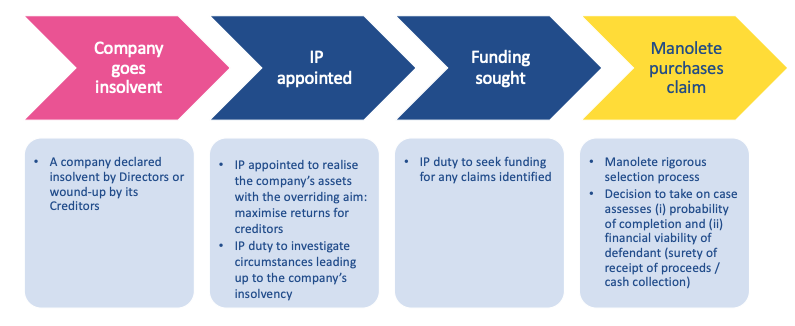

I haven’t written about this insolvency litigation company for a couple of years. At the beginning of the pandemic, the share price spiked up to 550p, as investors saw it potentially benefiting from a wave of insolvencies. In H1 Sept 2020, revenues were up +153% and PBT was up +49%. Then the government temporarily suspended insolvency laws and set aside £600bn of financial support for the business sector. This caused Manolete’s revenues to fall -27% FY Mar 2022 to £20m; revenues have taken a while to recover, even after insolvency laws were re-introduced. I can remember seeing Steve Cooklin, the CEO, present at Mello in both May 2023 and 2024, when the share price was around 220p (May 2023), then 130p (May 2024). Both years, I had the same thought: “too early in the turnaround, but worth looking at again in a year.” So here we are.

The company reported record revenues of £30.5m, +16% y-o-y growth, inline with the company’s trading statement at the end of April. Worth noting that although management suggest in the FY results that they are “well ahead of market forecasts” – those forecasts they’ve beaten (£26m Realised Revenue and £0.9m Realised EBIT) had not been updated since April’s RNS which suggested £29.5m Realised Revenue and £2.0m Realised EBIT.

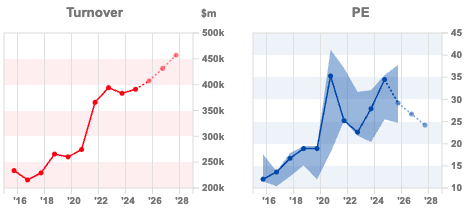

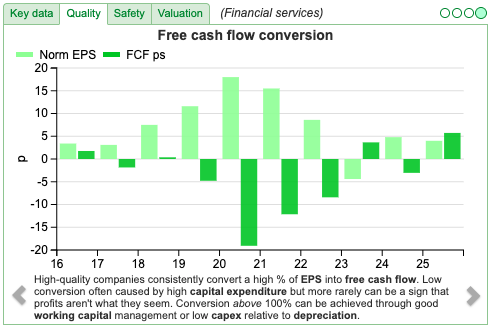

Second point of note: cashflow tends to lag accounting profits, because the company settles claims relatively quickly and writes up their fair value. However, individuals (former directors of insolvent companies) tend not to have millions of pounds set aside to pay immediately once a settlement has been agreed. For example, Manolete said in September 2020 that they had won a claim for £15m, of which Manolete’s share was £4.1m. To allow the Defendants time to liquidate assets, MANO were to receive the settlement proceeds in stages over the following decade. Hence, the difference between EPS and FCF per share, in the chart below. If you can’t discern the two shades of green, FCF per share is the negative number in 2020, 2021, 2022 and 2024. We are now at the point in the cycle though, where FCF per share stands at 5.7p, higher than versus 4p of normalised EPS just reported FY Mar 2025. Maynard wrote up the Fair Value accounting here; the article is 5 years old, but the analysis still stands.

Balance sheet: The company has £41m invested in 419 cases, accounted for on a “fair value” rather than “cost” basis. They also have £32m of trade receivables, which are sums that they have been awarded, but are yet to collect. On the liability side, that compares to net debt of £11m and shareholders’ equity of £41m. They have a £17.5m RCF with HSBC, of which £5m was utilised at the end of March. Normally, I would suggest trade receivables greater than FY revenues would be a ‘red flag’ – in the case of Manolete, those receivables have been agreed as a legally binding settlement. Although there’s still some collection risk (MANO had credit loss provisions of £6m FY Mar 2025), I wouldn’t view that receivables figure in the same way as for a support services company. Collecting receivables is MANO’s core business. Often, they have a charge over a former director’s family home as collateral, but they rarely have to take possession of their property; as normally the debtor pays up and they don’t need to seize their home.

Cartel case: Manolete has purchased 22 cases against truck manufacturers who had been price fixing. These were valued at £15m, as part of the £41m investments on the balance sheet. In February, this case was put back 10 months, from November this year to September 2026, with a provisional estimate of 12 weeks for the hearing. MANO say settlement discussions continue, so it’s possible this settles before trial. I would imagine that those 22 cartel cases recorded on the balance sheet could be worth more than £15m, but they could also be written down to zero if the court ruling is unfavourable.

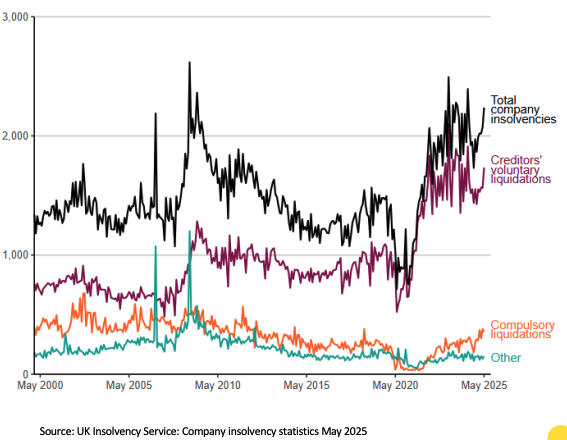

Outlook: Management show a chart from the UK Insolvency Service (published 20 June) showing high levels of corporate insolvencies. This ought to be a lead indicator for revenue, though revenues have taken longer to recover post-pandemic than initially hoped.

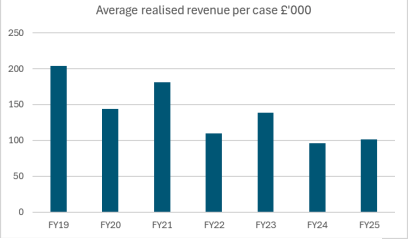

MANO said new cases are up at least +27% to 56 Q1 (Apr-Jul) 2026F versus the same quarter last year. Management say one effect of Covid has been that they’ve taken on many smaller cases, so revenue per case has halved from £200K FY Mar 2019 to £100K currently. They are now seeing the larger cases coming through, management expect case size to trend back up to the pre-COVID levels, which ought to be good for bottom line profit (same work, more reward).

Shareholders: Mithaq Capital, the Saudi-based fund, own 17% of the company. Originally, Jon Moulton, the venture capitalist, owned a large stake, though I can’t see him on the shareholder register now. Steve Cooklin, the CEO, owns just under 10%

Valuation: The shares are trading on a PER of 18x Mar 2026F, dropping to 12x the following year. That translates to 1.2x sales, remarkably before the pandemic. ShareScope shows that investors were prepared to pay around 15x sales.

Opinion: I’m going to stick my neck out and suggest that MANO has now bottomed, following a 5-year downtrend. I prefer the Manolete investment case to Begbies Traynor, which I wrote up in May. There’s not much evidence of operational gearing at BEG, and revenue growth is forecast to be +5% this year and next. In contrast, MANO is forecast to grow the topline +20% next year and +14% the following year with EBIT growth well ahead of that. I bought a position paying 93p after the results. I was unnerved to see the shares fall -10% after I bought. Let me know in the chat if you think I’ve missed something!

ActiveOps FY Mar Results

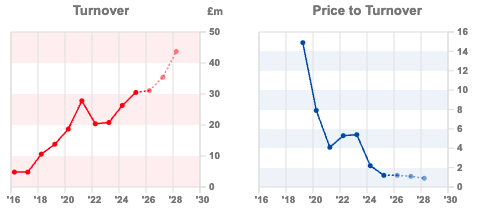

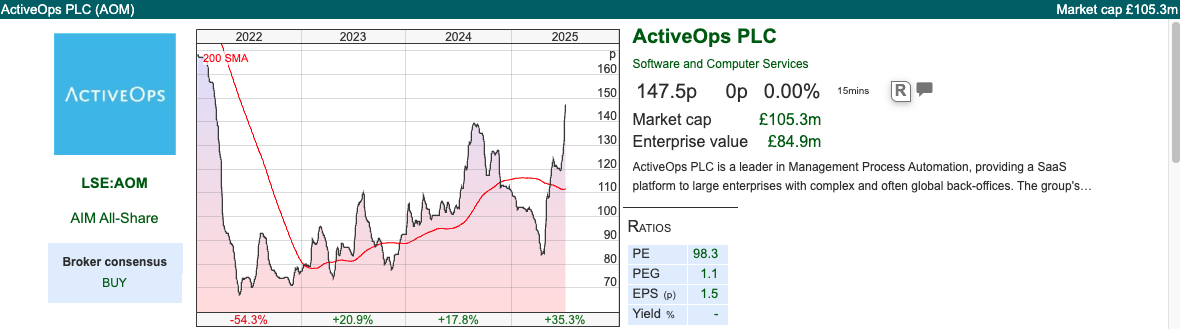

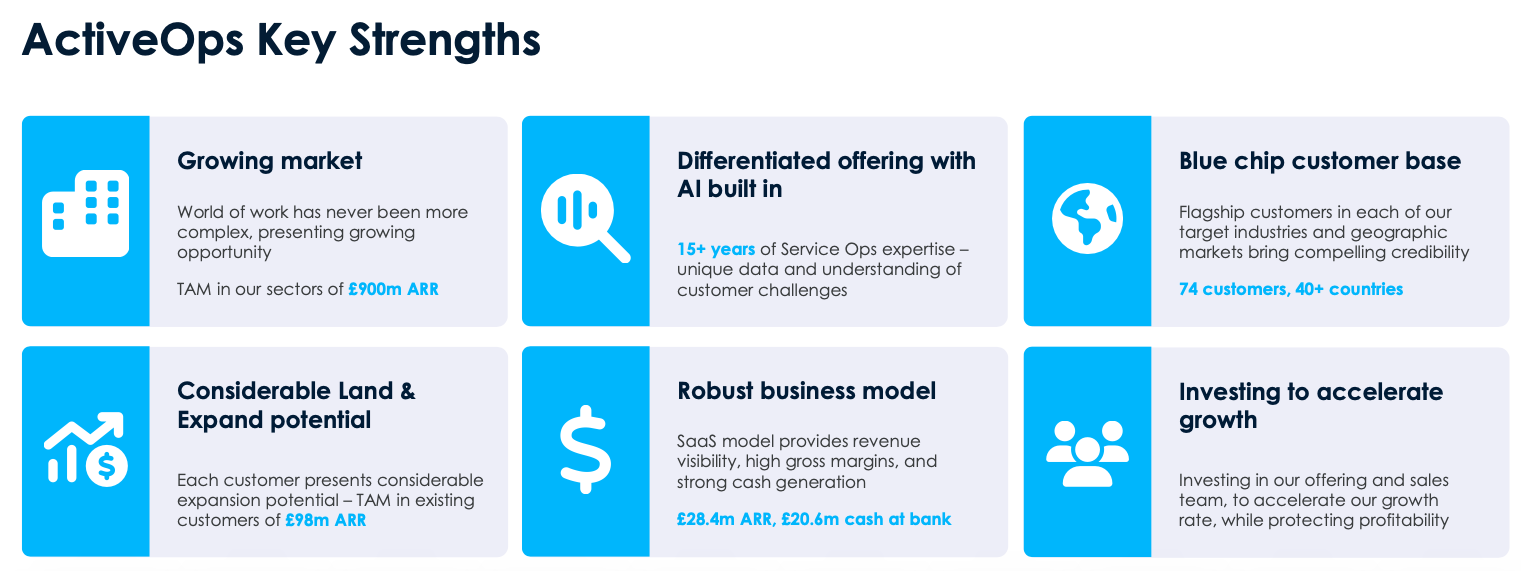

I last wrote about this company in 2023, when I mentioned that fishing in the pool of 2021 IPO’s down more than -50% could be profitable. I did indeed go fishing and bought a position when the share price was 80p vs 148p today. I think it’s an interesting example of a company that looks optically expensive on a PE ratio, but has some attractive features which could justify the valuation, specifically: i) high recurring revenues from “locked-in” customers, Net Revenue Retention of 106% ii) 84% gross margin, but low operating margin, because marketing expenses of £6.5m are 21% of group revenue and almost 5x PBT. Some of that marketing spend is providing the match data analytics graphics for British and Irish Lions Tour of Australia.

Revenues were up +14% to £30.5m while statutory PBT rose +35% to £1.3m FY Mar 2025. Software companies are allowed to capitalise the development costs of their new software as long as the software is a product they’re selling to clients, so new versions of ControliQ and CaseWorkiQ, which include AI-based product features, have been capitalised on the balance sheet. If that £1m cost had been expensed through the P&L, the company would have only just broken even. That said, net cash generated from operating activities was £4.5m, so cash from operations is around 5x higher than operating profits. Management are emphatically not capitalising software costs to disguise poor cashflow. There’s also £21m of net cash on the balance sheet at the end of March, but that will fall because AOM has bought a competitor for £16m (see below).

Acquisition: At the end of June, management announced the acquisition of Enlighten, a US-based competitor business for £16m maximum consideration, of which more than half is deferred consideration dependent on financial performance achieved. The price was approximately 2x revenues, so AOM’s revenue should rise by £8m, and EPS is expected to be +15% in the first full year of ownership (ie FY Mar 2027F).

Valuation: The shares look extremely expensive, just above 50x PER Mar 2026F. However, the 84% gross margin and +32% revenue growth forecast this year suggest that it may not be the best way to value the company. On a price/sales the shares are on less than 3x, while management say that their Total Addressable Market (TAM) is £900m, and TAM from existing customers is £98m, Annual Recurring Revenue (3.5x the ARR of £28m just reported).

Opinion: I bought a starter position a couple of years ago, but didn’t have any conviction, because like many Enterprise SaaS businesses, it’s difficult to know how differentiated the AOM offering is. As investors, we can research consumer companies, for instance ordering gifts from Moonpig, drink Fevertree or play Warhammer, but it’s hard to compare Elixirr versus ActiveOps. I did spend time on YouTube watching some “Decision Intelligence” videos, but I am still none the wiser! The shares have doubled in value, and I am happy to let my winning positions run in this market, but admit I may have been lucky rather than good.

~

Bruce Packard

Notes

Bruce owns shares in ActiveOps and Manolete

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 09/07/2025 | MANO, AOM | Are we asking the right questions about LLMs?

How confident can we be that the tech companies spending hundreds of billions of capex on LLM will generate adequate returns? Companies covered MANO and AOM.

The FTSE 100 was up around +0.5% over the last 5 trading days. In comparison, the Nasdaq100 and S&P500 were up just under +1%. Platinum (PT$) is now the best-performing commodity YTD, up +53% to $1,368 per ounce, which compares to gold (G$) +28% YTD to $3,333 per ounce. I would suggest that if precious metals prices are rising faster than industrial metals like copper, then investors are buying safe haven assets. However, the Nasdaq100 is also at an all-time high and has more than doubled since the start of 2023.

Andrej Karpathy (ex OpenAI and Tesla Artificial Intelligence) has given a fascinating YouTube talk on how programming is changing. He invented the term “vibe coding” to mean that it’s now possible to tell computers what to do in English, rather than having to learn a specific programming language like Python, JavaScript or C++.

Karpathy asks: Are LLMs like ChatGPT like utility companies supplying electricity or water? Or are they like semiconductor “Fab” manufacturers such as Intel? Or are LLMs an “operating system” like Microsoft Windows or Linux? I’ve been chatting with my programmer friends about “vibe coding” tools like Replit or Cursor, which they’re using. Cursor is indifferent to whether you use GPT, Claude 4-sonnet, Gemini 2.5-pro or DeepSeek, so maybe it will be Cursor and Replit which capture the value, not the LLMs.

These are important questions, because this year alone Amazon, Alphabet, Meta and Microsoft are spending $320bn of capex, mostly on datacentres, with no obvious way to earn a financial return on that spend. For instance, OpenAI reports 20m paying customers and is expected to earn around $8-$10bn in revenue this year. If customers are not locked into a relationship with one LLM, then the best analogy for LLMs may be telecom’s infrastructure companies like Global Crossing from the late 1990s. Huge sums of money funded the “plumbing” of the internet, like fibre optic cables beneath the Atlantic, but Global Crossing, WorldCom or Lucent all went bankrupt. The benefit of that investment splurge went to Google, Amazon and perhaps Facebook, not telecoms investors. Often, investors can make gains or avoid losses just by asking the right questions.

For instance, a decade ago, many tech investors questioned whether Apple had lost its innovative edge, and what the next iPhone or iPad would be. A better question would have been: Is Apple now a tech company, reliant on innovation, or a consumer brand, where customers are locked into the ecosystem? If AAPL is a consumer brand, why was it then trading on a PER of less than 11x at the start of 2016? Warren Buffett asked the second and third questions – and did pretty well, before selling halfway through last year.

This week I look at insolvency litigation company Manolete and Decision Intelligence company, ActiveOps. Both companies look expensive on a simple PE ratio, but I’m attracted by the hopes of some operational gearing at both companies, combined with growing revenue.

Manolete FY Mar Results

I haven’t written about this insolvency litigation company for a couple of years. At the beginning of the pandemic, the share price spiked up to 550p, as investors saw it potentially benefiting from a wave of insolvencies. In H1 Sept 2020, revenues were up +153% and PBT was up +49%. Then the government temporarily suspended insolvency laws and set aside £600bn of financial support for the business sector. This caused Manolete’s revenues to fall -27% FY Mar 2022 to £20m; revenues have taken a while to recover, even after insolvency laws were re-introduced. I can remember seeing Steve Cooklin, the CEO, present at Mello in both May 2023 and 2024, when the share price was around 220p (May 2023), then 130p (May 2024). Both years, I had the same thought: “too early in the turnaround, but worth looking at again in a year.” So here we are.

The company reported record revenues of £30.5m, +16% y-o-y growth, inline with the company’s trading statement at the end of April. Worth noting that although management suggest in the FY results that they are “well ahead of market forecasts” – those forecasts they’ve beaten (£26m Realised Revenue and £0.9m Realised EBIT) had not been updated since April’s RNS which suggested £29.5m Realised Revenue and £2.0m Realised EBIT.

Second point of note: cashflow tends to lag accounting profits, because the company settles claims relatively quickly and writes up their fair value. However, individuals (former directors of insolvent companies) tend not to have millions of pounds set aside to pay immediately once a settlement has been agreed. For example, Manolete said in September 2020 that they had won a claim for £15m, of which Manolete’s share was £4.1m. To allow the Defendants time to liquidate assets, MANO were to receive the settlement proceeds in stages over the following decade. Hence, the difference between EPS and FCF per share, in the chart below. If you can’t discern the two shades of green, FCF per share is the negative number in 2020, 2021, 2022 and 2024. We are now at the point in the cycle though, where FCF per share stands at 5.7p, higher than versus 4p of normalised EPS just reported FY Mar 2025. Maynard wrote up the Fair Value accounting here; the article is 5 years old, but the analysis still stands.

Balance sheet: The company has £41m invested in 419 cases, accounted for on a “fair value” rather than “cost” basis. They also have £32m of trade receivables, which are sums that they have been awarded, but are yet to collect. On the liability side, that compares to net debt of £11m and shareholders’ equity of £41m. They have a £17.5m RCF with HSBC, of which £5m was utilised at the end of March. Normally, I would suggest trade receivables greater than FY revenues would be a ‘red flag’ – in the case of Manolete, those receivables have been agreed as a legally binding settlement. Although there’s still some collection risk (MANO had credit loss provisions of £6m FY Mar 2025), I wouldn’t view that receivables figure in the same way as for a support services company. Collecting receivables is MANO’s core business. Often, they have a charge over a former director’s family home as collateral, but they rarely have to take possession of their property; as normally the debtor pays up and they don’t need to seize their home.

Cartel case: Manolete has purchased 22 cases against truck manufacturers who had been price fixing. These were valued at £15m, as part of the £41m investments on the balance sheet. In February, this case was put back 10 months, from November this year to September 2026, with a provisional estimate of 12 weeks for the hearing. MANO say settlement discussions continue, so it’s possible this settles before trial. I would imagine that those 22 cartel cases recorded on the balance sheet could be worth more than £15m, but they could also be written down to zero if the court ruling is unfavourable.

Outlook: Management show a chart from the UK Insolvency Service (published 20 June) showing high levels of corporate insolvencies. This ought to be a lead indicator for revenue, though revenues have taken longer to recover post-pandemic than initially hoped.

MANO said new cases are up at least +27% to 56 Q1 (Apr-Jul) 2026F versus the same quarter last year. Management say one effect of Covid has been that they’ve taken on many smaller cases, so revenue per case has halved from £200K FY Mar 2019 to £100K currently. They are now seeing the larger cases coming through, management expect case size to trend back up to the pre-COVID levels, which ought to be good for bottom line profit (same work, more reward).

Shareholders: Mithaq Capital, the Saudi-based fund, own 17% of the company. Originally, Jon Moulton, the venture capitalist, owned a large stake, though I can’t see him on the shareholder register now. Steve Cooklin, the CEO, owns just under 10%

Valuation: The shares are trading on a PER of 18x Mar 2026F, dropping to 12x the following year. That translates to 1.2x sales, remarkably before the pandemic. ShareScope shows that investors were prepared to pay around 15x sales.

Opinion: I’m going to stick my neck out and suggest that MANO has now bottomed, following a 5-year downtrend. I prefer the Manolete investment case to Begbies Traynor, which I wrote up in May. There’s not much evidence of operational gearing at BEG, and revenue growth is forecast to be +5% this year and next. In contrast, MANO is forecast to grow the topline +20% next year and +14% the following year with EBIT growth well ahead of that. I bought a position paying 93p after the results. I was unnerved to see the shares fall -10% after I bought. Let me know in the chat if you think I’ve missed something!

ActiveOps FY Mar Results

I last wrote about this company in 2023, when I mentioned that fishing in the pool of 2021 IPO’s down more than -50% could be profitable. I did indeed go fishing and bought a position when the share price was 80p vs 148p today. I think it’s an interesting example of a company that looks optically expensive on a PE ratio, but has some attractive features which could justify the valuation, specifically: i) high recurring revenues from “locked-in” customers, Net Revenue Retention of 106% ii) 84% gross margin, but low operating margin, because marketing expenses of £6.5m are 21% of group revenue and almost 5x PBT. Some of that marketing spend is providing the match data analytics graphics for British and Irish Lions Tour of Australia.

Revenues were up +14% to £30.5m while statutory PBT rose +35% to £1.3m FY Mar 2025. Software companies are allowed to capitalise the development costs of their new software as long as the software is a product they’re selling to clients, so new versions of ControliQ and CaseWorkiQ, which include AI-based product features, have been capitalised on the balance sheet. If that £1m cost had been expensed through the P&L, the company would have only just broken even. That said, net cash generated from operating activities was £4.5m, so cash from operations is around 5x higher than operating profits. Management are emphatically not capitalising software costs to disguise poor cashflow. There’s also £21m of net cash on the balance sheet at the end of March, but that will fall because AOM has bought a competitor for £16m (see below).

Acquisition: At the end of June, management announced the acquisition of Enlighten, a US-based competitor business for £16m maximum consideration, of which more than half is deferred consideration dependent on financial performance achieved. The price was approximately 2x revenues, so AOM’s revenue should rise by £8m, and EPS is expected to be +15% in the first full year of ownership (ie FY Mar 2027F).

Valuation: The shares look extremely expensive, just above 50x PER Mar 2026F. However, the 84% gross margin and +32% revenue growth forecast this year suggest that it may not be the best way to value the company. On a price/sales the shares are on less than 3x, while management say that their Total Addressable Market (TAM) is £900m, and TAM from existing customers is £98m, Annual Recurring Revenue (3.5x the ARR of £28m just reported).

Opinion: I bought a starter position a couple of years ago, but didn’t have any conviction, because like many Enterprise SaaS businesses, it’s difficult to know how differentiated the AOM offering is. As investors, we can research consumer companies, for instance ordering gifts from Moonpig, drink Fevertree or play Warhammer, but it’s hard to compare Elixirr versus ActiveOps. I did spend time on YouTube watching some “Decision Intelligence” videos, but I am still none the wiser! The shares have doubled in value, and I am happy to let my winning positions run in this market, but admit I may have been lucky rather than good.

~

Bruce Packard

Notes

Bruce owns shares in ActiveOps and Manolete

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.